Professional Documents

Culture Documents

INFIBEAM StockReport 20230919 0135

INFIBEAM StockReport 20230919 0135

Uploaded by

sunny996316192Copyright:

Available Formats

You might also like

- Devon Archer - Defense Sentencing Memo OneDocument48 pagesDevon Archer - Defense Sentencing Memo OneWashington ExaminerNo ratings yet

- TALEO - Recruiter User GuideDocument42 pagesTALEO - Recruiter User GuideMarwan SNo ratings yet

- VEDL StockReport 20240410 1623Document14 pagesVEDL StockReport 20240410 1623sunny996316192No ratings yet

- TITAN StockReport 20230913 0850Document14 pagesTITAN StockReport 20230913 0850bloggingbongoNo ratings yet

- IRB StockReport 20240205 1614Document14 pagesIRB StockReport 20240205 1614Chetan ChouguleNo ratings yet

- SOUTHBANK StockReport 20230911 0016Document13 pagesSOUTHBANK StockReport 20230911 0016rameshwardas1980No ratings yet

- Indigopnts Stockreport 20231022 2029Document14 pagesIndigopnts Stockreport 20231022 2029Ayush SaxenaNo ratings yet

- KOTAKBANK StockReportDocument13 pagesKOTAKBANK StockReportSSK SNo ratings yet

- IRB StockReport 20231024 0120Document14 pagesIRB StockReport 20231024 0120Ashutosh AgarwalNo ratings yet

- SUNPHARMA StockReportDocument14 pagesSUNPHARMA StockReportJyotishman SahaNo ratings yet

- PENIND StockReport 20230828 1023Document14 pagesPENIND StockReport 20230828 1023Chetan ChouguleNo ratings yet

- HDFCBANK StockReport 20240117 1055Document13 pagesHDFCBANK StockReport 20240117 1055RAKESH ANABNo ratings yet

- LXCHEM StockReport 20231011 1009Document14 pagesLXCHEM StockReport 20231011 1009rajbus lessNo ratings yet

- IRFC StockReport 20240214 1118Document12 pagesIRFC StockReport 20240214 1118Sashibhusan NayakNo ratings yet

- MOIL StockReportDocument14 pagesMOIL StockReportMohak PalNo ratings yet

- ASHOKA StockReport 20231111 0031Document14 pagesASHOKA StockReport 20231111 0031yashbhutada156No ratings yet

- CHAMBLFERT StockReport 20240307 2009Document14 pagesCHAMBLFERT StockReport 20240307 2009Alicos MathewNo ratings yet

- ICICIBANK StockReport 20231101 1053Document13 pagesICICIBANK StockReport 20231101 1053SaadNo ratings yet

- VBL StockReport 20230907 1553Document14 pagesVBL StockReport 20230907 1553Sangeethasruthi SNo ratings yet

- ZENSARTECH StockReport 20240123 0818Document13 pagesZENSARTECH StockReport 20240123 0818Proton CongoNo ratings yet

- BAJAJFINSV-StockReport-2024 Jan 07-1614Document14 pagesBAJAJFINSV-StockReport-2024 Jan 07-1614ankit.johnnyNo ratings yet

- ITC StockReport 20231212 1335Document14 pagesITC StockReport 20231212 1335aarushisoral1No ratings yet

- RTSPOWR StockReport 20230916 1222Document12 pagesRTSPOWR StockReport 20230916 1222Firaa'ol GizaachooNo ratings yet

- IOC StockReport 20231122 1820Document14 pagesIOC StockReport 20231122 1820dherirmpkbqzfavunqNo ratings yet

- Chennpetro Stockreport 20231027 1724Document14 pagesChennpetro Stockreport 20231027 1724adcb704No ratings yet

- Annual Review 2018-1 PDFDocument33 pagesAnnual Review 2018-1 PDFMirang ShahNo ratings yet

- Annual Review 2018 PDFDocument33 pagesAnnual Review 2018 PDFSleek StyleNo ratings yet

- MorningStar ES0152768612Document6 pagesMorningStar ES0152768612Michelle Herize PenedoNo ratings yet

- PARAGMILK StockReport 20230828 1022Document12 pagesPARAGMILK StockReport 20230828 1022Chetan ChouguleNo ratings yet

- Report For Morning StarDocument5 pagesReport For Morning StarMuhammad NaqashNo ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Gronic MaybankDocument9 pagesGronic MaybankNicholas ChehNo ratings yet

- Quant Pick - Biocon: April 8, 2020Document5 pagesQuant Pick - Biocon: April 8, 2020anujonwebNo ratings yet

- MorningStar Research 2024Document6 pagesMorningStar Research 2024JINU JAMESNo ratings yet

- 3M India Share Price, Financials and Stock AnalysisDocument9 pages3M India Share Price, Financials and Stock AnalysisGaganNo ratings yet

- MORNINGSTARDocument5 pagesMORNINGSTARhectorhernandez5576No ratings yet

- Morningstar Report1Document6 pagesMorningstar Report1gcjhyjtnsxlvicnxivNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectthetrade180No ratings yet

- MorningStar ES0105083002Document4 pagesMorningStar ES0105083002Pedro García GuillénNo ratings yet

- Motilal Oswal PMS PortfolioDocument25 pagesMotilal Oswal PMS PortfolioHetanshNo ratings yet

- 0P0001L814Document6 pages0P0001L814peter.r.stephensonNo ratings yet

- Cler P 01012023Document4 pagesCler P 01012023XaninaNo ratings yet

- SDBL StockReport 20240323 1739Document12 pagesSDBL StockReport 20240323 1739khushkothari2004No ratings yet

- Investment Analysis Example ReportDocument28 pagesInvestment Analysis Example ReportOwenNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- Pt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Document3 pagesPt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Nia TjhoaNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- European Software & IT ServiceDocument39 pagesEuropean Software & IT Servicejefflovetoronto_5431No ratings yet

- Telecoms Churn FinalDocument1 pageTelecoms Churn FinalAdityaDarmawanNo ratings yet

- IDFC FIRST Bank Investor Presentation Q1 FY22Document68 pagesIDFC FIRST Bank Investor Presentation Q1 FY22UtkarshNo ratings yet

- PubCo ValuationDocument12 pagesPubCo ValuationAlan Zhu100% (1)

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectmohanchinnaiya7No ratings yet

- Dlom 2018 Q2Document76 pagesDlom 2018 Q2Catalina DumitrascuNo ratings yet

- KAMCO Research: Kuwait Stock Exchange Daily BriefingDocument4 pagesKAMCO Research: Kuwait Stock Exchange Daily Briefinghahaha123hahahaNo ratings yet

- Fixed Reference Ratio ChartDocument9 pagesFixed Reference Ratio ChartShreePanickerNo ratings yet

- Enclosures - Nuova ASPDocument156 pagesEnclosures - Nuova ASPNicolae VisanNo ratings yet

- BSNL MT Exam 2019 Test Series: Chapter 10 - Telecom KnowledgeDocument57 pagesBSNL MT Exam 2019 Test Series: Chapter 10 - Telecom KnowledgeSandeep SinghNo ratings yet

- Lord Agnew LetterDocument2 pagesLord Agnew LetterThe Guardian100% (1)

- Neja 1Document8 pagesNeja 1Fathan NugrahaNo ratings yet

- IRC Development Plan 2019 2024Document7 pagesIRC Development Plan 2019 2024James Alexander DezaNo ratings yet

- International Moot Arbitration in Commercial Disputes: Week 1 Nikki Krisadtyo, S.H., LL.MDocument11 pagesInternational Moot Arbitration in Commercial Disputes: Week 1 Nikki Krisadtyo, S.H., LL.MJeremia OktavetoNo ratings yet

- Sustainable Public Procurement: Research Trends and GapsDocument9 pagesSustainable Public Procurement: Research Trends and GapsApudjijonoNo ratings yet

- Graphic Design - A Beginners Guide To Mastering The Art of Graphic Design, Second Edition (PDFDrive)Document86 pagesGraphic Design - A Beginners Guide To Mastering The Art of Graphic Design, Second Edition (PDFDrive)Suleman MehmoodNo ratings yet

- Agricultural Extension in Asia Constraints and Options For ImprovementDocument15 pagesAgricultural Extension in Asia Constraints and Options For ImprovementMarejen Almedilla VillaremoNo ratings yet

- 8 Steps in Accounting CycleDocument2 pages8 Steps in Accounting CycleMarko Zero FourNo ratings yet

- Principal Reservoir Engineer - NOCDocument2 pagesPrincipal Reservoir Engineer - NOCGiang DuongNo ratings yet

- Disbursement Voucher (New Orence)Document4 pagesDisbursement Voucher (New Orence)user computerNo ratings yet

- Entrepreneurship: Antique National School - Senior High Lourene J. Guanzon, T-IIDocument410 pagesEntrepreneurship: Antique National School - Senior High Lourene J. Guanzon, T-IILourene Jauod- GuanzonNo ratings yet

- Activity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004Document13 pagesActivity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004hardeep waliaNo ratings yet

- Mid-Essay IE 124109Document6 pagesMid-Essay IE 124109Alexandra BragaNo ratings yet

- Pitch Deck Telkom YooBeeDocument18 pagesPitch Deck Telkom YooBeeDini Estri MulianingsihNo ratings yet

- IAB Europe AdEx Benchmark 2019 Report FINALDocument43 pagesIAB Europe AdEx Benchmark 2019 Report FINALhomesimp_1971No ratings yet

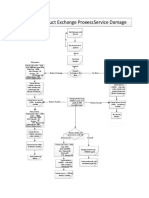

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Raw Material SOURCESING PROCESSDocument10 pagesRaw Material SOURCESING PROCESSSomya KumariNo ratings yet

- DB Managment Ch4Document15 pagesDB Managment Ch4Juan Manuel Garcia NoguesNo ratings yet

- CIBOK Sample PDFDocument43 pagesCIBOK Sample PDFArham KhanNo ratings yet

- Ptitstpow: Anggota Kelompok: Michael Prajana - 6141801004 Jose Thomas - 6141801112 Michael Osborn - 6141801134Document7 pagesPtitstpow: Anggota Kelompok: Michael Prajana - 6141801004 Jose Thomas - 6141801112 Michael Osborn - 6141801134Michael OsbornNo ratings yet

- Jafza Investor Guide New 1.2Document29 pagesJafza Investor Guide New 1.2nunov_144376No ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- America The Story of US Great Depression New DealDocument2 pagesAmerica The Story of US Great Depression New DealTori JemesNo ratings yet

- 1.2 Terms and Conditions For Subcontractor Rev. 01.2022Document11 pages1.2 Terms and Conditions For Subcontractor Rev. 01.2022melisbbNo ratings yet

- Apqc How Organizations Are Using Apqc Process PDFDocument13 pagesApqc How Organizations Are Using Apqc Process PDFsergioivanrsNo ratings yet

- RAYANAIR CASE STUDY1 - CompressedDocument20 pagesRAYANAIR CASE STUDY1 - Compressedyasser massryNo ratings yet

INFIBEAM StockReport 20230919 0135

INFIBEAM StockReport 20230919 0135

Uploaded by

sunny996316192Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INFIBEAM StockReport 20230919 0135

INFIBEAM StockReport 20230919 0135

Uploaded by

sunny996316192Copyright:

Available Formats

INFIBEAM AVENUES LTD.

Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

₹17.6 (-0.8% ) 52 Week High Low

12.8

17.6

20.4

Market Cap: 47.2B Avg Daily Volume: 79.0M

NSE | Sep 18, 2023 03:31 PM

DVM SUMMARY

Mid-range Performer D V M

These stocks are with strong quality. Their reasonable financials and technical aspects successfully gather investor's interest.

Durability Score (D) High Financial Strength Valuation Score (V) Mid Valuation Momentum Score (M) Technically Neutral

Bad Medium Good Bad Medium Good Bad Medium Good

60 45 59

0 35 55 100 0 30 50 100 0 35 60 100

ANALYST RECOMMENDATION TRENDLYNE CHECKLIST

Consensus Recommendation Target Price

STRONG BUY 28 (59.09%) 65.2% Passed in checklist

Financials 6 2

1

Total : 1 Ownership 2 2

Strong Buy Buy Hold Sell Strong Sell

Peer Comparison 2 1

Current Price High Estimate

17.6 28

Value & Momentum 5 3

Total 15 8

28

28

Average

Low

Estimate

Estimate

The consensus recommendation is based on 1 analyst recommendations. The Consensus Estimate is The Trendlyne Checklist checks if the company meets the key criteria for financial health and

the aggregate analyst estimates for listed Indian companies. consistent growth.

KEY STATISTICS

Ratios Financials

TTM PE Ratio ROE Annual % ROCE Annual % Operating Revenue TTM Cr Revenue Growth Annual YoY Net Profit Annual Cr

%

33.3 4.4 5.7 2286.4 139.6

55.9

Above industry Median Below industry Median Below industry Median Above industry Median High in industry

Below industry Median

EBIT Annual Margin % TTM PEG Ratio Long Term Debt To Equity

Annual Net Profit TTM Growth % Dividend yield 1yr % EPS TTM Growth %

9.6 0.7

- 47.5 0.3 47.5

Below industry Median Above industry Median

Below industry Median Low in industry Above industry Median

Above industry Median

PRICE VOLUME CHARTS

1 Year Return : 9.3% 5 Year Return : -70.4%

40

18

30

16

20

14

10

12 0

NOV JAN MAR MAY JUL SEP JAN JUL JAN JUL JAN JUL JAN JUL JAN JUL

Copyright © Giskard Datatech Pvt Ltd Page 1 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Durability Summary

Durability Score Infibeam Avenues Ltd. has a durability score of 60, which indicates High Financial Strength.

60 / 100

A High Durability Score (greater than 55) indicates good and consistent financial performance : stable revenues, cash flows, and low debt.

The Durability score looks at many different metrics, including long-term performance data, to identify stocks that have stood the test of time.

High Financial Strength

Bad Medium Good

60

0 35 55 100

Durability Trend Infibeam Avenues Ltd. : Sep '22 - Sep '23 Durability v/s Peers

80

Infibeam Avenues 60.0

60 Zomato 25.0

GOOD

Info Edge (India) 40.0

40

MEDIUM One97 Communications 45.0

20

PB Fintech 30.0

IndiaMART InterMESH 50.0

0

Oct '22 Nov '22 Dec '22 Jan '23 Feb '23 Mar '23 Apr '23 May '23 Jun '23 Jul '23 Aug '23 Sep '23

Affle (India) 70.0

0 10 20 30 40 50 60 70 80

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum Infibeam Avenues Ltd. (60) has second-highest Durability score amongst its peers, behind Affle

98.7% 1.3% 0% 65.0 (07 Aug '23) 50.0 (07 Nov '22) (India) Ltd. (70)

Financial Metrics

Total Revenue Annual Cr Net Profit Annual Cr Tax Annual Cr Revenue Growth Annual YoY %

2,033.07 55.9% YoY Mar'23 139.6 61.4% YoY Mar'23 45.95 212.5% YoY Mar'23 55.9% -37.9% YoY Mar'23

4k 200 75 100

55.9

139.6 141.9 90.2 34.4 90.1

127 46 48.4

2356.3 108 50 6.5

2k 100 88.2 86.5 0

1303.9 72.3 27.1 27.1

1170.2 21.6 -44.9

870.7 25 14.7

644.4 686.1 11.5

0 0 0 -100

8

3

M

M

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

TT

TT

TT

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

M

M

Total Revenue Annual Cr growth is higher Net Profit Annual Cr growth is higher than Tax Annual Cr growth is stable compared to Revenue Growth Annual YoY % is falling

than historical averages. historical averages. historical averages. faster than historical averages.

CAGR 2Y 72.2% CAGR 2Y 38.9% CAGR 2Y 99.7% CAGR 2Y 194.1%

3Y 46.7% 3Y 8.9% 3Y 28.6% 3Y 207.6%

5Y 18.5% 5Y 9.6% 5Y 11.2% 5Y -9.1%

Operating Profit Margin Annual % Net Profit TTM Growth % Operating Revenues Qtr Cr Net Profit Qtr Cr

8.8% -20.6% YoY Mar'23 62.6% 160.6% YoY Mar'23 742.36 77.5% YoY Jun'23 26.06 9.8% YoY Jun'23

30 200 1000 50

23.5 40.7 39.3

20.7 742.4 35.8

18 95 652.7

20 100 62.6 28.9 26.1

15.1 47.6 476.7 23.7

11.1 24 500 369.5 418.3 414.7 25

8.8 -14.9

10 0 -35.9

0 -100 0 0

2

22

22

23

22

22

23

8

'2

'2

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

n'

p'

n'

n'

p'

n'

ar

ar

ar

ar

ec

ec

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

Se

Se

Ju

Ju

Ju

Ju

M

M

D

D

M

Operating Profit Margin Annual % is falling Net Profit TTM Growth % is stable compared Operating Revenues Qtr Cr growth is stable Net Profit Qtr Cr is falling faster than

faster than historical averages. to historical averages. compared to historical averages. historical averages.

CAGR 2Y -34.6% CAGR 2Y 232.1% YoY 77.5% YoY 9.8%

3Y -27.8% 3Y 261.2% QoQ 13.7% QoQ -33.7%

5Y -13.3% 5Y -8.0%

Copyright © Giskard Datatech Pvt Ltd Page 2 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Balance Sheet

Total Assets Annual Cr Total ShareHolders Funds Annual Cr Working Capital Annual Cr

4,104 6.5% YoY Mar'23 3,165.5 7.0% YoY Mar'23 470.8 63.4% YoY Mar'23

5k 4k 500

3854.3 4104 3165.5

3549.6 2737.6 2803.3 2888.2 2957.9 470.8

3174.4 3130.1 2625.9 440.9

2968.8 293.5 273.9 288.2

236.2

2.5k 2k 250

0 0 0

8

3

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

M

M

Total Assets Annual Cr growth is lower than Total ShareHolders Funds Annual Cr growth Working Capital Annual Cr growth is higher

historical averages. is stable compared to historical averages. than historical averages.

CAGR 2Y 7.53% CAGR 2Y 4.69% CAGR 2Y 31.11%

3Y 9.45% 3Y 4.13% 3Y 25.85%

5Y 6.69% 5Y 3.81% 5Y 9.91%

Cashflow

Cash from Operating Activity Annual Cr Cash from Investing Activity Annual Cr Cash from Financing Annual Activity Cr Net Cash Flow Annual Cr

-100.0% YoY Mar'23 100.0% YoY Mar'23 100.0% YoY Mar'23 -100.0% YoY Mar'23

400 0 0 100

308.1 -15.9 -9.4

-36.7 81.5

-100 -64 -55 -50 -26.1 50 31.8

-35.8 31.2

200 154.9 -54.3

122

97.3 -200 -100 0

-96.8

22.4 -222 -40.4

-15.4

0 -300 -150 -50

8

3

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

M

M

Cash from Operating Activity Annual Cr is Cash from Investing Activity Annual Cr Cash from Financing Annual Activity Cr is Net Cash Flow Annual Cr is falling faster than

falling faster than historical averages. growth is stable compared to historical falling faster than historical averages. historical averages.

averages.

CAGR 2Y 133.4% CAGR 2Y -17.17% CAGR 2Y 187.95%

3Y -26.57% CAGR 2Y -22.44% 3Y 12.97% 3Y -0.65%

5Y 15.52% 3Y 37.2% 5Y 26.02% 5Y 162.12%

5Y 37.1%

Financial Ratios

ROE Annual % ROCE Annual % RoA Annual % Current Ratio Annual

4.4% 51.0% YoY Mar'23 5.7% 89.3% YoY Mar'23 3.4% 51.8% YoY Mar'23 1.6 17.0% YoY Mar'23

6 6 6 3

4.6 4.4 4.5 5.7

4 2.1

3.9 3.8 2

4 4 4 3.5 3.4 2 1.9

3.4 1.6

2.9 3 3 1.4

2.5 2.6 2.6 1.4

2 2.2

2 2 2 1

0 0 0 0

Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23 Mar'18 Mar'19 Mar'20 Mar'21 Mar'22 Mar'23

ROE Annual % is growing faster than ROCE Annual % is growing faster than RoA Annual % is growing faster than Current Ratio Annual growth is higher than

historical averages. historical averages. historical averages. historical averages.

CAGR 2Y 32.82% CAGR 2Y 47.52% CAGR 2Y 29.42% CAGR 2Y 5.07%

3Y 4.63% 3Y 29.1% 3Y -0.49% 3Y -4.93%

5Y 5.65% 5Y 4.58% 5Y 2.74% 5Y -4.36%

Net Profit Margin Annual % Interest Coverage Ratio Annual EBIT Annual Margin %

7.2% 22.6% YoY Mar'23 129 61.0% YoY Mar'23 9.6% 34.8% YoY Mar'23

15 200 20

10.6 10.2 14.5

9.1 129 11.9

10 8.7 11.4

7.2 9.1 9.6

5.8 100 80.1 10 7.1

5

21.2 16.3 17.8 21

0 0 0

8

3

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

'1

'1

'2

'2

'2

'2

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

ar

M

Net Profit Margin Annual % is growing faster Interest Coverage Ratio Annual growth is EBIT Annual Margin % is growing faster than

than historical averages. stable compared to historical averages. historical averages.

CAGR 2Y -11.28% CAGR 2Y 147.83% CAGR 2Y -8.02%

3Y -6.35% 3Y 93.55% 3Y -6.95%

5Y -7.49% 5Y 43.46% 5Y -7.87%

Copyright © Giskard Datatech Pvt Ltd Page 3 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Key Metrics - Peer Comparison

COMPARISON

INFIBEAM AVENUES LTD. ZOMATO LTD. INFO EDGE (INDIA) LTD. ONE97 COMMUNICATIONS LTD. PB FINTECH LTD. INDIAMART INTERMESH LTD. AFFLE (INDIA) LTD.

(1) (2) (3) (4) (5) (6) (7)

Valuation Score 44.7 6.5 7.8 9.8 4.8 16.0 13.8

P/E Ratio TTM 33.3 -112.2 -454.2 -37.2 -118.2 57.9 57.5

Forward P/E Ratio 36.7 928.6 72.7 -64.1 2272.2 55.4 49.8

PEG Ratio TTM 0.7 -4.6 4.5 -0.8 -1.7 2.3 5.7

Forward PEG Ratio -9.2 - 5.5 - - 3.1 2.4

Price to Book Value 1.5 4.5 4.0 4.3 6.3 9.0 10.0

Price to Sales TTM 2.1 10.9 23.9 6.4 12.8 17.8 9.9

Price to Sales Annual 1.9 6.0 20.5 5.1 11.2 15.6 9.2

EV to EBITDA 14.1 -78.7 50.5 -27.3 -69.5 34.2 36.7

Market Cap to Sales 1.9 6.0 20.5 5.1 11.2 15.6 9.2

Price to Free Cash Flow 31.2 119.0 156.1 1928.8 -73.1 8.6 3.8

Graham Number 11.9 - - - - 629.0 218.4

Copyright © Giskard Datatech Pvt Ltd Page 4 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Valuation Summary

Valuation Score Infibeam Avenues Ltd. has a valuation score of 45, which indicates an Mid Valuation.

45 / 100

A High Valuation Score (greater than 50) indicates the stock is competitively priced at current P/E, P/BV and share price.

The Valuation helps you identify stocks which are still bargains, and whose strengths are not fully priced into the share price.

Mid Valuation

Bad Medium Good

45

0 30 50 100

Valuation Trend Infibeam Avenues Ltd. : Sep '22 - Sep '23 Valuation v/s Peers

100

Infibeam Avenues 44.7

75 Zomato 6.5

GOOD Info Edge (India) 7.8

50

One97 Communications 9.8

MEDIUM

25

PB Fintech 4.8

0 IndiaMART InterMESH 16.0

22

23

23

3

'2

'2

'2

'2

'2

'2

'2

'2

'2

'

r'

l'

Affle (India) 13.8

ar

ec

b

ct

p

ov

ay

g

Ju

Ap

Ju

Au

Fe

Se

Ja

O

M

D

N

0 5 10 15 20 25 30 35 40 45 50

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum Infibeam Avenues Ltd. (45) has highest Valuation score amongst its peers.

0% 99.2% 0.8% 49.8 (28 Aug '23) 28.8 (01 Nov '22)

P/E Buy Sell Zone

Infibeam Avenues Ltd. has spent 27.0% of the time below the current P/E 33.3. This puts it in the PE

Buy Zone

Buy Zone 27.0% into P/E buy sell zone This is based on the tendency of the P/E value to revert to its historical mean.

If the P/E value has spent most of its time below the current value, then it means that most gains

have probably been realised already, and it is time to sell.

Strong upside potential % time spent below current P/E Gains already realized If the P/E value has spent very little time below the current value, then it means that there is strong

potential upside, and it is time to buy.

Valuation Metrics

PE TTM Price to Earnings Price To Sales Annual Dividend Payout CP Annual % Graham Number

33.3 13.5% YoY Sep'23 1.9 -51.7% YoY Sep'23 8.9% 0% YoY Sep'23 11.9 8.4% YoY Sep'23

50 10 10 50

47 9.3 46.4

33.3 8.9 8.9

29.1 29.3 30.8

25 5 4 5 4.1 25

3.6 18

14.8

2.5 10.9 11.9

1.9

0 0

0 0 0 0

Mar'20 Mar'21 Mar'22 Mar'23 Sep'23 Mar'20 Mar'21 Mar'22 Mar'23 Sep'23 Mar'20 Mar'21 Mar'22 Mar'23 Sep'23 Mar'20 Mar'21 Mar'22 Mar'23 Sep'23

PE_TTM is falling faster than historical Price To Sales Annual is falling faster than Graham Number growth is higher than

averages. historical averages. historical averages.

CAGR 2Y 48.0%

CAGR 2Y -45.3% CAGR 2Y -54.5% 3Y - CAGR 2Y -14.0%

3Y 8.9% 3Y -18.5% 5Y - 3Y -33.0%

5Y -21.8% 5Y -27.3% 5Y -22.3%

Copyright © Giskard Datatech Pvt Ltd Page 5 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Momentum Summary

Momentum Score Infibeam Avenues Ltd. has a Momentum score of 59, which indicates that it is Technically Neutral.

59 / 100

A High Momentum Score indicates the stock is seeing buyer demand, and is bullish across its technicals compared to the rest of the stock

universe.

Momentum is a very effective short term score, while Durability and Valuation help assess the stock’s health over the long term.

Technically Neutral

Bad Medium Good

59

0 35 60 100

Momentum Trend Infibeam Avenues Ltd. : Sep '22 - Sep '23 Momentum v/s Peers 15 Sep '23

100

Infibeam Avenues 58.8

75 Zomato 67.1

GOOD

Info Edge (India) 66.3

50

MEDIUM One97 Communications 63.1

25

PB Fintech 60.9

0 IndiaMART InterMESH 58.9

22

23

23

3

'2

'2

'2

'2

'2

'2

'2

'2

'2

'

r'

l'

Affle (India) 57.3

ar

ec

b

ct

p

ov

ay

g

Ju

Ap

Ju

Au

Fe

Se

Ja

O

M

D

N

0 10 20 30 40 50 60 70 80

Score Distribution (% of time in each zone) Variability (Range)

Good Medium Bad Maximum Minimum Infibeam Avenues Ltd. (59) has sixth-highest Momentum score amongst its peers, behind

4.4% 83.1% 12.5% 68.3 (23 Jan '23) 30.3 (18 Oct '22) IndiaMART InterMESH Ltd. (59)

Price Change Analysis Key Momentum Metrics

LTP : 17.6 RSI MFI

1 Day 17.4 18.25

62.4 76.4

1 Week 16.4 19.05

RSI is 62.4, RSI below 30 is considered oversold MFI is 76.4, MFI above 70 is considered

and above 70 overbought overbought. This implies that stock may show

1 Month 13.8 19.05

pullback.

3 Months 13.7 19.05

6 Months 12.85 19.05 MACD MACD Signal Line

1 Year 12.85 20.35 0.8 0.5

3 Year 12.5 29.2 MACD is above its center and signal Line, this MACD is above its center and signal Line, this

is a bullish indicator. is a bullish indicator.

5 Year 6.6 59.91

0 10 20 30 40 50 60 70

ATR

1

ATR is low in its industry

Simple Moving Averages Exponential Moving Averages

Infibeam Avenues Ltd. is trading above 8 out of 8 SMAs. Infibeam Avenues Ltd. is trading above 8 out of 8 EMAs.

BULLISH BULLISH

8/8 8/8

Bullish v/s Bearish SMAs Bullish v/s Bearish SMAs

(if the current price is above a moving average, it is considered bullish) (if the current price is above a moving average, it is considered bullish)

5Day SMA Rs 17.5 50Day SMA Rs 15.1 5Day EMA Rs 17.4 26Day EMA Rs 15.8

10Day SMA Rs 16.7 100Day SMA Rs 15 10Day EMA Rs 16.8 50Day EMA Rs 15.4

20Day SMA Rs 15.6 150Day SMA Rs 15 12Day EMA Rs 16.6 100Day EMA Rs 15.2

30Day SMA Rs 15.1 200Day SMA Rs 15.5 20Day EMA Rs 16 200Day EMA Rs 15.4

Copyright © Giskard Datatech Pvt Ltd Page 6 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Momentum Oscillators Pivot Support & Resistances

Infibeam Avenues Ltd. is trading above 5 out of 9 Oscillators in bullish zone. Infibeam Avenues Ltd. at 17.60 is trading below it's Pivot 17.75.

BEARISH NEUTRAL BULLISH 19 R3 - 18.9

3/9 1/9 5/9 R2 - 18.6

Bullish v/s Bearish Oscillators R1 - 18.1

(if an oscillator is in its negative range, it is considered bearish) 18

PIVOT - 17.8

LTP - 17.6

RSI(14) 62.4 MACD(12, 26, 9) 0.8

S1 - 17.3

Stochastic Oscillator 70.1 Stochastic RSI 48.4

17

S2 - 16.9

CCI 20 111.4 William -30.9

Awesome Oscillator 2.6 Ultimate Oscillator 47.5 S3 - 16.4

Momentum Oscillator 2.6

16

Neutral Bullish Bearish

Volatility Metrics

Beta

1 month 3 month 1 year 3 year ADX Day Bollinger Bands Mid_20_2

6.09 1.43 1.22 0.91 43.4 15.5

ADX is high in its industry Bollinger Bands Mid_20_2 is low in its industry

beta value for 3 month indicates price tends to be more volatile than the market

Daily Volume Analysis Active Candlesticks

Daily average delivery volume over the past week is 24.4%

Bullish Candlestick Pattern Bearish Candlestick Patterns

18 Sep, 2023 18.5M 79.0M

No active candlesticks No active candlesticks

Week 29.4M 120.5M

Month 19.5M 65.1M

0 20M 40M 60M 80M 100M 120M 140M

Combined Delivery Volume NSE + BSE Traded Volume

Daily Avg. Delivery Volume %

18 Sep, 2023 Week Month

23.5% 24.4% 30.0%

Copyright © Giskard Datatech Pvt Ltd Page 7 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Checklist Summary

Trendlyne Checklist Score

65.2% pass 15 | 8

=

Financial

6|2

+

Value & Momentum

5|3

+

Ownership

2|2

+

Peer Comparison

2|1

Financial Value & Momentum

6 criteria met | 2 not met 5 criteria met | 3 not met

Company has seen consistent profit growth in the last eight The stock is in the Buy Zone according to its historical P/E?

quarters? No

Yes The stock is in the Buy Zone according to its historical P/E

Stock has seen consistent profit growth in the last eight quarters

The stock is in the Buy Zone according to its historical P/BV?

Company has seen consistent sales growth in the last eight quarters? No

Yes The stock is in the Buy Zone according to its historical P/BV

Stock has seen consistent sales growth in the last eight quarters

Company's valuation score signals overall affordability?

Company has high Trendlyne Durability Score? Yes

Yes Company's valuation score signals overall affordability

Stock has high Trendlyne Durability Score (>=60)

Trendlyne Momentum Score shows bullishness?

Company has high Piotroski Score? Yes

No Trendlyne Momentum Score shows bullishness

Stock has high Piotroski Score (>= 7)

Stock is trading above all short term SMAs?

Company has Low Debt? Yes

Yes Stock is trading above all short term SMAs

Stock has Low Debt

Stock is trading above all long term SMAs?

Shareholder Value: Company has Strong ROE? Yes

No Stock is trading above all long term SMAs

Shareholder Value: Stock has Strong ROE

Stock has bullish candlesticks?

Company has Positive Net Cash Flow? Yes

Yes Stock has bullish candlesticks OR Stock has no bearish candlesticks

Stock has Positive Net Cash Flow

Stock has active positive breakouts?

Company is generating increasing cash from operations? No

Yes Stock has active positive breakouts

Positive CFO for last 2 years

Ownership Peer Comparison

2 criteria met | 2 not met 2 criteria met | 1 not met

FII/FPI or DIIs are buying the stock? Company is giving better long term returns than the industry?

No

Institutions have been increasing stake in the company over the past No Company is giving better long term returns than the industry

four quarters

Company's sales growth is better than the industry median?

Promoters are buying the stock or ownership is stable? Yes

No Company's sales growth is better than the industry median

Promoters are buying the stock or ownership is stable

Company's profit growth is better than the industry median?

Promoter pledge is low and not increasing? Yes

Yes Company's profit growth is better than the industry median

Promoter pledge is low and not increasing

Insider have not sold stock in the past 3 months?

Yes

Insider have not sold stock in the past 3 months

Copyright © Giskard Datatech Pvt Ltd Page 8 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Forecaster

Consensus Recommendation Share Price Target

Consensus Recommendation Share Price Target (Avg)

STRONG BUY ₹ 28 (59.1% upside)

100

80

60

1 1 1 1 1 1

40

28.0

2023-04-30 2023-05-31 2023-06-25 2023-07-30 2023-08-27 2023-09-17 20

FY21 FY22 FY23 FY24 FY25

Strong Buy Buy Hold Sell Strong Sell

Future Avg. Estimate High Estimate Low Estimate

The consensus recommendation from 1 analyst for Infibeam Avenues Ltd. is STRONG BUY

Infibeam Avenues Ltd.'s share price target is above the current price, with an upside of 59.1%

Key Metrics - Average Estimates Actual Revenue Avg. Estimate

EPS Interest expense Net income

1 4 200

0.8 0.6 3.6 135.1 129.0 172.3

0.5 0.5

-34.2% 25.0% 1.7% 0.9% -5.6%

0.75 -4.2%

0.3 3 2.1 1.5 150

19.2% -8.1% 29.3% 67.5

0.5 104.6 23.9%

-32.8%

2 100

0.25

0 1 50

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY21 FY22 FY23 FY24 FY25

-34.2% 19.2% 0% -4.2% 25.0% 1.7% -8.1% 29.3% -32.8% 23.9% 0.9% -5.6% 0%

Surprises Estimate Surprises Surprises Estimate

EPS is expected to reduce by 4.0% in FY24 Infibeam Avenues Ltd.'s Interest expense was higher than Net income is expected to reduce by 5.3% in FY24

Infibeam Avenues Ltd.'s EPS was lower than average estimate 2 average estimate 2 times in past 3 years Infibeam Avenues Ltd.'s Net income was higher than average

times in past 3 years estimate 2 times in past 3 years

Depreciation & amortization EBIT Revenue

100 300 4k

194.9 2315.6 2987.1

79.9 1729.3

137.0 29.7% 15.3% 22.5%

89.2 76.4 4.4% 116.7 3k 13.5%

200 13.9% 1326.7

-15.8% 19.4% 98.6 63.5 1.1%

-13.4% 42.2% -2.5%

80 2k 706.0

75.3 62.3 -4.2%

-16.8% 100

-1.1% 1k

60 0 0

FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25 FY21 FY22 FY23 FY24 FY25

-15.8% -16.8% -1.1% 19.4% 4.4% -13.4% 42.2% 1.1% 13.9% 29.7% -4.2% -2.5% 13.5% 15.3% 22.5%

Surprises Estimate Surprises Estimate Surprises Estimate

Depreciation & amortization is expected to grow by 24.0% in EBIT is expected to grow by 16.1% in FY24 Revenue is expected to grow by 18.0% in FY24

FY24 Infibeam Avenues Ltd.'s EBIT was higher than average estimate Infibeam Avenues Ltd.'s Revenue was lower than average

Infibeam Avenues Ltd.'s Depreciation & amortization was lower 2 times in past 3 years estimate 2 times in past 3 years

than average estimate 3 times in past 3 years

Copyright © Giskard Datatech Pvt Ltd Page 9 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Shareholding Summary Shareholding Trend

40%

Promoter 30.6%

30.6% 30.6% 30.6% 30.6% 30.6%

30%

DII 0.1%

20%

FII 6.1%

10% 7.1% 7.1%

6.0% 6.5% 6.1%

Public 62.7%

0.0% 0.1% 0.1% 0.1% 0.1%

0%

Others 0.5% Jun 2022 Sep 2022 Dec 2022 Mar 2023 Jun 2023

Promoter FII DII

0% 10% 20% 30% 40% 50% 60% 70%

Retail investors (Public) form the biggest shareholding segment Promoter , FII , DII , over the Jun 2023 quarter

Mutual Fund Holding and Action

15 Promoters holding remains unchanged at 30.63% in Jun 2023 qtr

Mutual Funds have increased holdings from 0.06% to 0.07% in Jun 2023 qtr.

11.0 11.0 11.0 11.0 11.0

10.0 10.0

10 9.0 9.0 Number of MF schemes remains unchanged at 6 in Jun 2023 qtr

8.0

6.0 FII/FPI have decreased holdings from 6.46% to 6.11% in Jun 2023 qtr

5

3.0

Number of FII/FPI investors decreased from 89 to 86 in Jun 2023 qtr

2.0 2.0

1.0 Institutional Investors have decreased holdings from 6.53% to 6.18% in Jun 2023

0 qtr

Mar-2023 Apr-2023 May-2023 Jun-2023 Jul-2023 Aug-2023

Net Holders Bought some / all Sold some / all

Major Shareholders Infibeam Avenues Ltd. : Jun '23

Superstar Promoters

Name Shares % Change % Name Shares % Change %

Vishwas Ambalal Pat 11.4% - Vishal Ajitbhai Mehta 9.0% -2.5%

el

Infinium Motors Pvt L 8.7% -0.3%

HUF 3.9% -0.6% td

Bulk / Block Deals

Date Client Name Deal Type Action Avg Price Qty Exchange

13 Sep'23 HRTI PRIVATE LIMITED Bulk Sell 17.5 16,624,891 NSE

13 Sep'23 HRTI PRIVATE LIMITED Bulk Purchase 17.5 16,138,518 NSE

12 Sep'23 HRTI PRIVATE LIMITED Bulk Sell 17.3 17,385,879 NSE

12 Sep'23 HRTI PRIVATE LIMITED Bulk Purchase 17.3 17,843,075 NSE

11 Sep'23 HRTI PRIVATE LIMITED Bulk Sell 17.9 15,498,854 NSE

11 Sep'23 QE SECURITIES LLP Bulk Sell 18 13,661,096 NSE

11 Sep'23 QE SECURITIES LLP Bulk Purchase 17.9 13,280,859 NSE

11 Sep'23 HRTI PRIVATE LIMITED Bulk Purchase 17.9 13,998,980 NSE

08 Sep'23 CITADEL SECURITIES INDIA MARKETS PRIVATE LIMITED Bulk Sell 16.1 3,112,240 NSE

08 Sep'23 CITADEL SECURITIES INDIA MARKETS PRIVATE LIMITED Bulk Purchase 15.8 13,887,954 NSE

Copyright © Giskard Datatech Pvt Ltd Page 11 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Insider Trading / SAST

Reporting Date Client Name Client Type Regulation Action Avg Price Qty Mode

15 Sep'23 Anupama Salvi Designated Person Insider Trading Disposal 17.6 90,000 Market Sale

15 Sep'23 Ramya Murthy K S Designated Person Insider Trading Disposal 17.1 150,000 Market Sale

08 Sep'23 Rakesh Ranjan Singh Designated Person Insider Trading Disposal 15 90,000 Market Sale

08 Sep'23 Rohit V Doke Employee Insider Trading Disposal 16 127,760 Market Sale

01 Sep'23 Anupama Salvi Designated Person Insider Trading Disposal 14.8 70,000 Market Sale

25 Aug'23 Anoli Mehta Promoter Group Insider Trading Disposal 14.1 3,873,931 Market Sale

25 Aug'23 Pramod Ganji Employee Insider Trading Disposal 14.1 132,280 Market Sale

24 Aug'23 Rahul Hirve Designated Person Insider Trading Disposal 13.8 165,000 Market Sale

24 Aug'23 Abhijit Petkar Designated Person Insider Trading Disposal 13.9 200,000 Market Sale

18 Aug'23 Rahul Hirve Designated Person Insider Trading Disposal 14 334,444 Market Sale

Copyright © Giskard Datatech Pvt Ltd Page 12 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

ABOUT THE COMPANY

Infibeam Avenues Ltd.

Infibeam Avenues is primarily business of software development services, maintenance, web development, payment gateway services, e-commerce and other ancillary services.

website: www.ia.ooo

MANAGEMENT INFORMATION

Mr. Sunil Bhagat Shyamal Trivedi

Chief Financial Officer Senior Vice President & Secretary,Company

Secretary

- 2023-3-31

Gross Remuneration Year

- 2023-3-31

Gross Remuneration Year

DIRECTOR INFORMATION

Keyoor Madhusudan Bakshi Vijaylaxmi Sheth Roopkishan Dave Ajit Mehta

Independent Non Exe. Director Independent Non Exe. Director Independent Non Exe. Director Chairman & Non Executive Dir.

₹0.02Cr. 2023 ₹0.02Cr. 2023 ₹0.02Cr. 2023 ₹0.02Cr. 2023

Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year Gross Remuneration Year

Copyright © Giskard Datatech Pvt Ltd Page 13 of 14 All rights reserved

INFIBEAM AVENUES LTD. Trendlyne Stock Report

Internet Software & Services Sep 18, 2023 03:31 PM

Software & Services

Detailed stock report terminology

Trendlyne’s stock report is a comprehensive company analysis report based on its durability, valuation and momentum scores along with the forecaster data, to give you a detailed analysis. The report also

includes Trendlyne’s checklist summary, technical analysis, peer comparison, mutual fund holdings details, insider trading and more.

Durability Score Trendlyne Checklist Score

Durability scores are calculated from 0-100, with zero the worst and 100 the best. Trendlyne Checklist evaluates a stock based on its financial performance, ownership, peer

Durability scores above 55 are considered good(G) and below 35 are considered bad(B). comparison, value and momentum. This helps give an overall performance of the

Scores between 35-55 are considered neutral/Medium/Middle(M). company based on the score.

Stocks with a high durability score (top 20 percentile) are companies that have

consistently and over time, demonstrated good growth and cash flow, stable revenues

and profits, and low debt. PE buy/sell zone

The durability score considers several different metrics and ratios around earnings and

models these over time. Our stocks with high durability scores outperform the index The PE buy/sell zone is calculated based on how many days a stock has traded at its

significantly current PE level. The current PE is compared to the stock’s historical PE performance, to

find out how often (for how many days in the past) the stock has traded at its current PE

value.

Valuation Score If the stock has usually traded above its current PE level (it’s at a higher PE for the

majority of trading days), then the stock is cheaper than usual and in the PE buy zone.

Valuation scores are calculated from 0-100, with zero the worst and 100 the best. If the stock has usually traded below its current PE level (it’s at a lower PE for the

Valuation scores above 50 are considered good(G) and below 30 are considered bad(B). majority of trading days), then the stock is more expensive than usual and in the PE sell

Scores between 30-50 are considered neutral/Medium/Middle(M) zone.

Stocks with a high valuation score (top 20 percentile) are companies whose business and

financial advantages have not yet been priced into their share price. These companies

typically have strong earnings but are currently flying under the radar, and Trendlyne’s Price Volume Charts

valuation score helps shine a spotlight on these companies.

Firms with a low valuation score (bottom 20 percentile) are expensive stocks that have Price volume charts are a type of financial chart that combines two key pieces of

good broker coverage and already have their strengths priced in. They are popular but information about a stock: its price and trading volume. They are commonly used in

pricey. If you are buying them now it would be for a steep price tag: valuation scores help technical analysis to identify trends and patterns in the market.

you identify that. In a price volume chart, the price of the security is plotted on the vertical axis, while the

trading volume is shown on the horizontal axis. Each data point on the chart represents a

single trading day, and the size of the data point may be proportional to the trading

Momentum Score volume.

Scores are calculated from 0-100, with zero being the worst and 100 the best.

Momentum scores above 59 are considered good(G) and below 30 are considered Peer Comparison

bad(B). Scores between 30-59 are considered neutral/Medium/Middle(M)

Momentum score or momentum score identifies the bullish/bearish nature of the stock. Peer comparison in financial analysis is a method of comparing the financial performance

Stocks with a high momentum score (which is calculated daily from over 30 technical and position of one company to its competitors or peers in the same industry or sector.

indicators) are seeing their share price rise, and increase in volumes and sentiment. The purpose of this comparison is to gain insights into how the company is performing

A low and falling momentum score indicates a falling share price. The pace at which this is relative to its competitors and to identify areas where it may be underperforming or

changing is also important for the momentum score. overperforming. In Trendlyne’s stock report, DVM scores are also included in the peer

comparison section.

Analyst recommendation

Technical Analysis

Analyst recommendation of a stock is an assessment made by financial analysts or

brokerage firms about the investment potential of a particular stock. It is usually based Technical analysis is a method of analyzing stocks and other financial instruments that

on a thorough analysis of the company's financial performance, market trends, industry relies on charts and statistical indicators to identify trends and patterns in price and

outlook, and other factors that may impact the stock's value. trading volume.

The analyst recommendation of a stock typically takes the form of a rating or a Key momentum metrics included - relative strength index (RSI), Stochastic RSI, Ultimate

recommendation, such as "buy," "hold," or "sell." The recommendation is usually Oscillator, moving average convergence divergence (MACD), average true range (ATR),

accompanied by a price target, which is the analyst's estimate of the stock's fair value. money flow index (MFI), William, CCI 20 and Awesome Oscillator. Simple and

A low and falling momentum score indicates a falling share price. The pace at which this is exponential moving averages are also included.

changing is also important for the momentum score. To analyse the volatility of the stock, Beta over different periods of time, Average

Directional Movement Index and Bollinger bonds are used. Along with this, active

candlesticks, daily volume analysis is also provided in the rapport.

Disclaimer

© 2023 Giskard Datatech Pvt Ltd

Republication or redistribution of Giskard content, including by framing or similar means, is prohibited without the prior written consent of Giskard. All information in this report is assumed to be

accurate to the best of our ability. Giskard is not liable for any errors or delays in Giskard content, or for any actions taken in reliance on such content. Any forward-looking statements included in the

Giskard content are based on certain assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from current expectations.

Copyright © Giskard Datatech Pvt Ltd Page 14 of 14 All rights reserved

You might also like

- Devon Archer - Defense Sentencing Memo OneDocument48 pagesDevon Archer - Defense Sentencing Memo OneWashington ExaminerNo ratings yet

- TALEO - Recruiter User GuideDocument42 pagesTALEO - Recruiter User GuideMarwan SNo ratings yet

- VEDL StockReport 20240410 1623Document14 pagesVEDL StockReport 20240410 1623sunny996316192No ratings yet

- TITAN StockReport 20230913 0850Document14 pagesTITAN StockReport 20230913 0850bloggingbongoNo ratings yet

- IRB StockReport 20240205 1614Document14 pagesIRB StockReport 20240205 1614Chetan ChouguleNo ratings yet

- SOUTHBANK StockReport 20230911 0016Document13 pagesSOUTHBANK StockReport 20230911 0016rameshwardas1980No ratings yet

- Indigopnts Stockreport 20231022 2029Document14 pagesIndigopnts Stockreport 20231022 2029Ayush SaxenaNo ratings yet

- KOTAKBANK StockReportDocument13 pagesKOTAKBANK StockReportSSK SNo ratings yet

- IRB StockReport 20231024 0120Document14 pagesIRB StockReport 20231024 0120Ashutosh AgarwalNo ratings yet

- SUNPHARMA StockReportDocument14 pagesSUNPHARMA StockReportJyotishman SahaNo ratings yet

- PENIND StockReport 20230828 1023Document14 pagesPENIND StockReport 20230828 1023Chetan ChouguleNo ratings yet

- HDFCBANK StockReport 20240117 1055Document13 pagesHDFCBANK StockReport 20240117 1055RAKESH ANABNo ratings yet

- LXCHEM StockReport 20231011 1009Document14 pagesLXCHEM StockReport 20231011 1009rajbus lessNo ratings yet

- IRFC StockReport 20240214 1118Document12 pagesIRFC StockReport 20240214 1118Sashibhusan NayakNo ratings yet

- MOIL StockReportDocument14 pagesMOIL StockReportMohak PalNo ratings yet

- ASHOKA StockReport 20231111 0031Document14 pagesASHOKA StockReport 20231111 0031yashbhutada156No ratings yet

- CHAMBLFERT StockReport 20240307 2009Document14 pagesCHAMBLFERT StockReport 20240307 2009Alicos MathewNo ratings yet

- ICICIBANK StockReport 20231101 1053Document13 pagesICICIBANK StockReport 20231101 1053SaadNo ratings yet

- VBL StockReport 20230907 1553Document14 pagesVBL StockReport 20230907 1553Sangeethasruthi SNo ratings yet

- ZENSARTECH StockReport 20240123 0818Document13 pagesZENSARTECH StockReport 20240123 0818Proton CongoNo ratings yet

- BAJAJFINSV-StockReport-2024 Jan 07-1614Document14 pagesBAJAJFINSV-StockReport-2024 Jan 07-1614ankit.johnnyNo ratings yet

- ITC StockReport 20231212 1335Document14 pagesITC StockReport 20231212 1335aarushisoral1No ratings yet

- RTSPOWR StockReport 20230916 1222Document12 pagesRTSPOWR StockReport 20230916 1222Firaa'ol GizaachooNo ratings yet

- IOC StockReport 20231122 1820Document14 pagesIOC StockReport 20231122 1820dherirmpkbqzfavunqNo ratings yet

- Chennpetro Stockreport 20231027 1724Document14 pagesChennpetro Stockreport 20231027 1724adcb704No ratings yet

- Annual Review 2018-1 PDFDocument33 pagesAnnual Review 2018-1 PDFMirang ShahNo ratings yet

- Annual Review 2018 PDFDocument33 pagesAnnual Review 2018 PDFSleek StyleNo ratings yet

- MorningStar ES0152768612Document6 pagesMorningStar ES0152768612Michelle Herize PenedoNo ratings yet

- PARAGMILK StockReport 20230828 1022Document12 pagesPARAGMILK StockReport 20230828 1022Chetan ChouguleNo ratings yet

- Report For Morning StarDocument5 pagesReport For Morning StarMuhammad NaqashNo ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Gronic MaybankDocument9 pagesGronic MaybankNicholas ChehNo ratings yet

- Quant Pick - Biocon: April 8, 2020Document5 pagesQuant Pick - Biocon: April 8, 2020anujonwebNo ratings yet

- MorningStar Research 2024Document6 pagesMorningStar Research 2024JINU JAMESNo ratings yet

- 3M India Share Price, Financials and Stock AnalysisDocument9 pages3M India Share Price, Financials and Stock AnalysisGaganNo ratings yet

- MORNINGSTARDocument5 pagesMORNINGSTARhectorhernandez5576No ratings yet

- Morningstar Report1Document6 pagesMorningstar Report1gcjhyjtnsxlvicnxivNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectthetrade180No ratings yet

- MorningStar ES0105083002Document4 pagesMorningStar ES0105083002Pedro García GuillénNo ratings yet

- Motilal Oswal PMS PortfolioDocument25 pagesMotilal Oswal PMS PortfolioHetanshNo ratings yet

- 0P0001L814Document6 pages0P0001L814peter.r.stephensonNo ratings yet

- Cler P 01012023Document4 pagesCler P 01012023XaninaNo ratings yet

- SDBL StockReport 20240323 1739Document12 pagesSDBL StockReport 20240323 1739khushkothari2004No ratings yet

- Investment Analysis Example ReportDocument28 pagesInvestment Analysis Example ReportOwenNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- Pt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Document3 pagesPt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Nia TjhoaNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- European Software & IT ServiceDocument39 pagesEuropean Software & IT Servicejefflovetoronto_5431No ratings yet

- Telecoms Churn FinalDocument1 pageTelecoms Churn FinalAdityaDarmawanNo ratings yet

- IDFC FIRST Bank Investor Presentation Q1 FY22Document68 pagesIDFC FIRST Bank Investor Presentation Q1 FY22UtkarshNo ratings yet

- PubCo ValuationDocument12 pagesPubCo ValuationAlan Zhu100% (1)

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectmohanchinnaiya7No ratings yet

- Dlom 2018 Q2Document76 pagesDlom 2018 Q2Catalina DumitrascuNo ratings yet

- KAMCO Research: Kuwait Stock Exchange Daily BriefingDocument4 pagesKAMCO Research: Kuwait Stock Exchange Daily Briefinghahaha123hahahaNo ratings yet

- Fixed Reference Ratio ChartDocument9 pagesFixed Reference Ratio ChartShreePanickerNo ratings yet

- Enclosures - Nuova ASPDocument156 pagesEnclosures - Nuova ASPNicolae VisanNo ratings yet

- BSNL MT Exam 2019 Test Series: Chapter 10 - Telecom KnowledgeDocument57 pagesBSNL MT Exam 2019 Test Series: Chapter 10 - Telecom KnowledgeSandeep SinghNo ratings yet

- Lord Agnew LetterDocument2 pagesLord Agnew LetterThe Guardian100% (1)

- Neja 1Document8 pagesNeja 1Fathan NugrahaNo ratings yet

- IRC Development Plan 2019 2024Document7 pagesIRC Development Plan 2019 2024James Alexander DezaNo ratings yet

- International Moot Arbitration in Commercial Disputes: Week 1 Nikki Krisadtyo, S.H., LL.MDocument11 pagesInternational Moot Arbitration in Commercial Disputes: Week 1 Nikki Krisadtyo, S.H., LL.MJeremia OktavetoNo ratings yet

- Sustainable Public Procurement: Research Trends and GapsDocument9 pagesSustainable Public Procurement: Research Trends and GapsApudjijonoNo ratings yet

- Graphic Design - A Beginners Guide To Mastering The Art of Graphic Design, Second Edition (PDFDrive)Document86 pagesGraphic Design - A Beginners Guide To Mastering The Art of Graphic Design, Second Edition (PDFDrive)Suleman MehmoodNo ratings yet

- Agricultural Extension in Asia Constraints and Options For ImprovementDocument15 pagesAgricultural Extension in Asia Constraints and Options For ImprovementMarejen Almedilla VillaremoNo ratings yet

- 8 Steps in Accounting CycleDocument2 pages8 Steps in Accounting CycleMarko Zero FourNo ratings yet

- Principal Reservoir Engineer - NOCDocument2 pagesPrincipal Reservoir Engineer - NOCGiang DuongNo ratings yet

- Disbursement Voucher (New Orence)Document4 pagesDisbursement Voucher (New Orence)user computerNo ratings yet

- Entrepreneurship: Antique National School - Senior High Lourene J. Guanzon, T-IIDocument410 pagesEntrepreneurship: Antique National School - Senior High Lourene J. Guanzon, T-IILourene Jauod- GuanzonNo ratings yet

- Activity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004Document13 pagesActivity-Based Costing System Advantages and Disadvantages: SSRN Electronic Journal July 2004hardeep waliaNo ratings yet

- Mid-Essay IE 124109Document6 pagesMid-Essay IE 124109Alexandra BragaNo ratings yet

- Pitch Deck Telkom YooBeeDocument18 pagesPitch Deck Telkom YooBeeDini Estri MulianingsihNo ratings yet

- IAB Europe AdEx Benchmark 2019 Report FINALDocument43 pagesIAB Europe AdEx Benchmark 2019 Report FINALhomesimp_1971No ratings yet

- Product Exchange Process - Service Damage: Old Product Old ProductDocument2 pagesProduct Exchange Process - Service Damage: Old Product Old ProductsameerjaleesNo ratings yet

- Raw Material SOURCESING PROCESSDocument10 pagesRaw Material SOURCESING PROCESSSomya KumariNo ratings yet

- DB Managment Ch4Document15 pagesDB Managment Ch4Juan Manuel Garcia NoguesNo ratings yet

- CIBOK Sample PDFDocument43 pagesCIBOK Sample PDFArham KhanNo ratings yet

- Ptitstpow: Anggota Kelompok: Michael Prajana - 6141801004 Jose Thomas - 6141801112 Michael Osborn - 6141801134Document7 pagesPtitstpow: Anggota Kelompok: Michael Prajana - 6141801004 Jose Thomas - 6141801112 Michael Osborn - 6141801134Michael OsbornNo ratings yet

- Jafza Investor Guide New 1.2Document29 pagesJafza Investor Guide New 1.2nunov_144376No ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- America The Story of US Great Depression New DealDocument2 pagesAmerica The Story of US Great Depression New DealTori JemesNo ratings yet

- 1.2 Terms and Conditions For Subcontractor Rev. 01.2022Document11 pages1.2 Terms and Conditions For Subcontractor Rev. 01.2022melisbbNo ratings yet

- Apqc How Organizations Are Using Apqc Process PDFDocument13 pagesApqc How Organizations Are Using Apqc Process PDFsergioivanrsNo ratings yet

- RAYANAIR CASE STUDY1 - CompressedDocument20 pagesRAYANAIR CASE STUDY1 - Compressedyasser massryNo ratings yet