Professional Documents

Culture Documents

Note On SSE

Note On SSE

Uploaded by

kavishvyas999Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note On SSE

Note On SSE

Uploaded by

kavishvyas999Copyright:

Available Formats

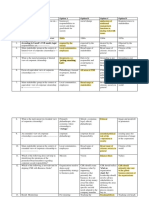

SOCIAL STOCK EXCHANGE

2. Eligible Investor: Retail investors are permitted to invest only in securities offered by

A. Social Stock Exchange (SSE): SSEs is a separate segment of the existing stock

FPEs under the main board. In all other cases, only institutional investors and non-

exchanges, that help a social enterprise(s) (“SE”) to raise funds from the public

institutional investors can invest in securities issued by SE.

through the stock exchange mechanism.

3. Reporting Requirements: A SE shall be required to submit an annual impact report

B. Legal Framework governing the SSE: Chapter X-A of the Securities and Exchange

(assessed by a social impact assessment firm employing social impact assessor(s)) to

Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018

the SSE.

provides a legal framework for the SSE. The key provisions are given below:

The aim behind using the aforementioned criteria is to select only those entities that

1. Social Enterprise: An entity fulfilling the following criteria qualifies to be recognised

create measurable social impact and report such impact.

as a ‘SE’: (i) The entity shall be engaged in one or more of the eligible activities

such as health care, education, environment etc.; (ii) the entity shall target

C. Utility Factor for NPOs and FPEs

underserved or less privileged population; and (iii) at least 67% of its activities

must benefit the target population, demonstrated by either one or more of: (a)

1. For NPOs:

revenue; (b) expenditure; and (c) customer base

Issue of ZCZP: (i) suited to investors who are looking to create social impact and do

not wish to have their funds returned to them; (ii) No guarantee of creating social

impact; (iii) automatic delisting at the end of the maturity; and (iii) non-tradable,

hence no tax on transactions.

Donations through MF: It is proposed that funds will be raised through close-ended

mutual funds whereby the investors will donate the returns earned on such mutual

funds to the NPOs.

2. FPEs: for fundraising, the FPEs have access to the capital markets through

conventional sources, viz., the main board, SME exchange, or debt segment. The

additional recognition of being a “SE” may benefit it in long-term value creation as

profit generation and social impact creation can be complementary to each other.

D. First Listing on SSE: A Bangalore-based NPO, SGBS Unnati Foundation (SUF) has

become the first entity to list ZCZP on the social SSE442. SUF raised an amount of Rs.

2 Crores for a tenure of 12 months.

As of today, 54 NPOs are registered with SSE, and it is expected that listing at SSEs

can provide visibility to SE thereby, helping them to approach the public for fundraise

at regular intervals if they can show good outcomes.

You might also like

- 7 Emails For Potential InvestorsDocument24 pages7 Emails For Potential InvestorsVenugopal T RNo ratings yet

- The Singapore Variable Capital Companies (VCC) at A GlanceDocument8 pagesThe Singapore Variable Capital Companies (VCC) at A GlanceMinal SequeiraNo ratings yet

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- Stuvia 330016 Political Economy in International Perspective PDFDocument61 pagesStuvia 330016 Political Economy in International Perspective PDFJohn100% (1)

- Decoding Social Stock ExchangeDocument13 pagesDecoding Social Stock Exchangedpandya2209No ratings yet

- Framework For SSE 2021Document38 pagesFramework For SSE 2021Akash JeganNo ratings yet

- ICReport Crowdfunding VFDocument16 pagesICReport Crowdfunding VFromainNo ratings yet

- Client Alert - Amendments To SEBI ICDR RegulationsDocument6 pagesClient Alert - Amendments To SEBI ICDR RegulationsSakshi JhaNo ratings yet

- Social Stock Exchange: Why in NewsDocument2 pagesSocial Stock Exchange: Why in NewsCHINNABABUNo ratings yet

- Social Stock Exchange FAQs - EnglishDocument13 pagesSocial Stock Exchange FAQs - EnglishShivaniNo ratings yet

- Vinod Kothari Guide On SSEDocument5 pagesVinod Kothari Guide On SSEAkash JeganNo ratings yet

- CFL - Amendments - June 2023Document12 pagesCFL - Amendments - June 2023Ranjana YadavNo ratings yet

- Role of Financial InstitutionDocument20 pagesRole of Financial InstitutionSheebu ShamimNo ratings yet

- D0683SP Ans2Document18 pagesD0683SP Ans2Tanmay SanchetiNo ratings yet

- Collective Investment Scheme (Cis)Document13 pagesCollective Investment Scheme (Cis)AdyashaNo ratings yet

- SKS IPO AnalysisDocument6 pagesSKS IPO Analysissri1No ratings yet

- Wadia Ghady QuestionsDocument6 pagesWadia Ghady Questionsshantanu.shimpi220No ratings yet

- Last 8 Years PT 365 Important Economy TermsDocument28 pagesLast 8 Years PT 365 Important Economy TermsakrajputmarcosNo ratings yet

- AMFI Budget Proposals - FY 2019-20Document23 pagesAMFI Budget Proposals - FY 2019-20rajeshtripathi2006No ratings yet

- Social Stock ExchangeDocument4 pagesSocial Stock Exchangeyodeci3893No ratings yet

- Transformation of Microfinance in India: Experiences, Options and FutureDocument17 pagesTransformation of Microfinance in India: Experiences, Options and FutureAnonymous VOVCOiNo ratings yet

- Hustler FundDocument13 pagesHustler Fundtutorfelix777No ratings yet

- CSR FaqDocument3 pagesCSR Faqmerayogdaan123No ratings yet

- Introduction To Social Finance and Impact InvestmentDocument13 pagesIntroduction To Social Finance and Impact InvestmentreliaNo ratings yet

- PCC Assignment 5 P2270410.Document4 pagesPCC Assignment 5 P2270410.p2270304No ratings yet

- RBI FAQs NBFCs 10-04-15Document8 pagesRBI FAQs NBFCs 10-04-15jeetNo ratings yet

- Ham4e - Textbook Errata - 032119 PDFDocument16 pagesHam4e - Textbook Errata - 032119 PDFAstha GoplaniNo ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument28 pagesChapter 1 - Introduction To Financial ManagementArminda Villamin100% (1)

- Benchmark Construction and Performance Evaluation of Mezzanine Finance Funds - 2017Document7 pagesBenchmark Construction and Performance Evaluation of Mezzanine Finance Funds - 2017farid.ilishkinNo ratings yet

- Frequently Asked QuestionsDocument4 pagesFrequently Asked QuestionspradeepNo ratings yet

- SRI Operating GuidelinesDocument9 pagesSRI Operating GuidelinesAJAY KUMAR JAINNo ratings yet

- Private Equity Part 3Document6 pagesPrivate Equity Part 3Paolina NikolovaNo ratings yet

- Mutual Fund RigDocument74 pagesMutual Fund RigRig VedNo ratings yet

- Cat Bonds Demystified: RMS Guide To The Asset ClassDocument12 pagesCat Bonds Demystified: RMS Guide To The Asset ClassRicha TripathiNo ratings yet

- The Legal Aspects of Foreign Investment in India 1646141643Document103 pagesThe Legal Aspects of Foreign Investment in India 1646141643Sanket PatilNo ratings yet

- NBFC Note RBI MAT 2Document19 pagesNBFC Note RBI MAT 2Prashant RatnpandeyNo ratings yet

- Topic: Nidhi Companies: L - D M C.PDocument15 pagesTopic: Nidhi Companies: L - D M C.PAnusha Rao ThotaNo ratings yet

- Test 11 (Economy Chapter On Resource Mobilisation in India)Document29 pagesTest 11 (Economy Chapter On Resource Mobilisation in India)CyrilMaxNo ratings yet

- CSR Practice Quiz 2020 Sl. No. Questions Option A Option B Option C Option DDocument5 pagesCSR Practice Quiz 2020 Sl. No. Questions Option A Option B Option C Option DMuskan ManchandaNo ratings yet

- Public Issue FaqDocument19 pagesPublic Issue Faqapi-3705645No ratings yet

- Primary Market India: Assignment of Management of Financial ServicesDocument16 pagesPrimary Market India: Assignment of Management of Financial ServicesRajneesh BansalNo ratings yet

- Sources of Financing: Prepared By: Nur Hayati Binti Ab Samad Faculty of AccountancyDocument29 pagesSources of Financing: Prepared By: Nur Hayati Binti Ab Samad Faculty of AccountancyAmirah SufianNo ratings yet

- 2.1 The Business Environment: Chapter 2: Financial Institutions, Intruments, and MarketsDocument12 pages2.1 The Business Environment: Chapter 2: Financial Institutions, Intruments, and MarketsIan BucoyaNo ratings yet

- Venture Capital FinancingDocument31 pagesVenture Capital FinancingkumbharnehaNo ratings yet

- This Content Downloaded From 122.170.126.143 On Sun, 28 Mar 2021 09:32:50 UTCDocument5 pagesThis Content Downloaded From 122.170.126.143 On Sun, 28 Mar 2021 09:32:50 UTCGaurav AgrawalNo ratings yet

- Under The Guidance Of:-Presented By: - Ms. Geeta Saini Shubham Bansal Mba 2 Year 2017038Document21 pagesUnder The Guidance Of:-Presented By: - Ms. Geeta Saini Shubham Bansal Mba 2 Year 2017038akshay guptaNo ratings yet

- MF PDFDocument27 pagesMF PDFPk AroraNo ratings yet

- Textual Learning Material - Module 3Document33 pagesTextual Learning Material - Module 3Jerry JohnNo ratings yet

- Social Stock Exchange: A Global Perspective With Indian FeasibilityDocument13 pagesSocial Stock Exchange: A Global Perspective With Indian FeasibilityINSTITUTE OF LEGAL EDUCATIONNo ratings yet

- Now, Pay Health Premium Monthly: Preview PreviewDocument1 pageNow, Pay Health Premium Monthly: Preview PreviewsudNo ratings yet

- MFKRDocument33 pagesMFKRsanjit kadneNo ratings yet

- June 15Document24 pagesJune 15arjunjoshiNo ratings yet

- Sid - Combined - IIDocument86 pagesSid - Combined - IInitinNo ratings yet

- SynopsisDocument14 pagesSynopsisManish NaharNo ratings yet

- Unit II-d-Collective Investment SchemeDocument5 pagesUnit II-d-Collective Investment SchemeRana Pratap SwainNo ratings yet

- Suggested Answer - Syl12 - June 2015 - Paper - 13Document150 pagesSuggested Answer - Syl12 - June 2015 - Paper - 13SEYAD SHARIAT FINANCE LIMITEDNo ratings yet

- WEF Alternative Investments 2020 FutureDocument59 pagesWEF Alternative Investments 2020 FutureOwenNo ratings yet

- Company Structure and Organisation: Compiled by Lecturer Vida Burbiene Vilnius College Faculty of Economics, 2009Document8 pagesCompany Structure and Organisation: Compiled by Lecturer Vida Burbiene Vilnius College Faculty of Economics, 2009Daiva ValienėNo ratings yet

- Submitted To: Dr. Suveera Gill: Submitted By: Adhiraj Aditya Ashish Deepak Chandhok Deepak Rana Maninder VipinDocument57 pagesSubmitted To: Dr. Suveera Gill: Submitted By: Adhiraj Aditya Ashish Deepak Chandhok Deepak Rana Maninder VipinRavNeet KaUrNo ratings yet

- Mutual Fund ProspectusDocument2 pagesMutual Fund ProspectusJitiNo ratings yet

- Pub Issue FaqDocument22 pagesPub Issue Faqapi-3713753No ratings yet

- Topic 1 - Overview: Licensing Exam Paper 1 Topic 1Document18 pagesTopic 1 - Overview: Licensing Exam Paper 1 Topic 1anonlukeNo ratings yet

- Microstructure of The Egyptian Stock MarketDocument21 pagesMicrostructure of The Egyptian Stock MarketZakaria HegazyNo ratings yet

- Expanding The Indian Equities Market Through ETFsDocument62 pagesExpanding The Indian Equities Market Through ETFsdanielpolk100% (2)

- Testbank Fim Từ A Đến Z Học Đi Quyên Sap Thi Final Roi Quyên chap 3Document18 pagesTestbank Fim Từ A Đến Z Học Đi Quyên Sap Thi Final Roi Quyên chap 3s3932168No ratings yet

- Articles About Finance - HBS Working KnowledgeDocument98 pagesArticles About Finance - HBS Working KnowledgesaqawsaqawNo ratings yet

- MC 0728Document16 pagesMC 0728mcchronicleNo ratings yet

- R&R in Banking SecurityDocument53 pagesR&R in Banking SecuritySudipa RouthNo ratings yet

- Secrets of The World's Greatest FX Traders2Document11 pagesSecrets of The World's Greatest FX Traders2Wayne Gonsalves100% (2)

- Global Investor Experience The Fees and Expenses Report 2019 v4 PDFDocument57 pagesGlobal Investor Experience The Fees and Expenses Report 2019 v4 PDFCarlo André Peralta InfantesNo ratings yet

- Role of Fii in Share MarketDocument7 pagesRole of Fii in Share MarketMukesh Kumar MishraNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasFernanda ZapataNo ratings yet

- IAB ReportDocument198 pagesIAB ReportMrutunjay PatraNo ratings yet

- Distribution Channels of Mutual FundsDocument1 pageDistribution Channels of Mutual FundsPuvvula KranthikumarNo ratings yet

- Introduction To PE Fund Formation: 22 January 2011 Dali Qian Jian ShenDocument24 pagesIntroduction To PE Fund Formation: 22 January 2011 Dali Qian Jian ShenCrystalonthewayNo ratings yet

- Alex Easson and Eric M. Zolt: I. OverviewDocument35 pagesAlex Easson and Eric M. Zolt: I. OverviewMCINo ratings yet

- The Art of The Variance SwapDocument5 pagesThe Art of The Variance SwapMatt Wall100% (1)

- Mizuho - Bank StatementsDocument5 pagesMizuho - Bank StatementsNaresh KumarNo ratings yet

- SIM Inflation Plus Fund Class B4 Latest13 PDFDocument4 pagesSIM Inflation Plus Fund Class B4 Latest13 PDFSizweNo ratings yet

- The Investing Secrets Of: ISA MillionairesDocument6 pagesThe Investing Secrets Of: ISA MillionairesRamNo ratings yet

- SC Guidelines On SukukDocument69 pagesSC Guidelines On SukukTeam JobbersNo ratings yet

- Securities and Exchange Board of India Sebi Investor Education Programme (Investments in Mutual Funds)Document15 pagesSecurities and Exchange Board of India Sebi Investor Education Programme (Investments in Mutual Funds)myschool90No ratings yet

- Impact of Digitization On Mutual Fund Services in India: KeywordsDocument9 pagesImpact of Digitization On Mutual Fund Services in India: KeywordsKapil RewarNo ratings yet

- Unshakeable SummaryDocument27 pagesUnshakeable SummaryfarookNo ratings yet

- Kimco Realty Corporation: October 06, 2018 Kim - KIMDocument9 pagesKimco Realty Corporation: October 06, 2018 Kim - KIMjaNo ratings yet

- Anz Research: Anz-Roy Morgan Consumer ConfidenceDocument4 pagesAnz Research: Anz-Roy Morgan Consumer Confidencepathanfor786No ratings yet

- R03.4 Guidance For Standards III (A) and III (B)Document14 pagesR03.4 Guidance For Standards III (A) and III (B)Bảo TrâmNo ratings yet

- Project Jito - DRHP (Filing Version) (Blackline) - 20200218172419Document238 pagesProject Jito - DRHP (Filing Version) (Blackline) - 20200218172419SubscriptionNo ratings yet

- Leverage Analysis ProjectDocument106 pagesLeverage Analysis Projectbalki123No ratings yet