Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsHttpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Uploaded by

roopumgautam95My house history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Solution Manual For Macroeconomics 5th Edition Charles I JonesDocument34 pagesSolution Manual For Macroeconomics 5th Edition Charles I Jonestrojanauricled0mfv100% (40)

- Zolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Document2 pagesZolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Kunal AgarwalNo ratings yet

- NDMC Property Tax Delhi 2020-21 PDFDocument2 pagesNDMC Property Tax Delhi 2020-21 PDFravi_bhateja_2No ratings yet

- 2020 Rove Concepts - Lookbook UpdateDocument198 pages2020 Rove Concepts - Lookbook UpdateTulaNo ratings yet

- Seran MamaDocument1 pageSeran MamachauhantonyNo ratings yet

- Print BillDocument1 pagePrint BillSumit NandalNo ratings yet

- Property TAX 7707 2024 Due 2025Document1 pageProperty TAX 7707 2024 Due 2025decemberrealtygurgaonNo ratings yet

- Print BillDocument1 pagePrint BillThe sukhmani AutomobileNo ratings yet

- Print Bill 343Document1 pagePrint Bill 343modi jiNo ratings yet

- PrintBill 95Document1 pagePrintBill 95gauravNo ratings yet

- PrintBill 109Document1 pagePrintBill 109gauravNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Print BillDocument1 pagePrint Billvkr4035No ratings yet

- Un Cyberpark TB-7TH FloorDocument1 pageUn Cyberpark TB-7TH Flooruttamcse2021No ratings yet

- Prem NagarDocument1 pagePrem NagarvikramNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TC-16TH FLR 1603Document1 pageUn Cyberpark TC-16TH FLR 1603uttamcse2021No ratings yet

- Un Cyberpark Ta-1st FLR 103-BDocument1 pageUn Cyberpark Ta-1st FLR 103-Buttamcse2021No ratings yet

- SDMC Property Tax Delhi 2016-17Document2 pagesSDMC Property Tax Delhi 2016-17Bhuvanesh KohliNo ratings yet

- BillDocument1 pageBillRAVINDER PANJETANo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewchandhiranNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- 1701 P4.1Document2 pages1701 P4.1asteriaswan14No ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportMeseret ShimelisNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewvrsapthagiriNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportNaaben AbNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- March ReportDocument2 pagesMarch Reportgetayawokal wendosenNo ratings yet

- Basic Details: Detailed Computation As Per OLD Tax RegimeDocument2 pagesBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaNo ratings yet

- S. No Date 1Document16 pagesS. No Date 1pragya pathakNo ratings yet

- ReceiptDocument1 pageReceiptCOLLINS IMONo ratings yet

- Surat Municipal CorporationDocument1 pageSurat Municipal CorporationTonny HiktonNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportakmeljundi092No ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- GSTR3B 09hbjps0079a1zi 122021Document3 pagesGSTR3B 09hbjps0079a1zi 122021birpal singhNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BABCNo ratings yet

- LOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetDocument5 pagesLOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetJomidy Midtanggal100% (1)

- Certificate 1 - Mayrose SamynadenDocument2 pagesCertificate 1 - Mayrose SamynadenDeepum HalloomanNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAjit GuptaNo ratings yet

- ZFSGDocument1 pageZFSGJeorge VerbaNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bamershareef337No ratings yet

- Budget Tracker: Personal Income Statement WorksheetDocument2 pagesBudget Tracker: Personal Income Statement Worksheetapi-353423707No ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShorya JainNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B 24cirpp4542d1z5 092020Document3 pagesGSTR3B 24cirpp4542d1z5 092020Bhaumik PatelNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- Ki GST 3B Oct 18 PDFDocument3 pagesKi GST 3B Oct 18 PDFPreethi LoansNo ratings yet

- Paper Mill Asset MaterialDocument141 pagesPaper Mill Asset MaterialMD. MONIRUZZAMANNo ratings yet

- Mapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringDocument43 pagesMapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringCha RobinNo ratings yet

- Aggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDocument28 pagesAggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDiego PalmiereNo ratings yet

- Strategic Management: Vision and Mission AnalysisDocument25 pagesStrategic Management: Vision and Mission AnalysisAgit_MuhammadNo ratings yet

- Danh Sach Cac Du An FdiDocument75 pagesDanh Sach Cac Du An FdiTrinh NguyenThiNo ratings yet

- The First Industrial RevolutionDocument28 pagesThe First Industrial RevolutionArturo SolórzanoNo ratings yet

- Managerial Theories of Firm: Game Theory - II: DR Suneel GuptaDocument23 pagesManagerial Theories of Firm: Game Theory - II: DR Suneel GuptaMahak Gupta Student, Jaipuria LucknowNo ratings yet

- Inv and PMT TRK@SPDFVDocument4 pagesInv and PMT TRK@SPDFVANAND MADHABAVINo ratings yet

- Sample Paper-CAIIB-ABFM-By Dr. MuruganDocument92 pagesSample Paper-CAIIB-ABFM-By Dr. MuruganMURALINo ratings yet

- Procurement Tracking Sheet - 18-Feb-2024Document4 pagesProcurement Tracking Sheet - 18-Feb-2024Amir ShahxadNo ratings yet

- RDO No. 55 - San Pablo City 3Document367 pagesRDO No. 55 - San Pablo City 3Dianne May Cruz100% (3)

- Milestone ScheduleDocument1 pageMilestone ScheduleKiyimba DanielNo ratings yet

- Kojeve - Colonialism From A European PerspectiveDocument18 pagesKojeve - Colonialism From A European PerspectiveTetsuya MaruyamaNo ratings yet

- Invoice AmzDocument1 pageInvoice AmzSohail AslamNo ratings yet

- Technology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesDocument5 pagesTechnology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesCholo Marcus GetesNo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Code of EthicsDocument2 pagesCode of EthicsHimani sailabNo ratings yet

- Full Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All ChapterDocument30 pagesFull Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All Chapterkaluzzfurger100% (5)

- OMS Final Version 20220823 1Document46 pagesOMS Final Version 20220823 1helenpkusocNo ratings yet

- Final ME-Construction Chemicals MarketDocument11 pagesFinal ME-Construction Chemicals MarketAlaz FofanaNo ratings yet

- Intermediate Financial Management 11th Edition Brigham Solutions ManualDocument26 pagesIntermediate Financial Management 11th Edition Brigham Solutions ManualSabrinaFloresmxzie100% (51)

- B. Subsidiary Ledger Concepcion Nhs Jhs ShsDocument12 pagesB. Subsidiary Ledger Concepcion Nhs Jhs ShsRancy Escabarte TambelingNo ratings yet

- ARCHITECTURAL DETAILS - LibroDocument9 pagesARCHITECTURAL DETAILS - LibroLuis Job100% (2)

- Cavinkare: Company Website AboutDocument3 pagesCavinkare: Company Website AboutKpvs NikhilNo ratings yet

- MATH39032Document6 pagesMATH39032Luke MillerNo ratings yet

- Business Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Document1 pageBusiness Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Pulkit MittalNo ratings yet

- Vessel and Conveyors - VPDDocument4 pagesVessel and Conveyors - VPDAntonio Mizraim Magallon SantanaNo ratings yet

Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Uploaded by

roopumgautam950 ratings0% found this document useful (0 votes)

10 views1 pageMy house history

Original Title

Httpsproperty.ulbharyana.gov.InBillReportPrintBillPID=1KD14OO0&UlbID=61

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMy house history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageHttpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61

Uploaded by

roopumgautam95My house history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

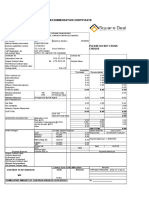

MUNICIPAL CORPORATION YAMUNA NAGAR BillSrNo.

: 59

Property Tax Notice Cum Bill

Property Id: 1KD14OO0 Old Property Id: 287C87U277 Financial Year: 2023-2024 Print Date : 17 February 2024

Property Location: 30.1344210000000 : 77.2632440000000 Mobile No: 82XXXXX037 Colony Name: Harbans Pura

Particulars of Owner(s) / Occupiers(s): Plot Address: 7, NEAR BOOTER PETROL PUMP, 135001, Linked OLD PID Owner Name : Amravati

Owner Name: AMRAWATI, PREM CHAND Permanent Address:

Total Area : 120.000 SqYard Category : Residential AuthorizedStatus : Authorized

Property And FireTax Detail

Floor Property Property Property Carpet Area used Applicable Calculation Usage Property Floor Fire Tax(F) After Floor Building Rebate

Category Type SubCatego Area for taxrate Formula / Tax(H) Rs Rebate(R) Rs Rebate Type Remark

ry (Sq.Feet) calculation after Rebate(if Rs (P)=(H+F)- Rebate

of tax rebate(if any) (R) Rs

any)

Ground Residential House Independent 1080.00 120 SqYard 0.75 0.75 Self 90.00 0.00 0.00 90.00 No Rebate 0% - Ground

Floor House Occupied Floor

1F Residential House Independent 1080.00 120 SqYard 0.75 0.75 Self 90.00 36.00 0.00 54.00 No Rebate 40% - 1F

House Occupied

2F Residential House Independent 100.00 120 SqYard 0.75 0.75 Self 90.00 45.00 0.00 45.00 No Rebate 50% - 2F

House Occupied

Total : 270.00 81.00 0.00 189.00

Total Property & Fire Tax Outstanding(PO): 34.00

Property Tax Arrear(A)= Fire Tax Arrear(FA)= 0.00/- Interest on Arrear(I)= 27.90/- Garbage Collection Charges(S1)= Garbage Collection Total Tax(P+A+FA+I+S1+S2)= 651.90/-

155.00/- 280.00/- Arrear(S2)= 0.00/-

Outstanding as on Outstanding as on date(IO)= 0.00/- Total Outstanding as on

Outstanding as on date(FO)= 0/- Outstanding as on date(PO+AO+FO+IO+SO1+SO2)= 34.00/-

date(AO)= 0.00/- Outstanding as on date(SO1)= 0.00/- date(SO2)= 0/-

•This bill pertain to current financial year only. This bill is for Property Tax collection purpose only. In case of Payment made up to 31st July of Current Financial year,Tax Payer will get 10 % rebate on Current

Demand of Property Tax.

•15% Rebate on the principal amount of property tax arrears for the years 2010-11 to 2022-23 to those property owners who clear all the property tax arrears for the year 2010-11 to 2022-23 and also self-certify

their property information on Property Tax Dues Payment and No Dues Certificate Management System Portal by the 29th February, 2024.

•100 % Rebate on Interest on the arrears of property tax pending since year 2010 - 11 to 2022 - 23 shall be allowed to all tax payers, if their arrears are paid and also self-certify their property information on

Property Tax Dues Payment and No Dues Certificate Management System Portal by the 29th February, 2024.

•15 % Rebate on the property tax for the assessment year 2023 - 24 shall be admissible to those assesses who self - certify their property information on “property Tax Payment and No Dues Certificate

Management System Portal” and pay their total property tax dues up to the assessment year 2023 - 24 by the 29th February, 2024

You might also like

- Solution Manual For Macroeconomics 5th Edition Charles I JonesDocument34 pagesSolution Manual For Macroeconomics 5th Edition Charles I Jonestrojanauricled0mfv100% (40)

- Zolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Document2 pagesZolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Kunal AgarwalNo ratings yet

- NDMC Property Tax Delhi 2020-21 PDFDocument2 pagesNDMC Property Tax Delhi 2020-21 PDFravi_bhateja_2No ratings yet

- 2020 Rove Concepts - Lookbook UpdateDocument198 pages2020 Rove Concepts - Lookbook UpdateTulaNo ratings yet

- Seran MamaDocument1 pageSeran MamachauhantonyNo ratings yet

- Print BillDocument1 pagePrint BillSumit NandalNo ratings yet

- Property TAX 7707 2024 Due 2025Document1 pageProperty TAX 7707 2024 Due 2025decemberrealtygurgaonNo ratings yet

- Print BillDocument1 pagePrint BillThe sukhmani AutomobileNo ratings yet

- Print Bill 343Document1 pagePrint Bill 343modi jiNo ratings yet

- PrintBill 95Document1 pagePrintBill 95gauravNo ratings yet

- PrintBill 109Document1 pagePrintBill 109gauravNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Print BillDocument1 pagePrint Billvkr4035No ratings yet

- Un Cyberpark TB-7TH FloorDocument1 pageUn Cyberpark TB-7TH Flooruttamcse2021No ratings yet

- Prem NagarDocument1 pagePrem NagarvikramNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TC-16TH FLR 1603Document1 pageUn Cyberpark TC-16TH FLR 1603uttamcse2021No ratings yet

- Un Cyberpark Ta-1st FLR 103-BDocument1 pageUn Cyberpark Ta-1st FLR 103-Buttamcse2021No ratings yet

- SDMC Property Tax Delhi 2016-17Document2 pagesSDMC Property Tax Delhi 2016-17Bhuvanesh KohliNo ratings yet

- BillDocument1 pageBillRAVINDER PANJETANo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewchandhiranNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- 1701 P4.1Document2 pages1701 P4.1asteriaswan14No ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportMeseret ShimelisNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewvrsapthagiriNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportNaaben AbNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- March ReportDocument2 pagesMarch Reportgetayawokal wendosenNo ratings yet

- Basic Details: Detailed Computation As Per OLD Tax RegimeDocument2 pagesBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaNo ratings yet

- S. No Date 1Document16 pagesS. No Date 1pragya pathakNo ratings yet

- ReceiptDocument1 pageReceiptCOLLINS IMONo ratings yet

- Surat Municipal CorporationDocument1 pageSurat Municipal CorporationTonny HiktonNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportalemayehu21tNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportakmeljundi092No ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- GSTR3B 09hbjps0079a1zi 122021Document3 pagesGSTR3B 09hbjps0079a1zi 122021birpal singhNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BABCNo ratings yet

- LOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetDocument5 pagesLOCAL SOURCES (11+15) TAX REVENUE (12+13+14) : Original Budget Final BudgetJomidy Midtanggal100% (1)

- Certificate 1 - Mayrose SamynadenDocument2 pagesCertificate 1 - Mayrose SamynadenDeepum HalloomanNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAjit GuptaNo ratings yet

- ZFSGDocument1 pageZFSGJeorge VerbaNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bamershareef337No ratings yet

- Budget Tracker: Personal Income Statement WorksheetDocument2 pagesBudget Tracker: Personal Income Statement Worksheetapi-353423707No ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShorya JainNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B 24cirpp4542d1z5 092020Document3 pagesGSTR3B 24cirpp4542d1z5 092020Bhaumik PatelNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- Ki GST 3B Oct 18 PDFDocument3 pagesKi GST 3B Oct 18 PDFPreethi LoansNo ratings yet

- Paper Mill Asset MaterialDocument141 pagesPaper Mill Asset MaterialMD. MONIRUZZAMANNo ratings yet

- Mapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringDocument43 pagesMapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringCha RobinNo ratings yet

- Aggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDocument28 pagesAggregate Demand: Applying The IS-LM Model: MACROECONOMICS, 8th EditionDiego PalmiereNo ratings yet

- Strategic Management: Vision and Mission AnalysisDocument25 pagesStrategic Management: Vision and Mission AnalysisAgit_MuhammadNo ratings yet

- Danh Sach Cac Du An FdiDocument75 pagesDanh Sach Cac Du An FdiTrinh NguyenThiNo ratings yet

- The First Industrial RevolutionDocument28 pagesThe First Industrial RevolutionArturo SolórzanoNo ratings yet

- Managerial Theories of Firm: Game Theory - II: DR Suneel GuptaDocument23 pagesManagerial Theories of Firm: Game Theory - II: DR Suneel GuptaMahak Gupta Student, Jaipuria LucknowNo ratings yet

- Inv and PMT TRK@SPDFVDocument4 pagesInv and PMT TRK@SPDFVANAND MADHABAVINo ratings yet

- Sample Paper-CAIIB-ABFM-By Dr. MuruganDocument92 pagesSample Paper-CAIIB-ABFM-By Dr. MuruganMURALINo ratings yet

- Procurement Tracking Sheet - 18-Feb-2024Document4 pagesProcurement Tracking Sheet - 18-Feb-2024Amir ShahxadNo ratings yet

- RDO No. 55 - San Pablo City 3Document367 pagesRDO No. 55 - San Pablo City 3Dianne May Cruz100% (3)

- Milestone ScheduleDocument1 pageMilestone ScheduleKiyimba DanielNo ratings yet

- Kojeve - Colonialism From A European PerspectiveDocument18 pagesKojeve - Colonialism From A European PerspectiveTetsuya MaruyamaNo ratings yet

- Invoice AmzDocument1 pageInvoice AmzSohail AslamNo ratings yet

- Technology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesDocument5 pagesTechnology and Automation As Sources of 21 - Century Firm Productivity: The Economics of Slow Internet Connectivity in The PhilippinesCholo Marcus GetesNo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Code of EthicsDocument2 pagesCode of EthicsHimani sailabNo ratings yet

- Full Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All ChapterDocument30 pagesFull Download PDF of Elementary Statistics Triola 11th Edition Solutions Manual All Chapterkaluzzfurger100% (5)

- OMS Final Version 20220823 1Document46 pagesOMS Final Version 20220823 1helenpkusocNo ratings yet

- Final ME-Construction Chemicals MarketDocument11 pagesFinal ME-Construction Chemicals MarketAlaz FofanaNo ratings yet

- Intermediate Financial Management 11th Edition Brigham Solutions ManualDocument26 pagesIntermediate Financial Management 11th Edition Brigham Solutions ManualSabrinaFloresmxzie100% (51)

- B. Subsidiary Ledger Concepcion Nhs Jhs ShsDocument12 pagesB. Subsidiary Ledger Concepcion Nhs Jhs ShsRancy Escabarte TambelingNo ratings yet

- ARCHITECTURAL DETAILS - LibroDocument9 pagesARCHITECTURAL DETAILS - LibroLuis Job100% (2)

- Cavinkare: Company Website AboutDocument3 pagesCavinkare: Company Website AboutKpvs NikhilNo ratings yet

- MATH39032Document6 pagesMATH39032Luke MillerNo ratings yet

- Business Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Document1 pageBusiness Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Pulkit MittalNo ratings yet

- Vessel and Conveyors - VPDDocument4 pagesVessel and Conveyors - VPDAntonio Mizraim Magallon SantanaNo ratings yet