Professional Documents

Culture Documents

2022-6 JUNEFunda Fin Analysisof HULLtd

2022-6 JUNEFunda Fin Analysisof HULLtd

Uploaded by

Shrey CholeraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022-6 JUNEFunda Fin Analysisof HULLtd

2022-6 JUNEFunda Fin Analysisof HULLtd

Uploaded by

Shrey CholeraCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/375058190

Fundamental Financial Analysis of HUL Ltd

Article in Pramana · October 2023

CITATIONS READS

0 759

2 authors:

Prasanna Kumar Sarveshwar Sridhar

Loyola College Loyola College

9 PUBLICATIONS 1 CITATION 1 PUBLICATION 0 CITATIONS

SEE PROFILE SEE PROFILE

All content following this page was uploaded by Prasanna Kumar on 28 October 2023.

The user has requested enhancement of the downloaded file.

Pramana Research Journal ISSN NO: 2249-2976

Fundamental Financial Analysis of HUL Ltd

Sarveshwar S1, Dr Prasanna Kumar2

1

Student, Department of Commerce, Loyola College, Chennai

2

Assistant Professor, Department of Commerce, Loyola College, Chennai

1

sarveshwar.sridhar@gmail.com

2

drprasannakumar@loyolacollege.edu

Abstract

This study aims at analyzing the financial performance and growth of the company. For this

research data is taken for a period of five years from 2016 to 2021. The data for the purpose

of the research is obtained from published annual reports of the company from the NSE

website. The stocks are analyzed by using financial tools. The tools used for measuring the

financial performance are ratios such as liquidity ratio, Profitability ratio and Turnover ratio.

The analyses conclude that the company can generate consistent growth in the wealth of the

shareholders and it has a low debt to equity ratio, which indicates lower risk to the

shareholders. There has been an inefficient utilization of assets by the company and the

company can improve its profitability by efficient usage of assets.

Keywords: Ratio analysis, financial performance, FMCG, Liquidity ratio, Financial Analysis

Introduction

Indian economy is one of the top five economies in the world in terms of its market potential.

It is also ranked as the third-largest economy in Asia in terms of its GDP. This makes India a

profitable investment avenue for investors across the world. Capital markets play a vital part

in the development of a country. They help in providing the financial resources required for

the long-term sustainable development of the economy. Investors need to be more prudent to

the market fluctuations in the stock market. To minimize the risk in the stock market, the

investors before investing should analysis about the company’s past performance, market

fluctuations in the industry, the reason for such fluctuation, inflation etc. (R. Amsaveni & S.

Gomathi, 2013)There are two ways of analyzing a stock. Firstly, Technical analysis is

analyzing the security by the study the price movement by scrutinizing a security's past pricing

predominately through charts and indicators. Secondly, Fundamental analysis is analyzing the

security by analyzing the firm's financial statements and examining ratios and other metrics.

This is used to estimate a company's intrinsic value based on its revenues, profit, costs, capital

structure, cash flows, and so on. These results are compared with industry peers and

competitors. Finally, these results can be used to compare to the broader market or larger

economic environment.

Hindustan Unilever is one of the largest FMCG company in India. with a market share of 14%.

The parent company of HUL ltd is British Company Uniliver. Hindustan Uniliver produces

Several products like cleaning agents, personal and care products, water purifiers Other FMCG

Volume 12, Issue 6, 2022 1 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

goods. The company was started the year 1931 as Hindustan Vanasapathi Manufacturing ltd

and later renamed as Hindustan Lever Uniliver ltd in 1936. In 2007 it is later named Hindustan

Uniliver Ltd. The Company’s portfolio includes several brands such as Dove, lifebuoy, lux,

Clinic Plus, Sunsilk, close up, Vaseline etc. (Hindustan Unilever Limited, 2020)The company

has over 50 brands spread over 15 categories of products such as skin care, hair care, oral care,

coffee, tea, home & hygiene etc. A study shows that an average Indian household uses 9 out

10 household products of HUL. The main motto of HUL is to create a better future every day

and helps people feel good, look good and get more out of life with brands and services that

are good for them and the planet.

Need for Study:

This study on the financial performance of Hindustan Uniliver Ltd provides information about

the financial position and stability of the company. It helps the investors understand the

company and helps them to decide to make an investment in the company. This study provides

vital information about the company’s future performance. This study helps to understand the

solvency and profitability of the company.

Objectives of the study:

1. To analyze the financial position of the company.

2. To ascertain the growth of HUL ltd.

3. To perform a fundamental analysis of HUL ltd.

Review of Literature:

‘To Study the Financial Position of Maruti Suzuki India Ltd Using Ratio Analysis’ this study

reveals that various financial ratios such as liquidity ratios, and profitability ratios were used

to understand the financial performance of the company. This research was conducted for a

definite period time from 2014-15 to 2018-19. The study revealed that the company has a

balanced liquidity proportion and it also has a consistent increase in the gross profit YoY.(Dr

Kaakandikar Rishikaysh & Miss Seema Ramhari Ponde, 2019)

“Fundamental Factors Influencing Investments in Mutual Funds the EIC Approach” This study

concentrates on the financial analysis of mutual funds in India. For the purpose of this study

various variables such as RBI bank rate, money supply, Gross National Product, Wholesale

Price Index, Domestic savings and forex reserves. The analyses of economic variables

indicated that all the economic variables were positively correlated except the wholesale price

index and bank rate. The study revealed that market capitalization, net asset value, Price

earning Ratio, Price to book ratio and fund size affect the rate of return of the specified mutual

funds. (K.Viyyanna Rao & Nirmala Daita, 2011)

This study, analysis about accounting-based fundamental signals and future earnings of

security prices. Multiple regression analysis was used to analyze the data. Further, the study

also revealed that variables such as Gross Domestic Product, inflation, firm-specific variables

such as prior earnings, expected earnings growth, and the relation between fundamental signal

Volume 12, Issue 6, 2022 2 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

and future earnings play a significant role in the fundamental analysis of the company.(Jeffrey

S. Abarbanell & Brian J. Bushee, 1997)

This study is conducted on Business Failure Risk Analysis using Financial Ratios. The

objective of this research is to investigate the effectiveness of financial ratios on listed

companies on the Romanian stock exchange. This study used a t-test method is applied and the

result concludes that financial ratios can discriminate between failed and non-failed companies.

This discrimination can be in regard to profitability, financial position and leverage.(Maricica

& Georgeta, 2012)

This research focuses on analyzing the financial performance of selected FMCG companies

and the impact of their performance in the stock market. The study was conducted for a period

of twelve years from 1st April 2006 to 31st March 2017. In this research companies were

classified into three categories Market Under-Performers, Market Average-Performers and

Market Out-Performers in the stock market and multiple discriminant function analysis was

used to analyze the performance of selected companies’ performance. The study concluded

that revenue from operations is an important ratio that has a direct impact on the company’s

market performance. Debt equity ratio and inventory turnover ratio have a moderate impact on

the stock market performance of companies and the least impact ratio is the dividend payout

ratio in assessing the company’s stock market performance. (Dhingra et al., 2018)

This research shows the financial performance and stability of the steel industry. For the

purpose of this study financial ratios such as Liquidity, Solvency, Profitability and Efficiency

position. This study uses ANOVA-Test to evaluate the impact of selected ratios on the financial

performance of identified units in the steel industry The study concluded that the steel industry

needs special turnaround plans to uplift the industry and achieve the goals set by the

government. (Das, 2018)

This paper aims to quantify the financial performance of the top three companies in the

pharmaceutical industry. In order to analyze the financial performance tools such as ROE, ROI

and Du point analysis were carried out. It concluded that the ROE and ROI is a comprehensive

measure of the company’s profitability. (Sheela & Karthikeyan, 2012)

This study is based on the technical analysis of the securities. The research was conducted

using tools such as Candlestick Chart, Moving Average, Moving Average Convergence

Divergence (MACD), and Relative Strength Index (RSI). The research was conducted for a

period of three years from Feb- 2018 to 31- Jan- 2020. The study concludes that technical

analysis can be used to forecast the price movements in future by providing guidance to

investors.(Kishori & Divya, 2020)

Research Methodology:

1. Research Design and Period of the Study:

This study covers a period of 5 years from 2016 to 2021.

2. Data Collection:

Volume 12, Issue 6, 2022 3 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

This research is based on secondary data. Secondary data for this research is collected

from published annual reports of the company obtained from the NSE website.

3. Tools used:

For this research, financial tools such as ratio analysis were used to analyze the financial

performance of Hindustan Uniliver Ltd.

Analysis and Interpretation:

A. Solvency ratio:

Current Ratio:

This ratio evaluates the concerns liquidity and meets its current obligations. The ratio. To

measure the liquidity of a concern, the current assets and current liability of the concern are

correlated with each other.

Formula:

Current Ratio = Current Assert / Current Liabilities

Current Ratio

1.50 1.46

1.45

1.40 1.37

1.35 1.32 1.31 1.32

1.30 1.28

1.25

1.20

1.15

2016 2017 2018 2019 2020 2021

Years

Figure 1: Current Ratio

Figure 1 shows that there has been a consistent decline in the current ratio of the company. The

volume of inventory in current asserts is significant in the years 2016, 2017 and 2021 while

compared to cash and bank, such situation causes difficulty for the company to meet its current

obligations. The current ratio of the company is below the ideal ratio of 2:1 for the past five

years.

Equity Ratio:

This ratio compares the shareholder’s funds or owner's funds of the company with its total

tangible assets. This ratio indicates the general soundness of the company. It is of particular

interest to the creditors of the company as it helps them to ascertain the shareholder’s funds in

the total assets of the business. A higher ratio indicates safety to the creditors and a lower ratio

shows a greater risk to the creditors.

Formula: Shareholder’s funds / Total tangible assets

The shareholder’s funds consist of equity shares, preference share retained earnings and long-

term debt.

Volume 12, Issue 6, 2022 4 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Table 2: Equity ratio

Equity Ratio 2021 2020 2019 2018 2017 2016

Shareholder’s Equity 47674 8229 7867 7281 6744 6573

Total Assets 68,757 20,153 18,629 17,862 15,706 14,794

Equity Ratio 0.69337 0.40833 0.4223 0.40763 0.42939 0.4443

(Source: Computed)

There has been a decline in the proprietary ratio in the years 2017 and 2018. Above table 2

shows that the proprietary ratio improved in the year 2019 as there is a growth in both

shareholder’s funds and the total asset of the company. In 2020, the ratio fell by 0.02 compared

to the previous year. However, there has been a significant improvement in the ratio in the year

2021 as the ratio improved from 0.40833: 1 to 0.69337: 1. The proprietary ratio of Hindustan

Unilever has been below the ideal ratio of 0.5: 1 from 2016 to 2020. The proprietary ratio below

0.5 is alarming for creditors since, in the event of liquidation of the company the creditors are

settled in the order of preference, and creditors have to lose heavily because the company has

more creditors’ funds compared to shareholder’s funds.

Debt to Equity Ratio

This ratio compares the total debt of the company with its total equity.

Formula: Total Debt / Total Equity

A higher the debt-equity ratio indicates that higher risk to shareholders of the company and

vice versa. The ideal debt-equity ratio is difficult to determine as it varies from one industry to

another.

Table 3: Debt to Equity Ratio

Debt to Equity Ratio 2021 2020 2019 2018 2017 2016

Total Debt 21,063 11,907 10,744 10,561 8,940 8,201

Total Equity 47694 8246 7885 7301 6766 6593

Debt to Equity Ratio 0.44 1.44 1.36 1.45 1.32 1.24

(Source: Computed)

Table 3 shows that the debt-to-equity ratio of Hindustan Unilever Ltd from 2016 to 2020 there

has been a consistent ratio of 1.2 to 1.4 times. However, for the year ended 31st March 2021,

there has been a substantial increase in both debt and equity which has led to a fall in the ratio

to 0.4 times. This has resulted in a significant decline in the risk for the shareholders of the

company.

B. Turnover Ratio:

Working Capital Turnover Ratio:

This ratio measures the effective utilization of working capital by the company. It also

measures the placid running of the business. The ratio tends to establish a relation between the

cost incurred for the production goods sold and the working capital of the company. A high

Working Capital Turnover ratio shows that the company make a lower investment in working

Volume 12, Issue 6, 2022 5 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

capital and can generate higher profit and vice versa. This shows that the company is efficient

in its utilization of assets.

Formula:

Working capital turnover ratio = Sales/Cost of sales/ Net working capital

Net working capital = Current assets - Current liabilities

Table 4: Working Capital Turnover Ratio

Working Capital 2021 2020 2019 2018 2017 2016

Turnover Ratio

Total Sales 47,028 39,783 39,310 36,238 35,759 34,616

Working Capital 3,114 3,004 3,247 2,773 2,504 3,278

Working Capital

Turnover Ratio 15.1021 13.2433 12.1066 13.0682 14.2808 10.5601

(Source: Computed)

Table 4 shows that the working capital ratio grows from 10.5 to 14.28 from 2016 to 2017 as

there has been an increase in sales and also there has been a decline in working capital. In the

subsequent year from 2018 to 2021, there has been an increasing trend in sales of the company

but there was a downward trend in the working capital turnover ratio because the working

capital requirement was also increased from the year 2018 to 2020 which led to a decline in

the ratio from 14.28 to 13.23 in the year 2020. However, the company have bounced back from

it in the year 2021 which resulted in a working capital turnover ratio of 15.10.

Fixed Assert turnover ratio:

This ratio indicates the efficiency of utilization of fixed assets and profitability of a business

concern. A Higher Fixed Assert turnover ratio indicates more efficient utilization of fixed

assets and a lower Fixed Assert turnover ratio indicates inefficient utilization of fixed assets.

Formula:

Fixed asset turnover ratio = Cost of sales/ Net Fixed Asserts

Or = Sales/ Net Fixed Asserts

Table 5: Fixed asset turnover ratio

2021 2020 2019 2018 2017 2016

Fixed asset turnover

ratio

Total Sales 47,028 39,783 39,310 36,238 35,759 34,616

Total Fixed Assert 6,861 5,557 4,598 4,541 4,197 3,573

Fixed Assets Turnover

Ratio 6.85439 7.15908 8.54937 7.98018 8.52013 9.68822

(Source: Computed)

The ideal Fixed asset turnover ratio is 2.5 or more. Table 5 shows that the Fixed asset turnover

ratio of HUL ltd is highly above the ideal ratio this indicates that there has been an effective

utilization of fixed assets by the company. There was a downward movement in the fixed asset

turnover ratio from 2016 to 2018. However, in the year 2019, the Fixed assert turnover ratio

Volume 12, Issue 6, 2022 6 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

has improved compared to the previous year. In 2020 and 2021 there is again a downfall in the

Fixed asset turnover ratio due to the pandemic and lockdown imposed by the company as it

affected the efficiency of the company.

Inventory turnover ratio:

This ratio indicates that in a given period how many times the company has made sales or used

the inventory, it shows to company’s efficiency towards inventory. A higher inventory turnover

ratio indicates reduced storage costs and any other holding costs for holding the inventory. A

lower inventory turnover ratio indicates poor sales, excess stock, or ineffective management.

Formula:

Inventory Turnover Ratio = Sales/ Average Inventory

Stock Velocity = 365 / Inventory Turnover Ratio (in days)

or = 12 / Inventory Turnover Ratio (in months)

Table 6: Inventory Turnover Ratio

Inventory Turnover Ratio 2021 2020 2019 2018 2017

Net Sales 47,028 39,783 39,310 36,238 35,759

Average Inventory 4962.5 4054 3830.5 3783.5 3914

Inventory Turnover Ratio 9.47668 9.81327 10.2624 9.5779 9.13618

Stock Velocity (in days) 38.5156 37.1945 35.5668 38.1085 39.9511

(Source: Computed)

Table 6 indicates that the Inventory Turnover Ratio of HUL Ltd ranges from 9 to 10.5 times.

This indicates that an average stock item remains in store for 40 days before it is sold or used.

The general thumb rule is higher Inventory Turnover Ratio is preferred as it reduces the number

of days the items in inventory remain as stock.

Capital turnover ratio:

Managerial efficiency is also calculated by establishing the relation between the cost of sales

or sales with the amount of capital invested in the business concern. A higher capital turnover

ratio indicates higher efficiency and a lower capital turnover ratio indicates ineffective usage

of capital.

Formula:

Capital Turnover Ratio = Cost of Sales / Capital Employed

Or = Sales / Capital Employed

Capital employed = Shareholder’s funds + Long term Debt or Total Assert – Current

Liability

Volume 12, Issue 6, 2022 7 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Table 7: Capital Turnover Ratio

Capital Turnover Ratio 2021 2020 2019 2018 2017 2016

Net Sales 47,028 39,783 39,310 36,238 35,759 34,616

Capital employed 57,654 10,836 9,962 8,975 7,992 7,727

Capital Turnover Ratio 0.82 3.67 3.95 4.04 4.47 4.48

(Source: Computed)

The above table 7 shows that there has been a diminishing trend in the Capital turnover ratio

of HUL for the past five years. In the year 2021, there is a significant decline in the Capital

turnover ratio as it fell from 3.67 to 0.82. This decline indicates that there is ineffective

utilization of capital by the company. This is due to lockdown restrictions imposed by the

government and the company’s inability to use its available capital effectively and efficiently

to generate maximum sales.

Total asset turnover Ratio:

This ratio indicates the efficiency of the company with respect to the company’s use of its

assets to produce sales. A high asset turnover ratio indicates that the company operates

efficiently and a low asset turnover ratio indicates an inefficient utilization of assets by the

company.

Formula:

Total asset turnover ratio = Total Sales/ Total Asset

Table 8: Total asset turnover Ratio

Total asset 2021 2020 2019 2018 2017 2016

turnover Ratio

Sales 47,028 39,783 39,310 36,238 35,759 34,616

Total assets 68757 20153 18629 17862 15706 14794

Total Assert

Turnover Ratio 0.68397 1.97405 2.11015 2.02878 2.27677 2.33987

(Source: Computed)

The above table 8 depicts that there has been a decline in the asset turnover ratio from 2016 to

2018. In the year 2019, the asset turnover ratio has improved from 2.029 to 2.110 because of

significant growth in the sales of the company. In the years 2020 and 2021 there is a downfall

in the ratio. The ratio drastically fell from 1.974 in 2020 to 0.684 in 2021because there has

been a huge rise in the total asset without any corresponding growth in the level of sales.

C. Profitability Ratio:

Return on investment:

This ratio measures the sufficiency or otherwise of profit in relation to capital employed. A

comparison of ROI with that of similar firms, with that of industry and with past ratios will

help determine how efficiently the long-term funds of owners and creditors are being put into

use. Higher ROI indicates efficient usage of capital employed by the company.

Volume 12, Issue 6, 2022 8 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Formula:

R.O.I. = Operating Profit / Capital Employed x 100

Table 9: Return on investment

2021 2020 2019 2018 2017 2016

Return on Investment

Profit 7,999 6,756 6,060 5,227 4,490 4,151

Investment 2,707 1,253 2,714 2,871 3,788 2,560

Return on Investment 295.493 539.186 223.287 182.062 118.532 162.148

(Source: Computed)

Table 9 shows that there has been a positive return on investment for the past five years.

However, there has been a decline in ROI after an exponential return of 539.186% to 295.493%

in the year 2020 to 2021 because the investment of the company has grown from 1253 to 2707

without any corresponding level of growth in profit.

Return on Equity:

This ratio shows the return on equity shareholders’ funds. The profit to calculate return on

equity id profit after payment of dividend to preference shareholders.

Formula:

Return on Equity = Net Profit after interest, tax and preference dividend/ Equity Dividend *

100

The term equity shareholders’ funds (or) Equity (or) Net worth refers to equity share capital +

Reserves + Profits - Accumulated losses.

Table 10: Return on Equity

2021 2020 2019 2018 2017 2016

Return on Equity

Net Profit available to

equity shareholders

after Preference

dividend 7,999 6,756 6,060 5,227 4,490 4,151

Equity 47674 8229 7867 7281 6744 6573

Return on Equity 16.7785 82.0999 77.0306 71.7896 66.5777 63.1523

(Source: Computed)

The above table 10 shows that there has been positive growth in Return on equity from 2016

to 2020. At the end of the study period, the ROE of the company declined significantly from

82.09% to 16.77%, this indicates that the company is becoming less efficient in making profits

and increasing the value of the shareholders.

Return on capital employed:

This ratio measures the efficiency of the company, in using its capital to generate profit for the

stakeholders of the company.

Formula:

Volume 12, Issue 6, 2022 9 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

ROCE = Profit Before Interest and Tax / Capital Employed * 100

Table 11: Return on capital employed

Return on Capital 2021 2020 2019 2018 2017 2016

Employed

Profit Before

Interest and Tax 10,845 9,373 8,832 7,337 6,242 6,073

Capital Employed 57,654 10,836 10,061 8,975 8,269 7,904

ROSE 18.81 86.4987 87.785 81.749 75.487 76.835

(Source: Computed)

Table 11 reveals that the ROCE of the company has consistent growth from the beginning of

the study period to 31st March 2019. It further reveals HUL experienced a downfall in the

ROCE marginally in the year 2020 and significantly in the year 2021because of the pandemic

and lockdown imposed by the government.

Net Profit Ratio:

This ratio is also called the net profit to sales ratio. It indicates the management’s efficiency in

operating the business successfully from the owner's point of view. It shows the return on

shareholders' investments. The higher the ratio better is the operational efficiency of the

business concern.

Formula:

Net profit ratio= Net profit after tax / Net sales x 100

Net Profit Ratio

10,000 20.00%

7,999

8,000 16.98% 17.01%

15.42% 6,756 15.00%

14.42% 6,060

6,000 11.99% 12.56% 5,227

4,151 4,490

10.00%

4,000

5.00%

2,000

0 0.00%

2016 2017 2018 2019 2020 2021

Net Profit for the year Net Profit Ratio

Figure 2: Net profit ratio

The above Figure 2 shows that there is an upwards movement in the net profit ratio of HUL

Ltd in the study period. This indicates that the company has the highest net profit ratio at the

end of the research period. The has consistent growth in the Net profit over for last five years.

EPS:

This ratio highlights the overall success of the concern from the owners' point of view and it is

helpful in determining the market price of equity shares. EPS show the ability of the company

to declare dividend to its shareholders.

Formula:

E.P.S.= Net profit after tax and preference dividend / No. of Equity shares

Volume 12, Issue 6, 2022 10 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Table 13: Earnings Per Share

2021 2020 2019 2018 2017 2016

Earnings Per Share

Net profit available to equity

shareholders 7,999 6,756 6,060 5,227 4,490 4,151

Number of Equity Shares 235 216 216 216 216 216

Earnings Per Share 34.0383 31.2778 28.0556 24.1991 20.787 19.2176

(Source: Computed)

Table 13 shows the EPS of the company. The company has a positive growth in the EPS till

the study period. There has been a consistent growth of ₹ 3 YoY in the earnings per share of

the company. This reveals that the company is profitable enough to pay sufficient money as

dividends to shareholders.

Dividend Payout ratio:

This ratio measures the amount of dividend paid to the equity shareholders with respect to the

total amount of net earnings generated by the company. It indicates the percentage of earnings

distributed as dividends to the shareholders.

Formula:

Dividend payout ratio = Dividend per share/ Earnings per share*100

Table 14: Dividend payout ratio

Dividend 2021 2020 2019 2018 2017 2016

payout Ratio

Dividend Per

Share 40.50 25.00 22.00 20.00 17.00 16.00

EPS 34.0383 31.2778 28.0556 24.1991 20.787 19.2176

Dividend

Payout 118.984 79.929 78.4158 82.6478 81.7817 83.257

(Source: Computed)

Table 14 shows that the dividend payout to equity shareholders is increasing YoY during the

research period. In the year 2021 the dividend payout ratio is significantly higher than the

average dividend payout in the preceding previous years because the dividend declared is

higher than the earnings per share as a dividend per share of ₹40.50 includes ₹34.04 of EPS

and the remaining ₹6.46 is paid using retained earnings of the company.

Conclusion

The fundamental analysis of the company provides information about the real value of the

company. This analysis provides the necessary information to investors on whether to invest

in the company or not. The objective of the study is to analyze the growth and financial

performance of HUL ltd. The study indicates that there has been a constant increase in the

wealth of the shareholders of the company and also growth in the profit earned from operations.

The pandemic has affected the company by way of a decline in ROCE which indicates

inefficient use of assets by the company and also the liquidity of the company. The debt-to-

equity ratio of the company has reduced significantly which shows that the risk associated with

Volume 12, Issue 6, 2022 11 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

equity shareholders has reduced. The company can increase its profitability by improving its

efficiency in the utilization of assets.

References

Das, A. R. (2018). Financial Performance of Steel Industry in India. International Journal of

Management Studies, V(3(2)), 18. https://doi.org/10.18843/ijms/v5i3(2)/03

Dhingra, R., Dev, K., & Gupta, M. (2018). Performance Analysis of FMCG Sector in India.

http://publishingindia.com/ijbai/

Dr Kaakandikar Rishikaysh, & Miss Seema Ramhari Ponde. (2019). THINK INDIA (Quarterly

Journal) To Study The Financial Position Of Maruti Suzuki India Ltd Using Ratio

Analysis.

Hindustan Unilever Limited. (2020). Integrated Annual Report 2020-21.

https://www.unilever.com/

Jeffrey S. Abarbanell, & Brian J. Bushee. (1997). Fundamental Analysis, Future Earnings, and

Stock Prices. Journal of Accounting Research, 35(1), 1–24.

Kishori, M. B., & Divya, K. (2020). A STUDY ON TECHNICAL ANALYSIS FOR SELECTED

COMPANIES OF BSE. https://pramanaresearch.org/

K.Viyyanna Rao, & Nirmala Daita. (2011). Fundamental Factors Influencing Investment in

Mutual Funds - EIC Approach - A Case Study of RCAML.

Maricica, M., & Georgeta, V. (2012). Business Failure Risk Analysis using Financial Ratios.

Procedia - Social and Behavioral Sciences, 62, 728–732.

https://doi.org/10.1016/j.sbspro.2012.09.123

R. Amsaveni, & S. Gomathi. (2013). Fundamental Analysis of Selected FMCG Companies in

India. Asia-Pacific Finance and Accounting Review, 1(3), 37–55.

Sheela, S. C., & Karthikeyan, K. (2012). Financial Performance of Pharmaceutical Industry

in India using DuPont Analysis. In European Journal of Business and Management

www.iiste.org ISSN (Vol. 4, Issue 14). Online. www.iiste.org

Volume 12, Issue 6, 2022

View publication stats

12 https://pramanaresearch.org/

You might also like

- Fundamental Analysis of Indian Pharmaceutical Companies: June 2018Document25 pagesFundamental Analysis of Indian Pharmaceutical Companies: June 2018Prakhar BhatnagarNo ratings yet

- Research Paper On Capital StructureDocument12 pagesResearch Paper On Capital StructureJack AroraNo ratings yet

- Measuring Financial Health of A Public Limited Company Using Z' Score Model - A Case StudyDocument18 pagesMeasuring Financial Health of A Public Limited Company Using Z' Score Model - A Case Studytrinanjan bhowalNo ratings yet

- 139 April2019Document11 pages139 April2019vaibhav pachputeNo ratings yet

- DR +Khushbu+JainDocument6 pagesDR +Khushbu+JainSonali MoreNo ratings yet

- Financial Performance Analysis of Corporation BankDocument8 pagesFinancial Performance Analysis of Corporation BankManjunath ShettyNo ratings yet

- Financial Performance AnalysisDocument8 pagesFinancial Performance AnalysisJanus GalangNo ratings yet

- Trend Analysis Final Project by ArjitDocument37 pagesTrend Analysis Final Project by Arjitsandeepkaur1131992No ratings yet

- A Study On Financial Analysis and Performance of Kotak Mahindra BankDocument12 pagesA Study On Financial Analysis and Performance of Kotak Mahindra BankAkash DevNo ratings yet

- Comparative Studyon Financial Performanceof Hindustan Unileverand Nestle IndiaDocument8 pagesComparative Studyon Financial Performanceof Hindustan Unileverand Nestle Indianeha.talele22.stNo ratings yet

- A Comparative Analysis of The Financial Ratios of Selected Banks in The India For The Period of 2011-2014Document17 pagesA Comparative Analysis of The Financial Ratios of Selected Banks in The India For The Period of 2011-2014Rawan AbuzaidNo ratings yet

- Performance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaDocument5 pagesPerformance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaaqsakhanaljedeelNo ratings yet

- University School of Business Studies Talwandi Sabo: SynopsisDocument10 pagesUniversity School of Business Studies Talwandi Sabo: SynopsisInder Dhaliwal KangarhNo ratings yet

- Performance and Evaluation of Mutual FundsDocument6 pagesPerformance and Evaluation of Mutual FundsManali RanaNo ratings yet

- Comparative Study On Financial PerformanceDocument8 pagesComparative Study On Financial PerformancedurranibroseNo ratings yet

- Literature Review Analysis of Recorded Facts of Business PDFDocument8 pagesLiterature Review Analysis of Recorded Facts of Business PDFMohammed YASEENNo ratings yet

- Wa0004.Document50 pagesWa0004.pradhanraja05679No ratings yet

- 25-11-2023-1700920501-7-Ijfm-3. Ijfm - A Project Report On Financial Analysis of Reliance Industries Limited Through Comparative Balance SheetsDocument10 pages25-11-2023-1700920501-7-Ijfm-3. Ijfm - A Project Report On Financial Analysis of Reliance Industries Limited Through Comparative Balance SheetsAbhay ShuklaNo ratings yet

- Aeee PDFDocument21 pagesAeee PDFMane DaralNo ratings yet

- Aditya PatnaikDocument55 pagesAditya PatnaikAD CREATIONNo ratings yet

- Impact of Non-Performing Asset On Profitability and Efficiency of Banking Sector in IndiaDocument10 pagesImpact of Non-Performing Asset On Profitability and Efficiency of Banking Sector in Indiarohan mohapatraNo ratings yet

- SSRN-id3090997 - MFDocument8 pagesSSRN-id3090997 - MFsameer balamNo ratings yet

- Performance Evaluation of 10 Listed Bank Stocks & Comparison With Nifty 50Document6 pagesPerformance Evaluation of 10 Listed Bank Stocks & Comparison With Nifty 50Bijal DanichaNo ratings yet

- Financial Structure Analysis of Indian Companies: A Review of LiteratureDocument9 pagesFinancial Structure Analysis of Indian Companies: A Review of LiteratureVįňäý Ğøwđã VįñîNo ratings yet

- Julia18gsob1010373 Bba FinalDocument35 pagesJulia18gsob1010373 Bba FinalVijayakumar ChNo ratings yet

- .. Current 2018 Feb BDj0Gy8teJzklCWDocument14 pages.. Current 2018 Feb BDj0Gy8teJzklCWRAHUL KUMARNo ratings yet

- A Study On Evaluation of Financial Performance of FMCG Sector Prepared by Krutika R. Tank Under The Guidance of Dr. Hitesh ShuklaDocument16 pagesA Study On Evaluation of Financial Performance of FMCG Sector Prepared by Krutika R. Tank Under The Guidance of Dr. Hitesh ShuklaKRTNo ratings yet

- Comparative Study of Microfinance Institutions in India: March 2021Document8 pagesComparative Study of Microfinance Institutions in India: March 2021shubham475hNo ratings yet

- Chapter: 3 Research MethodologyDocument21 pagesChapter: 3 Research MethodologySamyuktha KNo ratings yet

- Sudeshnaa Final Yr ProjectDocument15 pagesSudeshnaa Final Yr ProjectShri hariniNo ratings yet

- Mutual Funds in India A Comparative Study of Select Public Sector and Private Sector CompaniesDocument13 pagesMutual Funds in India A Comparative Study of Select Public Sector and Private Sector Companiesarcherselevators0% (1)

- JETIR2302448Document7 pagesJETIR2302448Rupak RoyNo ratings yet

- Impactof Capitalstructureon Financial PerformanceanditsdeterminantsDocument11 pagesImpactof Capitalstructureon Financial PerformanceanditsdeterminantsLehar GabaNo ratings yet

- Ijrmec 749 54572Document14 pagesIjrmec 749 54572eunkyung ChoiNo ratings yet

- The Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshDocument5 pagesThe Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshAnonymous XIwe3KKNo ratings yet

- Incn15 Fin 059 PDFDocument15 pagesIncn15 Fin 059 PDFchirag_nrmba15No ratings yet

- IJMSS10 March 4335Document23 pagesIJMSS10 March 4335Avinash TiwariNo ratings yet

- A Study On Financial Perfomance of Alakode Service Co-Operative BankDocument58 pagesA Study On Financial Perfomance of Alakode Service Co-Operative BankjineshshajiNo ratings yet

- Camel ModelDocument8 pagesCamel ModelRabinNo ratings yet

- Comparison Between Some Debt Equity & Mutual FundsDocument20 pagesComparison Between Some Debt Equity & Mutual FundsJayesh PatelNo ratings yet

- A Critical Analysis: Related PapersDocument13 pagesA Critical Analysis: Related PapersAmit MishraNo ratings yet

- Literature Review of Performance Evaluation of Mutual FundDocument8 pagesLiterature Review of Performance Evaluation of Mutual FundafdtsadhrNo ratings yet

- 1 PBDocument10 pages1 PBxyzNo ratings yet

- Merger of ICICIDocument12 pagesMerger of ICICIVlkjogfijnb LjunvodiNo ratings yet

- A Study On Financial Performance Analysis at City Union BankDocument30 pagesA Study On Financial Performance Analysis at City Union BankArnab BaruaNo ratings yet

- 2dharmendra S Mistry - Pdfa Comparative Study of The Profitability Performance in TheDocument15 pages2dharmendra S Mistry - Pdfa Comparative Study of The Profitability Performance in ThePsubbu RajNo ratings yet

- Performance Analysis of Mutual Funds - A Comparative Study On Equity Diversified Mutual FundDocument17 pagesPerformance Analysis of Mutual Funds - A Comparative Study On Equity Diversified Mutual FundAnjali KajariaNo ratings yet

- Main ProjectDocument60 pagesMain ProjectRAJA SHEKHARNo ratings yet

- Financial Performance of Power and Co. by Amisha VaghaniDocument11 pagesFinancial Performance of Power and Co. by Amisha VaghaniAplus DigitalNo ratings yet

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDocument8 pagesFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalNo ratings yet

- Sudhir Final Doc (1) (Autosaved) NEWDocument45 pagesSudhir Final Doc (1) (Autosaved) NEWArvindsingh1857gmailNo ratings yet

- UntitledDocument68 pagesUntitledSurendra SkNo ratings yet

- SynopsisDocument11 pagesSynopsisshiv infotech0% (1)

- Neha Sharma Final Synopsis CapstoneDocument14 pagesNeha Sharma Final Synopsis CapstoneinxxxsNo ratings yet

- BushraDocument75 pagesBushraDhakeerath KsdNo ratings yet

- "Equity Research On Banking Sector": A Project Report OnDocument47 pages"Equity Research On Banking Sector": A Project Report OnMansi GuptaNo ratings yet

- An Analysis of Financial Performance of Bhargav Bikas Bank LimitedDocument8 pagesAn Analysis of Financial Performance of Bhargav Bikas Bank LimitedNamuna Joshi100% (2)

- MHRD-II YearDocument8 pagesMHRD-II YearANKIT SHENDENo ratings yet

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesFrom EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo ratings yet

- Assignment Nicmar PGCM 21Document19 pagesAssignment Nicmar PGCM 21punyadeep75% (4)

- Global CityDocument3 pagesGlobal CityKimNo ratings yet

- 2 Joint ArrangementsDocument3 pages2 Joint ArrangementsCha ChieNo ratings yet

- LC & Standby LCDocument8 pagesLC & Standby LCmanith_kim13No ratings yet

- Banking-Comunicare in Afaceri in Limba EnglezaDocument9 pagesBanking-Comunicare in Afaceri in Limba EnglezaMincu IulianNo ratings yet

- 04 Rittenberg SM Ch4 9-14-10 FINALDocument55 pages04 Rittenberg SM Ch4 9-14-10 FINALemanuelu4No ratings yet

- Analysis of Accounting Treatment of Capital Expenditure and Revenue ExpenditureDocument8 pagesAnalysis of Accounting Treatment of Capital Expenditure and Revenue ExpenditureMong MickoNo ratings yet

- Finincial Analysis of Tumkur Grain Merchants Co-Operative BankDocument110 pagesFinincial Analysis of Tumkur Grain Merchants Co-Operative BankPrashanth PB50% (2)

- Peter England-Madhura GarmentsDocument17 pagesPeter England-Madhura Garmentswintoday01100% (2)

- Agriculture Marketing Lec No 6Document27 pagesAgriculture Marketing Lec No 6MUZAMMIL GHORINo ratings yet

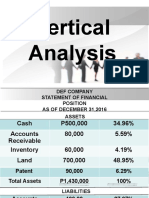

- Vertical AnalysisDocument8 pagesVertical AnalysisHannah Mae BautistaNo ratings yet

- Chaikin Power Gauge Report GMCR 29feb2012Document4 pagesChaikin Power Gauge Report GMCR 29feb2012Chaikin Analytics, LLCNo ratings yet

- Standard Costing and Variance Analysis FormulasDocument2 pagesStandard Costing and Variance Analysis FormulasRashid HussainNo ratings yet

- Wa0112.Document10 pagesWa0112.ali aliNo ratings yet

- What Ever Happened To The East Asian Developmental State The Unfolding DebateDocument23 pagesWhat Ever Happened To The East Asian Developmental State The Unfolding DebateCiCi GebreegziabherNo ratings yet

- Charlene MancusoDocument6 pagesCharlene MancusoThe News-HeraldNo ratings yet

- ErewwytruDocument6 pagesErewwytruMarjorie Joy DanzilNo ratings yet

- Corruption in Pakistan - Nguyễn Thị Thu Hằng - 425068 - MGT353Document4 pagesCorruption in Pakistan - Nguyễn Thị Thu Hằng - 425068 - MGT353Hằng ThuNo ratings yet

- Careers After COVID-19Document12 pagesCareers After COVID-19Iqbal Pugar RamadhanNo ratings yet

- Managing Supply Chain With Third Party Logistics Provider - An Overview of The IntegrationDocument8 pagesManaging Supply Chain With Third Party Logistics Provider - An Overview of The IntegrationKishore Kumar Galla100% (1)

- MINE1x Course SyllabusDocument6 pagesMINE1x Course Syllabusik43207No ratings yet

- ACCTG11B8-58-6 Answer KeysDocument3 pagesACCTG11B8-58-6 Answer KeysEUBELLE DAVE SOLATARIONo ratings yet

- CLBS Financial Statement 1Document6 pagesCLBS Financial Statement 1Peter Cranzo MeisterNo ratings yet

- 3.0 Cooperative Law (Notes and Activities) PDFDocument18 pages3.0 Cooperative Law (Notes and Activities) PDFmae camaganNo ratings yet

- Theories of Trade Theories of Trade Unions in India Unions in IndiaDocument27 pagesTheories of Trade Theories of Trade Unions in India Unions in IndiaKaruppasamy PandianNo ratings yet

- Quiz AKL - ConsolidationDocument2 pagesQuiz AKL - Consolidationsuciati_liaNo ratings yet

- Chapter 4 - Procurement & SourcingDocument7 pagesChapter 4 - Procurement & SourcingMaham ShaikhNo ratings yet

- Successful Capital Transfer Registration EUR 680,00: Charges: 2,50 EUR Shared (SHA)Document2 pagesSuccessful Capital Transfer Registration EUR 680,00: Charges: 2,50 EUR Shared (SHA)Annick RoumpazanisNo ratings yet

- Section 6-7 Group ADocument31 pagesSection 6-7 Group AVictor RudenkoNo ratings yet

- Bond ValuationDocument2 pagesBond ValuationIkram Ul Haq0% (1)