Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 views2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

Uploaded by

hftysndt2jCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Chrysler CaseDocument7 pagesChrysler CasejoedlaranoiiiNo ratings yet

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- RESA - AP-702S (MCQs Solutions To Problems)Document12 pagesRESA - AP-702S (MCQs Solutions To Problems)Mellani100% (1)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Audit of Cash PDFDocument3 pagesAudit of Cash PDFVincent SampianoNo ratings yet

- SM - ANSWERS To PROBLEM QUESTIONS - Chapter 12Document4 pagesSM - ANSWERS To PROBLEM QUESTIONS - Chapter 12Sufiyya HabeebNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- Answers To Bac AssignmentDocument3 pagesAnswers To Bac AssignmentcyrilmusondaNo ratings yet

- (03B) Cash SPECIAL Quiz ANSWER KEYDocument6 pages(03B) Cash SPECIAL Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Finals QuizDocument7 pagesFinals QuizRobert AlbanoNo ratings yet

- Audit: Cash-and-Cash Equivalent: Problem 1Document12 pagesAudit: Cash-and-Cash Equivalent: Problem 1Idh skyNo ratings yet

- Solution Chapter 12 Bank ReconciliationDocument5 pagesSolution Chapter 12 Bank Reconciliationsaiful syahmiNo ratings yet

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- ReconciliationDocument6 pagesReconciliationElizabethNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- MC - Bank Reconciliation and Proof of CashDocument4 pagesMC - Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Cvcitc: College of Business and Accountancy Department of Accountancy Proof of CashDocument2 pagesCvcitc: College of Business and Accountancy Department of Accountancy Proof of CashTyrelle Dela CruzNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- Additional Illustrations-14Document8 pagesAdditional Illustrations-14Gulneer LambaNo ratings yet

- Bank Reconciliation StatementDocument9 pagesBank Reconciliation StatementMarvin tvNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- Transes (Audw3)Document21 pagesTranses (Audw3)dave excelleNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Auditing Problems Summer 2011: Problem 1Document37 pagesAuditing Problems Summer 2011: Problem 1Iscandar Pacasum DisamburunNo ratings yet

- Auditing Problems Assignment AnswersDocument4 pagesAuditing Problems Assignment AnswersSophia Anne Margarette NicolasNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- SOLUTIONS - Metrobank Etc.Document3 pagesSOLUTIONS - Metrobank Etc.Avarel DPNo ratings yet

- Proof of CashDocument1 pageProof of Cashco230154No ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Conceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoDocument7 pagesConceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoJerelyn DaneNo ratings yet

- Prelim Quiz 2 CMPC 313Document10 pagesPrelim Quiz 2 CMPC 313Nicole ViernesNo ratings yet

- Audit of Cash and Cash EquivalentsDocument108 pagesAudit of Cash and Cash Equivalentscarl fuerzasNo ratings yet

- Congrats BSA 3 Namo Welcome To Auditing ProblemsDocument60 pagesCongrats BSA 3 Namo Welcome To Auditing ProblemsannyeongchinguNo ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentSalim MohamedNo ratings yet

- Ervin 2Document48 pagesErvin 2micaangelgonzales.smmcNo ratings yet

- Foundation Acc Full Sol Set 15.11.2021Document245 pagesFoundation Acc Full Sol Set 15.11.2021adityatiwari122006No ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Quiz 3-Audit CashDocument8 pagesQuiz 3-Audit CashCindy CrausNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Test 2 SolutionDocument8 pagesTest 2 SolutionFelicia ChinNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Vidhyaashram First Grade College Corporate Accounting III II AssignmentDocument4 pagesVidhyaashram First Grade College Corporate Accounting III II AssignmentveenaNo ratings yet

- Cash & Cash EDocument1 pageCash & Cash EJoyNo ratings yet

- Audit ProblemsDocument2 pagesAudit ProblemsTicia TungpalanNo ratings yet

- Quiz 1Document3 pagesQuiz 1Van MateoNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Subordinate Court Civil Procedure Manual 8Document78 pagesSubordinate Court Civil Procedure Manual 8hftysndt2jNo ratings yet

- Acc Midyr 2019Document6 pagesAcc Midyr 2019hftysndt2jNo ratings yet

- Diary Rules Zambia Institute of Advanced Legal EducationDocument6 pagesDiary Rules Zambia Institute of Advanced Legal Educationhftysndt2jNo ratings yet

- Certificate of ReconciliationDocument2 pagesCertificate of Reconciliationhftysndt2jNo ratings yet

- BSD ReportDocument18 pagesBSD Reportg domNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Instant Download Ebook PDF Financial Accounting 9th Edition by Robert Libby PDF ScribdDocument34 pagesInstant Download Ebook PDF Financial Accounting 9th Edition by Robert Libby PDF Scribdrobert.gourley486100% (42)

- Customer Relationship Management (CRM) : Submitted by Name: Ratul Bhattacharyya ROLL: 151 Section: CDocument15 pagesCustomer Relationship Management (CRM) : Submitted by Name: Ratul Bhattacharyya ROLL: 151 Section: CrratulrockssNo ratings yet

- Bisleri QUESTIONNAIRESDocument4 pagesBisleri QUESTIONNAIRESPritam KumarNo ratings yet

- Sample Mid Semester Exam With AnswersDocument15 pagesSample Mid Semester Exam With AnswersjojoinnitNo ratings yet

- F3 (Fa) BPP ST 2021-22Document666 pagesF3 (Fa) BPP ST 2021-22Jeyhun0% (1)

- Tugas SKT 11 - Evy Okvita Sari - 03021381823095 - A - PalembangDocument1 pageTugas SKT 11 - Evy Okvita Sari - 03021381823095 - A - PalembangEvy OkvitasariNo ratings yet

- Lukoil A-Vertically Integrated Oil CompanyDocument20 pagesLukoil A-Vertically Integrated Oil CompanyhuccennNo ratings yet

- Consumer Buying Behavior of Rural and Urban Consumers in Batangas City EditedDocument116 pagesConsumer Buying Behavior of Rural and Urban Consumers in Batangas City EditedJM MalaluanNo ratings yet

- Northern Forest ProductsDocument15 pagesNorthern Forest ProductsHương Lan TrịnhNo ratings yet

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- Valuation of Goodwill As On 21 12 2020Document13 pagesValuation of Goodwill As On 21 12 2020jeevan varmaNo ratings yet

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Marketing, Production & Business Analytics Functions of WalmartDocument15 pagesMarketing, Production & Business Analytics Functions of WalmartJay PrajapatiNo ratings yet

- Unit 2 Inventory Management: DR Rajkumari SoniDocument19 pagesUnit 2 Inventory Management: DR Rajkumari SoniAlka PatelNo ratings yet

- Delivering and Performing Services Through Employees and CustomersDocument35 pagesDelivering and Performing Services Through Employees and Customersneha ugyal100% (1)

- Chapter 13 - Marketing Mix - Promotion Business Studies IgcseDocument64 pagesChapter 13 - Marketing Mix - Promotion Business Studies IgcseRida AhmedNo ratings yet

- Case Study StudiesDocument8 pagesCase Study StudiesYagnesh ShahNo ratings yet

- Marketting MixDocument5 pagesMarketting MixyoyoNo ratings yet

- ACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditDocument8 pagesACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditJeffrey Jazz BugashNo ratings yet

- Vertical Analysis FinalDocument8 pagesVertical Analysis FinalLiya JahanNo ratings yet

- Bba 6Document7 pagesBba 6MAHENDERNo ratings yet

- Rfi Company Profile 2019 SeptDocument48 pagesRfi Company Profile 2019 SeptTaufiq Ihsan IsmailNo ratings yet

- Discussion Guide IHBDocument2 pagesDiscussion Guide IHBAnindya GangulyNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- Audit Case14 33 CompleteDocument9 pagesAudit Case14 33 CompleteIhsan NurhilmiNo ratings yet

- Summary Buku Introduction To Management - John SchermerhornDocument6 pagesSummary Buku Introduction To Management - John SchermerhornElyana BiringNo ratings yet

- Ms April 2022Document16 pagesMs April 2022Kuok Hei LeungNo ratings yet

2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

Uploaded by

hftysndt2j0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer to Assignment 3

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pages2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

2 BOOKKEEPING MODEL ANSER Bank Reconciliation - Answer To Assignment 3

Uploaded by

hftysndt2jCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 3

I.

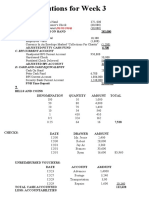

WISHIMANGA'S UP-DATED CASH BOOK (Bank Account)

DATE DETAILS F Dr Cr

K K

12/31/2009 Balance b/f 1,500,000

(ii) Dividends 240,000

(iii) Bank charges 30,000

(iv) Credit transfer - ZRA 260,000

(VI) Dishonoured cheque - Muhanga 1,400,000

(vii) Direct debit - Subscriptions 70,000

(vii) Standing order - Loan repayments 200,000

Balance c/d 3,100,000

3,400,000 3,400,000

1/1/2010 Balance b/d 3,100,000

BANK RECONCILIATION STATEMENT AS AT 31ST DECEMBER 2009

K K

Revised Cash Book Balance 3,100,000

Add: Unpresented cheques: M. Sakala 250,000

A.J. Lungu 290,000

540,000

3,640,000

Less: Uncleared cheques: 690,000

Bank Statement Balance 2,950,000

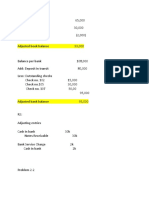

BANK RECONCILIATION STATEMENT AS AT 31ST MAY 2007

K'000 K'000

Revised Cash Book Balance 18,780

Add: Uncleared cheques 24,220

43,000

Less: Unpresented cheques: 7,120

34,640

3,920

45,680

BANK STATEMENT BALANCE -2,680

REVISED CASH BOOK (BANK ACCOUNT)

DATE DETAILS K'000 DATE DETAILS

Balance b/f 1,040 b. Subscriptions - Standing order

c. Errorneous deposit 500 d Bank charges

Credit transfers: 3,600 g. Undercast - Correction

Credit transfers: 620 Dishonoured cheque

Balance c/d 18,780

24,540

K'000

1,000

2,100

20,000

1,440

24,540

You might also like

- Chrysler CaseDocument7 pagesChrysler CasejoedlaranoiiiNo ratings yet

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- RESA - AP-702S (MCQs Solutions To Problems)Document12 pagesRESA - AP-702S (MCQs Solutions To Problems)Mellani100% (1)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Audit of Cash PDFDocument3 pagesAudit of Cash PDFVincent SampianoNo ratings yet

- SM - ANSWERS To PROBLEM QUESTIONS - Chapter 12Document4 pagesSM - ANSWERS To PROBLEM QUESTIONS - Chapter 12Sufiyya HabeebNo ratings yet

- Quiz Part 2 (Bank Reconciliation)Document2 pagesQuiz Part 2 (Bank Reconciliation)YameteKudasaiNo ratings yet

- Answers To Bac AssignmentDocument3 pagesAnswers To Bac AssignmentcyrilmusondaNo ratings yet

- (03B) Cash SPECIAL Quiz ANSWER KEYDocument6 pages(03B) Cash SPECIAL Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Finals QuizDocument7 pagesFinals QuizRobert AlbanoNo ratings yet

- Audit: Cash-and-Cash Equivalent: Problem 1Document12 pagesAudit: Cash-and-Cash Equivalent: Problem 1Idh skyNo ratings yet

- Solution Chapter 12 Bank ReconciliationDocument5 pagesSolution Chapter 12 Bank Reconciliationsaiful syahmiNo ratings yet

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Bank Recon and POC ProblemsDocument3 pagesBank Recon and POC ProblemsJanine IgdalinoNo ratings yet

- ReconciliationDocument6 pagesReconciliationElizabethNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- MC - Bank Reconciliation and Proof of CashDocument4 pagesMC - Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Cvcitc: College of Business and Accountancy Department of Accountancy Proof of CashDocument2 pagesCvcitc: College of Business and Accountancy Department of Accountancy Proof of CashTyrelle Dela CruzNo ratings yet

- Computations AE 04 2Document17 pagesComputations AE 04 2Julienne UntalascoNo ratings yet

- Additional Illustrations-14Document8 pagesAdditional Illustrations-14Gulneer LambaNo ratings yet

- Bank Reconciliation StatementDocument9 pagesBank Reconciliation StatementMarvin tvNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- Transes (Audw3)Document21 pagesTranses (Audw3)dave excelleNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFJerald Jay CatacutanNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Chapter 2-3, 2-6Document3 pagesChapter 2-3, 2-6XENA LOPEZNo ratings yet

- Auditing Problems Summer 2011: Problem 1Document37 pagesAuditing Problems Summer 2011: Problem 1Iscandar Pacasum DisamburunNo ratings yet

- Auditing Problems Assignment AnswersDocument4 pagesAuditing Problems Assignment AnswersSophia Anne Margarette NicolasNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- SOLUTIONS - Metrobank Etc.Document3 pagesSOLUTIONS - Metrobank Etc.Avarel DPNo ratings yet

- Proof of CashDocument1 pageProof of Cashco230154No ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Conceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoDocument7 pagesConceptual Framework and Accounting Standards: Quiz 02 Instructor: J. CayetanoJerelyn DaneNo ratings yet

- Prelim Quiz 2 CMPC 313Document10 pagesPrelim Quiz 2 CMPC 313Nicole ViernesNo ratings yet

- Audit of Cash and Cash EquivalentsDocument108 pagesAudit of Cash and Cash Equivalentscarl fuerzasNo ratings yet

- Congrats BSA 3 Namo Welcome To Auditing ProblemsDocument60 pagesCongrats BSA 3 Namo Welcome To Auditing ProblemsannyeongchinguNo ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentSalim MohamedNo ratings yet

- Ervin 2Document48 pagesErvin 2micaangelgonzales.smmcNo ratings yet

- Foundation Acc Full Sol Set 15.11.2021Document245 pagesFoundation Acc Full Sol Set 15.11.2021adityatiwari122006No ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aDocument16 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1aMiguel AmihanNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Quiz 3-Audit CashDocument8 pagesQuiz 3-Audit CashCindy CrausNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Test 2 SolutionDocument8 pagesTest 2 SolutionFelicia ChinNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Vidhyaashram First Grade College Corporate Accounting III II AssignmentDocument4 pagesVidhyaashram First Grade College Corporate Accounting III II AssignmentveenaNo ratings yet

- Cash & Cash EDocument1 pageCash & Cash EJoyNo ratings yet

- Audit ProblemsDocument2 pagesAudit ProblemsTicia TungpalanNo ratings yet

- Quiz 1Document3 pagesQuiz 1Van MateoNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Subordinate Court Civil Procedure Manual 8Document78 pagesSubordinate Court Civil Procedure Manual 8hftysndt2jNo ratings yet

- Acc Midyr 2019Document6 pagesAcc Midyr 2019hftysndt2jNo ratings yet

- Diary Rules Zambia Institute of Advanced Legal EducationDocument6 pagesDiary Rules Zambia Institute of Advanced Legal Educationhftysndt2jNo ratings yet

- Certificate of ReconciliationDocument2 pagesCertificate of Reconciliationhftysndt2jNo ratings yet

- BSD ReportDocument18 pagesBSD Reportg domNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Instant Download Ebook PDF Financial Accounting 9th Edition by Robert Libby PDF ScribdDocument34 pagesInstant Download Ebook PDF Financial Accounting 9th Edition by Robert Libby PDF Scribdrobert.gourley486100% (42)

- Customer Relationship Management (CRM) : Submitted by Name: Ratul Bhattacharyya ROLL: 151 Section: CDocument15 pagesCustomer Relationship Management (CRM) : Submitted by Name: Ratul Bhattacharyya ROLL: 151 Section: CrratulrockssNo ratings yet

- Bisleri QUESTIONNAIRESDocument4 pagesBisleri QUESTIONNAIRESPritam KumarNo ratings yet

- Sample Mid Semester Exam With AnswersDocument15 pagesSample Mid Semester Exam With AnswersjojoinnitNo ratings yet

- F3 (Fa) BPP ST 2021-22Document666 pagesF3 (Fa) BPP ST 2021-22Jeyhun0% (1)

- Tugas SKT 11 - Evy Okvita Sari - 03021381823095 - A - PalembangDocument1 pageTugas SKT 11 - Evy Okvita Sari - 03021381823095 - A - PalembangEvy OkvitasariNo ratings yet

- Lukoil A-Vertically Integrated Oil CompanyDocument20 pagesLukoil A-Vertically Integrated Oil CompanyhuccennNo ratings yet

- Consumer Buying Behavior of Rural and Urban Consumers in Batangas City EditedDocument116 pagesConsumer Buying Behavior of Rural and Urban Consumers in Batangas City EditedJM MalaluanNo ratings yet

- Northern Forest ProductsDocument15 pagesNorthern Forest ProductsHương Lan TrịnhNo ratings yet

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- Valuation of Goodwill As On 21 12 2020Document13 pagesValuation of Goodwill As On 21 12 2020jeevan varmaNo ratings yet

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Marketing, Production & Business Analytics Functions of WalmartDocument15 pagesMarketing, Production & Business Analytics Functions of WalmartJay PrajapatiNo ratings yet

- Unit 2 Inventory Management: DR Rajkumari SoniDocument19 pagesUnit 2 Inventory Management: DR Rajkumari SoniAlka PatelNo ratings yet

- Delivering and Performing Services Through Employees and CustomersDocument35 pagesDelivering and Performing Services Through Employees and Customersneha ugyal100% (1)

- Chapter 13 - Marketing Mix - Promotion Business Studies IgcseDocument64 pagesChapter 13 - Marketing Mix - Promotion Business Studies IgcseRida AhmedNo ratings yet

- Case Study StudiesDocument8 pagesCase Study StudiesYagnesh ShahNo ratings yet

- Marketting MixDocument5 pagesMarketting MixyoyoNo ratings yet

- ACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditDocument8 pagesACC Plus - Ch.4 - Analysis of Transactions and The Rules of Debit and CreditJeffrey Jazz BugashNo ratings yet

- Vertical Analysis FinalDocument8 pagesVertical Analysis FinalLiya JahanNo ratings yet

- Bba 6Document7 pagesBba 6MAHENDERNo ratings yet

- Rfi Company Profile 2019 SeptDocument48 pagesRfi Company Profile 2019 SeptTaufiq Ihsan IsmailNo ratings yet

- Discussion Guide IHBDocument2 pagesDiscussion Guide IHBAnindya GangulyNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- Audit Case14 33 CompleteDocument9 pagesAudit Case14 33 CompleteIhsan NurhilmiNo ratings yet

- Summary Buku Introduction To Management - John SchermerhornDocument6 pagesSummary Buku Introduction To Management - John SchermerhornElyana BiringNo ratings yet

- Ms April 2022Document16 pagesMs April 2022Kuok Hei LeungNo ratings yet