Professional Documents

Culture Documents

Financial Modeling

Financial Modeling

Uploaded by

Ronove Gaming0 ratings0% found this document useful (0 votes)

2 views3 pagesOriginal Title

FM2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesFinancial Modeling

Financial Modeling

Uploaded by

Ronove GamingCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Financial modeling

Financial modeling is the process of creating a mathematical representation of a company's

financial performance. It is a crucial tool in the world of finance, used for various purposes

such as valuation, budgeting, forecasting, and decision-making. Financial models help

businesses and investors make informed choices by analyzing the potential impact of

different financial scenarios.

The components of a financial model typically include:

1. Assumptions: Every financial model starts with a set of assumptions. These are the

inputs that drive the model and can include variables like revenue growth rates, cost

percentages, inflation rates, and more. Assumptions can be based on historical data,

market research, or management estimates.

2. Income Statement: This component represents a company's revenue, expenses, and

profits over a specific period, usually a year or a quarter. It includes line items like

revenue, cost of goods sold (COGS), gross profit, operating expenses, and net

income.

3. Balance Sheet: The balance sheet provides a snapshot of a company's financial

position at a specific point in time. It includes assets (such as cash, accounts

receivable, and property), liabilities (like loans and accounts payable), and

shareholders' equity.

4. Cash Flow Statement: This statement tracks the movement of cash into and out of a

company. It includes operating cash flow, investing cash flow, and financing cash

flow sections. It is crucial for assessing a company's liquidity and ability to meet its

financial obligations.

5. Historical Data: In many financial models, historical financial data is used as a

reference point. This data helps in analyzing trends and making comparisons to

assess how a company has performed in the past.

6. Projections: Financial models often involve projecting future financial performance

based on the assumptions made. Projections can extend over multiple years and are

used for various purposes like business planning, budgeting, and valuation.

7. Sensitivity Analysis: This component assesses how changes in key assumptions

impact the model's outputs. It helps in understanding the model's sensitivity to

different variables and assessing risk.

8. Valuation: For companies, financial models are often used to determine their

current or potential market value. Various valuation methods, such as discounted

cash flow (DCF), comparable company analysis (CCA), and precedent transactions,

are applied within the financial model.

9. Scenario Analysis: Financial models can be used to run different scenarios to assess

how the business might perform under different conditions. For example, a "base

case," "optimistic," and "pessimistic" scenario may be analyzed to understand

potential outcomes.

10. Graphs and Charts: Visual representations of the data, such as charts and graphs,

are often included in financial models to make the information more accessible and

to illustrate key trends and relationships.

11. Assumption Documentation: Clear documentation of the assumptions and

methodology used in the model is essential for transparency and to ensure that

others can understand and validate the model.

STEPS INVOLVED IN FINANCIAL MODELING

Financial modeling involves several steps to create a comprehensive and accurate

representation of a company's financial performance or to analyze a specific financial

scenario. Here are the typical steps involved in financial modeling:

1. Define the Objective:

Clearly define the purpose and scope of the financial model. What specific questions

or decisions do you want the model to address?

2. Gather Data and Assumptions:

Collect historical financial data, market research, and other relevant information.

Define and gather key assumptions that will drive the model, such as revenue

growth rates, expense projections, and discount rates.

3. Build the Model Structure:

Decide on the structure of the model, including the layout of the worksheets or

sections in a spreadsheet.

Set up the time periods (e.g., monthly, quarterly, annually) for which you will project

financials.

4. Income Statement Projection:

Start by projecting the company's revenue, including sales, pricing, and volume

assumptions.

Calculate the cost of goods sold (COGS) and other operating expenses based on your

assumptions.

Deduct expenses from revenue to calculate gross profit and then determine

operating income.

Factor in interest and taxes to arrive at net income.

5. Balance Sheet Projection:

Project the company's assets, liabilities, and shareholders' equity based on

assumptions.

Ensure that the balance sheet balances by maintaining the accounting equation

(Assets = Liabilities + Equity).

6. Cash Flow Projection:

Create a cash flow statement that outlines the inflows and outflows of cash.

Include operating cash flow, investing cash flow (e.g., capital expenditures), and

financing cash flow (e.g., debt repayments and equity issuances).

7. Integration of Statements:

Ensure that the income statement, balance sheet, and cash flow statement are

interconnected, so changes in one statement affect the others appropriately.

8. Sensitivity Analysis:

Conduct sensitivity analysis to assess the impact of changing key assumptions on the

model's outputs. Vary assumptions one at a time and observe the effects.

9. Scenario Analysis:

Run different scenarios (e.g., best-case, worst-case, base-case) to analyze how the

company's financials would fare under various conditions.

10. Valuation (if applicable):

Apply relevant valuation methods (e.g., DCF, comparable company analysis) to

determine the company's value based on the projected financials.

11. Graphs and Visuals:

Create charts, graphs, and visuals to present key findings and trends in the data.

12. Documentation:

Document all assumptions, formulas, and methodologies used in the model. This is

crucial for transparency and validation.

13. Review and Validate:

Thoroughly review the model for errors, circular references, and inconsistencies.

Validate the model by comparing its projections to historical data or benchmarks.

14. Report and Presentation:

Prepare a report or presentation summarizing the model's findings, including key

insights, sensitivities, and scenarios.

15. Iterate and Update:

Financial models are not static. Periodically update the model to reflect actual

performance and adjust assumptions as needed.

16. Finalize and Share:

Finalize the model and share it with relevant stakeholders for decision-making.

It's important to note that the complexity of financial modeling can vary significantly

depending on the purpose and requirements of the analysis. Additionally, it's a best

practice to use error-checking and documentation techniques to enhance the

reliability and transparency of the model. Financial modeling requires attention to

detail, a good understanding of finance and accounting principles, and proficiency in

spreadsheet software like Microsoft Excel or specialized financial modeling software.

You might also like

- FP&A Interview Questions and AnswersDocument7 pagesFP&A Interview Questions and Answershrithikoswal1603100% (1)

- Workshop Financial Modelling-ShareDocument58 pagesWorkshop Financial Modelling-ShareIdham Idham Idham100% (1)

- Solved Paper 2016-2017 - Financial ManagementDocument23 pagesSolved Paper 2016-2017 - Financial ManagementGaurav SharmaNo ratings yet

- Do 1221Document27 pagesDo 1221muluabebaw287No ratings yet

- Financial Modeling of M and ADocument9 pagesFinancial Modeling of M and Ashettymihir9No ratings yet

- Project On Financial ModelingDocument4 pagesProject On Financial ModelingHafiz Syed Ibrahim100% (2)

- FM Chapter 1Document6 pagesFM Chapter 1Ganesh VmNo ratings yet

- FM Chapter 1 & 2Document10 pagesFM Chapter 1 & 2Ganesh VmNo ratings yet

- Unit - 5 (Entrepreneurship - Financial Planning)Document9 pagesUnit - 5 (Entrepreneurship - Financial Planning)Moshika VetrivelNo ratings yet

- A Guide To Financial ModelingDocument9 pagesA Guide To Financial ModelingAayush KothariNo ratings yet

- FM 3Document13 pagesFM 3ganeshraokhande99No ratings yet

- Financial Modelling: ObjectivesDocument4 pagesFinancial Modelling: ObjectivesRohit BajpaiNo ratings yet

- Report On Financial ModellingDocument5 pagesReport On Financial ModellingSourabh Singh100% (1)

- Financial Modeling Imporatnt Question For VivaDocument2 pagesFinancial Modeling Imporatnt Question For Vivayogesh.kumar29.iitmNo ratings yet

- Overview of Financial ModelingDocument25 pagesOverview of Financial Modelingalanoud100% (2)

- FP&A Interview QuestionsDocument8 pagesFP&A Interview QuestionsDEVDATTA NIMBALKARNo ratings yet

- Topic 1 Introduction To Financial Modeling PDFDocument15 pagesTopic 1 Introduction To Financial Modeling PDFMARY ANN COLIBARNo ratings yet

- Chapter 1 Introduction To Financial Modelling and ValuationDocument30 pagesChapter 1 Introduction To Financial Modelling and Valuationnatiman090909No ratings yet

- Exam Reviewer Midterm Financial ModelingDocument3 pagesExam Reviewer Midterm Financial ModelingKlinton Francis Consular BuyaNo ratings yet

- First Module Financial ModellingDocument7 pagesFirst Module Financial ModellingSeba MohantyNo ratings yet

- What Is A Financial Model?: 1. Historical Results and AssumptionsDocument5 pagesWhat Is A Financial Model?: 1. Historical Results and AssumptionsRupasree DeyNo ratings yet

- Confidential NotesDocument35 pagesConfidential Noteskamaljit kaushikNo ratings yet

- Financial Modelling NOTESDocument29 pagesFinancial Modelling NOTESmelvinngugi669No ratings yet

- Financial ModelingDocument8 pagesFinancial ModelingSakshi KatochNo ratings yet

- Overview of Financial Modeling: 3 Statement Model Types of Models DCF Model LBO M&ADocument18 pagesOverview of Financial Modeling: 3 Statement Model Types of Models DCF Model LBO M&ALaila Ubando100% (1)

- Financial ModelingDocument56 pagesFinancial Modelingvikas.a.haryanviNo ratings yet

- Financial Analysis GuideDocument6 pagesFinancial Analysis GuideRomelyn Joy JangaoNo ratings yet

- Accounts Jun 21Document5 pagesAccounts Jun 21Nisha MandaleNo ratings yet

- ModelingDocument12 pagesModelingIbrahimNo ratings yet

- Types of Financial Model: Why Financial Models Are Prepared?Document4 pagesTypes of Financial Model: Why Financial Models Are Prepared?2460985No ratings yet

- Prerequisites To Learning Financial ModelingDocument6 pagesPrerequisites To Learning Financial ModelingRohit BajpaiNo ratings yet

- Mini ProjectDocument4 pagesMini Projectayeshashifa2716No ratings yet

- Financial ModelingDocument6 pagesFinancial Modelingrajeshdhnashire100% (1)

- Sos ReportDocument6 pagesSos ReportTushaar JhamtaniNo ratings yet

- Business Valuation-Student NotesDocument15 pagesBusiness Valuation-Student NotesMohit RawatNo ratings yet

- Module 2 Smart Task 2Document3 pagesModule 2 Smart Task 2YASHASVI SHARMANo ratings yet

- Financial ModellingDocument3 pagesFinancial ModellingEswara kumar JNo ratings yet

- Financial Health of Your BusinessDocument20 pagesFinancial Health of Your BusinessJuan LamasNo ratings yet

- Financial Modeling and ValuationDocument18 pagesFinancial Modeling and ValuationSaniya MemonNo ratings yet

- Overview of Financial Modeling - What Is Financial ModelingDocument12 pagesOverview of Financial Modeling - What Is Financial ModelingDungNo ratings yet

- Financial InterpretationDocument3 pagesFinancial Interpretationayeshashifa2716No ratings yet

- Valuation ProcessDocument3 pagesValuation ProcessVernon BacangNo ratings yet

- The Basics of Financial ModelingDocument2 pagesThe Basics of Financial ModelingRohit BajpaiNo ratings yet

- Account ManagementDocument10 pagesAccount ManagementThe SpectreNo ratings yet

- MODULE 1 Lesson 2 and 3Document22 pagesMODULE 1 Lesson 2 and 3Annabeth BrionNo ratings yet

- FinanceDocument2 pagesFinancekhandelwal2121No ratings yet

- Financial ManagementDocument1 pageFinancial ManagementImran KhanNo ratings yet

- Smart Task 02: Answer: - List of Assumptions With The Values Used in Project FinanceDocument6 pagesSmart Task 02: Answer: - List of Assumptions With The Values Used in Project Financeavinash singhNo ratings yet

- Facilitates Preparation of Financial StatementsDocument7 pagesFacilitates Preparation of Financial Statementsankitasaatpute21No ratings yet

- Business Finance Week 3 4Document10 pagesBusiness Finance Week 3 4Camille CornelioNo ratings yet

- Corporate Financial PlanningDocument12 pagesCorporate Financial PlanningMuhaiminul IslamNo ratings yet

- Corporate Finance Assignment 6Document4 pagesCorporate Finance Assignment 6amitchellpeartNo ratings yet

- Top 50 QuestionsDocument11 pagesTop 50 Questionsmax financeNo ratings yet

- Act08 - Lfca133e022 - Lique GiinoDocument4 pagesAct08 - Lfca133e022 - Lique GiinoGino LiqueNo ratings yet

- Financial Statements, Tools and BudgetsDocument20 pagesFinancial Statements, Tools and BudgetsVanessa Mae AguilarNo ratings yet

- Financial Analysis - Kotak Mahindra BankDocument43 pagesFinancial Analysis - Kotak Mahindra BankKishan ReddyNo ratings yet

- Constructing Consistent Financial Planning Models For ValuationDocument32 pagesConstructing Consistent Financial Planning Models For ValuationFlavio Vilas-BoasNo ratings yet

- Financial AnalysisDocument67 pagesFinancial Analysisdushya4100% (1)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Brighttalk Digital Marketing Maturity Benchmarks Report Smart InsightsDocument24 pagesBrighttalk Digital Marketing Maturity Benchmarks Report Smart InsightsmdcarnayNo ratings yet

- ASSIGNMENT NO 03 DBDocument6 pagesASSIGNMENT NO 03 DBMohsin AbbasiNo ratings yet

- FN2191 Commentary 2020Document13 pagesFN2191 Commentary 2020slimshadyNo ratings yet

- Acf2 2024Document48 pagesAcf2 2024Fabio BarbosaNo ratings yet

- BUSINESSDocument17 pagesBUSINESSGemuel JutagNo ratings yet

- Vikas Kejriwal - How To Invest in Commercial Real Estate Step by StepDocument2 pagesVikas Kejriwal - How To Invest in Commercial Real Estate Step by Stepethanpeter993No ratings yet

- All SlidesDocument31 pagesAll SlidessinginiwizNo ratings yet

- Buyout Firm Thoma Bravo Goes From Niche To Big League - Financial TimesDocument2 pagesBuyout Firm Thoma Bravo Goes From Niche To Big League - Financial Timesefweqfweq wdwdNo ratings yet

- Financial Markets ReviewerDocument21 pagesFinancial Markets ReviewerChristine RepuldaNo ratings yet

- Trung NguyenDocument11 pagesTrung NguyenKhoa Lê TiếnNo ratings yet

- Business PlanDocument23 pagesBusiness Planhailu badyeNo ratings yet

- Bbe A1.1Document18 pagesBbe A1.1220004nguyen.hanNo ratings yet

- MCO 04 Previous Year Question Papers by IgnouassignmentguruDocument102 pagesMCO 04 Previous Year Question Papers by Ignouassignmentgurudenny josephNo ratings yet

- Options Trading For Beginners NOV 6Document164 pagesOptions Trading For Beginners NOV 6cj.rhodanNo ratings yet

- Chapter 5 Strategic ChoiceDocument39 pagesChapter 5 Strategic Choiceprasad guthiNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Topic 5 PresentationDocument11 pagesTopic 5 PresentationLidia SamuelNo ratings yet

- 20 Pip Challenge (Creative Currency Edition) - 3Document3 pages20 Pip Challenge (Creative Currency Edition) - 3Muhammad SufyanNo ratings yet

- Investment Deck - Ambassador 6Document14 pagesInvestment Deck - Ambassador 6Tom ChoiNo ratings yet

- CRDB Bank Annual Report 2019Document349 pagesCRDB Bank Annual Report 2019MSHANA ALLYNo ratings yet

- CA Final Audit Company Audit Free Sample NotesDocument39 pagesCA Final Audit Company Audit Free Sample Notesabhimanyusingh baiseNo ratings yet

- Business Igcse TestDocument13 pagesBusiness Igcse TestAshutosh BishtNo ratings yet

- 1 Notes General Banking LawDocument18 pages1 Notes General Banking Lawraymund lumantaoNo ratings yet

- Laporan Keuangan TSPC Q1-23Document81 pagesLaporan Keuangan TSPC Q1-23Ardina LukitaNo ratings yet

- Signal 2023 05 20 135538Document5 pagesSignal 2023 05 20 135538Shahid NadeemNo ratings yet

- Implementasi Strategi Bauran Pemasaran Pertenakan Lebah Di UMKMDocument7 pagesImplementasi Strategi Bauran Pemasaran Pertenakan Lebah Di UMKMDedy TrianaNo ratings yet

- December Bolt 2022Document73 pagesDecember Bolt 2022ADITI VAISHNAVNo ratings yet

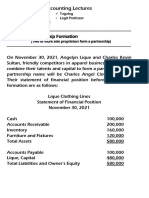

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- Silicon Valley Bank Fiasco Simply ExplainedDocument21 pagesSilicon Valley Bank Fiasco Simply ExplainedGoMarkhaArjNo ratings yet

- Underwriting of Shares and DebenturesDocument76 pagesUnderwriting of Shares and DebenturesShamik ChakrabortyNo ratings yet