Professional Documents

Culture Documents

Form No.16 Aa-1

Form No.16 Aa-1

Uploaded by

Vishnu Vardhan ACopyright:

Available Formats

You might also like

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Employee Release FormDocument2 pagesEmployee Release FormKhan Mohammad Mahmud Hasan100% (1)

- Gelos Vs Court of Appeals 1992Document2 pagesGelos Vs Court of Appeals 1992Ruperto A. Alfafara III100% (1)

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Form 16 2023-2024Document2 pagesForm 16 2023-2024Suprasanna KallakuntlaNo ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- B Praveen 20-21Document2 pagesB Praveen 20-21psyamala2004No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- 7562 Form16-B-201819-379 PDFDocument1 page7562 Form16-B-201819-379 PDFAnonymous vlaen0sHNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- INCOME TAX 2015-16. Annexure - IDocument5 pagesINCOME TAX 2015-16. Annexure - IPhani PitchikaNo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Digitally Signed by DINESH MOHAN: (Refer Annexure)Document3 pagesDigitally Signed by DINESH MOHAN: (Refer Annexure)Er Mayank UppalNo ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21suhail amirNo ratings yet

- Form No 16Document2 pagesForm No 16saran2rasuNo ratings yet

- Form16_PDF2023-2024-4Document2 pagesForm16_PDF2023-2024-4memer.guru07No ratings yet

- Amit Singh-Payslip - Apr-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Apr-2021-Unlocked PDFamitNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form16 BKGDocument4 pagesForm16 BKGapi-3706890100% (2)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Topik10 - 11pengurusan Kewangan - Etika, Profesionalism Tanggungjawab SosialDocument12 pagesTopik10 - 11pengurusan Kewangan - Etika, Profesionalism Tanggungjawab SosialAdlina SyahirahNo ratings yet

- Resume CreaterDocument5 pagesResume Createrfhtjmdifg100% (2)

- An Analysis of The Causes and Impact of ReworkDocument143 pagesAn Analysis of The Causes and Impact of Reworksm_carvalhoNo ratings yet

- Assignment 2 Frame WorkDocument20 pagesAssignment 2 Frame WorkSunday MwanzaNo ratings yet

- ResearchDocument21 pagesResearchmirrorsanNo ratings yet

- ArchanaDocument7 pagesArchanaArchana KalaiselvanNo ratings yet

- Undertaking From Employee For Documents - HRDocument2 pagesUndertaking From Employee For Documents - HRDevender Rao TakkalapellyNo ratings yet

- Tata MotorsDocument41 pagesTata MotorsAnu Srivastava0% (1)

- Winter Internship Report at SRM Star Mercedes BenzDocument24 pagesWinter Internship Report at SRM Star Mercedes BenzNazreena MukherjeeNo ratings yet

- Micro Economics SolDocument202 pagesMicro Economics Solkhushi nagpalNo ratings yet

- BUS 1101 - Written Assignment Unit 7Document6 pagesBUS 1101 - Written Assignment Unit 7SouAi AzIzNo ratings yet

- Iopsy M1L3Document6 pagesIopsy M1L3Maria Helen PalacayNo ratings yet

- Human Resources (Done)Document24 pagesHuman Resources (Done)Nur ZulaikhaNo ratings yet

- Human Resource AccountingDocument28 pagesHuman Resource AccountingGyanashree RoutNo ratings yet

- Id (E) 982Document25 pagesId (E) 982Amir KhanNo ratings yet

- Business Budgeting Is One of The Most Powerful Financial Tools Available To Any SmallDocument3 pagesBusiness Budgeting Is One of The Most Powerful Financial Tools Available To Any SmallShanmuka SreenivasNo ratings yet

- Sementara Gini DuluDocument8 pagesSementara Gini Duludiana noveraNo ratings yet

- Work-Life Balance and Life Balance Among Healthcare ProfessionalsDocument6 pagesWork-Life Balance and Life Balance Among Healthcare Professionalsindex PubNo ratings yet

- Facility Layout - Objectives, Design and Factors Affecting The LayoutDocument11 pagesFacility Layout - Objectives, Design and Factors Affecting The LayoutKaran ShoorNo ratings yet

- External Application FormDocument3 pagesExternal Application Formchaitali jawaleNo ratings yet

- Dual Career Couples in BangladeshDocument30 pagesDual Career Couples in BangladeshFatema ChowdhuryNo ratings yet

- 9708 w08 QP 3Document12 pages9708 w08 QP 3roukaiya_peerkhanNo ratings yet

- Industry Readiness Learning Materials No. 01 ContDocument143 pagesIndustry Readiness Learning Materials No. 01 ContAbegail Calbitaza DucenaNo ratings yet

- Dimensions of CultureDocument5 pagesDimensions of CulturefunshareNo ratings yet

- Myob Ace Payroll: Accounting &Document2 pagesMyob Ace Payroll: Accounting &Muhammad RamadhanNo ratings yet

- Organizational Behavior مترجمDocument36 pagesOrganizational Behavior مترجمSamsonNo ratings yet

- International Institute of Professional Studies, DAVVDocument5 pagesInternational Institute of Professional Studies, DAVVGulshan GurnaniNo ratings yet

- Management Quiz BowlDocument53 pagesManagement Quiz BowlFaye ColasNo ratings yet

Form No.16 Aa-1

Form No.16 Aa-1

Uploaded by

Vishnu Vardhan AOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No.16 Aa-1

Form No.16 Aa-1

Uploaded by

Vishnu Vardhan ACopyright:

Available Formats

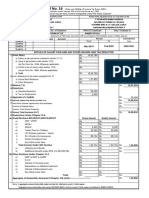

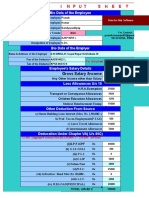

FORM NO.

16 AA

(Sce rule 31(1)(a))

Certificate under section 203 of the incomc-tax deducied at source from income chargable under thehead "Salarics"

Name and |Nane A, SANDHYA

&dcsignation

Iddress of employer :O/o Commissioner of Policc, Rachakonda. of cinploycc : Women Police Constable - 8852 - 2400201

DAN NO., of the Deductor AN NO. of the Deductor : PAN NO. of thc Employcc:

HYDCO7829D BOLPA6120K

Acknowledgement Nos. of allquarterlystatement of TDS under

sub-section (3) of section 200 as provided by Facilitation Centre or Period Assess1ncnt ycar

NSDL web-site.

Quarter Acknowlcdge No. From To

01-03-2022 28-02-2023 2023-2024

DETAILS OF SALARY PAID AND OTHER INCOME AND TAX DEDUCTED

1. Gross Salary:

(a) Salary as per provisions contained in Section 17 (1) Rs. 517148

(b) Value of perquisites u/S 17(2) (as per Form No. 12BA, wherever appicable) Rs.

(c) Profits in lieu of salary u/S 17(3) (as per Form No. 12 BA, wherever appicable Rs.

Rs. 517148

(d) Total

2. Less: Allowance to the extent exempt U/s 10 (13A)

(a) Least of : (i) Actual Amount of HRA received Rs. Rs

(ii) Expenditure of rent in excess of 10% of salary (Indicate Rs.

the amount of rent paid Rs 0 per annum)

(iii) 40% of Salary (Basic + DA) Rs.

Rs. 3180 Rs. 3180

(b) (i) Transport Allowance

3. Balance (1-2) Rs. 513968

4. Deductions

(a) Entertainment allowance Rs.

(b) Tax on employment - (Prof. Tax) Rs. 2200

(c) KMA /RA Rs. 3575

Rs. 5775

5. Aggregate of 4(a) to 4(b)

6. Income chargeable under the head 'Salaries(3-5) Rs. 508193

7. Add: Any other income reported by the employee

Rs.

Income from House Property

Rs. 508193

8. Gross total income(6+7)

9. Deduction under chapter VIA Gross Amt. Ded Amt.

(A) Section 80C, 80CCC AND 80CCD

(a)Section 80C

Rs.

(i) GPF

(ii) APGLI Rs. 11000

(ii) GIS Rs. 330

(v) EWF Rs.

(vi) HBA Principal Amt. Rs.

(vii)LIC RS.

(viii)Pvt. LIC RS

(ix) RD (PLI) RS

Rs

(x) UTI

(xi) Child Education Expenses Rs.

Rs

(xii) Invest in MF's/Eqity Shares/Debntrs/Bonds Rs Rs. 11330

(xii)FD'S (more than Five year's)

Rs.

(b)Section 80 CCA (NSC)

Rs.

(c) Section 80 CCB (ELSS)

Rs.

(d) Section 80CCC(Other Pension Funds)

Pension Schcnne) |Rs. 17000 Rs, 49) l6

(c) Section 80 CCD(Contributory Rs. 49) l6 Rs I50000

Total Section 80C

Qu:al. At. Ded Amt.

Chapler VI A Gross At.

(B) Other Scction (For c , 80E, 80G ctc) under R

(a) Scction 192 2(B)(HBA lnt) Rs.

(d) Scction 80 D (Medical lnsurance Premium)

Rs.

(C) Scction 80 DD (Mcdical Expenses)

() Section 80E (nt. on Lon taken on Higher Education

Rs.

Rs.

(g) Scction 80 G (DonationsFunds)

Rs.

(h) Scction 80 U (Person with Disability)

Rs.

(i) LTAExemption Rs.

() Othcr Excmptions

Rs. S0000

(C) Standard Deduction U/s 16 (ia) Rs 992 36

Rs. S0000

10. Aggregate of Deductible amount Chapter VIA Rs, 408957

l1. Total incomc(8-10) Rs, 7948

12 Tax on Total income Rs. 7948

13. Rebate under Section 87A (Total lIncome < 5,00,000) Rs

14. Relief under Section 89(attach details)

Rs, 0

15. Tax payable (12 - (13+14))

Rs.

l6. Surcharge (on tax computcd at S.No. 15)

Rs.

17. Education Cess a3% (on tax at S.No. 15 and Surcharge at S.No. l6)

Rs.

18. Tax payable (15+16+17)

19. Less (a) Tax deduction at source ws 192(1) Rs.

(b) Tax paid by the employer on behalf of the

employee ws 192(1lA) on perquisitics u's Rs

17(2)(1)

Rs

20. Tax payable/refundable(17-18)

INTO CENTRAL GOVERNMENT ACCOUNT

DETAILS OF TAX DEDUCTION AND DEPOSITED

BSR Code of Datc on which Transfer Voucher/

S.NO. TDS Education Total Chequc/DD Challan identification

Cess tax

Bank Branch tax depositcd

capacity of Asst. Accounts Officcr (designation)

I. P. Pradeep Kumar Son of P. Venkanna working in the

(in words) has been deducted at source and paid to the credit of the

do hereby cerífy that a sum of Rs. 0 (Rupees zeroOnly) given

Central Governmcnt. Ifurther certify that the information abovc is true and corrcct bascd on the books of Account, document

and other available records.

Signature of the person respon_iðlofor deduction of tav

Full Namne

Place :

Designation

Date :

You might also like

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Employee Release FormDocument2 pagesEmployee Release FormKhan Mohammad Mahmud Hasan100% (1)

- Gelos Vs Court of Appeals 1992Document2 pagesGelos Vs Court of Appeals 1992Ruperto A. Alfafara III100% (1)

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Form 16 2023-2024Document2 pagesForm 16 2023-2024Suprasanna KallakuntlaNo ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- B Praveen 20-21Document2 pagesB Praveen 20-21psyamala2004No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- 7562 Form16-B-201819-379 PDFDocument1 page7562 Form16-B-201819-379 PDFAnonymous vlaen0sHNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- INCOME TAX 2015-16. Annexure - IDocument5 pagesINCOME TAX 2015-16. Annexure - IPhani PitchikaNo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Digitally Signed by DINESH MOHAN: (Refer Annexure)Document3 pagesDigitally Signed by DINESH MOHAN: (Refer Annexure)Er Mayank UppalNo ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21suhail amirNo ratings yet

- Form No 16Document2 pagesForm No 16saran2rasuNo ratings yet

- Form16_PDF2023-2024-4Document2 pagesForm16_PDF2023-2024-4memer.guru07No ratings yet

- Amit Singh-Payslip - Apr-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Apr-2021-Unlocked PDFamitNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form16 BKGDocument4 pagesForm16 BKGapi-3706890100% (2)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Topik10 - 11pengurusan Kewangan - Etika, Profesionalism Tanggungjawab SosialDocument12 pagesTopik10 - 11pengurusan Kewangan - Etika, Profesionalism Tanggungjawab SosialAdlina SyahirahNo ratings yet

- Resume CreaterDocument5 pagesResume Createrfhtjmdifg100% (2)

- An Analysis of The Causes and Impact of ReworkDocument143 pagesAn Analysis of The Causes and Impact of Reworksm_carvalhoNo ratings yet

- Assignment 2 Frame WorkDocument20 pagesAssignment 2 Frame WorkSunday MwanzaNo ratings yet

- ResearchDocument21 pagesResearchmirrorsanNo ratings yet

- ArchanaDocument7 pagesArchanaArchana KalaiselvanNo ratings yet

- Undertaking From Employee For Documents - HRDocument2 pagesUndertaking From Employee For Documents - HRDevender Rao TakkalapellyNo ratings yet

- Tata MotorsDocument41 pagesTata MotorsAnu Srivastava0% (1)

- Winter Internship Report at SRM Star Mercedes BenzDocument24 pagesWinter Internship Report at SRM Star Mercedes BenzNazreena MukherjeeNo ratings yet

- Micro Economics SolDocument202 pagesMicro Economics Solkhushi nagpalNo ratings yet

- BUS 1101 - Written Assignment Unit 7Document6 pagesBUS 1101 - Written Assignment Unit 7SouAi AzIzNo ratings yet

- Iopsy M1L3Document6 pagesIopsy M1L3Maria Helen PalacayNo ratings yet

- Human Resources (Done)Document24 pagesHuman Resources (Done)Nur ZulaikhaNo ratings yet

- Human Resource AccountingDocument28 pagesHuman Resource AccountingGyanashree RoutNo ratings yet

- Id (E) 982Document25 pagesId (E) 982Amir KhanNo ratings yet

- Business Budgeting Is One of The Most Powerful Financial Tools Available To Any SmallDocument3 pagesBusiness Budgeting Is One of The Most Powerful Financial Tools Available To Any SmallShanmuka SreenivasNo ratings yet

- Sementara Gini DuluDocument8 pagesSementara Gini Duludiana noveraNo ratings yet

- Work-Life Balance and Life Balance Among Healthcare ProfessionalsDocument6 pagesWork-Life Balance and Life Balance Among Healthcare Professionalsindex PubNo ratings yet

- Facility Layout - Objectives, Design and Factors Affecting The LayoutDocument11 pagesFacility Layout - Objectives, Design and Factors Affecting The LayoutKaran ShoorNo ratings yet

- External Application FormDocument3 pagesExternal Application Formchaitali jawaleNo ratings yet

- Dual Career Couples in BangladeshDocument30 pagesDual Career Couples in BangladeshFatema ChowdhuryNo ratings yet

- 9708 w08 QP 3Document12 pages9708 w08 QP 3roukaiya_peerkhanNo ratings yet

- Industry Readiness Learning Materials No. 01 ContDocument143 pagesIndustry Readiness Learning Materials No. 01 ContAbegail Calbitaza DucenaNo ratings yet

- Dimensions of CultureDocument5 pagesDimensions of CulturefunshareNo ratings yet

- Myob Ace Payroll: Accounting &Document2 pagesMyob Ace Payroll: Accounting &Muhammad RamadhanNo ratings yet

- Organizational Behavior مترجمDocument36 pagesOrganizational Behavior مترجمSamsonNo ratings yet

- International Institute of Professional Studies, DAVVDocument5 pagesInternational Institute of Professional Studies, DAVVGulshan GurnaniNo ratings yet

- Management Quiz BowlDocument53 pagesManagement Quiz BowlFaye ColasNo ratings yet