Professional Documents

Culture Documents

Lord Caramelo Pine Script

Lord Caramelo Pine Script

Uploaded by

olympioCopyright:

Available Formats

You might also like

- Crypto SlayaDocument12 pagesCrypto SlayaYudistira WaskitoNo ratings yet

- Auto BuySell+Trend and Targets V4Document10 pagesAuto BuySell+Trend and Targets V4Jeniffer RayenNo ratings yet

- Gaussian FilterDocument4 pagesGaussian Filterkashinath09No ratings yet

- Warrior Trendline-V1Document23 pagesWarrior Trendline-V1Devidas KalhapureNo ratings yet

- A Study On Employee MotivationDocument69 pagesA Study On Employee MotivationAnantha Vijayan100% (2)

- Multiindicator MojaDocument14 pagesMultiindicator MojatoengsayaNo ratings yet

- Alarm FisherDocument6 pagesAlarm FishersepsevugneNo ratings yet

- NNFX All in OneDocument20 pagesNNFX All in Oneedmund november koboNo ratings yet

- JMK Strategy Use This OnlyDocument64 pagesJMK Strategy Use This OnlyhafeezNo ratings yet

- S&R TVDocument2 pagesS&R TVwetanNo ratings yet

- SAB PRO Pivot Master@free_fx_proDocument24 pagesSAB PRO Pivot Master@free_fx_prowarumonokisouNo ratings yet

- Treds Detectores de BaleiasDocument2 pagesTreds Detectores de BaleiasMarconi CruzNo ratings yet

- LooxgausanDocument6 pagesLooxgausanMichael BauerNo ratings yet

- Comert Ultimate KY-ToolBox by HassonyaDocument16 pagesComert Ultimate KY-ToolBox by HassonyatanalpoguzNo ratings yet

- HVSD SSLDocument9 pagesHVSD SSLHimmat ChoudharyNo ratings yet

- Ezalgo v11 CleanedDocument13 pagesEzalgo v11 Cleanedjavainternet453No ratings yet

- Tradingview ScriptsDocument3 pagesTradingview ScriptsAlex LeongNo ratings yet

- Qqe MT4Document3 pagesQqe MT4Francis Nano FerrerNo ratings yet

- Small Trend. ʜɪʜDocument14 pagesSmall Trend. ʜɪʜVipul AgrawalNo ratings yet

- FIBDocument10 pagesFIBAndrei ShadowSNo ratings yet

- Implied Volatility Suite & ALL RSI MTFDocument4 pagesImplied Volatility Suite & ALL RSI MTFkashinath09No ratings yet

- Jaque Al Bitcoin B v3.0Document5 pagesJaque Al Bitcoin B v3.0Enrique AmesquitaNo ratings yet

- STORSI SmoothedDocument2 pagesSTORSI Smoothedbharatbaba363No ratings yet

- Swing CallDocument1 pageSwing Callsmit20051410No ratings yet

- Gann Medians MA Targets PremiumDocument36 pagesGann Medians MA Targets PremiumKailashNo ratings yet

- EffectDocument5 pagesEffectElton crescêncio GuiambaNo ratings yet

- SAIYANATOR_Strategy_v1.37Document9 pagesSAIYANATOR_Strategy_v1.37warumonokisouNo ratings yet

- Trading Strategy Pinescript CodeDocument10 pagesTrading Strategy Pinescript CodeSayantan DasNo ratings yet

- amck-cprDocument12 pagesamck-cpralistermackinnon554No ratings yet

- SwingArm ATR Trend Indicator by VSNFNDDocument3 pagesSwingArm ATR Trend Indicator by VSNFNDM BabaNo ratings yet

- Trendline Break With Super Ichimoku CloudDocument6 pagesTrendline Break With Super Ichimoku Cloudabcd9661595653No ratings yet

- EzSMC CompactDocument21 pagesEzSMC CompacttoengsayaNo ratings yet

- BB + LC + RKE BUY SELL Indicator Revised 2Document9 pagesBB + LC + RKE BUY SELL Indicator Revised 2olympioNo ratings yet

- Openscad Manual 3Document13 pagesOpenscad Manual 3keeyanNo ratings yet

- Heiken Profit Normal BacktestDocument4 pagesHeiken Profit Normal Backtestbicolorfifeiro88No ratings yet

- OccDocument3 pagesOccbalenoanuragNo ratings yet

- BB + LC + RKE BUY SELL Indicator Revised 3 FinalDocument9 pagesBB + LC + RKE BUY SELL Indicator Revised 3 FinalolympioNo ratings yet

- Indicador Contagens de Ondas de ElliotDocument15 pagesIndicador Contagens de Ondas de Elliotmamae.fornariNo ratings yet

- GladiatorDocument4 pagesGladiatorViswanath PalyamNo ratings yet

- Elite Algo + TP + Smart MoneyDocument58 pagesElite Algo + TP + Smart MoneyRafael RubioNo ratings yet

- EarnWithKoKo 1.1Document18 pagesEarnWithKoKo 1.1h76bfj6yrqNo ratings yet

- Major Trend. ʜɪʜDocument3 pagesMajor Trend. ʜɪʜavdheskNo ratings yet

- Super Z Strategy Buy and SellDocument3 pagesSuper Z Strategy Buy and Sellkeerthanktrade1555No ratings yet

- RSI Bands (LazyBear)Document1 pageRSI Bands (LazyBear)MatíasNo ratings yet

- 9 - Indicador de Canais FoiDocument3 pages9 - Indicador de Canais Foibicolorfifeiro88No ratings yet

- DashboardDocument6 pagesDashboardbicolorfifeiro88No ratings yet

- RSIretDocument4 pagesRSIretPrasanna Pharaoh100% (1)

- Effect 3Document7 pagesEffect 3Mateus MarquesNo ratings yet

- DynReg EMA Levels SMART DIV - STR AlphaDocument36 pagesDynReg EMA Levels SMART DIV - STR Alphakashinath09No ratings yet

- Gladiator 3.0Document9 pagesGladiator 3.0Vikas0% (1)

- New Text DocumentDocument2 pagesNew Text DocumentNadun NethmikaNo ratings yet

- Dynamic Regression-EMA-PD Level-Alpha TrendDocument7 pagesDynamic Regression-EMA-PD Level-Alpha Trendkashinath09No ratings yet

- NadarayaDocument2 pagesNadarayaJorge Almirante BurnsNo ratings yet

- 3 Candle StochasticsDocument3 pages3 Candle Stochasticstvhjm8vw7zNo ratings yet

- Nadaraya WatsonDocument2 pagesNadaraya WatsonM BabaNo ratings yet

- Stock - Warrior - Buy - Sale - Condition: For SL ChartDocument30 pagesStock - Warrior - Buy - Sale - Condition: For SL ChartRafael AlacornNo ratings yet

- Nadaraya WatsonDocument2 pagesNadaraya WatsonM BabaNo ratings yet

- Setup Mafia 3.5Document5 pagesSetup Mafia 3.5Gustavo rcNo ratings yet

- Plot RSIDocument11 pagesPlot RSIBipinNo ratings yet

- VMC ADocument3 pagesVMC AJeffrey LiwanagNo ratings yet

- Practical and Assignment 6Document3 pagesPractical and Assignment 6ioleNo ratings yet

- Hippias Major PlatonDocument4 pagesHippias Major PlatonLaura LapoviţăNo ratings yet

- 11.9 - Anh Đ C - Task 1 - Writing 16 - EDITEDDocument3 pages11.9 - Anh Đ C - Task 1 - Writing 16 - EDITEDNickNo ratings yet

- Staffing: The Management and Nonmanagerial Human Resources InventoryDocument22 pagesStaffing: The Management and Nonmanagerial Human Resources InventorySophia Pintor0% (1)

- Priyanshu Raj 20EE10055 Exp 5 Part 2Document17 pagesPriyanshu Raj 20EE10055 Exp 5 Part 2Priyanshu rajNo ratings yet

- Seligram, IncDocument5 pagesSeligram, IncAto SumartoNo ratings yet

- Allocation of 17 BatchDocument21 pagesAllocation of 17 BatchWick TodayNo ratings yet

- Confessions of Some High Ranking 1Document111 pagesConfessions of Some High Ranking 1Habilian AssociationNo ratings yet

- Software Architecture: An: Vanilson BurégioDocument44 pagesSoftware Architecture: An: Vanilson BurégioAsim RazaNo ratings yet

- GSCFF APF TechniquesDocument18 pagesGSCFF APF TechniquesMaharaniNo ratings yet

- E. B. Magalona National High School Summative Test in CSS 10 Quarter 1 Week 1 Multiple Choice. Choose The Letter of The Correct AnswerDocument2 pagesE. B. Magalona National High School Summative Test in CSS 10 Quarter 1 Week 1 Multiple Choice. Choose The Letter of The Correct Answerric jason pedralNo ratings yet

- Hasegawa v. Giron, G.R. No. 184536, August 14, 2013Document6 pagesHasegawa v. Giron, G.R. No. 184536, August 14, 2013Braian HitaNo ratings yet

- BiomesDocument23 pagesBiomesdipon deb nathNo ratings yet

- Invitation Accp 2011Document5 pagesInvitation Accp 2011Klub 'Apoteker' IndonesiaNo ratings yet

- 99 Ways To Be A Better MusicianDocument14 pages99 Ways To Be A Better Musiciangunter_wepplerNo ratings yet

- GCC Lab Manual Mahesh Kumar PDFDocument130 pagesGCC Lab Manual Mahesh Kumar PDFMohan ReddyNo ratings yet

- MSG456 Mathematical - Programming (May 2010)Document7 pagesMSG456 Mathematical - Programming (May 2010)dikkanNo ratings yet

- Change Your Diet Change Your Mind DR Georgia Ede Full Chapter PDFDocument69 pagesChange Your Diet Change Your Mind DR Georgia Ede Full Chapter PDFsygamagobas3100% (6)

- I 0610026377Document15 pagesI 0610026377Arif KurniawanNo ratings yet

- Techciti: Managed ServicesDocument6 pagesTechciti: Managed ServicesTechciti TechnologiesNo ratings yet

- Kara Resume 2014Document1 pageKara Resume 2014api-248363003No ratings yet

- Digital Fundamentals: FloydDocument17 pagesDigital Fundamentals: FloydadilNo ratings yet

- NPCIL - Question PapersDocument3 pagesNPCIL - Question PapersRamnadh MandaliNo ratings yet

- Petroleum & Petrochemicals Test Method Capabilities: Intertek Caleb Brett 1Document18 pagesPetroleum & Petrochemicals Test Method Capabilities: Intertek Caleb Brett 1Eng-sadeq HesseinNo ratings yet

- Thesis BalDocument110 pagesThesis BalshreejimbuNo ratings yet

- ARM130A1 - Aermacchi MB.339 Series Archived NOVDocument5 pagesARM130A1 - Aermacchi MB.339 Series Archived NOVLava R5s2019No ratings yet

- Test Bank For Principles of Anatomy and Physiology 14th Edition Gerard J Tortora Bryan H Derrickson Isbn 10 1118774566 Isbn 13 9781118774564 Isbn 9781118808979 Isbn 9781118344392 IsbnDocument24 pagesTest Bank For Principles of Anatomy and Physiology 14th Edition Gerard J Tortora Bryan H Derrickson Isbn 10 1118774566 Isbn 13 9781118774564 Isbn 9781118808979 Isbn 9781118344392 Isbnjohnlipceqgkjnbt100% (53)

- Hardness Test: Materials Science and TestingDocument6 pagesHardness Test: Materials Science and TestingCharlyn FloresNo ratings yet

- February 28 2014Document48 pagesFebruary 28 2014fijitimescanadaNo ratings yet

Lord Caramelo Pine Script

Lord Caramelo Pine Script

Uploaded by

olympioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lord Caramelo Pine Script

Lord Caramelo Pine Script

Uploaded by

olympioCopyright:

Available Formats

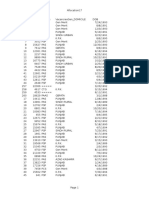

// This source code is subject to the terms of the Mozilla Public License 2.

0 at

https://mozilla.org/MPL/2.0/

// © Oly FX

//@version=4

study("[Oly FX] Lord Caramelo Oscillator", overlay=false)

//functions

xrf(values, length) =>

r_val = float(na)

if length >= 1

for i = 0 to length by 1

if na(r_val) or not na(values[i])

r_val := values[i]

r_val

r_val

xsa(src,len,wei) =>

sumf = 0.0

ma = 0.0

out = 0.0

sumf := nz(sumf[1]) - nz(src[len]) + src

ma := na(src[len]) ? na : sumf/len

out := na(out[1]) ? ma : (src*wei+out[1]*(len-wei))/len

out

//set up a simple model of Oscilador DuK

fundtrend = ((3*xsa((close- lowest(low,27))/(highest(high,27)-

lowest(low,27))*100,5,1)-2*xsa(xsa((close-lowest(low,27))/(highest(high,27)-

lowest(low,27))*100,5,1),3,1)-50)*1.032+50)

//define typical price for banker fund

typ = (2*close+high+low+open)/5

//lowest low with mid term fib # 34

lol = lowest(low,34)

//highest high with mid term fib # 34

hoh = highest(high,34)

//define banker fund flow bull bear line

bullbearline = ema((typ-lol)/(hoh-lol)*100,13)

//define banker entry signal

bankerentry = crossover(fundtrend,bullbearline) and bullbearline<25

//banker fund entry with yellow candle

plotcandle(0,50,0,50, title='Amarela', color=bankerentry ?

color.new(color.yellow,0):na)

//banker increase position with green candle

plotcandle(fundtrend,bullbearline,fundtrend,bullbearline, title='Verde',

color=fundtrend>bullbearline ? color.new(color.green,0):na)

//banker decrease position with white candle

plotcandle(fundtrend,bullbearline,fundtrend,bullbearline, title='Branca',

color=fundtrend<(xrf(fundtrend*0.95,1)) ? color.new(color.white,0):na)

//banker fund exit/quit with red candle

plotcandle(fundtrend,bullbearline,fundtrend,bullbearline, title='Vermelha',

color=fundtrend<bullbearline ? color.new(color.red,0):na)

//banker fund Weak rebound with blue candle

plotcandle(fundtrend,bullbearline,fundtrend,bullbearline, title='Azul',

color=fundtrend<bullbearline and fundtrend>(xrf(fundtrend*0.95,1)) ?

color.new(color.blue,0):na)

//overbought and oversold threshold lines

h1 = hline(80,color=color.red, linestyle=hline.style_dotted)

h2 = hline(20, color=color.yellow, linestyle=hline.style_dotted)

h3 = hline(10,color=color.lime, linestyle=hline.style_dotted)

h4 = hline(90, color=color.fuchsia, linestyle=hline.style_dotted)

fill(h2,h3,color=color.rgb(14, 133, 40),transp=70)

fill(h1,h4,color=color.fuchsia,transp=70)

//alert conditions

xUp = crossover(fundtrend,20)

xDown = crossunder(fundtrend,80)

alertcondition(xUp, title='Alerta de Compra', message='Compra logo essa bagaça!')

alertcondition(xDown, title='Alerta de Venda', message='Vende logo essa bagaça!')

alertcondition(bankerentry, title='Alerta de vela amarela', message='Vela

amarela!')

alertcondition(fundtrend>bullbearline, title='Alerta de vela verde', message='Vela

verde!')

alertcondition(fundtrend<(xrf(fundtrend*0.95,1)), title='Alerta de vela branca',

message='Vela Branca!')

alertcondition(fundtrend<bullbearline, title='Alerta de vela vermelha',

message='Vela vermelha!')

alertcondition(fundtrend<bullbearline and fundtrend>(xrf(fundtrend*0.95,1)),

title='Alerta de vela azul', message='Vela azul!')

You might also like

- Crypto SlayaDocument12 pagesCrypto SlayaYudistira WaskitoNo ratings yet

- Auto BuySell+Trend and Targets V4Document10 pagesAuto BuySell+Trend and Targets V4Jeniffer RayenNo ratings yet

- Gaussian FilterDocument4 pagesGaussian Filterkashinath09No ratings yet

- Warrior Trendline-V1Document23 pagesWarrior Trendline-V1Devidas KalhapureNo ratings yet

- A Study On Employee MotivationDocument69 pagesA Study On Employee MotivationAnantha Vijayan100% (2)

- Multiindicator MojaDocument14 pagesMultiindicator MojatoengsayaNo ratings yet

- Alarm FisherDocument6 pagesAlarm FishersepsevugneNo ratings yet

- NNFX All in OneDocument20 pagesNNFX All in Oneedmund november koboNo ratings yet

- JMK Strategy Use This OnlyDocument64 pagesJMK Strategy Use This OnlyhafeezNo ratings yet

- S&R TVDocument2 pagesS&R TVwetanNo ratings yet

- SAB PRO Pivot Master@free_fx_proDocument24 pagesSAB PRO Pivot Master@free_fx_prowarumonokisouNo ratings yet

- Treds Detectores de BaleiasDocument2 pagesTreds Detectores de BaleiasMarconi CruzNo ratings yet

- LooxgausanDocument6 pagesLooxgausanMichael BauerNo ratings yet

- Comert Ultimate KY-ToolBox by HassonyaDocument16 pagesComert Ultimate KY-ToolBox by HassonyatanalpoguzNo ratings yet

- HVSD SSLDocument9 pagesHVSD SSLHimmat ChoudharyNo ratings yet

- Ezalgo v11 CleanedDocument13 pagesEzalgo v11 Cleanedjavainternet453No ratings yet

- Tradingview ScriptsDocument3 pagesTradingview ScriptsAlex LeongNo ratings yet

- Qqe MT4Document3 pagesQqe MT4Francis Nano FerrerNo ratings yet

- Small Trend. ʜɪʜDocument14 pagesSmall Trend. ʜɪʜVipul AgrawalNo ratings yet

- FIBDocument10 pagesFIBAndrei ShadowSNo ratings yet

- Implied Volatility Suite & ALL RSI MTFDocument4 pagesImplied Volatility Suite & ALL RSI MTFkashinath09No ratings yet

- Jaque Al Bitcoin B v3.0Document5 pagesJaque Al Bitcoin B v3.0Enrique AmesquitaNo ratings yet

- STORSI SmoothedDocument2 pagesSTORSI Smoothedbharatbaba363No ratings yet

- Swing CallDocument1 pageSwing Callsmit20051410No ratings yet

- Gann Medians MA Targets PremiumDocument36 pagesGann Medians MA Targets PremiumKailashNo ratings yet

- EffectDocument5 pagesEffectElton crescêncio GuiambaNo ratings yet

- SAIYANATOR_Strategy_v1.37Document9 pagesSAIYANATOR_Strategy_v1.37warumonokisouNo ratings yet

- Trading Strategy Pinescript CodeDocument10 pagesTrading Strategy Pinescript CodeSayantan DasNo ratings yet

- amck-cprDocument12 pagesamck-cpralistermackinnon554No ratings yet

- SwingArm ATR Trend Indicator by VSNFNDDocument3 pagesSwingArm ATR Trend Indicator by VSNFNDM BabaNo ratings yet

- Trendline Break With Super Ichimoku CloudDocument6 pagesTrendline Break With Super Ichimoku Cloudabcd9661595653No ratings yet

- EzSMC CompactDocument21 pagesEzSMC CompacttoengsayaNo ratings yet

- BB + LC + RKE BUY SELL Indicator Revised 2Document9 pagesBB + LC + RKE BUY SELL Indicator Revised 2olympioNo ratings yet

- Openscad Manual 3Document13 pagesOpenscad Manual 3keeyanNo ratings yet

- Heiken Profit Normal BacktestDocument4 pagesHeiken Profit Normal Backtestbicolorfifeiro88No ratings yet

- OccDocument3 pagesOccbalenoanuragNo ratings yet

- BB + LC + RKE BUY SELL Indicator Revised 3 FinalDocument9 pagesBB + LC + RKE BUY SELL Indicator Revised 3 FinalolympioNo ratings yet

- Indicador Contagens de Ondas de ElliotDocument15 pagesIndicador Contagens de Ondas de Elliotmamae.fornariNo ratings yet

- GladiatorDocument4 pagesGladiatorViswanath PalyamNo ratings yet

- Elite Algo + TP + Smart MoneyDocument58 pagesElite Algo + TP + Smart MoneyRafael RubioNo ratings yet

- EarnWithKoKo 1.1Document18 pagesEarnWithKoKo 1.1h76bfj6yrqNo ratings yet

- Major Trend. ʜɪʜDocument3 pagesMajor Trend. ʜɪʜavdheskNo ratings yet

- Super Z Strategy Buy and SellDocument3 pagesSuper Z Strategy Buy and Sellkeerthanktrade1555No ratings yet

- RSI Bands (LazyBear)Document1 pageRSI Bands (LazyBear)MatíasNo ratings yet

- 9 - Indicador de Canais FoiDocument3 pages9 - Indicador de Canais Foibicolorfifeiro88No ratings yet

- DashboardDocument6 pagesDashboardbicolorfifeiro88No ratings yet

- RSIretDocument4 pagesRSIretPrasanna Pharaoh100% (1)

- Effect 3Document7 pagesEffect 3Mateus MarquesNo ratings yet

- DynReg EMA Levels SMART DIV - STR AlphaDocument36 pagesDynReg EMA Levels SMART DIV - STR Alphakashinath09No ratings yet

- Gladiator 3.0Document9 pagesGladiator 3.0Vikas0% (1)

- New Text DocumentDocument2 pagesNew Text DocumentNadun NethmikaNo ratings yet

- Dynamic Regression-EMA-PD Level-Alpha TrendDocument7 pagesDynamic Regression-EMA-PD Level-Alpha Trendkashinath09No ratings yet

- NadarayaDocument2 pagesNadarayaJorge Almirante BurnsNo ratings yet

- 3 Candle StochasticsDocument3 pages3 Candle Stochasticstvhjm8vw7zNo ratings yet

- Nadaraya WatsonDocument2 pagesNadaraya WatsonM BabaNo ratings yet

- Stock - Warrior - Buy - Sale - Condition: For SL ChartDocument30 pagesStock - Warrior - Buy - Sale - Condition: For SL ChartRafael AlacornNo ratings yet

- Nadaraya WatsonDocument2 pagesNadaraya WatsonM BabaNo ratings yet

- Setup Mafia 3.5Document5 pagesSetup Mafia 3.5Gustavo rcNo ratings yet

- Plot RSIDocument11 pagesPlot RSIBipinNo ratings yet

- VMC ADocument3 pagesVMC AJeffrey LiwanagNo ratings yet

- Practical and Assignment 6Document3 pagesPractical and Assignment 6ioleNo ratings yet

- Hippias Major PlatonDocument4 pagesHippias Major PlatonLaura LapoviţăNo ratings yet

- 11.9 - Anh Đ C - Task 1 - Writing 16 - EDITEDDocument3 pages11.9 - Anh Đ C - Task 1 - Writing 16 - EDITEDNickNo ratings yet

- Staffing: The Management and Nonmanagerial Human Resources InventoryDocument22 pagesStaffing: The Management and Nonmanagerial Human Resources InventorySophia Pintor0% (1)

- Priyanshu Raj 20EE10055 Exp 5 Part 2Document17 pagesPriyanshu Raj 20EE10055 Exp 5 Part 2Priyanshu rajNo ratings yet

- Seligram, IncDocument5 pagesSeligram, IncAto SumartoNo ratings yet

- Allocation of 17 BatchDocument21 pagesAllocation of 17 BatchWick TodayNo ratings yet

- Confessions of Some High Ranking 1Document111 pagesConfessions of Some High Ranking 1Habilian AssociationNo ratings yet

- Software Architecture: An: Vanilson BurégioDocument44 pagesSoftware Architecture: An: Vanilson BurégioAsim RazaNo ratings yet

- GSCFF APF TechniquesDocument18 pagesGSCFF APF TechniquesMaharaniNo ratings yet

- E. B. Magalona National High School Summative Test in CSS 10 Quarter 1 Week 1 Multiple Choice. Choose The Letter of The Correct AnswerDocument2 pagesE. B. Magalona National High School Summative Test in CSS 10 Quarter 1 Week 1 Multiple Choice. Choose The Letter of The Correct Answerric jason pedralNo ratings yet

- Hasegawa v. Giron, G.R. No. 184536, August 14, 2013Document6 pagesHasegawa v. Giron, G.R. No. 184536, August 14, 2013Braian HitaNo ratings yet

- BiomesDocument23 pagesBiomesdipon deb nathNo ratings yet

- Invitation Accp 2011Document5 pagesInvitation Accp 2011Klub 'Apoteker' IndonesiaNo ratings yet

- 99 Ways To Be A Better MusicianDocument14 pages99 Ways To Be A Better Musiciangunter_wepplerNo ratings yet

- GCC Lab Manual Mahesh Kumar PDFDocument130 pagesGCC Lab Manual Mahesh Kumar PDFMohan ReddyNo ratings yet

- MSG456 Mathematical - Programming (May 2010)Document7 pagesMSG456 Mathematical - Programming (May 2010)dikkanNo ratings yet

- Change Your Diet Change Your Mind DR Georgia Ede Full Chapter PDFDocument69 pagesChange Your Diet Change Your Mind DR Georgia Ede Full Chapter PDFsygamagobas3100% (6)

- I 0610026377Document15 pagesI 0610026377Arif KurniawanNo ratings yet

- Techciti: Managed ServicesDocument6 pagesTechciti: Managed ServicesTechciti TechnologiesNo ratings yet

- Kara Resume 2014Document1 pageKara Resume 2014api-248363003No ratings yet

- Digital Fundamentals: FloydDocument17 pagesDigital Fundamentals: FloydadilNo ratings yet

- NPCIL - Question PapersDocument3 pagesNPCIL - Question PapersRamnadh MandaliNo ratings yet

- Petroleum & Petrochemicals Test Method Capabilities: Intertek Caleb Brett 1Document18 pagesPetroleum & Petrochemicals Test Method Capabilities: Intertek Caleb Brett 1Eng-sadeq HesseinNo ratings yet

- Thesis BalDocument110 pagesThesis BalshreejimbuNo ratings yet

- ARM130A1 - Aermacchi MB.339 Series Archived NOVDocument5 pagesARM130A1 - Aermacchi MB.339 Series Archived NOVLava R5s2019No ratings yet

- Test Bank For Principles of Anatomy and Physiology 14th Edition Gerard J Tortora Bryan H Derrickson Isbn 10 1118774566 Isbn 13 9781118774564 Isbn 9781118808979 Isbn 9781118344392 IsbnDocument24 pagesTest Bank For Principles of Anatomy and Physiology 14th Edition Gerard J Tortora Bryan H Derrickson Isbn 10 1118774566 Isbn 13 9781118774564 Isbn 9781118808979 Isbn 9781118344392 Isbnjohnlipceqgkjnbt100% (53)

- Hardness Test: Materials Science and TestingDocument6 pagesHardness Test: Materials Science and TestingCharlyn FloresNo ratings yet

- February 28 2014Document48 pagesFebruary 28 2014fijitimescanadaNo ratings yet