Professional Documents

Culture Documents

Value Added Tax

Value Added Tax

Uploaded by

Mhaybelle Jovellano0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

Value added tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views6 pagesValue Added Tax

Value Added Tax

Uploaded by

Mhaybelle JovellanoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

Value added tax ● Has been adopted in our country by

virtue of E.O No 273 (July 25, 1987),

effective January 1, 1988

(1) Tax Replaced

A. Preliminary topics

(a) Original sales tax imposed on sales

Value added tax (VAT) by manufacturers or producers of

goods or articles other tha those

● Is a consumption tax imposed at subject to exercise taxes;

every stage of the distribution (b) Subsequent sales (turnover) tax

process on the sale, barter, every sale after the original sale of

exchange, or lease of goods or taxable article

properties. (c) Advance sales tax imposed on the

importation of goods for business

Tax base of VAT use

(d) Compensating tax goods for non

● The tax based on the gross selling

business use

price or gross value in money of the

(e) Exercise taxes imposed on certain

goods or properties sold, bartered,

articles (videotapes, solvents,

or exchanged or the gross receipts

matches)

derived from the sale.

(f) Miller’s tax imposed on the

production or milling of certain

Nature of VAT agricultural products (sugar,

- Tax is called VAT because it is coconut)

imposed on the value not previously (g) Percentage taxes payable by

subjected to the VAT contractors, brokers, lessor of

personal property

(1) VAT is a privilege tax imposed by law

directly, not on the thing or services, but on (2) Advantages

the act (sale, barter, exchange or lease of

goods or properties) of the seller, transferor, (a) It eliminates the cascading problem

importer, or lessor, although the burden of experienced under the former sales

the tax is borne by the ultimate consumer. tax particularly the subsequent

(2) It is an ad valorem tax, the amount turnover tax because only the value

based on the gross selling price or value in added to the sale is subject thereto;

money (b) VAT is neutral between different

(3)It is an indirect tax. It may be shifted or goods, properties, and services or

passed on to the buyer, transferee, lessee, businesses because it applies to all

(4) It is ultimately a tax on consumption, persons and transaction at uniform

even though it is assessed on many levels rate

of transaction based on a fixed percentage. (c) Wider tax base

(d) Easy to administer

The Vat System (e) Payments are now based on the

output tax (VAT) and the input tax

(Tax credits) as supported by ➢ VAT registrable persons any persons

receipts who is required to register. (Exceed

(f) It is expected to generate large to 3M, but not yet registered)

revenues (3) Goods or properties refer to all tangible

and intangible

(3) Important features (4) Gross selling price means total amount

(a) All persons liable to the VAT shall of money or its equivalent which the

register with the appropriate revenue purchaser pays.

district officer

(b) It provided two rates: (1) 0% rate for Persons liable to VAT

export sales and sales and services;

(2) 12% for all other goods, Any persons who sells, barters, exchanges

properties, and services in the course of trade or business and any

(c) A VAT registered person is entitled persons who imports goods whether or not

to credit input taxes evidenced by a course of business is subject to the

VAT invoice VAT(liable to pay output VAT whether

(d) It is consumption type of VAT registered or not if his annual gross sales or

(e) Although the tax is levied at all receipt exceed 3M)

stages, the total value of the goods

is subject to tax only once

(f) The commissioner may suspend the C. Sale of Goods or properties

business operations and temporarily

close the business establishment of

taxpayer for violation of VAT law or Requisite for liability

regulations (didnt issue an invoice, (1) There must be a sale, barter,

didnt register, exceed to 3M) exchange, or lease in the Philppines

(2) The VATable transactio must involve

taxable goods properties

B. Imposition of the tax (transaction must not be VAT exemp

or zero rated)

Meaning of certain terms (3) The VATable transaction must be

(1) The term persons refer to any individual made by a taxable person in the

➢ Government owned or controlled course of business or trade

corporations are subject to VAT if the

course of trade or business they sell

goods or properties, import goods Activity in trade or business

etc The phrase “in the course of trade or

(2) Taxable persons any person liable for business” means the regular conduct or

the payment of the VAT, whether registered pursuit of a commercial or pursuit of a

or registrable commercial or an economic activity

➢ VAT registered persons refers to any

persons registered accordance with (1) Association dues, membership fees,

section 236. and other assessment/charges by

condominium corp are not subject to (1) Sales subject to 0% VAT - these sales by

VAT. VATregustered persons are subject to 0%

VAT

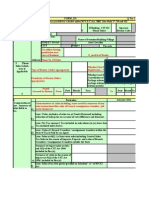

Rate and base of VAT on sale of goods or (a) Export sales made by VAT

properties registered persons

(b) Sales of goods or property to

(1) 12% VAT persons or entities who are tax

exempt under special laws or

Illustration: international agreements.

(2) Export sales

X sold an account to Y, 100 pieces or (a) The sale and actual shipment of

merchandise. The invoice given by X to Y is goods from the Philippines to foreign

as follows: country

(b) The sale of raw materials or

100 pieces Merchandise “X” P1,100 packaging materials to a nonresident

buyer for delivery to a resident local

In this case, X should segregate the amount export oriented. (export enterprise)

intended to cover the tax. The amount (c) The sale of raw materials or

intended to cover the tax is arrived at by packaging material export oriented

multiplying the total invoice amount by 1/11 enterprise whose enterprise whose

or: export sales exceed 70% total

P1,100 x 1/11 = P1,100 x1 / 11 = 100 annual production

(d) Transaction considered export sales

The resulting figure of 100 is the output tax under executive

which should be deducted from P1,100 to

arrive at the gross selling price of P1,000 (3) Need for prior application and BIR

without the tax approval

(4) Pertinent rules - to encourage to export

Based on 12% VAT the following product

computation may be used

P1,100 (gross sale) ÷ 1. 12 = 982.15 (net

Export sales under omnibus investment

sale)

code

982.15 x 12% = 117.85 (VAT)

(1) Considered export sales

982.15 + 117.85 = 1,100.00 (2) Considered constructive export

sales

Zero rated sale of goods or properties (a) Sales to bonded

manufacturing warehouse

A zero rated transaction refers to a sale, export-oriented

barter, exchange subject to VAT at the rate manufacturers

of 0% under section 106. The transaction is (b) Sales to export processing to

taxable for VAT proposes, with the input tax export processing zones

on purchases of goods, but such sale shall (c) Sales to enterprise duly

not result in any output tax accredited with the SBMA

(d) Sales to registered export

traders operating bonded (c) Sale of house and lot and other

trading warehouse supplying residential dwellings with a selling

raw materials price of 2M and below

(e) Sales to diplomatic missions (d) Lease of residential unit with

and other agencies monthly rental not exceeding 15K

(ambassador ng ibang bansa

0 rated) Transaction taxable as sales

1. Barter or exchange

Transaction involving real properties

2. Contract for a piece of work

(1) Persons liable to VAT (customize)

(a) Any person, whether natural 3. Leases and hiring agreements with

or juridical engaged in the option to buy

sale, barter or exchange or 4. Transactiondeemed sale

real properties in the ordinary ➢ Transfer, use or consumption

course of trade or business not in the course of business

(b) Real estate lessors or sub of the business of goods or

lessors properties originally intended

(c) Nonresident lessors of real for sale

property located in the the ➢ Distribution or transfer of

Philippines goods or properties

(d) Non stock, non profit ➢ Consignment of goods if

organizations engaged in the actual sale is not made within

sale, barter, exchange, or sixty days following the date

lease such goods were consigned

(e) Government , its agencies ➢ Retirement from or cessation

and instrumentalities of business, with respect to

including GOCCs engaged i inventories of taxable goods

the sale, barter, exchange, or existing as of such retirement

lease or cessation

(2) Transaction subject to VAT

➢ Sale of real property held Tax based of deemed sale transactions

primarily for sale customers

or held for lease in the (1) For transaction deemed sale, the

course of trade or business output tax shall be based on the

of the seller market value of the goods deemed

(3) Transaction not subject to VAT sold as of the time of the occurrence

(a) Sale of real property not primarily of the transaction enumerated above

held for sale to customers or held for (2) In the case of retirement from or

lease in the ordinary course of trade cessation of business, the tax base

or business of the seller shall be acquisition cost,or the

(b) Sale of real property utilized for low current market price of the goods or

cost and socialized housing properties, whichever is lower

(3) In the case of sale where the gross

Sales = 250,000,000

selling price is lower than fair market subject to

value, the actual market value shall VAT

be the tax base

Multiply = 12%

by:VAT rate

Retirement from or cessation of business

Change in or cessation of status as a VAT- Output tax = 30,000,000

for the

registered person

period

(1) Subject to output tax - the VAT

provided in section 106 on sale of Deduct: = =

goods or properties shall apply to Input tax for

goods or properties originally the period

intended for sale or use in business

● Change of business activity from

value added taxable status to

exempt status. (discontinued

business)

● Approval of request for cancellation

of registration due to reversion to

exempt status; Sale > 3M

Determination of tax base

(1) Two cases - the commissioner shall,

by rules and regulations prescribed

by sec of finance

(a) Where a transaction is

deemed a sale

(b) Where the gross selling price

is unreasonably lower than

the actual market value

(more than 30% yung

understatement)

(2) Gross selling price unreasonably low - if

it is lower by more than 30% of the actual

market value of the same goods or

properties of the same quantity and quality

Allowable deductions from gross selling

price

(1) Sales return and allowances

QUIZ

The difference between the two is that in

zero rated, the sales are 0%, so the input

tax is also 0%. However, because you

already paid for it (input tax) when you

purchased raw materials, etc., the VAT you

paid will be refunded and can be used to

pay other taxes. While tax exempt, you

cannot receive a VAT refund because you

have not paid any VAT because you are

exempt.

For example, when I purchased materials, I

paid P200 plus P24 VAT. If I am a VAT

registered exporter, the 24 pesos will be

refunded or used as a tax credit because

my sales will be zero-rated. However, if I am

exempted from paying VAT, I just pay 200

pesos because I will not pay the VAT and

hence have nothing to claim as a tax credit

or refund.

VAT is not considered a progressive tax, as

it imposes a greater burden on those with

lower incomes than on those with higher

incomes, making it a regressive tax.

However, the uniform and equitable

implementation of VAT, along with the

Congress's exemption of essential goods

and services consumed by those with lower

incomes, reduces the regressive nature of

VAT and allows it to remain constitutional.

You might also like

- Articles of Incorporation Merchandising Trading CompanyDocument3 pagesArticles of Incorporation Merchandising Trading CompanyAlex Felices100% (4)

- Best Buy Order DetailsDocument2 pagesBest Buy Order DetailsDr. Asif Rahman100% (1)

- 07 Business Tax and VATDocument5 pages07 Business Tax and VATlemvin121003No ratings yet

- Lecture 6 - Value-Added TaxDocument6 pagesLecture 6 - Value-Added TaxVic FabeNo ratings yet

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoNo ratings yet

- Lecture 6 - Value-Added TaxDocument7 pagesLecture 6 - Value-Added TaxPiyey LlarenaNo ratings yet

- VAT Handouts TaxDocument9 pagesVAT Handouts TaxRenmar CruzNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- Sarah ReviewerDocument20 pagesSarah ReviewerdoraemoanNo ratings yet

- Module 7 - Introduction To Business TaxesDocument6 pagesModule 7 - Introduction To Business TaxesKyrah Angelica DionglayNo ratings yet

- VAT Output TaxesDocument7 pagesVAT Output TaxesJocelyn Verbo-AyubanNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Effectively Zero-Rated SalesDocument2 pagesEffectively Zero-Rated Salesgeraldjohn.mondejarNo ratings yet

- Jpia-Hau: Business and Transfer TaxationDocument12 pagesJpia-Hau: Business and Transfer Taxationronniel tiglaoNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Princess ManaloNo ratings yet

- TX-301 Vat Subject Trans PDFDocument12 pagesTX-301 Vat Subject Trans PDFDea LingaoNo ratings yet

- VAT Input TaxesDocument7 pagesVAT Input TaxesJocelyn Verbo-AyubanNo ratings yet

- 04 Value - Added TaxDocument8 pages04 Value - Added TaxfelixacctNo ratings yet

- TAX-303 (Input Taxes)Document7 pagesTAX-303 (Input Taxes)Edith DalidaNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- Input Taxes SummaryDocument8 pagesInput Taxes SummaryMichael AquinoNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Introduction To Value Added TaxDocument5 pagesIntroduction To Value Added TaxNYSHAN JOFIELYN TABBAYNo ratings yet

- Chapter 2Document4 pagesChapter 2Trisha Mae BoholNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- Value Added Tax - Module ExercisesDocument8 pagesValue Added Tax - Module ExercisesChiarra ArceoNo ratings yet

- Tax 43 - Vat PayableDocument6 pagesTax 43 - Vat PayableFemie AmazonaNo ratings yet

- Chapter 1Document2 pagesChapter 1Trisha Mae BoholNo ratings yet

- CLWTAXN Value Added Tax NotesDocument8 pagesCLWTAXN Value Added Tax NotesReynelyn HabanNo ratings yet

- Vat & OptDocument14 pagesVat & OptDaphnie BoloNo ratings yet

- Bullet Notes 8 - Value Added TaxDocument10 pagesBullet Notes 8 - Value Added TaxFlores Renato Jr. S.No ratings yet

- TAX 301 VAT Subject Transaction 1Document9 pagesTAX 301 VAT Subject Transaction 1Jeen JeenNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesUbalda AbuboNo ratings yet

- Lec 7 - VATDocument82 pagesLec 7 - VATShaun LeeNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- Value-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayableDocument15 pagesValue-Added Tax: Who Are Liable To VAT? Formula in Computing Vat PayablePrimo WilliamsNo ratings yet

- Tax 303 - Input VatDocument7 pagesTax 303 - Input VatiBEAYNo ratings yet

- Module 2. Lesson 1. Value Added TaxDocument34 pagesModule 2. Lesson 1. Value Added TaxJoy RubioNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxJune Romeo ObiasNo ratings yet

- Notes On VATDocument15 pagesNotes On VATRica BlancaNo ratings yet

- Input VatDocument3 pagesInput Vatyatot carbonelNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- Tax ReviewerDocument8 pagesTax ReviewerCharina NipesNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument11 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesJune Baricanosa AlvarezNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- PM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Document22 pagesPM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Riel Picardal-VillalonNo ratings yet

- Module Author: Charles C. Onda, MD, CpaDocument9 pagesModule Author: Charles C. Onda, MD, CpaCSJNo ratings yet

- Value-Added Tax: Vat On Sale of Goods or PropertiesDocument12 pagesValue-Added Tax: Vat On Sale of Goods or PropertiesWin TambongNo ratings yet

- TAX 301 VAT Subject TransactionsDocument9 pagesTAX 301 VAT Subject TransactionsMyrrielNo ratings yet

- VatDocument22 pagesVatFarhani Sam RacmanNo ratings yet

- Value Added Tax: Output Tax Less Input Tax VAT PayableDocument26 pagesValue Added Tax: Output Tax Less Input Tax VAT PayableRon RamosNo ratings yet

- Vat - Ransfer & Business Taxation Enrico D. TabagDocument30 pagesVat - Ransfer & Business Taxation Enrico D. TabagJhon baal S. SetNo ratings yet

- Introduction To Business Taxes 2022Document17 pagesIntroduction To Business Taxes 2022Trisha Mae BoholNo ratings yet

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDocument13 pagesExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- Microfinance ROITO CANTIKA SINAGA C0C019009Document6 pagesMicrofinance ROITO CANTIKA SINAGA C0C019009Franita FauziantiNo ratings yet

- Amazon Easysell MarchDocument23 pagesAmazon Easysell MarchBala Krishna100% (1)

- Assignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreDocument2 pagesAssignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreKris Tine100% (1)

- Online Lecutre 1Document21 pagesOnline Lecutre 1Dinar HassanNo ratings yet

- Bba G Unit-II Pm-302 E-NotesDocument13 pagesBba G Unit-II Pm-302 E-Notesbba01624201719No ratings yet

- 2 New HSS 101Document29 pages2 New HSS 101Aviraj KhareNo ratings yet

- GST - It's Meaning and ScopeDocument11 pagesGST - It's Meaning and ScopeRohit NagarNo ratings yet

- Role of Stakeholder in Supply ChainDocument19 pagesRole of Stakeholder in Supply ChainAbdullah ButtNo ratings yet

- Sun PharmaDocument24 pagesSun PharmaMaanhvi Ralhan0% (1)

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Why Do Change Management Initiatives FailDocument4 pagesWhy Do Change Management Initiatives FailNkvNo ratings yet

- ConnectPay UABDocument17 pagesConnectPay UABAhmer HussainNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Dciq-De2d2-211153 245781 Phinia Pelado Manual 20240508Document15 pagesDciq-De2d2-211153 245781 Phinia Pelado Manual 20240508Ingenieria 1 PROTEAMNo ratings yet

- MAF661 Test 1 2017 September Question & SolutionDocument5 pagesMAF661 Test 1 2017 September Question & SolutionNadiah NajjibNo ratings yet

- 2022 2 Bbac 322 ExamDocument18 pages2022 2 Bbac 322 ExamsipanjegivenNo ratings yet

- II.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Document1 pageII.A.1 San Miguel Brewery Sales v. Ople, February 8, 1989Jin AghamNo ratings yet

- Updated Blackstone Agency Rate Card 2021Document16 pagesUpdated Blackstone Agency Rate Card 2021Arief Al FirdausyNo ratings yet

- Punjabi Universty Patiala: A Project Report ONDocument30 pagesPunjabi Universty Patiala: A Project Report ONJas DhillonNo ratings yet

- Nimesh Gupta SIP ProposalDocument3 pagesNimesh Gupta SIP ProposalNimesh guptaNo ratings yet

- Nishat Tasnim (ID - 60)Document37 pagesNishat Tasnim (ID - 60)Hasimuddin TafadarNo ratings yet

- GGRM - LK TW IiiDocument41 pagesGGRM - LK TW Iiianggi gayoNo ratings yet

- Marketing AnalyticsDocument9 pagesMarketing AnalyticsNeha PalNo ratings yet

- ABM 12 BESR Week 2Document19 pagesABM 12 BESR Week 2Victoria Quebral CarumbaNo ratings yet

- Linear Programming-Example On MarketingDocument13 pagesLinear Programming-Example On Marketingmandeep_tcNo ratings yet

- Module 2 Project - The Accounting Cycle of A Service BusinessDocument6 pagesModule 2 Project - The Accounting Cycle of A Service BusinessNadaineNo ratings yet

- CH 2Document16 pagesCH 2Naina GargNo ratings yet