Professional Documents

Culture Documents

HMI - 23-PNH-568PL - Fiscal Review Report - Final

HMI - 23-PNH-568PL - Fiscal Review Report - Final

Uploaded by

Sindhu SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HMI - 23-PNH-568PL - Fiscal Review Report - Final

HMI - 23-PNH-568PL - Fiscal Review Report - Final

Uploaded by

Sindhu SinghCopyright:

Available Formats

CITY TAX LEVY (CTL) - FISCAL REVIEW REPORT

SUBRECIPIENT NAME: The Hetrick-Martin Institute Inc.

SERVICE CATEGORY: PlaySure Network 2.0 in Non-Healthcare Settings (PNH)

ROOT CONTRACT NUMBER: 22-PNH-568

CONTRACT TERM NUMBER: 22-PNH-568T-558 CONTRACT TERM: 3/1/22 - 8/31/25

BUDGET PERIOD NUMBER: 23-PNH-568PL BUDGET PERIOD: 7/1/22 - 6/30/23

DATE OF REVIEW: June 6, 2023 REVIEW PERIOD: January 2023

DATE OF REPORT: June 30, 2023 SUBAWARD AMOUNT: $68,563.92

SENIOR ADMINISTRATOR: Bridget Hughes

PROGRAM MANAGER: Lazara Paz-Gonzalez

FISCAL MANAGER: Weedly Prospert

SUBRECIPIENT STAFF: Eswarakumar Bolisetty

PHS STAFF: Carlos Checa

OTHER ATTENDEES: NA

REVIEW SUMMARY

For this remote fiscal review, the subrecipient submitted the required fiscal documentation on the due date of June 6, 2023. Some of the fiscal back-up

documentation submitted included general ledger, payroll register for staff expensed, timecards, methodology vouchering, and proof of disbursement

to support salary/wage and fringe expenses.

The PHS Contract Manager (CM) reviewed documentation provided in support of expenditures reported for budget items selected for January 2023

(review period). For the review period, subrecipient submitted only PS related expenses. Other than Personnel Services (OTPS) budget line expenses

were not reported during this review period.

For payroll verification, CM reviewed the expenses reported for 3 of 3 (100%) staff. It is important to note that this subrecipient submitted a budget

modification to reflect the permanent funding for the workforce enhancement initiative, and also to reflect other budget adjustments. Budget

modification reflected some changes with their current staff, and reason why expenses were only submitted for 3 staff during the review period

(January 2023). CM reached out to subrecipient to request missing supporting PS documentation related to the Program Manager and the Licensed

Counselor. Subrecipient provided requested information expeditiously. In reviewing timecards, CM noted that timecards for the Program Manager and

the Licensed Counselor did not have their "In" or "Out" times recorded. Forms were blank, only indicating the total hours worked per day and per week.

This issue was also a finding in the last RW fiscal review portion for this same subaward. CM found a discrepancy between hours worked recorded in

the Timecards and the Payroll Registers for staff Adams and staff Murray for the entire review period. CM recommends subrecipient to ensure that the

hours on the timecard matches the hours on the payroll register.

In addition, the expenses reported for staff Murray ($986.55) were not supported by the supporting documentation submitted by subrecipient ($956.67).

The amount not supported ($29.88) will be recouped at closeout.

CM also noted during the fiscal review that the subrecipient provided a document entitled "Monthly Claim, CTL Submitted V1". This document records

expenses for the Director of Community & Program Operations, however, payroll expenses were not reported for this staff during this review period.

Subrecipient is expected to reconcile any payroll expenses at closeout via a budget modification.

Regarding FTEs: approved FTE for Program Manager is 0.1170, for the Licensed Counselor is 0.050. Subrecipient's submitted documentation

indicates 0.16 and 0.04 respectively. Subrecipient is expected to ensure that the approved FTE is used as reflected in their latest budget. Subrecipient

should inform CM of any changes with the FTE, and the justification for the change. Subrecipient is expected to reflect their current FTE in the

Schedule B CTL Budget form for the new budget period of July-June 2024 when the program documents are received.

For Fringe benefits, subrecipient claims reimbursement based on the FB approved rate (25%) as indicated in document "Monthly Claim". Based on

the fringe benefits percentages used (25%), the amount reported should have been $385.22 but only $382.14 was submitted . Subrecipient should

reconcile any difference to reflect the actual cost of their fringe benefits at closeout. The PHS CM reviewed proof of medical insurance disbursements,

dental insurance disbursements, as well as other PS related taxes. There are no findings to report at this time.

For OTPS, no OTPS expenses were reported for this review period.

Please refer to the Schedule I section of this report for detailed information about PS and fringe amounts reviewed and verified. A total of $29.88 will be

recouped at closeout. Throughout the fiscal review, the subrecipient was available by phone and email to answer questions about the fiscal

documentation provided.

FISCAL REVIEW METHODOLOGY

Scheduling of the Remote Site Visit was done in coordination with Subrecipient. An email was sent to subrecipient informing of the need to conduct a

Remote Fiscal Review. A formal document entitled "Fiscal Review Notification Letter" was attached to the email.. This letter contained further details

such as the review period, and the list of fiscal backup documents requested. Contract Manager received the majority of documentation in a timely

manner. CM had to reach out to subrecipient for 2 missing documents. Subrecipient responded promptly and provided all requested documentation.

During the Remote Fiscal Review, PHS CM reviewed PS documentation and all other relevant documents that were provided by the subrecipient. To

complete the review, the PHS CM also referred to subrecipient's initial Schedule B Budget, First Amendment (budget mod including WEI), MER in

PAMS, as well as previous Fiscal Review Reports.

Public Health Solutions

Fiscal Review Report 1 of 3

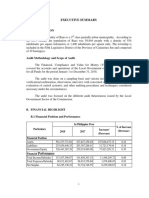

SCHEDULE - I

SUBRECIPIENT NAME: The Hetrick-Martin Institute Inc.

NUMBER: 22-PNH-568

BUDGET PERIOD: 7/1/22 - 6/30/23

REVIEW PERIOD: January 2023

(B)

(A) Claimed (C) (D) (E)

Budget Categories and Line Items Expenses Per Documented Disallowances Disallowance

MER Amount (D=B-C) Code

Program Manager--Christopher Murray $ 986.55 $ 956.67 29.88 E

Accountability Specialist/Data Entry Specialist-Darlene Dominguez $ 187.68 $ 197.47 0.00

Licensed Counselor--Elizabeth McAdams $ 366.66 $ 366.67 0.00

Total Salaries Costs $ 1,540.89 1,520.80 29.88

Total Related Fringe Benefits

Fringe Benefits Rate 25.00% 385.22

Total Fringe Costs: $ 382.14 385.22 0.00

Total Personnel Services Costs $ 1,923.03 1,906.02 29.88

Indirect Cost $ 156.15

Totals Amount $ 2,079.18 $ 1,906.02 $ 29.88

Explanation of Disallowance Code

B Item not in Budget

D Waiting for requested Support Documentation

E Requested support documentation insufficient

I Expense falls outside budget period

L Expense not allowable

M Expense charged to wrong budget line

N Improper cost allocation

U Expense not liquidated within 90 days after the contract end date

Public Health Solutions

Fiscal Review Report 2 of 3

SUBRECIPIENT NAME: The Hetrick-Martin Institute Inc.

SERVICE CATEGORY: PlaySure Network 2.0 in Non-Healthcare Settings (PNH)

ROOT CONTRACT NUMBER: 22-PNH-568 CONTRACT TERM: 3/1/22 - 8/31/25

CONTRACT TERM NUMBER: 22-PNH-568T-558 BUDGET PERIOD: 7/1/22 - 6/30/23

BUDGET PERIOD NUMBER: 23-PNH-568PL REVIEW PERIOD: January 2023

PHS CERTIFICATION

Report prepared by: Carlos Checa, Contract Manager

Signature:

Date: June 26, 2023

INDIRECT COSTS ATTESTATION

By signing this report, you attest that the use of subaward funds to support indirect costs does not exceed the rate indicated

below, and is also in accordance with the rate indicated in the latest approved subaward budget.

Indirect Costs (at or below 10% De Minimis Rate) 7.99%

SUBRECIPIENT ACKNOWLEDGEMENT

Please acknowledge receipt and review of this report by providing signature and date of Fiscal Manager or Senior

Administrator. A signed copy is to be returned to Public Health Solutions/ Contracting and Management Services no later than

Tuesday, July 11, 2023. If applicable, it is expected you will implement or adhere to the recommendations to the findings

contained therein and according to the prescribed timeframe. A space has been provided for comments.

Name:

Title:

Signature:

Date:

Comments:

Public Health Solutions

Fiscal Review Report 3 of 3

Signature:

Email: wprospert@btqfinancial.com

You might also like

- Stardew Valley Community Center ChecklistDocument7 pagesStardew Valley Community Center Checklistpauchanmnl100% (2)

- P.3. Workforce and Higher Access To Markets (WHAM) Activity Request For Reimbursement FormDocument1 pageP.3. Workforce and Higher Access To Markets (WHAM) Activity Request For Reimbursement FormSani FajićNo ratings yet

- Paris Monitoring Preliminary - FSMDocument35 pagesParis Monitoring Preliminary - FSMNewsTeam20No ratings yet

- D&A: 28082020 NIH Grant NoticeDocument386 pagesD&A: 28082020 NIH Grant NoticeD&A Investigations, Inc.No ratings yet

- 03-DBM2017 Executive SummaryDocument5 pages03-DBM2017 Executive SummarybolNo ratings yet

- PH r3 06 Ecoweb Financial Report 2023 FinalDocument54 pagesPH r3 06 Ecoweb Financial Report 2023 Finalnicnavarro.olphaNo ratings yet

- Durham - Expenditures - October 1, 2021 To March 31, 2022Document5 pagesDurham - Expenditures - October 1, 2021 To March 31, 2022Washington ExaminerNo ratings yet

- RBCPB MooeDocument7 pagesRBCPB MooeDan MarkNo ratings yet

- Colombia OFDA II Award OriginalDocument131 pagesColombia OFDA II Award OriginaljuansecarrilloNo ratings yet

- 2024 Skmangga RobcpbDocument12 pages2024 Skmangga RobcpbShery CariagaNo ratings yet

- N E HSA National and Regional FindingsDocument20 pagesN E HSA National and Regional FindingsdfolconsultingNo ratings yet

- GenSantosCity SoCot ES2015Document5 pagesGenSantosCity SoCot ES2015J JaNo ratings yet

- pubInfAgenda202101123B4 PDFDocument25 pagespubInfAgenda202101123B4 PDFNancy GarthhNo ratings yet

- 03-OVP2022 Executive SummaryDocument6 pages03-OVP2022 Executive SummaryarchaosdesigngroupNo ratings yet

- DDO Instructions3Document65 pagesDDO Instructions3Sarfraz BhuttoNo ratings yet

- Petitioner Respondent: Bpi Capital Corporation, Commissioner of Internal RevenueDocument16 pagesPetitioner Respondent: Bpi Capital Corporation, Commissioner of Internal Revenuerian.lee.b.tiangcoNo ratings yet

- Northeast Center For Youth and FamiliesDocument51 pagesNortheast Center For Youth and FamiliesNewspapers of New EnglandNo ratings yet

- Josefina Executive Summary 2017Document8 pagesJosefina Executive Summary 2017Virgo Philip Wasil ButconNo ratings yet

- ICR Review: 1. Project DataDocument9 pagesICR Review: 1. Project Dataﹺ ﹺ ﹺ ﹺNo ratings yet

- Case Study InformationDocument3 pagesCase Study InformationNafilah RahmaNo ratings yet

- A. Introduction: Executive SummaryDocument4 pagesA. Introduction: Executive Summarysandra bolokNo ratings yet

- DHD Anx B Rev906Document26 pagesDHD Anx B Rev906iese027No ratings yet

- 2017 CobDocument14 pages2017 CobOrne PaulNo ratings yet

- Portland Hotel Society Audit: VCHDocument34 pagesPortland Hotel Society Audit: VCHThe ProvinceNo ratings yet

- Examination of Select Payments Made by The Office of Mental Health (OMH) To PSCHDocument8 pagesExamination of Select Payments Made by The Office of Mental Health (OMH) To PSCHcrainsnewyorkNo ratings yet

- FAS February 10 To September 10Document11 pagesFAS February 10 To September 10Arman Hossain WarsiNo ratings yet

- 09-NBDB2022 Part2-Observations and RecommDocument28 pages09-NBDB2022 Part2-Observations and RecommjoevincentgrisolaNo ratings yet

- NEA Memo To ECs No. 2015-036 - Guidelines in The Preparation of Accounting of Funds (AOF) and Identification of Allowable Charges Against Contingency Funds For Subsidy Funded ProjectsDocument8 pagesNEA Memo To ECs No. 2015-036 - Guidelines in The Preparation of Accounting of Funds (AOF) and Identification of Allowable Charges Against Contingency Funds For Subsidy Funded ProjectsPBB OTSO BATCH4 HIGHLIGHTSNo ratings yet

- Health Awareness 2009 Title X GrantDocument126 pagesHealth Awareness 2009 Title X GranthealthawarenessNo ratings yet

- Subcommittees Chairs Report On Budget ExcerciseDocument21 pagesSubcommittees Chairs Report On Budget ExcercisePhil AmmannNo ratings yet

- Local Govt Budgeting For in ServiceDocument60 pagesLocal Govt Budgeting For in ServiceMark Jonathan SacataniNo ratings yet

- Uganda Blood Transfusion Service-HealthDocument8 pagesUganda Blood Transfusion Service-HealthjayramdeepakNo ratings yet

- Government Accounting Manual: (For National Government Agencies)Document28 pagesGovernment Accounting Manual: (For National Government Agencies)Carlo CruzNo ratings yet

- Appendix+ G PM-Abhim TOR 2023-24Document7 pagesAppendix+ G PM-Abhim TOR 2023-24cfeaakashtiwariNo ratings yet

- Macrohon Executive Summary 2013Document7 pagesMacrohon Executive Summary 2013rominadulfo4bNo ratings yet

- 09-PA2018 Part2-Observations and RecommendationsDocument29 pages09-PA2018 Part2-Observations and RecommendationsVERA FilesNo ratings yet

- Philippine-Drug-Enforcement-Agency-Executive-Summary-2019Document4 pagesPhilippine-Drug-Enforcement-Agency-Executive-Summary-2019Jenesa Mae YacoNo ratings yet

- G. Prepayments and Other Current Assets - 2023 DoneDocument24 pagesG. Prepayments and Other Current Assets - 2023 DoneAllan CamachoNo ratings yet

- Exhibit 56 November 28 2023 Tax LetterDocument8 pagesExhibit 56 November 28 2023 Tax LetterAnthony TalcottNo ratings yet

- Coon or Tax Appeals: Third DnisiikDocument31 pagesCoon or Tax Appeals: Third DnisiikAemie JordanNo ratings yet

- EE Disburse PPM - June 1 2021Document25 pagesEE Disburse PPM - June 1 2021roxanneNo ratings yet

- T P. Din 110 S S C A, N Y 12236: A. Results of ExaminationDocument13 pagesT P. Din 110 S S C A, N Y 12236: A. Results of ExaminationCeleste KatzNo ratings yet

- Costing & Cost AllocationDocument10 pagesCosting & Cost AllocationSultan Mohiuddin BhuiyanNo ratings yet

- 08-Looc2012 Part2-Findings and RecommendationsDocument10 pages08-Looc2012 Part2-Findings and RecommendationsMiss_AccountantNo ratings yet

- 2024 - 0227 Preliminary Budget FactorsDocument16 pages2024 - 0227 Preliminary Budget FactorsShadeNo ratings yet

- COA DECISION NO. 2022-079 Payment of CNA BenefitsDocument13 pagesCOA DECISION NO. 2022-079 Payment of CNA BenefitsLovely MacarioNo ratings yet

- Government AccountingDocument56 pagesGovernment AccountingJoleaNo ratings yet

- CAP ICR Uniform-Guidance Handout-2Document13 pagesCAP ICR Uniform-Guidance Handout-2Ioanna ZlatevaNo ratings yet

- Fi - BBP - 01 GLDocument15 pagesFi - BBP - 01 GLusasidharNo ratings yet

- 42960-Professional Services Contracts Final BLA ReportDocument105 pages42960-Professional Services Contracts Final BLA ReportSohail Ahmed KhiljiNo ratings yet

- 02-Loboc2012 Executive SummaryDocument9 pages02-Loboc2012 Executive SummaryMiss_AccountantNo ratings yet

- FINANCE (23) : Agency Plan: Mission, Goals and Budget SummaryDocument39 pagesFINANCE (23) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNo ratings yet

- Ngaslecture NewDocument56 pagesNgaslecture NewGenelyn LangoteNo ratings yet

- 2a Order Ace IipDocument36 pages2a Order Ace IipMarcelon1No ratings yet

- SB 3 Financial AnalysisDocument16 pagesSB 3 Financial AnalysisSteven DoyleNo ratings yet

- Iars PPMPDocument26 pagesIars PPMPMitzi Darryl Madaging BabaNo ratings yet

- Vignesh - DESIGNER CREATIVE - 0 - OfferletterDocument2 pagesVignesh - DESIGNER CREATIVE - 0 - OfferletterNavamani VigneshNo ratings yet

- Government Accounting and AuditingDocument190 pagesGovernment Accounting and AuditingCharles John Palabrica CubarNo ratings yet

- Ol Lessos Technical Training Institute 2019 2020Document14 pagesOl Lessos Technical Training Institute 2019 2020ochiengpeter397No ratings yet

- DVB Si BasicsDocument2 pagesDVB Si BasicsAbhishek PandeyNo ratings yet

- Interfacing Seven Segment Display To 8051Document16 pagesInterfacing Seven Segment Display To 8051Virang PatelNo ratings yet

- Duclos Family Report MissisquoiDocument195 pagesDuclos Family Report MissisquoiNancyNo ratings yet

- Is 228 9 1989Document8 pagesIs 228 9 1989Andrewz PachuauNo ratings yet

- Data Analysis PDFDocument10 pagesData Analysis PDFKenny Stephen CruzNo ratings yet

- SponsorDocument11 pagesSponsorMaulina SalmahNo ratings yet

- Yashoda Singh Indian Coins Lots 1001-1242Document29 pagesYashoda Singh Indian Coins Lots 1001-1242Ashwin SevariaNo ratings yet

- 19 8 English+Manual+Rt 3Document249 pages19 8 English+Manual+Rt 3aleba1975No ratings yet

- TENSYMP - Special TRACK - Climate SmartDocument1 pageTENSYMP - Special TRACK - Climate SmartMayurkumar patilNo ratings yet

- PAFLU Vs Sec of LaborDocument1 pagePAFLU Vs Sec of LaborMavic Morales100% (1)

- Sabam Sariaman CVDocument1 pageSabam Sariaman CVsabamsiregarNo ratings yet

- Crypt Arithmatic Problem SolutionDocument10 pagesCrypt Arithmatic Problem SolutionHariom Patel100% (4)

- Iphone DissertationDocument7 pagesIphone DissertationPapersWritingServiceCanada100% (1)

- Buying Vs Renting: Net Gain by Buying A HomeDocument2 pagesBuying Vs Renting: Net Gain by Buying A HomeAnonymous 2TgTjATtNo ratings yet

- Nigeria's Agenda 21 Draft Objectives and Strategies ForDocument77 pagesNigeria's Agenda 21 Draft Objectives and Strategies ForbenNo ratings yet

- Three Phase Induction Motor - Squirrel Cage: Data SheetDocument6 pagesThree Phase Induction Motor - Squirrel Cage: Data Sheetjulio100% (1)

- An Experiment of DensityDocument4 pagesAn Experiment of DensitySamuel TumewaNo ratings yet

- Wizard - School of DiabolismDocument1 pageWizard - School of DiabolismHope LaneNo ratings yet

- Lewis Dot Structures #1Document3 pagesLewis Dot Structures #1Dustin MoenchNo ratings yet

- Instant Download Ebook PDF Dorlands Illustrated Medical Dictionary 32nd Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Dorlands Illustrated Medical Dictionary 32nd Edition PDF Scribdemiko.johnson659100% (44)

- Loss Tangent of High Resistive Silicon Substrate in HFSSDocument2 pagesLoss Tangent of High Resistive Silicon Substrate in HFSSNam ChamNo ratings yet

- Ateneo Philosophy Club: Project ProposalDocument2 pagesAteneo Philosophy Club: Project ProposalArmando MataNo ratings yet

- Wifi LBS - CiscoDocument206 pagesWifi LBS - Cisconassr_ismailNo ratings yet

- Promotion Safe Med ChildrensDocument64 pagesPromotion Safe Med ChildrensAbdul khodir jaelani100% (1)

- Victoria Resume 2Document2 pagesVictoria Resume 2api-549232785No ratings yet

- Financial Summary Statement Period 03/10/23 - 04/09/23: Deposit Accounts Total DepositsDocument14 pagesFinancial Summary Statement Period 03/10/23 - 04/09/23: Deposit Accounts Total DepositsLuis RodríguezNo ratings yet

- Joel Nicholas Feimer - The Figure of Medea in Medieval Literature - A Thematic Metamorphosis-City University of New York (1983)Document342 pagesJoel Nicholas Feimer - The Figure of Medea in Medieval Literature - A Thematic Metamorphosis-City University of New York (1983)grzejnik1No ratings yet

- Social Venture Inherent Constitution:: Perceptions of ValueDocument3 pagesSocial Venture Inherent Constitution:: Perceptions of ValuePallavi GuptaNo ratings yet

- Advanced Baking 1Document61 pagesAdvanced Baking 1Judelmae SisonNo ratings yet