Professional Documents

Culture Documents

Interim Budget 2024-25-1

Interim Budget 2024-25-1

Uploaded by

singh99anushka19Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interim Budget 2024-25-1

Interim Budget 2024-25-1

Uploaded by

singh99anushka19Copyright:

Available Formats

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 1

Interim Budget

2024-25

This PAID PDF is provided by AffairsCloud’s dedicated team that works

diligently to provide aspirants with high-quality content. We recommend

you to purchase this PDF subscription and seize the opportunity to learn

efficiently.

Help Us to Grow & Provide Quality Service

Click here to Download the CareersCloud APP

Click here to Join the Telegram Channel

AffairsCloud Hindu Vocabs

Suggestions & Feedback are welcomed

Support@affairscloud.com

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 2

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 3

Interim Budget

2024-25

What is the Budget?

It is an Annual Financial statement of the estimated receipts and expenditure of the Government in a

Financial Year (which begins on 1st April of the current year and ends on 31st March of the following

year). Every year, the Finance Minister of India presents the Union Budget.

The Union Budget has two parts: The Annual Financial Statement and the Demand for Grants.

The Annual Financial Statement provides a summary of the government's revenue for the

upcoming year.

Demand for Grants includes an estimated expenditure from the Consolidated Fund that needs

to be submitted.

Until 2018, as a part of tradition, finance ministers carried the budget in a leather briefcase ‘Bahi

Khata’ (a ledger wrapped in red cloth) and now it replaced with Made in India tablet (paperless

budget) for the second consecutive year.

Union Budget of India also referred to as the Annual Financial Statement in Article 112 of the

Constitution of India. It will be on the first day of February. Until 2016 it was presented on the last

working day of February by the finance minister in Parliament.

Union Budget 2024-25

On February 1, 2024, the Budget session was held in Parliament under the chairmanship of Lok Sabha

Speaker Om Birla, in which the Union Finance Minister (FM) Nirmala Sitharaman presented the

Interim Budget/Vote on Account of India for 2025-2024.

This said to be India’s 4th paperless budget, it replaced the traditional ‘Bahi-Khata’ with a Made-in-

India tablet wrapped in a red-coloured cover with a national emblem emblazoned on it.

It was the 6th and 1st interim budget of the Narendra Modi-led National Democratic Alliance (NDA)

Government second term (from 2019-2024). This was also the 6th Budget presentation of Nirmala

Sitharaman since 2019.

Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Interim

Union Budget 2024-25 in Parliament with the mantra of ‘Sabka Saath, Sabka Vikas, and Sabka

Vishwas’ and the whole of nation approach of “Sabka Prayas”.

It is an interim Budget for the new fiscal, FY25. The full Budget for the mentioned fiscal will be

introduced in July 2024, after a new government is formed following the upcoming general elections

in the first half of 2024.

The 2024 Union Budget goal was “Viksit Bharat” by 2047 (Developed India @2047)

Vision: Prosperous Bharat in harmony with nature, modern infrastructure, and opportunities for all.

Vote on account:

Vote on account is the process where an outgoing government seeks interim permission from the

Parliament to withdraw funds from the Consolidated Fund of India and spend money on expenditures

and crucial government schemes for a few months until a new government is formed after the

elections. As defined by Article 116 of the Indian Constitution, vote on account is a grant in advance

for the Central government to meet short-term expenditure, generally lasting for a few months till the

new financial year starts.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 4

Interim Budget

2024-25

Consolidated Fund:

Article 266 of the Indian Constitution defines the Consolidated Fund of India, which is where all the

revenue of the central government, be it from taxes, funds raised by loans and interest on loans, and a

portion of taxes from states, is Stored. It states that no money from the Consolidated Fund may be

withdrawn except under an appropriation undertaken by law, for which the Centre passes an

appropriation bill during the Union Budget.

Finance Minister Speech

Nirmala Sitharaman has presented interim budget 2024 for 58 minutes in Parliament and became her

shortest Budget speech.Finance Minister Nirmala Sitharaman is set to match the record of former

Prime Minister Morarji Desai as she presents her 6th Union Budget in February 2024.

Nirmala Sitharaman created a new record by surpassing the achievement of her predecessors,

including Manmohan Singh, Arun Jaitley, P Chidambaram, and Yashwant Sinha, who had presented

five consecutive budgets.

India’s Fiscal Position

i.The Fiscal Deficit (FD) for Budget Estimate (BE) of 2024-25(FY25) is estimated to be 5.1% of GDP

(Gross Domestic Product) against 5.8% in the Revised Estimates (RE) for 2023-24.

The government plans to stick to its financial strategy, as mentioned in the budget for 2021-22.

The goal is to decrease the fiscal deficit to less than 4.5 percent by the fiscal year 2025-26.

Fiscal Deficit (FD) is the adverse fiscal balance which is a difference between the Revenue Receipts

Plus Non-Debt Capital Receipts (NDCR) i.e. total of the non-debt receipts and the total expenditure.

FD is reflective of the total borrowing requirement of Government.

ii.Nominal GDP for BE 2024-25 has been projected at 3,27,71,808 crore assuming 10.5 % growth

over the estimated Nominal GDP of `2,96,57,745 crore as per the First Advance Estimates of FY 2023-

24.

iii.Capital Expenditure (CapEx) outlay for 2024-25 is being increased by 11.1 per cent to eleven

lakh, eleven thousand, one hundred and eleven crore rupees (₹ 11,11,111 crore).This amounts to 3.4

per cent of GDP

iii.No changes are anticipated in taxation, and the current direct and indirect tax rates, along with

import duties, are proposed to be maintained.

iv. In the interim budget for FY25 presented in parliament, the central government plans to borrow

₹14.13 trillion from the bond markets to fund its fiscal deficit in 2024-25.

v.Monetary Policy Committee (MPC) maintained status quo on the policy repo rate at 6.5 per cent in

FY 2023-24 so far (till December 2023).

vi.The growth estimate of the Indian economy in FY 2023-24 is 7.3 per cent as per the National

Statistics office. For FY 2024-25 the RBI has forecast a growth of 7.0 per cent.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 5

Interim Budget

2024-25

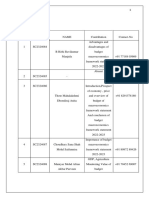

Budget 2024-25 (Rs crore)

Item Revised Estimates Budget Estimates (BE) % change (RE

(RE) 2023-24 (Rs 2024-25 (Rs crore) 2023-24 to BE

crore) 2024-25)

Total Receipts (other 27,55,713 30,80,274 +11.8%

than borrowings)

Revenue Receipts 26,99,713 30,01,275 +11.2%

Capital Receipts 56,000 79,000 +41.1%

Total Receipts 44,90,486 47,65,769 +6.1%

(including

borrowings)

Total Expenditure 44,90,486 cr 47,65,768 cr +6.1%

Revenue Expenditure 35,40,239 36,54,657 +3.2%

Capital Expenditure 9,50,246 cr 11,11,111 cr +16.9%

Fiscal Deficit (as % of 5.8% (17,34,773) 5.1% (16,85,494) -2.8%

GDP)

Revenue Deficit (as % 2.8 % (8,40,527) 2.0% (6,53,383) -22.3%

of GDP)

Primary Deficit (as % 2.3% (6,79,346) 1.5% (4,95,054) -27.1%

of GDP)

Total Expenditure: The government is estimated to spend Rs 47,65,768 crore in 2024-25. This

is an increase of 6% over the revised estimate of 2023-24.

In 2024-25, Capital expenditure is expected to increase by about 16.9% over the revised

estimates of 2023-24.

Revenue expenditure is expected to increase by 3.2% over the revised estimates of

2023-24.

Total Receipts: Government receipts (excluding borrowings) are estimated to be Rs 30,80,274

crore, 11.8% higher than the revised estimates of 2023-24.

The gap between these receipts and the expenditure will be plugged by borrowings,

budgeted to be Rs 16,85,494 crore, 2.8% lower than the revised estimate of 2023-24.

Transfer to states: The central government will transfer Rs 22,74,541 crore to states and

union territories in 2024-25, an increase of 8.4% over the revised estimates of 2023-24.

Deficits: Revenue deficit is targeted at 2% of GDP, lower than the 2.9% budgeted in 2023-24.

Fiscal deficit is targeted at 5.1% of GDP in 2024-25, lower than the revised estimates for 2023-

24 (5.9% of GDP). The lower fiscal deficit is on account of receipts growing at 11.8%, which is

higher than the expenditure growth of 6%.

GDP: The government has estimated a nominal GDP growth rate of 10.5% in 2024-25 (i.e., real

growth plus inflation).

Budgetary Allocations to Ministries:

In 2024-25, Ministry of Defence has the highest allocation in 2024-25, at Rs 6,21,541 crore. It

accounts for 13% of the total budgeted expenditure of the central government.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 6

Interim Budget

2024-25

Other ministries with high allocation include: (i) Road Transport and Highways (5.8% of total

expenditure), (ii) Railways (5.4%), and (iii) Consumer Affairs, Food and Public Distribution

(4.5%).

The Agriculture Ministry got the lowest amount at ₹1.27 lakh crore.

Department of Economic Affairs (Ministry of Finance): R. 70,449 crore has been allocated to a new

item of expenditure ‘New Schemes’ (details not available). This accounts for about 84% of the

Department’s total allocation. The entire allocation is for capital expenditure.

Budgetary Allocations to Schemes:

Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has the highest

allocation in 2024-25 at Rs 86,000 crore. This amount is the same as the revised estimate for 2023-24.

In 2023-24, allocation on the scheme is estimated to increase by 43% over the budget estimate.

The Pradhan Mantri Awas Yojana (PMAY) has the second highest allocation in 2024-25 at Rs

80,671 crore, an increase of 49.1% over the revised estimate of 2023-24.

The Jal Jeevan Mission(JJM) has the third highest allocation in 2024-25 at Rs 70,163 crore, an

increase of 0.2% over the revised estimate of 2023-24.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 7

Interim Budget

2024-25

BSNL gets capital infusion of ₹82,900 crore in Budget

In the 2024-25 Budget, the government has raised the capital infusion in the public-owned telecom

operator Bharat Sanchar Nigam Limited(BSNL) to ₹82,916 crore, compared to ₹52,937 crore in the

2023-24 period.

Rs 900 crore allocated for KHELO India

Finance Minister Nirmala Sitharaman allocates ₹900 crore for the KHELO India programme 2024-25

budget.

KHELO India, a Central government initiative, focuses on enhancing sports culture at the

grassroots level was launched in 2018 by former Union Sports Minister Col. Rajyavardhan Singh

Rathore, it is officially known as the National Programme for Development of Sports.

Subsidies in 2024-25 (Rs crore)

In 2024-25, the total expenditure on subsidies is estimated to be Rs 4,09,723 crore, a decrease of 7%

from the revised estimate of 2023-24.

Part A

Roadmap to Viksit Bharat” by 2047 (Developed India @2047)

Social Justice

‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’ (Farmers) are the four-pillars of

the Viksit Bharat Budget 2024.

Empowerment of women (Nari Sakthi)

30 crore Mudra Yojana loans have been given to women entrepreneurs.

Female enrolment in higher education increased by 28 per cent in 10 years.

In STEM (science, technology, engineering, and math) courses, girls and women constitute

43 per cent of enrolment, one of the highest in the world.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 8

Interim Budget

2024-25

Making ‘Triple Talaq’ illegal,and and reserving one-third of seats for women in legislative

bodies.

Over 70% of houses under PM Awas Yojana in rural areas are now owned by women.

83 lakh self-help groups (SHGs) with nine crore women contribute to rural empowerment; the

target for 'Lakhpati Didi' is increased from 2 crore to 3 crore.

According to data from the Centre for Monitoring Indian Economy (CMIE), the unemployment

rate has dropped for women from 14.9 per cent in December 2023 to 11 per cent in January

2024.

‘Garib Kalyan, Desh ka Kalyan’ (Below Poverty Line)

Government assisted 25 crore people out of multi-dimensional poverty in last 10 years.

Direct Benefit Transfer(DBT) of Rs. 34 lakh crore using Pradhan Mantri Jan-Dhan Yojana

(PMJDY) accounts led to savings of Rs. 2.7 lakh crore for the Government.

Prime Minister Street Vendor's AtmaNirbhar Nidhi (PM SVANidhi) Scheme provided credit

assistance to 78 lakh street vendors. 2.3 lakh have received credit for the third time.

Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan (PM JANMAN) Yojana to aid the

development of particularly vulnerable tribal groups (PVTG).

PM-Vishwakarma Yojana provides end-to-end support to artisans and crafts people engaged in

18 trades.

Welfare of Annadata (Farmers)

Under PM-KISAN SAMMAN Yojana, direct financial assistance is provided to 11.8 crore farmers,

including marginal and small farmers.

The PM Kisan Samman Nidhi Yojana provides financial assistance of Rs. 6000 per year to

small farmers in three installments. The three instalments of 2000 were given to farmers to

manage their Ministry of Agriculture and Farmer Welfare.

Crop insurance is given to 4 crore farmers under Pradhan Mantri Fasal Bima Yojana (PMFBY).

Electronic National Agriculture Market (e-NAM) integrated 1361 mandis, providing services to

1.8 crore farmers with trading volume of Rs. 3 lakh crore.

Development of Youth

1.4 crore youth trained under Skill India Mission.

A large number of new institutions of higher learning, namely 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS

and 390 universities have been set up.

43 crore loans sanctioned under PM Mudra Yojana to Youths.

Increase in PM ScHools for Rising India (PM SHRI) Budget Allocation.

Strategy for Amrit Kaal

Sustainable Development

Green Energy - Commitment to meet ‘Net Zero’ by 2070

Coal gasification and liquefaction capacity of 100 MT to be set up by 2030.

Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for

transport and piped natural gas (PNG) for domestic purposes to be mandated.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 9

Interim Budget

2024-25

New scheme of biomanufacturing and bio-foundry to be launched to support environment

friendly alternatives.

PM Awas Yojana (Grameen)

Despite COVID challenges, the target of three crore houses under PM Awas Yojana (Grameen)

will be achieved soon.

Two crore more houses to be taken up in the next five years.

Rooftop solarization and muft Bijli

The 'Rooftop Solarisation and Muft Bijli'(Free Electricity) initiative, in pursuit of 'net-zero' emissions by

2070.

1 crore households to obtain 300 units free electricity every month through rooftop

solarization.

Each household is expected to save Rs.15000 to Rs.18000 annually.

Ayushman Bharat

Healthcare cover under Ayushman Bharat scheme to be extended to all Accredited Social Health

Activist (ASHA) workers, Anganwadi Workers and Helpers. The Ayushman Bharat, India's

primary universal health scheme, experienced a year-on-year outlay increase of 10 percent,

reaching ₹7,500 crore.

Ayushman Bharat, or the PM Jan Arogya Yojana (PMJAY), provides families with an

annual cashless and paperless benefit cover of ₹5 lakh on a floater basis, accessible at

empanelled hospitals across India.

Health

Encourage vaccination for girls in age group of 9 to 14 years for prevention of cervical cancer.

Upgradation of Anganwadi centres under “Saksham Anganwadi and Poshan 2.0” will be

expedited for improved nutrition delivery, early childhood care and development.

The newly designed U-WIN platform for managing immunization and intensified efforts of

Mission Indradhanush will be rolled out expeditiously throughout the country.

Agriculture and food processing

Pradhan Mantri Kisan Sampada Yojana has benefitted 38 lakh farmers and generated 10 lakh

employment.

Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4

lakh SHGs and 60000 individuals with credit linkages.

Application of Nano DAP on various crops will be expanded in all agro-climatic zones.

Strategy will be formulated to achieve ‘atmanirbharta’ for oil seeds such as mustard, groundnut,

sesame, soybean, and sunflower.

Dairy Development- India is the world’s largest milk producer but with low productivity of

milch-animals. The programme will be built on the success of existing schemes such Rashtriya

Gokul Mission, National Livestock Mission, and Infrastructure Development Funds for dairy

processing and animal husbandry.

Fisheries - Seafood export since 2013-14 has also doubled. Implementation of Pradhan Mantri

Matsya Sampada Yojana (PMMSY) will be stepped up to:

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 10

Interim Budget

2024-25

enhance aquaculture productivity from existing 3 to 5 tons per hectare,

double exports to 1 lakh crore

Five integrated aquaparks will be setup.

Research and Innovation for catalyzing growth, employment and development

A corpus of Rs.1 lakh crore to be established with 50-year interest free loan to provide long-

term financing or refinancing with long tenors and low or nil interest rates.

A new scheme to be launched for strengthening deep-tech technologies for defence purposes

and expediting ‘atmanirbharta’.

Note*- 50-year interest-free loan: A loan suggests that the funds are provided with the expectation of

repayment. However, in this case, the loan comes with a unique feature of being interest-free, meaning

that the borrower is not required to pay any interest on the borrowed amount.

Infrastructure

Capital expenditure outlay for Infrastructure development and employment generation to be increased

by 11.1 per cent to Rs.11,11,111 crore, that will be 3.4 per cent of the GDP.

Blue Economy 2.0

For promoting climate resilient activities for blue economy 2.0, a scheme for restoration and adaptation

measures, and coastal aquaculture and mariculture with integrated and multi-sectoral approach will be

launched.

Railways

3 major economic railway corridor programmes identified under the PM Gati Shakti to be

implemented to improve logistics efficiency and reduce cost

Energy, mineral and cement corridors

Port connectivity corridors

High traffic density corridors

Forty thousand normal rail bogies to be converted to Vande Bharat standards.

Promotion of urban transformation via Metro rail and NaMo Bharat.

Aviation Sector

Number of airports in the country doubled to 149.

Five hundred and seventeen new routes are carrying 1.3 crore passengers.

Indian carriers have placed orders for over 1000 new aircrafts.

Tourism sector

States to be encouraged to take up comprehensive development of iconic tourist centres

including their branding and marketing at global scale.

Framework for rating of the tourist centres based on quality of facilities and services to be

established.

Long-term interest free loans to be provided to States for financing such development on

matching basis.

Investments

Foreign Direct Investment (FDI) inflow during 2014-23 of USD 596 billion was twice of the

inflow during 2005-14.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 11

Interim Budget

2024-25

Sovereign Gold Bond (SGB) in Budget 2024

In Budget 2024, the government aims to more than double the issuance of Sovereign Gold Bonds

(SGB) for the next fiscal year (FY25) to ₹3,500 crore, compared to ₹1,500 crore in the previous

financial year ending March 31, 2023.

i.The Budget estimate for the current fiscal year(FY24) remains at ₹1,500 crore, sustaining the

increase from ₹402 crore raised in the last fiscal year. Government is likely to issue sovereign green

bonds worth at least ₹20,000 crore as part of the borrowing programme for fiscal 2025 (FY25).

ii.The next issuance of Sovereign Gold Bonds is scheduled for subscription between February 12-16,

this financial instrument offers an eight-year tenure with the option for premature redemption after

the fifth year.

iii.The government has estimated 40-45 tonnes for Sovereign Gold Bonds (SGBs) in the interim

Budget.

As per the Statement of Liabilities, for the current financial year's provision under SGB

liabilities is Rs 69,998 crore.

For FY25, this provision has been increased to Rs 96,136 crore against the revised

estimate 2023-24, reflecting a significant rise of Rs 26,138 crore.

What is Sovereign Gold Bond (SGB)

i.The Government of India introduced the Sovereign Gold Bond (SGB) Scheme in November 2015 to

offer an alternative investment to physical gold.

ii.Sovereign Gold Bond (SGB), administered by the Reserve Bank of India, are government securities

denominated in grams of gold but substitutes for holding physical gold. Investors have to pay the

issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve

Bank of India on behalf of Government of India.

The Bonds are issued in denominations of one gram of gold and in multiples thereof.

Minimum investment in the Bond shall be one gram with a maximum limit of subscription

of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and

similar entities notified by the government from time to time per fiscal year (April –

March).

FINANCIAL AID TO MALDIVES, BHUTAN, & NEPAL

India will reduce financial assistance to the Maldives by 22%, with the majority share of aid directed

towards Bhutan and Nepal.

i.For the fiscal year 2024-25, India has brought down the developmental assistance to INR 600 crore.

Despite the reduction, the Maldives remains the third-highest recipient of foreign aid from the Indian

government.

ii.Bhutan and Nepal are the leading recipients of government grants, with Bhutan receiving INR

2068.56 crore and Nepal getting INR 700 crore for developmental assistance.

Divestment target for FY25 set to Rs 50,000 cr

In the interim budget for 2024-25, the government has set a disinvestment target of Rs 50,000 crore,

an increase from the revised estimate of Rs 30,000 crore in the current financial year(FY24).

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 12

Interim Budget

2024-25

Reforms in the States for ‘Viksit Bharat’

A provision of Rs.75,000 crore rupees as 50-year interest free loan is proposed to support

milestone-linked reforms by the State Governments.

Rupee comes in and goes out:

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 13

Interim Budget

2024-25

Part B

Direct taxes

FM proposes to retain same tax rates for direct taxes

Direct tax collection tripled, return filers increased to 2.4 times, in the last 10 years

Government to improve tax payer services

Outstanding direct tax demands upto Rs 25000 pertaining to the period upto FY 2009-10

withdrawn

Outstanding direct tax demands upto Rs 10000 for financial years 2010-11 to 2014-15

withdrawn

This will benefit one crore tax payers

Tax benefits to Start-Ups, investments made by Sovereign wealth funds or pension funds

extended to 31.03.2025

Tax exemption on certain income of International Financial Services Centre (IFSC) units

extended by a year to 31.03.2025 from 31.03.2024

Indirect taxes

FM proposes to retain same tax rates for indirect taxes and import duties

Goods & Service Tax (GST) unified the highly fragmented indirect tax regime in India

Average monthly gross GST collection doubled to Rs 1.66 lakh crore this year

GST tax base has doubled

State SGST revenue buoyancy (including compensation released to states) increased to

1.22 in post-GST period(2017-18 to 2022-23) from 0.72 in the pre-GST period (2012-13

to 2015-16)

94% of industry leaders view transition to GST as largely positive

GST led to supply chain optimization

GST reduced the compliance burden on trade and industry

Lower logistics cost and taxes helped reduce prices of goods and services, benefiting the

consumers

Tax rationalization efforts over the years

No tax liability for income upto Rs 7 lakh, up from Rs 2.2 lakh in FY 2013-14

Presumptive taxation threshold for retail businesses increased to Rs 3 crore from Rs 2 crore

Presumptive taxation threshold for professionals increased to Rs 75 lakh from Rs 50 lakh

Corporate income tax decreased to 22% from 30% for existing domestic companies

Corporate income tax rate at 15% for new manufacturing companies

Achievements in tax-payer services

Average processing time of tax returns has reduced to 10 days from 93 days in 2013-14

Faceless Assessment and Appeal introduced for greater efficiency

Updated income tax returns, new form 26AS and prefilled tax returns for simplified return filing

Reforms in customs leading to reduced Import release time

Reduction by 47% to 71 hours at Inland Container Depots

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 14

Interim Budget

2024-25

Reduction by 28% to 44 hours at Air Cargo complexes

Reduction by 27% to 85 hours at Sea Ports

Tax Slabs as per Previous Budget (2023-2024)

Personal Income Tax slabs:

New tax regime New tax regime Old tax regime

(Revised) (Previous)

Income Slabs Income Tax Income Slabs Income Tax Income Income Tax

Rate Rate Slabs Rate

Rs 2.5 lakh Nil 0-2.5 lakh Nil

Rs 0-3 lakh Nil

Rs 2.5-5 lakh 5%

Rs 2.5-5 5%

Rs 3-6 lakh 5% Rs 5-7.5 lakh 10% lakh

Rs 6-9 lakh 10% Rs 7.5-10 lakh 15%

Rs 5 -10 20%

Rs 9-12 lakh 15% Rs 10-12.5 20% lakh

lakh

Rs 12-15 lakh 20% Rs 12.5-15 25%

lakh Above 10 30%

lakh

Above Rs 15 30% Above Rs 15 30%

lakh lakh

Rebate: Under Budget 2023-24, tax rebate limit in the new tax regime was increased to Rs 7 lakhs from

Rs 5 lakhs

Surcharge on income-tax under both old regime and new regime:

Income slabs Surcharge on income-tax Surcharge on income-tax

(old tax regime) (new tax regime)

Above Rs 50 lakh up to Rs 1 crore 10% 10%

Above Rs 1 crore up to Rs 2 crore 15 % 15 %

Above Rs 2 crore and up to Rs 5 crore 25 %

25 %

Above Rs 5 crore 37%

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 15

Interim Budget

2024-25

Surcharge on income-tax: Highest surcharge under the new tax regime has been reduced to

25% from 37% for people earning more than Rs 5 crore. No change in surcharge is proposed for

those who opt to be under the old regime.

Rise in tax exemption limit: The limit of tax exemption on leave encashment (up to 10 months

of average salary) at the time of retirement of non-govt salaried employees was last fixed at Rs

3 lakh in the year 2002 when the highest basic pay in the govt was Rs 30,000.

In line with the increase in govt salaries, the limit was increased to Rs 25 lakh.

Overall Tax proposals:

Income Tax Slab Rates

Individuals below 60 years

Net Income Range Rate of Income-tax

Up to Rs. 2,50,000 Nil

Rs. 2,50,000 to Rs. 5,00,000 5%

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

Senior citizens between 60 and 80 years

Up to Rs. 3,00,000 Nil

Rs. 3,00,000 to Rs. 5,00,000 5%

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

Super senior citizens (80 years and above)

Up to Rs. 5,00,000 Nil

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

Facts About Union Budget:

i.Under Article 112 of the Constitution of India, Union Budget is an Annual financial statement that

encompasses the receipt and expenditure of the Indian government, the information on the

Consolidated Fund of India, Contingency Fund of India and Public Accounts.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 16

Interim Budget

2024-25

Union Budget of India also referred to as the Annual Financial Statement in Article 112 of the

Constitution of India. It will be on the first day of February. Until 2016 it was presented on the last

working day of February by the finance minister in Parliament.

But in 2017 Arun Jaitley (FM IN 2014) started presenting the Union Budget on February 1 departing

from the colonial-era tradition of using the last working day of February.

The budget is presented by means of the financial bill and Appropriation bill which has to be passed by

the houses.

The budget division of the department of economic affairs (DEA) in the finance ministry is the nodal

body responsible for producing the budget.

Note- Article 267 of the Constitution authorizes the existence of a Contingency Fund of India

ii.The list of Budget documents presented to the Parliament:

A. Annual Financial Statement (AFS)

B. Demands for Grants (DG)

C. Finance Bill

D. Fiscal Policy Statements mandated under Fiscal Responsibility and Budget

Management Act(FRBM Act), Act:

i. Macro-Economic Framework Statement

ii. Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement

E. Expenditure Budget

F. Receipt Budget

G. Expenditure Profile

H. Budget at a Glance

I. Memorandum Explaining the Provisions in the Finance Bill

J. Output Outcome Monitoring Framework

K. Key Features of Budget 2024-25

L. Implementation of Budget Announcements, 2023-2024

The documents shown at Serial Nos. A, B, and C are mandated by Article 112,113 and 110 (a) of the

Constitution of India respectively, while the documents at Serial No. D (i) and (ii) are presented as per

the provisions of the Fiscal Responsibility and Budget Management Act, 2003.

iii.History of Budget:

The Budget was first introduced in India on April 7, 1860, when Scottish economist and

politician James Wilson from the East India Company presented it to the British Crown.

First Union budget of independent India was presented by India’s first finance minister R. K.

Shanmukham Chetty in 1947.

First Indian governor of RBI who presented the Interim Budget In 1951-52 was C D Deshmukh

First PM who presented the Union Budget Pandit was Jawaharlal Nehru in 1958-59.

Black Budget – Union Budget 1973-74 is known as Black Budget of India as budget deficit rose

to Rs 550 crore.

Until 2016, every year it is presented on the last working day of February by the Finance

Minister of India in Parliament.

But after 2016 govt presents it on the first day of February.

In 1959, Morarji Desai, the finance minister of India, presented the maximum number of

budgets so far i.e. 10.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 17

Interim Budget

2024-25

In 2017, Rail Budget was merged with the Union Budget.

Nirmala Sitharaman in her first budget in 2019 replaced the leather briefcase carrying budget

documents with a traditional red cloth ‘bahi-khata’.

Union Budget of 2021-22 was delivered in paperless form for the first time. A ‘Union Budget

Mobile App’ was also launched for hassle-free access of Budget documents by Members of

Parliament (MPs) and the general public.

Every year, the government follows the annual tradition of organising a Halwa ceremony, days

before the Budget is presented in the Parliament. There is an occasion observed by the Ministry

of Finance, called Halwa ceremony, which marks the commencement of the Budget printing

process.

Key Terminologies:

i.Fiscal Deficit (FD): It is the adverse fiscal balance which is a difference between the Revenue

Receipts Plus Non-Debt Capital Receipts (NDCR) i.e., total of the non-debt receipts and the total

expenditure.

FD is reflective of the total borrowing requirement of govt.

ii.Revenue Deficit (RD): It refers to the excess of revenue expenditure over revenue receipts.

iii.Effective Revenue Deficit (ERD): It is the difference between Revenue Deficit and Grant-in-Aid for

Creation of Capital Assets.

iv.Primary Deficit: It is measured as Fiscal Deficit less interest payments. Effective Capital

Expenditure (Eff-Capex) refers to the sum of Capital Expenditure and Grants-in-Aid for the Creation of

Capital Assets.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 18

Interim Budget

2024-25

Question & Answer

1.What is the estimated Fiscal Deficit (FD) for the Budget Estimate of 2024-25

(FY25) as a percentage of GDP?

1) 5.8%

2) 5.1%

3) 4.5%

4) 5.5%

5) 6.0%

Answer - 2) 5.1%

Explanation –

The Fiscal Deficit (FD) for Budget Estimate (BE) of 2024-25(FY25) is estimated to be 5.1% of GDP

(Gross Domestic Product) against 5.8% in the Revised Estimates (RE) for 2023-24.

The government plans to stick to its financial strategy, as mentioned in the budget for 2021-22.

The goal is to decrease the fiscal deficit to less than 4.5 percent by the fiscal year 2025-26.

2. What is the target set by the government regarding the Fiscal Deficit (FD) by

the fiscal year 2025-26?

1) Decrease to 4.5%

2) Maintain at 5.1%

3) Increase to 5.8%

4) Increased to 4.8%

5) No specific goal mentioned

Answer - 1) Decrease to 4.5%

Explanation –

The Fiscal Deficit (FD) for Budget Estimate (BE) of 2024-25(FY25) is estimated to be 5.1% of GDP

(Gross Domestic Product) against 5.8% in the Revised Estimates (RE) for 2023-24.

The government plans to stick to its financial strategy, as mentioned in the budget for 2021-22.

The goal is to decrease the fiscal deficit to less than 4.5 percent by the fiscal year 2025-26.

3.What is the percentage growth assumed for Nominal GDP from FY 2023-24 to

BE 2024-25?

1) 9.5%

2) 10.5%

3) 11.5%

4) 12.5%

5) 8.5%

Answer: 2) 10.5%

Explanation –

Nominal GDP for BE 2024-25 has been projected at 3,27,71,808 crore assuming 10.5 % growth over

the estimated Nominal GDP of `2,96,57,745 crore as per the First Advance Estimates of FY 2023-24.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 19

Interim Budget

2024-25

4.Answer the below questions

i. By what percentage is the Capital Expenditure (CapEx) outlay increased in the

Budget 2024-25? and

ii. What is the CapEx outlay as a percentage of GDP for 2024-25?

1) 9.8% and 4.6 %

2) 10.1% and 3.6 %

3) 11.1% and 3.4 %

4) 12.5% and 2.6 %

5) 8.7% and 4.3 %

Answer: 3) 11.1% and 3.4 %

Explanation :-

Capital Expenditure (CapEx) outlay for 2024-25 is being increased by 11.1 per cent to eleven lakh,

eleven thousand, one hundred and eleven crore rupees (₹ 11,11,111 crore).This amounts to 3.4

percent of GDP.

5. What is the percentage change in Total Receipts (other than borrowings) from

Revised Estimates (RE) 2023-24 to Budget Estimate(BE) 2024-25?

1) -10.8%

2) +11.8%

3) +15.0%

4) -5.5%

5) +8.2%

Answer- 2) +11.8%

Explanation :-

Item RE 2023-24 (Rs BE 2024-25 (Rs % change (RE 2023-24 to

crore) crore) BE 2024-25)

Total Receipts (other than 27,55,713 30,80,274 +11.8%

borrowings)

6.Which ministry has received the highest allocation in Budget 2024-25?

1) Ministry of Finance

2) Ministry of Defence

3) Ministry of Agriculture

4) Ministry of Health

5) Ministry of Education

Answer - 2) Ministry of Defence

Explanation:-

In 2024-25, the Ministry of Defence had the highest allocation in 2024-25, at Rs 6,21,541 crore.

Other ministries with high allocation include: (i) Road Transport and Highways (5.8% of total

expenditure), (ii) Railways (5.4%), and (iii) Consumer Affairs, Food and Public Distribution (4.5%).

The Agriculture Ministry got the lowest amount at ₹1.27 lakh crore.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 20

Interim Budget

2024-25

7. What percentage of the total budgeted expenditure does the Ministry of

Defence account for in 2024-25?

1) 10%

2) 20%

3) 15%

4) 8%

5) 13%

Answer- 5) 13%

Explanation: -

In 2024-25, the Ministry of Defence had the highest allocation in 2024-25, at Rs 6,21,541 crore. It

accounts for 13% of the total budgeted expenditure of the central government.

8.Which scheme has the highest allocation in the budget of 2024-25?

1) PM-KISAN (Pradhan Mantri Kisan Samman Nidhi)

2) Jal Jeevan Mission(JJM)

3) Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)

4) Pradhan Mantri Fasal Bima Yojana (PMFBY)

5) Pradhan Mantri Awas Yojana (PMAY)

Answer - 3) Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)

Explanation -

Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) has the highest

allocation in 2024-25 at Rs 86,000 crore. This amount is the same as the revised estimate for 2023-

24. In 2023-24, allocation on the scheme is estimated to increase by 43% over the budget estimate.

The Pradhan Mantri Awas Yojana (PMAY) has the second highest allocation in 2024-25 at Rs

80,671 crore, an increase of 49.1% over the revised estimate of 2023-24.

The Jal Jeevan Mission(JJM) has the third highest allocation in 2024-25 at Rs 70,163 crore, an

increase of 0.2% over the revised estimate of 2023-24.

9. According to the Budget for 2024-25, which government scheme provided Crop

insurance to 4 crore farmers?

1) Pradhan Mantri Jan Dhan Yojana(PMJDY)

2) PM Kisan Samman Nidhi Yojana

3) Ayushman Bharat

4) Pradhan Mantri Fasal Bima Yojana (PMFBY)

5) National Food Security Act (NFSA)

Answer- 4) Pradhan Mantri Fasal Bima Yojana (PMFBY)

Explanation:-

Welfare of Annadata (Farmers) - Crop insurance is given to 4 crore farmers under Pradhan Mantri

Fasal Bima Yojana (PMFBY).

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 21

Interim Budget

2024-25

10.According to the Budget for 2024-25, under PM-KISAN SAMMAN Yojana, direct

financial assistance is provided to 11.8 crore farmers, including marginal and

small farmers.

Under the PM Kisan Samman Nidhi Yojana, how much financial assistance is

provided to small farmers per year?

1) Rs.1000

2) Rs.4000

3) Rs.5000

4) Rs.6000

5) Rs.8000

Answer- 4) Rs.6000

Explanation –

Under PM-KISAN SAMMAN Yojana, direct financial assistance is provided to 11.8 crore farmers,

including marginal and small farmers.

PM Kisan Samman Nidhi Yojana is going on under which small farmers can get financial

assistance of Rs.6000 in the year in three installments.

The three installments of 2000 were given to farmers to manage their Ministry of Agriculture

and Farmer Welfare.

11.Under the 'Rooftop Solarisation and Muft Bijli' initiative mentioned in Budget

2024-25,

i. What does the term 'Muft Bijli' refer to in the context of the initiative? and

ii. How many units of free electricity will one crore households obtain every

month through rooftop solarization initiative?

1) Net-zero emissions and 100 units

2) Energy-efficient appliances and 500 units

3) Solar panels and 400 units

4) Free electricity and 300 units

5) Clean energy and 200 units

Answer -4) Free electricity and 300 units

Explanation -

The 'Rooftop Solarisation and Muft Bijli(Free Electricity)' initiative, in pursuit of 'net-zero'

emissions by 2070.One crore households to obtain 300 units free electricity every month through

rooftop solarization.

12. What is the proposed corpus amount for Research and Innovation in Budget

2024-25?

1) Rs.50,000 crore

2) Rs.75,000 crore

3) Rs.1 lakh crore

4) Rs.1.5 lakh crore

5) Rs.2 lakh crore

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 22

Interim Budget

2024-25

Answer- 3) Rs.1 lakh crore

Explanation-

Research and Innovation for catalyzing growth, employment and development ·

A corpus of Rs.1 lakh crore to be established.

A new scheme to be launched for strengthening deep-tech technologies for defence purposes

and expediting ‘atmanirbharta’.

13. According to the budget 2024-25, how is the Research and Innovation corpus

intended to be funded?

1) 50-year interest-bearing grant

2) 25-year interest-free loan

3) 50-year interest-free loan

4) 10-year interest-bearing loan

5) Direct government funding

Answer: 3) 50-year interest-free loan

Explanation :-

Research and Innovation for catalyzing growth, employment and development

A corpus of Rs.1 lakh crore to be established with 50-year interest free loan to provide long-

term financing or refinancing with long tenors and low or nil interest rates.

50-year interest-free loan: A loan suggests that the funds are provided with the expectation of

repayment. However, in this case, the loan comes with a unique feature of being interest-free,

meaning that the borrower is not required to pay any interest on the borrowed amount.

14. How many normal rail bogies (railway trucks) are planned to be converted to

Vande Bharat standards in Budget 2024-25?

1) 10,000

2) 20,000

3) 30,000

4) 40,000

5) 50,000

Answer- 4) 40,000

Explanation –

Railways in Budget 2024-25

i.3 major economic railway corridor programmes identified under the PM Gati Shakti to be

implemented to improve logistics efficiency and reduce cost.

ii.Forty thousand normal rail bogies to be converted to Vande Bharat standards.

15. Reforms in the States for ‘Viksit Bharat’ in Budget 2024-25.

i.What financial provision has been made in Budget 2024-25 to support

milestone-linked reforms by State Governments under 'Viksit Bharat'?,and

ii.For how many years is the interest-free loan proposed in Budget 2024-25 to

support state-level reforms under 'Viksit Bharat'?

1) Rs.70,000 crore and 25 years

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 23

Interim Budget

2024-25

2) Rs.75,000 crore and 50 years

3) Rs.80,000 crore and 25 years

4) Rs.85,000 crore and 50 years

5) Rs.90,000 crore and 25 years

Answer- 2) Rs.75,000 crore and 50 years

Explanation:-

Reforms in the States for ‘Viksit Bharat’

A provision of Rs.75,000 crore rupees as 50-year interest free loan is proposed to support

milestone-linked reforms by the State Governments.

16. What is the year-on-year increase in the outlay for Ayushman Bharat or the

PM Jan Arogya Yojana (PMJAY), in Budget 2024-25?

1) 5 percent

2) 7 percent

3) 10 percent

4) 12 percent

5) 15 percent

Answer- 3) 10 percent

Explanation:-

Ayushman Bharat in Budget 2024-25

Healthcare cover under Ayushman Bharat scheme to be extended to all Accredited Social Health

Activist (ASHA) workers, Anganwadi Workers and Helpers.The Ayushman Bharat, India's primary

universal health scheme, experienced a year-on-year outlay increase of 10 percent, reaching ₹7,500

crore.

Ayushman Bharat, or the PM Jan Arogya Yojana (PMJAY), provides families with an annual

cashless and paperless benefit cover of ₹5 lakh on a floater basis, accessible at empanelled

hospitals across India.

17.What is the government's target for Sovereign Gold Bond (SGB) issuance in the

next fiscal year (FY25), as per Budget 2024-25?

1) Rs.1,000 crore

2) Rs.2,000 crore

3) Rs.2,500 crore

4) Rs.3,000 crore

5) Rs.3,500 crore

Answer- 5) Rs.3,500 crore

Explanation :-

In Budget 2024-25, the government aims to more than double the issuance of Sovereign Gold Bonds

(SGB) for the next fiscal year (FY25) to Rs. 3,500 crore, compared to Rs. 1,500 crore in the previous

financial year ending March 31, 2023.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 24

Interim Budget

2024-25

18. What is the maximum limit of subscription for trusts and similar entities in

the Sovereign Gold Bond (SGB) per fiscal year according to the Government of

India?

1) 5 kg

2) 10 kg

3) 15 kg

4) 20 kg

5) 25 kg

Answer- 4) 20 kg

Explanation :-

Sovereign Gold Bonds (SGB), administered by the Reserve Bank of India, are government securities

denominated in grams of gold but substitutes for holding physical gold. Investors have to pay the

issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve

Bank of India on behalf of Government of India.

The Bonds are issued in denominations of one gram of gold and in multiples thereof.

Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4

kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar

entities notified by the government from time to time per fiscal year (April – March).

19. How much has the government increased the allocation for organic fertilizers

in Budget 2024-25 compared to the previous allocation?

1) 5 times

2) 8 times

3) 11 times

4) 16 times

5) 20 times

Answer- 4) 16 times

Explanation-

The government increases the allocation for organic fertilizers by 16 times in Budget 2024-25.The

launching of nano di-ammonia phosphate (nano-DAP) could eventually lead the government to

significantly reduce subsidies on phosphatic fertilizers.

A new scheme for promotion of organic fertilizers providing Market Development Assistance

(MDA) and promotion of Research and Development as GOBARdhan initiatives, was introduced

in 2023.

20. What is the percentage, India’s reduction and revised financial assistance to

the Maldives as per the information provided in Budget 2024-25?

1) 12% and INR 200 crore

2) 14% and INR 300 crore

3) 20% and INR 400 crore

4) 22% and INR 600 crore

5) 24% and INR 800 crore

Answer- 4) 22% and INR 600 crore

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 25

Interim Budget

2024-25

Explanation :-

Financial Aid to Maldives, Bhutan, & Nepal in Budget 2024-25

India will reduce financial assistance to the Maldives by 22%, with the majority share of aid directed

towards Bhutan and Nepal.

i.For the fiscal year 2024-25, India has brought

down the developmental assistance to INR 600 crore. Despite the reduction, the

Maldives remains the third-highest recipient of foreign aid from the Indian

government.

ii.Bhutan and Nepal are the leading recipients of

government grants, with Bhutan receiving INR 2068.56 crore and Nepal getting

INR 700 crore for developmental assistance.

21. What is the disinvestment target set by the government for the fiscal year

2024-25 as per the interim budget?

1) Rs 30,000 crore

2) Rs 40,000 crore

3) Rs 50,000 crore

4) Rs 60,000 crore

5) Rs 70,000 crore

Answer- 3) Rs.50,000 crore

Explanation-

In the interim budget for 2024-25, the government has set a disinvestment target of Rs 50,000

crore, an increase from the revised estimate of Rs 30,000 crore in the current financial year(FY24).

22. What is the increased capital infusion in Bharat Sanchar Nigam Limited

(BSNL) in the 2024-25 Budget?

1) Rs.32,937 crore

2) Rs.52,937 crore

3) Rs.62,916 crore

4) Rs.72,916 crore

5) Rs.82,916 crore

Answer- 5) Rs.82,916 crore

Explanation :-

In the 2024-25 Budget, the government has raised the capital infusion in the public-owned telecom

operator Bharat Sanchar Nigam Limited (BSNL) to Rs.82,916 crore, compared to Rs.52,937 crore in

the 2023-24 period.

The capital infusion for BSNL in the 2024-25 Budget saw a 30% increase compared to the

2023-24 period.

23.What is the allocated budget for the KHELO India programme in the 2024-25

budget?

1) Rs.900 crore

2) Rs.700 crore

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 26

Interim Budget

2024-25

3) Rs.500 crore

4) Rs.1,000 crore

5) Rs.1,200 crore

Answer- 1) Rs.900 crore

Explanation –

Finance Minister Nirmala Sitharaman allocated Rs. 900 crore for the KHELO India programme in

2024-25 budget.

KHELO India, a Central government initiative, focuses on enhancing sports culture at the

grassroots level was launched in 2018 by former Union Sports Minister Col. Rajyavardhan

Singh Rathore, it is officially known as the National Programme for Development of Sports.

24. For which period and amount are outstanding direct tax demands withdrawn

by the government in the recent announcement under Budget 2024-25?

1) Upto FY 2015-16, Rs 15,000

2) Upto FY 2014-15, Rs 10,000

3) Upto FY 2010-11, Rs 25,000

4) Upto FY 2009-10, Rs 25,000

5) Upto FY 2016-17, Rs 20,000

Answer- 4) Upto FY 2009-10, Rs 25,000

Explanation:-

Direct taxes – Finance Minister Nirmala Sitharaman proposes to retain the same tax rates for direct

taxes.Government to improve taxpayer services.

Outstanding direct tax demands upto Rs 25000 pertaining to the period upto FY 2009-10

withdrawn.

25.What is the maximum outstanding direct tax demand amount withdrawn for

financial years 2010-11 to 2014-15?

1) Rs 5,000

2) Rs 10,000

3) Rs 15,000

4) Rs 20,000

5) Rs 25,000

Answer- 2) Rs 10,000

Explanation :-

Direct taxes – Finance Minister Nirmala Sitharaman proposes to retain the same tax rates for direct

taxes.

Government to improve taxpayer services

Outstanding direct tax demands upto Rs 10000 for financial years 2010-11 to 2014-15 withdrawn.

26. Until which date have tax benefits for Start-Ups and investments by Sovereign

wealth funds or pension funds been extended, as per the budget for the fiscal

year 2024-25?

1) 30.04.2024

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 27

Interim Budget

2024-25

2) 31.03.2024

3) 31.03.2025

4) 31.12.2024

5) 01.01.2025

Answer- 3) 31.03.2025

Explanation

According to the Finance Minister Nirmala Sitharaman announcement in Budget 2024-25, tax benefits

to Start-Ups, investments made by Sovereign wealth funds or pension funds extended to 31.03.2025.

27. Until which date has the tax exemption on certain income of GIFT City's

International Financial Services Centre (IFSC) units been extended, according to

the announcement in Budget 2024-25?

1) 30.04.2024

2) 01.01.2025

3) 31.03.2024

4) 31.03.2025

5) 31.12.2024

Answer- 4) 31.03.2025

Explanation-

According to the Finance Minister Nirmala Sitharaman announcement in Budget 2024-25,tax

exemption on certain income of GIFT City's International Financial Services Centre (IFSC) units

extended by a year to 31.03.2025 from 31.03.2024.

28.What is the current average processing time for tax returns, as per the latest

Budget 2024-25?

1) 5 days

2) 10 days

3) 15 days

4) 20 days

5) 30 days

Answer - 2) 10 days

Explanation -

Achievements in tax-payer services

As per the Budget 2024-25 updates, average processing time of tax returns has reduced to 10

days. Specifically, the processing time has reduced to 10 days, a notable improvement from the

93 days it took in the fiscal year 2013-14.

29. What constitutional provision defines the concept of "vote on account" in the

Indian context?

1) Article 116

2) Article 93

3) Article 201

4) Article 124

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 28

Interim Budget

2024-25

5) Article 144

Answer- 1) Article 116

Explanation –

Vote on account is the process where an outgoing government seeks interim permission

from the Parliament to withdraw funds from the Consolidated Fund of India and spend

money on expenditures and crucial government schemes for a few months until a new

The government is formed after the elections. As defined by Article 116 of the Indian Constitution,

vote on account is a grant in advance for the Central government to meet short-term expenditure,

generally lasting for a few months till the new financial year starts.

30. What does Article 266 of the Indian Constitution define?

1) Budget allocations

2) Economic policies

3) Consolidated Fund of India

4) Tax rates

5) Government expenditures

Answer - 3) Consolidated Fund of India

Explanation –

Consolidated Fund:

Article 266 of the Indian Constitution defines the Consolidated Fund of India, which is

where all the revenue of the central government, be it from taxes, funds raised by loans

and interest on loans, and a portion of taxes from states, is Stored. It states that no

money from the Consolidated Fund may be withdrawn except under an appropriation

undertaken by law, for which the Centre passes an appropriation bill during the Union

Budget.

31. Under the new tax scheme, there is now no tax liability for taxpayers with

income up to____________, up from Rs 2.2 lakh in the financial year 2013-14.

1) Rs 11 lakh

2) Rs 8 lakh

3) Rs 10 lakh

4) Rs 7 lakh

5) Rs 9 lakh

Answer- 4) Rs 7 lakh

Explanation:

Tax rationalization efforts over the years

No tax liability for income upto Rs 7 lakh, up from Rs 2.2 lakh in FY 2013-14

Presumptive taxation threshold for retail businesses increased to Rs 3 crore from Rs 2 crore

Presumptive taxation threshold for professionals increased to Rs 75 lakh from Rs 50 lakh

32. What is the rate of tax for Personal Income tax slab (New tax regime) between

the income of Rs 3 Lakh to Rs 6 Lakh for 2024-25 ?

1) 10%

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 29

Interim Budget

2024-25

2) 20%

3) 5%

4) 30%

5) 15%

Answer- 3) 5%

Explanation:

Personal Income Tax slabs:

New Tax Regime (Revised)

Income Slabs Income Tax Rate

Rs 0-3 lakh Nil

Rs 3-6 lakh 5%

Rs 6-9 lakh 10%

Rs 9-12 lakh 15%

Rs 12-15 lakh 20%

Above Rs 15 lakh 30%

33. What is the rate of tax for Personal Income tax slab (New tax regime) between

the income of Rs 9 Lakh to Rs 12 Lakh for 2024-25 ?

1) 15%

2) 20%

3) 10%

4) 30%

5) 5%

Answer- 1) 15%

Explanation:

Personal Income Tax slabs:

New Tax Regime (Revised)

Income Slabs Income Tax Rate

Rs 0-3 lakh Nil

Rs 3-6 lakh 5%

Rs 6-9 lakh 10%

Rs 9-12 lakh 15%

Rs 12-15 lakh 20%

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 30

Interim Budget

2024-25

Above Rs 15 lakh 30%

34. The Highest surcharge under the new tax regime has been reduced

to ________________ form 37% for people earning more than Rs 5 crore in the new

tax regime.

1) 10%

2) 15%

3) 35%

4) 25%

5) 30%

Answer- 4) 25%

Explanation:

Surcharge on income-tax: Highest surcharge under the new tax regime has been reduced to 25% from

37% for people earning more than Rs 5 crore. No change in surcharge is proposed for those who opt

to be under the old regime.

35. What is the rate of tax for Income tax slabs (Senior citizens between 60 and

80 years) between the income of Rs 3 Lakh to Rs 5 Lakh for 2024-25 ?

1) 20%

2) 5%

3) 10%

4) 30%

5) 15%

Answer- 2) 5%

Explanation:

Income Tax Slab Rates

Individuals below 60 years

Net Income Range Rate of Income-tax

Up to Rs. 2,50,000 Nil

Rs. 2,50,000 to Rs. 5,00,000 5%

Rs. 5,00,000 to Rs. 10,00,000 20%

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 31

Interim Budget

2024-25

Above Rs. 10,00,000 30%

Senior citizens between 60 and 80 years

Up to Rs. 3,00,000 Nil

Rs. 3,00,000 to Rs. 5,00,000 5%

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

Super senior citizens (80 years and above)

Up to Rs. 5,00,000 Nil

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

36. In which Article of Indian Constitution, the Union Budget is referred as the

Annual Financial Statement (AFS)?

1) Article 110

2) Article 111

3) Article 100

4) Article 114

5) Article 112

Answer- 5) Article 112

Explanation:

Under Article 112 of the Constitution of India, the Union Budget is an Annual financial statement that

encompasses the receipt and expenditure of the Indian government, the information on the

Consolidated Fund of India, Contingency Fund of India and Public Accounts.

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 32

Interim Budget

2024-25

Union Budget of India also referred to as the Annual Financial Statement in Article 112 of the

Constitution of India. It will be on the first day of February. Until 2016 it was presented on the

last working day of February by the finance minister in Parliament.

37. Who presented the first budget for India in 1860 (Pre independence)?

1) Franklin Allen

2) Christopher Allsopp

3) Sir Alison

4) James Wilson

5) Julia Aglionby

Answer- 4) James Wilson

Explanation:

The Budget was first introduced in India on April 7, 1860 when Scottish economist and politician

James Wilson from East India Company presented it to the British Crown.

38. The 1st Budget of Independent India was presented on 26th November ______

(year) by ___________.

1) 1950; Moraji Desai

2) 1950; Jawaharlal Nehru

3) 1947; R K Shanmukham Chetty

4) 1949; John Mathal

5) 1947; C D Deshmukh

Answer- 3) 1947; R K Shanmukham Chetty

Explanation:

The first Budget of Independent India was presented on November 26, 1947, by India's 1st finance

minister R K Shanmukham Chetty.

39. In which year Finance Minister (FM) Nirmala Sitharaman replaced the leather

briefcase carrying budget documents with a traditional red cloth ‘bahi-khata’?

1) 2020

2) 2022

3) 2019

4) 2023

5) 2021

Answer- 3) 2019

Explanation:

Nirmala Sitharaman in her first budget in 2019 replaced the leather briefcase carrying budget

documents with a traditional red cloth ‘bahi-khata’.

40. Which of the following finance ministers of India, has presented the

maximum number of budgets?

1) Morarji Desai

2) T.T. Krishnamachari

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 33

Interim Budget

2024-25

3) Manmohan Singh

4) Nirmala Sitharaman

5) P. Chidambaram

Answer- 1) Morarji Desai

Explanation:

In 1959, Morarji Desai, the finance minister of India, presented the maximum number of budgets so

far i.e. 10.

i. In 2017, the Rail Budget was merged with the Union Budget.

Aspirant Queries

Aspirant: Does Affairscloud covers all the Current affairs topics related

to examinations?

Affairscloud: We Guaranteed All the Important topics related to

examination are covered in Our Daily CA content and Daily CA Quizzes.

Aspirant: Why is there a delayal in news?

Affairscloud: As some of the major news sites doesn't provide the required

data on the exact day, we take extra time for important data to be presented

to the aspirants on the examination basis to ensure nothing is missed.

Example: In 'Important Days' topics the International Organisations

publish their reports and Rankings in the evenings, to make sure every data

is covered, we delay the topics to the next day

Candidates appearing for Competitive Exams. Kindly Share the General

Awareness questions, which asked in their respective exams to

“gaanalysis.ac@gmail.com”

GA Questions Asked in Exams

Affairscloud’s Self Analysis for General Awareness Section

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 34

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 35

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 36

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 37

Interim Budget

2024-25

Report Errors in the PDF - ebooks@affairscloud.com Copyright 2014-2024 @ AffairsCloud.com 38

You might also like

- Union Budget 2023-24 by Affairscloud New 1 1Document62 pagesUnion Budget 2023-24 by Affairscloud New 1 1you & meNo ratings yet

- Rajasthan Budget Analysis 2024-25Document18 pagesRajasthan Budget Analysis 2024-25SAKSHI CHANDRESHNo ratings yet

- Compare Budget 2023 With 2022Document8 pagesCompare Budget 2023 With 2022Vartika VNo ratings yet

- Budget 2024-25 - SBI AnalysisDocument17 pagesBudget 2024-25 - SBI AnalysisSumiran BansalNo ratings yet

- Interim Budget 2024-2025Document13 pagesInterim Budget 2024-2025anushkajain1710No ratings yet

- Pib India Budget-HighlightsDocument7 pagesPib India Budget-HighlightsKeerthi EkambaramNo ratings yet

- India'S 1St Digital Budget:91St Union Budget 2021-22: Youtube Channel - Click Here App Click HereDocument38 pagesIndia'S 1St Digital Budget:91St Union Budget 2021-22: Youtube Channel - Click Here App Click HereNihal JamadarNo ratings yet

- Union Budget of India: HistoryDocument6 pagesUnion Budget of India: HistoryGOVIND JANGIDNo ratings yet

- Assam State Budget 2024 25Document16 pagesAssam State Budget 2024 25Partha DasNo ratings yet

- Budget 2024Document5 pagesBudget 2024radhaupadhyay150No ratings yet

- Aman Bhatt (PM)Document6 pagesAman Bhatt (PM)Pinkee SinghNo ratings yet

- SUMMARY of INTERIM BUDGET 2024-25Document8 pagesSUMMARY of INTERIM BUDGET 2024-25Shreya SinhaNo ratings yet

- Budget 2021Document5 pagesBudget 2021Saanya AroraNo ratings yet

- Macro 3 AssignmentDocument16 pagesMacro 3 AssignmentHarshit RathoreNo ratings yet

- Union Budget DisscussionDocument7 pagesUnion Budget DisscussionAbhinav VijayNo ratings yet

- A Brief Analysis of National Budget Fiscal Year 2023-24Document10 pagesA Brief Analysis of National Budget Fiscal Year 2023-24Foysal AhmedNo ratings yet

- Summary 2024Document2 pagesSummary 2024ngoepekamogelo2No ratings yet

- Union Budget 2023-2024 English PDF 1Document29 pagesUnion Budget 2023-2024 English PDF 1Arul VinothNo ratings yet

- Analysis of BudgetDocument5 pagesAnalysis of BudgetSargun KaurNo ratings yet

- Interim Budget 2024Document13 pagesInterim Budget 2024praneelalgot4No ratings yet

- Compliance With Annual Reduction Targets Specified Under The FRBM ActDocument38 pagesCompliance With Annual Reduction Targets Specified Under The FRBM ActBhanu UpadhyayNo ratings yet

- Macro Economics ProjectDocument7 pagesMacro Economics ProjectAyushi PatelNo ratings yet

- Budget 2024 25 - SummarynewDocument26 pagesBudget 2024 25 - SummarynewVarun kariyaNo ratings yet

- Press Information Bureau Budget 23-24Document8 pagesPress Information Bureau Budget 23-24AbhishekNo ratings yet

- BudgetDocument7 pagesBudgetShahida ChNo ratings yet

- Impact Analysis: Budget 2014-15Document4 pagesImpact Analysis: Budget 2014-15Raj AraNo ratings yet

- Budget 2024 25 Summary 1706888004Document20 pagesBudget 2024 25 Summary 1706888004scientist xyzNo ratings yet

- Current Affairs PDF PlansDocument29 pagesCurrent Affairs PDF PlansEddy EddyNo ratings yet

- An Analysis of The Budget of BangladeshDocument25 pagesAn Analysis of The Budget of Bangladeshmahbub rahmanNo ratings yet

- Press Information BureauDocument8 pagesPress Information Bureauabhi RanaNo ratings yet

- B MBA08120 Optional3Document2 pagesB MBA08120 Optional3Kunal NakumNo ratings yet

- B MBA08120 Optional3Document2 pagesB MBA08120 Optional3Kunal NakumNo ratings yet

- Viksit Bharat by 2050Document11 pagesViksit Bharat by 2050knowledgegalvanizerNo ratings yet

- 2024 BudgetDocument7 pages2024 Budgetullascr007No ratings yet

- Aakash GD3 BudgetanalysisDocument7 pagesAakash GD3 BudgetanalysisMen AtworkNo ratings yet

- Union Budget Analysis 2024-25Document15 pagesUnion Budget Analysis 2024-25i.bohraNo ratings yet

- Draft 2024 Budget Policy StatementDocument128 pagesDraft 2024 Budget Policy StatementMarvin nduko bosireNo ratings yet

- Union Budget 2021-22 IBMDocument9 pagesUnion Budget 2021-22 IBMKUMAR SIMHADHRI HU21CSEN0101917No ratings yet

- Union Budget 2023Document5 pagesUnion Budget 2023Datta CreationsNo ratings yet

- Fiscal Policy Statement FY 2023.24 - FinalDocument7 pagesFiscal Policy Statement FY 2023.24 - FinalAnubhav BhattaraiNo ratings yet

- Macroeconomic Framework Statement of Budget Macroeconomics Framework Statement 2022-2023 Group No - 16Document16 pagesMacroeconomic Framework Statement of Budget Macroeconomics Framework Statement 2022-2023 Group No - 16RENUKA THOTENo ratings yet

- Click Here To Download The Careerscloud App: Affairscloud Launched A New Long Awaited Mobile AppDocument42 pagesClick Here To Download The Careerscloud App: Affairscloud Launched A New Long Awaited Mobile AppOK BHaiNo ratings yet

- Union Interim Budget 2024-25 PDF - 2543Document7 pagesUnion Interim Budget 2024-25 PDF - 2543PiyushNo ratings yet

- 12.01.2024 - The Banking FrontlineDocument8 pages12.01.2024 - The Banking Frontlineservice.chennaiboiNo ratings yet

- Union Budget 2024 Complete AnalysisDocument52 pagesUnion Budget 2024 Complete Analysisarushi4703No ratings yet

- Government BudjetDocument34 pagesGovernment Budjetboysteacherevening003No ratings yet

- MacroeconomicsDocument7 pagesMacroeconomicsreinaelizabeth890No ratings yet

- Project Report On BUDGET (2022-23) : Computer Applications in BusinessDocument15 pagesProject Report On BUDGET (2022-23) : Computer Applications in BusinessDeepu yadavNo ratings yet

- MPR-February 2024Document21 pagesMPR-February 2024Pradheep VelusamyNo ratings yet

- Bb2023-02 Analysis of The Presidents Budget For The Fiscal Year 2024 1Document78 pagesBb2023-02 Analysis of The Presidents Budget For The Fiscal Year 2024 1ANTHONY BALDICANASNo ratings yet

- A Project On Analysis of Budget 2009-2010Document19 pagesA Project On Analysis of Budget 2009-2010Mohan KumarNo ratings yet

- Economic Survey Summary2Document8 pagesEconomic Survey Summary2m_vamshikrishna22No ratings yet

- Economics Assignment ON: Submitted To: Sunrita ChaudhuriDocument13 pagesEconomics Assignment ON: Submitted To: Sunrita ChaudhuriReshma MohanNo ratings yet

- Corporate Budget Memorandum No45Document6 pagesCorporate Budget Memorandum No45Alexis MuliNo ratings yet

- Indian Economics, FRBM3909Document5 pagesIndian Economics, FRBM3909Haritha SNo ratings yet

- Hindu Review January 2024Document57 pagesHindu Review January 2024creativelearningforlifeNo ratings yet

- Budget 2024Document5 pagesBudget 2024Vikram SharmaNo ratings yet

- Bumper RBI Dividend - More Fiscal RoomDocument1 pageBumper RBI Dividend - More Fiscal RoomAditya SinghNo ratings yet

- Budget 2024 HighlightsDocument2 pagesBudget 2024 Highlightshuzig004No ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Quadratic - Linear - Cubic Equations - BasicDocument22 pagesQuadratic - Linear - Cubic Equations - BasicRajesh KumarNo ratings yet

- Lok Katha Parmanand MahtoDocument75 pagesLok Katha Parmanand MahtoRajesh KumarNo ratings yet

- February 2024 - Half Month CA - EnglishDocument87 pagesFebruary 2024 - Half Month CA - EnglishRajesh Kumar100% (1)

- Rectenna DesignDocument14 pagesRectenna DesignRajesh Kumar100% (1)

- 3rd Feb SSC CGL 2020 Tier 2 Maths Paper PDF @exam - StocksDocument30 pages3rd Feb SSC CGL 2020 Tier 2 Maths Paper PDF @exam - StocksRajesh KumarNo ratings yet

- Jan 1st Week Details (Eng) by ACDocument26 pagesJan 1st Week Details (Eng) by ACRajesh KumarNo ratings yet

- Awareness and Perception of Senior Citizens On The Implementation of Republic Act 9994 in San Isidro in Nueva Ecija in The PhilippinesDocument19 pagesAwareness and Perception of Senior Citizens On The Implementation of Republic Act 9994 in San Isidro in Nueva Ecija in The PhilippinesFrances Rexanne AmbitaNo ratings yet

- TNMAS001990400B0063828 NewDocument2 pagesTNMAS001990400B0063828 NewLogeshNo ratings yet

- Invest Oct 2022Document521 pagesInvest Oct 2022the kingfishNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- Lalit Mohan Pandey Uttarakhand PensionDocument3 pagesLalit Mohan Pandey Uttarakhand PensionRajeshPandeyNo ratings yet

- MixDocument32 pagesMixUnnecessary BuyingNo ratings yet

- Employment Cost SerbiaDocument2 pagesEmployment Cost SerbiaD OMENNo ratings yet

- G.O.Ms - No.39, Dated24.06.2020new G.O PAYMENT OF SALARIES - GO - FINALDocument2 pagesG.O.Ms - No.39, Dated24.06.2020new G.O PAYMENT OF SALARIES - GO - FINALvaranasirk1No ratings yet

- Allowable Deductions From Gross Income: Reason: Lifeblood TheoryDocument10 pagesAllowable Deductions From Gross Income: Reason: Lifeblood TheoryDeeterose100% (1)

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDocument4 pages28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteMatías PierottiNo ratings yet

- Compensation Manual BALDocument27 pagesCompensation Manual BALPankaj KumarNo ratings yet

- Gra Form 2a and 7b2Document9 pagesGra Form 2a and 7b2Tarrick WeeksNo ratings yet

- Compensation Canadian 5th Edition by Milkovich Newman and Yap ISBN Test BankDocument13 pagesCompensation Canadian 5th Edition by Milkovich Newman and Yap ISBN Test Bankmichael100% (31)

- Impact of Compensation On Employee PerformanceDocument6 pagesImpact of Compensation On Employee PerformanceDeepesh YadavNo ratings yet

- Name: Vikrant Singh Tomar USN: 19MBAR0331 Sec:MF2 Subject: Insurance Assignment-02Document6 pagesName: Vikrant Singh Tomar USN: 19MBAR0331 Sec:MF2 Subject: Insurance Assignment-02Vikrant SinghNo ratings yet

- NPS Exit Manual User GuideDocument5 pagesNPS Exit Manual User GuideNavendu PandeyNo ratings yet

- ICGAB New Tax Syllabus (Sep-19)Document9 pagesICGAB New Tax Syllabus (Sep-19)Aminul HaqNo ratings yet

- Income Statement AccountDocument17 pagesIncome Statement Accountmaria cacaoNo ratings yet

- Political Science Term PaperDocument3 pagesPolitical Science Term PaperFahim ZamanNo ratings yet

- Stakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Document103 pagesStakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Ali ZilbermanNo ratings yet

- A Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarDocument56 pagesA Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarManoj MondalNo ratings yet

- 1001 Application Loans Bursaries 2023 2024Document9 pages1001 Application Loans Bursaries 2023 2024HadiNo ratings yet

- CPA UGANDA PAPER 11 TAXATION November 20Document4 pagesCPA UGANDA PAPER 11 TAXATION November 20agaba fredNo ratings yet

- MA-AO Sugar v. CADocument2 pagesMA-AO Sugar v. CAKaren Joy MasapolNo ratings yet

- Local Authorities Report 2020Document343 pagesLocal Authorities Report 2020Euston ChinharaNo ratings yet

- The Code On Wages, 2019 No. 29 of 2019Document29 pagesThe Code On Wages, 2019 No. 29 of 2019Awinash Kumar GuptaNo ratings yet

- BIR Rul. 102-95Document2 pagesBIR Rul. 102-95sdysangcoNo ratings yet

- Auditing: Control & Substantive Tests in Personnel & Payroll by David N. RicchiuteDocument19 pagesAuditing: Control & Substantive Tests in Personnel & Payroll by David N. RicchiuteTri Yuli ManurungNo ratings yet

- Cost Sheet FormatDocument1 pageCost Sheet Formatvenkataswamynath channa71% (35)

- 1 Listening C2 Text Script PDFDocument11 pages1 Listening C2 Text Script PDFRania NerNo ratings yet