Professional Documents

Culture Documents

M A 15 Feb 2024 Example

M A 15 Feb 2024 Example

Uploaded by

Arko GhoshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M A 15 Feb 2024 Example

M A 15 Feb 2024 Example

Uploaded by

Arko GhoshCopyright:

Available Formats

MERGERS AND ACQUISITIONS

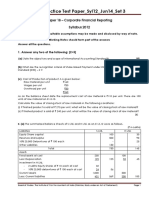

6] The financial position of two companies Harry Ltd. and S a l l y Ltd. as at 31st March 2021

was as under

Particulars Harry Ltd. Sally Ltd.

Equity and Liabilities

Shareholders’ funds

Share capital 11,00,000 4,00,000

General Reserve 70,000 70,000

Non-current liabilities

Long term provisions – Gratuity fund 50,000 20,000

Current liabilities

Trade Payables 1,30,000 80,000

Total 13,50,000 5,70,000

Assets

Non-current assets

Property, Plant and Equipment 8,00,000 2,50,000

Intangible assets - Goodwill 50,000 25,000

Current assets

Inventories 2,50,000 1,75,000

Trade receivables 2,00,000 1,00,000

Cash and Cash equivalents 50,000 20,000

Total 13,50,000 5,70,000

1) Equity share capital (Rs 10 each) Harry Ltd. Rs 10,00,000 while Sally Ltd 3,00,000

9% (Rs. 100) preference share capital of Harry Ltd Rs. 1 Lakh while 10% preference capital of

Sally Ltd. Rs. 1,00,000

2) PPE includes Land & Building Rs. 3 Lakh & 1 Lakh and plant and machinery of Rs. 5 Lakh &

1.5 lakh for Harry & sally.

Harry Ltd. absorbs Sally Ltd. on the following terms:

i. 10% Preference Shareholders are to be paid at 10% premium by issue of 9% Preference

Shares of Harry Ltd.

ii. Goodwill of Sally Ltd. is valued at Rs. 50,000, Buildings are valued at Rs. 1,50,000 and the

Machinery at Rs. 1,60,000.

iii. Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created

@ 7.5%.

iv. Equity Shareholders of S a l l y Ltd. will be issued necessary Equity Shares @ 5% premium

Draft the Balance Sheet after absorption as at 31st March, 2021.

You might also like

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- Chapter 2 ProblemDocument18 pagesChapter 2 ProblemJudielyn M GonzalesNo ratings yet

- Consolidation Part 1Document11 pagesConsolidation Part 1Benita BijuNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- CR Assignemt Unit 3Document25 pagesCR Assignemt Unit 3Calida SoaresNo ratings yet

- Financial Accounting & AuditingDocument13 pagesFinancial Accounting & Auditingkashish mehtaNo ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- FR & FSA - SuggestionDocument33 pagesFR & FSA - SuggestionBISHAL ROYNo ratings yet

- CFS Test - 1 Set-A 13-2-2022Document2 pagesCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Frias Activity 1Document6 pagesFrias Activity 1Lars FriasNo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- Unit 2 Merger & Purchase MethodDocument11 pagesUnit 2 Merger & Purchase MethodLuckygirl JyothiNo ratings yet

- Fa - 6 Amalgamation & LLPDocument10 pagesFa - 6 Amalgamation & LLPalokchowdhury111No ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Corporate Reporting Consolidation Review QuestionsDocument14 pagesCorporate Reporting Consolidation Review Questionssaidkhatib368No ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- Redemption of Preference ShareDocument6 pagesRedemption of Preference ShareAkash KamathNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet

- Exercises in English - VatelDocument18 pagesExercises in English - VatelQUYNHNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Nov 23 - FR Board NotesDocument42 pagesNov 23 - FR Board Notespratikdubey9586No ratings yet

- Activity 2 - Alaska Company - ADEVA, MKADocument3 pagesActivity 2 - Alaska Company - ADEVA, MKAMaria Kathreena Andrea AdevaNo ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezNo ratings yet

- Sums On Consolidation 2020 PDFDocument3 pagesSums On Consolidation 2020 PDFRohan DharneNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Holding Company ProblemsDocument22 pagesHolding Company ProblemsYashodhan MithareNo ratings yet

- Group 2 Ia3Document5 pagesGroup 2 Ia3Abe Mayores CañasNo ratings yet

- P18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012Document9 pagesP18 - Practice Test Paper - Syl12 - Jun14 - Set 3: Paper 18 - Corporate Financial Reporting Syllabus 2012ChandreshNo ratings yet

- Semester II (Ugcf) 2412091201 ADocument9 pagesSemester II (Ugcf) 2412091201 Aindukush8No ratings yet

- Sums On Cash Flow StatementDocument5 pagesSums On Cash Flow StatementAstha ParmanandkaNo ratings yet

- Statement of Financial Position: Learning CompetenciesDocument9 pagesStatement of Financial Position: Learning CompetenciesJmaseNo ratings yet

- Mutual OwingsDocument3 pagesMutual Owingsbriankuria21No ratings yet

- Redemption of Preference Shares IllustrationsDocument6 pagesRedemption of Preference Shares IllustrationsManya GargNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- UNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMDocument4 pagesUNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMAaryan K MNo ratings yet

- Picarra, Sherilyn - PROBLEM 8-4Document2 pagesPicarra, Sherilyn - PROBLEM 8-4Sherilyn PicarraNo ratings yet

- Internal Reconstruction - ProblemsDocument8 pagesInternal Reconstruction - ProblemsNaomi SaldanhaNo ratings yet

- Advanced Accounting: Attempt All Questions. Working Notes Should Form Part of The AnswerDocument119 pagesAdvanced Accounting: Attempt All Questions. Working Notes Should Form Part of The AnswerDipen AdhikariNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- ABE Company Provided The Following Account Balances On December 31Document4 pagesABE Company Provided The Following Account Balances On December 31angeline bulacanNo ratings yet

- Buy Back of Shares HandoutDocument15 pagesBuy Back of Shares Handoutdhiren.c.shekar99No ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- 9 Consolidated Financial StatementsDocument20 pages9 Consolidated Financial StatementsArpan SinghNo ratings yet

- Tutorial 1 PDFDocument2 pagesTutorial 1 PDFchirag chhabraNo ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Corporate Acc 6.2.22Document3 pagesCorporate Acc 6.2.22VANSHAJ SHAHNo ratings yet

- Financial Statement Sums - 230329 - 001857Document26 pagesFinancial Statement Sums - 230329 - 001857AppleNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Problem Based On Ratio Analysis - Part - 2Document1 pageProblem Based On Ratio Analysis - Part - 2Mohd shariqNo ratings yet

- Extreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldFrom EverandExtreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldRating: 2.5 out of 5 stars2.5/5 (1)