Professional Documents

Culture Documents

Course Outline - Fin 223

Course Outline - Fin 223

Uploaded by

DenisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course Outline - Fin 223

Course Outline - Fin 223

Uploaded by

DenisCopyright:

Available Formats

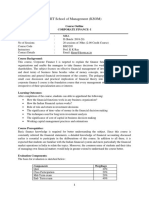

FIN 223: MANAGERIAL FINANCE

i Course Title: FIN 223:MANAGERIAL FINANCE

ii Course Aim: To provide students with the theory, principles and practices of

financial management, including basic models for the

determination of the value of the firm, and how these form the

basis for decisions in financial planning and control, current

asset management, capital budgeting decisions, capital structure

decisions, cost of capital and dividend policies of the firm.

iii Course expected At the end of this course, the student should be able to:

learning Describe financing strategies.

outcome(s): Appraise projects for investment purposes.

Assess the capital structure of business firms.

Evaluate corporate dividend policy.

Demonstrate how financial markets work and their usefulness

in economic development

iv Course status-core Core

or elective:

v Credit rating: 12 credit points

vi Total hours spent: 120

vii Course Content: 1. THE NATURE AND SCOPE OF MANAGERIAL

FINANCE AND PRINCIPLES OF FINANCIAL

RETURNS

The Concept of Managerial Finance

The Goals of the Firm

Profit and wealth maximization objectives of investors

The Roles of Financial Manager

Agency theory

Firm’s expected returns and risks

2. FINANCIAL MARKETS (MONEY AND CAPITAL

MARKETS)

The purpose of financial markets

Types of Financial markets

What constitutes the Financial Markets

Capital markets without security markets

Capital markets with security markets

Dar-es-salaam Stock Exchange Structure

Roles and Functions of the Dar-es-salaam Stock Exchange

Roles and Functions of the Capital Markets

Security Authority

Procedures in Dar-es-salaam stock Exchange

Effects of not having stock exchange

markets

Financial Institutions in Tanzania and Acts

related to Financial Activities.

3. SHORT-TERM FINANCING AND WORKING CAPITAL

The Management of Working Capital

Working capital fundamentals

Working capital strategies

Management of cash and marketable

securities

Management of receivables and inventories

Short - Term Financing:

Secured sources of short-term loans

Unsecured sources of short-term loans

Spontaneous sources of short-term financing

4. LONG TERM FINANCING

Raising Equity Capital

Equity financing for private companies

Going public – IPO

Debt Financing

Corporate bonds

Bond covenants

Leasing

Financing lease

Operating lease

5. CAPITAL BUDGETING (INVESTMENT) DECISIONS

Concepts of capital budgeting

Preparing cash budgets

Methods of evaluating investment alternatives

Capital rationing

Payback period

IRR

Accounting Rate of Return

Net Present Value and Capital Budgeting

Methods of evaluating investment alternatives

Capital Rationing and its types

6. COST OF CAPITAL AND CAPITAL STRUCTURE

Cost of capital

Capital structure

Weighted Average Cost of Capital and Weighted Marginal

Cost of Capital

Capital structure in practice.

7. PORTFOLIO THEORY

Measuring of Risk and Return

Portfolio Analysis

Expected Values

Sensitivity Analysis

8. VALUATION OF SECURITIES

Key inputs to Valuation

The Basic Valuation Model

CAPM and its practical use

The Arbitrage pricing model

Valuation of bonds/debentures

Valuation of preferred shares

Valuation of equity shares

viii Teaching and Lectures, seminars, assignments and independent study

learning activities:

ix Assessment Test, Individual Assignment, Group Assignment and Final

Methods: examination.

x Reading list : Books:

ACCA (Latest).Financial Management Exam Text; UK : BPP

Publishers.

Arnold, Glen (2012).Corporate Financial Reporting, 5th

ed ,UK: Prentice Hall..

Brealey, Myers and Allen (2013).Principles of Corporate

Finance. 11th ed. USA: McGraw- Hill Irwin.

Pandey, I, M (2011).Essentials of Financial Management, 3rd

ed,

Pandey, I.M (2015). Financial Management. 11th ed. India:

Prentice Hall.

Ross, S.A, et al, Irwin (2012). Corporate Finance. 10th

ed.Illinois.

You might also like

- Pettet, Lowry and Reisberg's Company LawDocument705 pagesPettet, Lowry and Reisberg's Company LawIbtikar MuntazirNo ratings yet

- Drew Eric Whitman - CA$HVERTISING (Deatailed Book Notes)Document47 pagesDrew Eric Whitman - CA$HVERTISING (Deatailed Book Notes)Kenneth Anderson100% (3)

- Advertising Age - Hispanic Fact PackDocument31 pagesAdvertising Age - Hispanic Fact Packdrummestudcom0% (1)

- Marketing Myopia - Theodore LevittDocument6 pagesMarketing Myopia - Theodore Levittapi-27014089100% (1)

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Course Outline All in OneDocument50 pagesCourse Outline All in OneMillionNo ratings yet

- CF - Co - MaDocument32 pagesCF - Co - MaANKIT GUPTANo ratings yet

- FM Course Outline & Materials-Thappar UnivDocument74 pagesFM Course Outline & Materials-Thappar Univharsimranjitsidhu661No ratings yet

- Business Finance Course Outline & NotesDocument173 pagesBusiness Finance Course Outline & NotesramboNo ratings yet

- Certified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDocument6 pagesCertified Investment Research Analyst (CIRA) : 1. Investments-Concepts & Featuresprithvisingh thakur100% (1)

- Course Outline Financial Management NTUDocument6 pagesCourse Outline Financial Management NTUHassaanNo ratings yet

- CF - CO Section - BDocument31 pagesCF - CO Section - BAditya SinghNo ratings yet

- Certified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDocument6 pagesCertified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesPesala Manoj KumarNo ratings yet

- Certified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDocument6 pagesCertified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDivyesh ChadotraNo ratings yet

- Financial Management Course OutlineDocument2 pagesFinancial Management Course OutlineMadiha ZamanNo ratings yet

- TextBook BusinessFinanceDocument7 pagesTextBook BusinessFinanceJot BawaNo ratings yet

- AXIS-BANKWealth-management - EDIT G9Document119 pagesAXIS-BANKWealth-management - EDIT G9AnupNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Corporate Finance NotesDocument99 pagesCorporate Finance NotesmwendaflaviushilelmutembeiNo ratings yet

- Course Description: Business FinanceDocument2 pagesCourse Description: Business FinanceAmir HayatNo ratings yet

- Financial Management Course OutlineDocument2 pagesFinancial Management Course OutlineRosenna99No ratings yet

- Afin209 FPD 1 2017 1Document3 pagesAfin209 FPD 1 2017 1Daniel Daka100% (1)

- BFM Sem Vi 1920Document8 pagesBFM Sem Vi 1920Hitesh BaneNo ratings yet

- Course Outline-CF-I PDFDocument3 pagesCourse Outline-CF-I PDFAkankshya PanigrahiNo ratings yet

- BF 412 Course OutlineDocument2 pagesBF 412 Course OutlineShadrick cholaNo ratings yet

- Financial Eduation and Investment Awareness-22Document6 pagesFinancial Eduation and Investment Awareness-22Vinay Gowda D M100% (1)

- Lexicon SAPM SyllabusDocument4 pagesLexicon SAPM SyllabusPushkarajNo ratings yet

- Certified Alternative Investment Manager (AIM)Document4 pagesCertified Alternative Investment Manager (AIM)manish jhaNo ratings yet

- Corporate Finance ManagementDocument9 pagesCorporate Finance Managementtrustmakamba23No ratings yet

- Financial Education & Investment Awareness SyllabusDocument6 pagesFinancial Education & Investment Awareness SyllabusPavitra KalasannavarNo ratings yet

- Ba5009 Corporate Finance L T P C 3 0 0 3 ObjectivesDocument1 pageBa5009 Corporate Finance L T P C 3 0 0 3 ObjectivespremNo ratings yet

- 09-MBA - F0902-Mgt of Financial Services and Institutions-SyllabusDocument3 pages09-MBA - F0902-Mgt of Financial Services and Institutions-SyllabusGanga DuttNo ratings yet

- Post-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IDocument5 pagesPost-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IAbhinav MahajanNo ratings yet

- S5 SFMDocument3 pagesS5 SFMWaqas AnjumNo ratings yet

- Air University Islamabad Department of Business AdministrationDocument7 pagesAir University Islamabad Department of Business AdministrationHamzaNo ratings yet

- Lesson 2 Introduction To Financial ManagementDocument33 pagesLesson 2 Introduction To Financial ManagementNombulelo NdlovuNo ratings yet

- Financial Management 1Document170 pagesFinancial Management 1rohiljulaniya1984No ratings yet

- AFM Study TextDocument224 pagesAFM Study TextleandrealouisNo ratings yet

- Law of Corporate FinanceDocument3 pagesLaw of Corporate FinanceAbdul Qadir Juzer AeranpurewalaNo ratings yet

- Syllabus Certified Alternative Investment Manager AIMDocument4 pagesSyllabus Certified Alternative Investment Manager AIMNellore AshwinNo ratings yet

- Intel College: Course Name: Business Finance and EconomicsDocument2 pagesIntel College: Course Name: Business Finance and EconomicsRocky Kaur100% (1)

- Financial Management 1Document5 pagesFinancial Management 1Nishant ShuklaNo ratings yet

- Theory Notes of All ModulesDocument2 pagesTheory Notes of All ModulesDarshan GowdaNo ratings yet

- MSC510 Corporate FinanceDocument1 pageMSC510 Corporate FinanceRahul PandeyNo ratings yet

- Teaching Schedule - Theory No. Topic Points To Be CoveredDocument2 pagesTeaching Schedule - Theory No. Topic Points To Be Coveredडॉ. प्रशांत पवारNo ratings yet

- Financial ManagementDocument60 pagesFinancial ManagementDEAN TENDEKAI CHIKOWONo ratings yet

- II - Yr - Lesson Plan PDFDocument189 pagesII - Yr - Lesson Plan PDFAbhishek goyalNo ratings yet

- Fundamental - Analysis - of - Reliance - Capital (AutoRecovered)Document70 pagesFundamental - Analysis - of - Reliance - Capital (AutoRecovered)Aryan KhatikNo ratings yet

- 3ad81financial MGMT PDFDocument1 page3ad81financial MGMT PDFÞãrül ÃgärwâlNo ratings yet

- Acc216 Lecture Notes 2017Document38 pagesAcc216 Lecture Notes 2017elfigio gwekwerereNo ratings yet

- FM BBC CourseoutlineDocument6 pagesFM BBC CourseoutlineReagan SsebbaaleNo ratings yet

- Managing The Finance FunctionDocument12 pagesManaging The Finance FunctionDumplings DumborNo ratings yet

- FM-I Course OutlineDocument5 pagesFM-I Course OutlineShaggYNo ratings yet

- MMS Corporate Valuation and Mergers Acquisitions 1Document139 pagesMMS Corporate Valuation and Mergers Acquisitions 1mayank makwanaNo ratings yet

- Finance Basic Session Prepcom FinalDocument29 pagesFinance Basic Session Prepcom FinalJITESHNo ratings yet

- Course Outline - FinanceDocument2 pagesCourse Outline - FinanceAnnabelle BuenaflorNo ratings yet

- FM Spring 2023Document7 pagesFM Spring 2023laibashahzad726No ratings yet

- 01 FM Introduction To FM 01012021Document33 pages01 FM Introduction To FM 01012021Prasad GharatNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementisamad820No ratings yet

- BabeDocument16 pagesBabeNathan FellixNo ratings yet

- DIPK202T - Corporate FinanceDocument1 pageDIPK202T - Corporate Financerohitrajbhar1845No ratings yet

- Il - 401 - Finance Management PDFDocument2 pagesIl - 401 - Finance Management PDFKairavi BhattNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Achieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsFrom EverandAchieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsNo ratings yet

- Lecture 1Document19 pagesLecture 1DenisNo ratings yet

- Lecture 3-1Document31 pagesLecture 3-1DenisNo ratings yet

- Branch AccountingDocument8 pagesBranch AccountingDenisNo ratings yet

- Statement of Cash FlowsDocument8 pagesStatement of Cash FlowsDenisNo ratings yet

- Project Report On Working Capital ManageDocument71 pagesProject Report On Working Capital ManageRushikesh JagtapNo ratings yet

- 01 Paraphrasing - UTS - StsDocument5 pages01 Paraphrasing - UTS - StsMai TrangNo ratings yet

- Bul 502 Company Law NoteDocument26 pagesBul 502 Company Law NoteTèmítọ́pé̩No ratings yet

- Performance Dashboard TemplateDocument24 pagesPerformance Dashboard TemplateEkta ParmarNo ratings yet

- VAHAN 4.0 (Online Appointment)Document1 pageVAHAN 4.0 (Online Appointment)Ashutosh PendkarNo ratings yet

- Process ComposerDocument9 pagesProcess ComposerZakia SadouNo ratings yet

- EDE Practical 1Document4 pagesEDE Practical 1Rugved BhalekarNo ratings yet

- Black BookDocument49 pagesBlack BookKiran PatilNo ratings yet

- FAST FudsDocument8 pagesFAST FudsMariel GozunNo ratings yet

- Alimul Imran Bin Amir (62362224008)Document3 pagesAlimul Imran Bin Amir (62362224008)alimul imranNo ratings yet

- DuopolyDocument18 pagesDuopolyAshish GondaneNo ratings yet

- Acc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025Document2 pagesAcc Statement 1020010537121 2023-01-01 2023-01-31 20230131193025TheBlackJenny TBJNo ratings yet

- Reading 1 - Burghardt2011 - Chapter - RelatedTheoreticalAndEmpiricalDocument25 pagesReading 1 - Burghardt2011 - Chapter - RelatedTheoreticalAndEmpiricalMeiliaNo ratings yet

- Organisation DevelopmentDocument55 pagesOrganisation DevelopmentKAYNo ratings yet

- MI TV 43 InchDocument2 pagesMI TV 43 Inchharry tharunNo ratings yet

- United States Lines vs. Comm. of CustomsDocument2 pagesUnited States Lines vs. Comm. of CustomsRhea CalabinesNo ratings yet

- Unit I Compensation - IntroductionDocument21 pagesUnit I Compensation - IntroductionmanojNo ratings yet

- HP - Strategic Management Case Study 2007Document18 pagesHP - Strategic Management Case Study 2007Furqan MohyuddinNo ratings yet

- Banquet and Catering Management (Tango)Document3 pagesBanquet and Catering Management (Tango)Renmar BaccayNo ratings yet

- Polycab 1Document5 pagesPolycab 1Suman BarellaNo ratings yet

- The Impact of Market Orders PDFDocument21 pagesThe Impact of Market Orders PDFSeverin SaubertNo ratings yet

- Research Report, Dark Horse & IPO Info From Smart InvestmentsDocument4 pagesResearch Report, Dark Horse & IPO Info From Smart InvestmentsRam hedaNo ratings yet

- 12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentDocument19 pages12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentnamNo ratings yet

- Practice Notes For Quantity Surveyors - Cost Control and Financial Statements 202109Document12 pagesPractice Notes For Quantity Surveyors - Cost Control and Financial Statements 202109lifei2998No ratings yet

- 1.0 Kenyas Public Debt Dr. Abraham RugoDocument17 pages1.0 Kenyas Public Debt Dr. Abraham RugoREJAY89No ratings yet

- Ifrs Sustainability Disclosure Standards GuidanceDocument21 pagesIfrs Sustainability Disclosure Standards GuidanceMJ DiazNo ratings yet