Professional Documents

Culture Documents

TermsKFS 9582497548

TermsKFS 9582497548

Uploaded by

dheerajpa009Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TermsKFS 9582497548

TermsKFS 9582497548

Uploaded by

dheerajpa009Copyright:

Available Formats

Dear Applicant,

We are pleased to welcome you to the Tata Capital Family!

Pursuant to your Loan Application, kindly find enclosed the below documents pertaining to your

Loan/ Facility:

a) Personal Loan Terms & Conditions

b) Key Fact Statement

c) Repayment Schedule

d) Link to Privacy Policy

Thank you,

Yours truly,

For Tata Capital Financial Services Limited

For Tata Capital Financial Services Limited

Signed and delivered by the within named Lender

Tata Capital Financial Services Limited

by the hands of its Authorized Signatory/

Constituted

Attorney Mr Deepak Aggarwal

Authorised Signatory/ies

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

Terms and Conditions – Personal Loan Facility

(A) The Borrower has represented to the Lender that the Borrower is in need of initial finance facility from the Lender

and requested the Lender to provide such initial finance facility. The Borrower has further requested the Lender

to provide for an additional top-up facility also.

(B) The Lender has agreed to grant the said initial finance facility for an amount specified in the Loan details section

(“Initial Facility”) on the terms and conditions contained herein and the Master Terms and Conditions registered

as Document No. 8980-2018 on November 6, 2018 with the Sub-Registrar at Mumbai City - 3 (hereinafter severally

referred to as “Master T&Cs”). Based on the request of the Borrower, the Lender has agreed, that, upon the

completion of 12 months from the date of first disbursement under the Initial Facility (“Period”) or such other

period as may be agreed, subject to the Borrower meeting the credit and other criteria of the Lender, the Borrower

shall be entitled to an additional facility not exceeding the amount as specified in the Loan details section

(“Additional Facility”), without further act or deed and the same may be disbursed to the Borrower at any time

after the said Period at the discretion of the Lender on the terms and conditions contained herein and the Master

T&Cs.

(C) The Lender shall, at its sole discretion, without assigning any reason, be entitled to cancel or reduce the Additional

Facility. The term “Facility” shall include the Initial Facility and also the Additional Facility and unless repugnant to

the context, references to the term ‘Facility’ in the Master T&Cs shall be read and construed accordingly.

(D) The Lender has agreed to extend the Facility to the Borrower, on the faith of the undertakings, representation and

warranties made by the Borrower (as more particularly stated in the Facility Documents).

1. Definitions and Interpretation:

(a) The capitalised terms wherever used in these Terms and Conditions, unless the context otherwise requires, have the

meanings ascribed to them in the Master T&Cs.

(b) The rules of interpretation as set out in the Master T&Cs shall apply mutatis mutandis to these Terms and Conditions.

2. Facility

(a) The Borrower agrees to borrow, and the Lender agrees to grant to the Borrower, the Facility, being the amount

specified in Loan details section and on such terms and conditions contained herein and in the Master T&Cs for the

Purpose as mentioned in the Facility Documents.

(b) The Borrower shall not be entitled to cancel or refuse to accept Disbursement of the Facility upon acceptance of these

Terms and Conditions except with prior written approval of the Lender and upon payment of such cancellation charges

as set out in the Loan details section. Further, such cancellation shall take effect only when the Borrower has paid to

the Lender the Outstanding in full to the Lender’s satisfaction.

(c) Borrower understands and agrees that no deferment of instalments or moratorium on account of Covid-19 as

contemplated by the COVID-19 – Regulatory Package announced by RBI or the relevant policy of Tata Capital shall be

available for this loan and borrower shall not apply for the same.

3. Repayment and Interest

(a) The Instalments and all other Outstanding from time to time with respect to the Initial Facility shall be paid / repaid

by the Borrower on or before the respective Due Dates in accordance with the Repayment Schedule as set out in the

Loan details section. The details of tenure, repayment etc. in respect of the Additional Facility shall be provided to the

Borrower at the time of availing the Additional Facility and shall be payable by the Borrower on or before their

respective Due Dates.

(b) Without prejudice to the rights of the Lender under the Facility Documents, the Interest shall be computed at a fixed

rate and shall be payable at such rate as set out in the Loan details section and the Interest shall be computed on the

actual daily outstanding principal balance of the Facility on the basis of a 360 days’ year and actual number of days

elapsed and compounded with monthly rests on the outstanding balance of the Facility at the end of every calendar

month.

4. Additional Interest

In case of default by the Borrower in the repayments of the Facility on the relevant Due Date or any other delay/

default/ breach committed by the Borrower, the Lender shall have a right at its option to charge Additional Interest

as set out in the Loan details section, over and above the prevailing interest rate for the period during which such

default continues.

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

5. Prepayment

The Borrower may be permitted to make part or full prepayment of the Outstanding on the terms and conditions

contained in the Master T&Cs and by making payment of applicable Prepayment / Foreclosure charges as set out in

the Loan details section and as may be revised by the Lender from time to time at its sole discretion.

6. Costs and Expenses

The Borrower shall be liable to pay Dishonour Charges and such other charges, costs, expenses related to and arising

out of the Facility as set out in the Loan details section. The Lender in its sole and absolute discretion reserves the

right to periodically review, revise, re-negotiate, waive any such charges or levy any new charges which shall be

updated by the Lender on its website (www.tatacapital.com) or otherwise intimated to the Borrower. The Borrower

shall be liable to pay such charges without any demur or delay and shall not be entitled to raise any objections. The

Borrower shall be liable to pay the Processing Fee set out in the Loan details section in respect of the Initial Facility as

also the Additional Facility.

7. Disclosure

The Borrower hereby agree and consent for disclosure and sharing of the information and data and for being

contacted vide various communication modes notwithstanding their names and / or numbers appearing in the Do Not

Call or Do Not Disturb registry, as per the terms and conditions contained in the Master T&Cs.

8. Lien, Set-off, Cross Default

Any default by the Obligors under any agreement, arrangement, guarantee, and/or under any of its/their

Indebtedness (whether actual or contingent, or whether primary or collateral, or whether joint and/ or several), with

the Lender, shall constitute an Event of Default under the Facility. The Lender, shall have a paramount lien and right

of set-off on/against all other, present as well as future monies, securities, deposits of any kind and nature, all other

assets and properties belonging to the Obligors’ credit (whether held singly or jointly with any other person), which

are deposited with/under the control of the Lender pursuant to any contract entered/to be entered into by the

Obligors in any capacity, notwithstanding that such deposits may not be expressed in the same currency as the

Indebtedness. The Lender shall be entitled and authorized to exercise such right of lien and set-off against all such

amounts/assets/properties for settlement of the Outstandings with or without any further notice to any Obligor. It

shall be the Obligors’ sole responsibility and liability to settle all disputes/objections with such joint account holders.

If so required, the Lender shall be well within their rights to exercise the right of set-off against the money lying in the

joint account(s) or in any deposit/bond/other assets held jointly, for settlement of Outstandings.

9. Other Conditions

(a) The Borrower shall abide by all terms and conditions as specified in the Master T&Cs including without limitation

general and special covenants mentioned therein, which shall form an integral part of these Terms and Conditions

as if incorporated herein. In case of any inconsistency or repugnancy between the terms of these Terms and

Conditions and the Master T&Cs, the terms of these Terms and Conditions shall prevail. It is hereby clarified that

Clause 1.1(v) and Clause 11 as appearing in the Master T&Cs shall be deemed to be deleted from the Master T&Cs.

(b) Nothing contained herein shall limit the rights of the Lender to enforce these Terms and Conditions independently

and in exclusivity to the Facility Documents.

(c) The Borrower hereby state that the Borrower has read and understood the Master T&Cs, a copy of which is available

on the website (i.e. www.tatacapital.com), and hereby agree to be bound by the terms and conditions as contained

in the Master T&Cs read with these Terms and Conditions.

(d) The Borrower shall adhere to the timelines set out in the Loan details section.

(e) Notwithstanding anything contained in the Facility Documents, the Lender may at its sole and absolute discretion,

without assigning reasons, and without notice to the Borrower, cancel the Facility or any part thereof and/or demand

immediate repayment of all Outstanding under/in relation to the Facility. The Lender shall intimate the Borrower

regarding such cancellation.

(f) In the event any amount is not paid when due, the account will be flagged as overdue as part of day-end process as

Special Mention Account (‘SMA’) or Non- Performing Asset (‘NPA’) (as the case may be) in accordance with the

extant RBI provisions. Examples of classification of an account as SMA/ NPA categories are provided below. The

Obligors confirm that they have read, understood and accepted the same.

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

Examples of SMA/NPA Classification

SMA Sub- Categories Basis for classification- Instalment or any

other amount wholly or partly overdue

SMA-0 1-30 days

SMA-1 31-60 days

SMA-2 61-90 days

NPA More than 90 days

Examples:

(a) If due date of a loan account of the borrower is 9th March 2021 and full dues are not received on this

date, the date of overdue shall be end of the day on 9th March 2021 and the loan account shall be

classified as SMA–0.

(b) If the loan account continues to remain overdue on 8th April 2021 i.e. upon completion of 30 days of

being continuously overdue, then this account shall be classified as SMA-1 on 8thApril, 2021.

(c) If the loan account continues to remain overdue upon running day-end process on 8th May 2021 i.e.

upon completion of 60 days of being continuously overdue, it shall be classified as SMA-2 on 8th May

2021.

(d) If the loan account continues to remain overdue upon running day-end process on 7th June 2021 i.e.

upon completion of 90 days of being continuously overdue, it shall be classified as NPA on 7th June

2021 along with all other loan accounts, if any, of the borrower/s with the Lender.

10. Arbitration

If any dispute, difference or claim arises between any of the Obligors and the Lender in connection with the Facility or

as to the interpretation, validity, implementation or effect of the Facility Documents or as to the rights and liabilities of

the parties under the Facility Documents or alleged breach of the Facility Documents or anything done or omitted to be

done pursuant to the Facility Documents, the same shall be settled by arbitration to be held at the said Location (as

defined below ) in accordance with the Arbitration and Conciliation Act, 1996, or any statutory amendments thereto

and shall be referred to a sole arbitrator appointed in accordance with the Arbitration and Conciliation Act, 1996. The

award of the arbitrator shall be final and binding on all parties concerned. The seat of arbitration for all purposes shall

be Chennai unless any other place is agreed and mentioned in Annexure 1 hereto (‘said Location’). The language of

arbitral proceedings shall be English.

The courts at the said Location shall have exclusive jurisdiction in respect of matters arising under this Agreement

including any application for setting aside the award/appeal and the Lender/ Borrower(s) shall not object to such

jurisdiction. The arbitration shall be conducted under the provisions of the Arbitration and Conciliation Act, 1996

together with its amendments, any statutory modifications or re-enactment thereof for the time being in force. The

award of the arbitrator shall be final and binding on all parties concerned. The cost of arbitration shall be borne by the

Borrower.

11. Jurisdiction

Subject to the clause 10 above, the Parties hereto agree that all disputes arising out of and/or in relation to this

Agreement, shall be subject to exclusive jurisdiction of the courts/tribunals in Chennai unless any other place is agreed

and mentioned in Annexure 1 hereto in which event the courts at the said place shall have exclusive jurisdiction. The

Lender may, however, in its absolute discretion commence any legal action or proceedings arising out of this Agreement

in any other court, tribunal or other appropriate forum and the Obligors hereby consent to that jurisdiction.

12. Miscellaneous Terms

(a) This Terms and Conditions is the Specific Agreement as referred to in the Master T&Cs.

(b) The Borrower hereby agree that this is a legally binding document between the Borrower and the Lender.

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

ANNEXURE 1

Personal Loan - Key Fact Statement and Loan Details

1) Place of Execution WEST DELHI

2) Date of Execution 09/11/2023

3) Name of Regulated Tata Capital Financial Services Limited.

Entity/ Lender

4) Details of the a) Name: NEETU SINGH

Borrower/s and b) Constitution: Individual

Co-Borrower/s c) Address RZ 553/405 GALI NO. 15 WEST SAGARPUR SHIVPURI Nang

al Raya S.O South West Delhi Delhi 110046

a) Name NA

b) Constitution NA

c) Address NA

5) Purpose Personal Use

6) a. Amount of the 289000

Rs. _______________________ /-

Initial Facility/ TWO LAKH EIGHTYNINE THOUSAND

(Rupees __________________________________________________________________only)

Loan Amount

b. Amount of Rs. _______________________ /-

Additional Facility (Rupees __________________________________________________________________only)

7) Processing Fees ________%

2.00 of the Loan Amount/ Facility Amount Rs. 5780

8) Other Deductions a) Insurance and Third-Party Product Charges Rs. 9067

b) Stamp Duty Rs.

c) Broken Period Interest Rs. 0

d) Other Charges (if any) Rs. NA

e) Total Deductions (a + b + c + d) Rs. 9067

9) Net Disbursed

Amount (6) less (7 + 8.e) Rs. 271482

10) Type of Facility Term Loan Facility:

✔ or Revolving Facility: 60

Tenure (in Months): _____________

opted

If Revolving Facility, then

a) Maximum Credit Limit Rs. _________________/-

(Rupees____________________________________________________________)

b) Dropline Facility

Flexi Facility (Combination of Fixedline + Dropline) of which Fixedline tenure of

___________ months.

c) Frequency at which the Maximum Credit Limit shall be reduced: Monthly

d) Amount by which Maximum Credit Line shall Maximum Credit Limit: ___________

be reduced on the frequency specified in (c)

Remaining Tenure: _____________

above:

11) Repayment a) First EMI due on 05/12/2023

Schedule b) Last EMI Date 05/11/2028

c) Instalment Due Date 5th of every month

d) No. of Instalments of Repayment 60

e) Monthly Instalment payable (including insurance in case Rs. _________________

8147

of insurance provision) under term loan facility per month

f) Repayment frequency by the Borrower Monthly

12) Moratorium period

(if any)

13) Interest Payable a) Interest Type: Fixed

b) Rate of Interest: 23.0 % p.a.

c) Total interest charged during the entire tenor of the loan 199823

14) Additional Interest a) For default in payment of interest and/ or principal amounts – 3% per month on

overdue amount (Annualized penal charge of 36%)

b) For delay or non-submission of the financial statements or such other

documents as required under the Facility Documents - 3% per month

(Annualized penal charge of 36%)

15) Part-Prepayment/ Part Prepayment:

Prepayment/ Lock-in Period: 12 months from the date of first disbursement

Foreclosure Part Prepayment is allowed once per year and the minimum gap between two part-

Charges a)

prepayments to be six months.

b) A maximum of 50% of the principal outstanding is allowed by way of part prepayment

during a single year.

c) A part prepayment charge of 2.5% shall be applicable on amount over and above 25%

of principal outstanding and upto maximum 50% of principal outstanding.

d) No part payment is allowed during the Lock-in period

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

e) Minimum Part prepayment amount to be greater than or equal to 2 months EMI

Foreclosure charges on Term Loan Facility:

a) 4.5% on the principal outstanding at the time of foreclosure.

b) In case the Borrower forecloses the Facility within 12 months after doing part-

prepayment, foreclosure charges of 4.5% will be levied on the principal outstanding

plus part prepayment amount.

c) Any prepayment/foreclosure made during the Lock-in period will attract additional 2%

over and above the prepayment/ foreclosure charges mentioned in (a) above on the

principal outstanding at the time of foreclosure.

Foreclosure charges on Top-up:

a) 2.50% on the principal outstanding at the time of foreclosure.

b) Foreclosure charges shall be levied only if new rate is lower than existing rate.

c) Any prepayment/ foreclosure made during the Lock-in Period will attract prepayment/

foreclosure charges of 4.5% on the principal outstanding.

Foreclosure Charges in Dropline Facility:

a) 4.5% on the Dropped down limit amount.

b) Any prepayment/ foreclosure made during the Lock-in Period will attract additional 2%

over and above the prepayment/ foreclosure charges mentioned in (a) above on the

Dropped down limit

16) Charges a) Payment Instruments Rs. 550/- per instance

swapping

b) Dishonour Charges Rs. 600/- for every Cheque/ Payment Instrument Dishonour

c) Mandate Rejection Rs. 450/-

Service Charges (Charges will be levied if new mandate form is not registered

within 30 days from the date of rejection of previous mandate

form by Borrower’s bank for any reasons whatsoever.)

d) Annual Maintenance 0.25% on Dropline Amount or Rs.1000, (whichever is higher)

Charges for PL per year will be deducted from the limit and shall be payable

Overdraft (Dropline at the end of the 13th month.

facility)

e) Cancellation charges 2% of the Loan Amount/ Facility amount OR

Rs. 5750/-

Whichever is higher

f) Duplicate Repayment Rs. 550/-

Schedule

g) Duplicate NOC Rs. 550/-

h) Outstation collection Rs.100 /- per repayment instrument

charges

i) Statement of Account Customer Portal – Nil

(SOA) Branch walk-in – Rs. 250/-

j) Foreclosure Letter Customer Portal – Nil

Charge Branch walk-in – Rs 199/-

Legal Charges

a) Section 138 & Section Rs. 3400/-

25 filing

b) Arbitration Filing Rs. 4000/-

c) Receiver Order District Court: Rs. 4000/- and High court: Rs. 13,500/-

d) Notice Rs. 125/-

e) Legal Notice Rs. 300/-

f) Lawyer Fees (at Actuals)

g) Execution of award Rs. 5600/-

17) Insurance and a) Life Insurance Premium

Third-Party b) General Insurance Premium

Product Charges

c) Health Insurance Premium

d) IHO Plan Amount Rs. 2119

e) One Assist Plan Amount Rs. 4745

f) CPP Plan Amount Rs. 2203

18) Other Important a) Total Amount to be paid by the borrower (6 + 13.c) Rs. 488823

Details b) Annual Percentage Rate % - Effective annualized __________%

23.99 p.a.

interest rate (in percentage) (computed on net disbursed

amount using IRR approach and reducing balance

method)

Note: APR may change in case there is change in the

Scheme opted.

19) Other Disclosures a) Cooling off/ look-up period during which borrower shall 3 days from the date of

not be charged any penalty on prepayment of loan loan disbursal

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

b) Details of the Lending Service Provider (‘LSP’) acting as Not Applicable

recovery agent and authorized to approach the borrower

c) Details of Nodal Grievance Redressal Officer:

i) Name Francyna Dias

ii) Designation, Grievance Redressal Officer

iii) Address 11th Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai -

400013

iv) Phone No. 18602676060

If you are not satisfied with the resolution, please visit the link:

https://www.tatacapital.com/contact-us/customer-grievances.html and submit your grievances.

Note: (GST, other government taxes and levies as applicable, will be levied on all fees and charges in

this document)

20) Place of Arbitration [Delhi / Chennai / Mumbai / Kolkata]

(Tick whichever is

applicable)

21) Jurisdiction [Delhi / Chennai / Mumbai / Kolkata]

(Tick whichever is

applicable)

22) Timelines Sr. No. Conditions Timelines

a) End use certificate shall be provided by the Obligors to Within 30 days

the Lender

b) Fresh Payment Instruments shall be delivered by the Within 7 days

Obligors to the Lender

c) TDS certificate in the Form No. 16A of the IT Act Within 45 days from the

downloaded from the TDS Reconciliation Analysis and end of the relevant quarter

Correction Enabling System (“TRACES”) website shall in which tax is deducted

be provided by the Obligors to the Lender and within 75 days from

the end of the last quarter

of the financial year

d) An amount equivalent to the TDS amount paid by the Within 90 days

Obligors shall be refunded to the Borrower by the Lender

upon receipt of the TDS certificate and subject to

compliance with the conditions stipulated in the relevant

provision of the T&Cs.

e) TDS refund claim will not be entertained by the Lender. After 30 days of the

succeeding financial year

f) Credit of the TDS amount may be requested by the Not later than 60 days of

Obligors by furnishing of the TDS certificate. the succeeding financial

year

23) Other Terms and In case the dues accrued for the month have not been paid by the due date of the succeeding

Conditions calendar month, the Lender shall be entitled to withhold/ cancel fresh drawdown made by the

Borrower of any amount under the Facility until the Borrower pays the entire dues. Further, in case

the dues are unpaid till 39 days after the due date, the Borrower will be required to submit 6 months

bank statement procured post making payment of the dues to the Lender, to evaluate the Borrower’s

request for further drawdown. Any such further disbursal shall be at the sole discretion of the Lender.

24) IP Address 42.105.139.157:7820

25) Date and Time

09-11-2023 17:24:41

Stamp

Note:

Broken Period Interest amount and 1st EMI date depend on the date of disbursal and the final figures would be

mentioned in the Welcome Letter and Repayment schedule.

Net Disbursed Amount may change if there is a difference in agreement execution date and actual loan disbursal date

on account of change in Broken Period Interest or any changes opted post execution of the agreement.

Privacy Policy: Please refer to the privacy policy on:

https://www.tatacapital.com/content/dam/tata-capital/pdf/footer/Privacy_Commitment.pdf

LSP Details: Please click on link below:

https://www.tatacapital.com/partners.html

Collection Vendor Details: Please click on link below:

https://www.tatacapital.com/collection-vendor.html

Mr Deepak Aggarwal NEETU SINGH

____________________ ________________ ____________________

Authorised Signatory / ies Borrower’s Signature Co-Borrower’s Signature

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

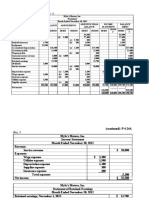

Personal Loan Term & Overdraft Agreement

Installment or Repayment Schedule Chart

Annual Loan Installment

Interest Rate 23.00 289,000 60

Amount (Tenor)

%

Amount (Rs.)

Effective

Opening

Instl. # Due Date Installment Principal Interest Rate (%) /

Balance Days

1 05/12/2023 289,000 8,147 2,608 5,539 23.00/30

2 05/01/2024 286,392 8,147 2,658 5,489 23.00/30

3 05/02/2024 283,734 8,147 2,709 5,438 23.00/30

4 05/03/2024 281,025 8,147 2,761 5,386 23.00/30

5 05/04/2024 278,265 8,147 2,814 5,333 23.00/30

6 05/05/2024 275,451 8,147 2,868 5,279 23.00/30

7 05/06/2024 272,584 8,147 2,923 5,225 23.00/30

8 05/07/2024 269,661 8,147 2,979 5,169 23.00/30

9 05/08/2024 266,682 8,147 3,036 5,111 23.00/30

10 05/09/2024 263,647 8,147 3,094 5,053 23.00/30

11 05/10/2024 260,553 8,147 3,153 4,994 23.00/30

12 05/11/2024 257,400 8,147 3,214 4,933 23.00/30

13 05/12/2024 254,186 8,147 3,275 4,872 23.00/30

14 05/01/2025 250,911 8,147 3,338 4,809 23.00/30

15 05/02/2025 247,573 8,147 3,402 4,745 23.00/30

16 05/03/2025 244,171 8,147 3,467 4,680 23.00/30

17 05/04/2025 240,704 8,147 3,534 4,613 23.00/30

18 05/05/2025 237,171 8,147 3,601 4,546 23.00/30

19 05/06/2025 233,569 8,147 3,670 4,477 23.00/30

20 05/07/2025 229,899 8,147 3,741 4,406 23.00/30

21 05/08/2025 226,159 8,147 3,812 4,335 23.00/30

22 05/09/2025 222,346 8,147 3,885 4,262 23.00/30

23 05/10/2025 218,461 8,147 3,960 4,187 23.00/30

24 05/11/2025 214,501 8,147 4,036 4,111 23.00/30

25 05/12/2025 210,465 8,147 4,113 4,034 23.00/30

26 05/01/2026 206,352 8,147 4,192 3,955 23.00/30

27 05/02/2026 202,160 8,147 4,272 3,875 23.00/30

28 05/03/2026 197,888 8,147 4,354 3,793 23.00/30

29 05/04/2026 193,534 8,147 4,438 3,709 23.00/30

30 05/05/2026 189,096 8,147 4,523 3,624 23.00/30

31 05/06/2026 184,573 8,147 4,609 3,538 23.00/30

32 05/07/2026 179,964 8,147 4,698 3,449 23.00/30

33 05/08/2026 175,266 8,147 4,788 3,359 23.00/30

34 05/09/2026 170,478 8,147 4,880 3,267 23.00/30

35 05/10/2026 165,599 8,147 4,973 3,174 23.00/30

36 05/11/2026 160,626 8,147 5,068 3,079 23.00/30

37 05/12/2026 155,557 8,147 5,166 2,982 23.00/30

38 05/01/2027 150,392 8,147 5,265 2,883 23.00/30

39 05/02/2027 145,127 8,147 5,365 2,782 23.00/30

40 05/03/2027 139,762 8,147 5,468 2,679 23.00/30

41 05/04/2027 134,293 8,147 5,573 2,574 23.00/30

42 05/05/2027 128,720 8,147 5,680 2,467 23.00/30

43 05/06/2027 123,040 8,147 5,789 2,358 23.00/30

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

Personal Loan Term & Overdraft Agreement

44 05/07/2027 117,252 8,147 5,900 2,247 23.00/30

45 05/08/2027 111,352 8,147 6,013 2,134 23.00/30

46 05/09/2027 105,339 8,147 6,128 2,019 23.00/30

47 05/10/2027 99,211 8,147 6,246 1,902 23.00/30

48 05/11/2027 92,966 8,147 6,365 1,782 23.00/30

49 05/12/2027 86,600 8,147 6,487 1,660 23.00/30

50 05/01/2028 80,113 8,147 6,612 1,536 23.00/30

51 05/02/2028 73,502 8,147 6,738 1,409 23.00/30

52 05/03/2028 66,763 8,147 6,867 1,280 23.00/30

53 05/04/2028 59,896 8,147 6,999 1,148 23.00/30

54 05/05/2028 52,897 8,147 7,133 1,014 23.00/30

55 05/06/2028 45,764 8,147 7,270 877 23.00/30

56 05/07/2028 38,494 8,147 7,409 738 23.00/30

57 05/08/2028 31,085 8,147 7,551 596 23.00/30

58 05/09/2028 23,533 8,147 7,696 451 23.00/30

59 05/10/2028 15,837 8,147 7,843 304 23.00/30

60 05/11/2028 7,994 8,147 7,994 153 23.00/30

Total 488,823 289,000 199,823

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

Note:

▪ 09/11/2023

This Repayment Schedule and its figures and calculation are as on _________ and may vary based on the

applicable date of disbursement.

IP Address:42.105.139.157:7820 Date & Time: 09-11-2023 17:24:46

You might also like

- Dear Applicant,: Tata Capital Financial Services LimitedDocument9 pagesDear Applicant,: Tata Capital Financial Services LimitedeamumeshNo ratings yet

- TermsKFS 8977767811Document12 pagesTermsKFS 8977767811Anime SensaiNo ratings yet

- TermsKFS 7558186721Document11 pagesTermsKFS 7558186721Vicky VimalNo ratings yet

- TermsKFS 7652940900Document11 pagesTermsKFS 7652940900pankajprajapati000078666No ratings yet

- Loan AgreementDocument10 pagesLoan AgreementMukesh VNo ratings yet

- Loan Agreement of Hinduja Leyland FinanceDocument14 pagesLoan Agreement of Hinduja Leyland FinanceAtaur Rahman HashmiNo ratings yet

- Loan - Contract - LIQUILOANS - AGREEMENT - 6821750 5Document17 pagesLoan - Contract - LIQUILOANS - AGREEMENT - 6821750 5zy6btrz6qkNo ratings yet

- Loan AgreementDocument16 pagesLoan AgreementReliable VideosNo ratings yet

- UntitledDocument13 pagesUntitledAMARJEET YADAVNo ratings yet

- Loan Document 477404Document18 pagesLoan Document 477404consultsantanudasNo ratings yet

- Loan AgreementDocument24 pagesLoan Agreementsuman prakashNo ratings yet

- Welcome_Letter_IDEP196884564141OL4Z_198249361986157Document15 pagesWelcome_Letter_IDEP196884564141OL4Z_198249361986157amitgohil1105No ratings yet

- gss-term-loan-agreement-ccd-5Document27 pagesgss-term-loan-agreement-ccd-5caillou.dreydenNo ratings yet

- Sanction LetterDocument23 pagesSanction LetterAYUSH MishraNo ratings yet

- NikeDocument22 pagesNikeaadharsevameNo ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- LDSDocument17 pagesLDSVenkataramana SarellaNo ratings yet

- DMI DMI0022846733 Agreement 1715403302588Document17 pagesDMI DMI0022846733 Agreement 1715403302588reghuvelanNo ratings yet

- LdsDocument16 pagesLdsRavi Rudr MishraNo ratings yet

- CF BILPL ClickWrapTermsAndConditionDocument13 pagesCF BILPL ClickWrapTermsAndConditionNiaz RNo ratings yet

- Sanction LetterDocument2 pagesSanction Letter313 65 Cheithanya Kumar MNo ratings yet

- This Sundaram Credit Line Loan Agreement ("Agreement") Is Made at Chennai BetweenDocument15 pagesThis Sundaram Credit Line Loan Agreement ("Agreement") Is Made at Chennai BetweenPrasanna KumaraNo ratings yet

- DMI DMI0031838999 Agreement 1709179676414Document18 pagesDMI DMI0031838999 Agreement 1709179676414hinglajsteel2No ratings yet

- DMI DMI0035392313 Agreement 1704702866776Document18 pagesDMI DMI0035392313 Agreement 1704702866776farhaan0091No ratings yet

- DMI DMI0030179395 Agreement 1704150274296Document17 pagesDMI DMI0030179395 Agreement 1704150274296debnathdebabrata123No ratings yet

- DMI DMI0032140135 Agreement 1709123645690Document17 pagesDMI DMI0032140135 Agreement 1709123645690razarahil369No ratings yet

- Personal Loan Agreement 060623Document9 pagesPersonal Loan Agreement 060623Abhishek ChauhanNo ratings yet

- LoanagreementDocument13 pagesLoanagreementKiran KumarNo ratings yet

- Agreement Personal LoanDocument8 pagesAgreement Personal LoanAnkush KotakNo ratings yet

- Loan AgreementDocument6 pagesLoan AgreementV KiranNo ratings yet

- DmiDocument16 pagesDmiprecisioncalibration2023No ratings yet

- Loanagreement DE7T8195A3A0Document19 pagesLoanagreement DE7T8195A3A0Santosh KumarNo ratings yet

- Sanction Letter FAST4631717476565817 576774193678181Document10 pagesSanction Letter FAST4631717476565817 576774193678181parasbhalla97No ratings yet

- Welcome Letter IDEP1817543492886BDW 573179184512158Document14 pagesWelcome Letter IDEP1817543492886BDW 573179184512158srivastavashivay0No ratings yet

- Personal Loan Agreement Loan Amount Less Than 5 LakhsDocument14 pagesPersonal Loan Agreement Loan Amount Less Than 5 LakhsShivam KumarNo ratings yet

- Gss Term Loan Agreement CCD 5Document21 pagesGss Term Loan Agreement CCD 5meebamamta5No ratings yet

- Welcome LetterDocument14 pagesWelcome LettershubhamNo ratings yet

- Bank Loan ContractDocument6 pagesBank Loan ContractSiddharth BaxiNo ratings yet

- DlaDocument7 pagesDlasurendraNo ratings yet

- Loan AgreementDocument25 pagesLoan Agreementreddyskyblue1No ratings yet

- FN1683347094 Loan AgreementDocument7 pagesFN1683347094 Loan AgreementAbhranil BiswasNo ratings yet

- UntitledDocument5 pagesUntitledKhatuJi HandicraftsNo ratings yet

- CR38CC5D01ID4551098 BorrowerDocument12 pagesCR38CC5D01ID4551098 BorrowerMohammed Ameer RNo ratings yet

- Aggregrator AgreementDocument15 pagesAggregrator AgreementKartikaeNo ratings yet

- Loan AgreementDocument25 pagesLoan AgreementShalika UNo ratings yet

- Loan Agreement: Transaction Details ScheduleDocument12 pagesLoan Agreement: Transaction Details ScheduleVamsi ThallapaneniNo ratings yet

- Welcome Letter IDEP169831873135LAWO 692816391183734Document14 pagesWelcome Letter IDEP169831873135LAWO 692816391183734tucker078605No ratings yet

- Custom ApplicationDocument40 pagesCustom Applicationrathornitin7812No ratings yet

- Credit AgreementDocument2 pagesCredit AgreementLeonard PaduaNo ratings yet

- Preview AgreementDocument6 pagesPreview AgreementdivyaNo ratings yet

- LAP and SME Loan AgreementDocument31 pagesLAP and SME Loan AgreementDeepali RajputNo ratings yet

- IDFC Personal Loan AgreementDocument16 pagesIDFC Personal Loan Agreementpritamjangir75No ratings yet

- Loan AgreementDocument20 pagesLoan AgreementAnjani DeviNo ratings yet

- Welcome Letter IDEP6519177878724Y5C 411695826587198Document12 pagesWelcome Letter IDEP6519177878724Y5C 411695826587198BhoomikaNo ratings yet

- Loan Agreement Bank 2.dotDocument20 pagesLoan Agreement Bank 2.dotlily kamwanaNo ratings yet

- Preview AgreementDocument6 pagesPreview AgreementBankloan easyNo ratings yet

- Loan AgreementDocument5 pagesLoan AgreementPriyanshu SinghNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)100% (1)

- Modification Agreement + ACH CompleteDocument4 pagesModification Agreement + ACH CompleteEJ RoblesNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Robin (GAA7277) 1Document1 pageRobin (GAA7277) 1dheerajpa009No ratings yet

- Payslip Feb 2024Document1 pagePayslip Feb 2024dheerajpa009No ratings yet

- Electricitybill May-2024Document1 pageElectricitybill May-2024dheerajpa009No ratings yet

- Payslip - JanuaryDocument1 pagePayslip - Januarydheerajpa009No ratings yet

- Payslip April 2024Document1 pagePayslip April 2024dheerajpa009No ratings yet

- Wa0027.Document1 pageWa0027.dheerajpa009No ratings yet

- Wa0088.Document1 pageWa0088.dheerajpa009No ratings yet

- Key Fact StatementDocument3 pagesKey Fact Statementdheerajpa009No ratings yet

- Inv 700724109062028 o 22112023Document1 pageInv 700724109062028 o 22112023dheerajpa009No ratings yet

- Syllabus G11 FABMoneDocument5 pagesSyllabus G11 FABMoneMJ TobiasNo ratings yet

- Mutual Fund PPT 123Document53 pagesMutual Fund PPT 123Sneha SinghNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- Accounting Chapter 4 SolutionsDocument14 pagesAccounting Chapter 4 Solutionsali sherNo ratings yet

- 1 Program Withdrawal & Refund Form (Merged)Document2 pages1 Program Withdrawal & Refund Form (Merged)Hartek BackupNo ratings yet

- CIA-1 Sushanth BSDocument5 pagesCIA-1 Sushanth BSKausik BhagatNo ratings yet

- CH 08Document75 pagesCH 08Surabaya Lindungi 2021No ratings yet

- Midterm Paper-FSP-Fall 2020Document4 pagesMidterm Paper-FSP-Fall 2020syed aliNo ratings yet

- Reseach AnalystDocument3 pagesReseach Analystnaveen0037No ratings yet

- Smartprotect Legacy Max BrochureDocument10 pagesSmartprotect Legacy Max BrochureSuthasiri DineshNo ratings yet

- ARCI - The New PlayerDocument4 pagesARCI - The New PlayerjohnNo ratings yet

- Understanding Financial Ratios AnalysisDocument6 pagesUnderstanding Financial Ratios AnalysismanuNo ratings yet

- 5-10 Fa1Document10 pages5-10 Fa1Shahab ShafiNo ratings yet

- Bank Term Deposit Scheme, 2006Document4 pagesBank Term Deposit Scheme, 2006Sundar RajNo ratings yet

- Islamic Banking in Bangladesh Current ST PDFDocument25 pagesIslamic Banking in Bangladesh Current ST PDFAbuzar GifariNo ratings yet

- Debit NoteDocument2 pagesDebit NoteRashad AhamedNo ratings yet

- Practice of General Insurance NotesDocument74 pagesPractice of General Insurance NotesMohit Kumar100% (15)

- Laporan Keuangan Era IndonesiaDocument188 pagesLaporan Keuangan Era IndonesiaCantyaNo ratings yet

- Int RemittanceDocument7 pagesInt Remittanceግሩም ሽ.No ratings yet

- Null 20220614 231107Document4 pagesNull 20220614 231107FARMASI BEC BUBATNo ratings yet

- Asia Order FormDocument10 pagesAsia Order FormVidya Sagar SundupalleNo ratings yet

- Spyder Active SportsDocument12 pagesSpyder Active SportsShubham SharmaNo ratings yet

- Chapter 4Document16 pagesChapter 4April Noreen Riego PizarraNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- Reconciliation TemplateDocument1 pageReconciliation TemplateSyed AmrohviNo ratings yet

- 76 Years Old and Still Growing Strong: HoldingsDocument45 pages76 Years Old and Still Growing Strong: HoldingsEdward NjorogeNo ratings yet

- Quarter 2 - Module 1 General MathematicsDocument6 pagesQuarter 2 - Module 1 General MathematicsKristine AlcordoNo ratings yet

- Annex I MSN012024-1Document5 pagesAnnex I MSN012024-1moashi chandraNo ratings yet

- Intermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFDocument61 pagesIntermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (8)