Professional Documents

Culture Documents

Tybms Sem5 Iapm Nov18

Tybms Sem5 Iapm Nov18

Uploaded by

kratos42exeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tybms Sem5 Iapm Nov18

Tybms Sem5 Iapm Nov18

Uploaded by

kratos42exeCopyright:

Available Formats

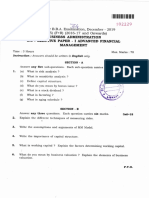

Paper / Subject Code: 46003 / Finance:Investment Analysis & Portfolio Management

Tqen..sf se'">Vf 2s ll,l?

Duration :2.30 Hours Marhs : 75

NB: (1) All questions are compulsory having intenial option. 6P=S

!/ rtFn*+;.v\i

(2) Figures to the right indicate marks allotted to each question. t \ t*rt -,-ir, f I

(3) Simple calculator allowed.

i. (A) Match the following columns. (Any 8)

k'r<'# (08 Marks)

Column A Column B

1 PPF A Liquidity.ratio

2 NIFTY B Uncertain & high return

a

J U4systematic Risk C William sharpe

4 Standard deviation D Elliot wave theory

5 Net Profit ratio E Technical Analvsis

6 Study of Charts & pattem. F Profitability ratio

1 Dow Theory G Measure of Risk

8 Capital Assets Pricing rnodel', H Controllable

9 Gambling I NSE

10 Current ratio J Highly illiquid

1.(B) Cive Tnre or False: (Any 7) (07 MaLks)

I ) Invesrments are ruade with primary objective of deriving returns.

2) Capital gain refels to increase in value of investments over a period of time.

3)Non - Marl<erable financial assers can be sold in capital market.

4) Public Provident Fund is a savings cum tax saving instrument in India.

5) Treasury Bills are one of the riskiest Money market instruments issued by Central Government.

6) Commercial Paper is a short term unsecured promissory note issued by Corporate and Financial

Institutions.

7) Equiry shareholdeLs does noL cany right of dividend.

8) Secondary Market is a market where existing securities are purchased and sold.

9; Merger and Acquisitions are rnajor functions of lnvestrnent Bankers.

l0) NSDL is the largest central security depository based in Mumbai.

2.(A) Explain the Non- rnarketable Financial Assets. (08 Marlcs)

2. (B) Explain in brief the objectives of Investrnent. (07 Marks)

OR

2. As Portfolio Management Consultant, you are approached by Mr. Wagh, aged 35 with investible funds of

Rs. 10 lakhs. He wants to know from you the following:

(i) What are the investment avenues available to him which will give a suitable return with maximr.un

return?

(ii) What are the various types of risks? (15 Mallis)

Paper / Subject Code: 46003 / Finance:Investment Analysis & Portfolio Management

3. (A) Calculation of Beta of each of the following two companies with the help of given iufomration.

(08 Marks)

Ilethvi Market

Year Rudra Ltd Ltd return

1 20 r9 20

2 18 16 t7

J l7 13 t4

4 2I 19 2A

5 24 23 24

3. (B) The rate of return of stock Mocktail and Cocktail under different status of economy are given belorv :

Particular Boom Normal Recession

Probability 0.30 0.45 0.25

Return of stock 35 ,55,' 70

Mocktail (%)

Return of stock 70 35,

Cocktail (%)

a) Calculate the expected retum and standard deviation of return on both the stock.

bt llyou could invest in either stock Mocktail or stock Cocktail, but not in both. Which stocl<

would you prefer? (07 Marks)

OR

3. Following is information about shares of Modi T td. and Gandhi Ltd. Under in various economic

conditions. At present both the shares are traded at Rs. 100.

Expected Price of the

shares (Rs.)

Modi

Situation Prohahilifv Ltd. Gandhi Ltd.

Hieh Growth 0.30 r40 150

Low Growth 0.40 110 100

Stagnation 0.20 r20 t20

Recession 0.10 100 80

(i) Which company has rnore risk to invest?

(ii) Mr. Kapil wants to invest Rs. 10,000.

(iii) Will your decision change if probabilities are 0.4,0.4,0.1, 0.1 respectively. (15 Marks)

4 (A) Give a brief on Technical Analysis. (08 Marks)

(B) what are charts? Explain the types of charts. (07 Malks)

OR

Paper / Subject Code: 46003 / Finance:Investment Analysis & Portfolio Management

4. Following information is available relating to Lokesh Limited and Mayur fimiteO.

Particulars Lokesh Limited Mayirx [,i6i1.4

Equity Share Capital (Rs.10 face Rs.400lakhs Rs.500lakhs

value)

l2o/o P r eference Share s Rs.1601akhs Rs;20o lakhs

Profit after tax Rs.100lakhs Rs,140lakhs

Proposed Dividend Rs.70lakhs Rs.S0lakhs

Market Price Per Share Rs.400 Rs.560

Cur:rent Assets Rs.160lakhs Rs.180lakhs

Cument Liabilities Rs.80lakhs Rs.90lakhs

Calculate :

(i) Earnings per share (ii) P/E Ratio (iii) Dividend Payout Ratio (iv) Retum on Equity Shares (v) Current

Ratio

As an analyst infonl the investor which is good in investing, (15 Markst

5. (A) The Expected return and Beta factors of 3 securities are as follows:

Securities Expected Return (%) Beta

Kotak Ltd. 18 1.6

Ganatra Ltd. 10 0.8

Thakkars Ltd. T2 1.2

If the risk free rate rs 1 oh and market retums are 12 %. Calculate returns for each security under CAPM.

(08 Mark:.;

5. (B) The details of three portfolios are given below.

Portfolio Average Beta Standard

Return on Deviation

Portfolio (%)

Nobeta 18 1.4 ,

0.30

Sezuka 12 0.9 0.35

Sunio t6 1.1 0.40

Market Index 14 1.0 0.25

Compare these portfolio on performance using Sharpe and Treynor measures.

Rish Free return is 8 %. (07 Marks)

OR

5. Give short notes on: (Any Three) (15 Marks)

l. CAPM Model

2. Elloit Wave Theory

3. Hybrid Schemes

4. Secondary market

5. Sensex

*r,<******{<***r<

You might also like

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Lecture 3 - Format Journal Entries PDFDocument3 pagesLecture 3 - Format Journal Entries PDFZamil AqidNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahNo ratings yet

- 0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial ManagementDocument60 pages0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial Management18651 SYEDA AFSHANNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationItikaa TiwariNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument120 pagesPaper - 2: Strategic Financial Management Questions Security ValuationKeshav SethiNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security Valuationsam kapoorNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- Afm RTP 2021Document42 pagesAfm RTP 2021rpj.group2018No ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- SFM Paper May 2019 Old Syllabus FinAppDocument12 pagesSFM Paper May 2019 Old Syllabus FinAppAkshat TongiaNo ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- MicroeconomicsDocument3 pagesMicroeconomicschelseaNo ratings yet

- TIME: 2!110VJR: 4. E Uit ShareholdersDocument10 pagesTIME: 2!110VJR: 4. E Uit ShareholdersAditi VengurlekarNo ratings yet

- Strategic Financial ManagementDocument5 pagesStrategic Financial ManagementdechickeraNo ratings yet

- CA33 Advanced Financial Management-1Document4 pagesCA33 Advanced Financial Management-1Bob MarshellNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- 15A52301 Managerial Economics & Financial AnalysisDocument2 pages15A52301 Managerial Economics & Financial AnalysisGeorgekutty FrancisNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Afm Past Papers (2002 - 2019)Document137 pagesAfm Past Papers (2002 - 2019)peterNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2022Document4 pagesBangalore University Previous Year Question Paper AFM 2022Ramakrishna NagarajaNo ratings yet

- Revision For Exams NBDocument15 pagesRevision For Exams NBDan Saul KnightNo ratings yet

- Fundamentals of Finance and Banking Section A - Compulsory: TH THDocument3 pagesFundamentals of Finance and Banking Section A - Compulsory: TH THShivamNo ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- Derivatives (Q) .Document3 pagesDerivatives (Q) .chandrakantchainani606No ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- 0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementDocument4 pages0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementsimranNo ratings yet

- Paper Finance IVDocument3 pagesPaper Finance IVAbhijeetNo ratings yet

- SAPMDocument2 pagesSAPMGautam KumarNo ratings yet

- Afm 1 AfDocument4 pagesAfm 1 AfDeepansh singhalNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- 2016 PaperDocument5 pages2016 PaperumeshNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- Portfolio Management PDFDocument27 pagesPortfolio Management PDFdwkr giriNo ratings yet

- Risk and Rates of Return: This Chapter Is Most Important and Will Be Emphasized in TestsDocument66 pagesRisk and Rates of Return: This Chapter Is Most Important and Will Be Emphasized in TestsAhmad Bello DogarawaNo ratings yet

- 73535bos59345 Final p2qDocument6 pages73535bos59345 Final p2qSakshi vermaNo ratings yet

- MArch Sem II 2022-2024Document4 pagesMArch Sem II 2022-2024shafayeeNo ratings yet

- Portfolio Management and SAPM Book Tybms and TybfmDocument40 pagesPortfolio Management and SAPM Book Tybms and TybfmRahul VengurlekarNo ratings yet

- Tybaf Sem5 Fm-Ii Nov18Document5 pagesTybaf Sem5 Fm-Ii Nov18rizwan hasmiNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- BEFA MID 2QP 2023 (Updated) - 1Document9 pagesBEFA MID 2QP 2023 (Updated) - 1SAI PRANEETHNo ratings yet

- BFC 3379 Investment Analysis and Portfolio MNGTDocument4 pagesBFC 3379 Investment Analysis and Portfolio MNGTsumeya.abdi4No ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- Civil and Water Individual Assignment Sept 2013Document6 pagesCivil and Water Individual Assignment Sept 2013tinoNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- SAPMDocument10 pagesSAPMadisontakke_31792263No ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- 6093 - Download - Third Merit List B.A For The A.Y. 2022-23Document4 pages6093 - Download - Third Merit List B.A For The A.Y. 2022-23kratos42exeNo ratings yet

- Sl-Circular-06-Advt 02.12.2022Document11 pagesSl-Circular-06-Advt 02.12.2022kratos42exeNo ratings yet

- Nature of EthicsDocument12 pagesNature of Ethicskratos42exeNo ratings yet

- Commerce - Bms Bachelor of Management Studies - Semester 5 - 2022 - November - Elective Finance Financial Accounting CbcgsDocument5 pagesCommerce - Bms Bachelor of Management Studies - Semester 5 - 2022 - November - Elective Finance Financial Accounting Cbcgskratos42exeNo ratings yet

- Portfolio Assignment 2018: Portfolio Optimization: The Markowitz Framework For Portfolio SelectionDocument2 pagesPortfolio Assignment 2018: Portfolio Optimization: The Markowitz Framework For Portfolio SelectionPhuc Hong PhamNo ratings yet

- Financial Stability Report December 2023 Lyst1034Document11 pagesFinancial Stability Report December 2023 Lyst1034Upsc NotesNo ratings yet

- Chapter 14Document2 pagesChapter 14abu.toyabNo ratings yet

- Mba Iii Financial Risk ManagementDocument75 pagesMba Iii Financial Risk ManagementSimran GargNo ratings yet

- Corporate Finance NotesDocument6 pagesCorporate Finance NotesccapgomesNo ratings yet

- FR Ias 32, Ifrs 9Document1 pageFR Ias 32, Ifrs 9Prachanda BhandariNo ratings yet

- Adv CH - 1 PARTNERSHIPSDocument21 pagesAdv CH - 1 PARTNERSHIPSMohammed AwolNo ratings yet

- Narendra Sir MergedDocument112 pagesNarendra Sir MergedShaurya GosainNo ratings yet

- Elective II Income Tax LawDocument63 pagesElective II Income Tax Lawprof.jothisNo ratings yet

- Ghana Investment Promotion Centre (Gipc) Act 865Document19 pagesGhana Investment Promotion Centre (Gipc) Act 865JeffreyNo ratings yet

- Foward Rate AgreementsDocument4 pagesFoward Rate AgreementsAbhy SinghNo ratings yet

- International Finance Eun & Resnick Complete Formula Sheet: S (J/K) S (C/K) S (C / J)Document5 pagesInternational Finance Eun & Resnick Complete Formula Sheet: S (J/K) S (C/K) S (C / J)Jemma JadeNo ratings yet

- Pool Canvas: Creation SettingsDocument26 pagesPool Canvas: Creation SettingsSmartunblurrNo ratings yet

- Solutions Nss NC 19Document8 pagesSolutions Nss NC 19lethiphuongdanNo ratings yet

- Introduction Cash FlowDocument10 pagesIntroduction Cash FlowAmrit TejaniNo ratings yet

- Sfsar Staat Hmrer Fees: Indian Oil Corporation LimitedDocument1 pageSfsar Staat Hmrer Fees: Indian Oil Corporation LimitedkhalandarNo ratings yet

- Exchange Rate RiskDocument18 pagesExchange Rate RiskolgappNo ratings yet

- Performance Task QuizDocument3 pagesPerformance Task QuizRhobie CuaresmaNo ratings yet

- Capital Gains Tax Handouts May2020Document29 pagesCapital Gains Tax Handouts May2020Elsie GenovaNo ratings yet

- Group 5 - Variable Universal Life (Final)Document32 pagesGroup 5 - Variable Universal Life (Final)Pút ChoiNo ratings yet

- Chapter 7 StudentDocument61 pagesChapter 7 StudentLinh HoangNo ratings yet

- 24.4.22 Treasury Presentation PDFDocument102 pages24.4.22 Treasury Presentation PDFkumarbk3No ratings yet

- Retained EarningsDocument6 pagesRetained EarningsRuth MacaspacNo ratings yet

- A Comparative Study On One Time Investment and Systematic Investment Plans in Mutual Funds-Conceptual StudyDocument6 pagesA Comparative Study On One Time Investment and Systematic Investment Plans in Mutual Funds-Conceptual StudySharon BennyNo ratings yet

- SEC-Cover - Sheet-for-AFSDocument13 pagesSEC-Cover - Sheet-for-AFSArlene FelicianoNo ratings yet

- Assignment OnDocument40 pagesAssignment OnTutul HassanNo ratings yet

- Global Unicorn Company 2019Document34 pagesGlobal Unicorn Company 2019rickyNo ratings yet

- May TechDocument6 pagesMay TechMonica LlenaresasNo ratings yet

- Rich Dad Poor Dad DBSDBJSBDJSSDDocument6 pagesRich Dad Poor Dad DBSDBJSBDJSSDEliza BethNo ratings yet