Professional Documents

Culture Documents

Workflow v1.06 English

Workflow v1.06 English

Uploaded by

fake.mCopyright:

Available Formats

You might also like

- 4 Step Trading Protocol Discretionary FrameworkDocument42 pages4 Step Trading Protocol Discretionary Frameworkfake.mNo ratings yet

- TRADING Hub 4Document27 pagesTRADING Hub 4fake.m100% (3)

- Competition and EntrepreneurshipDocument20 pagesCompetition and Entrepreneurshiplego mihandNo ratings yet

- Forexbee Co Candlestick Patterns Dictionary PDFDocument20 pagesForexbee Co Candlestick Patterns Dictionary PDFDaffy JackNo ratings yet

- Black Panther EA PDFDocument3 pagesBlack Panther EA PDFNaga yNo ratings yet

- Challan FormDocument1 pageChallan FormAsad Latif BhuttaNo ratings yet

- Harmonic Forex Patterns Cheat SheetDocument2 pagesHarmonic Forex Patterns Cheat SheetAklchanNo ratings yet

- Pekeliling Perbendaharaan Fee PerundingDocument18 pagesPekeliling Perbendaharaan Fee PerundinglarysubNo ratings yet

- Live (Realtime) Intraday Advance Decline Ratio V/S Nifty ChartDocument1 pageLive (Realtime) Intraday Advance Decline Ratio V/S Nifty ChartSubrata PaulNo ratings yet

- Venue FL & N Line 23MY IncrementalDocument4 pagesVenue FL & N Line 23MY IncrementalManish GadeNo ratings yet

- Charts Pattern For PrintoutDocument7 pagesCharts Pattern For PrintoutHarshaaal100% (3)

- Technical AnalysisDocument32 pagesTechnical AnalysisDhikshit ShettyNo ratings yet

- Price PatternsDocument36 pagesPrice PatternsРуслан СалаватовNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargNo ratings yet

- EW CourseDocument3 pagesEW CourseRay Firdausi100% (1)

- Chart SheetDocument5 pagesChart SheethappyNo ratings yet

- Modify Chart Pattern - 20230930 - 122659 - 0000Document18 pagesModify Chart Pattern - 20230930 - 122659 - 0000happyNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographvinuthaNo ratings yet

- 4.1 6.4. Using Elliot To Stoploss and Scale in StrategyDocument6 pages4.1 6.4. Using Elliot To Stoploss and Scale in StrategyJardel QuefaceNo ratings yet

- FA1 1 3 Chapters PDFDocument35 pagesFA1 1 3 Chapters PDFJerlin PreethiNo ratings yet

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Nifty and Bank Nifty - ATM - MIS 10 Lot Both SellDocument7 pagesNifty and Bank Nifty - ATM - MIS 10 Lot Both SellCA Rakesh PatelNo ratings yet

- Harmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorDocument24 pagesHarmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorKiongboh AngNo ratings yet

- MODULE 3 - ThesignalystDocument144 pagesMODULE 3 - Thesignalystpeter.g.hageNo ratings yet

- Free Chart Patterns BookDocument7 pagesFree Chart Patterns BookShaqayeq Mohammady kavehNo ratings yet

- Trading Chart PatternDocument25 pagesTrading Chart PatternSwetha Rakesh AdigaNo ratings yet

- White PaperDocument18 pagesWhite PaperGoku BabaNo ratings yet

- An Introduction To EzSMCDocument14 pagesAn Introduction To EzSMCMusa Ali0% (1)

- Morgan Stanley On Indian Economy Building Stronger Recovery WeDocument23 pagesMorgan Stanley On Indian Economy Building Stronger Recovery Wemanitjainm21No ratings yet

- Shruti Jain Smart Task 02Document7 pagesShruti Jain Smart Task 02shruti jainNo ratings yet

- Virtual 9k ChallengeDocument101 pagesVirtual 9k ChallengeGab ByNo ratings yet

- Full Guide On Support and Resistance: by Crypto VIP SignalDocument11 pagesFull Guide On Support and Resistance: by Crypto VIP SignalSaroj PaudelNo ratings yet

- Nifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiaDocument4 pagesNifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiasudhakarrrrrrNo ratings yet

- Chart Advisor - Five Chart Patterns You Need To Know - Ascending - Descending TriangleDocument2 pagesChart Advisor - Five Chart Patterns You Need To Know - Ascending - Descending Triangleronald_gapuz8596No ratings yet

- White PaperDocument16 pagesWhite PaperAndi Reza PerdanakusumaNo ratings yet

- Abhishek Singh Solanki: Types of Trading and Time ZoneDocument4 pagesAbhishek Singh Solanki: Types of Trading and Time ZoneNilanjan MukherjeeNo ratings yet

- XDocument7 pagesXmessaoudi05ffNo ratings yet

- G5-T8 How To Use ADXDocument8 pagesG5-T8 How To Use ADXThe ShitNo ratings yet

- Masnavi Rumi Sindhi Translation by Faheem AkhterDocument4 pagesMasnavi Rumi Sindhi Translation by Faheem Akhterfaheemquest0% (1)

- Trading Setups FinalDocument1 pageTrading Setups Finalbrightmemoir 3DNo ratings yet

- Moving AveragesDocument8 pagesMoving AveragesShakambhari KumariNo ratings yet

- FTP AtoDocument27 pagesFTP AtojallwynaldrinNo ratings yet

- Secret No Loss Banknifty Option Strategy Trade With 2,00,000 - and Earn Minimum 20,000 - Per Month (A D Patel) (Z-Library)Document12 pagesSecret No Loss Banknifty Option Strategy Trade With 2,00,000 - and Earn Minimum 20,000 - Per Month (A D Patel) (Z-Library)katiyarm51No ratings yet

- Elliott Wave Advanced Trading Guide: Daily FX ResearchDocument8 pagesElliott Wave Advanced Trading Guide: Daily FX ResearchFrank BenNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- Pip Factory EntryDocument35 pagesPip Factory EntryChristiana OnyinyeNo ratings yet

- Technical Analysis Volume 1Document35 pagesTechnical Analysis Volume 1kalathiyad7No ratings yet

- ArabicTrader Forex Setp by Step 4rd Edition PDFDocument79 pagesArabicTrader Forex Setp by Step 4rd Edition PDFakdicomNo ratings yet

- Enter High Low and CloseDocument4 pagesEnter High Low and CloseKeerthy VeeranNo ratings yet

- 1.1 7.5. Why We Need Combine SMC and Key LevelDocument4 pages1.1 7.5. Why We Need Combine SMC and Key LevelJardel QuefaceNo ratings yet

- Intravest Forex Trading JournalDocument26 pagesIntravest Forex Trading JournalEDWIN100% (1)

- Trading and Settlement ProcedureDocument41 pagesTrading and Settlement ProcedureAshray BhandaryNo ratings yet

- Trend Is Your FriendDocument3 pagesTrend Is Your Frienddyadav00No ratings yet

- PO3 AMDXtradesDocument16 pagesPO3 AMDXtradesFrom Shark To WhaleNo ratings yet

- Smcgelo EbookDocument7 pagesSmcgelo EbooksiyaNo ratings yet

- Elliott Wave Theory: Rules, Guidelines and Basic Structures Elliott Wave TheoryDocument20 pagesElliott Wave Theory: Rules, Guidelines and Basic Structures Elliott Wave TheoryBiraj ShresthaNo ratings yet

- Euroboor CatalogusDocument96 pagesEuroboor CatalogusThonny BarreraNo ratings yet

- Daytrade Master Indicator: Entry SetupDocument7 pagesDaytrade Master Indicator: Entry SetupyaxaNo ratings yet

- FVG PDFDocument4 pagesFVG PDFRadu MihaiNo ratings yet

- Charts Patterns For PrintoutDocument6 pagesCharts Patterns For PrintoutHarshaaal100% (1)

- Process/Product Failure Modes and Effects Analysis (FMEA) Process/Product Failure Modes and Effects Analysis (FMEA)Document1 pageProcess/Product Failure Modes and Effects Analysis (FMEA) Process/Product Failure Modes and Effects Analysis (FMEA)Abu BindongNo ratings yet

- Houseofquality TemplateDocument1 pageHouseofquality TemplateMuhammad Syafiq FarhanNo ratings yet

- C&E MatrixDocument1 pageC&E MatrixHector Alfredo Davalos PalmaNo ratings yet

- GFORM - 015 Risk Assessment - Sales DeptDocument4 pagesGFORM - 015 Risk Assessment - Sales DeptsumanNo ratings yet

- CRYPTORESEARCHpro - Akash Network - EnglishDocument11 pagesCRYPTORESEARCHpro - Akash Network - Englishfake.mNo ratings yet

- ZM CapitalsDocument33 pagesZM Capitalsfake.mNo ratings yet

- Maximising Your Exit Value: Middle East Private Equity InsightsDocument2 pagesMaximising Your Exit Value: Middle East Private Equity InsightsLoNo ratings yet

- Chapter 4Document20 pagesChapter 4My TraNo ratings yet

- "A Study On Customer Expectation From On-Line Marketing WithDocument89 pages"A Study On Customer Expectation From On-Line Marketing Withprathamesh kaduNo ratings yet

- Entrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaDocument24 pagesEntrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaAbduahi asadNo ratings yet

- Chapters and Cases SummaryDocument206 pagesChapters and Cases Summarynan100% (3)

- Economy Growing and Economic CyclesDocument20 pagesEconomy Growing and Economic CyclesIhor LantukhNo ratings yet

- Presentation LindtDocument13 pagesPresentation Lindtnue.florentinaNo ratings yet

- Project Report On Agriculture Foreign Trade in IndiaDocument17 pagesProject Report On Agriculture Foreign Trade in IndiarriittuuNo ratings yet

- United Rug Company Is A Small Rug Retailer Owned andDocument1 pageUnited Rug Company Is A Small Rug Retailer Owned andAmit PandeyNo ratings yet

- Wayne A. Thorp - Testing Trading Success PDFDocument5 pagesWayne A. Thorp - Testing Trading Success PDFSalomão LealNo ratings yet

- Chapter 9Document34 pagesChapter 9carlo knowsNo ratings yet

- 17 Functions and Structure of Ad AgencyDocument19 pages17 Functions and Structure of Ad Agencyhii_bhartiNo ratings yet

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurNo ratings yet

- FINE 342 SummaryDocument17 pagesFINE 342 SummaryJohn ThompsonNo ratings yet

- EMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONDocument31 pagesEMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONbuffon100% (1)

- HavaianasDocument27 pagesHavaianasFDigital67% (6)

- 18M183 Sharan Karvy SIP REPORTDocument26 pages18M183 Sharan Karvy SIP REPORTsharan ChowdaryNo ratings yet

- Eaa3jz - HMW - 1494477727 - Chapter 3 Business Envt Case StudyDocument3 pagesEaa3jz - HMW - 1494477727 - Chapter 3 Business Envt Case StudyMansukh SonagaraNo ratings yet

- Economics Assignment 1Document3 pagesEconomics Assignment 1GbengaNo ratings yet

- CaseDocument27 pagesCasearuba ansariNo ratings yet

- TAMANNA - List of Draft Internal Factors of UnileverDocument3 pagesTAMANNA - List of Draft Internal Factors of UnilevernazninNo ratings yet

- Media PlanningDocument3 pagesMedia PlanningSuvamDharNo ratings yet

- 3 Booklet HST Mark-Ups Discounts Revised Sept 17 2017 CW AkDocument12 pages3 Booklet HST Mark-Ups Discounts Revised Sept 17 2017 CW Akapi-286302284No ratings yet

- Busines Plan FinalDocument24 pagesBusines Plan FinalVictoria Quebral Carumba100% (1)

- Marketing ManagementDocument55 pagesMarketing ManagementAman Kumar YadavNo ratings yet

- NRCS Economic Handbook Neh-611Document232 pagesNRCS Economic Handbook Neh-611Alvaro LemosNo ratings yet

- Etp Business PlanDocument12 pagesEtp Business PlanAjaykumarraja Grandhi Ajaykumarraja GrandhiNo ratings yet

- Property Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Document8 pagesProperty Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Varalakshmy ChaudhariNo ratings yet

Workflow v1.06 English

Workflow v1.06 English

Uploaded by

fake.mCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workflow v1.06 English

Workflow v1.06 English

Uploaded by

fake.mCopyright:

Available Formats

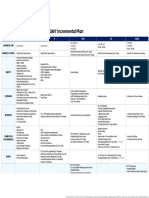

Sequence invalid Entry

Explanation of

Trademanagement

colours

0 1 2 3 4

Main process Sequence

Price Action System Trademanagement

determination

0 5

Market generates a

Subprocess High/Low

Point (0)

6

0 0 Market generates a

Low/High

Addition Link Point (A)

7

Market retraces

Point (B)

an

9 8 10 11

Possible trade

No trades Market does NOT Market exceeds entries:

No sequence exceed level 0.382 level 0.382 0.500 | 0.559 | 0.618

| 0.667

29 13

12

ef

Point (0)/(C) Market clearly

becomes Entry

exceeds

Point (0)/(A) Trademanagement

retracement level

28 14

St

A new sequence

could emerge Trades invalid

27

18 17 15

Sequence invalid Market moves to

Market reacts before Market exceeds

target level

Point (0) Point (0)

Point (C)

26 20

g 19 30

16

Market does NOT Market reaches

Market exceeds Market retraces

reach target level target level

Point (B) (B) -> (C) Sequence invalid

Point (C) Point (C)

sin

25 22 21 31 32

Possible trade

Possible trade

Market reacts before Entry entries: Entry

entries:

Point (B) Trademanagement 0.500 | 0.559 | 0.618 Trademanagement

1.618 | 1.809 | 2.000

| 0.667

24 23 34 33

Market clearly

Trades invalid Market exceeds

as

Trades invalid exceeds

Sequence valid level 2.000

retracement level

35

Market retraces entire

movement

(0) -> (C)

)K

38 37 36 39

Point (C) can extend Market does NOT Market exceeds

No trades

infinitely exceed level 0.382 level 0.382

40

Possible trade

entries:

(c

0.500 | 0.559 | 0.618

| 0.667

41 42 43

Market clearly

Entry

exceeds Trades invalid

Trademanagement

retracement level

48 47 46 44

New sequence Market creates a new Market reacts before Market exceeds

activated High/Low Point (0) Point (0)

45

Sequence invalid

(c) 2019 Kassing Stefan Version v1.06

Sequence

Price Action System Trademanagement

determination

Entry Position 35

Market makes a Trading System

No valid Point (0)

move

Market ends

Market creates an

movement and Possible Point (0)

absolute High/Low

changes direction

an

Market makes a

No valid Point (A)

move

ef

Market ends

Market creates a

movement and Possible Point (A)

Sub- High/Low

changes direction

Market makes a

corrective move

Market exceeds

level 0.382

St Confirmed Point (0)

and Point (A)

Entry System

g

Notes on trademanagement

Notes on sequence determination:

1) Risk

sin

1) A sequence can only be created at the beginning or

end of a movement. 1.1 Risk a maximum of 1-3% per trade - with a small account do not risk 1-3% per trade, but divide!

2) A sequence can not be created in the middle of a movement 2) Diversification

unless it results from an already active larger sequence.

2.1 Trade all markets if they give a valid entry..

3) A Point (0) usually represents the start of a movement, often as 2.2 Ideally hedge situations arise.

absolute High or Low.

3) Targets

4) Point A is only confirmed when the market retraces the

movement (0)-(A) and moves to our entry level. Risk Reward Ratio

as

100% Retracement

5) Sequence is activated when the market made a successful 100% Extension

Retracement and Point (A) is exceeded / undercut. 161-200er Extension

An activated sequence has a higher chance to reach the target Dailyrange Link: Forex Volatility Calculator

level than a not yet activated sequence.

4) StopLoss

4.1 Reduce risk = halve SL / max. 5 Pips SL

4.2 Move SL to BE if the market is in a bull/bear retracement level before your double profit

)K

4.3 Do not move the SL (except on BE) - Trade hits either BE or target level

4.4 Spread is not considered

4.5 Single trade strategy: If the market is within C-Target range (200 Ext) put your SL 20 Pips above

5) Entry

5.1 Consider Spread

5.2 The entry areas should not overlap with the SL of the previous entrylevel

5.3 The entry is traded as long as it is valid

5.4 If the StopLoss of the 0.5 retracement entry covers all other entry areas (50-66.7) -> reduce the SL

(c

and open another trade at 66.7 retracement level

6) General

6.1 If X trades hit SL and it is possible to compensate the losses with one trade -> Take your profit!

6.2 Profits should be secured intraday.

6.3 Trading in the direction of the sequence is less risky than trading against the sequence.

6.4 Theoretically, wave C can be of infinite length..

6.5 C-Wave is also considered to be completed if the market reacts 4 Pips before the target level (max. 5 Pips tolerance)

6.6 Retracement of the BC-Move always represents a possible reentry (if sequence is activated)

6.7 If the market reacts at the 200 extension level and successfully retraces

the entire move (0)->(C) Target level no longer gives entries.

6.8 If Trade is stopped out at BE -> get back in

6.9 From a sequential point of view, the market may move up to Point (0) (if B-C movement is dominant / impulsive).

From an entry point of view, only the 50-66.7 retracement level count.

(c) 2019 Kassing Stefan Version v1.06

You might also like

- 4 Step Trading Protocol Discretionary FrameworkDocument42 pages4 Step Trading Protocol Discretionary Frameworkfake.mNo ratings yet

- TRADING Hub 4Document27 pagesTRADING Hub 4fake.m100% (3)

- Competition and EntrepreneurshipDocument20 pagesCompetition and Entrepreneurshiplego mihandNo ratings yet

- Forexbee Co Candlestick Patterns Dictionary PDFDocument20 pagesForexbee Co Candlestick Patterns Dictionary PDFDaffy JackNo ratings yet

- Black Panther EA PDFDocument3 pagesBlack Panther EA PDFNaga yNo ratings yet

- Challan FormDocument1 pageChallan FormAsad Latif BhuttaNo ratings yet

- Harmonic Forex Patterns Cheat SheetDocument2 pagesHarmonic Forex Patterns Cheat SheetAklchanNo ratings yet

- Pekeliling Perbendaharaan Fee PerundingDocument18 pagesPekeliling Perbendaharaan Fee PerundinglarysubNo ratings yet

- Live (Realtime) Intraday Advance Decline Ratio V/S Nifty ChartDocument1 pageLive (Realtime) Intraday Advance Decline Ratio V/S Nifty ChartSubrata PaulNo ratings yet

- Venue FL & N Line 23MY IncrementalDocument4 pagesVenue FL & N Line 23MY IncrementalManish GadeNo ratings yet

- Charts Pattern For PrintoutDocument7 pagesCharts Pattern For PrintoutHarshaaal100% (3)

- Technical AnalysisDocument32 pagesTechnical AnalysisDhikshit ShettyNo ratings yet

- Price PatternsDocument36 pagesPrice PatternsРуслан СалаватовNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargNo ratings yet

- EW CourseDocument3 pagesEW CourseRay Firdausi100% (1)

- Chart SheetDocument5 pagesChart SheethappyNo ratings yet

- Modify Chart Pattern - 20230930 - 122659 - 0000Document18 pagesModify Chart Pattern - 20230930 - 122659 - 0000happyNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographvinuthaNo ratings yet

- 4.1 6.4. Using Elliot To Stoploss and Scale in StrategyDocument6 pages4.1 6.4. Using Elliot To Stoploss and Scale in StrategyJardel QuefaceNo ratings yet

- FA1 1 3 Chapters PDFDocument35 pagesFA1 1 3 Chapters PDFJerlin PreethiNo ratings yet

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Nifty and Bank Nifty - ATM - MIS 10 Lot Both SellDocument7 pagesNifty and Bank Nifty - ATM - MIS 10 Lot Both SellCA Rakesh PatelNo ratings yet

- Harmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorDocument24 pagesHarmonic Pattern Trading Strategy - Best Way To Use The Harmonic Patterns IndicatorKiongboh AngNo ratings yet

- MODULE 3 - ThesignalystDocument144 pagesMODULE 3 - Thesignalystpeter.g.hageNo ratings yet

- Free Chart Patterns BookDocument7 pagesFree Chart Patterns BookShaqayeq Mohammady kavehNo ratings yet

- Trading Chart PatternDocument25 pagesTrading Chart PatternSwetha Rakesh AdigaNo ratings yet

- White PaperDocument18 pagesWhite PaperGoku BabaNo ratings yet

- An Introduction To EzSMCDocument14 pagesAn Introduction To EzSMCMusa Ali0% (1)

- Morgan Stanley On Indian Economy Building Stronger Recovery WeDocument23 pagesMorgan Stanley On Indian Economy Building Stronger Recovery Wemanitjainm21No ratings yet

- Shruti Jain Smart Task 02Document7 pagesShruti Jain Smart Task 02shruti jainNo ratings yet

- Virtual 9k ChallengeDocument101 pagesVirtual 9k ChallengeGab ByNo ratings yet

- Full Guide On Support and Resistance: by Crypto VIP SignalDocument11 pagesFull Guide On Support and Resistance: by Crypto VIP SignalSaroj PaudelNo ratings yet

- Nifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiaDocument4 pagesNifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiasudhakarrrrrrNo ratings yet

- Chart Advisor - Five Chart Patterns You Need To Know - Ascending - Descending TriangleDocument2 pagesChart Advisor - Five Chart Patterns You Need To Know - Ascending - Descending Triangleronald_gapuz8596No ratings yet

- White PaperDocument16 pagesWhite PaperAndi Reza PerdanakusumaNo ratings yet

- Abhishek Singh Solanki: Types of Trading and Time ZoneDocument4 pagesAbhishek Singh Solanki: Types of Trading and Time ZoneNilanjan MukherjeeNo ratings yet

- XDocument7 pagesXmessaoudi05ffNo ratings yet

- G5-T8 How To Use ADXDocument8 pagesG5-T8 How To Use ADXThe ShitNo ratings yet

- Masnavi Rumi Sindhi Translation by Faheem AkhterDocument4 pagesMasnavi Rumi Sindhi Translation by Faheem Akhterfaheemquest0% (1)

- Trading Setups FinalDocument1 pageTrading Setups Finalbrightmemoir 3DNo ratings yet

- Moving AveragesDocument8 pagesMoving AveragesShakambhari KumariNo ratings yet

- FTP AtoDocument27 pagesFTP AtojallwynaldrinNo ratings yet

- Secret No Loss Banknifty Option Strategy Trade With 2,00,000 - and Earn Minimum 20,000 - Per Month (A D Patel) (Z-Library)Document12 pagesSecret No Loss Banknifty Option Strategy Trade With 2,00,000 - and Earn Minimum 20,000 - Per Month (A D Patel) (Z-Library)katiyarm51No ratings yet

- Elliott Wave Advanced Trading Guide: Daily FX ResearchDocument8 pagesElliott Wave Advanced Trading Guide: Daily FX ResearchFrank BenNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- Pip Factory EntryDocument35 pagesPip Factory EntryChristiana OnyinyeNo ratings yet

- Technical Analysis Volume 1Document35 pagesTechnical Analysis Volume 1kalathiyad7No ratings yet

- ArabicTrader Forex Setp by Step 4rd Edition PDFDocument79 pagesArabicTrader Forex Setp by Step 4rd Edition PDFakdicomNo ratings yet

- Enter High Low and CloseDocument4 pagesEnter High Low and CloseKeerthy VeeranNo ratings yet

- 1.1 7.5. Why We Need Combine SMC and Key LevelDocument4 pages1.1 7.5. Why We Need Combine SMC and Key LevelJardel QuefaceNo ratings yet

- Intravest Forex Trading JournalDocument26 pagesIntravest Forex Trading JournalEDWIN100% (1)

- Trading and Settlement ProcedureDocument41 pagesTrading and Settlement ProcedureAshray BhandaryNo ratings yet

- Trend Is Your FriendDocument3 pagesTrend Is Your Frienddyadav00No ratings yet

- PO3 AMDXtradesDocument16 pagesPO3 AMDXtradesFrom Shark To WhaleNo ratings yet

- Smcgelo EbookDocument7 pagesSmcgelo EbooksiyaNo ratings yet

- Elliott Wave Theory: Rules, Guidelines and Basic Structures Elliott Wave TheoryDocument20 pagesElliott Wave Theory: Rules, Guidelines and Basic Structures Elliott Wave TheoryBiraj ShresthaNo ratings yet

- Euroboor CatalogusDocument96 pagesEuroboor CatalogusThonny BarreraNo ratings yet

- Daytrade Master Indicator: Entry SetupDocument7 pagesDaytrade Master Indicator: Entry SetupyaxaNo ratings yet

- FVG PDFDocument4 pagesFVG PDFRadu MihaiNo ratings yet

- Charts Patterns For PrintoutDocument6 pagesCharts Patterns For PrintoutHarshaaal100% (1)

- Process/Product Failure Modes and Effects Analysis (FMEA) Process/Product Failure Modes and Effects Analysis (FMEA)Document1 pageProcess/Product Failure Modes and Effects Analysis (FMEA) Process/Product Failure Modes and Effects Analysis (FMEA)Abu BindongNo ratings yet

- Houseofquality TemplateDocument1 pageHouseofquality TemplateMuhammad Syafiq FarhanNo ratings yet

- C&E MatrixDocument1 pageC&E MatrixHector Alfredo Davalos PalmaNo ratings yet

- GFORM - 015 Risk Assessment - Sales DeptDocument4 pagesGFORM - 015 Risk Assessment - Sales DeptsumanNo ratings yet

- CRYPTORESEARCHpro - Akash Network - EnglishDocument11 pagesCRYPTORESEARCHpro - Akash Network - Englishfake.mNo ratings yet

- ZM CapitalsDocument33 pagesZM Capitalsfake.mNo ratings yet

- Maximising Your Exit Value: Middle East Private Equity InsightsDocument2 pagesMaximising Your Exit Value: Middle East Private Equity InsightsLoNo ratings yet

- Chapter 4Document20 pagesChapter 4My TraNo ratings yet

- "A Study On Customer Expectation From On-Line Marketing WithDocument89 pages"A Study On Customer Expectation From On-Line Marketing Withprathamesh kaduNo ratings yet

- Entrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaDocument24 pagesEntrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaAbduahi asadNo ratings yet

- Chapters and Cases SummaryDocument206 pagesChapters and Cases Summarynan100% (3)

- Economy Growing and Economic CyclesDocument20 pagesEconomy Growing and Economic CyclesIhor LantukhNo ratings yet

- Presentation LindtDocument13 pagesPresentation Lindtnue.florentinaNo ratings yet

- Project Report On Agriculture Foreign Trade in IndiaDocument17 pagesProject Report On Agriculture Foreign Trade in IndiarriittuuNo ratings yet

- United Rug Company Is A Small Rug Retailer Owned andDocument1 pageUnited Rug Company Is A Small Rug Retailer Owned andAmit PandeyNo ratings yet

- Wayne A. Thorp - Testing Trading Success PDFDocument5 pagesWayne A. Thorp - Testing Trading Success PDFSalomão LealNo ratings yet

- Chapter 9Document34 pagesChapter 9carlo knowsNo ratings yet

- 17 Functions and Structure of Ad AgencyDocument19 pages17 Functions and Structure of Ad Agencyhii_bhartiNo ratings yet

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurNo ratings yet

- FINE 342 SummaryDocument17 pagesFINE 342 SummaryJohn ThompsonNo ratings yet

- EMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONDocument31 pagesEMPRESAS POLAR vs. BAVARIA, S.AACQUISITIONbuffon100% (1)

- HavaianasDocument27 pagesHavaianasFDigital67% (6)

- 18M183 Sharan Karvy SIP REPORTDocument26 pages18M183 Sharan Karvy SIP REPORTsharan ChowdaryNo ratings yet

- Eaa3jz - HMW - 1494477727 - Chapter 3 Business Envt Case StudyDocument3 pagesEaa3jz - HMW - 1494477727 - Chapter 3 Business Envt Case StudyMansukh SonagaraNo ratings yet

- Economics Assignment 1Document3 pagesEconomics Assignment 1GbengaNo ratings yet

- CaseDocument27 pagesCasearuba ansariNo ratings yet

- TAMANNA - List of Draft Internal Factors of UnileverDocument3 pagesTAMANNA - List of Draft Internal Factors of UnilevernazninNo ratings yet

- Media PlanningDocument3 pagesMedia PlanningSuvamDharNo ratings yet

- 3 Booklet HST Mark-Ups Discounts Revised Sept 17 2017 CW AkDocument12 pages3 Booklet HST Mark-Ups Discounts Revised Sept 17 2017 CW Akapi-286302284No ratings yet

- Busines Plan FinalDocument24 pagesBusines Plan FinalVictoria Quebral Carumba100% (1)

- Marketing ManagementDocument55 pagesMarketing ManagementAman Kumar YadavNo ratings yet

- NRCS Economic Handbook Neh-611Document232 pagesNRCS Economic Handbook Neh-611Alvaro LemosNo ratings yet

- Etp Business PlanDocument12 pagesEtp Business PlanAjaykumarraja Grandhi Ajaykumarraja GrandhiNo ratings yet

- Property Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Document8 pagesProperty Sales Analysis in Vanderburgh County J Indiana - A Comprehensive Study of Real Estate Trends in 2013Varalakshmy ChaudhariNo ratings yet