Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsSummarize

Summarize

Uploaded by

Analyn MiñanoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Spotify in 2020: Can The Company Remain Competitive?: Case 9Document23 pagesSpotify in 2020: Can The Company Remain Competitive?: Case 9hieu mai71% (7)

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Document2 pagesWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- Forecasting Short-Term Financial RequirementsDocument22 pagesForecasting Short-Term Financial RequirementsArmando Robles100% (1)

- Budgeting and Its TypesDocument28 pagesBudgeting and Its Typesnitin0010No ratings yet

- Budget: Events Project OperationDocument3 pagesBudget: Events Project OperationAngelie SanchezNo ratings yet

- Distribution Transformer Manufacturing Process ManualDocument64 pagesDistribution Transformer Manufacturing Process ManualGaurav Sagar100% (2)

- CHAPTER III BudgetDocument10 pagesCHAPTER III BudgetGizachew NadewNo ratings yet

- Chapter Iii. Master Budget: An Overall PlanDocument10 pagesChapter Iii. Master Budget: An Overall PlanshimelisNo ratings yet

- BUDGETINGDocument11 pagesBUDGETINGCeceil PajaronNo ratings yet

- MA, CH 05Document16 pagesMA, CH 05Nahom AberaNo ratings yet

- Cost II CH-3@2014Document23 pagesCost II CH-3@2014firaolmosisabonkeNo ratings yet

- Chapter 3Document16 pagesChapter 3Chera HabebawNo ratings yet

- Unit II.0 - Budgetary Control and Standard CostingDocument22 pagesUnit II.0 - Budgetary Control and Standard CostingSarthak VermaNo ratings yet

- Tpc.4.Budgetng For Bsa.3Document21 pagesTpc.4.Budgetng For Bsa.3Khainza DianaNo ratings yet

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryNo ratings yet

- Performance Based Budgeting: Some ViewsDocument4 pagesPerformance Based Budgeting: Some ViewsadityatnnlsNo ratings yet

- Unit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingDocument11 pagesUnit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingbojaNo ratings yet

- Chapter 3Document14 pagesChapter 3Tariku KolchaNo ratings yet

- Budgeting in DetailDocument94 pagesBudgeting in DetailNyimaSherpaNo ratings yet

- Budget:: Factors Affecting Budget PlanningDocument5 pagesBudget:: Factors Affecting Budget Planningmadhu anvekarNo ratings yet

- Chapter 01 - IntrodutionDocument3 pagesChapter 01 - IntrodutionHiền VõNo ratings yet

- Fiscal PlaningDocument6 pagesFiscal PlaningJason YangaNo ratings yet

- Budgetary ControlDocument31 pagesBudgetary Controlraghavmore5_11660812No ratings yet

- Planning Involves Developing Objectives and Formulating Steps To Achieve Those ObjectivesDocument3 pagesPlanning Involves Developing Objectives and Formulating Steps To Achieve Those ObjectivesKarl Michael NavaretteNo ratings yet

- BudgetDocument6 pagesBudgetKedar SonawaneNo ratings yet

- Ch. 2 Master Budget-Rev-2Document27 pagesCh. 2 Master Budget-Rev-2solomon adamu100% (1)

- Lesson 14 TextbookDocument36 pagesLesson 14 Textbookluo jamesNo ratings yet

- 23 - Budgeting For Planning and ControlDocument37 pages23 - Budgeting For Planning and ControlEka FalahNo ratings yet

- Budgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToDocument6 pagesBudgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToJoy VNo ratings yet

- BUDGETDocument15 pagesBUDGETMAGOMU DAN DAVIDNo ratings yet

- Managerial Accounting: Summary: Chapter 10 - Master BudgetingDocument6 pagesManagerial Accounting: Summary: Chapter 10 - Master BudgetingIra PutriNo ratings yet

- Cost II Chapter IIIDocument9 pagesCost II Chapter IIIbushunanesa2015No ratings yet

- Budgeting/ Management by Objectives: Joy April M. de Leon, R.NDocument20 pagesBudgeting/ Management by Objectives: Joy April M. de Leon, R.NjoiabelaNo ratings yet

- Overhead BudgetDocument16 pagesOverhead BudgetRonak Singh75% (4)

- Chapter 11 Revision Notes: Planning and BudgetingDocument5 pagesChapter 11 Revision Notes: Planning and BudgetingRoli YonoNo ratings yet

- Budget in 1Document9 pagesBudget in 1Tanwi Jain100% (1)

- What Is A Budget?Document6 pagesWhat Is A Budget?vipasa ranaNo ratings yet

- TIS Budgeting Definition and Objectives of Budgeting March 09 242200912812Document7 pagesTIS Budgeting Definition and Objectives of Budgeting March 09 242200912812Mir Ali TalpurNo ratings yet

- Master Budget BestDocument10 pagesMaster Budget BestTekaling NegashNo ratings yet

- Budgetary Control at Omaxe LimitedDocument81 pagesBudgetary Control at Omaxe Limitedanshul5410100% (1)

- Rolling BudgetDocument7 pagesRolling BudgetThảo Hương PhạmNo ratings yet

- Seminar On Fiscal Planning: Submitted To MRS K. Sathiya Lakshmi Professor Sarvodaya College of NursingDocument9 pagesSeminar On Fiscal Planning: Submitted To MRS K. Sathiya Lakshmi Professor Sarvodaya College of Nursingsharinkvarghese100% (1)

- Cost Accounting Research Paper, B. Sri ArunaDocument7 pagesCost Accounting Research Paper, B. Sri ArunapriyaNo ratings yet

- Chapter Iii. Master Budget: An Overall PlanDocument16 pagesChapter Iii. Master Budget: An Overall PlanAsteway MesfinNo ratings yet

- Purpose For Budgeting - Literature Review: Santoshi AruDocument14 pagesPurpose For Budgeting - Literature Review: Santoshi AruSandesh PatilNo ratings yet

- UGB106 Introduction To Management AccountingDocument7 pagesUGB106 Introduction To Management AccountingRuzha FilevaNo ratings yet

- Budgetary ControlDocument64 pagesBudgetary ControlTapaswini MohapatraNo ratings yet

- Matriculation NoDocument12 pagesMatriculation NokerttanaNo ratings yet

- Master BudgetDocument11 pagesMaster BudgetEyuel SintayehuNo ratings yet

- SOE11144 Global Business Economics and FinanceDocument12 pagesSOE11144 Global Business Economics and FinanceNadia RiazNo ratings yet

- BudgetingDocument9 pagesBudgetingCaelah Jamie TubleNo ratings yet

- Budgetary ControlDocument20 pagesBudgetary ControlSailesh RoutNo ratings yet

- Budgetary Control ProcessDocument11 pagesBudgetary Control ProcessBasit 36No ratings yet

- Budget PlnningDocument17 pagesBudget PlnningIvine T MakandangweNo ratings yet

- BudgetDocument18 pagesBudgetembiale ayalu100% (1)

- Cost II Chapter ThreeDocument106 pagesCost II Chapter Threefekadegebretsadik478729No ratings yet

- Ethical Issues in Budget PreparationDocument26 pagesEthical Issues in Budget PreparationJoseph SimonNo ratings yet

- Chapter Two Master BudgetDocument15 pagesChapter Two Master BudgetNigussie BerhanuNo ratings yet

- Budgeting MAF 280Document6 pagesBudgeting MAF 280HazwaniSagimanNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Flexible Budgeting Essentials: A Route to Financial SuccessFrom EverandFlexible Budgeting Essentials: A Route to Financial SuccessNo ratings yet

- According To DizonDocument1 pageAccording To DizonAnalyn MiñanoNo ratings yet

- AssignDocument2 pagesAssignAnalyn MiñanoNo ratings yet

- PlanningDocument4 pagesPlanningAnalyn MiñanoNo ratings yet

- Travel Itinerar1Document1 pageTravel Itinerar1Analyn MiñanoNo ratings yet

- SafetyDocument11 pagesSafetyAnalyn MiñanoNo ratings yet

- RelationshipDocument2 pagesRelationshipAnalyn MiñanoNo ratings yet

- Chapter 1 and 2Document2 pagesChapter 1 and 2Analyn MiñanoNo ratings yet

- Chapter 1 and 2Document1 pageChapter 1 and 2Analyn MiñanoNo ratings yet

- Case StudyDocument6 pagesCase StudyAnalyn MiñanoNo ratings yet

- Chapter 1: Enterprise Agility - Agile 4 AllDocument14 pagesChapter 1: Enterprise Agility - Agile 4 AllDavid HernándezNo ratings yet

- Milestone 4 Task 2: Make A SaleDocument4 pagesMilestone 4 Task 2: Make A Salegatete samNo ratings yet

- 2 Financial AnalysisDocument22 pages2 Financial AnalysisAB11A4-Condor, Joana MieNo ratings yet

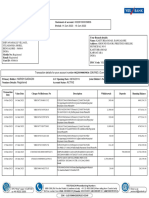

- Account Statement 14 Jun 2023-19 Jun 2023Document4 pagesAccount Statement 14 Jun 2023-19 Jun 2023propvisor real estateNo ratings yet

- Lesson 6 Close The Project - PhaseDocument29 pagesLesson 6 Close The Project - Phasemansoor karinchapadiNo ratings yet

- Emba, CRM 2Document17 pagesEmba, CRM 2Md Shahrier Jaman AyonNo ratings yet

- Bella Bolla - PrintInspectionDocument1 pageBella Bolla - PrintInspectionBryce AirgoodNo ratings yet

- Brief Prof Gitika KapoorDocument2 pagesBrief Prof Gitika KapoorNaman MaheshwariNo ratings yet

- Nahidah Rana 2022Document3 pagesNahidah Rana 2022nahidahcomNo ratings yet

- FR Ind As 101Document55 pagesFR Ind As 101Dheeraj TurpunatiNo ratings yet

- Financial Ration As A Powerful Instrument To Predict Insolvency, A Study Using Boosting Algorithms in Colombian Firms - JEDocument11 pagesFinancial Ration As A Powerful Instrument To Predict Insolvency, A Study Using Boosting Algorithms in Colombian Firms - JEJunior Adan Enriquez CabezudoNo ratings yet

- 1 GDP (NationalIncomeAccounting)Document53 pages1 GDP (NationalIncomeAccounting)smileseptemberNo ratings yet

- ApplyBoard Invoice Template CanadaDocument2 pagesApplyBoard Invoice Template CanadasmangrishNo ratings yet

- Qseap Technologies Company ProfileDocument4 pagesQseap Technologies Company ProfileSanjay MazumderNo ratings yet

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocument5 pagesSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L Blackplainingfriesishd1hNo ratings yet

- Mpirical BrochureDocument9 pagesMpirical BrochuresachinNo ratings yet

- Chapter 2Document23 pagesChapter 2Ashebir HunegnawNo ratings yet

- Cambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Document4 pagesCambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Sraboni ChowdhuryNo ratings yet

- Handout 7: MonopolyDocument8 pagesHandout 7: MonopolyRaulNo ratings yet

- Scan Aug 23, 2020 PDFDocument7 pagesScan Aug 23, 2020 PDFRgtdgcn c rydtNo ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- Sap Tcodes: Logistics ExecutionDocument53 pagesSap Tcodes: Logistics ExecutionGabrielNo ratings yet

- Comment To Reply - Logicore - WatsonDocument5 pagesComment To Reply - Logicore - WatsonSanchez Roman VictorNo ratings yet

- TIPS FOR LAND BUYERS IN KERALA A James Adhikaram PresentationDocument33 pagesTIPS FOR LAND BUYERS IN KERALA A James Adhikaram PresentationJames Adhikaram100% (1)

- Acct Statement - XX9767 - 09012024Document60 pagesAcct Statement - XX9767 - 09012024ansarimdfiroz029No ratings yet

- Blockchain and Central Bank Digital CurrencyDocument7 pagesBlockchain and Central Bank Digital CurrencyIgorFilkoNo ratings yet

- An Investigation Into The Succession in One of The Oldest and Biggest Family Businesses in India: Case Study of The Godrej GroupDocument8 pagesAn Investigation Into The Succession in One of The Oldest and Biggest Family Businesses in India: Case Study of The Godrej GroupSudha Swayam PravaNo ratings yet

Summarize

Summarize

Uploaded by

Analyn Miñano0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

summarize

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views2 pagesSummarize

Summarize

Uploaded by

Analyn MiñanoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Summary:

This learning unit aims to equip individuals with the skills

and knowledge to prepare budget information for hospitality

businesses. Budgets are essential management tools for small and

medium-sized businesses, serving different purposes and

connecting with each other. Operational and capital budgets are

two types of budgets that are created for different purposes.

Operational budgets are detailed projections of a company's

revenues and expenses for the upcoming fiscal year, recording

expected cash flows from buying and selling activities and their

effects on the income statement. They generally cover one fiscal

year. Capital budgets, on the other hand, are paid out of future

cash flows from projects and represent the sources of funding and

the purchases of fixed assets. Planning for capital acquisitions

is generally done for one to three years, while an operational

budget projects the activities of the firm in buying, selling,

and paying bills on an annual basis.

Interactions between operational and capital budgets are

crucial, as changes in one budget can lead to modifications in

the other. For example, the purchases of fixed assets projected

by the capital budget will have an impact on the operational

budget, as new equipment may reduce costs and increase revenues

due to more efficient production processes. These changes must be

coordinated with the capital budget and reflected on the

operations budget. If the company wants to purchase fixed assets,

some of the cash needed may have to come from the firm's normal

operations and cash flow, so an operational budget has to

incorporate this requirement for cash in addition to paying

normal expenses.

Budgets are essential management tools for all small

business owners, especially in the hospitality industry, where

careful management of expenses is essential. Hotels and resorts

have large staffing requirements, and it is important to have

sufficient human resources on the property to deliver excellent

customer service without being overstaffed, which can reduce the

hotel's profitability.

The budget planning process in businesses involves using

spreadsheet software to forecast revenues and expenses, as well

as strategic marketing planning and planning for capital

expenditures. The general manager reviews the consolidated budget

with other managers and makes adjustments based on discussions.

Relevant colleagues can contribute to the budget planning

process with adequate notice, and two different styles of budget

planning are used: the Top Down Approach and the Bottom Down

Approach. The Top Down Approach involves owners, managers, or the

budget committee creating the budget and informing all

stakeholders about the business objectives and the budget that

will meet those objectives. This approach has the advantage of

timely production and efficiency, but lack of communication and

input from relevant colleagues can compromise their cooperation.

The bottom-up approach is a popular strategy for managing

budgets. It involves owners seeking input from the budget

committee, who then make changes based on the committee's

objectives. This approach encourages staff to take ownership of

the budgets, even in cases of disagreements over scarce

resources. The budget committee forum allows for conflicting

demands to be discussed and resolved, ensuring accurate outcomes.

It also allows activity centre managers to coordinate and

circulate information for more accurate outcomes. The committee

relies on budget manual notices and other stakeholders to ensure

a smooth budget process. Some staff may be involved in budget

preparation but not in budget preparation.

You might also like

- Spotify in 2020: Can The Company Remain Competitive?: Case 9Document23 pagesSpotify in 2020: Can The Company Remain Competitive?: Case 9hieu mai71% (7)

- Wiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Document2 pagesWiley - Charlie D. - The Story of The Legendary Bond Trader - 978!0!471-15672-7Rushikesh Inamdar100% (1)

- Forecasting Short-Term Financial RequirementsDocument22 pagesForecasting Short-Term Financial RequirementsArmando Robles100% (1)

- Budgeting and Its TypesDocument28 pagesBudgeting and Its Typesnitin0010No ratings yet

- Budget: Events Project OperationDocument3 pagesBudget: Events Project OperationAngelie SanchezNo ratings yet

- Distribution Transformer Manufacturing Process ManualDocument64 pagesDistribution Transformer Manufacturing Process ManualGaurav Sagar100% (2)

- CHAPTER III BudgetDocument10 pagesCHAPTER III BudgetGizachew NadewNo ratings yet

- Chapter Iii. Master Budget: An Overall PlanDocument10 pagesChapter Iii. Master Budget: An Overall PlanshimelisNo ratings yet

- BUDGETINGDocument11 pagesBUDGETINGCeceil PajaronNo ratings yet

- MA, CH 05Document16 pagesMA, CH 05Nahom AberaNo ratings yet

- Cost II CH-3@2014Document23 pagesCost II CH-3@2014firaolmosisabonkeNo ratings yet

- Chapter 3Document16 pagesChapter 3Chera HabebawNo ratings yet

- Unit II.0 - Budgetary Control and Standard CostingDocument22 pagesUnit II.0 - Budgetary Control and Standard CostingSarthak VermaNo ratings yet

- Tpc.4.Budgetng For Bsa.3Document21 pagesTpc.4.Budgetng For Bsa.3Khainza DianaNo ratings yet

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryNo ratings yet

- Performance Based Budgeting: Some ViewsDocument4 pagesPerformance Based Budgeting: Some ViewsadityatnnlsNo ratings yet

- Unit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingDocument11 pagesUnit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingbojaNo ratings yet

- Chapter 3Document14 pagesChapter 3Tariku KolchaNo ratings yet

- Budgeting in DetailDocument94 pagesBudgeting in DetailNyimaSherpaNo ratings yet

- Budget:: Factors Affecting Budget PlanningDocument5 pagesBudget:: Factors Affecting Budget Planningmadhu anvekarNo ratings yet

- Chapter 01 - IntrodutionDocument3 pagesChapter 01 - IntrodutionHiền VõNo ratings yet

- Fiscal PlaningDocument6 pagesFiscal PlaningJason YangaNo ratings yet

- Budgetary ControlDocument31 pagesBudgetary Controlraghavmore5_11660812No ratings yet

- Planning Involves Developing Objectives and Formulating Steps To Achieve Those ObjectivesDocument3 pagesPlanning Involves Developing Objectives and Formulating Steps To Achieve Those ObjectivesKarl Michael NavaretteNo ratings yet

- BudgetDocument6 pagesBudgetKedar SonawaneNo ratings yet

- Ch. 2 Master Budget-Rev-2Document27 pagesCh. 2 Master Budget-Rev-2solomon adamu100% (1)

- Lesson 14 TextbookDocument36 pagesLesson 14 Textbookluo jamesNo ratings yet

- 23 - Budgeting For Planning and ControlDocument37 pages23 - Budgeting For Planning and ControlEka FalahNo ratings yet

- Budgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToDocument6 pagesBudgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToJoy VNo ratings yet

- BUDGETDocument15 pagesBUDGETMAGOMU DAN DAVIDNo ratings yet

- Managerial Accounting: Summary: Chapter 10 - Master BudgetingDocument6 pagesManagerial Accounting: Summary: Chapter 10 - Master BudgetingIra PutriNo ratings yet

- Cost II Chapter IIIDocument9 pagesCost II Chapter IIIbushunanesa2015No ratings yet

- Budgeting/ Management by Objectives: Joy April M. de Leon, R.NDocument20 pagesBudgeting/ Management by Objectives: Joy April M. de Leon, R.NjoiabelaNo ratings yet

- Overhead BudgetDocument16 pagesOverhead BudgetRonak Singh75% (4)

- Chapter 11 Revision Notes: Planning and BudgetingDocument5 pagesChapter 11 Revision Notes: Planning and BudgetingRoli YonoNo ratings yet

- Budget in 1Document9 pagesBudget in 1Tanwi Jain100% (1)

- What Is A Budget?Document6 pagesWhat Is A Budget?vipasa ranaNo ratings yet

- TIS Budgeting Definition and Objectives of Budgeting March 09 242200912812Document7 pagesTIS Budgeting Definition and Objectives of Budgeting March 09 242200912812Mir Ali TalpurNo ratings yet

- Master Budget BestDocument10 pagesMaster Budget BestTekaling NegashNo ratings yet

- Budgetary Control at Omaxe LimitedDocument81 pagesBudgetary Control at Omaxe Limitedanshul5410100% (1)

- Rolling BudgetDocument7 pagesRolling BudgetThảo Hương PhạmNo ratings yet

- Seminar On Fiscal Planning: Submitted To MRS K. Sathiya Lakshmi Professor Sarvodaya College of NursingDocument9 pagesSeminar On Fiscal Planning: Submitted To MRS K. Sathiya Lakshmi Professor Sarvodaya College of Nursingsharinkvarghese100% (1)

- Cost Accounting Research Paper, B. Sri ArunaDocument7 pagesCost Accounting Research Paper, B. Sri ArunapriyaNo ratings yet

- Chapter Iii. Master Budget: An Overall PlanDocument16 pagesChapter Iii. Master Budget: An Overall PlanAsteway MesfinNo ratings yet

- Purpose For Budgeting - Literature Review: Santoshi AruDocument14 pagesPurpose For Budgeting - Literature Review: Santoshi AruSandesh PatilNo ratings yet

- UGB106 Introduction To Management AccountingDocument7 pagesUGB106 Introduction To Management AccountingRuzha FilevaNo ratings yet

- Budgetary ControlDocument64 pagesBudgetary ControlTapaswini MohapatraNo ratings yet

- Matriculation NoDocument12 pagesMatriculation NokerttanaNo ratings yet

- Master BudgetDocument11 pagesMaster BudgetEyuel SintayehuNo ratings yet

- SOE11144 Global Business Economics and FinanceDocument12 pagesSOE11144 Global Business Economics and FinanceNadia RiazNo ratings yet

- BudgetingDocument9 pagesBudgetingCaelah Jamie TubleNo ratings yet

- Budgetary ControlDocument20 pagesBudgetary ControlSailesh RoutNo ratings yet

- Budgetary Control ProcessDocument11 pagesBudgetary Control ProcessBasit 36No ratings yet

- Budget PlnningDocument17 pagesBudget PlnningIvine T MakandangweNo ratings yet

- BudgetDocument18 pagesBudgetembiale ayalu100% (1)

- Cost II Chapter ThreeDocument106 pagesCost II Chapter Threefekadegebretsadik478729No ratings yet

- Ethical Issues in Budget PreparationDocument26 pagesEthical Issues in Budget PreparationJoseph SimonNo ratings yet

- Chapter Two Master BudgetDocument15 pagesChapter Two Master BudgetNigussie BerhanuNo ratings yet

- Budgeting MAF 280Document6 pagesBudgeting MAF 280HazwaniSagimanNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Document12 pagesSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarNo ratings yet

- Flexible Budgeting Essentials: A Route to Financial SuccessFrom EverandFlexible Budgeting Essentials: A Route to Financial SuccessNo ratings yet

- According To DizonDocument1 pageAccording To DizonAnalyn MiñanoNo ratings yet

- AssignDocument2 pagesAssignAnalyn MiñanoNo ratings yet

- PlanningDocument4 pagesPlanningAnalyn MiñanoNo ratings yet

- Travel Itinerar1Document1 pageTravel Itinerar1Analyn MiñanoNo ratings yet

- SafetyDocument11 pagesSafetyAnalyn MiñanoNo ratings yet

- RelationshipDocument2 pagesRelationshipAnalyn MiñanoNo ratings yet

- Chapter 1 and 2Document2 pagesChapter 1 and 2Analyn MiñanoNo ratings yet

- Chapter 1 and 2Document1 pageChapter 1 and 2Analyn MiñanoNo ratings yet

- Case StudyDocument6 pagesCase StudyAnalyn MiñanoNo ratings yet

- Chapter 1: Enterprise Agility - Agile 4 AllDocument14 pagesChapter 1: Enterprise Agility - Agile 4 AllDavid HernándezNo ratings yet

- Milestone 4 Task 2: Make A SaleDocument4 pagesMilestone 4 Task 2: Make A Salegatete samNo ratings yet

- 2 Financial AnalysisDocument22 pages2 Financial AnalysisAB11A4-Condor, Joana MieNo ratings yet

- Account Statement 14 Jun 2023-19 Jun 2023Document4 pagesAccount Statement 14 Jun 2023-19 Jun 2023propvisor real estateNo ratings yet

- Lesson 6 Close The Project - PhaseDocument29 pagesLesson 6 Close The Project - Phasemansoor karinchapadiNo ratings yet

- Emba, CRM 2Document17 pagesEmba, CRM 2Md Shahrier Jaman AyonNo ratings yet

- Bella Bolla - PrintInspectionDocument1 pageBella Bolla - PrintInspectionBryce AirgoodNo ratings yet

- Brief Prof Gitika KapoorDocument2 pagesBrief Prof Gitika KapoorNaman MaheshwariNo ratings yet

- Nahidah Rana 2022Document3 pagesNahidah Rana 2022nahidahcomNo ratings yet

- FR Ind As 101Document55 pagesFR Ind As 101Dheeraj TurpunatiNo ratings yet

- Financial Ration As A Powerful Instrument To Predict Insolvency, A Study Using Boosting Algorithms in Colombian Firms - JEDocument11 pagesFinancial Ration As A Powerful Instrument To Predict Insolvency, A Study Using Boosting Algorithms in Colombian Firms - JEJunior Adan Enriquez CabezudoNo ratings yet

- 1 GDP (NationalIncomeAccounting)Document53 pages1 GDP (NationalIncomeAccounting)smileseptemberNo ratings yet

- ApplyBoard Invoice Template CanadaDocument2 pagesApplyBoard Invoice Template CanadasmangrishNo ratings yet

- Qseap Technologies Company ProfileDocument4 pagesQseap Technologies Company ProfileSanjay MazumderNo ratings yet

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocument5 pagesSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L Blackplainingfriesishd1hNo ratings yet

- Mpirical BrochureDocument9 pagesMpirical BrochuresachinNo ratings yet

- Chapter 2Document23 pagesChapter 2Ashebir HunegnawNo ratings yet

- Cambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Document4 pagesCambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Sraboni ChowdhuryNo ratings yet

- Handout 7: MonopolyDocument8 pagesHandout 7: MonopolyRaulNo ratings yet

- Scan Aug 23, 2020 PDFDocument7 pagesScan Aug 23, 2020 PDFRgtdgcn c rydtNo ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- Sap Tcodes: Logistics ExecutionDocument53 pagesSap Tcodes: Logistics ExecutionGabrielNo ratings yet

- Comment To Reply - Logicore - WatsonDocument5 pagesComment To Reply - Logicore - WatsonSanchez Roman VictorNo ratings yet

- TIPS FOR LAND BUYERS IN KERALA A James Adhikaram PresentationDocument33 pagesTIPS FOR LAND BUYERS IN KERALA A James Adhikaram PresentationJames Adhikaram100% (1)

- Acct Statement - XX9767 - 09012024Document60 pagesAcct Statement - XX9767 - 09012024ansarimdfiroz029No ratings yet

- Blockchain and Central Bank Digital CurrencyDocument7 pagesBlockchain and Central Bank Digital CurrencyIgorFilkoNo ratings yet

- An Investigation Into The Succession in One of The Oldest and Biggest Family Businesses in India: Case Study of The Godrej GroupDocument8 pagesAn Investigation Into The Succession in One of The Oldest and Biggest Family Businesses in India: Case Study of The Godrej GroupSudha Swayam PravaNo ratings yet