Professional Documents

Culture Documents

HI6026 Final Assessment T3 2021

HI6026 Final Assessment T3 2021

Uploaded by

adityapatnaik.022Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HI6026 Final Assessment T3 2021

HI6026 Final Assessment T3 2021

Uploaded by

adityapatnaik.022Copyright:

Available Formats

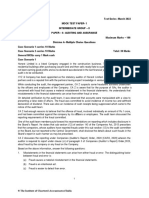

Student Number: (enter on the line below)

Student Name: (enter on the line below)

HI6026

AUDIT, ASSURANCE AND COMPLIANCE FINAL ASSESSMENT

TRIMESTER TR3, 2021

Assessment Weight: 50 total marks

Instructions:

All questionsmust be answered by using the answer boxes provided in this paper.

Completed answers must be submitted to Blackboard by the published due date

and time.

Submission instructions are at the end of this paper.

Purpose:

This assessment consists of six (6) questions and is designed to assess your level of

knowledge of the key topics covered in this unit

HI6026Final Assessment T3 2021

Question 1 (7 marks)

LockyPrivetra is considering investing in Sea Lounge Ltd (SLL), a large cruise ship company. Locky

has reviewed SLLL's 2020 audited financial report, which shows a net profit of $700 000 and a net

asset position of $3 million. The auditor's report is unmodified, stating that in the auditor's

opinion, the financial report gives a true and fair view of the entity's financial performance and

financial position. As a result, Locky is now confident about her proposed investment in SLL, as

she believes that the auditor's report provides absolute assurance about the accuracy of the

financial report, including the healthy profit and net asset figures, and there is no chance of the

company going bankrupt. Further, while she is aware of the management frauds that have

occurred in some companies in recent years, she is comforted by the fact that she believes that

the unmodified auditor's report means that no fraud has occurred within SLL.

Required:

Explain the situation and implications of the reasonable or absolute assurance and unmodified

Auditor’s opinion. Do you think this company should achieve absolute assurance and unmodified

Auditor’s opinion?

ANSWER: ** Answer box will enlarge as you type

No, simply giving an audit report as a unmodified assessment does not guarantee that the

accounts are fraud-free. The expectation gap explains the disparity between Locky's expectations

as well as the auditor's function and obligation. There is a disparity among Locky's impression of

the auditor's position and duty and the real function and obligations of the auditor. The user

thought that the auditor will avoid all frauds as well as check all transactions to ensure that they

were not fraudulent. However, this is not the case. The auditors get a small period of time to do

the audit (Romaniuc et al.2022, p190(1)). As a result, they are unable to verify single

transaction. They use a practise known as transaction sampling and verification. As a result, the

auditors are unable to guarantee total confidence. The auditors give reasonable confidence that

the financial statements are error-free.

Auditors often depend on management for a lot of the specifics and data. As a result,

determining if the information is accurate or not is not often easy, and it must occasionally be

taken too seriously. If a company's management is unethical and tries to cheat the system, it's

likely that perhaps the auditor might overlook it because management could generate data to

substantiate what they claimed.

HI6026Final Assessment T3 2021

Question 2 (7 marks)

Ronald Partners is negotiating with its audit client (Maxim Industries) for its upcoming audit fees.

Maxim Industries' audit partner offers the company a discounted audit fee if it also gives all its

tax consulting work to the firm.

Required

Explain whether the managing partner at Ronald Partners should agree to approve the deal

negotiated by the partner in charge of Maxim Industries' audit.

ANSWER:

No, Ronald Partners' managing partner must not approve the contract negotiated by Mazim's

managing partner. The cause for this is because the auditor's independence appears to be in

jeopardy. APES 110.100.12 and APES 110.200.3 show the same behaviour.

Moreover it includes:

Intimidation Threat: The auditor may be scared by the prospect of losing employment if the

charge is not revised. It would have an effect on their objectivity.

Self-review threat: If the auditor accepts the reduced charge for further tax advice. They may

advise businesses on numerous metrics, which they must later assess as auditors, therefore they

cannot be supposed to be objective while examining their respective work.

Self-interest threats: The auditor like to expand the company, thus getting tax consulting

employment for the auditor would have been in their best interests ( Li et al.2019,p5(1)).

Therefore, if an auditor is providing tax counselling, they will assist the firm in reporting lower

income and exaggerated costs in order to save money. This would be in direct contrast with their

auditing responsibilities, which require them to view the accurate and fair image of the books. As

a result, their independence is compromised.

Advocacy threat: Like a tax consultant, an auditor might well be forced to promote a client's

interest to the point that their impartiality is affected.

By analysing all the above threats, Ronald Partner must decline the agreement.

HI6026Final Assessment T3 2021

Question 3 (7marks)

All companies are required to disclose in their annual reports the amounts paid to their auditors

for both the financial report audit and any other services performed for the company.

Required

Obtain a copy of a recent annual report (most companies make their annual reports available on

the company's website) and find the disclosures explaining the amounts paid to auditors. How

much was the auditor paid for the audit, non-assurance, or other services?

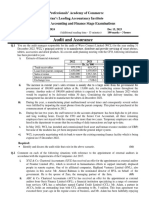

ANSWER:

I obtained a copy of ACE Wi-Fi annual report in order to conduct an evaluation of the fees paid

for audit, non-assurance, as well as other services.

The below data has been obtained and the same is stated in the disclosure:

2021 (in thousands) 2020 (in thousands)

Audit and review of group 695 627

financial statements

Audit and review of subsidiary 26 26

financial statements

Others assurance services 10 7

Total remuneration 731 660

In 2021, 721000 has been paid to the auditors for their audit services and 10,000 for additional

assurance services, as shown in the chart above ( Atmadja and Saputra, 2018, p22(5)). The

other assurance charges in 2021 has been 10000 and in 2020 the same has been 7000. The audit

charge has been increased from the previous year. The firm also used the services of an auditor

i.e,KPMG in certain tax concerns associated with the acquisition of Good Guys, although the

former owner of Good Guys is responsible for paying the fees.

HI6026Final Assessment T3 2021

Question 4 (7 marks)

You are the auditor of Birham Ltd and are in the process of completing the audit for the year

ended 30 June 2020.

There are two outstanding matters highlighted in your firm's completion documentation:

(i) You have heard rumours that Birham Ltd isready to merge with a competitor. If correct,

this may have disclosure implications. Management advises you that although they have

had several meetings with the competitor's management in question, no such merger is

currently planned. Management hasoffered to make written representations confirming

their intentions.

(ii) The invoices to support the cost of a significant purchase of plant and machinery cannot be

traced. Management hasoffered to make written representations confirming the cost of

the plant and machinery.

Required:

(a) What is the purpose of a management representation letter? (3 marks)

(b) Are the management's written representations sufficient to resolve the two outstanding

matters noted above? Please justify your answer. (4 marks)

ANSWER:

a) A management representation letter is written by the firm's auditors as well as approved

by the company's top key management, such as the Chief executive Officer an Chief Financial

Officer. The goal is essentially to delegate some of the financial statement duty to

management. First before auditors offer their view on the accounting information, the

management representation letter is normally signed. Although this doesn't free the auditors

of their auditing obligations and responsibilities, if a few items turn out to be misrepresented,

HI6026Final Assessment T3 2021

management might well be held responsible for these kind of misstatements based on a

management representation letter. Overall, it is used as part of the audit proof.

b) Management representation letters can also be used to fix unresolved issues by handing

over control to management. But, the auditors must still take responsibility for some

concerns.

i) Rumors cannot be used to form the foundation of an auditor's report. I reasoned that the

auditor should look into it. The first audit proof must be obtaining a management statement

on merging prospects with a key rival, because this would have been a source of substantial

information, coupled with meeting notes ( Mökander and Floridi, 2021, p31(2) ). As a result,

if Management Representation is required, it should have been examined.

ii) The management representation in the situation of misplaced receipts for purchases

of major plant and machinery has not been appear to be relevant. An auditor must examine

the financial statements as well as gather the relevant data in order to develop a judgement

on whether they are free of serious misleading statements. Because the asset acquisition in

issue is significantly important, it is inevitable to collect invoices as well as other

documentation proving the purchase of an asset and the amount of that asset, which must be

recorded on the audit report. Furthermore, if receipts could not be identified in relation to

the acquisition of substantial equipment and machinery, the company's accounting records

are called into doubt. In this case, management representation is insufficient to correct the

problem.

Question 5 (11 marks)

Healesville Sanctuary is a family-owned and operated wildlife park located in Melbourne.

Healesville Sanctuary has more than 150 animal species, some of which are loaned from overseas

animal parks. Healesville Sanctuary has two divisions for selling merchandise: a retail operation

that sells food, beverages, shirts, souvenirs and other novelties to visitors within the park, and a

wholesale operation that sells toys to department stores.

The following management figures are relevant for the year ended 30 June 2020:

HI6026Final Assessment T3 2021

Total assets 69 120 000

Total current assets 34 560 000

Inventories 28 800 000

Net assets 51 840 000

Profit after income tax 9 792 000

The company tax rate is 30 per cent.

During the conduct of the audit, the following items of interest were noted by the audit team:

(i) Due to an electrical contractor accidentally drilling through a power cable, all invoices for

items sold through HealesvilleSanctuary's wholesale operations on 22 and 23 June had to be

manually prepared. Many of the manual invoices from this period omitted some of the items that

were sold to department stores. The total value of the omitted items was $30 666 (2.75 marks).

(ii) Healesville Sanctuary lodged its tax return late and received a substantial fine. Payment of the

fine was not made by the required date, and liability for the amount has not been recorded. The

fine was $300 000 (2.75 marks).

(iii) Some of the toy crocodile products distributed to department stores by

HealesvilleSanctuary's wholesale operations were incorrectly priced due to a special one-off

'Crocodile Creature Month'discount not being reflected in the price the department stores were

charged. These incorrect sales were made on 23 June 2018. The total misstatement arising from

the incorrect sales was $14 261 (2.75 marks).

(iv) A number of senior executives flew to an animal conference in Melbourne. From the airport,

they hired cars and parked outside the hotel for three nights, ignoring 'No parking'signs. The

resulting parking fines were charged against HealesvilleSanctuary's meals and entertainment

account. The parking fines, totalling $1053, were all due before 30 June 2020 (2.75 marks).

Required:

For each of the individual misstatements listed, explain whether the item should be reported to

management or is clearly trivial.

ANSWER:

When determining whether or not a transaction must be disclosed to management, consider

how important the transaction is to the company's overall financial statements. The same may

be said for the percentage of revenue or the percentage of assets. If the sum is significant, the

HI6026Final Assessment T3 2021

relevance levels are too high, and it must be communicated to management. The cause for this is

that a large volume of material transactions might mislead financial statements, giving an

inaccurate image of the situation.

(i) The excluded items have a total sum of $30,666, that may be evaluated to net profit. Because

the company's net profit is $9,792,000, the missing items account for 0.31 percent of the net

profit. As a result, it has no meaningful influence on the financial statements and could be

omitted from management reporting.

(ii) In the above case scenario, there is a tax liability of amount 300,000 that has been not paid.

Moreover t he same thing is true for current liabilities, which must be matched to the company's

current assets (Shneiderman, 2020, p10(4)). The existing assets are utilised to pay off the

current debts. There is no need to record the amount because it is less than 1% of the existing

liabilities.

(iii) Missing sales amount to 14,261 dollars, or 0.14 percent of net revenue. The quantity is

likewise less than 1%, thus it has no bearing on the firm. As a result, it is not required to be

disclosed and communicated to management.

(iv) The parking fine of $103 is little to the company's financials and would not affect the

accurate and fair image of the financial statements, thus it doesn't have to be disclosed and

communicated to the management.

Question 6 (11 marks)

Oscar Wylee Women Glass Ltd is a supplier of fashion women sunglasses. The audit report for the

year ended 30 June 2021 was signed on 8 August 2021, and the financial report was mailed to

shareholders on 12 August.

Consider the following independent events. Assume that each event is material.

HI6026Final Assessment T3 2021

i. On 5 July, Oscar Wylee entered into a new contract to deliver sunglasses to Specsavers, a

new major department store. The contract was similar to other previously contracted

contracts(2.75 marks).

ii. Oscar Wylee has financed huge funds in developing a new type of solidsunglasses lens.

On 8 July, Oscar Wylee applied for a patent for the lens, only to identify that a competitor

had lodged a similar application on 25 June. The granting of Oscar Wylee application is

now ofmajor concern (2.75 marks).

iii. One of Oscar Wylee major customers, Phoenix Pty Ltd, suffered a fire on 23 July. Since

Phoenix Pty Ltd was uninsured, it is unlikely that their accounts receivable balance will be

paid (2.75 marks).

iv. On 27 July, a well-known financial planner advised his clients not to invest in Oscar Wylee

due to poor long-term growth prospects. The market price for Oscar

WyleeAccessories'shares subsequently declined by 50% (2.75 marks).

Required:

For each of the individual misstatements listed, explain auditors' responsibility and consequence

auditing report.

ANSWER:

In relation to the foregoing, the assessment of the auitor's duty and effects identifies the

occurrences.

i) In context of this situation, it is the operation's primary obligation to assess Oscar Wylee's

connection with Specsavers. The relationship review would offer relevant information about the

contract's motivation and its influence on accounting records.

ii) In the facts of this case, the auditor's principal role is to ensure that the organization's

stakeholders as well as investors are fully informed on the issues ( Al-Dhubaibi, 2020, p6(3)).

This would guarantee corporate operations are transparent, as well as offer sufficient

information to prospective investors in order for them to make decisions on making investment.

HI6026Final Assessment T3 2021

iii) In this case, the auditor should first comprehend the connection between the company and

its customers, as well as ensure that bad debt is properly disclosed in the financial accounts

when it occurs.

iv) Finally, it is the operation's primary obligation to investigate the different causes of a drop in

stock price, as well as to ensure that the organization's management accurately reflects a large

drop in stock price in its accounting records.

References

Romaniuc, R., Dubois, D., Dimant, E., Lupusor, A. and Prohnitchi, V., 2022. Understanding

cross-cultural differences in peer reporting practices: evidence from tax evasion games in

Moldova and France. Public Choice, 190(1), pp.127-147.

Li, Y., Huo, Y., Yu, L. and Wang, J., 2019. Quality control and nonclinical research on CAR-T

cell products: general principles and key issues. Engineering, 5(1), pp.122-131.

Atmadja, A.T. and Saputra, K.A.K., 2018. The influence of role conflict, complexity of

assignment, role obscurity and locus of control on internal auditor

performance. Academy of Accounting and Financial Studies Journal, 22(5), pp.1-5.

Mökander, J. and Floridi, L., 2021. Ethics-based auditing to develop trustworthy AI. Minds

and Machines, 31(2), pp.323-327.

Shneiderman, B., 2020. Bridging the gap between ethics and practice: guidelines for

reliable, safe, and trustworthy human-centered AI systems. ACM Transactions on

Interactive Intelligent Systems (TiiS), 10(4), pp.1-31.

HI6026Final Assessment T3 2021

Al-Dhubaibi, A., 2020. Auditors’ responsibility for fraud detection: Views of auditors,

preparers, and users of financial statements in Saudi Arabia. Accounting, 6(3), pp.279-

290.

END OF FINAL ASSESSMENT

Submission instructions:

Save submission with your STUDENT ID NUMBER and UNIT CODE e.g. EMV54897 HI6026

Submission must be in MICROSOFT WORD FORMAT ONLY

Upload your submission to the appropriate link on Blackboard

Only one submission is accepted. Please ensure your submissionis the correct

document as special consideration is not given if you make a mistake.

All submissions are automatically passed through SafeAssign to assess academic integrity.

HI6026Final Assessment T3 2021

You might also like

- Case Solution Chapter 12Document17 pagesCase Solution Chapter 12Annisa Kurnia100% (2)

- Tulip Me Qs 2021Document10 pagesTulip Me Qs 2021Jacqueline Kanesha JamesNo ratings yet

- Corrective Action Plan Template 04Document3 pagesCorrective Action Plan Template 04sarge18No ratings yet

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFDocument113 pagesAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- Risk Based Internal AuditingDocument89 pagesRisk Based Internal AuditingGun Gunawan100% (4)

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Aa Ma 2022Document5 pagesAa Ma 2022M Kazi ShuvoNo ratings yet

- CAF 8 AUD Spring 2020Document5 pagesCAF 8 AUD Spring 2020Huma BashirNo ratings yet

- Term Test 1Document3 pagesTerm Test 1Hassan TanveerNo ratings yet

- Hacc423 Question Bank 2021Document13 pagesHacc423 Question Bank 2021Tawanda Tatenda HerbertNo ratings yet

- Self - Test Questions - L1Document1 pageSelf - Test Questions - L1qmwdb2k27kNo ratings yet

- 304.AUDP - .L III December 2020Document3 pages304.AUDP - .L III December 2020Md Joinal AbedinNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument182 pagesF8 Workbook Questions & Solutions 1.1 PDFViembre Tr33% (3)

- AARS Practice QuestionsDocument211 pagesAARS Practice QuestionsChaudhury Ahmed HabibNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationAdil AfridiNo ratings yet

- Audit and Assurance: Solutions Manual To AccompanyDocument8 pagesAudit and Assurance: Solutions Manual To AccompanyTooshrinaNo ratings yet

- Audit Assurance Paper 2.3 July 2023Document16 pagesAudit Assurance Paper 2.3 July 2023Godliving J LyimoNo ratings yet

- 3.III-TERMS-Audit June.2024 Exam batch-80.12.20.SKK-68Document3 pages3.III-TERMS-Audit June.2024 Exam batch-80.12.20.SKK-68y.yubaraj001No ratings yet

- 5 - (S2) Aa MP PDFDocument3 pages5 - (S2) Aa MP PDFFlow RiyaNo ratings yet

- Trial Questions On AuditDocument4 pagesTrial Questions On AuditDaniel AmoahNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestshankitNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- Semester 1 - PAPER IDocument7 pagesSemester 1 - PAPER IShilongo OliviaNo ratings yet

- 2007 Summer QuestionsDocument4 pages2007 Summer QuestionsUmer AbdullahNo ratings yet

- Past Exam PaperDocument6 pagesPast Exam Paperprecious mountainsNo ratings yet

- Test 1Document2 pagesTest 1verdantly0No ratings yet

- P2 Audit Practice August 2018Document18 pagesP2 Audit Practice August 2018Vitalis MbuyaNo ratings yet

- ADVANCED AUDIT ASSURANCE PAPER 3.2 Nov 2017Document20 pagesADVANCED AUDIT ASSURANCE PAPER 3.2 Nov 2017akpanyapNo ratings yet

- 71485bos57500 p6Document18 pages71485bos57500 p6OPULENCENo ratings yet

- CA Inter Audit Suggested Answer May 2022Document18 pagesCA Inter Audit Suggested Answer May 2022Henry RobinsonNo ratings yet

- Ca Neeraj Arora Audit Important Questions May 2024Document4 pagesCa Neeraj Arora Audit Important Questions May 2024wiviwol553No ratings yet

- AUDIT & ASSURANCE - ND-2022 - QuestionDocument7 pagesAUDIT & ASSURANCE - ND-2022 - QuestionTamzid Ahmed AnikNo ratings yet

- Sub Rma 503Document10 pagesSub Rma 503Areeb BaqaiNo ratings yet

- AUDIT AND ASSURANCE - ND-2021 - Suggested AnswersDocument12 pagesAUDIT AND ASSURANCE - ND-2021 - Suggested AnswersMehedi Hasan TouhidNo ratings yet

- CFAP 6 AARS Winter 2020Document4 pagesCFAP 6 AARS Winter 2020ANo ratings yet

- Auditing Set 2Document7 pagesAuditing Set 2cleophacerevivalNo ratings yet

- Summary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersDocument46 pagesSummary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Worked ExampleDocument22 pagesSummary of Audit & Assurance Application Level - Worked ExampleIQBAL MAHMUDNo ratings yet

- AuditingDocument13 pagesAuditingAneeq TahirNo ratings yet

- Sprintclass Mock - Q1Document4 pagesSprintclass Mock - Q1Nur AmirahNo ratings yet

- MTP1 May2022 - Paper 6 AuditingDocument20 pagesMTP1 May2022 - Paper 6 AuditingYash YashwantNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- Audit CBT 1,2 QuestionDocument70 pagesAudit CBT 1,2 Questionpetrichor.doctorNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- 2022 Sep Dec Hybrid Q - KSDocument7 pages2022 Sep Dec Hybrid Q - KSAmmar GhausNo ratings yet

- Basic ConceptsDocument5 pagesBasic Conceptshaziquehussain8959No ratings yet

- Caf 8 Aud Spring 2022Document3 pagesCaf 8 Aud Spring 2022Huma BashirNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document18 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Suryanarayan RajanalaNo ratings yet

- Suggested Answers Compiler May 2018 To July 2021Document113 pagesSuggested Answers Compiler May 2018 To July 2021rabin067khatriNo ratings yet

- GM Test Series: Top 50 QuestionsDocument43 pagesGM Test Series: Top 50 QuestionsAryanAroraNo ratings yet

- Week 3 Discussion Questions and AnswersDocument6 pagesWeek 3 Discussion Questions and AnswersElaine LimNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- AUDIT & ASSURANCE - ND-2023 - QuestionDocument6 pagesAUDIT & ASSURANCE - ND-2023 - QuestionusmanbfaizNo ratings yet

- Audit & Assurance 2012Document13 pagesAudit & Assurance 2012S M Wadud TuhinNo ratings yet

- Paper 3 - Audit - TP-8Document6 pagesPaper 3 - Audit - TP-8Suprava MishraNo ratings yet

- CL1-Suggested Solutions - July 2021Document17 pagesCL1-Suggested Solutions - July 2021lakshan pereraNo ratings yet

- ACCA AAA EthicsDocument24 pagesACCA AAA EthicsSIRUI DINGNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Ebook & Notes - Construction Planning and SchedulingDocument47 pagesEbook & Notes - Construction Planning and SchedulingprakashNo ratings yet

- Chapter 14 - Comparative International Auditing and Corporate GovernanceDocument11 pagesChapter 14 - Comparative International Auditing and Corporate GovernanceLoretta SuryadiNo ratings yet

- AUD 0 Finals MergedDocument41 pagesAUD 0 Finals MergedBea MallariNo ratings yet

- Acce 311Document13 pagesAcce 311Jose Jalry TabasNo ratings yet

- Factors Influencing Accounting Students' Career PathsDocument11 pagesFactors Influencing Accounting Students' Career PathsYufi BintangNo ratings yet

- Strategy Review, Evaluation and Control: 1. Examining The Underlying Bases of A Firm's StrategyDocument11 pagesStrategy Review, Evaluation and Control: 1. Examining The Underlying Bases of A Firm's StrategyRaca DesuNo ratings yet

- NCAC Chamber Accreditation GuideDocument34 pagesNCAC Chamber Accreditation GuidejoshuaharaldNo ratings yet

- Global Shell Games Book Launch PresentationDocument42 pagesGlobal Shell Games Book Launch PresentationGlobal Financial Integrity100% (2)

- ACCA P1 Mock1 Answers June2018 PDFDocument28 pagesACCA P1 Mock1 Answers June2018 PDFKaran Bungshee Sr.No ratings yet

- Journal of Contemporary Accounting & Economics: Ahsan Habib, Abdul Haris Muhammadi, Haiyan JiangDocument19 pagesJournal of Contemporary Accounting & Economics: Ahsan Habib, Abdul Haris Muhammadi, Haiyan JiangAgus WijayaNo ratings yet

- Psre 2400 PDFDocument19 pagesPsre 2400 PDFAJ PeredoNo ratings yet

- ValidationDocument29 pagesValidationnilebhal100% (1)

- FM 10 - Dr. Cedric Val Naranjo, CPADocument5 pagesFM 10 - Dr. Cedric Val Naranjo, CPARichielen Navarro RabayaNo ratings yet

- Jet Airways Financial Report-2008Document2 pagesJet Airways Financial Report-2008RKMNo ratings yet

- Neha Gupta - CVDocument4 pagesNeha Gupta - CVKushagra SoniNo ratings yet

- Hh1 - Animal Feed Haccp PlanDocument74 pagesHh1 - Animal Feed Haccp PlanJyShe_laNo ratings yet

- Case 2 Infosys CSRDocument13 pagesCase 2 Infosys CSRsuryajeet patilNo ratings yet

- The Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Document29 pagesThe Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Cherry BlasoomNo ratings yet

- Manual of Information Technology Audit PDFDocument113 pagesManual of Information Technology Audit PDFgio33gioNo ratings yet

- Hul Annual Report 2020 21 - tcm1255 561812 - 1 - enDocument146 pagesHul Annual Report 2020 21 - tcm1255 561812 - 1 - enRamyaNo ratings yet

- MBA Syllabus 21-08-2020 FinalDocument160 pagesMBA Syllabus 21-08-2020 Finalgundarapu deepika0% (1)

- Ethiopia Second UWSSP PIM Volume II FM, Oct 11Document110 pagesEthiopia Second UWSSP PIM Volume II FM, Oct 11yesufNo ratings yet

- A Conceptual Framework For Financial Accounting and ReportingDocument6 pagesA Conceptual Framework For Financial Accounting and ReportingemjiyyyyNo ratings yet

- CreditAccess Grameen - Investor Presentation - Q4 - FY 2021 22Document54 pagesCreditAccess Grameen - Investor Presentation - Q4 - FY 2021 22Haidir AuliaNo ratings yet

- Audit ReportDocument15 pagesAudit ReportRica MarieNo ratings yet

- Ched Es2015Document11 pagesChed Es2015demos reaNo ratings yet

- Chapter 1: Basic of Cost Accounting: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Document55 pagesChapter 1: Basic of Cost Accounting: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Yash PardeshiNo ratings yet

- Financial Statement Fraud - Lesson From US N EuroDocument13 pagesFinancial Statement Fraud - Lesson From US N EuroEko Bayu Dian PNo ratings yet