Professional Documents

Culture Documents

TDS Final May 24

TDS Final May 24

Uploaded by

Kochu KuchuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Final May 24

TDS Final May 24

Uploaded by

Kochu KuchuCopyright:

Available Formats

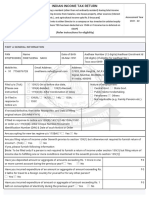

TAX DEDUCTED AT SOURCE (TDS) [CA Final May 24]

Sec 192 Average rate of tax Deducted at the time of payment Sec 194H 5% Limit :- Sec 194LD 5% (SC + CESS) Interest on:-

Salary (Slab) Commission or Payer : any person No TDS if aggregate amount ≤ 15000 Interest to FII or • Rupee denominated bonds

Sec 192A 10% Deducted at the time of Payment brokerage (other than Indv./HUF QFI Payer : Any person • Govt. securities

Payment of (If no PAN = MMR) No TDS if: (limit) whose TO/GR is up to No TDS If: Payee : FII/QFI • Municipal Debt securities

Accumulated • amount < 50000 in a year 1cr/ 50 lacs) • Commission or brokerage on professional Refer Sec115A – NR taxation

balance to • Service ≥ 5 years Payee : Resident person services Sec 194M 5% Limit :-

employee Sec 194I 10% - Land, building, Limit :- Payment of No TDS if aggregate amount in FY ≤ 50 Lacs

Sec 193 10% No TDS if interest: Rent furniture or No TDS if aggregate for all assets in a FY ≤ certain sums by Payer : Individual /HUF

Interest on • Payable on govt. securities fitting 240000 (in case of co ownership 240000 limit inv./HUF not covered u/s

securities Payer : any person • Payable on DMAT securities 2% - P&M, applied for each owners separately) (contract, Prof 194C/H/J

Payee : Resident • Payable to business trust by SPV equipment fees, comm./ Payee : Resident

person • Paid to LIC,GIC, or other insurers brokerage)

Sec194 10% Deducted at the time of Payment Payer : any person Sec 194N If Limit is 1 Crore -2% Limits :-

Dividend Payer : Indian Co. No TDS if: (limit) (other than Indv./HUF Withdrawing • Paying any sums > 1 Crore

Payee : Resident • Aggregate dividend < Rs 5000 p.a and paid whose TO/GR is up to cash If limit is 20 Lacs • In case of no filers of ROI for preceding 3

shareholder in other than cash mode 1cr/ 50 lacs) • 20 Lac to 1 Crore - 2% FY the limit is sum > 20 Lacs

• Paid to LIC,GIC, or other insurers or Payee : Resident person (If payee is co- • Above 1 Crore – 5% • Govt. securities

• Business trust (SPV TO BT) Sec 194IA 1% of (higher of Limit :- operative

Sec 194A 10% No TDS if Purchase of consideration or SDV) No TDS if consideration or SDV < 500000 society limit will Payer : Banks, co-op not applicable if payment made to : Govt,

Interest other • Interest paid by Bank/cooperative immovable (does not apply if 194LA applies) be 3 Crore ) banks, post office banks, co-op banks, post office, or person

than Interest on Payer : any person bank/post office ≤ 40000 p.a (senior citizen property other Payer : any person [FA -2023] Payee : Any person notified by CG

securities (other than Indv./HUF – 50000 p.a) than rural Payee : Resident Consideration includes all charges incidental Sec 194O 1% on Gross amount of No TDS if:-

agricultural land person to transfer such as – membership fee, • ECP is individual/ HUF; and

whose TO/GR is up to • Interest paid by others ≤ 5000 p.a Payment by E- sale

maintenance fee, parking fees etc commerce • Gross amount in FY < 5 Lacs; and

1cr/ 50 lacs) • Paid by Firm to a partner

Sec 194IB 5% Deducted at the time of credit or payment of operators (ECO) If no PAN furnished - 5% • ECP has furnished PAN/Aadhar to ECO

Payee : Resident person • Paid by CG under income tax Act

Renting of last month rent of PY or last month of to E- commerce

• Paid to LIC, other insurers, UTI, or any

Immovable Payer : individual or HUF tenancy, whichever is earlier participants Payer : ECO

banks

properties (not covered u/s 194I) (But deduction not to exceed Rent for last (ECP) Payee : ECP

Sec 194B 30% Deducted at the time of Payment

Payee : Resident month) Sec 194P Rates in Force Specified senior citizen means:-

Winning from • No TDS if Aggr. Amount ≤ 10000 for FY

lottery or Payer : Any person • If winning in Kind , the winnings will be Income of • Resident Individual aged ≥ 75 years; and

If no PAN furnished TDS - Limit :-

crossword Payee : Any person released only after ensuring that TDS is Specified Senior Payer : Specified Banks • Having pension income & no other income

20% Sec 206AA No TDS if rent ≤ 50000 p.m Citizen Payee : Specified senior

puzzles paid to the govt. (except interest income from same bank);

Sec 194IC 10% TDS only on the cash consideration (not on citizen

Sec 194BA 30% on net winnings on Deducted at the time of: and

Payment under kind)

Winning from his user account • Withdrawal from user account (net • Furnished declaration to the specified

Joint Payer : any person

Online Games winnings withdrawal) :and bank

development Payee : Resident If payment to NR – Sec 195 applies

[FA -2023] Payer : Any Person • At the end of FY (Balance amount) (such person is not required to file ROI u/s

agreement person

Payee : Any person If winning in Kind , the winnings will be 139)

Sec 194J 2% - FPS, call centre, Limits :-

released only after TDS is paid to the govt. Sec 194Q 0.1% of excess of 50 Lacs Limit :-

Fees for royalty on sale - Professional fees ≤ 30000

Sec 194BB 30% No TDS if Aggregate Amount ≤ 10000 for FY Payment for Aggregate amount in a year ≤ 50 Lacs

professional and or distribution - Technical fees For each

Winning from Payer : Any person purchase of If no PAN furnished - 5%

technical of films - Royalty category of

horse race Payee : Any person goods No TDS u/s 194Q if:-

services 10% - Others - Non-compete fees payments

Sec 194C Individual/HUF – 1% Limits :- Payer : Resident buyer • TDS already deducted under other sec

Sitting fees to DIR – No Limit

Payment to Others – 2% • Single payment ≤ 30000 whose T/O of preceding (194O)

Payer : any person

contractors • Aggregate during FY ≤ 100000 PY > 10 Crore • TCS already collected u/s 206C(1H)

(other than Indv./HUF No tds if:-

Payer : any person Payee : Resident Seller • In case 194Q & 206C(1H) both applies –

(once exceeded 1 lac, TDS deducted on total whose TO/GR is up to • Payment by Indv./HUF for personal

(other than Indv. /HUF amount) 1cr/ 50 lacs) apply sec 194Q,

purpose

whose TO/GR is up to No TDS if :- Payee : Resident person • 194Q is applicable on advance amount

1cr/ 50 lacs) • Payment made by indv/HUF exclusively for Sec 194K 10% Limit :- • In the year of incorporation 194Q does not

Payee : Resident person personal purpose Income in • No TDS if aggregate amount in FY ≤ 5000 apply Bcoz PY turnover is NIL

Sec 194D 5% Limit :- respect of units Payer : any person No TDS if income is in the nature of capital Sec194R 10% of value of benefit Limit:-

Insurance Payer : any person No TDS if aggregate amount ≤ 15000 Payee : Resident gain Benefits or (FMV) Aggregate amount in FY ≤ 20000

commission Payee : Resident Sec 194LA 10% Deducted at the time of Payment perquisites in • If gift is in kind, payer has to ensure that

Sec 194DA 5% On (maturity amount Deducted at the time of Payment Compensation Limit :- money or in kind Payer : any person TDS has been deducted & paid to govt.

Maturity – premium) on compulsory Payer : any person No TDS if aggregate amount ≤ 250000 w.r.t business or (other than Indv./HUF • 194R NA on loan waiver /settlement by

proceeds of Life No TDS if acquisition of Payee : Resident person (does not apply if 194LA applies) profession whose TO/GR is up to banks

insurance policy Payer : any person • maturity amount in FY < 100000 immovable Prop No TDS on rural agricultural Land 1cr/ 50 lacs) • 194R NA on sale discount, cash discount or

Payee : Resident • exempt under sec 10(10D) Payee : Resident person rebates between seller and buyer

Sec 194 LB 5% (SC + CESS) Refer Sec115A – NR taxation

Sec 194E 20% (SC + CESS) • No limit Interest on • 194R NA on Bonus and right issues

Payment to NR • Sportsmen/ entertainer - NR + non citizen infrastructure Payer : IDF Sec 194S 1% of consideration Limits:-

sportsmen, • Umpire and referee not covered here Debt fund Payee : NR/FC Transfer of • Amount ≤ 10000 for

sports assoc., • Refer Sec 115BBA Sec 194LC 5% (SC + CESS) Refer Sec115A – NR taxation virtual digital Payer : Buyer ✓ Individual/HUF whose T/O ≤ 1 crore or

entertainer Interest on assets Payee : Seller GR ≤ 50 Lacs

Sec 194G 5% Limit :- Foreign currency Payer : Indian co/ BT (Sec 206AA not applicable) • Amount ≤ 50000 for

Commission on Payer : Any person No TDS if amount ≤ 15000 Borrowings Payee : NR/FC ✓ Assessee other than individual /HUF

sale of lottery Payee : Any person made by Indian ✓ Individual/HUF whose T/O > 1 crore or

tickets co./ bus. trust GR > 50 Lacs

www.linkedin.com/in/bilal-ahmed-kabeer bilalkabeeer8@gmail.com t.me/BeyondCAFinals

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- Capital Trainers Full PPT On TDSDocument78 pagesCapital Trainers Full PPT On TDSYamuna GNo ratings yet

- TDS Chart Nov 23Document1 pageTDS Chart Nov 23Flashcap693No ratings yet

- TDS & TCS Rates - Yash KhandelwalDocument15 pagesTDS & TCS Rates - Yash KhandelwalSahoo PrabhasNo ratings yet

- TDS SummaryDocument4 pagesTDS Summaryshubhamsingh143deepNo ratings yet

- TDS Summary May 24Document2 pagesTDS Summary May 24Akil MalekNo ratings yet

- Tax Deduction at Source: Subject NameDocument7 pagesTax Deduction at Source: Subject Nameharshita23hrNo ratings yet

- Direct Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceDocument20 pagesDirect Taxation Mujtaba Zaidi Deduction and Collection of Tax at SourceManohar LalNo ratings yet

- Deduction of Tax at Source With Regard To Salary Income Section 192 1. 2. 3Document4 pagesDeduction of Tax at Source With Regard To Salary Income Section 192 1. 2. 3Vidit GuptaNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- 1.Tds, Tcs SummaryDocument5 pages1.Tds, Tcs SummaryKishore HariNo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- TDSTCSDocument4 pagesTDSTCSankitamishra985No ratings yet

- TDS & TCS - DT Nov 22Document4 pagesTDS & TCS - DT Nov 22bnanduriNo ratings yet

- Tax PlanningDocument6 pagesTax PlanningprasadNo ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- Tds TcsDocument4 pagesTds TcsranveerNo ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDocument10 pagesTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNo ratings yet

- Income TaxDocument77 pagesIncome TaxSachin KumarNo ratings yet

- Tax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in LndiDocument5 pagesTax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in Lndirahulmehta1578No ratings yet

- All About TDS Part 2Document9 pagesAll About TDS Part 2Animesh Kumar TilakNo ratings yet

- TDS ChartDocument3 pagesTDS ChartmmrkfastNo ratings yet

- TDS RatesDocument9 pagesTDS RatesCharu JagetiaNo ratings yet

- PWC - India - Corporate - Withholding TaxesDocument11 pagesPWC - India - Corporate - Withholding Taxessanket.tatedNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- TCS Provisions For The FY 2021-22 AY 2022-23Document11 pagesTCS Provisions For The FY 2021-22 AY 2022-23Hardik gabaNo ratings yet

- Tax Deduction at SourceDocument8 pagesTax Deduction at SourceSonali MuskanNo ratings yet

- Tds Rate ChartDocument15 pagesTds Rate ChartJain MjNo ratings yet

- Lumbera LectureDocument3 pagesLumbera LectureRyeNo ratings yet

- Net of Withholding Kailangan Niyo I Gross Up, KayaDocument7 pagesNet of Withholding Kailangan Niyo I Gross Up, KayaJPNo ratings yet

- 2018 Income Tax RatesDocument14 pages2018 Income Tax RatesMaria Celiña PerezNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- For Tds On Non SalaryDocument39 pagesFor Tds On Non SalaryicahimanshumehtaNo ratings yet

- Income-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at SourceDocument5 pagesIncome-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at Sourcem310235No ratings yet

- AH Presentation Aug 21 2021Document8 pagesAH Presentation Aug 21 2021Hasan MurtazaNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Sec 194 Ic, 194la, 194J (TDS)Document3 pagesSec 194 Ic, 194la, 194J (TDS)kalyanikamineniNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument11 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- Taxation of Different Fixed Income Instruments W e F April 01 2023Document4 pagesTaxation of Different Fixed Income Instruments W e F April 01 2023ArpNo ratings yet

- TdsPac RateCard 0910Document2 pagesTdsPac RateCard 0910Ebanezer PaulrajNo ratings yet

- AX Educted at Ource - I: KPPM & AssociatesDocument67 pagesAX Educted at Ource - I: KPPM & AssociatesSaksham JoshiNo ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument6 pagesC.H. Padliya & Co.: Chartered AccountantsSarat KumarNo ratings yet

- TDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inDocument15 pagesTDS Rate Chart For FY 2022-2023 (AY 2023-2024) Including Budget 2022 Amendments - Taxguru - inSachin GuptaNo ratings yet

- Ty Tax Project (Final)Document14 pagesTy Tax Project (Final)raj_s_harmaNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- Passive IncomeDocument14 pagesPassive IncomeJeannie de leonNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- Supplemental Note #2 - Individuals - Final Taxation & Capital Gains TaxationDocument8 pagesSupplemental Note #2 - Individuals - Final Taxation & Capital Gains TaxationRicojay FernandezNo ratings yet

- TDS Rates For FY 2021-22Document12 pagesTDS Rates For FY 2021-222022 YearNo ratings yet

- Analia Tax Notes-2011Document23 pagesAnalia Tax Notes-2011Butch MaatNo ratings yet

- TDS Rates Smart Notes (Nov 22) - Yash KhandelwalDocument12 pagesTDS Rates Smart Notes (Nov 22) - Yash KhandelwalUmang BansalNo ratings yet

- 6.input Tax CreditDocument24 pages6.input Tax CreditBhuvaneswari karuturiNo ratings yet

- INCTAX Final Income Taxation Rob NotesDocument7 pagesINCTAX Final Income Taxation Rob NotesEvelyn LabhananNo ratings yet

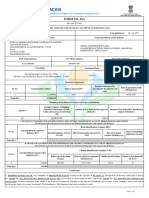

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

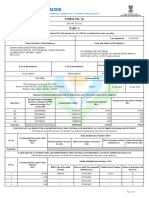

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961forty oneNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Alok Kumar BanerjeeNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Tax Deduction at Source (TDS)Document15 pagesTax Deduction at Source (TDS)yierbNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Document3 pagesSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- Ch-9 Advance Tax, TDS, TCSDocument122 pagesCh-9 Advance Tax, TDS, TCSrinkal jethiNo ratings yet

- Compounding Guidelines Dated 16.09.2022Document29 pagesCompounding Guidelines Dated 16.09.2022Mane TVNo ratings yet

- RupalDocument6 pagesRupalsivaganga MNo ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General Informationsushilprajapati10_77No ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Neeraj JoshiNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Internship ReportDocument47 pagesInternship ReportDeep ChandraNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)MaheshNo ratings yet

- Form PDF 869004400261222Document10 pagesForm PDF 869004400261222mohilNo ratings yet

- Ekxps0001n 2022Document5 pagesEkxps0001n 2022SiddharthNo ratings yet

- Jaspal Singh ItrDocument9 pagesJaspal Singh Itrvarunyadav3050No ratings yet

- Bocpv0011d 2023Document4 pagesBocpv0011d 2023Vyshak Bisha ValsanNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 644546640190719 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 644546640190719 Assessment Year: 2019-20Rajput Vaibhav Singh AzamgarhNo ratings yet

- FTRPS1276R 2020-21Document2 pagesFTRPS1276R 2020-21manasNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- Itr 4 - Ay 2022-23 - VarunDocument10 pagesItr 4 - Ay 2022-23 - VarunAkash AggarwalNo ratings yet