Professional Documents

Culture Documents

ABM 1 Drillsheet#6

ABM 1 Drillsheet#6

Uploaded by

Johanna Lyn Inocencio0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesABM 1 Drillsheet#6

ABM 1 Drillsheet#6

Uploaded by

Johanna Lyn InocencioCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

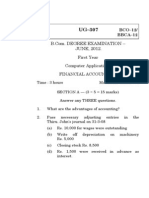

O.B.

Montessori Center

SENIOR HIGH SCHOOL

FIRST SEMESTER 2023-2024

DRILLSHEET#6

ABM 1: Fundamentals of Accountancy, Business, and Management

Name: _________________________Level / Sec.: __________ Date: _______

Teacher:________________________Campus:_____________ Score:_______

Directions: Using the Trial Balance Information given below, adjust the following transactions of

ABC Food Corp. at the end of December 31, 2017.

Additional Information:

1. It is estimated that 10% of the Service Revenue is doubtful accounts.

2. The truck was purchased last November 1, 2017. It has a scrap value of 300,000 and 5 years

of useful life.

3. Mr. Lee paid 480,000 in advance for 1-year monthly food supplies which was recorded to

Unearned Service Revenue. Delivery starts on November 15, 2017.

4. ABC Food Corp. issued a check worth 100,000 on June 31, 2017. It has a 10% interest

per annum.

5. Interest from the outstanding notes payable is 50,000 at December 31, 2017. The business

intends to pay it on January 2, 2018.

6. The remaining office supplies left unused is 33% of the recorded value in the trial balance.

7. 100,000 of the outstanding Accounts Receivable bears a 15% interest which is to be paid

within by June 30, 2018. The start of the accrual is October 21.

8. Insurance bill for 10,000 was sent to the business December 31, 2017.

9. The office equipment has an estimated useful life of 3 years. It was purchased on February

28, 2017.

10. Accrued 30-day salaries are to be paid on January 20, 2018. For the 30-day salaries, the cut-

off period of January 20 pay is from December 15 to January 15. The business has 7

employees.

You might also like

- (NEW) Assessment II - FinanceDocument13 pages(NEW) Assessment II - FinanceCindy Huang50% (8)

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaNo ratings yet

- Cas Dip Ge b1 (Final Exam)Document2 pagesCas Dip Ge b1 (Final Exam)John Michael Zamoras100% (2)

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- MODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINALDocument4 pagesMODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINALmimi96No ratings yet

- BNS01 RS1 in 44 Internship 3 1 Participant Form STDDocument3 pagesBNS01 RS1 in 44 Internship 3 1 Participant Form STDihdaNo ratings yet

- Drill Sheet # 8Document2 pagesDrill Sheet # 8Johanna Lyn InocencioNo ratings yet

- Learning Activity Sheet 4.2Document2 pagesLearning Activity Sheet 4.2Melu Jean MayoresNo ratings yet

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhNo ratings yet

- Final Examination GenMath Q2 Setb HUMSS & ABMDocument2 pagesFinal Examination GenMath Q2 Setb HUMSS & ABMMarjon GarabelNo ratings yet

- Problem # 17.7Document2 pagesProblem # 17.7Glomarie GonayonNo ratings yet

- Final Examination GenMath Q2 Seta HUMSS & ABMDocument3 pagesFinal Examination GenMath Q2 Seta HUMSS & ABMMarjon GarabelNo ratings yet

- Corporate Reporting November 2017 ExamDocument16 pagesCorporate Reporting November 2017 ExamAlyssa AuNo ratings yet

- Financial Accounting Part 3 Quiz 1Document1 pageFinancial Accounting Part 3 Quiz 1Jenica Joyce Bautista100% (1)

- AllDocument21 pagesAllmanojkumar235100% (1)

- Employee Loan AppDocument3 pagesEmployee Loan AppZeshan IqbalNo ratings yet

- Final Exam FgeDocument5 pagesFinal Exam FgetelilaalilemlemNo ratings yet

- Activity 6 Deferred AnnuityDocument1 pageActivity 6 Deferred AnnuityKenshin LuatNo ratings yet

- Emilee Boddery ResumeDocument1 pageEmilee Boddery Resumeapi-302405849No ratings yet

- Sample Promissory NoteDocument1 pageSample Promissory NoteJoseph BatonNo ratings yet

- Finals - QuestionsDocument3 pagesFinals - QuestionsClarence RevadilloNo ratings yet

- Financial Accounting Part 1Document5 pagesFinancial Accounting Part 1Christopher Price100% (1)

- Title I Grant Request For Services v5 12 15 092Document8 pagesTitle I Grant Request For Services v5 12 15 092api-134134588No ratings yet

- Ulep - Future ValueDocument4 pagesUlep - Future ValueNoel BajadaNo ratings yet

- Following Is The Unadjusted Trial Balance For Augustus Institute AsDocument1 pageFollowing Is The Unadjusted Trial Balance For Augustus Institute Astrilocksp SinghNo ratings yet

- Department Exam StationeryDocument2 pagesDepartment Exam StationeryVL DadangNo ratings yet

- Activity: Notes PayableDocument3 pagesActivity: Notes PayablePiaNo ratings yet

- First Draft Business PlanDocument35 pagesFirst Draft Business PlanĐoàn Nhâm TânNo ratings yet

- Addiction Professionals Certification Board, Inc.: Educational ManualDocument42 pagesAddiction Professionals Certification Board, Inc.: Educational ManualLeonNo ratings yet

- Ecs New Form LicDocument4 pagesEcs New Form LicAtul Thakur0% (1)

- Draft Client Service AgreementDocument9 pagesDraft Client Service Agreementkumar pcNo ratings yet

- MAC001 Examination Guideline S3 2018Document4 pagesMAC001 Examination Guideline S3 2018josephNo ratings yet

- Standing InstructionDocument1 pageStanding InstructionbidyuttezuNo ratings yet

- The Following Unadjusted Trial Balance Is For Ace Construction CoDocument1 pageThe Following Unadjusted Trial Balance Is For Ace Construction Cotrilocksp SinghNo ratings yet

- 125.230 Test1 - (0801)Document6 pages125.230 Test1 - (0801)Tong PanNo ratings yet

- Request For Authority To Open A Bank Account For Non - Iu SchoolDocument1 pageRequest For Authority To Open A Bank Account For Non - Iu SchoolJoan DalilisNo ratings yet

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECNo ratings yet

- HOSP1860 4 AdjustingtheaccountsDocument6 pagesHOSP1860 4 AdjustingtheaccountsLule RamaNo ratings yet

- UG307 BCO12-bbca12Document6 pagesUG307 BCO12-bbca12Vignesh KumarNo ratings yet

- SITXFIN004 - Student Assessment v2.0Document15 pagesSITXFIN004 - Student Assessment v2.0Heloisa GalesiNo ratings yet

- Xii One Mark Questions 23 - 24Document5 pagesXii One Mark Questions 23 - 24Lalitha BalajiNo ratings yet

- 2017 Further Mathematics Year 12 Financial Modelling TaskDocument7 pages2017 Further Mathematics Year 12 Financial Modelling Tasksaumyaixlm0016No ratings yet

- LAS Q2 Gen Math Week 3-4 - Simple and General AnnuitiesDocument3 pagesLAS Q2 Gen Math Week 3-4 - Simple and General AnnuitiesFlor LegaspiNo ratings yet

- AcSIR-SACC Form PDFDocument1 pageAcSIR-SACC Form PDFamanNo ratings yet

- SACC FormDocument1 pageSACC FormaswinswarrierNo ratings yet

- Re Registration FormDocument1 pageRe Registration Formeithinzarko19941994No ratings yet

- A 17 QuizDocument5 pagesA 17 QuizLei0% (1)

- Refund of Fee Preforma 5th DraftDocument1 pageRefund of Fee Preforma 5th DraftSyed FaisalNo ratings yet

- Executive Summary: ". During MyDocument49 pagesExecutive Summary: ". During MyAjay KaundalNo ratings yet

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- Reversing EntriesDocument5 pagesReversing EntriesRizky AjiNo ratings yet

- Non Profit Questions EdexcelDocument35 pagesNon Profit Questions EdexcelNipuni PereraNo ratings yet

- Auto Debit FormDocument2 pagesAuto Debit FormEmir SalimNo ratings yet

- Job DescriptionDocument1 pageJob Descriptionkiar rerisyaNo ratings yet

- FormDocument5 pagesFormAbhishekNo ratings yet

- Research Centre For Modeling & Simulation (RCMS) : Application For Withdrawal of Original Academic DocumentsDocument1 pageResearch Centre For Modeling & Simulation (RCMS) : Application For Withdrawal of Original Academic DocumentsZeeshan KhanNo ratings yet

- Internship 3+1 Participant Registration: WebsiteDocument2 pagesInternship 3+1 Participant Registration: WebsiteFifi valentineNo ratings yet

- Revised Butajira District Annual Plan Naration 2016 17Document6 pagesRevised Butajira District Annual Plan Naration 2016 17costw7520No ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet