Professional Documents

Culture Documents

Project Five

Project Five

Uploaded by

abi GCopyright:

Available Formats

You might also like

- Paystub 3Document1 pagePaystub 3J RequenaNo ratings yet

- Cit ExcercisesDocument15 pagesCit Excercises20. Lê Phúc HoànNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Cash Flow in Capital Budgeting KeownDocument37 pagesCash Flow in Capital Budgeting Keownmad2kNo ratings yet

- Accounting Income StatementDocument5 pagesAccounting Income Statementjane100% (1)

- Section TWO 2024Document5 pagesSection TWO 2024basuonyshowNo ratings yet

- Taxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh HoaiDocument10 pagesTaxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh Hoainguyễnthùy dươngNo ratings yet

- Additional Business in AccountingDocument2 pagesAdditional Business in AccountingHaider CasanovaNo ratings yet

- Section Three-2024Document4 pagesSection Three-2024basuonyshowNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- B203B-Week 6 - (Accounting-3) Updated 31-10Document38 pagesB203B-Week 6 - (Accounting-3) Updated 31-10ahmed helmyNo ratings yet

- Group 4 ReportDocument16 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Level TwoDocument39 pagesLevel TwoADUGNA DEGEFENo ratings yet

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Lesson 6 FabmDocument3 pagesLesson 6 FabmCristina Dela RomaNo ratings yet

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocument28 pagesTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNo ratings yet

- Calculate Foreign Currency Credit - Effective Rate - Tax PayableDocument4 pagesCalculate Foreign Currency Credit - Effective Rate - Tax PayablepuddinsouseNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

- Problem Fs - SolutionDocument5 pagesProblem Fs - SolutionÁnh NguyễnNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- BudgetingDocument44 pagesBudgetingYellow CarterNo ratings yet

- AnswerDocument2 pagesAnswerRenzNo ratings yet

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- Group 4 ReportDocument13 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Final Exam Review2aStudentDocument9 pagesFinal Exam Review2aStudentFatima SNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- MPAC604 L2A FINAL TaxDocument103 pagesMPAC604 L2A FINAL TaxKanokporn TangthamvanichNo ratings yet

- Answer 1: Introduction:: Particulars RsDocument10 pagesAnswer 1: Introduction:: Particulars RsRupesh SinghNo ratings yet

- Tugas Week 1 - Bagus SeptiawanDocument3 pagesTugas Week 1 - Bagus SeptiawanBagus SeptiawanNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Supply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions ManualDocument10 pagesSupply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions Manualdammar.jealousgvg6100% (23)

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Cash Flow Statement 2022 Part I SharedDocument41 pagesCash Flow Statement 2022 Part I SharedVinay Mehta100% (1)

- MY Solution PaperDocument3 pagesMY Solution Paperyara hazemNo ratings yet

- Improving Management PerformanceDocument11 pagesImproving Management PerformanceYuki Dwi DarmaNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- PGBP Part 2 SolutionDocument14 pagesPGBP Part 2 SolutionDhruv SetiaNo ratings yet

- Particular Amount: Profit Before Tax Dep. & Amortization Financial CostDocument5 pagesParticular Amount: Profit Before Tax Dep. & Amortization Financial CostviewpawanNo ratings yet

- Senior Auditor Cost-Accounting-McqsDocument101 pagesSenior Auditor Cost-Accounting-McqsMuhammad HamidNo ratings yet

- Statement of Comprehensive IncomeDocument14 pagesStatement of Comprehensive IncomeDanerish PabunanNo ratings yet

- 5 6336743075766863237 PDFDocument75 pages5 6336743075766863237 PDFshagufta afrin100% (1)

- VAT ET EIT PIT OfficialDocument9 pagesVAT ET EIT PIT OfficialĐàm Ngọc Giang NamNo ratings yet

- Corporate Income TaxDocument70 pagesCorporate Income TaxNhung HồngNo ratings yet

- Tax Note No. 6 (Tax On Commercial - Part1)Document10 pagesTax Note No. 6 (Tax On Commercial - Part1)Eman AbasiryNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Lecture 11 IncomeDocument14 pagesLecture 11 IncomeСильвия ГабриэльNo ratings yet

- Tax-week12 test bankDocument3 pagesTax-week12 test bankzeinab.iaems.researchNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisHassanNo ratings yet

- IPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamDocument12 pagesIPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamSushant Saxena100% (1)

- Notes 240603 065537Document45 pagesNotes 240603 065537etaferaw beyeneNo ratings yet

- Entrep Presentation Q4 Gross ProfitDocument16 pagesEntrep Presentation Q4 Gross ProfitChristian Dela TorreNo ratings yet

- Chapter 3 Value Added Tax Sale of Good PropertiesDocument8 pagesChapter 3 Value Added Tax Sale of Good PropertiesMary Grace BaquiranNo ratings yet

- Mam Faiza: Supervised By: Presented By: Roll No. BS Semester (E)Document26 pagesMam Faiza: Supervised By: Presented By: Roll No. BS Semester (E)samad489No ratings yet

- Updated Where To File IRSDocument3 pagesUpdated Where To File IRSDrmookieNo ratings yet

- 48 - Pay Slip ModelDocument1 page48 - Pay Slip Modeltapanamoria80% (5)

- Hdfcbank Credit CtalogueDocument1 pageHdfcbank Credit CtalogueDrSudhanshu MishraNo ratings yet

- Flemingo Travel Retail Limited Versus Union of India Ti Be EditedDocument51 pagesFlemingo Travel Retail Limited Versus Union of India Ti Be EditedmandiraNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowtrapatialaNo ratings yet

- Bir Tax Calendar2014Document40 pagesBir Tax Calendar2014jaysraelNo ratings yet

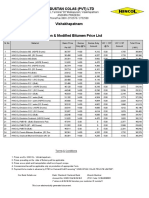

- Emulsion Rate 1APR16 PDFDocument2 pagesEmulsion Rate 1APR16 PDFRama Raju Gottumukkala0% (1)

- BookMyShow - Book Movie TicketsDocument2 pagesBookMyShow - Book Movie TicketsMayank RajputNo ratings yet

- 1910Document2 pages1910Mohsin Khan50% (2)

- Chapter-11 Compound InterestDocument25 pagesChapter-11 Compound InterestscihimaNo ratings yet

- Obligation Request and Status Budget Utilization Request and StatusDocument2 pagesObligation Request and Status Budget Utilization Request and StatusKatrina SedilloNo ratings yet

- TestbankDocument3 pagesTestbankMarizMatampaleNo ratings yet

- Message Grammar School Message Grammar School Message Grammar SchoolDocument1 pageMessage Grammar School Message Grammar School Message Grammar SchoolUMW BrosNo ratings yet

- Thank You For Your Payment!: HWGC6X044Document1 pageThank You For Your Payment!: HWGC6X044Krishna Prasad KanchojuNo ratings yet

- Goods and Service TaxDocument14 pagesGoods and Service TaxkejkarNo ratings yet

- 2nd Installment Academic Fee Demand Notice 2023-2024Document3 pages2nd Installment Academic Fee Demand Notice 2023-2024mamtakanwar.mech26No ratings yet

- T4 B14 FBI Docs - Received Early April FDR - Hijacker Financial Transaction Spreadsheet - OldDocument76 pagesT4 B14 FBI Docs - Received Early April FDR - Hijacker Financial Transaction Spreadsheet - Old9/11 Document ArchiveNo ratings yet

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- Facture Att LaurisDocument4 pagesFacture Att LauriscedricNo ratings yet

- Government Accounting: Accounting For Income and Other Cash ReceiptsDocument18 pagesGovernment Accounting: Accounting For Income and Other Cash ReceiptsJoan May PeraltaNo ratings yet

- Invoice 4Document1 pageInvoice 4Namagiri Lakshmi TBNo ratings yet

- Types of Accounts in A Bank: BY Abdul Qadir BhamaniDocument23 pagesTypes of Accounts in A Bank: BY Abdul Qadir Bhamaniafzaal khanNo ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Cash App Guide SolutionsDocument40 pagesCash App Guide Solutionsmarinemercyasd50% (2)

- SFC ICON 2013 First MemoDocument19 pagesSFC ICON 2013 First MemoAiza GarnicaNo ratings yet

- Img 20230108 0001Document1 pageImg 20230108 0001Medhansh BhardwajNo ratings yet

- Acc Ledger LatesDocument14 pagesAcc Ledger LatesVinayak SinghNo ratings yet

Project Five

Project Five

Uploaded by

abi GOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Five

Project Five

Uploaded by

abi GCopyright:

Available Formats

Project Five:

Project Five:

Task 1.1: Indirect Tax Liabilities For the merchandise sold:

VAT Exclusive Price of Purchased Merchandise: Br 20,000,000

VAT Inclusive Price of Sold Merchandise: Br 20,000,000

Percentage of Merchandise Sold: 75%

To calculate the VAT collected, we need to find the VAT rate. Assuming the standard VAT rate is 15%, we

can calculate the VAT on the sold merchandise.

First, we find the VAT exclusive selling price: [ \text{VAT Exclusive Selling Price} = \frac{\text{VAT

Inclusive Price}}{1 + \text{VAT Rate}} ] [ \text{VAT Exclusive Selling Price} = \frac{Br 20,000,000}{1 + 0.15}

] [ \text{VAT Exclusive Selling Price} = Br 17,391,304.35 ]

Now, we calculate the VAT collected on the sale: [ \text{VAT Collected} = \text{VAT Inclusive Price} - \

text{VAT Exclusive Selling Price} ] [ \text{VAT Collected} = Br 20,000,000 - Br 17,391,304.35 ] [ \text{VAT

Collected} = Br 2,608,695.65 ]

Task 1.2: Direct Tax Liabilities The direct tax liability would be the business profit tax which is 30% of the

profit. To calculate the profit, we subtract the cost of goods sold (COGS) and expenses from the sales

revenue.

[ \text{Profit} = \text{Sales Revenue} - \text{COGS} - \text{Expenses} ] [ \text{Profit} = Br 20,000,000 -

(0.75 \times Br 20,000,000) - Br 1,000,000 ] [ \text{Profit} = Br 20,000,000 - Br 15,000,000 - Br

1,000,000 ] [ \text{Profit} = Br 4,000,000 ]

Now, we calculate the business profit tax: [ \text{Business Profit Tax} = \text{Profit} \times \text{Tax

Rate} ] [ \text{Business Profit Tax} = Br 4,000,000 \times 0.30 ] [ \text{Business Profit Tax} = Br

1,200,000 ]

Project Six:

Task 1.1: Net Profit Total Income (including VAT): Br 2,500,000 (Adama) + Br 1,500,000 (AAU) + Br

150,000 (Other) Total Expenses: Br 2,000,000 (COGS) + Br 200,000 (Administrative) Employment Income

Tax Withheld: Br 55,000

[ \text{Net Profit} = \text{Total Income} - \text{Total Expenses} - \text{Employment Income Tax

Withheld} ] [ \text{Net Profit} = (Br 2,500,000 + Br 1,500,000 + Br 150,000) - (Br 2,000,000 + Br 200,000)

- Br 55,000 ] [ \text{Net Profit} = Br 3,150,000 - Br 2,200,000 - Br 55,000 ] [ \text{Net Profit} = Br

895,000 ]

Task 1.2: Direct Tax Liabilities [ \text{Business Profit Tax} = \text{Net Profit} \times \text{Tax Rate} ] [ \

text{Business Profit Tax} = Br 895,000 \times 0.30 ] [ \text{Business Profit Tax} = Br 268,500 ]

Task 1.3: Indirect Tax Liabilities Assuming VAT is included in the income and the rate is 15%, we

calculate the VAT paid on sales: [ \text{VAT Paid} = \text{Total Income} - \frac{\text{Total Income}}{1 + \

text{VAT Rate}} ] [ \text{VAT Paid} = Br 3,150,000 - \frac{Br 3,150,000}{1 + 0.15} ] [ \text{VAT Paid} = Br

3,150,000 - Br 2,739,130.43 ] [ \text{VAT Paid} = Br 410,869.57 ]

Task 1.4: Direct & Indirect Taxes

Direct Taxes: Taxes levied directly on income, such as business profit tax and employment

income tax.

Indirect Taxes: Taxes collected by an intermediary (such as a retailer) from the person who

bears the ultimate economic burden of the tax (such as VAT).

You might also like

- Paystub 3Document1 pagePaystub 3J RequenaNo ratings yet

- Cit ExcercisesDocument15 pagesCit Excercises20. Lê Phúc HoànNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Assign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020Document6 pagesAssign 5 Chapter 7 Cash Flow Analysis Answer Cabrera 2019-2020mhikeedelantar50% (2)

- Cash Flow in Capital Budgeting KeownDocument37 pagesCash Flow in Capital Budgeting Keownmad2kNo ratings yet

- Accounting Income StatementDocument5 pagesAccounting Income Statementjane100% (1)

- Section TWO 2024Document5 pagesSection TWO 2024basuonyshowNo ratings yet

- Taxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh HoaiDocument10 pagesTaxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh Hoainguyễnthùy dươngNo ratings yet

- Additional Business in AccountingDocument2 pagesAdditional Business in AccountingHaider CasanovaNo ratings yet

- Section Three-2024Document4 pagesSection Three-2024basuonyshowNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- B203B-Week 6 - (Accounting-3) Updated 31-10Document38 pagesB203B-Week 6 - (Accounting-3) Updated 31-10ahmed helmyNo ratings yet

- Group 4 ReportDocument16 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Level TwoDocument39 pagesLevel TwoADUGNA DEGEFENo ratings yet

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Lesson 6 FabmDocument3 pagesLesson 6 FabmCristina Dela RomaNo ratings yet

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocument28 pagesTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNo ratings yet

- Calculate Foreign Currency Credit - Effective Rate - Tax PayableDocument4 pagesCalculate Foreign Currency Credit - Effective Rate - Tax PayablepuddinsouseNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

- Problem Fs - SolutionDocument5 pagesProblem Fs - SolutionÁnh NguyễnNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- BudgetingDocument44 pagesBudgetingYellow CarterNo ratings yet

- AnswerDocument2 pagesAnswerRenzNo ratings yet

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- Group 4 ReportDocument13 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Final Exam Review2aStudentDocument9 pagesFinal Exam Review2aStudentFatima SNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- MPAC604 L2A FINAL TaxDocument103 pagesMPAC604 L2A FINAL TaxKanokporn TangthamvanichNo ratings yet

- Answer 1: Introduction:: Particulars RsDocument10 pagesAnswer 1: Introduction:: Particulars RsRupesh SinghNo ratings yet

- Tugas Week 1 - Bagus SeptiawanDocument3 pagesTugas Week 1 - Bagus SeptiawanBagus SeptiawanNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Supply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions ManualDocument10 pagesSupply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions Manualdammar.jealousgvg6100% (23)

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Cash Flow Statement 2022 Part I SharedDocument41 pagesCash Flow Statement 2022 Part I SharedVinay Mehta100% (1)

- MY Solution PaperDocument3 pagesMY Solution Paperyara hazemNo ratings yet

- Improving Management PerformanceDocument11 pagesImproving Management PerformanceYuki Dwi DarmaNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- PGBP Part 2 SolutionDocument14 pagesPGBP Part 2 SolutionDhruv SetiaNo ratings yet

- Particular Amount: Profit Before Tax Dep. & Amortization Financial CostDocument5 pagesParticular Amount: Profit Before Tax Dep. & Amortization Financial CostviewpawanNo ratings yet

- Senior Auditor Cost-Accounting-McqsDocument101 pagesSenior Auditor Cost-Accounting-McqsMuhammad HamidNo ratings yet

- Statement of Comprehensive IncomeDocument14 pagesStatement of Comprehensive IncomeDanerish PabunanNo ratings yet

- 5 6336743075766863237 PDFDocument75 pages5 6336743075766863237 PDFshagufta afrin100% (1)

- VAT ET EIT PIT OfficialDocument9 pagesVAT ET EIT PIT OfficialĐàm Ngọc Giang NamNo ratings yet

- Corporate Income TaxDocument70 pagesCorporate Income TaxNhung HồngNo ratings yet

- Tax Note No. 6 (Tax On Commercial - Part1)Document10 pagesTax Note No. 6 (Tax On Commercial - Part1)Eman AbasiryNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Lecture 11 IncomeDocument14 pagesLecture 11 IncomeСильвия ГабриэльNo ratings yet

- Tax-week12 test bankDocument3 pagesTax-week12 test bankzeinab.iaems.researchNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisHassanNo ratings yet

- IPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamDocument12 pagesIPCC Cost Accounting Financial Management Guideline Answer Nov 2015 ExamSushant Saxena100% (1)

- Notes 240603 065537Document45 pagesNotes 240603 065537etaferaw beyeneNo ratings yet

- Entrep Presentation Q4 Gross ProfitDocument16 pagesEntrep Presentation Q4 Gross ProfitChristian Dela TorreNo ratings yet

- Chapter 3 Value Added Tax Sale of Good PropertiesDocument8 pagesChapter 3 Value Added Tax Sale of Good PropertiesMary Grace BaquiranNo ratings yet

- Mam Faiza: Supervised By: Presented By: Roll No. BS Semester (E)Document26 pagesMam Faiza: Supervised By: Presented By: Roll No. BS Semester (E)samad489No ratings yet

- Updated Where To File IRSDocument3 pagesUpdated Where To File IRSDrmookieNo ratings yet

- 48 - Pay Slip ModelDocument1 page48 - Pay Slip Modeltapanamoria80% (5)

- Hdfcbank Credit CtalogueDocument1 pageHdfcbank Credit CtalogueDrSudhanshu MishraNo ratings yet

- Flemingo Travel Retail Limited Versus Union of India Ti Be EditedDocument51 pagesFlemingo Travel Retail Limited Versus Union of India Ti Be EditedmandiraNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowtrapatialaNo ratings yet

- Bir Tax Calendar2014Document40 pagesBir Tax Calendar2014jaysraelNo ratings yet

- Emulsion Rate 1APR16 PDFDocument2 pagesEmulsion Rate 1APR16 PDFRama Raju Gottumukkala0% (1)

- BookMyShow - Book Movie TicketsDocument2 pagesBookMyShow - Book Movie TicketsMayank RajputNo ratings yet

- 1910Document2 pages1910Mohsin Khan50% (2)

- Chapter-11 Compound InterestDocument25 pagesChapter-11 Compound InterestscihimaNo ratings yet

- Obligation Request and Status Budget Utilization Request and StatusDocument2 pagesObligation Request and Status Budget Utilization Request and StatusKatrina SedilloNo ratings yet

- TestbankDocument3 pagesTestbankMarizMatampaleNo ratings yet

- Message Grammar School Message Grammar School Message Grammar SchoolDocument1 pageMessage Grammar School Message Grammar School Message Grammar SchoolUMW BrosNo ratings yet

- Thank You For Your Payment!: HWGC6X044Document1 pageThank You For Your Payment!: HWGC6X044Krishna Prasad KanchojuNo ratings yet

- Goods and Service TaxDocument14 pagesGoods and Service TaxkejkarNo ratings yet

- 2nd Installment Academic Fee Demand Notice 2023-2024Document3 pages2nd Installment Academic Fee Demand Notice 2023-2024mamtakanwar.mech26No ratings yet

- T4 B14 FBI Docs - Received Early April FDR - Hijacker Financial Transaction Spreadsheet - OldDocument76 pagesT4 B14 FBI Docs - Received Early April FDR - Hijacker Financial Transaction Spreadsheet - Old9/11 Document ArchiveNo ratings yet

- DEPOSITSLIP#192792#1Document1 pageDEPOSITSLIP#192792#1AsadNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023rk41001No ratings yet

- Facture Att LaurisDocument4 pagesFacture Att LauriscedricNo ratings yet

- Government Accounting: Accounting For Income and Other Cash ReceiptsDocument18 pagesGovernment Accounting: Accounting For Income and Other Cash ReceiptsJoan May PeraltaNo ratings yet

- Invoice 4Document1 pageInvoice 4Namagiri Lakshmi TBNo ratings yet

- Types of Accounts in A Bank: BY Abdul Qadir BhamaniDocument23 pagesTypes of Accounts in A Bank: BY Abdul Qadir Bhamaniafzaal khanNo ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Cash App Guide SolutionsDocument40 pagesCash App Guide Solutionsmarinemercyasd50% (2)

- SFC ICON 2013 First MemoDocument19 pagesSFC ICON 2013 First MemoAiza GarnicaNo ratings yet

- Img 20230108 0001Document1 pageImg 20230108 0001Medhansh BhardwajNo ratings yet

- Acc Ledger LatesDocument14 pagesAcc Ledger LatesVinayak SinghNo ratings yet