Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsSHRIRAM TRANSPORT FINANCE LTD. 15G Form

SHRIRAM TRANSPORT FINANCE LTD. 15G Form

Uploaded by

Rakesh LahoriCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shriram Transport Finance Ltd.Document3 pagesShriram Transport Finance Ltd.Rakesh LahoriNo ratings yet

- IDFC Common Application With SIPDocument3 pagesIDFC Common Application With SIPRakesh LahoriNo ratings yet

- INVESCO Common Application With SIPDocument6 pagesINVESCO Common Application With SIPRakesh LahoriNo ratings yet

- JM Mutual FundDocument4 pagesJM Mutual FundRakesh LahoriNo ratings yet

- L&T Common Application With SIPDocument5 pagesL&T Common Application With SIPRakesh LahoriNo ratings yet

- Kotak MF Common Application With SIPDocument4 pagesKotak MF Common Application With SIPRakesh LahoriNo ratings yet

- Nippon India Common Application With SIPDocument3 pagesNippon India Common Application With SIPRakesh LahoriNo ratings yet

- Canara Robeco Common Application With SIPDocument5 pagesCanara Robeco Common Application With SIPRakesh LahoriNo ratings yet

- Iti MFDocument5 pagesIti MFRakesh LahoriNo ratings yet

- Quantum Common Application With SIPDocument4 pagesQuantum Common Application With SIPRakesh LahoriNo ratings yet

- SBI Common Application With SIPDocument4 pagesSBI Common Application With SIPRakesh LahoriNo ratings yet

- Motilal Oswal Common Application With SIPDocument4 pagesMotilal Oswal Common Application With SIPRakesh LahoriNo ratings yet

- Principal Common Application With SIPDocument4 pagesPrincipal Common Application With SIPRakesh LahoriNo ratings yet

- BNP Common Application With SIPDocument3 pagesBNP Common Application With SIPRakesh LahoriNo ratings yet

- Quant Common Application With SIPDocument5 pagesQuant Common Application With SIPRakesh LahoriNo ratings yet

- Aditya Birla Sunlife Common Application With SIPDocument8 pagesAditya Birla Sunlife Common Application With SIPRakesh LahoriNo ratings yet

- Boi Axa Common Application With SipDocument4 pagesBoi Axa Common Application With SipRakesh LahoriNo ratings yet

- Axis Common Application With SIPDocument7 pagesAxis Common Application With SIPRakesh LahoriNo ratings yet

SHRIRAM TRANSPORT FINANCE LTD. 15G Form

SHRIRAM TRANSPORT FINANCE LTD. 15G Form

Uploaded by

Rakesh Lahori0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

4 views2 pagesSHRIRAM TRANSPORT FINANCE LTD. 15G Form

SHRIRAM TRANSPORT FINANCE LTD. 15G Form

Uploaded by

Rakesh LahoriCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

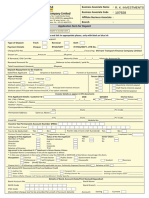

FORM NO. 15¢

[Sce section 197A (1), 197A (1A) and rule 29C]

Declaration under section 197A (1) and section 197A (IA) to be made by an individual or a person

(not being a company or firm) claiming certain incomes without deduction of tax.

PARTI

1, Name of the Assessee (Declarant) 2. PAN of the Assessec!

3, Status’ 4, Previous year (PY.)" 5, Residential Status’

(for which declaration is being made)

6. Flat/Door/Block No] 7. Name of Premises 8 Road/Street/Lane ‘9. Area/Locality

10. Town/City/District | 11. State 12.PIN 13. Email

14. Telephone No. (with STD | 15.(a) Whether assessedtotaxunderthe Yes C No

Code) and Mobile No, Income - tax Act,1961'

(b) If Yes, latest assessment year for which assessed

16. Estimated income for which this declaration is made | 17, Estimated total income of the PY. in which

income mentioned in column 16 to be included"

118, Details of Form No. 15G other than this form filed during the previous year if any

Total No, of Form No. 156 filed ‘Aggregate amount of income for which Form No. 156 filed

19, Details of income for which the declaration is filed

Si. | Identification number ofrelevant | Nature of income] Section under which tax] Amount of income

No. | invest ment/account, etc’ is deductible

ignature of the Declarant

Declaration/Veritication”™

“We, do hereby declare that tothe best of *my/our knowledge and belief what i stated above is corect,

‘complete and is truly stated *U/We declare thatthe incomes referred to inthis form are not ineludible in the total income of any other

person under sections 60 to 64 ofthe Income-tax Act, 1961. */We further declare thatthe tax *on my/our estimated otal income including

*incomefincomes referred to in column 16 *and aggregate amount of *incomelincomes refered to in column 18 computed inaccondance

with the provisions of the Income-tax Act, 1961, forthe previous year ending on relevant to the assessment year

will be nil. *LWe also declare that *my/our *income/incomes referred to in column 16 "and the aggregate amount of

* incomelincomes referred tain column 18 for the previous year ending on relevant to the assessment year will

not exceed the maximum amount which snot chargeable toincome-ta

Place

Date “Signature of the Declarant

PARTI

[To be filled by the person responsible for paying the income referred ton column 16 of Part I]

1 Name of the person responsible for paying 2. Unique Identification No.”

SHRIRAM TRANSPORT FINANCE COMPANY LIMITED

3. PANofthe person | 4. Complete Address '5 TAN of the person responsible for paying

responsible for paying| 244, SOUTH PHASE, ‘CHESOO300E

‘AAACS7018R INDUSTRIAL ESTATE, GUINDY,

CHENNAI - 600032.

6. Email 7-Telephone No : 044 485 24 666 Amount of income paid™

Fax : 044 485 25 666

9, Date on which Declaration is received 10. Date on which the income tas been paid/credited

(oo/mMyy) (Ca

Place

Signature of the person responsible for paying

Date the income referred to in column 16 of Pert 1

“Delete whichever is not applicable.

1 As per provisions of section 206AA(2), the declaration under section 197A(I) or 197A(IA) shall be invalid if the

declarant fails to furnish his valid Permanent Account Number (PAN).

2 Declaration can be furnished by an individual under section 197A(1) and a person (other than a company or a firm) under

section 197A(IA).

3 The financial year to which the income pertains.

4 Please mention the residential status as per the provisions of section 6 of the Income-tax Act, 1961

5 Please mention “Yes” ifassessed to tax under the provisions of Income- tax Act, 1961 for any of the assessment year out of six

assessment years preceding the year in which the declaration is filed.

6 Please mention the amount of estimated total income of the previous year for which the declaration is filed including the

amount of income for which this declaration is made.

7 In ease any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total

‘number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed.

8 Mention the distinctive number of shares, account number of term deposit, recurring deposit, National Savings

‘Schemes, life insurance policy number, employee code, etc.

9 Indicate the capacity in which the declaration is furnished on behalf of a HUF, AOP, etc.

10 Before signing the declaration/verification, the declarant should satisfy himself that the information furnished in th

form is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to

prosecution under section 277 of the Income-tax Act, 1961 and on conviction be punishable-

(i) ima case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which

shall not be less than six months but which may extend to seven years and with fine;

Gi) _inany other case, with rigorous imprisonment which shall not be less than three months but which may

extend to two years and with fine.

11 The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to

all the Form No. 15G received by him during a quarter of the financial year and report this reference number along with the

particulars prescribed in rule 31 A(4)(vii) of the Income-tax Rules, 1962 in the TDS statement furnished for the same quarter.

In case the person has also received Form No.1SH during the same quarter, please allot separate series of serial number for

Form No.15Gand Form No. 15H.

12 The person responsible for paying the income referred to in column 16 of Part I shall not accept the declaration where the

amount of income of the nature referred to in sub-section (1) or sub-section (1A) of section 197A or the aggregate of the

amounts of such income credited or paid or likely to be credited or paid during the previous year in which such income is to be

included exceeds the maximum amount which is not chargeable to tax. For deciding the eligibility, he is required to verity

income or the aggregate amount of incomes, as the case may be, reported by the declarant in columns 16nd 18.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shriram Transport Finance Ltd.Document3 pagesShriram Transport Finance Ltd.Rakesh LahoriNo ratings yet

- IDFC Common Application With SIPDocument3 pagesIDFC Common Application With SIPRakesh LahoriNo ratings yet

- INVESCO Common Application With SIPDocument6 pagesINVESCO Common Application With SIPRakesh LahoriNo ratings yet

- JM Mutual FundDocument4 pagesJM Mutual FundRakesh LahoriNo ratings yet

- L&T Common Application With SIPDocument5 pagesL&T Common Application With SIPRakesh LahoriNo ratings yet

- Kotak MF Common Application With SIPDocument4 pagesKotak MF Common Application With SIPRakesh LahoriNo ratings yet

- Nippon India Common Application With SIPDocument3 pagesNippon India Common Application With SIPRakesh LahoriNo ratings yet

- Canara Robeco Common Application With SIPDocument5 pagesCanara Robeco Common Application With SIPRakesh LahoriNo ratings yet

- Iti MFDocument5 pagesIti MFRakesh LahoriNo ratings yet

- Quantum Common Application With SIPDocument4 pagesQuantum Common Application With SIPRakesh LahoriNo ratings yet

- SBI Common Application With SIPDocument4 pagesSBI Common Application With SIPRakesh LahoriNo ratings yet

- Motilal Oswal Common Application With SIPDocument4 pagesMotilal Oswal Common Application With SIPRakesh LahoriNo ratings yet

- Principal Common Application With SIPDocument4 pagesPrincipal Common Application With SIPRakesh LahoriNo ratings yet

- BNP Common Application With SIPDocument3 pagesBNP Common Application With SIPRakesh LahoriNo ratings yet

- Quant Common Application With SIPDocument5 pagesQuant Common Application With SIPRakesh LahoriNo ratings yet

- Aditya Birla Sunlife Common Application With SIPDocument8 pagesAditya Birla Sunlife Common Application With SIPRakesh LahoriNo ratings yet

- Boi Axa Common Application With SipDocument4 pagesBoi Axa Common Application With SipRakesh LahoriNo ratings yet

- Axis Common Application With SIPDocument7 pagesAxis Common Application With SIPRakesh LahoriNo ratings yet