Professional Documents

Culture Documents

Bmo Bill Connect Pricing Schedule

Bmo Bill Connect Pricing Schedule

Uploaded by

HermanCopyright:

Available Formats

You might also like

- Something Special For You: Your $100 Apple Gift CardDocument1 pageSomething Special For You: Your $100 Apple Gift CardHermanNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- t1003 Parts CatalogDocument299 pagest1003 Parts CatalogHerman100% (2)

- 84 A 226035Document6 pages84 A 226035Herman50% (2)

- AARTO Form 14 20190130Document2 pagesAARTO Form 14 20190130Herman50% (2)

- Thermamax TIG200P - 000Document3 pagesThermamax TIG200P - 000Herman100% (1)

- Lesson of Passion - Living With Serena - Forbidden Fruit v2.09Document12 pagesLesson of Passion - Living With Serena - Forbidden Fruit v2.09HermanNo ratings yet

- PasswordsDocument4 pagesPasswordsHerman100% (1)

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Citibank, N.ADocument3 pagesCitibank, N.AjohnwregNo ratings yet

- SAPS 91aDocument1 pageSAPS 91aHermanNo ratings yet

- NPR 400 AmtDocument3 pagesNPR 400 AmtHermanNo ratings yet

- Bmo 3370 Edb Agreement en 07-22 v5 Final-SDocument59 pagesBmo 3370 Edb Agreement en 07-22 v5 Final-SIT TLiNo ratings yet

- Key Fact Statement of SBM Credilio Credit Card Description FeesDocument5 pagesKey Fact Statement of SBM Credilio Credit Card Description Feesgargmayank489.mgNo ratings yet

- 16 1679 F16 PricingChange CustomerComm TakeOne Ev7Document4 pages16 1679 F16 PricingChange CustomerComm TakeOne Ev7mieNo ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Business Banking Charges GuideDocument19 pagesBusiness Banking Charges Guidedariaivanov25No ratings yet

- BT Credit Card Summary BoxDocument2 pagesBT Credit Card Summary BoxDawoodd10No ratings yet

- GCredit Product Disclosure Sheet 19032021Document6 pagesGCredit Product Disclosure Sheet 19032021Anthony GalvezNo ratings yet

- Balance Transfer Special Rate - HomeDocument2 pagesBalance Transfer Special Rate - Hometech.filnipponNo ratings yet

- Banking by Design Account: Simply Stated Product GuideDocument6 pagesBanking by Design Account: Simply Stated Product GuidetomNo ratings yet

- BBPS For Agent Institutions 26 05 17Document9 pagesBBPS For Agent Institutions 26 05 17Rachit AntaniNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- Loan Term Sheet - 09 - 50 - 35Document13 pagesLoan Term Sheet - 09 - 50 - 35Kumar SaurabhNo ratings yet

- 2022 Purchase Convert Special Rate - HomeDocument3 pages2022 Purchase Convert Special Rate - HomeOT PRACTICE TIMENo ratings yet

- Why ICICI BankDocument9 pagesWhy ICICI BankRakesh ShahNo ratings yet

- Auto Pay Registration Process - Existing CustomerDocument19 pagesAuto Pay Registration Process - Existing Customerkaran singhNo ratings yet

- Business Banking Price ListDocument15 pagesBusiness Banking Price ListSARFRAZ ALINo ratings yet

- Funding Your COL AccountDocument16 pagesFunding Your COL AccountHazel Alcantara RoxasNo ratings yet

- Bmo Eclipse Visa Rise Benefit Guide enDocument8 pagesBmo Eclipse Visa Rise Benefit Guide enjennyla.zxjNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Prepaid Travel COB E FNLDocument1 pagePrepaid Travel COB E FNLBobNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresLauren EgasNo ratings yet

- CE Cashback Program - Oct 22Document8 pagesCE Cashback Program - Oct 22Kamal SharmaNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- RB Chapter 2 - Current DepositsDocument6 pagesRB Chapter 2 - Current DepositsHarish YadavNo ratings yet

- Brazil and India Payment SystemDocument6 pagesBrazil and India Payment SystemRahul SinghNo ratings yet

- Schedule of Fees & ChargesDocument9 pagesSchedule of Fees & ChargesJamesNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Bharat Billpay: Consumer Frequently Asked QuestionsDocument5 pagesBharat Billpay: Consumer Frequently Asked QuestionsShashi PrakashNo ratings yet

- Cma 01007 12282022Document16 pagesCma 01007 12282022Chris LNo ratings yet

- Long Term SheetDocument8 pagesLong Term SheetZabid khanNo ratings yet

- Products Pdspersonalloan 01092021v2Document4 pagesProducts Pdspersonalloan 01092021v2Christopher Sarcinia EnrileNo ratings yet

- Gen MathDocument4 pagesGen MathgapcenizalNo ratings yet

- Faqs Agent Institution BbpsDocument9 pagesFaqs Agent Institution BbpsrahulmNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening DisclosuresEliseu Simplicio de OliveiraNo ratings yet

- What Is This Product About?Document6 pagesWhat Is This Product About?Franco BegnadenNo ratings yet

- Professional Membership Payment and Renewal Options: Phone Direct DebitDocument2 pagesProfessional Membership Payment and Renewal Options: Phone Direct DebitMir MoinNo ratings yet

- FAQs Auto BillsPay 2011Document1 pageFAQs Auto BillsPay 2011elyaskhan4573No ratings yet

- Mini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775Document10 pagesMini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775sampv90No ratings yet

- PDS Personal Financing IDocument2 pagesPDS Personal Financing IfireflydudeNo ratings yet

- E-Mandate 01102021Document3 pagesE-Mandate 01102021Djxjfdu fjedjNo ratings yet

- Prority Mid Version XviiDocument2 pagesPrority Mid Version XviiKartik ShuklaNo ratings yet

- Most Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)Document2 pagesMost Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)ankitshinde1No ratings yet

- 411DPFHZ539384 Foreclosure LetterDocument3 pages411DPFHZ539384 Foreclosure LetterSaikiran VeepuriNo ratings yet

- Soc Idfc 2Document1 pageSoc Idfc 2rk4322016No ratings yet

- Foreclosure Letter 13-51-59Document3 pagesForeclosure Letter 13-51-59Kavipriyan MagudeeswaranNo ratings yet

- Everyday Credit Card Keyfacts DocumentDocument10 pagesEveryday Credit Card Keyfacts Documentnoddieedwards260373No ratings yet

- PDS Ba en 1.0Document2 pagesPDS Ba en 1.0NURIN IMANINA 'ADANI MARZUKINo ratings yet

- Corporate Internet Banking FaqsDocument17 pagesCorporate Internet Banking FaqsAshNo ratings yet

- Sanction Dla E2f4e2cc Aed5 4d8c b867 c528fcdfb175Document17 pagesSanction Dla E2f4e2cc Aed5 4d8c b867 c528fcdfb175titoneasyNo ratings yet

- Date Transaction Description Amount (In RS.)Document1 pageDate Transaction Description Amount (In RS.)Probal DasNo ratings yet

- CIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFDocument5 pagesCIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFClaudette LopezNo ratings yet

- Balance Transfer Application FormDocument1 pageBalance Transfer Application FormChloe VillegasNo ratings yet

- Loan Term Sheet - 17!57!59Document16 pagesLoan Term Sheet - 17!57!59Kishan AhirNo ratings yet

- Vio Fee AAD PrivacyDocument17 pagesVio Fee AAD PrivacyChimezie GregNo ratings yet

- Interest Rates and Interest Charges: Capital One Application TermsDocument6 pagesInterest Rates and Interest Charges: Capital One Application TermsMohammad Azam khanNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1kannankadirveluNo ratings yet

- Direct Deposit / Automatic Payment: Information FormDocument1 pageDirect Deposit / Automatic Payment: Information FormHermanNo ratings yet

- PNC Savings Acc StatementDocument1 pagePNC Savings Acc StatementHermanNo ratings yet

- Department of Home Affairs Republic of South Africa: (Attach Fingerprint Form, With Photograph)Document8 pagesDepartment of Home Affairs Republic of South Africa: (Attach Fingerprint Form, With Photograph)HermanNo ratings yet

- Commercial Purity Aluminium1050Document1 pageCommercial Purity Aluminium1050HermanNo ratings yet

- SVR 1630Document42 pagesSVR 1630HermanNo ratings yet

- NCR Form 17.W: Debt Matters (Pty) LTD Trading AsDocument1 pageNCR Form 17.W: Debt Matters (Pty) LTD Trading AsHermanNo ratings yet

- Architectural Solutions: 0DU 3ulfhvh (Foxgh9$7Document5 pagesArchitectural Solutions: 0DU 3ulfhvh (Foxgh9$7HermanNo ratings yet

- K1280 Keyboard User's Guide: System RequirementDocument3 pagesK1280 Keyboard User's Guide: System RequirementHermanNo ratings yet

- g4hg EngineDocument91 pagesg4hg EngineHermanNo ratings yet

- Engineering & Design Handbook EditedDocument140 pagesEngineering & Design Handbook EditedHermanNo ratings yet

- Conical SpringDocument1 pageConical SpringHermanNo ratings yet

- RCD 510 Specs 1Document1 pageRCD 510 Specs 1HermanNo ratings yet

- 002 - Gen5700 - 000 - PD2 - 01 2Document1 page002 - Gen5700 - 000 - PD2 - 01 2HermanNo ratings yet

- Jaspersoft ETL™: Data Integration For BIDocument4 pagesJaspersoft ETL™: Data Integration For BIHermanNo ratings yet

- A12c19 Ps 20141021113940Document2 pagesA12c19 Ps 20141021113940HermanNo ratings yet

- KMC SAE '19 ChallanDocument1 pageKMC SAE '19 ChallanPartha DeyNo ratings yet

- Tax 100 Questions FINALDocument17 pagesTax 100 Questions FINALQuendrick SurbanNo ratings yet

- Ffars PPTDocument35 pagesFfars PPTsabra allyNo ratings yet

- Ride Details Fare Details: Thanks For Travelling With Us, Atul GargDocument3 pagesRide Details Fare Details: Thanks For Travelling With Us, Atul GargAtul GargNo ratings yet

- Larga International Logistic IncDocument7 pagesLarga International Logistic IncJanette SumagaysayNo ratings yet

- Investwhizz SOP On Binance and Fund TransferDocument5 pagesInvestwhizz SOP On Binance and Fund Transferbooks.sriramNo ratings yet

- XXXXXXXXXX1191 20230728113715988340..Document6 pagesXXXXXXXXXX1191 20230728113715988340..MOHAMMAD IQLASHNo ratings yet

- HTV International Pvt. Ltd.Document1 pageHTV International Pvt. Ltd.Raj GuptaNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument7 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisHoo Keong TeoNo ratings yet

- Request Form For Documents: University of The Philippines Open University Office of The University RegistrarDocument2 pagesRequest Form For Documents: University of The Philippines Open University Office of The University RegistrarAlexander LigawadNo ratings yet

- Account StatementDocument16 pagesAccount Statementjasonhileni8No ratings yet

- Marine WriteDocument20 pagesMarine WriteKrushik DhadukNo ratings yet

- Statement 674xxxx5353 27022024 115729Document4 pagesStatement 674xxxx5353 27022024 115729ManiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument8 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancecity cyberNo ratings yet

- Project Claim Form FormatDocument6 pagesProject Claim Form FormatReynald RyanNo ratings yet

- Frami Pallet 1.20m and 1.50m: 1997 Models OnwardDocument5 pagesFrami Pallet 1.20m and 1.50m: 1997 Models OnwardBoruida MachineryNo ratings yet

- Sbi Bank Statement Lalit PrajapatiDocument12 pagesSbi Bank Statement Lalit PrajapatiLalit JainNo ratings yet

- AARYADocument6 pagesAARYARavindra JadhavNo ratings yet

- DynDNS Invoice #12540511 LuduvicoDocument1 pageDynDNS Invoice #12540511 LuduvicoLuduvico ClaudioNo ratings yet

- Field Status Group in Sap Define Field Status Variants PDFDocument7 pagesField Status Group in Sap Define Field Status Variants PDFsrinivas ChowdaryNo ratings yet

- Tourism UNIT - 4 PDFDocument19 pagesTourism UNIT - 4 PDFAbhishek ChakrabortyNo ratings yet

- MYOB Qualification Test: Level BasicDocument8 pagesMYOB Qualification Test: Level BasicGalihNo ratings yet

- RRLDocument3 pagesRRLStevenson OzonNo ratings yet

- Incoterms 2020Document3 pagesIncoterms 2020Vladyslav KalchevskiiNo ratings yet

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet

- Bank Alfalah Limited Bank Alfalah Limited Bank Alfalah LimitedDocument1 pageBank Alfalah Limited Bank Alfalah Limited Bank Alfalah LimitedAli Zain BhattiNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Affidavit of Mailing: 126719046025, Photocopy of The Demand Letter Dated March 4, 2018Document2 pagesAffidavit of Mailing: 126719046025, Photocopy of The Demand Letter Dated March 4, 2018Rex Romulos Dulfo100% (3)

- 20181222009-14 Mahaboobnagar InvoicesDocument6 pages20181222009-14 Mahaboobnagar InvoicesManglam Consultancy services HyderabadNo ratings yet

- LK PD AngkasaDocument19 pagesLK PD AngkasaTashya NovitaNo ratings yet

Bmo Bill Connect Pricing Schedule

Bmo Bill Connect Pricing Schedule

Uploaded by

HermanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bmo Bill Connect Pricing Schedule

Bmo Bill Connect Pricing Schedule

Uploaded by

HermanCopyright:

Available Formats

Business Banking

BMO Bill Connect - Pricing Schedule

BMO business checking1 customers enrolled in BMO Digital Banking are eligible to enroll in BMO Bill Connect.

During enrollment, select either the Basic or Advanced plan and accept the pricing terms outlined herein.

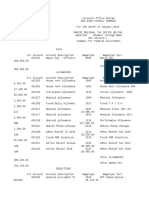

BMO Bill Connect Pricing Schedule

Basic Advanced (recommended)

Free Trial 2

60 days free 60 days free

Subscription Fee $5 per month $30 per month

No charge for first Collaborator User;

Collaborator User N/A

$14 per month for each additional user

BMO Bill Connect Transaction Fees

ACH (inbound and outbound) $0.49 per ACH $0.49 per ACH

Check $1.49 per check $1.49 per check

Virtual Card Payment (Virtual Card)3 Free Free

BMO Bill Connect Service Fee

Check Stop4 $35.00 $35.00

BMO Bill Connect Invoices

Create & Send Free Free

Each month, the BMO Bill Connect Billing Summary Statement will be displayed in BMO Digital Banking. All BMO Bill Connect subscription,

transaction, collaborator user and service fees will be summarized on the Billing Summary Statement and the total amount will be auto‑debited

from the BMO Bill Connect Payment Account5. BMO Bill Connect transaction activity will appear on each linked business checking account

statement6 that is also available for viewing in BMO Digital Banking.

1 BMO Bill Connect transactions will not count towards business checking product transaction limit. If a BMO Bill Connect payment results in an overdrawn account, overdraft fees will apply.

Standard fees apply for all business checking accounts. See your product disclosure for standard business checking product fees.

2 Free trial offer is available for the monthly subscription price of BMO Bill Connect and all transaction fees, collaborator fee and service fees for the first 60 calendar days of service, starting

from the date of enrollment. Your account will automatically be charged on a monthly basis until you cancel. To be eligible for this offer you must be a new BMO Bill Connect customer. Free

trial offer may be extended, modified or discontinued at any time without notice and may vary by market. You may cancel your subscription at any time in BMO Digital Banking by going to

“BMO Bill Connect” and select “Cancel your Bill Connect plan” to unenroll from BMO Bill Connect. Your cancellation will become effective immediately and you will be charged for all applicable

transaction and services fees through the date of cancellation. All future dated transactions must be cancelled before you can cancel your plan. There’s no contract, you’re free to switch plans

or cancel at any time. Basic users can upgrade to the Advanced Plan at anytime without losing data.

3 BMO Bill Connect customers can use the Virtual Card digital payment method (Virtual Card) to pay their vendors who have opted to receive credit card payment. Vendors that accept virtual

card payments will be paid with a single‑use Mastercard™ number. When a BMO Bill Connect customer initiates an ACH debit from their bank account, BMO Bill Connect will issue a single‑

use exact‑amount card for the value of the payment, when the ACH debit has cleared. BMO Bill Connect will work with vendors to verify their card acceptance information is up to date.

Using the BMO Bill Connect virtual card payment method is fast, secure, and free.

4 Check stop requests can be initiated in BMO Bill Connect and the fee is applied on a per check basis.

5 The BMO Bill Connect Payment Account is set up at the time of enrollment. BMO Bill Connect monthly Billing Summary Statement will summarize the total subscription, transaction, collab‑

orator user and service fees and auto‑debit the Payment Account for one amount by the 4th business day of each month. Subscription fees are based on the plan type assigned on the last

business day of the month. Subscription fees are not prorated when changed mid‑month. All accounts linked to BMO Bill Connect must be active business checking accounts. BMO will verify

that the Payment Account is open each time the BMO Bill Connect platform is accessed through BMO Digital Banking. For customers with multiple business checking accounts linked to BMO

Bill Connect and the Payment Account is closed, then the lowest active account number numerically will be charged for the monthly Billing Summary Statement amount. If all accounts

linked to BMO Bill Connect are closed, then the Bank will unenroll the business from BMO Bill Connect and all future scheduled transactions will be cancelled. Fee reversals may be processed

by the Bank and will appear on the next month’s Bill Connect Billing Summary Statement. To change the Payment Account in BMO Digital Banking go to “BMO Bill Connect” and select

“Update linked account(s).”

6 Business checking statements distribution and storage will not be impacted by enrollment in BMO Bill Connect. When applicable, the earnings credit from a business analyzed account can

not be used to offset BMO Bill Connect fees.

23-1469

Banking products are subject to approval and are provided in the United States by BMO Bank N.A. Member FDIC © 2023 BMO Bank N.A.

You might also like

- Something Special For You: Your $100 Apple Gift CardDocument1 pageSomething Special For You: Your $100 Apple Gift CardHermanNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- t1003 Parts CatalogDocument299 pagest1003 Parts CatalogHerman100% (2)

- 84 A 226035Document6 pages84 A 226035Herman50% (2)

- AARTO Form 14 20190130Document2 pagesAARTO Form 14 20190130Herman50% (2)

- Thermamax TIG200P - 000Document3 pagesThermamax TIG200P - 000Herman100% (1)

- Lesson of Passion - Living With Serena - Forbidden Fruit v2.09Document12 pagesLesson of Passion - Living With Serena - Forbidden Fruit v2.09HermanNo ratings yet

- PasswordsDocument4 pagesPasswordsHerman100% (1)

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Citibank, N.ADocument3 pagesCitibank, N.AjohnwregNo ratings yet

- SAPS 91aDocument1 pageSAPS 91aHermanNo ratings yet

- NPR 400 AmtDocument3 pagesNPR 400 AmtHermanNo ratings yet

- Bmo 3370 Edb Agreement en 07-22 v5 Final-SDocument59 pagesBmo 3370 Edb Agreement en 07-22 v5 Final-SIT TLiNo ratings yet

- Key Fact Statement of SBM Credilio Credit Card Description FeesDocument5 pagesKey Fact Statement of SBM Credilio Credit Card Description Feesgargmayank489.mgNo ratings yet

- 16 1679 F16 PricingChange CustomerComm TakeOne Ev7Document4 pages16 1679 F16 PricingChange CustomerComm TakeOne Ev7mieNo ratings yet

- Smart Advantage C Reg DDDocument4 pagesSmart Advantage C Reg DDekinediepreyeNo ratings yet

- Business Banking Charges GuideDocument19 pagesBusiness Banking Charges Guidedariaivanov25No ratings yet

- BT Credit Card Summary BoxDocument2 pagesBT Credit Card Summary BoxDawoodd10No ratings yet

- GCredit Product Disclosure Sheet 19032021Document6 pagesGCredit Product Disclosure Sheet 19032021Anthony GalvezNo ratings yet

- Balance Transfer Special Rate - HomeDocument2 pagesBalance Transfer Special Rate - Hometech.filnipponNo ratings yet

- Banking by Design Account: Simply Stated Product GuideDocument6 pagesBanking by Design Account: Simply Stated Product GuidetomNo ratings yet

- BBPS For Agent Institutions 26 05 17Document9 pagesBBPS For Agent Institutions 26 05 17Rachit AntaniNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresMarcus Wilson100% (1)

- Loan Term Sheet - 09 - 50 - 35Document13 pagesLoan Term Sheet - 09 - 50 - 35Kumar SaurabhNo ratings yet

- 2022 Purchase Convert Special Rate - HomeDocument3 pages2022 Purchase Convert Special Rate - HomeOT PRACTICE TIMENo ratings yet

- Why ICICI BankDocument9 pagesWhy ICICI BankRakesh ShahNo ratings yet

- Auto Pay Registration Process - Existing CustomerDocument19 pagesAuto Pay Registration Process - Existing Customerkaran singhNo ratings yet

- Business Banking Price ListDocument15 pagesBusiness Banking Price ListSARFRAZ ALINo ratings yet

- Funding Your COL AccountDocument16 pagesFunding Your COL AccountHazel Alcantara RoxasNo ratings yet

- Bmo Eclipse Visa Rise Benefit Guide enDocument8 pagesBmo Eclipse Visa Rise Benefit Guide enjennyla.zxjNo ratings yet

- Bankciwamb Bank PH Pds Fast Plus AccountDocument6 pagesBankciwamb Bank PH Pds Fast Plus AccountChuckie TajorNo ratings yet

- Prepaid Travel COB E FNLDocument1 pagePrepaid Travel COB E FNLBobNo ratings yet

- Account Opening DisclosuresDocument7 pagesAccount Opening DisclosuresLauren EgasNo ratings yet

- CE Cashback Program - Oct 22Document8 pagesCE Cashback Program - Oct 22Kamal SharmaNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- RB Chapter 2 - Current DepositsDocument6 pagesRB Chapter 2 - Current DepositsHarish YadavNo ratings yet

- Brazil and India Payment SystemDocument6 pagesBrazil and India Payment SystemRahul SinghNo ratings yet

- Schedule of Fees & ChargesDocument9 pagesSchedule of Fees & ChargesJamesNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Bharat Billpay: Consumer Frequently Asked QuestionsDocument5 pagesBharat Billpay: Consumer Frequently Asked QuestionsShashi PrakashNo ratings yet

- Cma 01007 12282022Document16 pagesCma 01007 12282022Chris LNo ratings yet

- Long Term SheetDocument8 pagesLong Term SheetZabid khanNo ratings yet

- Products Pdspersonalloan 01092021v2Document4 pagesProducts Pdspersonalloan 01092021v2Christopher Sarcinia EnrileNo ratings yet

- Gen MathDocument4 pagesGen MathgapcenizalNo ratings yet

- Faqs Agent Institution BbpsDocument9 pagesFaqs Agent Institution BbpsrahulmNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening DisclosuresEliseu Simplicio de OliveiraNo ratings yet

- What Is This Product About?Document6 pagesWhat Is This Product About?Franco BegnadenNo ratings yet

- Professional Membership Payment and Renewal Options: Phone Direct DebitDocument2 pagesProfessional Membership Payment and Renewal Options: Phone Direct DebitMir MoinNo ratings yet

- FAQs Auto BillsPay 2011Document1 pageFAQs Auto BillsPay 2011elyaskhan4573No ratings yet

- Mini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775Document10 pagesMini Money Line of Credit Agreement and Disclosure Statement Mar-06-2024 6388775sampv90No ratings yet

- PDS Personal Financing IDocument2 pagesPDS Personal Financing IfireflydudeNo ratings yet

- E-Mandate 01102021Document3 pagesE-Mandate 01102021Djxjfdu fjedjNo ratings yet

- Prority Mid Version XviiDocument2 pagesPrority Mid Version XviiKartik ShuklaNo ratings yet

- Most Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)Document2 pagesMost Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)ankitshinde1No ratings yet

- 411DPFHZ539384 Foreclosure LetterDocument3 pages411DPFHZ539384 Foreclosure LetterSaikiran VeepuriNo ratings yet

- Soc Idfc 2Document1 pageSoc Idfc 2rk4322016No ratings yet

- Foreclosure Letter 13-51-59Document3 pagesForeclosure Letter 13-51-59Kavipriyan MagudeeswaranNo ratings yet

- Everyday Credit Card Keyfacts DocumentDocument10 pagesEveryday Credit Card Keyfacts Documentnoddieedwards260373No ratings yet

- PDS Ba en 1.0Document2 pagesPDS Ba en 1.0NURIN IMANINA 'ADANI MARZUKINo ratings yet

- Corporate Internet Banking FaqsDocument17 pagesCorporate Internet Banking FaqsAshNo ratings yet

- Sanction Dla E2f4e2cc Aed5 4d8c b867 c528fcdfb175Document17 pagesSanction Dla E2f4e2cc Aed5 4d8c b867 c528fcdfb175titoneasyNo ratings yet

- Date Transaction Description Amount (In RS.)Document1 pageDate Transaction Description Amount (In RS.)Probal DasNo ratings yet

- CIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFDocument5 pagesCIMB Product Disclosure Sheet - UpSave Account - 03252019 PDFClaudette LopezNo ratings yet

- Balance Transfer Application FormDocument1 pageBalance Transfer Application FormChloe VillegasNo ratings yet

- Loan Term Sheet - 17!57!59Document16 pagesLoan Term Sheet - 17!57!59Kishan AhirNo ratings yet

- Vio Fee AAD PrivacyDocument17 pagesVio Fee AAD PrivacyChimezie GregNo ratings yet

- Interest Rates and Interest Charges: Capital One Application TermsDocument6 pagesInterest Rates and Interest Charges: Capital One Application TermsMohammad Azam khanNo ratings yet

- Balance Conv TandCs Final 1Document12 pagesBalance Conv TandCs Final 1kannankadirveluNo ratings yet

- Direct Deposit / Automatic Payment: Information FormDocument1 pageDirect Deposit / Automatic Payment: Information FormHermanNo ratings yet

- PNC Savings Acc StatementDocument1 pagePNC Savings Acc StatementHermanNo ratings yet

- Department of Home Affairs Republic of South Africa: (Attach Fingerprint Form, With Photograph)Document8 pagesDepartment of Home Affairs Republic of South Africa: (Attach Fingerprint Form, With Photograph)HermanNo ratings yet

- Commercial Purity Aluminium1050Document1 pageCommercial Purity Aluminium1050HermanNo ratings yet

- SVR 1630Document42 pagesSVR 1630HermanNo ratings yet

- NCR Form 17.W: Debt Matters (Pty) LTD Trading AsDocument1 pageNCR Form 17.W: Debt Matters (Pty) LTD Trading AsHermanNo ratings yet

- Architectural Solutions: 0DU 3ulfhvh (Foxgh9$7Document5 pagesArchitectural Solutions: 0DU 3ulfhvh (Foxgh9$7HermanNo ratings yet

- K1280 Keyboard User's Guide: System RequirementDocument3 pagesK1280 Keyboard User's Guide: System RequirementHermanNo ratings yet

- g4hg EngineDocument91 pagesg4hg EngineHermanNo ratings yet

- Engineering & Design Handbook EditedDocument140 pagesEngineering & Design Handbook EditedHermanNo ratings yet

- Conical SpringDocument1 pageConical SpringHermanNo ratings yet

- RCD 510 Specs 1Document1 pageRCD 510 Specs 1HermanNo ratings yet

- 002 - Gen5700 - 000 - PD2 - 01 2Document1 page002 - Gen5700 - 000 - PD2 - 01 2HermanNo ratings yet

- Jaspersoft ETL™: Data Integration For BIDocument4 pagesJaspersoft ETL™: Data Integration For BIHermanNo ratings yet

- A12c19 Ps 20141021113940Document2 pagesA12c19 Ps 20141021113940HermanNo ratings yet

- KMC SAE '19 ChallanDocument1 pageKMC SAE '19 ChallanPartha DeyNo ratings yet

- Tax 100 Questions FINALDocument17 pagesTax 100 Questions FINALQuendrick SurbanNo ratings yet

- Ffars PPTDocument35 pagesFfars PPTsabra allyNo ratings yet

- Ride Details Fare Details: Thanks For Travelling With Us, Atul GargDocument3 pagesRide Details Fare Details: Thanks For Travelling With Us, Atul GargAtul GargNo ratings yet

- Larga International Logistic IncDocument7 pagesLarga International Logistic IncJanette SumagaysayNo ratings yet

- Investwhizz SOP On Binance and Fund TransferDocument5 pagesInvestwhizz SOP On Binance and Fund Transferbooks.sriramNo ratings yet

- XXXXXXXXXX1191 20230728113715988340..Document6 pagesXXXXXXXXXX1191 20230728113715988340..MOHAMMAD IQLASHNo ratings yet

- HTV International Pvt. Ltd.Document1 pageHTV International Pvt. Ltd.Raj GuptaNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument7 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisHoo Keong TeoNo ratings yet

- Request Form For Documents: University of The Philippines Open University Office of The University RegistrarDocument2 pagesRequest Form For Documents: University of The Philippines Open University Office of The University RegistrarAlexander LigawadNo ratings yet

- Account StatementDocument16 pagesAccount Statementjasonhileni8No ratings yet

- Marine WriteDocument20 pagesMarine WriteKrushik DhadukNo ratings yet

- Statement 674xxxx5353 27022024 115729Document4 pagesStatement 674xxxx5353 27022024 115729ManiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument8 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancecity cyberNo ratings yet

- Project Claim Form FormatDocument6 pagesProject Claim Form FormatReynald RyanNo ratings yet

- Frami Pallet 1.20m and 1.50m: 1997 Models OnwardDocument5 pagesFrami Pallet 1.20m and 1.50m: 1997 Models OnwardBoruida MachineryNo ratings yet

- Sbi Bank Statement Lalit PrajapatiDocument12 pagesSbi Bank Statement Lalit PrajapatiLalit JainNo ratings yet

- AARYADocument6 pagesAARYARavindra JadhavNo ratings yet

- DynDNS Invoice #12540511 LuduvicoDocument1 pageDynDNS Invoice #12540511 LuduvicoLuduvico ClaudioNo ratings yet

- Field Status Group in Sap Define Field Status Variants PDFDocument7 pagesField Status Group in Sap Define Field Status Variants PDFsrinivas ChowdaryNo ratings yet

- Tourism UNIT - 4 PDFDocument19 pagesTourism UNIT - 4 PDFAbhishek ChakrabortyNo ratings yet

- MYOB Qualification Test: Level BasicDocument8 pagesMYOB Qualification Test: Level BasicGalihNo ratings yet

- RRLDocument3 pagesRRLStevenson OzonNo ratings yet

- Incoterms 2020Document3 pagesIncoterms 2020Vladyslav KalchevskiiNo ratings yet

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet

- Bank Alfalah Limited Bank Alfalah Limited Bank Alfalah LimitedDocument1 pageBank Alfalah Limited Bank Alfalah Limited Bank Alfalah LimitedAli Zain BhattiNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Affidavit of Mailing: 126719046025, Photocopy of The Demand Letter Dated March 4, 2018Document2 pagesAffidavit of Mailing: 126719046025, Photocopy of The Demand Letter Dated March 4, 2018Rex Romulos Dulfo100% (3)

- 20181222009-14 Mahaboobnagar InvoicesDocument6 pages20181222009-14 Mahaboobnagar InvoicesManglam Consultancy services HyderabadNo ratings yet

- LK PD AngkasaDocument19 pagesLK PD AngkasaTashya NovitaNo ratings yet