Professional Documents

Culture Documents

FundNews Second Edition 2013

FundNews Second Edition 2013

Uploaded by

leeracrownOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FundNews Second Edition 2013

FundNews Second Edition 2013

Uploaded by

leeracrownCopyright:

Available Formats

fundnews

Second Edition 2013

The quarterly newsletter for pensioners of the Government Employees Pension Fund

Payment of Tax Directives: Unsecured Lending

pension benefits All you need to know – It can be a TRAP!

PAGE 2 PAGE 4 PAGE 8

Welcome Life Certificates – No need to confirm Life Status

We are proud to announce that your A new system has replaced the Life

pension fund is growing and going from Certificate and it is called Auto-Life

strength to strength. GEPF received the Verification (ALV). Basically this means

inaugural Africa investor African Pension that pensioners no longer need to visit a

Fund Initiative of the Year award. Commissioner of Oaths to confirm their

life status. The ALV system does this

The awards took place at the New York in conjunction with the Department of

Stock Exchange in September. We hope Home Affairs.

that you are as proud as we are to be part P3

of such a wonderful fund. Did you know

that the GEPF is the largest investor in Scan this QR Code and go straight to our website

JSE-listed companies?

If you have a smartphone or tablet, you can use the built-

We at the Government Employees Pension in camera to scan this code, which will direct you to our

Fund strive to be the best in all we do. We website. If you have an iPad, Samsung Galaxy Tablet,

hope this newsletter will help you to learn iPhone, Samsung smartphone, or any other smartphone,

in the Appstore search for Scan – QR Code and Barcode.

more about your fund’s progress and the

It is a free download and really easy to use.

benefits we offer.

Scan CODE

Do you like the Your opinions and inputs are important to

new-look newsletter? us, so please send your suggestions to:

Please let us know if you like GEPF’s new-look The Editor, GEPF Communication,

newsletter by sending us your comments. The

Private Bag X63, Pretoria, 0001

best letter will be published in the next edition

and the author will win a GEPF-branded gift.

Call Centre - 0800 117 669 www.gepf.co.za

GEPF and its Principal awarded

for thei r e xcep ti o n a l busi ness pr acti ces

Dear GEPF member

We are very proud to be able to inform you

that GEPF was awarded the first Institutional

Investor of the Year Award at the Africa investor

(Ai) Investment and Business Leader Awards

held on Friday, 10 October 2013 at a gala

event in New York. While this award is itself a

very notable achievement, GEPF’s Principal

Executive Officer, John Oliphant, was also

named Up and Coming Future Leader of the

Year by Ai.

The international Africa investment (Ai)

Awards were created to reward outstanding

business practices, economic achievements

and investments across Africa, recognising

the institutions and individuals improving the

continent’s investment environment.

John Oliphant

Mr Oliphant feels that, as Africa’s largest pension fund, GEPF has a responsibility to ensure

its investments serve the long-term interests of all of its stakeholders and make significant

and sustainable contributions to the infrastructure and development of Africa.

For GEPF, receiving these two awards means that the investment community is recognising,

in Mr Oliphant’s words, “The valuable work we are doing.”

The winning of this award shows the strength and importance of the pension fund of which

you are a member. It also further shows that the Fund is administered in a way that is

sustainable and that is helping to grow both our country and our continent.

Thank you for taking part

in pensioner Board member elections

During the last few months GEPF’s pensioners have been involved in

the process of electing their representatives to sit on GEPF’s Board

of Trustees through a postal ballot. This process has been completed

and we would like to thank everyone who participated for their efforts.

The successful candidates were Dr Frans le Roux, who was re-

elected as a Trustee, and Mr Cornelius Booyens, who was elected

as the alternate Trustee. In our next newsletter, we explore the Board

and their responsibilities in more detail.

2 fundnews | Second Edition 2013

Pay ment of pensi on benefits

– don’t be fooled by rumours

An unfounded rumour is spreading

regarding GEPF pension payments.

It is important for all GEPF members

and pensioners to know that GEPF

will continue to pay all benefits due

to members leaving according to the

rules. This means that those who are

entitled to a once-off lump sum payment

will receive this payment, while those

entitled to a monthly pension over and

above the once-off lump sum payment

will receive this money.

There are very strict rules about the

kind of benefits that GEPF must pay

and how the money collected must be

invested and safeguarded. These rules

are spelled out in a special law called

the Government Employees Pension

(GEP) Law. The aim of this law and the Your benefits

are guaranteed

rules that guide the Fund is to ensure

that GEPF puts the interests of its

members first at all times.

All GEPF benefits are defined in the GEP Law and

rules, which is why GEPF is called a defined benefit

fund. The advantage of belonging to a defined

benefit fund is that the benefits are guaranteed.

You, as a GEPF member, whether an active

member or pensioner member, will never receive

less than the benefits that you qualify for according

to the law and the rules.

Your pensions are safe:

GEPF is financially sound.

There is no cause to fear

that your benefits will not

be paid going into the

future.

3 fundnews | Second Edition 2013

Auto-Life Verification (ALV)

means no more Life Certificates

In line with GEPF’s mission of improving services and

ensuring timely and efficient delivery of benefits, the

Fund’s Board of Trustees endorsed the replacement

of the manual issuing of Life Certificates to pensioners

residing in South Africa with an automatic update of the

life status, with effect from 1 October 2011.

The new system is called Auto-Life Verification (ALV),

and it confirms a pensioner’s life status in conjunction

with the Department of Home Affairs. Pensioners who

are in possession of a valid South African identity

document and who live in South Africa on a full time

basis therefore no longer receive Life Certificates from

GEPF.

This means that these pensioners are no longer

WHAT DOES ALV required to physically visit a Commissioner of

Oaths to confirm their life status in order to continue

MEAN FOR ME? receiving their monthly pension payment (their

annuity). Only pensioners who live outside the borders

It means that you don’t need to

go to Home Affairs to carry on of South Africa and those whose status cannot be verified

receiving your pension – with the Department of Home Affairs continue to receive

a paper-based Life Verification form which still needs to

Who cannot use ALV? be completed and certified by a Commissioner of Oaths.

• People outside South Africa All pensioners/annuitants receiving the Life Verification

• People without a form will only receive one form per annum regardless of

South African ID the number of benefits they receive from GEPF.

Our offi ces w ill be

closi ng ov er December

Our offices will be closed from the 27th to the

31st of December 2013. If you have any queries or

concerns that need to be addressed to our offices,

please keep this in mind.

4 fundnews | Second Edition 2013

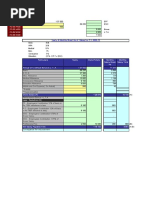

Tax directives:

an integral part of GEPF’s processes

TAX DIRECTIVE

A document that tells your pension fund how much tax you owe to SARS

What is a Why is it

tax directive? important to GEPF?

A tax directive is issued by the South In order to pay lump sum benefits, we first

African Revenue Services (SARS) to need to receive a tax directive from SARS.

instruct a pension fund on how much The process of requesting and receiving

tax to deduct from lump sum payments these directives is thus fundamentally

(gratuities). important to our operations.

How does What does this mean

the process work? for GEPF Pensioners?

SARS has an automated system in place GEPF is required to pay tax directly to

that allows external organisations, like SARS based on the amount stated in the

GEPF, to request tax directives. Such tax directive. The Fund does not decide

organisations submit files that contain how much tax needs to be paid and it is

requests for directives to SARS. The required by law to deduct the amount

directive request is then evaluated before payment. This can delay payment

based on the status of the taxpayer. of benefits and so we request that you

SARS then responds, letting the Fund keep your tax affairs in order to ensure

know what must be done. the fast and efficient payment of benefits

from GEPF.

If there is any tax that needs to

be paid according to SARS, it is

deducted from the lump sum and is

paid directly to SARS.

5 fundnews | Second Edition 2013

Don’t fall into

the unsecured lending trap

When you’re looking to take out loans in South Africa, you

have two choices: secured or unsecured. Secured

loans are those that you provide security for in the form of

an asset (your house or your car). If you default (are unable

to pay), the credit provider can sell the asset to make up the

outstanding amount. When a loan is unsecured, it means

that you provide no security, only the promise that you’ll pay

back the loan amount, however, the penalties of not repaying

the loan are very harsh.

SECURED UNSECURED

You provide security – an asset – to No security provided

promise you will repay the loan. If High interest rates

you do not repay the loan, the asset

is taken instead.

Very risky!

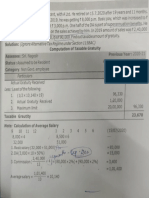

There was once a time when an unsecured The interest charged on unsecured loans has

loan was only used as an ‘emergency’ loan also increased. If you borrowed R10,000 in

that you needed for a necessary but usually 2007, your interest charges would be R5,800.

unexpected expense. Today, it is a debt trap. So you would pay back R15,800. For example,

Moneylenders (loan sharks, mashonisa), if today you borrowed R10,000 to put down as

including banks, are now giving cash as a deposit on a car or house, your total interest

unsecured loans at very high interest rates charges would be R10,200 – that is 77% more.

and not just for emergencies. They know So you would pay back R20 200 in total.

you will pay because they have very strict

collection methods. Reasonable borrowing costs should be around

13.5% (prime + 5%) per year and the time to pay

Five years ago, the average amount that it off would be 42 months . When you take an

someone borrowed on an unsecured loan unsecured loan, the moneylenders charge

was R5,000 . The average time to pay this an average interest of 40%. If you are unable

off was about 29 months. Today, the average to make payments, then the moneylenders will

amount being borrowed is R12,000 to be paid charge you additional costs, increasing your

off over 48 months. This is good business for debt. You can see what a big debt trap these

the moneylenders, and it is growing. loans are.

6 fundnews | Second Edition 2013

One of the ways that the moneylenders The National Credit Regulator (NCR) is

make sure that you pay them back is there to help you understand the dangers

called a ‘garnishee order’ or ‘emolument of unsecured lending. However, if you are

attachment order’ (EAO). This means that having a problem with unsecured loans or

the moneylender takes what is owed directly are thinking of taking out an unsecured loan,

from your salary every month or week before first talk to your human resources manager

you are paid. This is dangerous for you and at work. The best advice you can take is to

can mean that you will not be able to buy rather save up for what you need and then

basic household items. buy it for cash — and avoid the trap of an

unsecured loan.

If you do not pay back an unsecured loan, you

may lose your whole salary!

Source: Mazi Visio Management Company– Unsecured Lending Presentation to GEPF (2013:9)

Source: Mazi Visio Management Company– Unsecured Lending Presentation to GEPF (2013:9)

Source: Mazi Visio Management Company– Unsecured Lending Presentation to GEPF (2013:24)

Keeping in touch with our progress

Mobile offices

GEPF’s mobile offices continue to service members around the country,

including those living in rural areas. Notification of the location of the mobile

offices are advertised in the press so keep an eye out for our visit to your area!

Call Centre technology changes

GEPF is improving its Call Centre by implementing state-of-the-art technology

and offering training to staff to enable them to provide a higher level of customer

service to callers. To experience these changes yourself, feel free to contact

the Call Centre on 0800 117 669.

New security software implemented

GEPF transfers important personal information to banks, SARS, medical aids

and the Post Office on a daily basis. In order to ensure that this information is

safe from intervention, new software and systems have been deployed.

DISCLAIMER

The information provided in this document is protected by applicable intellectual property laws and cannot be copied, distributed or

modified for commercial purposes. While every effort has been made to ensure that the information contained herein is current, fair

and accurate, this cannot be guaranteed. The use of this information by any third party shall be entirely at the third party’s discretion

and is of a factual nature only. The information contained herein does not constitute financial advice as contemplated in terms of

the Financial Advisory and Intermediary Service Act, 2002. GEPF does not expressly or by implication represent, recommend or

propose that products or services referred to herein are appropriate to the particular needs of any third party. GEPF does not accept

any liability due to any loss, damages, costs and expenses, which may be sustained or incurred directly or indirectly as a result of

any error or omission contained herein.

7 fundnews | Second Edition 2013

OUR Offices

HEAD OFFICE Mpumalanga Port Elizabeth

(Gauteng: Pretoria) 19 Hope Street Ground Floor, Kwantu Towers

Ciliata Building Sivuyile Mini-Square, next to City

34 Hamilton Street Block A, Ground Floor Hall

Arcadia Nelspruit

Pretoria Mthatha

North West 2nd Floor, PRD Building

PROVINCIAL OFFICES Mmabatho Mega City Cnr Sutherland & Madeira Streets

Eastern Cape Office No. 4/17

No. 12, Global Life Ground Floor, Entrance 4 Durban

Office Centre Mafikeng 8th Floor, Salmon Grove

Circular Drive Chambers

Bhisho Northern Cape 407 Anton Lembede Street

11 Old Main Road

Free State Kimberley OUR CONTACT DETAILS

No. 2 President Brand Street

Toll free no: 0800 117 669

Bloemfontein Western Cape

Fax: 012 326 2507

21st Floor, No. 1

KwaZulu-Natal Thibault Square

Web address:

3rd Floor, Brasfort House Long Street www.gepf.co.za/www.gepf.gov.za

262 Langalibalele Street Cape Town

Pietermaritzburg E-mail:

SATELLITE OFFICES enquiries@gepf.co.za

Limpopo Johannesburg

87(a) Bok Street 2nd Floor, Lunga House, Postal address:

Polokwane 124 Marshall Street (Cnr GEPF Private Bag X63

Marshall & Eloff – Pretoria

Gandhi Square Precinct)

Marshalltown

You might also like

- FGPL Rsa BrochureDocument6 pagesFGPL Rsa BrochureAnonymous nqukBeNo ratings yet

- FWD All Set and All Set Higher Investment-Linked Insurance Brochure V3.0 June 2023Document7 pagesFWD All Set and All Set Higher Investment-Linked Insurance Brochure V3.0 June 2023lozaritasunshine0921No ratings yet

- 23.06.16 OLDMUTUAL Ecoretire Brochure (1) - 1Document4 pages23.06.16 OLDMUTUAL Ecoretire Brochure (1) - 1Asante LeslieNo ratings yet

- EEA Fact Sheet April 2010Document2 pagesEEA Fact Sheet April 2010maxamsterNo ratings yet

- CPF: How It Works: Pension Reforms Gather Pace As Demands GrowDocument1 pageCPF: How It Works: Pension Reforms Gather Pace As Demands GrowpaulineNo ratings yet

- SuperannuationDocument28 pagesSuperannuationMOHIT NagpalNo ratings yet

- Prospective of Moyofade Microfinance Bank LimitedDocument12 pagesProspective of Moyofade Microfinance Bank LimitedOLAGBOYE ADESANYANo ratings yet

- Example Transactional ReportDocument31 pagesExample Transactional ReportShivanan SinghNo ratings yet

- Personal Plan: Product Disclosure StatementDocument28 pagesPersonal Plan: Product Disclosure StatementNick KNo ratings yet

- PDS PersonalDocument28 pagesPDS PersonalgnajsgnjllvmvlmklvmNo ratings yet

- GHD Superannuation Plan: Product Disclosure StatementDocument32 pagesGHD Superannuation Plan: Product Disclosure StatementNick KNo ratings yet

- Proposal - Fixed Term Deposits Living Word AssemblyDocument5 pagesProposal - Fixed Term Deposits Living Word AssemblySolomon nkusiNo ratings yet

- Money Matters PDFDocument24 pagesMoney Matters PDFBhavesh PatelNo ratings yet

- Loan Money: Big % Interest Zero% InterestDocument26 pagesLoan Money: Big % Interest Zero% InterestJonathan DelaCruz ReNo ratings yet

- Australiansuper: Product Disclosure StatementDocument32 pagesAustraliansuper: Product Disclosure StatementAybenNo ratings yet

- PDS PublicSectorDocument16 pagesPDS PublicSectorNick KNo ratings yet

- Investment ProposalDocument13 pagesInvestment ProposalAzly MnNo ratings yet

- Columban College, Inc.: Effectivity of Provident Fund Among Nicera Employees of Subic Bay Freeport ZoneDocument8 pagesColumban College, Inc.: Effectivity of Provident Fund Among Nicera Employees of Subic Bay Freeport ZoneBenedict Patrick PeñaNo ratings yet

- MphasisDocument4 pagesMphasisAngel BrokingNo ratings yet

- PDS SuperOptionsDocument32 pagesPDS SuperOptionsNick KNo ratings yet

- Internship Report'S: Submitted ToDocument27 pagesInternship Report'S: Submitted Toalichampion68No ratings yet

- PRUlink Funds Report 2010Document367 pagesPRUlink Funds Report 2010Su PeiNo ratings yet

- Benflex Brochure 2023 - 2024Document22 pagesBenflex Brochure 2023 - 2024ANo ratings yet

- MGFP Brochure Tcm47 73025Document14 pagesMGFP Brochure Tcm47 73025gargdiya0823No ratings yet

- IMG Member BenefitsDocument42 pagesIMG Member BenefitsEthan RobNo ratings yet

- Australiansuper: Product Disclosure StatementDocument32 pagesAustraliansuper: Product Disclosure StatementNick KNo ratings yet

- Staff Benefits Brochure - January 2019 - 3 Columns - FINALDocument6 pagesStaff Benefits Brochure - January 2019 - 3 Columns - FINALnoel_manroeNo ratings yet

- SB UITF PresentationDocument12 pagesSB UITF PresentationJoya Labao Macario-BalquinNo ratings yet

- Equity Mutual Fund 10 SIPs That Made Equity MutuDocument1 pageEquity Mutual Fund 10 SIPs That Made Equity MutudrhimanshuagniNo ratings yet

- Australiansuper Select: Product Disclosure StatementDocument16 pagesAustraliansuper Select: Product Disclosure StatementNick KNo ratings yet

- New Sanima Multipurpose Cooperative Limited Business Profile 2023Document10 pagesNew Sanima Multipurpose Cooperative Limited Business Profile 2023vivek yadavNo ratings yet

- The Indian Employee PF Black BoxDocument9 pagesThe Indian Employee PF Black BoxdhanasekarenNo ratings yet

- Goaltrust PDFDocument16 pagesGoaltrust PDFbri teresiNo ratings yet

- AFPF FSCreditGuide 2019Document12 pagesAFPF FSCreditGuide 2019mybaggageNo ratings yet

- Jubilee Life InsuranceDocument26 pagesJubilee Life InsuranceAfrah Choudary100% (1)

- Citizens Charter - Provident Benefits Claim - May 2016Document13 pagesCitizens Charter - Provident Benefits Claim - May 2016Louie RamosNo ratings yet

- I-Great TerasDocument23 pagesI-Great Terasapi-240706460No ratings yet

- Vanguard Key FeaturesDocument12 pagesVanguard Key FeaturesRocketNo ratings yet

- Vanguard Key FeaturesDocument12 pagesVanguard Key FeaturesTara L T MsiskaNo ratings yet

- Partnership Deed FormatDocument56 pagesPartnership Deed Formatumair iqbalNo ratings yet

- Prop Ae771263afd9bjptDocument7 pagesProp Ae771263afd9bjptPenielle SaguindanNo ratings yet

- Super Choice - Fund Nomination Form PDFDocument1 pageSuper Choice - Fund Nomination Form PDFsachin.patel240996No ratings yet

- HDFC 2Document41 pagesHDFC 2Anonymous o4dzRfNo ratings yet

- Group 1 BDO MOTORTRADE TOYOTA 1Document63 pagesGroup 1 BDO MOTORTRADE TOYOTA 1Julla Agnes EscosioNo ratings yet

- No Endowment No ULIPsDocument15 pagesNo Endowment No ULIPsApacheBullNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsWilson ManyongaNo ratings yet

- Misc. Information Regarding Provident Fund ImpDocument3 pagesMisc. Information Regarding Provident Fund Impajit25singhNo ratings yet

- Essential SuperDocument16 pagesEssential SuperJrNo ratings yet

- SaveNGrow Online LeafletDocument2 pagesSaveNGrow Online LeafletAmit Kumar KandiNo ratings yet

- Interim ReportDocument17 pagesInterim Report1906ankitNo ratings yet

- History and Definition of ENGRO RUPIYADocument10 pagesHistory and Definition of ENGRO RUPIYAZeeshan MehdiNo ratings yet

- Interim Report 15Document14 pagesInterim Report 15Prasant Kumar PradhanNo ratings yet

- Australian Super BrochureDocument4 pagesAustralian Super Brochurehail capiralNo ratings yet

- Health Saver Brochure 6may ICICI PrudentialDocument12 pagesHealth Saver Brochure 6may ICICI Prudentialrajeshtripathi2004No ratings yet

- Variable Life Insurance Proposal: 0PROP.07.4Document4 pagesVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNo ratings yet

- Project Report HR Bajaj KirtiDocument65 pagesProject Report HR Bajaj Kirtisandeeprandhawa12No ratings yet

- Portfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisDocument22 pagesPortfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisAnkita ModiNo ratings yet

- The Employee's Provident FundDocument22 pagesThe Employee's Provident Fundshubham bhokareNo ratings yet

- Effect of Relationship Marketing On HospDocument12 pagesEffect of Relationship Marketing On Hospfiomorillo1No ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Img 20160113 0002Document1 pageImg 20160113 0002leeracrownNo ratings yet

- E1 Exam Practice Kit 5Document25 pagesE1 Exam Practice Kit 5leeracrownNo ratings yet

- Code of Practice For Runningball Data Scouts 2.2.0Document19 pagesCode of Practice For Runningball Data Scouts 2.2.0leeracrownNo ratings yet

- E1 Exam Practice Kit 1Document33 pagesE1 Exam Practice Kit 1leeracrownNo ratings yet

- E1 Exam Practice Kit 3Document22 pagesE1 Exam Practice Kit 3leeracrownNo ratings yet

- CIL - BP Hlubi - OTTA001981-1Document2 pagesCIL - BP Hlubi - OTTA001981-1leeracrownNo ratings yet

- Cidb - Concrete Newsletter - Issue 2 Nov 2014Document15 pagesCidb - Concrete Newsletter - Issue 2 Nov 2014leeracrownNo ratings yet

- Business Plan RDocument1 pageBusiness Plan RleeracrownNo ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- Finance Act 2023 Gazetted 20 July 2023Document258 pagesFinance Act 2023 Gazetted 20 July 2023ReshmaNo ratings yet

- Kindly Find The Complete Steps For Indian Payroll ConfigurationDocument10 pagesKindly Find The Complete Steps For Indian Payroll ConfigurationAmruta HanagandiNo ratings yet

- Salary Fitment - RK SharmaDocument6 pagesSalary Fitment - RK SharmaNikhilaNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- LS4 - Workers, Wages & BenefitsDocument9 pagesLS4 - Workers, Wages & BenefitsAlanie Grace Beron TrigoNo ratings yet

- Automatic Enrolment Online Registration ChecklistDocument2 pagesAutomatic Enrolment Online Registration ChecklistzoyaNo ratings yet

- Formulas: F - Future Value P - Present/Principal ValueDocument2 pagesFormulas: F - Future Value P - Present/Principal ValueJimuel Ace SarmientoNo ratings yet

- Perman 14rDocument17 pagesPerman 14rVon J. MoreNo ratings yet

- Jawaban 10 - Accounting For PensionDocument2 pagesJawaban 10 - Accounting For PensionBie SapuluhNo ratings yet

- Taxation LawDocument9 pagesTaxation LawKundan BhardwajNo ratings yet

- Case Analysis About MUP BillDocument2 pagesCase Analysis About MUP BillMissy OrgelaNo ratings yet

- Taxation Notes 2021Document135 pagesTaxation Notes 2021Viral MehtaNo ratings yet

- Format of Income Affidavit For MCM & SC-ST Scholarship (4833) PDFDocument1 pageFormat of Income Affidavit For MCM & SC-ST Scholarship (4833) PDFshubhamNo ratings yet

- Jeevan Shanthi - IllustrationDocument3 pagesJeevan Shanthi - IllustrationPranav WarneNo ratings yet

- Income Tax Study Material 2019-20 PDFDocument632 pagesIncome Tax Study Material 2019-20 PDFGajendra AudichyaNo ratings yet

- 2021 Contribution ScheduleDocument14 pages2021 Contribution SchedulePrincess MogulNo ratings yet

- SIP Project FinalDocument45 pagesSIP Project FinalHrishikesh BadeNo ratings yet

- Public Service Superannuation Scheme Act: Laws of KenyaDocument25 pagesPublic Service Superannuation Scheme Act: Laws of KenyaBen MusimaneNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Pension Revision For Higher Education Institutions 2009Document45 pagesPension Revision For Higher Education Institutions 2009bhajjiNo ratings yet

- Annuity (GENERAL MATHEMATICS)Document15 pagesAnnuity (GENERAL MATHEMATICS)Synta FluxNo ratings yet

- 2018 Annual Report Asr NederlandDocument326 pages2018 Annual Report Asr NederlandVenkatesh BilvamNo ratings yet

- Bromford Company Financial StatementDocument121 pagesBromford Company Financial StatementHelen VinyatskaNo ratings yet

- Life Insurance (Or Life Assurance, Especially in The: HistoryDocument10 pagesLife Insurance (Or Life Assurance, Especially in The: HistoryBiplab SwainNo ratings yet

- Click On Link To Get Updates: HR updates&HR JobsDocument33 pagesClick On Link To Get Updates: HR updates&HR JobsSagar ShiriskarNo ratings yet

- IITB AR ACCTS SYALLABUS - New PDFDocument5 pagesIITB AR ACCTS SYALLABUS - New PDFVipin Kumar ChandelNo ratings yet

- Quiz Employee BenefitsDocument4 pagesQuiz Employee Benefitscrispin leanoNo ratings yet

- Unit: TCS - BFSI - Insurance Parent ProjectDocument1 pageUnit: TCS - BFSI - Insurance Parent ProjectNagendra MNo ratings yet

- Acc 108 Emp BeneDocument4 pagesAcc 108 Emp BeneSam GallineroNo ratings yet