Professional Documents

Culture Documents

NETFLIX

NETFLIX

Uploaded by

AmitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NETFLIX

NETFLIX

Uploaded by

AmitCopyright:

Available Formats

Netflix experienced some membership turbulence in 2016 as a price increase was phased in

for its US subscribers. In May 2014, Netflix announced that the price of its standard

subscription service would increase from $8 to $9. However, established customers were

allowed to stay at the $7.99 price for two years. In 2015, Netflix increased the standard price

to $9.99. As a result of the pricing plan and the deferred price increase, in May, 2016, the

standard pricing plan for long time customers of Netflix increased from $7.99 per month to

$9.99 per month. Netflix began notifying customers in April that the price increase would

become effective in the second quarter.

Netflix was trying to implement price increases more slowly after a 2011 increase led to

negative publicity and a customer backlash. In that case, Netflix separated its streaming and

DVD services, and charged separately for both services.

However, regardless of the implementation of the price increase, the higher monthly prices

seem to have impacted the growth of membership among US subscribers. In the two

quarters before the price increase, Netflix added net membership of 1.6 million and 2.2

million members. By contrast, the number of members added in Q2 was only 160,000, and

in Q3 only 400,000. The Q2 growth in US subscribers was the lowest since Netflix began

reporting those numbers in 2012.

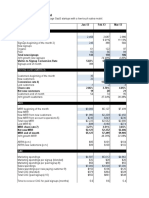

US Streaming (millions) Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Revenue 1026 1064 1106 1161 1208 1304

Contribution Profit 340 344 379 413 414 475

Contribution Margin 33.1% 32.3% 34.3% 35.6% 34.3% 36.4%

Paid Memberships 41.1 42.1 43.4 45.7 46.0 46.5

Total Memberships 42.3 43.2 44.7 47.0 47.1 47.5

Net Additions 0.90 0.88 1.56 2.23 0.16 0.40

Monthly Revenue per

Paid Member $ 8.33 $ 8.43 $ 8.49 $ 8.47 $ 8.75 $ 9.40

Percentage Chg. Rev 3.7% 3.9% 5.0% 4.0% 7.9%

Percentage Chg.

Memberships 2.5% 3.2% 5.3% 0.6% 0.9%

Source: Netflix 10Q Q3, 2016

According to a MarketWatch article1 on the price increase:

Netflix said Monday that customers who learned in April that the price was about to

increase had begun canceling their subscriptions, leading to unexpected “churn.”

Netflix did not flat-out say in its letter to investors that the price increase led to

higher churn among subscribers, however, instead saying it coincided with “press

coverage” of the rate hike and that subscribers misunderstood “the news as an

impending new price increase rather than the completion of two years of

grandfathering.”

The stock market reacted to news of Netflix price increase as well. The stock closed at

$102.23 as of March 31, 2016. After the release of second quarter earnings in July, the stock

price had fallen to $85.84 per share, a decline of 16%. This decline wiped out almost $7

billion of shareholder value during this period. Most of this decline was immediately

following the release of the second quarter numbers.

With competition increasing in for streaming services, especially with the growth of Amazon

Prime Video and Hulu, the decline in membership growth could be a troubling sign.

Ques a. Can we use the information in the case to estimate the elasticity of demand for Netflix

subscription services?

Ques b. Calculate an own-price elasticity of demand?

Ques c. What do we expect to happen to Netflix’s revenue due to the price increase?

Ques d. What do we expect to happen to Netflix’s profit due to the price increase?

You might also like

- Netflix Equity Analysis ReportDocument15 pagesNetflix Equity Analysis Reportapi-739767325No ratings yet

- AFM 273 F2021 Midterm W AnswersDocument31 pagesAFM 273 F2021 Midterm W AnswersAustin BijuNo ratings yet

- 105 18 Subscription Revenue Model ExcelDocument6 pages105 18 Subscription Revenue Model ExcelJack JacintoNo ratings yet

- ELasticity of Demand For NetflixDocument4 pagesELasticity of Demand For NetflixVasanth ParthasarathyNo ratings yet

- All Dollar Values in Millions: Operating InformationDocument32 pagesAll Dollar Values in Millions: Operating InformationanuNo ratings yet

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsFrom EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNo ratings yet

- Netflix Q410 Letter To ShareholdersDocument17 pagesNetflix Q410 Letter To ShareholdersTechCrunchNo ratings yet

- Sample Monthly Subscription ForecastDocument5 pagesSample Monthly Subscription Forecastdolpiro43No ratings yet

- q2 Fy17 EarningsDocument14 pagesq2 Fy17 EarningsЂорђе МалешевићNo ratings yet

- FlixDocument14 pagesFlixandre.torresNo ratings yet

- Q1 11 Letter To ShareholdersDocument16 pagesQ1 11 Letter To ShareholdersJay YarowNo ratings yet

- Writers Guild of America, West, Inc.: Annual Financial ReportDocument29 pagesWriters Guild of America, West, Inc.: Annual Financial ReportTHR100% (1)

- Investor Letter Q2 2012 07.24.12Document16 pagesInvestor Letter Q2 2012 07.24.12TechCrunchNo ratings yet

- Netflix 2Document8 pagesNetflix 2Brittany Price100% (2)

- Duolingo Q4FY23 Shareholder LetterDocument23 pagesDuolingo Q4FY23 Shareholder LetterrcossichNo ratings yet

- NYT Press Release Q3 2023Document22 pagesNYT Press Release Q3 2023Hafidz Ash ShidieqyNo ratings yet

- Disney Q3 2018 EarningsDocument14 pagesDisney Q3 2018 EarningsStephen LoiaconiNo ratings yet

- Revenue Projections With PNLDocument60 pagesRevenue Projections With PNLamitjain310No ratings yet

- U S Media New National 102877197Document12 pagesU S Media New National 102877197ForbesNo ratings yet

- 2021.08.17 Sea Second Quarter 2021 ResultsDocument19 pages2021.08.17 Sea Second Quarter 2021 ResultsMarirs LapogajarNo ratings yet

- 7209-Internet Marketing PDFDocument7 pages7209-Internet Marketing PDFSumit Kumar SinghNo ratings yet

- q3 Fy17 EarningsDocument14 pagesq3 Fy17 EarningsЂорђе МалешевићNo ratings yet

- NFLX 1Q07Document8 pagesNFLX 1Q07Brian BolanNo ratings yet

- Q3FY23 Duolingo Shareholder LetterDocument24 pagesQ3FY23 Duolingo Shareholder LetterrcossichNo ratings yet

- Final Q1 23 Shareholder LetterDocument15 pagesFinal Q1 23 Shareholder LetterMNo ratings yet

- 1Q16 - Quarterly ResultsDocument13 pages1Q16 - Quarterly ResultsSenthil KumarNo ratings yet

- July Investor Letter NetflixDocument17 pagesJuly Investor Letter NetflixTechCrunchNo ratings yet

- BigTech Analysis - Example AnswerDocument22 pagesBigTech Analysis - Example AnswerÚdita ShNo ratings yet

- MD&a NetflixDocument16 pagesMD&a NetflixMike SimpsonNo ratings yet

- Study Case Netflix'sDocument21 pagesStudy Case Netflix'sOda RetnoNo ratings yet

- Duolingo SHL Q22023Document23 pagesDuolingo SHL Q22023Alvaro CaminoNo ratings yet

- PTON Q3 2023 Shareholder Letter - VFDocument13 pagesPTON Q3 2023 Shareholder Letter - VFbhuvaneshNo ratings yet

- Storytel AB (Publ) - Interim Report January - September 2021 1Document21 pagesStorytel AB (Publ) - Interim Report January - September 2021 1Axel LiliedahlNo ratings yet

- Sales ForecastDocument2 pagesSales ForecastBerk BilgiçNo ratings yet

- Verifone Reports Results For The Fourth Quarter and Full Year Fiscal 2016Document28 pagesVerifone Reports Results For The Fourth Quarter and Full Year Fiscal 2016Atul VishwakarmaNo ratings yet

- Assumptions-1: Monthly CalculationDocument43 pagesAssumptions-1: Monthly CalculationRahmati RahmatullahNo ratings yet

- NFLXDocument7 pagesNFLXe39dinanNo ratings yet

- Joseph Carlson - Netflix ValuationDocument4 pagesJoseph Carlson - Netflix ValuationNicoletta MarianiNo ratings yet

- 2021 10 27 Life360 September 2021 Quarter 4C Final For ASXDocument12 pages2021 10 27 Life360 September 2021 Quarter 4C Final For ASXAlfred NgNo ratings yet

- Marketing Calendar TemplateDocument42 pagesMarketing Calendar Templateiamsudiro7674No ratings yet

- FIPP GDS Snapshot 2020 Q4 V1Document11 pagesFIPP GDS Snapshot 2020 Q4 V1HouNo ratings yet

- Lyon Real Estate Press Release June 2012Document2 pagesLyon Real Estate Press Release June 2012Lyon Real EstateNo ratings yet

- DCF Excel FormatDocument5 pagesDCF Excel FormatRaja EssakyNo ratings yet

- Suhani Maths IA-2Document12 pagesSuhani Maths IA-2nazmidhaNo ratings yet

- NFLX Q3 LetterDocument17 pagesNFLX Q3 LetterZerohedgeNo ratings yet

- SaaS Metrics DashboardDocument12 pagesSaaS Metrics DashboardalexmuiaNo ratings yet

- Upwork FinancialDocument19 pagesUpwork FinancialVvb SatyanarayanaNo ratings yet

- SM AssignmentDocument6 pagesSM AssignmentShaon Chandra Saha 181-11-5802No ratings yet

- PC2020 Mid Year ReportDocument9 pagesPC2020 Mid Year ReportKW SoldsNo ratings yet

- 4Q21 Earnings ReleaseDocument24 pages4Q21 Earnings ReleaseRichard May QuinteroNo ratings yet

- 1st Quarter 2003 Earnings Conference Call: Doreen A. TobenDocument41 pages1st Quarter 2003 Earnings Conference Call: Doreen A. TobenJohn LeeNo ratings yet

- Streamer Deal Analysis Case StudyDocument1 pageStreamer Deal Analysis Case StudyDS DSNo ratings yet

- Message AssignmentDocument11 pagesMessage AssignmentGurneet RandhawaNo ratings yet

- Meta Reports Fourth Quarter and Full Year 2021 ResultsDocument12 pagesMeta Reports Fourth Quarter and Full Year 2021 ResultsorvinwankeNo ratings yet

- Vingroup JSC (Vic) : Company Update BriefsDocument4 pagesVingroup JSC (Vic) : Company Update BriefsDBLNguyễn Thị Phương LinhNo ratings yet

- Equity Valuation Report - TwitterDocument3 pagesEquity Valuation Report - TwitterFEPFinanceClubNo ratings yet

- Asm 5285Document29 pagesAsm 5285AmitNo ratings yet

- Noida Holiday 202Document1 pageNoida Holiday 202AmitNo ratings yet

- NiluDocument1 pageNiluAmitNo ratings yet

- Circular 03 OrientationDocument3 pagesCircular 03 OrientationAmitNo ratings yet

- LSS - Project Book1Document10 pagesLSS - Project Book1AmitNo ratings yet

- ISB - PM - Week 5 - Required Assignment 5.3Document2 pagesISB - PM - Week 5 - Required Assignment 5.3AmitNo ratings yet

- The Influence of Packaging As A Promotional Tool in The Detergent IndustryDocument49 pagesThe Influence of Packaging As A Promotional Tool in The Detergent IndustryOgunwa Gerald100% (1)

- Quotation: Subject To Jamshedpur Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureDocument2 pagesQuotation: Subject To Jamshedpur Jurisdiction This Is A Computer Generated Quotation and Does Not Require Signaturepratap chauhanNo ratings yet

- Statistics of ManagementDocument7 pagesStatistics of ManagementSara PervezNo ratings yet

- Uef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentDocument39 pagesUef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentTrí Võ MinhNo ratings yet

- Channel Management - 14Document19 pagesChannel Management - 14dua khanNo ratings yet

- ERP Modules: Chapter (IDocument54 pagesERP Modules: Chapter (ISudhakar BolledduNo ratings yet

- Marketing AssignmentDocument8 pagesMarketing AssignmentSheikh Humayoun FaridNo ratings yet

- Joint and By-Product CostingDocument13 pagesJoint and By-Product CostingErlinda NavalloNo ratings yet

- Solution Manual For College Accounting A Contemporary Approach 5th Edition M David Haddock John Price Michael Farina 3Document7 pagesSolution Manual For College Accounting A Contemporary Approach 5th Edition M David Haddock John Price Michael Farina 3GregoryRussellajwd100% (51)

- Invoice PDFDocument1 pageInvoice PDFShreya AgarwalNo ratings yet

- Shiseido Case StudyDocument17 pagesShiseido Case StudyNaban NabanroyNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Lecture+1 MCQDocument5 pagesLecture+1 MCQjackywen1024100% (1)

- Twilight Lumina Company Recently Began Production of A New ProductDocument2 pagesTwilight Lumina Company Recently Began Production of A New ProductMiroslav GegoskiNo ratings yet

- ECON1268 Managerial and Business Economics: Lecture 7: MonopolyDocument42 pagesECON1268 Managerial and Business Economics: Lecture 7: MonopolyKim YếnNo ratings yet

- Content Company ProfileDocument60 pagesContent Company Profilepmcmbharat264No ratings yet

- Bsbmkg514A: Implement and Monitor Marketing ActivitiesDocument15 pagesBsbmkg514A: Implement and Monitor Marketing ActivitiesChunhui LoNo ratings yet

- Cash and Receivables: Chapter ReviewDocument6 pagesCash and Receivables: Chapter ReviewOmar HosnyNo ratings yet

- AM TRITONE-SSS-3068-Invoiced-2Document1 pageAM TRITONE-SSS-3068-Invoiced-2RYAN LEYBAGNo ratings yet

- PDF Chapter 5 MKT205 Lecture Notes & TutorialsDocument42 pagesPDF Chapter 5 MKT205 Lecture Notes & TutorialsFiruz AkhmadovNo ratings yet

- Ap Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)Document127 pagesAp Value Added Tax ACT - 2005: (As Amended by Act 4 of 2009)parul_shukla_1No ratings yet

- MP Reprt On Textile SectorDocument41 pagesMP Reprt On Textile SectorHuma AliNo ratings yet

- Pricing Products: Pricing Considerations, Approaches, and StrategyDocument32 pagesPricing Products: Pricing Considerations, Approaches, and StrategyJocky AryantoNo ratings yet

- Project Management Plan: "Development of Marketing Campaign For Heinz Ketchup"Document26 pagesProject Management Plan: "Development of Marketing Campaign For Heinz Ketchup"zehra_fz467886% (7)

- Invoiceto MeDocument1 pageInvoiceto MeC@9959836560No ratings yet

- Internship Report of Starco Fan LimitedDocument47 pagesInternship Report of Starco Fan Limitedbbaahmad89No ratings yet

- Coke Case StudyfinalDocument12 pagesCoke Case Studyfinalsherryl caoNo ratings yet

- Marginal Costing 2-ApplicationDocument11 pagesMarginal Costing 2-Applicationprapulla sureshNo ratings yet

- Global Immersion Project Group Italy Batch36Document5 pagesGlobal Immersion Project Group Italy Batch36Vineet PandeyNo ratings yet

- RM Final ProjectDocument17 pagesRM Final ProjectareebNo ratings yet