Professional Documents

Culture Documents

Treasury Reviewer

Treasury Reviewer

Uploaded by

catapanggwen0 ratings0% found this document useful (0 votes)

2 views5 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views5 pagesTreasury Reviewer

Treasury Reviewer

Uploaded by

catapanggwenCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

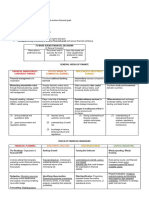

TREASURY MANAGEMENT providing financial leadership and insights to

support informed decision-making and drive

CHIEF FINANCIAL OFFICER (CFO)- highest-

long-term value creation for the organization.

ranking financial professional in an organization

and is responsible for the fiscal health of the FUNCTION OF A CONTROLLER

business.

WHAT IS CONTROLLER?

-plays a critical role in an

responsible for the internal financial

organization's leadership team and providing

management and reporting of the organization.

strategic guidance to ensure financial stability

and growth managing financial transactions,

ensuring the accuracy of financial records, and

FINANCIAL STRATEGY- developing and

overseeing the preparation of financial

executing financial strategies that align with the

statements

organization's overall goals and objectives.

supervises activities related to

-analyzing financial data, identifying

budgeting, internal controls, financial analysis,

trends, and making recommendations to

and audit management.

optimize financial performance

FINANCIAL REPORTING

FINANCIAL REPORTING- accurate and timely

financial reports are prepared in accordance - financial statements, including

with regulatory requirements balance sheets, income statements, and cash

flow statements, ensuring accuracy and

-stakeholders, including investors,

compliance with accounting standards.

lenders, and the board of directors.

INTERNAL CONTROLS- safeguard assets, ensure

RISK MANAGEMENT- manages financial risks

the accuracy of financial records, and prevent

that could impact the organization's stability

fraud or errors.

and profitability

BUDGETING AND FORECASTING- helps develop

-market conditions, credit, liquidity, and

budgets and forecasts, working closely with

operational issues, and implementing strategies

department heads to ensure that financial plans

to mitigate them.

align with strategic objectives.

TREASURY MANAGEMENT- organization's cash

FINANCIAL ANALYSIS- identify trends, assess

flow, liquidity, and working capital to ensure

performance, and provide insights to support

sufficient funds are available to meet

decision-making by management.

operational needs and financial obligations.

COMPLIANCE- accounting principles, tax

-banking relationships, optimizing cash

regulations, and other financial reporting

balances, and implementing cash management

requirements imposed by regulatory bodies.

strategies

AUDIT MANAGEMENT- to facilitate the audit

INVESTOR RELATIONS- serves as a key liaison

process and address any findings or

between the organization and its investors,

recommendations.

providing financial updates, responding to

inquiries, and participating in investor meetings FUNCTION OF A TREASURER

and conferences.

TREASURER- responsible for managing the TREASURER- play a crucial role in

organization's finances, cash flow, investments, ensuring the long-term financial

and banking relationships. stability and success of the business.

CASH MANAGEMENT- task of managing

- include managing liquidity, optimizing

the institution's global cash flows

cash balances, investing excess cash, and

COLLATERAL MANAGEMENT-

overseeing banking and financing activities.

eliminating unnecessary credit risk

- financial risks, such as interest rate between counterparties

risk and currency risk, and makes decisions ASSET MANAGEMENT- task of having

regarding capital structure, capital raising the right, actual and regulatory liquidity

activities, and dividend policies. FUNDING- always having enough cash

available for the institution

CASH MANAGEMENT- cash flow, ensuring that

CAPITAL MANAGEMENT- task of

there is sufficient liquidity to meet short-term

always having sufficient capital available

obligations and optimizing cash balances

to cover internal - and regulatory

BANKING AND FINANCING- financing requirements

arrangements, including lines of credit, loans, o RESPONSIBILITIES OF A

and other forms of debt or equity financing. TREASURER

INVESTMENT MANAGEMENT- managing the Perform risk management (liquidity,

organization's investment portfolio, making interest rates, ventures etc.)

decisions about asset allocation

Assume responsibility for cash

RISK MANAGEMENT- Interest rate risk, management procedures

currency risk, and liquidity risk, implementing

Manage the company’s investment

strategies to mitigate exposure to adverse

activity and make decisions

market conditions

CAPITAL STRUCTURE- evaluates the Assist in the development of

organization's capital structure and makes financing strategies

recommendations regarding capital raising Provide advice in matters of corporate

activities finance

TREASURY OPERATIONS- including cash Prepare budgets and monitor

disbursements, collections, and treasury expenditures

systems and processes.

Implement relevant legislation and

COMPLIANCE AND REPORTING- compliance policies

with financial regulations and reporting

requirements related to treasury activities, Submit reports of present financial

including regulatory filings and disclosures situation and forecasting

RESPONSIBILITIES OF A TREASURER, FINANCIAL o ROLE OF THE TREASURER

SYSTEM AND FINANCIAL MARKETS

General financial oversight CRYPTOCURRENCT MARKETS-

exchanges host digital wallets for

Funding, fundraising and sales

traders to swap one cryptocurrency

Financial planning and budgeting FINANCIAL SYSTEM- is a set of

institutions, such as banks, insurance

Financial reporting companies, and stock exchanges, that

Banking, book keeping and record permit the exchange of funds

keeping

Control of fixed assets and stock

FINANCIAL MARKETS- refer broadly to

any marketplace where securities

trading occurs

-may include assets or securities

that are either listed on regulated

exchanges or trade CONSTITUENTS OF FINANCIAL SYSTEM

-economic disruption, including FINANCIAL SYSTEM- complex network

recession and rising unemployment of institutions, markets, and

STOCK MARKETS- venues where intermediaries that facilitate the flow of

companies list their shares, which are funds between savers and borrowers.

bought and sold by traders and Financial Institutions- entities that

investors provide financial services, such as

OVER-THE-COUNTER MARKETS- banks, credit unions, insurance

decentralized market—meaning it does companies, investment banks, and

not have physical locations, and trading pension funds

is conducted electronically o Banks- Commercial banks,

BOND MARKETS- security in which an savings banks, and credit unions

investor loans money for a defined accept deposits and provide

period at a pre-established interest rate loans and other financial

MONEY MARKETS- trade in products services.

with highly liquid short-term maturities o Non-Banking Financial

DERIVATIVES MARKETS- contract Institutions (NBFI)- include

between two or more parties whose insurance companies, pension

value is based on an agreed-upon funds, mutual funds, and other

underlying financial asset financial intermediaries

FOREX MARKET- where participants can o Central banks- , such as the

buy, sell, hedge, and speculate on the Federal Reserve in the United

exchange rates between currency pairs States or the European Central

COMMODITIES MARKETS- venues Bank, play a pivotal role in

where producers and consumers meet monetary policy and financial

to exchange stability.

wealth management, and

Financial Markets- are platforms where consultancy.

individuals, businesses, and Regulatory Authorities- Governmental

governments buy and sell financial or independent regulatory bodies

assets regulate all financial systems

o Money Market: Deals with Payment and Settlement Systems-

short-term debt instruments enable fund transfer between

and securities. individuals, businesses, and financial

o Capital Market: Deals with institutions

long-term securities, such as Financial Infrastructure- technological

stocks and bonds. system that supports the financial

o Derivatives Market: Involves system’s smooth functioning

financial contracts whose value o Bank branches and physical

is derived from an underlying payment processing systems.

asset or index. o ATM networks.

Financial Instruments- instruments are o SWIFT (Society for Worldwide

monetary contracts that can be traded. Interbank Financial

Financial instruments include stocks, Telecommunication) network

bonds, options, futures contracts, for global payment processing.

mortgages, and derivatives o Credit card processing

o Equities: Represent ownership networks.

in a company and include Financial Intermediaries- Entities that

stocks. act as intermediaries between savers

o Debt Instruments: Include and borrowers, facilitating the flow of

bonds and other fixed-income funds.

securities representing loans. o commercial bank

o Derivatives: Include options, o investment bank

futures, and swaps. o mutual fund

Financial Services- services offered by o pension fund

financial institutions, such as loans, Investors and Savers- Individuals,

deposits, payment services, investment corporations, and governments that

services, insurance services provide funds by saving or investing in

o Investment Banking: Assists various financial instrument

companies in raising capital

through issuing stocks and o Savers play the role of building

bonds. the reserve energy-reserve

o Asset Management: Manages money of a country.

investment portfolios on behalf o Investors play the role of

of individuals and institutions. channelizing capital into risky

o Insurance: Provides protection new projects that will increase

against various risks. the general well being of

o Financial Advisory Services: everyone

Includes financial planning,

You might also like

- Time Value of Money ConceptsDocument341 pagesTime Value of Money ConceptsArn KylaNo ratings yet

- Test Bank For The Economics of Money Banking and Financial Markets 7th Canadian Edition Mishkin DownloadDocument30 pagesTest Bank For The Economics of Money Banking and Financial Markets 7th Canadian Edition Mishkin Downloadariananavarrofkaeicyprn100% (22)

- Mastering Securities Lending DocumentationDocument2 pagesMastering Securities Lending Documentationphard234567% (3)

- Chapter 1 - Introduction To Treasury ManagementDocument17 pagesChapter 1 - Introduction To Treasury ManagementCarlos Reid89% (9)

- Correct Answers Are Shown inDocument14 pagesCorrect Answers Are Shown inAkshay Mathur0% (1)

- Accounting Vs Finance Ze0rpwDocument1 pageAccounting Vs Finance Ze0rpwstriker strikerNo ratings yet

- Business Finance ReviewerDocument3 pagesBusiness Finance ReviewerJannah Nicole Devera RazonableNo ratings yet

- Lesson 1 (Chapter 1) - Financial Management FunctionDocument27 pagesLesson 1 (Chapter 1) - Financial Management FunctionHafiz HishamNo ratings yet

- 20 CFO RESPONSIBILITIES 406faaDocument1 page20 CFO RESPONSIBILITIES 406faanimisha vermaNo ratings yet

- IntroDocument39 pagesIntrostd30000No ratings yet

- Career As Finance Manager: Job ProfileDocument5 pagesCareer As Finance Manager: Job ProfileSneha KumarNo ratings yet

- Finance NotesDocument8 pagesFinance Notescrist.jahnskieNo ratings yet

- Treasury REVIEWERDocument7 pagesTreasury REVIEWERdantesdrechgioNo ratings yet

- Various Functional Areas of Management (2nd Quarter - 1st Semester)Document2 pagesVarious Functional Areas of Management (2nd Quarter - 1st Semester)AbigailNo ratings yet

- Fin MGT Presentation 1Document7 pagesFin MGT Presentation 1Michael John NicolasNo ratings yet

- Advanced Financial ManagementDocument201 pagesAdvanced Financial ManagementMahantesh Halgatti100% (1)

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementJaeNo ratings yet

- Key Difference: Accounting Is The Process of Creating and Managing FinancialDocument3 pagesKey Difference: Accounting Is The Process of Creating and Managing FinancialMartinNo ratings yet

- PT FinanceDocument4 pagesPT FinanceDarlianne Klyne BayerNo ratings yet

- Scope of OM in The Financial SectorDocument8 pagesScope of OM in The Financial SectorJoshua AureliaNo ratings yet

- Topic 1 Overview of Financial Accounting and ReportingDocument19 pagesTopic 1 Overview of Financial Accounting and ReportingJean AltheaNo ratings yet

- FinanceDocument9 pagesFinancekhanalsamikcha123No ratings yet

- Financial Management Session 1 2Document12 pagesFinancial Management Session 1 2Khushi HemnaniNo ratings yet

- Accbp100 FMDocument3 pagesAccbp100 FMeri keiNo ratings yet

- Introduction To Financial ManagementDocument13 pagesIntroduction To Financial Managementankitjain13No ratings yet

- Acctg 402aDocument2 pagesAcctg 402aPauline Keith Paz ManuelNo ratings yet

- Career Profile: Manager Operations and FinanceDocument3 pagesCareer Profile: Manager Operations and FinanceYASIR MEHMOODNo ratings yet

- Matrices CH1-4Document6 pagesMatrices CH1-4JACQUELYN PABLITONo ratings yet

- Toaz - Info Strategic Cost Management PRDocument5 pagesToaz - Info Strategic Cost Management PRNangalisan SsgNo ratings yet

- CFASDocument25 pagesCFASkaiaav.i09No ratings yet

- THE MEANING OF FINANCE RESOURCE MANAGEMENT PRACTICESDocument1 pageTHE MEANING OF FINANCE RESOURCE MANAGEMENT PRACTICESkl202850No ratings yet

- Job Description: Reference Number: Job Title: Location: Remuneration: Key Performance AreasDocument3 pagesJob Description: Reference Number: Job Title: Location: Remuneration: Key Performance AreasshrimisahaNo ratings yet

- Role of The TreasurerDocument39 pagesRole of The TreasurerWasifAhmadNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- For USAID Partners: Implementation TipsDocument3 pagesFor USAID Partners: Implementation TipsjeankerlensNo ratings yet

- Financial Management: Unit - 1Document26 pagesFinancial Management: Unit - 1Sukumar SomasundaramNo ratings yet

- BF PPTDocument115 pagesBF PPTSharanaya SureshNo ratings yet

- Smart Task - 1: FinanceDocument15 pagesSmart Task - 1: FinanceharryNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementTrisha Kaira RodriguezNo ratings yet

- Strategic Cost ManagementDocument4 pagesStrategic Cost ManagementAndrew Miguel Santos100% (1)

- FINMAN2 ReviewerDocument17 pagesFINMAN2 ReviewerKYLA MARIE BLANDONo ratings yet

- Finance101 ReviewerDocument2 pagesFinance101 Reviewerzenyasula13No ratings yet

- Financial Management Strategies - NotetakingDocument15 pagesFinancial Management Strategies - NotetakinglouellakayleyNo ratings yet

- Introduction To Basic Finance - v.1Document28 pagesIntroduction To Basic Finance - v.1Yannah HidalgoNo ratings yet

- Chapter 2 The Professional Environment of Cost ManagementDocument8 pagesChapter 2 The Professional Environment of Cost ManagementAryan LeeNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementJaeNo ratings yet

- Overview of Financial ManagementDocument37 pagesOverview of Financial Managementtiffany_manzanoNo ratings yet

- Finman 12Document4 pagesFinman 12trishabanania5No ratings yet

- Lesson 1 Definition of Finance Goals of The Financial ManagerDocument14 pagesLesson 1 Definition of Finance Goals of The Financial ManagerJames Deo CruzNo ratings yet

- Roles of Cfo: Financial ManagementDocument30 pagesRoles of Cfo: Financial ManagementTara GilaniNo ratings yet

- Summary BASICS OF BUSINESS FINANCINGDocument3 pagesSummary BASICS OF BUSINESS FINANCINGScribdTranslationsNo ratings yet

- FM8 Module 2Document5 pagesFM8 Module 2Kim HeidelynNo ratings yet

- Introduction To FinanceDocument10 pagesIntroduction To Financenecope7409No ratings yet

- Business Enterprise SimulationDocument6 pagesBusiness Enterprise SimulationFrancine CasidaNo ratings yet

- Financial MangementDocument8 pagesFinancial Mangementkumarvikash720945No ratings yet

- Lesson 1 (Chapter 1) - Financial Management Function (Notes)Document11 pagesLesson 1 (Chapter 1) - Financial Management Function (Notes)Hafiz HishamNo ratings yet

- Management of Funds Entire SubjectDocument85 pagesManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- JD - Chief Financial OfficerDocument4 pagesJD - Chief Financial OfficerjaspreetsaroraNo ratings yet

- Value For Money. Basically, It Means Applying: Notes in Financial ManagementDocument6 pagesValue For Money. Basically, It Means Applying: Notes in Financial ManagementKristine PerezNo ratings yet

- TM ReviewerDocument9 pagesTM ReviewerkyliebellecNo ratings yet

- Financial Intelligence: Navigating the Numbers in BusinessFrom EverandFinancial Intelligence: Navigating the Numbers in BusinessNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Jian Zhi TehNo ratings yet

- Break Even Analysis and Ratio AnalysisDocument63 pagesBreak Even Analysis and Ratio AnalysisJaywanti Akshra Gurbani100% (1)

- Period 0Document25 pagesPeriod 0dma003ginnyNo ratings yet

- Class Assignment-02 of Fundamental Analysis Company-Hindustan Aeronautics LimitedDocument4 pagesClass Assignment-02 of Fundamental Analysis Company-Hindustan Aeronautics LimitedRia HembromNo ratings yet

- FM303 Tutorial Question Week 5Document3 pagesFM303 Tutorial Question Week 5Smriti LalNo ratings yet

- 01 MergedDocument199 pages01 MergedfifaNo ratings yet

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedNo ratings yet

- Ch1 HW SolutionsDocument6 pagesCh1 HW SolutionsNuzul Hafidz Yaslin0% (1)

- 01-Problem Set Unit 04Document21 pages01-Problem Set Unit 04Tatiana BuruianaNo ratings yet

- Annual Report Raiffeisen Bank 2021Document233 pagesAnnual Report Raiffeisen Bank 2021awayjanuar16No ratings yet

- Financial Analysis of Cipla, Dr. Reddy and LupinDocument14 pagesFinancial Analysis of Cipla, Dr. Reddy and LupinParth GuptaNo ratings yet

- Share Based Payments by Ca PS BeniwalDocument16 pagesShare Based Payments by Ca PS Beniwalhrudaya boys100% (1)

- CV ContohDocument1 pageCV ContohFikriNo ratings yet

- Candle Stick Pattern 1-10Document15 pagesCandle Stick Pattern 1-10zazankhan19No ratings yet

- Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialDocument121 pagesReporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialZahra Zafirah AmaliaNo ratings yet

- DLFLTD.: Mar 2004 Mar 2005 Mar 2006 12 Mths12 Mths12 MthsDocument24 pagesDLFLTD.: Mar 2004 Mar 2005 Mar 2006 12 Mths12 Mths12 MthsgaganNo ratings yet

- Immunization StrategiesDocument20 pagesImmunization StrategiesnehasoninsNo ratings yet

- Mergers and AcquisitionDocument60 pagesMergers and AcquisitionVarsha JaisinghaniNo ratings yet

- Cfi Upload GoodwillDocument3 pagesCfi Upload GoodwillLalit mohan PradhanNo ratings yet

- What Is CAPM?: CAPM Formula and CalculationDocument3 pagesWhat Is CAPM?: CAPM Formula and CalculationMillat AfridiNo ratings yet

- TS2 User Guide PDFDocument42 pagesTS2 User Guide PDFRizki Sya'banNo ratings yet

- Chapter Iv Powers of CorporationsDocument9 pagesChapter Iv Powers of CorporationsAlexa OlchondraNo ratings yet

- 2) Short Notes: A) Forms of DividendDocument2 pages2) Short Notes: A) Forms of DividendTarunvir KukrejaNo ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- MGT501 Assignment No 1 Spring 2023 Solved by Bella PDFDocument3 pagesMGT501 Assignment No 1 Spring 2023 Solved by Bella PDFQuadra Kill100% (1)

- LeapUp FM-Val Workshop Slide DeckDocument47 pagesLeapUp FM-Val Workshop Slide DeckKhushal NarangNo ratings yet