Professional Documents

Culture Documents

Wanda

Wanda

Uploaded by

Juegos Debe0 ratings0% found this document useful (0 votes)

20 views1 pagew-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentw-2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views1 pageWanda

Wanda

Uploaded by

Juegos Debew-2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

-, ·,- ·,

amazon

..:,

'-,,

Form Referente ID

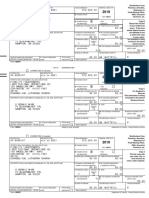

US_2023_1099NEC_1006938737_0

AMAZON.COM, INC.

PO BOX80683

SEATTLE, WA 98108·0683

WANDA MARTINEZ VAZQUEZ

5 FIELDSTONE RD

BEAR, DE19701

0 CORRECTED (if checkedl

°'AMAZON.COM,

PAYE:R'S name, stteet addfess, city Of town, state Or' ptOVinoe, couot,y, ZIP

foreign postal eo<le, and telephone no.

INC.

0MB No. 1545-0116

Fonn 1099-NEC

PO BOX 80683 Nonemployee

SEATTlE, WA 98108·0683 (Rev. January 2022)

1-425·697-9440

Compensation

f0< calendar year

20 23

PAYER'STIN AECIPIENT'STIN 1 Nonemployae compensatlon CopyB

23-2774532 XXX-XX.1132

$ 4 9.786.92 For Recipíent

o

2 PBy$ made direct sales totaling SS,000 0< more of Thís is � tax

RECIPIENT'S name and infonNlion and i$ being

ooosumer products to fecipient fof resale

address h.rrished to the IRS. 1 you an,

WANDA MARTINEZ VAZQUEZ 3 requlred 10 file a rett.rn, a

5 FIELDSTONERD nogigence penalty or olher

BEAR, DE19701 sanction � be in-.,o,ed on

4 Federal income tax withhetd you tt ltis looome Is lalCable

end the IRS determnes lhat �

$ 0.00 has not been-ed.

5 State tax wlthheld 6 State/Poye,'s

state no. 7 State lncome

Account number (see instructlons) $ PA

------------------- --------------- --

$

1099NEC_ 1006938737 $ ....................... . $ ........................

Fonn 1099-NEC (keep f0< your reoo«ls) www.irs.gov/F0<m1099NEC Oepartmeot of the Tfeasury - lntema1 Revenue Setvice

lnstructions for Recipient

You received this form instead of Form W-2 because the payer did not Note: lf you are receiving payments on which no income. social security,

consider you an employee and did not withhokl income tax or social and Medicare laxes are withheld, you should make estimated tax

security and Medicare tax. payments. See Form 1040-ES (or Form 1040-ES (NA)). lndividuals must

lf you believe you are an employee and cannot get the payer to correct report these amounts as explained in these box 1 instructions.

this form, report the amount shown in box 1 on the line for "Wages, Corporations, fiduclaries, and partnerships must report these amounts on

salaries, tips, etc." of Form 1040, 1040·SR, or 1040-NR. You must also the appropriate Une of thelr tax retums.

complete Form 8919 and attach it to your retum. For more lnformatlon, see Box 2. lf checked. consumar products totaling $5,000 or more were sold

Pub. 1779, lndependent Contracto, or Employee. to you for resale, on a buy•sell. a deposit-commlsslon, or other basis.

lf you are not an employee but the arnount in box 1 is not self• Generally, report any income from your sale of these products on

employment (SE) income (for example, it Is lncome from a sporadlc activity Schedule e (Form 1040).

or a hobby), report the amount shown in box 1 on the "Other íncome" line Box 3. Reserved for future use.

(on Schedule 1 (Form 1040)). Box 4. Shows backup withhokllng. A payer must backup withhold on

Recipient's taxpayer identification number (TIN). FO< your protection, this certain payments if you did not give your TIN to the payer. See Form W-9,

fonn may show only the last four diglts of your TIN (social security number Request for Taxpayer ldentif,cation Number and Certification, for

(SSN), indivídual taxpayer identification number (ITIN), adoplion taxpayer information on backup wi1hhokling. lnclude this arnount on your income

identificatioo number (ATIN), or employer identificatioo number (EIN)). tax return as tax withheld.

However, the issuer has reported your complete TIN to the IRS. Boxes !>-7. State lncome tax withheld reporting boxes.

Account number. May show an account or other unique number the payer Futura developments. For the lates! information about developments

assigned to distlngulsh your account. related to Form 1099-NEC and ils lnstructlons, such as legislation enacted

Box 1. Shows nonemployee compensation. lf the amount In thls box is SE alter they were published, 90 to www.irs.gov/Form1099NEC.

income, report it on Schedule C or F (Form 1040) lf a sole proprletor, or on Free File Program. Go to www.irs.gov/FreeFife to see if you qualify for

Form 1065 and Schedule K-1 (Form 1065) if a partnershlp. and the no-cost onllne federal tax preparation, e-fillng, and dlrect deposit or

recíplenVpartner completes Schedule SE (Form 1040). payment options.

Printed On Jan 02, 2024

You might also like

- 5 Questioning Strategies - Sandler FoundationsDocument16 pages5 Questioning Strategies - Sandler FoundationsJose Ivan Miranda CamposNo ratings yet

- Uber Misc PDFDocument2 pagesUber Misc PDFWaleed A ElTahanNo ratings yet

- Richard Feeney w2's 2018 2Document3 pagesRichard Feeney w2's 2018 2Richy FeeneyNo ratings yet

- QuestionsDocument68 pagesQuestionsTrickdady BonyNo ratings yet

- Amado Fernandez MartinezDocument1 pageAmado Fernandez MartinezJuegos DebeNo ratings yet

- Maplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65Document2 pagesMaplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65YoSoyOscarMesaNo ratings yet

- Form 1099 IntDocument1 pageForm 1099 IntEdeke0% (1)

- Miscellaneous Information: Copy B For RecipientDocument4 pagesMiscellaneous Information: Copy B For RecipientAubree Gates100% (1)

- Miscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Document2 pagesMiscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Mark JamesNo ratings yet

- 1099-r Taxable Amount Example - Google SearchDocument1 page1099-r Taxable Amount Example - Google SearchAnthony KevinNo ratings yet

- JL PDFDocument1 pageJL PDFJuegos DebeNo ratings yet

- 1099 Misc John NixonDocument1 page1099 Misc John NixonpayfallusdNo ratings yet

- 1099 Oid Tax EXAMPLE 3Document9 pages1099 Oid Tax EXAMPLE 3Lamario StillwellNo ratings yet

- For 1099Document3 pagesFor 1099enudo SolomonNo ratings yet

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- Nonemployee Compensation: David Moore 62 CR 478 Jonesboro AR 72404 David Moore (870) 882-1488 430-57-7877 500-11-5427Document4 pagesNonemployee Compensation: David Moore 62 CR 478 Jonesboro AR 72404 David Moore (870) 882-1488 430-57-7877 500-11-5427davidmoore214No ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- 2022 1099necDocument2 pages2022 1099necShirley MazariegosNo ratings yet

- Google 1099-MISC 2021Document2 pagesGoogle 1099-MISC 2021sharprespaldoNo ratings yet

- Leoncio Robles MR 9924 Overest Ave WHITTIER, CA 90605: Interest IncomeDocument2 pagesLeoncio Robles MR 9924 Overest Ave WHITTIER, CA 90605: Interest Incomeleonrobles99No ratings yet

- $0 Copy B: Miscellaneous InformationDocument2 pages$0 Copy B: Miscellaneous InformationGustavo BonillaNo ratings yet

- 2019 Form 1099-MISCDocument1 page2019 Form 1099-MISCKeller Brown JnrNo ratings yet

- Irs Form 1099 Misc PDFDocument8 pagesIrs Form 1099 Misc PDFMikhael Yah-Shah Dean: VeilourNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- View FileDocument2 pagesView FilejpneebNo ratings yet

- TWCCorrespondence 2Document1 pageTWCCorrespondence 2geeterbob123No ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Instructions For Recipient: Copy BDocument2 pagesInstructions For Recipient: Copy Bjohana150218No ratings yet

- Lindsay 1099Document1 pageLindsay 1099Thomas SheffieldNo ratings yet

- Interest Income: For Questions Please Call: 1-888-464-0727Document2 pagesInterest Income: For Questions Please Call: 1-888-464-0727Lisa Nielsen-SmithNo ratings yet

- f1099msc PDFDocument8 pagesf1099msc PDFblcksourceNo ratings yet

- 2023 1099necDocument1 page2023 1099neckarenr2143No ratings yet

- 9 Keland Cossia 2019 Form 1099-MISCDocument1 page9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonNo ratings yet

- F 1099 MSCDocument8 pagesF 1099 MSCVenkatapavan SinagamNo ratings yet

- PLA Intiff'S Exhibit 73Document13 pagesPLA Intiff'S Exhibit 73Jessie SmithNo ratings yet

- Invotce: Executive Hotels & ResortsDocument1 pageInvotce: Executive Hotels & Resortsbeenaproblem87No ratings yet

- Capital One TaxDocument2 pagesCapital One Tax16baezmcNo ratings yet

- 1099 G 2018documentdownloadDocument1 page1099 G 2018documentdownloadKristine McVeighNo ratings yet

- Tax Year 2015: Important Tax Information DocumentDocument2 pagesTax Year 2015: Important Tax Information DocumentBoldie LutwigNo ratings yet

- US Internal Revenue Service: f1099msc - 1992Document9 pagesUS Internal Revenue Service: f1099msc - 1992IRSNo ratings yet

- 1099 (2013) Misc.Document8 pages1099 (2013) Misc.Ian MañagoNo ratings yet

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Document1 pageOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonNo ratings yet

- Certain Government Payments 1099G: Claimant: Daniel Young Claimant ID: 0003011053Document1 pageCertain Government Payments 1099G: Claimant: Daniel Young Claimant ID: 0003011053Daniel YoungNo ratings yet

- Date: Jan 13 2021 Letter ID: L0031761089 Claimant ID: FMGGKWDocument2 pagesDate: Jan 13 2021 Letter ID: L0031761089 Claimant ID: FMGGKWJoshua PrimacioNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Walmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)Document1 pageWalmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)maria rodriguezNo ratings yet

- 1099 Form Year 2021Document8 pages1099 Form Year 2021Candy Valentine100% (1)

- 1099 Misc 1Document1 page1099 Misc 1Anonymous FR8yGDSVgNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099Marie CaragNo ratings yet

- 1099-C For Government Debt TemplateDocument1 page1099-C For Government Debt TemplaterndvdbNo ratings yet

- Form 1099 MISC David Kovach-1Document1 pageForm 1099 MISC David Kovach-1dolapo BalogunNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- 2020 1099necDocument2 pages2020 1099necgi silNo ratings yet

- 2020 1099NECkDocument2 pages2020 1099NECkJessica ZhicayNo ratings yet

- 2023 1099necDocument2 pages2023 1099necjose.oliverosflacNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMJackson kaylaNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- CORRECTED (If Checked) : Nonemployee CompensationDocument2 pagesCORRECTED (If Checked) : Nonemployee CompensationNathalin De IsoldiNo ratings yet

- UICAnnual1099 2010 01 09 00.32.54.009000Document1 pageUICAnnual1099 2010 01 09 00.32.54.009000Paul Michael WiremanNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's New Tax Law Simplified 2004: Get a Bigger RefundFrom EverandJ.K. Lasser's New Tax Law Simplified 2004: Get a Bigger RefundNo ratings yet

- Richard Valentin MaralesDocument4 pagesRichard Valentin MaralesJuegos DebeNo ratings yet

- Moises A Valentin Aponte 2.0Document1 pageMoises A Valentin Aponte 2.0Juegos DebeNo ratings yet

- Miguel Figueroa Colon 3Document1 pageMiguel Figueroa Colon 3Juegos DebeNo ratings yet

- Miguel Figueroa Colon 2Document1 pageMiguel Figueroa Colon 2Juegos DebeNo ratings yet

- Amado Fernandez MartinezDocument1 pageAmado Fernandez MartinezJuegos DebeNo ratings yet

- FACTURA2Document1 pageFACTURA2Juegos DebeNo ratings yet

- JL PDFDocument1 pageJL PDFJuegos DebeNo ratings yet

- 6 THDocument33 pages6 THCzara DyNo ratings yet

- Commerce: Pearson Edexcel International GCSEDocument16 pagesCommerce: Pearson Edexcel International GCSEAbdul Kader OniNo ratings yet

- CHAPTER 3 - LandReformsDocument26 pagesCHAPTER 3 - LandReformsTyped FY100% (1)

- Auditing HR and HR SystemsDocument11 pagesAuditing HR and HR SystemsHamza Hassan100% (1)

- Implementation of Anti Bullying Act, PangasinanDocument2 pagesImplementation of Anti Bullying Act, PangasinanBurgoa TomNo ratings yet

- PDF Upload-381349 PDFDocument10 pagesPDF Upload-381349 PDFGunjeetNo ratings yet

- Lecture - 03 Convertibles 13102022 111838amDocument19 pagesLecture - 03 Convertibles 13102022 111838amdua nadeemNo ratings yet

- 4dbe52c73b395 - Company Act (Dhivehi)Document26 pages4dbe52c73b395 - Company Act (Dhivehi)Mohamed MiuvaanNo ratings yet

- Voters Education (Ate Ann)Document51 pagesVoters Education (Ate Ann)Jeanette FormenteraNo ratings yet

- (220009488) Contemporary Issue On Labour Law Reform in India An OverviewDocument30 pages(220009488) Contemporary Issue On Labour Law Reform in India An OverviewIshaan YadavNo ratings yet

- Parks Vs Province of TarlacDocument2 pagesParks Vs Province of TarlacTippy Dos Santos100% (2)

- Jesus On FriendshipDocument6 pagesJesus On FriendshipCharmae BrutasNo ratings yet

- Santos v. PeopleDocument5 pagesSantos v. PeopleRMN Rommel DulaNo ratings yet

- VB 08 Errors StatmentsDocument4 pagesVB 08 Errors StatmentsMike LouisNo ratings yet

- Dell EMC™ ProDeploy Set Up A Production-Ready Environment in Less Time and Fewer StepsDocument14 pagesDell EMC™ ProDeploy Set Up A Production-Ready Environment in Less Time and Fewer StepsPrincipled TechnologiesNo ratings yet

- 1 Mendezona Vs OzamizDocument21 pages1 Mendezona Vs OzamizJerric CristobalNo ratings yet

- Circular and Rotational Motion (Rev1)Document52 pagesCircular and Rotational Motion (Rev1)Nilambar DebSharmaNo ratings yet

- ISACA CCAK v2022-03-22 q27Document7 pagesISACA CCAK v2022-03-22 q27Deepa NairNo ratings yet

- Mumbai To Jaipur Y8Lkvm: Goair G8-390Document3 pagesMumbai To Jaipur Y8Lkvm: Goair G8-390Avinash KharcheNo ratings yet

- Nothing But The Blood DrumsDocument1 pageNothing But The Blood DrumsTom PayneNo ratings yet

- Rutc CertificateDocument2 pagesRutc CertificateimranNo ratings yet

- Alequip SDN - BHD 2013Document31 pagesAlequip SDN - BHD 2013Syed HuzaifahNo ratings yet

- The Public Assembly Act of 1985Document14 pagesThe Public Assembly Act of 1985Samn Pistola Cadley100% (1)

- 59 Lim Vs FelixDocument3 pages59 Lim Vs FelixRuiz Arenas AgacitaNo ratings yet

- My 12/17/14 Complaint About Sydnee McElroy MD To The WV Board of Medicine and The Board's Next-Day ReplyDocument3 pagesMy 12/17/14 Complaint About Sydnee McElroy MD To The WV Board of Medicine and The Board's Next-Day ReplyPeter M. Heimlich0% (13)

- Spectrum Summary - The Foundation and The Moderate Phase of The Inc - History For Upsc Cse PDF DownloadDocument9 pagesSpectrum Summary - The Foundation and The Moderate Phase of The Inc - History For Upsc Cse PDF DownloadSpade AceNo ratings yet

- Representation and Transportation Allowances of Contractual PersonnelDocument3 pagesRepresentation and Transportation Allowances of Contractual PersonnelNinNin IMSNo ratings yet

- Kh. Shafiqur RahmanDocument48 pagesKh. Shafiqur RahmanAnonymous UqGvTrNo ratings yet