Professional Documents

Culture Documents

Bank Reconciliation (Millan, 2022)

Bank Reconciliation (Millan, 2022)

Uploaded by

didit.canon0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageBank Reconciliation (Millan, 2022)

Bank Reconciliation (Millan, 2022)

Uploaded by

didit.canonCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

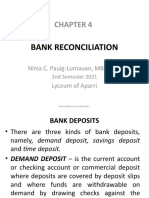

BANK RECONCILIATION______________________ 1.

Collections made by the bank on behalf of the

depositor

Bank reconciliation statement – is a report that is

2. Interest income earned by the deposit

prepared for the purpose of bringing the balances of

3. Proceeds from loan directly credited/added by

cash per records and per bank statement into

the bank to the depositor’s account

agreement

4. Unrolled-over matured time deposits

Monthly – how often bank reconciliations are prepared transferred by the bank to the entity’s account

Bank statement – is a report issued by a bank that Examples of debit memos

shows deposits and withdrawals during the period and

1. Bank service charges for fees, penalties, and

the cumulative balance of a depositor’s bank account

subcharges

Checking accounts – accounts where bank 2. No sufficient funds check (NSF) or Drawn

reconciliations are normally required against insufficient funds check (DAIF)

ABC Co. 3. Automatic debits, such as when the depositor

Bank Reconciliation and the bank agrees that the bank will make

For the month ended, Jan 1, 20x1 automatic payment of bills on behalf of the

Balance per books, end Balance per bank, end depositor

4. Payment of loans which the depositor agreed to

Add: Credit Memos Add: Deposits in Transit

be made out directly from its bank account

Less: Debit Memos Less: Outstanding Checks

Book reconciling items

Add/Less: Book Errors Add/Less: Bank errors

1. Credit memos

Adjusted Balance Adjusted Balance 2. Debit memos

3. Book errors

Balance per books, end – the cash balance in the Bank reconciling items

accounting records as of the end of the current month

1. Deposits in transit

Balance per bank statement, end – the ending cash 2. Outstanding checks

balance in the bank statement of the current month 3. Bank errors

Credit memos – are additions made by the bank to the

depositor’s bank account but not yet recorded by the

depositor (bank credits)

Debit memos – are deductions made by the bank to the

depositor’s bank account but not yet recorded by the

depositor (bank debits)

Book errors – errors committed by the depositor

Deposits in transit – are deposits made but not yet

credited by the bank to the depositor’s bank account

Outstanding checks – are checks drawn and released to

payees but are not yet encashed with the bank

*Certified checks and Stale checks are excluded in

outstanding checks*

Bank errors – errors committed by the bank

Examples of credit memos

You might also like

- Legal English How To Understand and Master The Language of Law by William McKayDocument257 pagesLegal English How To Understand and Master The Language of Law by William McKayKarolina LucjaNo ratings yet

- Ten Steps To Improving College Reading S PDFDocument1 pageTen Steps To Improving College Reading S PDFCat girl jhoselin0% (1)

- ACCELE4Document3 pagesACCELE4Karylle AnneNo ratings yet

- Financial Accounting Chapter 8Document2 pagesFinancial Accounting Chapter 8Noel Guerra100% (2)

- Bank Recon NotesDocument2 pagesBank Recon NotesFrancine PimentelNo ratings yet

- FABM REVIEWER 2nd QUARTERDocument5 pagesFABM REVIEWER 2nd QUARTERMikaella Adriana GoNo ratings yet

- 1.2 Bank Reconciliation and Proof of CashDocument6 pages1.2 Bank Reconciliation and Proof of CashShally Lao-unNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationGiyah UsiNo ratings yet

- Bank ReconciliationDocument14 pagesBank ReconciliationKim Ternura100% (1)

- Bank Reconciliation NotesDocument4 pagesBank Reconciliation NotesGerson ManawisNo ratings yet

- Bank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument60 pagesBank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- Bank ReconciliationDocument24 pagesBank ReconciliationCyrelle MagpantayNo ratings yet

- CFAS - Bank ReconciliationDocument5 pagesCFAS - Bank ReconciliationAltessa Lyn ContigaNo ratings yet

- M10 TranscriptDocument3 pagesM10 TranscriptJanna RodriguezNo ratings yet

- Chapter 5 - Bank Reconciliation StatementDocument23 pagesChapter 5 - Bank Reconciliation StatementNchumthung JamiNo ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Lesson 8 - Bank Reconciliation StatementDocument5 pagesLesson 8 - Bank Reconciliation StatementUnknownymousNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate Accountingjaninasachadelacruz0119No ratings yet

- Unit 7. Cash 6.0 Aims & ObjectivesDocument10 pagesUnit 7. Cash 6.0 Aims & ObjectivesKaleab TesfayeNo ratings yet

- Final Chapter 6Document6 pagesFinal Chapter 6Hussen AbdulkadirNo ratings yet

- Chapter 2 & 3 - Bank Recon and Proof of CashDocument3 pagesChapter 2 & 3 - Bank Recon and Proof of CashAvia Chelsy DeangNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- Fundamentas of Accounting I CH 5Document24 pagesFundamentas of Accounting I CH 5israelbedasa3100% (1)

- Bank Reconciliation: Intermediate Accounting 1Document4 pagesBank Reconciliation: Intermediate Accounting 1Kesiah FortunaNo ratings yet

- Chapter - 6Document12 pagesChapter - 6Mehamed NureNo ratings yet

- Chapter 2 Bank ReconciliationDocument15 pagesChapter 2 Bank Reconciliation2021315379No ratings yet

- Final Chapter 6Document12 pagesFinal Chapter 6Nigussie BerhanuNo ratings yet

- Bank Reconciliation ReviewerDocument2 pagesBank Reconciliation Reviewerfred ferrera jrNo ratings yet

- Accounting For CashDocument6 pagesAccounting For CashAsnake YohanisNo ratings yet

- How To Prepare A Bank ReconciliationDocument6 pagesHow To Prepare A Bank ReconciliationMk Fisiha100% (1)

- Bank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyDocument2 pagesBank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyWimrod CanenciaNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Cash EquivalentDocument8 pagesCash EquivalentEyra MercadejasNo ratings yet

- MODULE 3 - Part 3 Bank ReconciliationDocument16 pagesMODULE 3 - Part 3 Bank ReconciliationShaena Mae50% (2)

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- Bank Reconciliation: MeaningDocument1 pageBank Reconciliation: MeaningMark Johnson LeeNo ratings yet

- Final Chapter 4Document8 pagesFinal Chapter 4Abraham RayaNo ratings yet

- L2 Bank ReconciliationDocument3 pagesL2 Bank ReconciliationAshley BrevaNo ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- Main IdeasDocument7 pagesMain IdeasIsabel Jost SouribioNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- 1 Updates LoanDocument7 pages1 Updates LoanFor PurposeNo ratings yet

- Bank Reconciliation-1Document5 pagesBank Reconciliation-1Chin DyNo ratings yet

- Learning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Document13 pagesLearning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Yuri GalloNo ratings yet

- Chapter-2 Bank Reconciliation StatementDocument10 pagesChapter-2 Bank Reconciliation Statementyisog79636No ratings yet

- 6 - Bank Reconciliation StatementDocument3 pages6 - Bank Reconciliation StatementNeeraj RaikwarNo ratings yet

- CCEDocument4 pagesCCEせい じよNo ratings yet

- Key Terms and Chapter Summary-13Document2 pagesKey Terms and Chapter Summary-13onstudy015No ratings yet

- ACTBAS2 - Cash HandoutsDocument2 pagesACTBAS2 - Cash HandoutsAliaJustineIlaganNo ratings yet

- Chapter 8 - Bank ReconciliationDocument6 pagesChapter 8 - Bank ReconciliationAdan EveNo ratings yet

- Bank Reconciliation Synchronous Lecture 1-1Document4 pagesBank Reconciliation Synchronous Lecture 1-1jojo beatNo ratings yet

- Abm Fabm2 Module 7 Lesson 1 Bank ReconciliationDocument15 pagesAbm Fabm2 Module 7 Lesson 1 Bank ReconciliationAtria Lenn Villamiel Bugal100% (1)

- CHAPTER SIX - Doc Internal Control Over CashDocument7 pagesCHAPTER SIX - Doc Internal Control Over CashYared DemissieNo ratings yet

- Ch.4 - Cash and Receivables - MHDocument75 pagesCh.4 - Cash and Receivables - MHSamZhaoNo ratings yet

- Cash Chapter 5Document9 pagesCash Chapter 5yoantanNo ratings yet

- 206bank Reconcilliation StatementDocument3 pages206bank Reconcilliation StatementRAKESH VARMANo ratings yet

- Assignment 1571213669 SmsDocument13 pagesAssignment 1571213669 SmsJayasuriya SNo ratings yet

- PRI II Note CH 1-7Document78 pagesPRI II Note CH 1-7AbelNo ratings yet

- Final Chapter 6Document14 pagesFinal Chapter 6zynab123No ratings yet

- Foxflash ReadWrite MAN ECU EDC7C32 by OBD or Bench - PCMtuner Official BlogDocument1 pageFoxflash ReadWrite MAN ECU EDC7C32 by OBD or Bench - PCMtuner Official BlogcrazyracerNo ratings yet

- A Level Economics Paper 1 MSDocument25 pagesA Level Economics Paper 1 MSYusuf SaleemNo ratings yet

- Mall of Asia ManilaDocument43 pagesMall of Asia ManilaEmil BarengNo ratings yet

- Unit 2 Carbohydrates 2018Document109 pagesUnit 2 Carbohydrates 2018Christine Annmarie TapawanNo ratings yet

- Digests 31 - 40Document16 pagesDigests 31 - 40KarlNo ratings yet

- 1 s2.0 S0898656821000693 MainDocument4 pages1 s2.0 S0898656821000693 MainLívia MeloNo ratings yet

- Ukpor Owes Dim Nnakife A LotDocument7 pagesUkpor Owes Dim Nnakife A LotBen OkoyeNo ratings yet

- Corrosion of Steel in Concrete Understanding Investigation and Repair-51-100Document50 pagesCorrosion of Steel in Concrete Understanding Investigation and Repair-51-100Sumit Singh ThakurNo ratings yet

- Istorijat DresstaDocument4 pagesIstorijat DresstaAmdMsiNo ratings yet

- Mathematics Achievement Test (MAT)Document18 pagesMathematics Achievement Test (MAT)Rustico Y Jerusalem0% (1)

- Sabine Pass Approval Order, DOEDocument50 pagesSabine Pass Approval Order, DOEcprofitaNo ratings yet

- AGAR2(UTTARPRADESH)-1Document234 pagesAGAR2(UTTARPRADESH)-1cdon40432No ratings yet

- CRM Assignment 2Document11 pagesCRM Assignment 2Arneet SarnaNo ratings yet

- Slokas and Mantras: Bhaja Govindam Was Written by Jagadguru Adi ShankaracharyaDocument12 pagesSlokas and Mantras: Bhaja Govindam Was Written by Jagadguru Adi Shankaracharyan.devanathanNo ratings yet

- 5/ What Is The Relationship Between Structure of The Small Intestine and Its Function?Document3 pages5/ What Is The Relationship Between Structure of The Small Intestine and Its Function?just kimbooNo ratings yet

- Evolution of One China PolicyDocument86 pagesEvolution of One China Policygabby0213No ratings yet

- How To Make Jarvis Iron Man ComputerDocument6 pagesHow To Make Jarvis Iron Man ComputerYori Hadi PutraNo ratings yet

- Ps.c1.lecture SlidesDocument33 pagesPs.c1.lecture SlidesRida TahirNo ratings yet

- 03 Industrial RevolutionDocument103 pages03 Industrial Revolutioninfo12060% (1)

- Assessment For Learning ToolsDocument72 pagesAssessment For Learning ToolsElaine How Yuen50% (2)

- Electronic Diary Instructions: Click HereDocument72 pagesElectronic Diary Instructions: Click HereashishvaidNo ratings yet

- ResumeDocument2 pagesResumeSamm0% (1)

- Eco No MetricsDocument299 pagesEco No Metricsdmchoi87No ratings yet

- Shiva AyyaduraiDocument60 pagesShiva AyyaduraiJoy Velu100% (2)

- Universidad Tecnologica de Honduras: Ingles IDocument2 pagesUniversidad Tecnologica de Honduras: Ingles Ianon_8852222000% (1)

- Chapter 4Document62 pagesChapter 4abbyNo ratings yet

- Gabion Walls: Design The Change: Engineering A Better SolutionDocument2 pagesGabion Walls: Design The Change: Engineering A Better SolutionJaime BojorqueNo ratings yet

- APT ReviewerDocument22 pagesAPT ReviewerboorijanNo ratings yet