Professional Documents

Culture Documents

Decree Chart - MARK COPY - ENLARGE FIGURES COPY - NEW EDIT

Decree Chart - MARK COPY - ENLARGE FIGURES COPY - NEW EDIT

Uploaded by

sasta jiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Decree Chart - MARK COPY - ENLARGE FIGURES COPY - NEW EDIT

Decree Chart - MARK COPY - ENLARGE FIGURES COPY - NEW EDIT

Uploaded by

sasta jiCopyright:

Available Formats

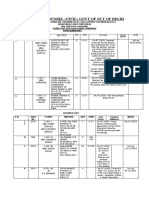

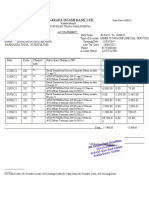

CHART DISCLOSING PARTICULARS OF PAYMENT OF ENTIRE PRINCIPAL AMOUNTS RELEASED TO BANKS ON AN ADHOC BASIS BY

HON'BLE SPECIAL COURT AND HON'BLE SUPREME COURT AGAINST EX-PARTE DECREES WHICH ARE STILL UNDER CHALLENGE

BEFORE HON'BLE SUPREME COURT

Decree

Date of Amount paid

Sr. No. Name of the Bank Particulars Amount Order Date

Order (In Crs.)

(In Crs.)

1 Standard Chartered Bank Suit No. 28 of 95 SCB Vs. HSM 25.07.2003 506.54 506.54 08.09.2017

2 State Bank of India 86.99 25.02.2011

Suit No. 41 of 95 SCB Vs. HSM 03.03.2003 137.12

50.13 03.03.2003

Feb., March

2003,

M.P. No. 63 of 1992 SBI, NHB Vs HSM 22.04.2003 706.97 706.97 25.02.2011 &

09.09.2011

Feb., March

M.P. No. 14 of 1995 SBI Vs HSM 14.08.2003 222.04 130.73 2003

91.31 08.09.2017

3 State Bank of Saurashtra (since Suit No. 52 of 1993 S B of Sau. Vs. HSM 18.01.1999 99.11 99.11 25.02.2011

merged with State Bank of India)

Suit No. 44 of 1995 S B of Sau. Vs. HSM 23.09.2003 0.14 0.14 25.02.2011

4 SBI Capital Markets Ltd. M.P. No. 61 of 1992 SBI Capital Mkt. Vs HSM 25.06.2003 16.25 16.25 12.01.2018

5* Canfina Report of 11 of 2018 Canfina Vs ASM 12.04.2018 25.00 25.00 12.04.2018

6* Canfina 2.90

M P 22 OF 1992 CANFINA VS ASM 2007 2.90

GRAND TOTAL 1716.07 1716.07

*

1 . These are Decrees against M/s. Ashwin Mehta for transactions in Capital market.

2. Smt. Jyoti Mehta discovered around 2008 after taking inspection of records that ex-parte decrees

have been obtained by SBI, SBI Capital Markets, Standard Chartered Bank by playing a fraud on Hon'ble Special

Court and by acting in collusion with the Custodian and therefore she has challenged these

decrees.

3. In terms of his statutory duties as also as per settled law, the Custodian had a duty to contest the false claims

ofthe banks on HSM but instead he supported them by acting in collusion with them on several counts.

4. As per settled law, no interest was leviable on HSM by banks post his notification on 08.06.1992 but

Custodian did not oppose levy of interest on HSM @ 15% to 18% p.a. so that he becomes bankrupt.

Besides above, huge losses of Rs.20,677.28 Crores have been suffered by Mehtas by premature sale of

their investments in blue-chips to release monies to IT department and banks even before the claims are

crystallized and became final and binding on Mehtas.

5. Complete demands of tax of Rs.3285.46 Crores and entire principal sum of Rs.1716.07 Crores have

been paid to the banks overruling the objections in complete violation of law laid down by Hon'ble

Supreme Court in the case of Harshad Shantilal Mehta Vs Custodian reported as (1998) 5 SCC 1.

You might also like

- The 2023 Andex Chart StoryDocument3 pagesThe 2023 Andex Chart Storypridetag.contatoNo ratings yet

- Statement of Account For Month The November-2021Document3 pagesStatement of Account For Month The November-2021Manish Kumar100% (3)

- The Bag Making BibleDocument166 pagesThe Bag Making Biblenicole Menes100% (2)

- Chapter 2 Lesson 3 - Discount, Inflation, and TaxDocument9 pagesChapter 2 Lesson 3 - Discount, Inflation, and TaxMae AsuncionNo ratings yet

- List of Adverse Orders Passed by SPL Court Against Banks and InstitutionsDocument1 pageList of Adverse Orders Passed by SPL Court Against Banks and Institutionssasta jiNo ratings yet

- The State of West Bengal Vs Afcons Pauling (India) LTD On 3 February, 2017Document15 pagesThe State of West Bengal Vs Afcons Pauling (India) LTD On 3 February, 2017SarinNo ratings yet

- Final NI Notice Final 17.09.2020. (6.00)Document5 pagesFinal NI Notice Final 17.09.2020. (6.00)rashid pathanNo ratings yet

- List of Efforts Done by HSM 05 06 2022Document2 pagesList of Efforts Done by HSM 05 06 2022palamettarajeshbabuNo ratings yet

- Account StatementDocument1 pageAccount Statementkatwal000No ratings yet

- Wajih IciDocument1 pageWajih IciSyed Wajih HaiderNo ratings yet

- Ganga Tourism 1Document11 pagesGanga Tourism 1Shwetank GoelNo ratings yet

- 1614060049-VSVT Ashok K. Shah56ee56Document2 pages1614060049-VSVT Ashok K. Shah56ee56akhil layogNo ratings yet

- Branch Sett# SK MD Giusuddin (S01623) Voucher Date Entry DetailsDocument6 pagesBranch Sett# SK MD Giusuddin (S01623) Voucher Date Entry DetailssoumojitNo ratings yet

- Sarfaesi PNB CaseDocument1 pageSarfaesi PNB CaseDipti SawantNo ratings yet

- FACash Benefit Payment Register SummaryDocument1 pageFACash Benefit Payment Register SummaryMagesh RamarNo ratings yet

- 2012 (2) ALL MR 127: Writ Petition No. 92 of 2009, Writ Petition No. 1230 of 2009Document7 pages2012 (2) ALL MR 127: Writ Petition No. 92 of 2009, Writ Petition No. 1230 of 2009Ajay PathakNo ratings yet

- 373.miscellaneous Application 1278 of 2023 - EngDocument2 pages373.miscellaneous Application 1278 of 2023 - EngsarayusindhuNo ratings yet

- State Bank of India Vs Sarathi Textiles and Ors 21SC2002080818160429152COM54278Document2 pagesState Bank of India Vs Sarathi Textiles and Ors 21SC2002080818160429152COM54278Advocate UtkarshNo ratings yet

- IDFCFIRSTBankstatement 10091703423 080526772Document37 pagesIDFCFIRSTBankstatement 10091703423 080526772Sonu HussainNo ratings yet

- Claim Form CA Prashant KumarDocument6 pagesClaim Form CA Prashant Kumarjoshinachiket.jlcNo ratings yet

- DMS Portal Cause List Court-II - 2Document3 pagesDMS Portal Cause List Court-II - 2Devanshu PareekNo ratings yet

- Second Division: Security Bank and Trust Company, Rizal Commercial BANKING CORPORATION, RespondentDocument11 pagesSecond Division: Security Bank and Trust Company, Rizal Commercial BANKING CORPORATION, RespondentAj SobrevegaNo ratings yet

- Digitally Signed By:Dushyant RawalDocument31 pagesDigitally Signed By:Dushyant Rawalaridaman raghuvanshiNo ratings yet

- File Name2Document17 pagesFile Name2VarunNo ratings yet

- Citi Bank NA and Ors Vs Standard Chartered BankDocument21 pagesCiti Bank NA and Ors Vs Standard Chartered BankRyan MichaelNo ratings yet

- SOA Sanjoy DasDocument9 pagesSOA Sanjoy DasSandip BanerjeeNo ratings yet

- IDFCFIRSTBankstatement 10037581443 163730180Document10 pagesIDFCFIRSTBankstatement 10037581443 163730180srisaifancynumbersNo ratings yet

- Loan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Document12 pagesLoan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Omprakash KatreNo ratings yet

- Mass Transfer PDFDocument1 pageMass Transfer PDFNihar GandhiNo ratings yet

- Verma Glass CoDocument8 pagesVerma Glass CoJai Bhushan BharmouriaNo ratings yet

- Service Tax Audit II Delhi IV vs. M/S DLF Cyber CityDocument13 pagesService Tax Audit II Delhi IV vs. M/S DLF Cyber CityNeeraj MishraNo ratings yet

- 2016 (I) ILR - CUT-208: Mines & Minerals (Development & Regulations) Act, 1957 - S.9Document230 pages2016 (I) ILR - CUT-208: Mines & Minerals (Development & Regulations) Act, 1957 - S.9boobay ghoshNo ratings yet

- 2018 9 1501 21186 Judgement 28-Feb-2020Document28 pages2018 9 1501 21186 Judgement 28-Feb-2020HunnuNo ratings yet

- Amore Commercial Premises Co Op Society Ltd. Vs Central Processing Centre ITAT MumbaiDocument10 pagesAmore Commercial Premises Co Op Society Ltd. Vs Central Processing Centre ITAT MumbaitaxationsocietyNo ratings yet

- StatementDocument2 pagesStatementKekanda FauziNo ratings yet

- Total Amount PayableDocument2 pagesTotal Amount Payableadysingh29110% (1)

- Standing Counsel (Civil) Govt of NCT of Delhi: S.N. File No. Court MatterDocument2 pagesStanding Counsel (Civil) Govt of NCT of Delhi: S.N. File No. Court MatterGurdev SinghNo ratings yet

- Adugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Document13 pagesAdugna Shibabaw (Waklara Import & Export) LC Settlement Annex 2023Meseret LemmaNo ratings yet

- Important Important Case LAW LAW: Tamil Nadu State Jud Tamil Nadu State Judicial Academy Icial AcademyDocument23 pagesImportant Important Case LAW LAW: Tamil Nadu State Jud Tamil Nadu State Judicial Academy Icial AcademyVenkat Raman JNo ratings yet

- Al-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VDocument2 pagesAl-Arafa Islami Bank LTD.: V-V - V - V - V - V - V - V - VRaju AhamedNo ratings yet

- IDFCFIRSTBankstatement 10052774504 PDFDocument4 pagesIDFCFIRSTBankstatement 10052774504 PDFpravin awalkondeNo ratings yet

- Statement of Accounts - 212555530Document7 pagesStatement of Accounts - 212555530meet12mrurNo ratings yet

- Split 20240328 1915Document4 pagesSplit 20240328 1915sofeahumairah1987No ratings yet

- StatementOfAccount 6666782077 12022023 210845Document1 pageStatementOfAccount 6666782077 12022023 210845Ankita KumariNo ratings yet

- Ach FormDocument2 pagesAch FormPamu PungleNo ratings yet

- Statement of Account: 1092'D Jalan Jawa 36000 Teluk Intan, PerakDocument11 pagesStatement of Account: 1092'D Jalan Jawa 36000 Teluk Intan, PerakattikajaafarNo ratings yet

- Bank Statement - Amit SharmaDocument1 pageBank Statement - Amit SharmaBaid GroupNo ratings yet

- ARCIL vs. Ms Daewoo Motors Ltd.Document4 pagesARCIL vs. Ms Daewoo Motors Ltd.Harshit GuptaNo ratings yet

- Union Miles SL SURESHDocument3 pagesUnion Miles SL SURESHsaranbayireddy69No ratings yet

- JP Builders and Ors Vs A Ramadas Rao and OrsDocument20 pagesJP Builders and Ors Vs A Ramadas Rao and OrsAbhineet KaliaNo ratings yet

- Bank of India Vs KuldeepDocument8 pagesBank of India Vs KuldeepkumarlawfirmindiaNo ratings yet

- LCF Mum 0007001053Document4 pagesLCF Mum 0007001053The Shah'sNo ratings yet

- In The Court of MRDocument1 pageIn The Court of MRrayadurgam bharatNo ratings yet

- IDFCFIRSTBankstatement 10072945058 105209731Document26 pagesIDFCFIRSTBankstatement 10072945058 105209731anita vermaNo ratings yet

- Shankeshwar Water Conn Feb 24 BillsDocument60 pagesShankeshwar Water Conn Feb 24 Billsbinitasinha100No ratings yet

- Ach - Form - 2023-06-09T205028.461Document2 pagesAch - Form - 2023-06-09T205028.461Flex ClipNo ratings yet

- ENach Form (1)Document1 pageENach Form (1)vivek.kumar9No ratings yet

- Gecls Extension Input SheetDocument21 pagesGecls Extension Input SheetS V RAMARAJANNo ratings yet

- IDFCFIRSTBankstatement 10111794196Document10 pagesIDFCFIRSTBankstatement 10111794196dabu choudharyNo ratings yet

- Dokumen PDF (1) 3Document2 pagesDokumen PDF (1) 3Areta 9011No ratings yet

- Display CauselistDocument8 pagesDisplay CauselistmydreamgirlNo ratings yet

- 66-C-1 - Set 1 - Main PaperDocument47 pages66-C-1 - Set 1 - Main Papersasta jiNo ratings yet

- CC 14 Sociological Research Methods-II - FinalDocument4 pagesCC 14 Sociological Research Methods-II - Finalsasta jiNo ratings yet

- Fia 2026 Formula 1 Sporting Regulations Pu - Issue 5 - 2024-03-29 0Document16 pagesFia 2026 Formula 1 Sporting Regulations Pu - Issue 5 - 2024-03-29 0sasta jiNo ratings yet

- Short StoryyDocument1 pageShort Storyysasta jiNo ratings yet

- Clat Set CDocument2 pagesClat Set Csasta jiNo ratings yet

- BudgetDocument362 pagesBudgetsasta jiNo ratings yet

- Two Natural Disaster Occurred in IndiaDocument2 pagesTwo Natural Disaster Occurred in Indiasasta jiNo ratings yet

- Task 1 - Email Template v2Document2 pagesTask 1 - Email Template v2sasta jiNo ratings yet

- 9 Math Eng 2018Document179 pages9 Math Eng 2018sasta jiNo ratings yet

- Purpose HypothesisDocument2 pagesPurpose Hypothesissasta jiNo ratings yet

- Samyak Kataria 9I 22 7647 Maths ExamDocument20 pagesSamyak Kataria 9I 22 7647 Maths Examsasta jiNo ratings yet

- Sample Paper Class 9 2020Document14 pagesSample Paper Class 9 2020sasta jiNo ratings yet

- B8 - Gatus, Dustin Wayne B.Document2 pagesB8 - Gatus, Dustin Wayne B.Jharelle SaronaNo ratings yet

- 192.102 Instructions For Assignment 1Document9 pages192.102 Instructions For Assignment 1Samrah QamarNo ratings yet

- Micro Economics-I Chapter - One AndThreeDocument41 pagesMicro Economics-I Chapter - One AndThreeYonatanNo ratings yet

- 2 Core X 2.5 SQ - MMDocument4 pages2 Core X 2.5 SQ - MMJay VishnuNo ratings yet

- Trial BalanceDocument17 pagesTrial BalanceIsha ParwaniNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- Cash Flow - Turtorial 8Document33 pagesCash Flow - Turtorial 8Kevin ChandraNo ratings yet

- Chapter 5 - An Introduction To MacroeconomicsDocument40 pagesChapter 5 - An Introduction To MacroeconomicsDan GregoriousNo ratings yet

- UL Aires DAEWOO EMERSONDocument3 pagesUL Aires DAEWOO EMERSONeduin gonzalezNo ratings yet

- Form PDF 931954470220722Document7 pagesForm PDF 931954470220722vaierNo ratings yet

- Hanuman MotorsDocument4 pagesHanuman MotorsNabakishoreNo ratings yet

- Full Download Economics of Money Banking and Financial Markets Global 10th Edition Mishkin Solutions ManualDocument36 pagesFull Download Economics of Money Banking and Financial Markets Global 10th Edition Mishkin Solutions Manualmac2reyes100% (36)

- Beginners Guide To Estcon TradingDocument18 pagesBeginners Guide To Estcon Tradinglegithustle100No ratings yet

- G8 Math Q1 - Week 6 - Slope Intercept FormDocument13 pagesG8 Math Q1 - Week 6 - Slope Intercept FormWenilyn MananganNo ratings yet

- AFGRI EQUIPMENT (Private) Limited Zimbabwe - Parts Quotation - 33255Document1 pageAFGRI EQUIPMENT (Private) Limited Zimbabwe - Parts Quotation - 33255Hugh O'Brien GwazeNo ratings yet

- RDRRMC Memo No. 25, S. 2024 - GK Regional OrientationDocument2 pagesRDRRMC Memo No. 25, S. 2024 - GK Regional OrientationMDRRMO San LuisNo ratings yet

- The 4% Rule Financial CalculatorDocument8 pagesThe 4% Rule Financial Calculatorsiti norfaizahNo ratings yet

- Higher Education in Vietnam: Industries & MarketsDocument28 pagesHigher Education in Vietnam: Industries & MarketsNguyễn ChiNo ratings yet

- Unified Payments Interface (UPI) A Payment Solution Designed To Transform Economies of The 21st CenturyDocument35 pagesUnified Payments Interface (UPI) A Payment Solution Designed To Transform Economies of The 21st CenturyVedartha PathakNo ratings yet

- Quarterly Test in Mathematics 5Document5 pagesQuarterly Test in Mathematics 5darlene bianzonNo ratings yet

- E/ Izns'K HKKST Eqdr Fo'Ofo - Ky ) Hkksiky: Madhya Pradesh Bhoj (Open) University, BhopalDocument6 pagesE/ Izns'K HKKST Eqdr Fo'Ofo - Ky ) Hkksiky: Madhya Pradesh Bhoj (Open) University, BhopalPushpendra SinghNo ratings yet

- TradeStation The Ultimate Guide To ETFsDocument24 pagesTradeStation The Ultimate Guide To ETFskashak1325No ratings yet

- MasterSchool 11 Az BuraxılışDocument12 pagesMasterSchool 11 Az BuraxılışNurlan NagizadeNo ratings yet

- Prashant Shah - RSIDocument5 pagesPrashant Shah - RSIIMaths PowaiNo ratings yet

- Economical Development Midterm NotesDocument3 pagesEconomical Development Midterm NotesDoug ConwayNo ratings yet

- AER Presentation On RAB MultiplesDocument18 pagesAER Presentation On RAB MultiplesKGNo ratings yet

- Asher-Divide Euroregion CultureDocument35 pagesAsher-Divide Euroregion CultureAlexandru PadureanuNo ratings yet