Professional Documents

Culture Documents

MalikOVERHEAD COST

MalikOVERHEAD COST

Uploaded by

Zeeshan BakaliCopyright:

Available Formats

You might also like

- The Second Chance Scalp Cheat SheetDocument2 pagesThe Second Chance Scalp Cheat SheetZeeshan Bakali100% (1)

- Back$Ide Cheat SheetDocument2 pagesBack$Ide Cheat SheetZeeshan Bakali100% (1)

- The Rubberband Scalp Cheat SheetDocument2 pagesThe Rubberband Scalp Cheat SheetZeeshan Bakali100% (1)

- SOP Sales ManagerDocument2 pagesSOP Sales ManagerDesyFortuna55% (11)

- Capital Investment Analysis For Engineering and ManagementDocument316 pagesCapital Investment Analysis For Engineering and ManagementCFA100% (2)

- Bài tập chương 4cDocument10 pagesBài tập chương 4cHậu MinNgôNo ratings yet

- Overhead Absorption MCQs and SolutionsDocument2 pagesOverhead Absorption MCQs and Solutionsfastnuces86% (7)

- MX - Cost Accounting PDFDocument5 pagesMX - Cost Accounting PDFZamantha TiangcoNo ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- ISO - TC 258 - Project, Programme and Portfolio ManagementDocument5 pagesISO - TC 258 - Project, Programme and Portfolio ManagementFai's AlDahlanNo ratings yet

- De 4 F 2Document7 pagesDe 4 F 2Quỳnh QuỳnhNo ratings yet

- Test of Labour Overheads and Absorption and Marginal CostingDocument4 pagesTest of Labour Overheads and Absorption and Marginal CostingzairaNo ratings yet

- Review SessionDocument10 pagesReview SessionMaajid Bashir0% (1)

- Overheads Test (Q)Document13 pagesOverheads Test (Q)Rabia SattarNo ratings yet

- MA 习题带练 Chapter 8-13Document13 pagesMA 习题带练 Chapter 8-13roseliu.521.jackNo ratings yet

- 4 2005 Jun QDocument9 pages4 2005 Jun Qapi-19836745No ratings yet

- Absorption and Marginal Costing With Answers 2Document6 pagesAbsorption and Marginal Costing With Answers 2Hassaan ImranNo ratings yet

- 4 2006 Dec QDocument9 pages4 2006 Dec Qapi-19836745No ratings yet

- Financial Information For Management: Time Allowed 3 HoursDocument14 pagesFinancial Information For Management: Time Allowed 3 HoursAnousha DookheeNo ratings yet

- Financial AccountingDocument68 pagesFinancial AccountingAvinash SharmaNo ratings yet

- c1 Test 2Document5 pagesc1 Test 2Tinashe MashoyoyaNo ratings yet

- FIA MA1 Mock Exam - QuestionsDocument20 pagesFIA MA1 Mock Exam - QuestionsSim LeeWen50% (2)

- T4 - Past Paper CombinedDocument53 pagesT4 - Past Paper CombinedU Abdul Rehman100% (1)

- 4 2007 Jun QDocument9 pages4 2007 Jun Qapi-19836745No ratings yet

- 4 2006 Jun QDocument10 pages4 2006 Jun Qapi-19836745No ratings yet

- 04 AC212 Lecture 4-Overheads and Absorption Costing PDFDocument17 pages04 AC212 Lecture 4-Overheads and Absorption Costing PDFJam JamNo ratings yet

- 04 AC212 Lecture 4-Overheads and Absorption Costing PDFDocument17 pages04 AC212 Lecture 4-Overheads and Absorption Costing PDFsengpisalNo ratings yet

- Past Exam QSHDocument2 pagesPast Exam QSHLinyVatNo ratings yet

- Ma2 Test 2Document4 pagesMa2 Test 2saad shahidNo ratings yet

- Ma1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockDocument9 pagesMa1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockMino MinaNo ratings yet

- Chapter 2 Question Review1Document8 pagesChapter 2 Question Review1Shamshu AmanurNo ratings yet

- Accounting For Costs: Thursday 10 June 2010Document11 pagesAccounting For Costs: Thursday 10 June 2010umarmughaNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- 9 - Assessment-StuDocument3 pages9 - Assessment-StuThanh LamNo ratings yet

- FREV Finman 1Document10 pagesFREV Finman 1Jay Ann DomeNo ratings yet

- Cup-Management Advisory ServicesDocument7 pagesCup-Management Advisory ServicesJerauld BucolNo ratings yet

- Management Accounting QuestionsDocument11 pagesManagement Accounting QuestionsManfredNo ratings yet

- Job Batch Costing-PQDocument9 pagesJob Batch Costing-PQRohaib MumtazNo ratings yet

- MA1 Past Exam QuestionsDocument14 pagesMA1 Past Exam Questionssramnarine1991No ratings yet

- Accounting For OverheadsDocument13 pagesAccounting For OverheadsfyrNo ratings yet

- Practice Exam 02 S04 312S05Document13 pagesPractice Exam 02 S04 312S05azirNo ratings yet

- F2 MockDocument23 pagesF2 MockH Hafiz Muhammad AbdullahNo ratings yet

- Chapter 8Document71 pagesChapter 8MAN HIN NGAI100% (2)

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- CAPE AccountingDocument10 pagesCAPE Accountingget thosebooksNo ratings yet

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDocument9 pagesD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngNo ratings yet

- Costacc Module 5 QuizDocument11 pagesCostacc Module 5 QuizGemNo ratings yet

- Food Costs Supervisory SalariesDocument11 pagesFood Costs Supervisory SalariesJames CrombezNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- MA1 First Test UpdatedDocument14 pagesMA1 First Test UpdatedHammad KhanNo ratings yet

- AY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Document8 pagesAY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Chew Hong KaiNo ratings yet

- Seatwork No. 3 Comprehensive IncomeDocument5 pagesSeatwork No. 3 Comprehensive IncomeHoney Rose AncianoNo ratings yet

- Mockboard MASDocument9 pagesMockboard MASlalala010899No ratings yet

- Local Media1744076886409665709Document12 pagesLocal Media1744076886409665709Lovely Dela Cruz GanoanNo ratings yet

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Factory Overhead: Planned, Actual, and Applied: Multiple ChoiceDocument16 pagesFactory Overhead: Planned, Actual, and Applied: Multiple ChoiceCassandra Dianne Ferolino Macado100% (1)

- Absorption % Marginal Costing - Practice QuestionsDocument6 pagesAbsorption % Marginal Costing - Practice Questionssramnarine1991No ratings yet

- F5 Practice Questions 1-7Document22 pagesF5 Practice Questions 1-7Dilli Ram Pokhrel100% (2)

- F2 Pre-Exam QuestionsDocument7 pagesF2 Pre-Exam Questionsaddi420100% (1)

- Costing - Oar - Absorptional - MCQ'SDocument7 pagesCosting - Oar - Absorptional - MCQ'SMusthari KhanNo ratings yet

- Financial Management - IIDocument7 pagesFinancial Management - IIR SheeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Afc QM Dawood Shahid Sampling & Sampling Distribution-1Document25 pagesAfc QM Dawood Shahid Sampling & Sampling Distribution-1Zeeshan BakaliNo ratings yet

- BMS Quiz 1Document2 pagesBMS Quiz 1Zeeshan BakaliNo ratings yet

- Afc QM Dawood Shahid Chap 10 Matrices & Determinants-1Document23 pagesAfc QM Dawood Shahid Chap 10 Matrices & Determinants-1Zeeshan BakaliNo ratings yet

- MA2 Syllabus Changes (Effective For 2023 To 24)Document3 pagesMA2 Syllabus Changes (Effective For 2023 To 24)Zeeshan BakaliNo ratings yet

- BUDGETING Ovation.Document15 pagesBUDGETING Ovation.Zeeshan BakaliNo ratings yet

- BMSICMADocument5 pagesBMSICMAZeeshan BakaliNo ratings yet

- Pay Back Period (Nom-Discount FD Payback Periods TellsDocument14 pagesPay Back Period (Nom-Discount FD Payback Periods TellsZeeshan BakaliNo ratings yet

- High Low Method - Forecasting TechniqueDocument15 pagesHigh Low Method - Forecasting TechniqueZeeshan BakaliNo ratings yet

- Hiatt Loin Meito - Forecasting. - PRED1 (IronDocument10 pagesHiatt Loin Meito - Forecasting. - PRED1 (IronZeeshan BakaliNo ratings yet

- Inform Action' For ComparisonDocument12 pagesInform Action' For ComparisonZeeshan BakaliNo ratings yet

- Hypothesis Testing Z 2Document5 pagesHypothesis Testing Z 2Zeeshan BakaliNo ratings yet

- MCQ FA1 TenDocument12 pagesMCQ FA1 TenZeeshan BakaliNo ratings yet

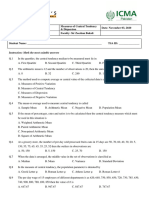

- Competency To Contract: MinorDocument4 pagesCompetency To Contract: MinorZeeshan BakaliNo ratings yet

- QMT AssignmentDocument95 pagesQMT AssignmentZeeshan BakaliNo ratings yet

- Free Consent: CoercionDocument7 pagesFree Consent: CoercionZeeshan BakaliNo ratings yet

- QM Assignment July 22 by Permal Sajjad - SolutionDocument7 pagesQM Assignment July 22 by Permal Sajjad - SolutionZeeshan BakaliNo ratings yet

- QM Assignment July 22 by Permal Sajjad - SolutionDocument7 pagesQM Assignment July 22 by Permal Sajjad - SolutionZeeshan Bakali100% (1)

- Statistics CAF Results Spring 2021Document1 pageStatistics CAF Results Spring 2021Zeeshan BakaliNo ratings yet

- Import Export 5Document2 pagesImport Export 5Devesh JhaNo ratings yet

- Amaravati Status Report by Commissioner APCRDADocument51 pagesAmaravati Status Report by Commissioner APCRDAPriyaNo ratings yet

- Bup Mock 2 FinalDocument10 pagesBup Mock 2 Finalilove9/11helloNo ratings yet

- OD427403318394300100Document1 pageOD427403318394300100sarkarbapuni8No ratings yet

- Demand, Supply, and Market Equilibrium - Part IIDocument23 pagesDemand, Supply, and Market Equilibrium - Part IIAsem AmerNo ratings yet

- Blended Learning: Is For Grounding and Ensuring The Hot and Neutral Prongs Are Inserted Into Correct Receptacles SlotsDocument5 pagesBlended Learning: Is For Grounding and Ensuring The Hot and Neutral Prongs Are Inserted Into Correct Receptacles SlotsLORIAN COMETANo ratings yet

- IB Economics - UnemploymentDocument6 pagesIB Economics - UnemploymentSohee YimNo ratings yet

- Factor That Influence Housing Price in MalaysiaDocument84 pagesFactor That Influence Housing Price in MalaysiaKARNIBAL100% (19)

- MJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Document16 pagesMJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Jasmine ActaNo ratings yet

- Question 11.4Document2 pagesQuestion 11.4KimNo ratings yet

- Annex 51 Inventory and Inspection Report of Unserviceable PropertyDocument1 pageAnnex 51 Inventory and Inspection Report of Unserviceable PropertyFreddie TabamoNo ratings yet

- CytoUpdate FinalbrochureCOMDocument4 pagesCytoUpdate FinalbrochureCOMBrian WangNo ratings yet

- Flowchart of Raw Materials Purchasing FunctionDocument1 pageFlowchart of Raw Materials Purchasing Function05. Ariya ParendraNo ratings yet

- Building Materials and Construction II: Arch 2162Document47 pagesBuilding Materials and Construction II: Arch 2162HULE ADDIS ENTERTAINMENTNo ratings yet

- Russia - A Wounded EconomyDocument8 pagesRussia - A Wounded EconomyPham Thi Diem PhuongNo ratings yet

- Basic Microeconomics REVIEWER - Theory of Consumer BehaviorDocument3 pagesBasic Microeconomics REVIEWER - Theory of Consumer BehaviorJig PerfectoNo ratings yet

- SBQ SBC 1842 Lecture 5Document28 pagesSBQ SBC 1842 Lecture 5Akmarn MakmurNo ratings yet

- Tugas MLTIDocument16 pagesTugas MLTIArinisa PakpahanNo ratings yet

- Double Entry Cash BookDocument3 pagesDouble Entry Cash BookGyanish JhaNo ratings yet

- Vicinity Vacation RentalsDocument4 pagesVicinity Vacation RentalsHendry teikNo ratings yet

- Tech TipsDocument5 pagesTech TipsAngel CastNo ratings yet

- Effect of Public ExpenditureDocument5 pagesEffect of Public ExpenditureSantosh ChhetriNo ratings yet

- Chapter 12 Exercises: Project 4Document11 pagesChapter 12 Exercises: Project 4Divya GoyalNo ratings yet

- Problem SolvingDocument32 pagesProblem SolvingJoanna Paula MagadiaNo ratings yet

- Aa025 KMNS - QN Pra1920Document5 pagesAa025 KMNS - QN Pra1920JOSEPH LEE ZE LOONG MoeNo ratings yet

- Overheads FinalDocument12 pagesOverheads FinalSanskar VarshneyNo ratings yet

- Ffiq Ffiq: (Ftd-RoorrDocument37 pagesFfiq Ffiq: (Ftd-Roorrjshankar84No ratings yet

MalikOVERHEAD COST

MalikOVERHEAD COST

Uploaded by

Zeeshan BakaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MalikOVERHEAD COST

MalikOVERHEAD COST

Uploaded by

Zeeshan BakaliCopyright:

Available Formats

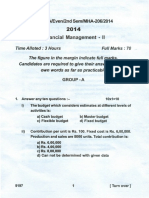

MA1 Managing Information

Overhead cost

Class practice question

1Budgeted labour hours 8,500

Budgeted overheads $148,750

Actual labour hours 7,928

Actual overheads $146,200

Based on the data given above, what is the labour hour overhead absorption rate?

A $17.20 per hour

B $17.50 per hour

C $18.44 per hour

D $18.76 per hour

2 Canberra has established the following information regarding fixed overheads for the coming

month:

Budgeted information:

Fixed overheads £180,000

Labour hours 3,000 hours

Machine hours 10,000 hours

Units of production 5,000 units

Actual fixed costs for the last month were £160,000.

Canberra produces many different products using highly automated manufacturing processes and absorbs

overheads on the most appropriate basis.

What will be the pre-determined overhead absorption rate?

A £16

B £18

C £36

D £60

3 Which of the following statements about overhead absorption rates are true?

(i) They are predetermined in advance for each period

(ii) They are used to charge overheads to products

(iii) They are based on actual data for each period

(iv) They are used to control overhead costs

A (i) and (ii) only

B (i), (ii) and (iv) only

C (ii), (iii) and (iv) only

D (iii) and (iv) only

Compiled By: Muzzamil Malik Page 1

MA1 Managing Information

4 Factory overheads can be absorbed by which of the following methods?

(i) Direct labour hours

(ii) Machine hours

(iii) As a percentage of prime cost

(iv) $x per unit

A (i), (ii), (iii) and (iv)

B (i) and (ii) only

C (i), (ii) and (iii) only

D (ii), (iii) and (iv) only

5 A company uses an overhead absorption rate of £3·50 per machine hour, based on 32,000 budgeted

machine hours for the period. During the same period the actual total overhead expenditure amounted to

£108,875 and 30,000 machine hours were recorded on actual production.

By how much was the total overhead under or over absorbed for the period?

A Under absorbed by £3,875

B Under absorbed by £7,000

C Over absorbed by £3,875

D Over absorbed by £7,000

6 Over-absorbed overheads occur when

A absorbed overheads exceed actual overheads

B absorbed overheads exceed budgeted overheads

C actual overheads exceed budgeted overheads

D budgeted overheads exceed absorbed overheads

7 A company has over absorbed fixed production overheads for the period by £6,000. The fixed production

overhead absorption rate was £8 per unit and is based on the normal level of activity of 5,000 units. Actual

production was4,500 units.

What was the actual fixed production overheads incurred for the period?

A £30,000

B £36,000

C £40,000

D £42,000

8 A company absorbs overheads on machine hours which were budgeted at 11,250 with overheads

of$258,750. Actual results were 10,980 hours with overheads of $254,692. Overheads were

A under absorbed by $2,152

B over absorbed by $4,058

C under absorbed by $4,058

D over absorbed by $2,152

Compiled By: Muzzamil Malik Page 2

MA1 Managing Information

9 Edison has the following data relating to overheads.

Budget Actual

Fixed overheads $15,000 $14,000

Direct labour hours 20,000 19,500

Overheads are absorbed on the basis of labour hours.

Which of the following statements is true?

A Overheads will be under absorbed by $1,000 due to the lower than expected expenditure.

B Overheads will be under absorbed by $1,000 due to the unexpected decrease in labour hours.

C Overheads will be under absorbed by $625 due to lower than expected expenditure and lower

than expected labour hours

D Overheads will be over absorbed by $625 due to lower than expected expenditure offset by lower than

expected labour hours.

10 A company absorbs overheads on the basis of machine hours. In a period, actual machine hours were

22,435, actual overheads were $496,500 and there was over absorption of $64,375.

The budgeted overhead absorption rate was $ per machine hour (to the nearest $).

11 A method of dealing with overheads involves spreading common costs over cost centres on the

basis of benefit received. This is known as

A overhead absorption

B overhead apportionment

C overhead allocation

D overhead analysis

12 Which of the following is correct when considering the allocation, apportionment and

reapportionment of overheads in an absorption costing situation?

A Only production related costs should be considered.

B Allocation is the situation where part of an overhead is assigned to a cost centre.

C Costs may only be reapportioned from production centres to service centres.

D Any overheads assigned to a single department should be ignored

Compiled By: Muzzamil Malik Page 3

MA1 Managing Information

Compiled By: Muzzamil Malik Page 4

You might also like

- The Second Chance Scalp Cheat SheetDocument2 pagesThe Second Chance Scalp Cheat SheetZeeshan Bakali100% (1)

- Back$Ide Cheat SheetDocument2 pagesBack$Ide Cheat SheetZeeshan Bakali100% (1)

- The Rubberband Scalp Cheat SheetDocument2 pagesThe Rubberband Scalp Cheat SheetZeeshan Bakali100% (1)

- SOP Sales ManagerDocument2 pagesSOP Sales ManagerDesyFortuna55% (11)

- Capital Investment Analysis For Engineering and ManagementDocument316 pagesCapital Investment Analysis For Engineering and ManagementCFA100% (2)

- Bài tập chương 4cDocument10 pagesBài tập chương 4cHậu MinNgôNo ratings yet

- Overhead Absorption MCQs and SolutionsDocument2 pagesOverhead Absorption MCQs and Solutionsfastnuces86% (7)

- MX - Cost Accounting PDFDocument5 pagesMX - Cost Accounting PDFZamantha TiangcoNo ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- ISO - TC 258 - Project, Programme and Portfolio ManagementDocument5 pagesISO - TC 258 - Project, Programme and Portfolio ManagementFai's AlDahlanNo ratings yet

- De 4 F 2Document7 pagesDe 4 F 2Quỳnh QuỳnhNo ratings yet

- Test of Labour Overheads and Absorption and Marginal CostingDocument4 pagesTest of Labour Overheads and Absorption and Marginal CostingzairaNo ratings yet

- Review SessionDocument10 pagesReview SessionMaajid Bashir0% (1)

- Overheads Test (Q)Document13 pagesOverheads Test (Q)Rabia SattarNo ratings yet

- MA 习题带练 Chapter 8-13Document13 pagesMA 习题带练 Chapter 8-13roseliu.521.jackNo ratings yet

- 4 2005 Jun QDocument9 pages4 2005 Jun Qapi-19836745No ratings yet

- Absorption and Marginal Costing With Answers 2Document6 pagesAbsorption and Marginal Costing With Answers 2Hassaan ImranNo ratings yet

- 4 2006 Dec QDocument9 pages4 2006 Dec Qapi-19836745No ratings yet

- Financial Information For Management: Time Allowed 3 HoursDocument14 pagesFinancial Information For Management: Time Allowed 3 HoursAnousha DookheeNo ratings yet

- Financial AccountingDocument68 pagesFinancial AccountingAvinash SharmaNo ratings yet

- c1 Test 2Document5 pagesc1 Test 2Tinashe MashoyoyaNo ratings yet

- FIA MA1 Mock Exam - QuestionsDocument20 pagesFIA MA1 Mock Exam - QuestionsSim LeeWen50% (2)

- T4 - Past Paper CombinedDocument53 pagesT4 - Past Paper CombinedU Abdul Rehman100% (1)

- 4 2007 Jun QDocument9 pages4 2007 Jun Qapi-19836745No ratings yet

- 4 2006 Jun QDocument10 pages4 2006 Jun Qapi-19836745No ratings yet

- 04 AC212 Lecture 4-Overheads and Absorption Costing PDFDocument17 pages04 AC212 Lecture 4-Overheads and Absorption Costing PDFJam JamNo ratings yet

- 04 AC212 Lecture 4-Overheads and Absorption Costing PDFDocument17 pages04 AC212 Lecture 4-Overheads and Absorption Costing PDFsengpisalNo ratings yet

- Past Exam QSHDocument2 pagesPast Exam QSHLinyVatNo ratings yet

- Ma2 Test 2Document4 pagesMa2 Test 2saad shahidNo ratings yet

- Ma1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockDocument9 pagesMa1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockMino MinaNo ratings yet

- Chapter 2 Question Review1Document8 pagesChapter 2 Question Review1Shamshu AmanurNo ratings yet

- Accounting For Costs: Thursday 10 June 2010Document11 pagesAccounting For Costs: Thursday 10 June 2010umarmughaNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- 9 - Assessment-StuDocument3 pages9 - Assessment-StuThanh LamNo ratings yet

- FREV Finman 1Document10 pagesFREV Finman 1Jay Ann DomeNo ratings yet

- Cup-Management Advisory ServicesDocument7 pagesCup-Management Advisory ServicesJerauld BucolNo ratings yet

- Management Accounting QuestionsDocument11 pagesManagement Accounting QuestionsManfredNo ratings yet

- Job Batch Costing-PQDocument9 pagesJob Batch Costing-PQRohaib MumtazNo ratings yet

- MA1 Past Exam QuestionsDocument14 pagesMA1 Past Exam Questionssramnarine1991No ratings yet

- Accounting For OverheadsDocument13 pagesAccounting For OverheadsfyrNo ratings yet

- Practice Exam 02 S04 312S05Document13 pagesPractice Exam 02 S04 312S05azirNo ratings yet

- F2 MockDocument23 pagesF2 MockH Hafiz Muhammad AbdullahNo ratings yet

- Chapter 8Document71 pagesChapter 8MAN HIN NGAI100% (2)

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- CAPE AccountingDocument10 pagesCAPE Accountingget thosebooksNo ratings yet

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDocument9 pagesD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngNo ratings yet

- Costacc Module 5 QuizDocument11 pagesCostacc Module 5 QuizGemNo ratings yet

- Food Costs Supervisory SalariesDocument11 pagesFood Costs Supervisory SalariesJames CrombezNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- MA1 First Test UpdatedDocument14 pagesMA1 First Test UpdatedHammad KhanNo ratings yet

- AY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Document8 pagesAY 201 2013 EXAMINATION: 1. This Paper Consists of 6 Pages (Excluding Cover Page)Chew Hong KaiNo ratings yet

- Seatwork No. 3 Comprehensive IncomeDocument5 pagesSeatwork No. 3 Comprehensive IncomeHoney Rose AncianoNo ratings yet

- Mockboard MASDocument9 pagesMockboard MASlalala010899No ratings yet

- Local Media1744076886409665709Document12 pagesLocal Media1744076886409665709Lovely Dela Cruz GanoanNo ratings yet

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Factory Overhead: Planned, Actual, and Applied: Multiple ChoiceDocument16 pagesFactory Overhead: Planned, Actual, and Applied: Multiple ChoiceCassandra Dianne Ferolino Macado100% (1)

- Absorption % Marginal Costing - Practice QuestionsDocument6 pagesAbsorption % Marginal Costing - Practice Questionssramnarine1991No ratings yet

- F5 Practice Questions 1-7Document22 pagesF5 Practice Questions 1-7Dilli Ram Pokhrel100% (2)

- F2 Pre-Exam QuestionsDocument7 pagesF2 Pre-Exam Questionsaddi420100% (1)

- Costing - Oar - Absorptional - MCQ'SDocument7 pagesCosting - Oar - Absorptional - MCQ'SMusthari KhanNo ratings yet

- Financial Management - IIDocument7 pagesFinancial Management - IIR SheeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Afc QM Dawood Shahid Sampling & Sampling Distribution-1Document25 pagesAfc QM Dawood Shahid Sampling & Sampling Distribution-1Zeeshan BakaliNo ratings yet

- BMS Quiz 1Document2 pagesBMS Quiz 1Zeeshan BakaliNo ratings yet

- Afc QM Dawood Shahid Chap 10 Matrices & Determinants-1Document23 pagesAfc QM Dawood Shahid Chap 10 Matrices & Determinants-1Zeeshan BakaliNo ratings yet

- MA2 Syllabus Changes (Effective For 2023 To 24)Document3 pagesMA2 Syllabus Changes (Effective For 2023 To 24)Zeeshan BakaliNo ratings yet

- BUDGETING Ovation.Document15 pagesBUDGETING Ovation.Zeeshan BakaliNo ratings yet

- BMSICMADocument5 pagesBMSICMAZeeshan BakaliNo ratings yet

- Pay Back Period (Nom-Discount FD Payback Periods TellsDocument14 pagesPay Back Period (Nom-Discount FD Payback Periods TellsZeeshan BakaliNo ratings yet

- High Low Method - Forecasting TechniqueDocument15 pagesHigh Low Method - Forecasting TechniqueZeeshan BakaliNo ratings yet

- Hiatt Loin Meito - Forecasting. - PRED1 (IronDocument10 pagesHiatt Loin Meito - Forecasting. - PRED1 (IronZeeshan BakaliNo ratings yet

- Inform Action' For ComparisonDocument12 pagesInform Action' For ComparisonZeeshan BakaliNo ratings yet

- Hypothesis Testing Z 2Document5 pagesHypothesis Testing Z 2Zeeshan BakaliNo ratings yet

- MCQ FA1 TenDocument12 pagesMCQ FA1 TenZeeshan BakaliNo ratings yet

- Competency To Contract: MinorDocument4 pagesCompetency To Contract: MinorZeeshan BakaliNo ratings yet

- QMT AssignmentDocument95 pagesQMT AssignmentZeeshan BakaliNo ratings yet

- Free Consent: CoercionDocument7 pagesFree Consent: CoercionZeeshan BakaliNo ratings yet

- QM Assignment July 22 by Permal Sajjad - SolutionDocument7 pagesQM Assignment July 22 by Permal Sajjad - SolutionZeeshan BakaliNo ratings yet

- QM Assignment July 22 by Permal Sajjad - SolutionDocument7 pagesQM Assignment July 22 by Permal Sajjad - SolutionZeeshan Bakali100% (1)

- Statistics CAF Results Spring 2021Document1 pageStatistics CAF Results Spring 2021Zeeshan BakaliNo ratings yet

- Import Export 5Document2 pagesImport Export 5Devesh JhaNo ratings yet

- Amaravati Status Report by Commissioner APCRDADocument51 pagesAmaravati Status Report by Commissioner APCRDAPriyaNo ratings yet

- Bup Mock 2 FinalDocument10 pagesBup Mock 2 Finalilove9/11helloNo ratings yet

- OD427403318394300100Document1 pageOD427403318394300100sarkarbapuni8No ratings yet

- Demand, Supply, and Market Equilibrium - Part IIDocument23 pagesDemand, Supply, and Market Equilibrium - Part IIAsem AmerNo ratings yet

- Blended Learning: Is For Grounding and Ensuring The Hot and Neutral Prongs Are Inserted Into Correct Receptacles SlotsDocument5 pagesBlended Learning: Is For Grounding and Ensuring The Hot and Neutral Prongs Are Inserted Into Correct Receptacles SlotsLORIAN COMETANo ratings yet

- IB Economics - UnemploymentDocument6 pagesIB Economics - UnemploymentSohee YimNo ratings yet

- Factor That Influence Housing Price in MalaysiaDocument84 pagesFactor That Influence Housing Price in MalaysiaKARNIBAL100% (19)

- MJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Document16 pagesMJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Jasmine ActaNo ratings yet

- Question 11.4Document2 pagesQuestion 11.4KimNo ratings yet

- Annex 51 Inventory and Inspection Report of Unserviceable PropertyDocument1 pageAnnex 51 Inventory and Inspection Report of Unserviceable PropertyFreddie TabamoNo ratings yet

- CytoUpdate FinalbrochureCOMDocument4 pagesCytoUpdate FinalbrochureCOMBrian WangNo ratings yet

- Flowchart of Raw Materials Purchasing FunctionDocument1 pageFlowchart of Raw Materials Purchasing Function05. Ariya ParendraNo ratings yet

- Building Materials and Construction II: Arch 2162Document47 pagesBuilding Materials and Construction II: Arch 2162HULE ADDIS ENTERTAINMENTNo ratings yet

- Russia - A Wounded EconomyDocument8 pagesRussia - A Wounded EconomyPham Thi Diem PhuongNo ratings yet

- Basic Microeconomics REVIEWER - Theory of Consumer BehaviorDocument3 pagesBasic Microeconomics REVIEWER - Theory of Consumer BehaviorJig PerfectoNo ratings yet

- SBQ SBC 1842 Lecture 5Document28 pagesSBQ SBC 1842 Lecture 5Akmarn MakmurNo ratings yet

- Tugas MLTIDocument16 pagesTugas MLTIArinisa PakpahanNo ratings yet

- Double Entry Cash BookDocument3 pagesDouble Entry Cash BookGyanish JhaNo ratings yet

- Vicinity Vacation RentalsDocument4 pagesVicinity Vacation RentalsHendry teikNo ratings yet

- Tech TipsDocument5 pagesTech TipsAngel CastNo ratings yet

- Effect of Public ExpenditureDocument5 pagesEffect of Public ExpenditureSantosh ChhetriNo ratings yet

- Chapter 12 Exercises: Project 4Document11 pagesChapter 12 Exercises: Project 4Divya GoyalNo ratings yet

- Problem SolvingDocument32 pagesProblem SolvingJoanna Paula MagadiaNo ratings yet

- Aa025 KMNS - QN Pra1920Document5 pagesAa025 KMNS - QN Pra1920JOSEPH LEE ZE LOONG MoeNo ratings yet

- Overheads FinalDocument12 pagesOverheads FinalSanskar VarshneyNo ratings yet

- Ffiq Ffiq: (Ftd-RoorrDocument37 pagesFfiq Ffiq: (Ftd-Roorrjshankar84No ratings yet