Professional Documents

Culture Documents

Mefa Mid 2

Mefa Mid 2

Uploaded by

Vadlamudi DhyanamalikaCopyright:

Available Formats

You might also like

- Case 3 Much Ado About Fair Value Group 8Document18 pagesCase 3 Much Ado About Fair Value Group 8NUR SABRINA ALIA BINTI MOHD ASRINo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- FA Progress Test - Answers S20-A21 PDFDocument10 pagesFA Progress Test - Answers S20-A21 PDFAlpha MpofuNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Karnataka II PUC Accountancy Sample Question Paper 18Document6 pagesKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreNo ratings yet

- Assignment: Financial Management Unit 1Document2 pagesAssignment: Financial Management Unit 1sachinNo ratings yet

- Budget 1Document2 pagesBudget 1Mr MasterNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- CompreDocument2 pagesCompref20220077No ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- BC 502 Management Accounting 908088840Document8 pagesBC 502 Management Accounting 908088840Saibal SandhirNo ratings yet

- Test 5Document4 pagesTest 5suzalaggarwalllNo ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Corporate AccountingDocument6 pagesCorporate Accountingrajamritdas3No ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- 3903 Question PaperDocument4 pages3903 Question PaperPacific TigerNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- bài tập về nhà chapter 1Document7 pagesbài tập về nhà chapter 1Nguyễn Linh NhiNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Financial Accounting 2015 B Com Part 1 PDocument5 pagesFinancial Accounting 2015 B Com Part 1 PPraver MalhotraNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- Assignment Financial AccountingDocument4 pagesAssignment Financial AccountingJatin SinghalNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Assignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022Document3 pagesAssignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022aishuNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Finacial Accountig1Document7 pagesFinacial Accountig1Prashanth PendyalaNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Chaithanya Info SystemsDocument5 pagesChaithanya Info SystemsMichael WellsNo ratings yet

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- (ACC 2023) Xii Target Paper by Sir Irfan JanDocument36 pages(ACC 2023) Xii Target Paper by Sir Irfan JanmohsinbeforwardNo ratings yet

- Account XII For Board Exam PracticeDocument18 pagesAccount XII For Board Exam PracticeBicky ShahNo ratings yet

- Topper'S Classes: Ca-Foundation (U-86)Document4 pagesTopper'S Classes: Ca-Foundation (U-86)RishabhNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- All Subjects For B.Com TPP 6th SemDocument3 pagesAll Subjects For B.Com TPP 6th SemBaavaraja.KNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Q.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsDocument6 pagesQ.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsTejas ChandanshiveNo ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Business Information Systems-DCSD 104: Page 1 of 8Document8 pagesBusiness Information Systems-DCSD 104: Page 1 of 8HarNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- 1st Unit Test B.K 12th 2020Document2 pages1st Unit Test B.K 12th 2020Soham SahareNo ratings yet

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsDocument9 pagesSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookNo ratings yet

- DL Mid 2Document1 pageDL Mid 2Vadlamudi DhyanamalikaNo ratings yet

- Project On Plant Leaf Disease DetectionDocument10 pagesProject On Plant Leaf Disease DetectionVadlamudi DhyanamalikaNo ratings yet

- LLDDDocument18 pagesLLDDVadlamudi DhyanamalikaNo ratings yet

- Tips Reference 7Document38 pagesTips Reference 7Vadlamudi DhyanamalikaNo ratings yet

- Wepik Unleashing The Zesty Potential Deep Learning For Lemon Leaf Disease Detection 202402041503523FxBDocument12 pagesWepik Unleashing The Zesty Potential Deep Learning For Lemon Leaf Disease Detection 202402041503523FxBVadlamudi DhyanamalikaNo ratings yet

- TaxationDocument5 pagesTaxationsn nNo ratings yet

- Business LawDocument2 pagesBusiness LawGanpatlal ChunnilalchoudharyNo ratings yet

- F7 (FR) Revision KitDocument6 pagesF7 (FR) Revision KitAye Myat ThawtarNo ratings yet

- Organization and Management Quiz Lesson 4Document1 pageOrganization and Management Quiz Lesson 4Anne MoralesNo ratings yet

- EKRP311 Vc-Jun2022Document3 pagesEKRP311 Vc-Jun2022dfmosesi78No ratings yet

- Assignment #1 (Template)Document4 pagesAssignment #1 (Template)Chad OngNo ratings yet

- Case 5Document26 pagesCase 5ibrahim ahmedNo ratings yet

- Dividend PolicyDocument32 pagesDividend PolicyStar AngelNo ratings yet

- 12th SP Paper Time Management March 2022Document17 pages12th SP Paper Time Management March 2022Sharvari PatilNo ratings yet

- Ratio Analysis of Suzlon EnergyDocument3 pagesRatio Analysis of Suzlon EnergyBharat RajputNo ratings yet

- Description: - TXN Date ValueDocument25 pagesDescription: - TXN Date ValueUday GurijalaNo ratings yet

- Chapter 9 - Financial ManagementDocument11 pagesChapter 9 - Financial ManagementNaman JainNo ratings yet

- CH 5 Cash and ReceivblesDocument92 pagesCH 5 Cash and ReceivblesYohanna SisayNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- 3 - CokeDocument30 pages3 - CokePranali SanasNo ratings yet

- Chapter Exam - Partnership Operations - 2Document13 pagesChapter Exam - Partnership Operations - 2NarikoNo ratings yet

- Title Iv Powers of CorporationsDocument7 pagesTitle Iv Powers of CorporationsSean FrancisNo ratings yet

- Statement of Cash Flow - MerchandisingDocument43 pagesStatement of Cash Flow - Merchandisingissachar barezNo ratings yet

- Chương 8. IAS 21 - The Effects of Changes inDocument33 pagesChương 8. IAS 21 - The Effects of Changes inLinh TrầnNo ratings yet

- Gr11 Acc June 2018 Possible AnswersDocument19 pagesGr11 Acc June 2018 Possible Answersora mashaNo ratings yet

- Corporate Law Dividend CSRDocument8 pagesCorporate Law Dividend CSRGulshan KashyapNo ratings yet

- Model Exit Exam - Fundamentals of Accounting IDocument9 pagesModel Exit Exam - Fundamentals of Accounting Inatnael0224No ratings yet

- Mergers and Acquisition Study NotesDocument3 pagesMergers and Acquisition Study NotesmimiNo ratings yet

- Ola Electric Mobility Limited DRHPDocument444 pagesOla Electric Mobility Limited DRHPdurgeshraj1098No ratings yet

- Dividend-Policy SolutionDocument20 pagesDividend-Policy Solutions-28-2021910906No ratings yet

- 4 - Preparation of Final AccountsDocument6 pages4 - Preparation of Final Accountskeval.dave120812No ratings yet

- Il RMDocument2 pagesIl RMKent Judehilee BacalNo ratings yet

- MGSB Prospectus FullDocument367 pagesMGSB Prospectus FullOliver OscarNo ratings yet

Mefa Mid 2

Mefa Mid 2

Uploaded by

Vadlamudi DhyanamalikaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mefa Mid 2

Mefa Mid 2

Uploaded by

Vadlamudi DhyanamalikaCopyright:

Available Formats

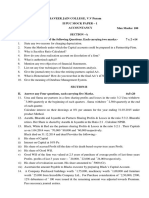

NRI INSTITUTE OF TECHNOLOGY

II MID EXAM QUESTION PAPER – MAY 2022

Year / Sem: II B.Tech, II Sem Programme: II B.Tech CIVIL, CSE, EEE, IT, DS Course Code:

( Common to all )

Course Name: MEFA Total Marks: 15 M Time: 90mins

UNIT - III

1. A) Explain features & Merits & Demerits of Partnership

B) Explain business Cycle and its phases.

2. Determine Price out Determination under Monopolistic Market.

UNIT – IV: PROBLEM . 2 ( COMPULSORY )

1. A. Explain Profitability Ratios and Give them a detail Formulas.

b. Define Accounting, accounting cycle and its significance?

2. Journalize the following transactions in the books of Mr.M.Tech Company

Date Particulars Amount

( Rs )

1/4/2015 Mr.Madan Started business with a 60000

capital

3/4/2015 Bought furniture from Furniture 2000

marts

8/4/2015 Bought goods from Devika & sons 14000

9/4/2015 Sold goods to Mahendra Singh 2000

10/4/2015 Returned goods to Devika & Sons 1000

11/4/2015 Cash Sales 75000

12/4/2015 Sold goods to Ramesh 14000

13/4/2015 Sold goods to Bombay Shop 15000

14/4/2015 Bombay Shop pays in full settlement 14000

of a/c

18/4/2015 Paid salaries 500

26/4/2015 Paid telephone bill 300

27/4/2015 Paid Devika & Sons full settlements 12500

28/4/2015 Paid wages 400

31/4/2015 Withdrew for personal use 500

3. From the following trial balance of Vikram Co. prepare Trading account, Profit &

Losses Balance sheet for the year ending 31/3/2015.

Particulars Amount Particulars Amount

Dr Cr

Electricity 14000 Interest 16000

Received

Land 140000 Discount 6000

Received

Interest 16000 Sales 800000

Wages 50000 Returns 10000

Opening Stock 20000 Sundry Creditors 60000

Rent 24000 Capital 302000

Purchases 300000 Bills Payable 15000

Office Expenses 30000

Building 400000

Salaries 90000

Power gas and 30000

Water

Returns 20000

Furniture 15000

Sundry Debtors 60000

120900

Total 1209000

0

Adjustments:

1. Outstanding Salaries Rs.10000.

2. Closing Stock Rs.80000.

3. Depreciate Buildings @10% p.a

4. Interest Received in advance Rs.2000.

5. Write off bad debts Rs.10000.

UNIT – V PROBLEM .

1. A. Briefly explain IRR Steps in Capital Budgeting.

b. define Capital Budgeting , and Explain Methods of Capital Budgeting.

2. A company is considering an investment proposal Rs.55000/-. The facility has a life

expectancy of 5years and no salvage value. The tax rate is 30%. Assume the firm uses

single line depreciation and the same is allowed for tax purposes. The estimated cash

flow before depreciation and tax (CFBT) from the investment proposal are as

follows.Calculate NPV & PI

Year 1 2 3 4 5

Cash

13600 16590 14769 13660 24855

flows

DCF

@ 0.909 0.826 0.751 0.683 0.621

10%

3. Given that a projects yields the following cash inflows for 6 years at an original cost of

Investment Rs.50000. find out IRR method.

Year 1 2 3 4 5 6

Cash

inflow 0 16000 24000 30000 30000 30000

s

You might also like

- Case 3 Much Ado About Fair Value Group 8Document18 pagesCase 3 Much Ado About Fair Value Group 8NUR SABRINA ALIA BINTI MOHD ASRINo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- FA Progress Test - Answers S20-A21 PDFDocument10 pagesFA Progress Test - Answers S20-A21 PDFAlpha MpofuNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Karnataka II PUC Accountancy Sample Question Paper 18Document6 pagesKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreNo ratings yet

- Assignment: Financial Management Unit 1Document2 pagesAssignment: Financial Management Unit 1sachinNo ratings yet

- Budget 1Document2 pagesBudget 1Mr MasterNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- CompreDocument2 pagesCompref20220077No ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- BC 502 Management Accounting 908088840Document8 pagesBC 502 Management Accounting 908088840Saibal SandhirNo ratings yet

- Test 5Document4 pagesTest 5suzalaggarwalllNo ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Corporate AccountingDocument6 pagesCorporate Accountingrajamritdas3No ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- 3903 Question PaperDocument4 pages3903 Question PaperPacific TigerNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- bài tập về nhà chapter 1Document7 pagesbài tập về nhà chapter 1Nguyễn Linh NhiNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Financial Accounting 2015 B Com Part 1 PDocument5 pagesFinancial Accounting 2015 B Com Part 1 PPraver MalhotraNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- Assignment Financial AccountingDocument4 pagesAssignment Financial AccountingJatin SinghalNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Assignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022Document3 pagesAssignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022aishuNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Finacial Accountig1Document7 pagesFinacial Accountig1Prashanth PendyalaNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Chaithanya Info SystemsDocument5 pagesChaithanya Info SystemsMichael WellsNo ratings yet

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- (ACC 2023) Xii Target Paper by Sir Irfan JanDocument36 pages(ACC 2023) Xii Target Paper by Sir Irfan JanmohsinbeforwardNo ratings yet

- Account XII For Board Exam PracticeDocument18 pagesAccount XII For Board Exam PracticeBicky ShahNo ratings yet

- Topper'S Classes: Ca-Foundation (U-86)Document4 pagesTopper'S Classes: Ca-Foundation (U-86)RishabhNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- All Subjects For B.Com TPP 6th SemDocument3 pagesAll Subjects For B.Com TPP 6th SemBaavaraja.KNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Q.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsDocument6 pagesQ.Prepare A Statement of P & L A/C As Per Revised Schedule III AnsTejas ChandanshiveNo ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Business Information Systems-DCSD 104: Page 1 of 8Document8 pagesBusiness Information Systems-DCSD 104: Page 1 of 8HarNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- 1st Unit Test B.K 12th 2020Document2 pages1st Unit Test B.K 12th 2020Soham SahareNo ratings yet

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsDocument9 pagesSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookNo ratings yet

- DL Mid 2Document1 pageDL Mid 2Vadlamudi DhyanamalikaNo ratings yet

- Project On Plant Leaf Disease DetectionDocument10 pagesProject On Plant Leaf Disease DetectionVadlamudi DhyanamalikaNo ratings yet

- LLDDDocument18 pagesLLDDVadlamudi DhyanamalikaNo ratings yet

- Tips Reference 7Document38 pagesTips Reference 7Vadlamudi DhyanamalikaNo ratings yet

- Wepik Unleashing The Zesty Potential Deep Learning For Lemon Leaf Disease Detection 202402041503523FxBDocument12 pagesWepik Unleashing The Zesty Potential Deep Learning For Lemon Leaf Disease Detection 202402041503523FxBVadlamudi DhyanamalikaNo ratings yet

- TaxationDocument5 pagesTaxationsn nNo ratings yet

- Business LawDocument2 pagesBusiness LawGanpatlal ChunnilalchoudharyNo ratings yet

- F7 (FR) Revision KitDocument6 pagesF7 (FR) Revision KitAye Myat ThawtarNo ratings yet

- Organization and Management Quiz Lesson 4Document1 pageOrganization and Management Quiz Lesson 4Anne MoralesNo ratings yet

- EKRP311 Vc-Jun2022Document3 pagesEKRP311 Vc-Jun2022dfmosesi78No ratings yet

- Assignment #1 (Template)Document4 pagesAssignment #1 (Template)Chad OngNo ratings yet

- Case 5Document26 pagesCase 5ibrahim ahmedNo ratings yet

- Dividend PolicyDocument32 pagesDividend PolicyStar AngelNo ratings yet

- 12th SP Paper Time Management March 2022Document17 pages12th SP Paper Time Management March 2022Sharvari PatilNo ratings yet

- Ratio Analysis of Suzlon EnergyDocument3 pagesRatio Analysis of Suzlon EnergyBharat RajputNo ratings yet

- Description: - TXN Date ValueDocument25 pagesDescription: - TXN Date ValueUday GurijalaNo ratings yet

- Chapter 9 - Financial ManagementDocument11 pagesChapter 9 - Financial ManagementNaman JainNo ratings yet

- CH 5 Cash and ReceivblesDocument92 pagesCH 5 Cash and ReceivblesYohanna SisayNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- 3 - CokeDocument30 pages3 - CokePranali SanasNo ratings yet

- Chapter Exam - Partnership Operations - 2Document13 pagesChapter Exam - Partnership Operations - 2NarikoNo ratings yet

- Title Iv Powers of CorporationsDocument7 pagesTitle Iv Powers of CorporationsSean FrancisNo ratings yet

- Statement of Cash Flow - MerchandisingDocument43 pagesStatement of Cash Flow - Merchandisingissachar barezNo ratings yet

- Chương 8. IAS 21 - The Effects of Changes inDocument33 pagesChương 8. IAS 21 - The Effects of Changes inLinh TrầnNo ratings yet

- Gr11 Acc June 2018 Possible AnswersDocument19 pagesGr11 Acc June 2018 Possible Answersora mashaNo ratings yet

- Corporate Law Dividend CSRDocument8 pagesCorporate Law Dividend CSRGulshan KashyapNo ratings yet

- Model Exit Exam - Fundamentals of Accounting IDocument9 pagesModel Exit Exam - Fundamentals of Accounting Inatnael0224No ratings yet

- Mergers and Acquisition Study NotesDocument3 pagesMergers and Acquisition Study NotesmimiNo ratings yet

- Ola Electric Mobility Limited DRHPDocument444 pagesOla Electric Mobility Limited DRHPdurgeshraj1098No ratings yet

- Dividend-Policy SolutionDocument20 pagesDividend-Policy Solutions-28-2021910906No ratings yet

- 4 - Preparation of Final AccountsDocument6 pages4 - Preparation of Final Accountskeval.dave120812No ratings yet

- Il RMDocument2 pagesIl RMKent Judehilee BacalNo ratings yet

- MGSB Prospectus FullDocument367 pagesMGSB Prospectus FullOliver OscarNo ratings yet