Professional Documents

Culture Documents

83C95U54

83C95U54

Uploaded by

janmejoy.rayCopyright:

Available Formats

You might also like

- Simple Path 1Document40 pagesSimple Path 1goldbudda701No ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- (Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvancesDocument3 pages(Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvanceschanderpawaNo ratings yet

- CAPE Caribbean Studies Notes - Globalisation and DevelopmentDocument6 pagesCAPE Caribbean Studies Notes - Globalisation and Developmentsmartkid16780% (5)

- RG1 StandardDocument1 pageRG1 StandardAshit_tanejaNo ratings yet

- Nyati Equatorial Sep 2016Document5 pagesNyati Equatorial Sep 2016sharmaabhayNo ratings yet

- Tugas Ch10 10-5 10-6 10-7 10-8Document8 pagesTugas Ch10 10-5 10-6 10-7 10-8Apri IpraNo ratings yet

- Billing - July102020Document3 pagesBilling - July102020Angel Dela CruzNo ratings yet

- KMCAssessment PDDemand PrintDocument1 pageKMCAssessment PDDemand PrintGopal prasad ShawNo ratings yet

- 2015 Saln FormDocument3 pages2015 Saln FormROSALINDA LATONo ratings yet

- Saln SampleDocument2 pagesSaln SampleJudilyn TupasNo ratings yet

- Total Result 80Document4 pagesTotal Result 80Milan NaikNo ratings yet

- KBT Proposal SheetDocument14 pagesKBT Proposal SheetSouvik BakshiNo ratings yet

- Rent AssesmentDocument4 pagesRent AssesmentAnshul ChaudharyNo ratings yet

- 002 Lease-Accouting-2Document2 pages002 Lease-Accouting-2caparvez25No ratings yet

- Kannipayoor Rou CompensationDocument4 pagesKannipayoor Rou CompensationsebincherianNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- MSM 27-11-2023Document1 pageMSM 27-11-2023Jegan SwamyNo ratings yet

- Preleased Office in Andheri East 2097Document4 pagesPreleased Office in Andheri East 2097qwikkreturnsNo ratings yet

- Price: IrrigationDocument5 pagesPrice: IrrigationAE MeenkaraNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Annual Monthly: Rent Utilities Total By2 SegregatedDocument2 pagesAnnual Monthly: Rent Utilities Total By2 SegregatedsffhassanNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument22 pagesSummary of Current Charges (RS) : Talk To Us SMSRuben PrattNo ratings yet

- MRNOI00489060000017020Document1 pageMRNOI00489060000017020Ramesh MishraNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- PT Ramawijaya SportDocument29 pagesPT Ramawijaya SportDarDer DorNo ratings yet

- It FebDocument3 pagesIt Febchandra veerNo ratings yet

- Payment Plan: For Tata Housing Development Co. LTDDocument1 pagePayment Plan: For Tata Housing Development Co. LTDSushil AroraNo ratings yet

- HLF068 HousingLoanApplication V08Document5 pagesHLF068 HousingLoanApplication V08Permits & LicensingNo ratings yet

- Cover Sheet (Summary) : As Per Previous InvoiceDocument1 pageCover Sheet (Summary) : As Per Previous InvoiceKamlesh YadavNo ratings yet

- (ANSWER) Week 10 Problem 2Document3 pages(ANSWER) Week 10 Problem 2Vidya IntaniNo ratings yet

- LNL Iklcqd /: Grand Total 4,331 1,324 0 0 2,983Document1 pageLNL Iklcqd /: Grand Total 4,331 1,324 0 0 2,983Deepak kumar M RNo ratings yet

- IndoreDocument9 pagesIndorelapreeservicesNo ratings yet

- O2 Price List For Villas - Nov 13Document1 pageO2 Price List For Villas - Nov 13pradpmNo ratings yet

- North Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Document2 pagesNorth Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Gautam BhallaNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- CostiDistri BatasanHills 12hrsDocument1 pageCostiDistri BatasanHills 12hrsJera May RaraNo ratings yet

- 1 SALN 2015 - 1oconDocument3 pages1 SALN 2015 - 1oconKarissaNo ratings yet

- Miraclz 231Document2 pagesMiraclz 231Hamza AhmedNo ratings yet

- Time Book and PayrollDocument9 pagesTime Book and PayrollStefano Abao OyanNo ratings yet

- DL Reg Aug CSD ListDocument14 pagesDL Reg Aug CSD Listfatrag amloNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- Grill WorkDocument2 pagesGrill WorkAbijithNo ratings yet

- Micro FinanceDocument9 pagesMicro FinanceAssejerNo ratings yet

- Loan SPL.P Ay SPL - Pa y NET Amount of A.G. Subcripti OnDocument24 pagesLoan SPL.P Ay SPL - Pa y NET Amount of A.G. Subcripti OnMuralinadh SamayamantulaNo ratings yet

- Pre Final Bill Lakhnavali-1Document28 pagesPre Final Bill Lakhnavali-1Sajid SayeedNo ratings yet

- Payment COBLE Certificate New 3Document7 pagesPayment COBLE Certificate New 3mohammedshaddin260No ratings yet

- REF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00Document1 pageREF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00RajNo ratings yet

- Mont Tremblant 695 Rue de Lamontagne enDocument5 pagesMont Tremblant 695 Rue de Lamontagne enAnonymous Twci6g2BYNo ratings yet

- Real Estate ModelDocument13 pagesReal Estate Modelw_fibNo ratings yet

- A 312Document1 pageA 312KASATSANo ratings yet

- Datum B+G+5Document1 pageDatum B+G+5wess adelNo ratings yet

- Barola - Bill Ra - Prefinal - CHDocument12 pagesBarola - Bill Ra - Prefinal - CHSajid SayeedNo ratings yet

- ASK PP18 1BZ0-Oct2023 (A)Document32 pagesASK PP18 1BZ0-Oct2023 (A)Vijayagan ChinnappanNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- TariffDocument1 pageTariffbicava7460No ratings yet

- Assessment Year: 2016-2017: Statement of Income During The Income Year Ended On30.6.2016Document4 pagesAssessment Year: 2016-2017: Statement of Income During The Income Year Ended On30.6.2016ArnabNo ratings yet

- V. N. Hari: Sudhakar & Kumar AssociatesDocument35 pagesV. N. Hari: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- UrvishaDocument1 pageUrvishacathedraliteeNo ratings yet

- 02 Segment UpdateDocument74 pages02 Segment Updatedfsgd rhdfNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- The Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRDocument29 pagesThe Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRrohanjha007No ratings yet

- T Code SAPDocument4 pagesT Code SAPGaparNo ratings yet

- 2018 Topic TestDocument7 pages2018 Topic Testjuniorpula8052No ratings yet

- FORMS OF FUTURE WILL or BE GOING TODocument13 pagesFORMS OF FUTURE WILL or BE GOING TOtatiana100% (1)

- Annual Report 0607Document45 pagesAnnual Report 0607Sudhir YadavNo ratings yet

- Public Finance, Chapter 3Document8 pagesPublic Finance, Chapter 3YIN SOKHENGNo ratings yet

- Ceo Letter To Shareholders 2023Document60 pagesCeo Letter To Shareholders 2023TanayNo ratings yet

- Bank of The Philippine Islands Vs Herridge G.R. No. L-21005 December 20, 1924 FactsDocument3 pagesBank of The Philippine Islands Vs Herridge G.R. No. L-21005 December 20, 1924 FactsYasuhiro KeiNo ratings yet

- Finance Bill or Finance Act - ArthapediaDocument4 pagesFinance Bill or Finance Act - ArthapediaSiddharth JhaNo ratings yet

- 0004 KKR - Investor - Presentation - August - 2010Document34 pages0004 KKR - Investor - Presentation - August - 2010Nuno1977No ratings yet

- Women EntrepreneurshipDocument16 pagesWomen Entrepreneurshipdeepanshu99990% (1)

- Mango Peel Product Final With FSDocument49 pagesMango Peel Product Final With FSJhasper Managyo100% (1)

- Islamic Structured Investment Products (Sip)Document15 pagesIslamic Structured Investment Products (Sip)Adib .iq02No ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital ManagementscottleeyNo ratings yet

- Ketan Parekh AccountDocument20 pagesKetan Parekh AccountdhruvinNo ratings yet

- ReasoningDocument80 pagesReasoningwork workNo ratings yet

- CFAS Module 2 - ReviewerDocument4 pagesCFAS Module 2 - ReviewerAthena LedesmaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument14 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionOsvaldo GonçalvesNo ratings yet

- Business Plan SampleDocument14 pagesBusiness Plan SampleGwyneth MuegaNo ratings yet

- Impairment of Assets: A Guide To Applying IAS 36 in Practice March 2014Document82 pagesImpairment of Assets: A Guide To Applying IAS 36 in Practice March 2014Markjoseph CarilloNo ratings yet

- Forecast Document (1) yNPZPDocument153 pagesForecast Document (1) yNPZPVasilis TsekourasNo ratings yet

- Strategic Plan: December 2019Document27 pagesStrategic Plan: December 2019Vedhica AgarwalNo ratings yet

- The Rise and Fall of Global Trust BankDocument26 pagesThe Rise and Fall of Global Trust BankKashish SehgalNo ratings yet

- Contrasting Lean Accounting With Traditional Standard CostingDocument1 pageContrasting Lean Accounting With Traditional Standard CostingAxl BenaventeNo ratings yet

83C95U54

83C95U54

Uploaded by

janmejoy.rayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

83C95U54

83C95U54

Uploaded by

janmejoy.rayCopyright:

Available Formats

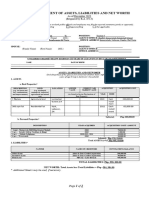

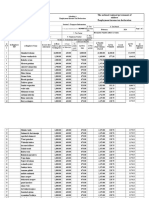

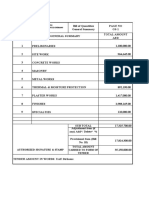

uxj fuxe vEckyk MUNICIPAL CORPORATION AMBALA

Lo;a vkdyu lEifÙkdj QkeZ ¼o"kZ 2010&11 ls 2013&14 rd½ Self Assessment Property Tax Form (2010-11 to 2013-14)

Permanent Property ID: 83C95U54 Ward No.: 6 Zone: City Locality: Thakurdwara

Owner/Occupier Name: Thakur Dwara Trust Property Address: Thakurdwara, Ambala City 134,003

.

A. B. C. D. E. F. G H. I. J.

Total Plot Area Building Use Special Category Floor (Basement Floor wise Self Occupied/ Rate for calculation Annual Annual Fire tax Total Annual

(Sq.Yds.) /GF/1F/ 2F… Carpet area Rented of Property Tax Property Tax* @ 10% of Property Tax Property Tax(H+I)

(Sq. Ft.) [only on non

resl.property]

500 WOR Mandir 1F 2,100 Self 100% Rebate 0 0 0

- WOR Mandir GF 2,100 Self 100% Rebate 0 0 0

- Coml Shop GF 1,860 Rented 36 x 1.25 9,270 927 10,197

TOTAL - - - 6,060 - - 9,270 927 10,197

1. 2. 3. 4. 5. 6. 7.

Old House Tax Arrear before 2010-11 Amount of the Property Amount of the Property Amount of the Property Amount of the Property Grand Total

Property No. Tax for the Year 2010-11 Tax for the Year 2011-12 Tax for the Year 2012-13 Tax for the Year 2013-14 (3+4+5+6)

(after rebate 30%) (after rebate 30%) (after rebate 30%) (after rebate 10%)

7,137 7,137 7,137 9,177 30,588

8. 9. 10. 11.

Last payment details (only for the year 2010-11 to 2013-14) Balance to be paid by assessee Balance to be adjusted by MCA Remarks

Amount paid Receipt No. & Date (7-8) (8-7)

izekf.kr fd;k tkrk gS fd bl QkeZ esa iznku fd, x;s lHkh fooj.k esjh tkudkjh vuqlkj lR; ,oa lgh gSA blessa dqN Hkh Nqik;k ugh x;k gSA eS ;g Hkh ?kks"k.kk djrk gwW fd fdlh Hkh izdkj dh fHkUurk ik;s tkus ij eSa lEifrdj vf/klwpuk fnukad 11-10-

2013 ,oa gfj;k.kk uxj fuxe vf/kfu;e 1994 ds izko/kkuksa vuqlkj mÙkjnk;h jgwxkW@jgwxhaA eSa Lo;a lEifÙkdj vkdyu QkeZ dks gLrk{kj djus ds fy, vf/kd`r gwWA

It is certified that the particulars filled in this form are true and correct to the best of my knowledge and nothing has been concealed. I further declare that I shall be responsible for any discrepancy as per provision made in property

tax notification dated 11-10-2013 and Haryana Municipal Corporation Act 1994. I am authorized to sign self assessment property tax form.

Name of the Owner/Occupier Owner's/Occupier's Phone No./Mobile No. & Email ID Date Signature

*Formula as per Government policy @ 11-10-2013.

# PAYMENT: The owner / occupier can deposit the payment of property tax at the office of Municipal Corporation Ambala at Ambala City, Jagadhari Gate-134003 and Ambala Cantt., Near Parshuram Chowk – 133001, through

cash or an A/c payee cheque or a demand draft in favour of “Commissioner Municipal Corporation Ambala”. No cheque will be accepted until the "owner name”, “phone number", "property ID" & "assessment year" is

mentioned on the back of cheque.

# PLEASE IGNORE IF ALREADY PAID

You might also like

- Simple Path 1Document40 pagesSimple Path 1goldbudda701No ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- (Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvancesDocument3 pages(Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvanceschanderpawaNo ratings yet

- CAPE Caribbean Studies Notes - Globalisation and DevelopmentDocument6 pagesCAPE Caribbean Studies Notes - Globalisation and Developmentsmartkid16780% (5)

- RG1 StandardDocument1 pageRG1 StandardAshit_tanejaNo ratings yet

- Nyati Equatorial Sep 2016Document5 pagesNyati Equatorial Sep 2016sharmaabhayNo ratings yet

- Tugas Ch10 10-5 10-6 10-7 10-8Document8 pagesTugas Ch10 10-5 10-6 10-7 10-8Apri IpraNo ratings yet

- Billing - July102020Document3 pagesBilling - July102020Angel Dela CruzNo ratings yet

- KMCAssessment PDDemand PrintDocument1 pageKMCAssessment PDDemand PrintGopal prasad ShawNo ratings yet

- 2015 Saln FormDocument3 pages2015 Saln FormROSALINDA LATONo ratings yet

- Saln SampleDocument2 pagesSaln SampleJudilyn TupasNo ratings yet

- Total Result 80Document4 pagesTotal Result 80Milan NaikNo ratings yet

- KBT Proposal SheetDocument14 pagesKBT Proposal SheetSouvik BakshiNo ratings yet

- Rent AssesmentDocument4 pagesRent AssesmentAnshul ChaudharyNo ratings yet

- 002 Lease-Accouting-2Document2 pages002 Lease-Accouting-2caparvez25No ratings yet

- Kannipayoor Rou CompensationDocument4 pagesKannipayoor Rou CompensationsebincherianNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- MSM 27-11-2023Document1 pageMSM 27-11-2023Jegan SwamyNo ratings yet

- Preleased Office in Andheri East 2097Document4 pagesPreleased Office in Andheri East 2097qwikkreturnsNo ratings yet

- Price: IrrigationDocument5 pagesPrice: IrrigationAE MeenkaraNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Annual Monthly: Rent Utilities Total By2 SegregatedDocument2 pagesAnnual Monthly: Rent Utilities Total By2 SegregatedsffhassanNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument22 pagesSummary of Current Charges (RS) : Talk To Us SMSRuben PrattNo ratings yet

- MRNOI00489060000017020Document1 pageMRNOI00489060000017020Ramesh MishraNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- PT Ramawijaya SportDocument29 pagesPT Ramawijaya SportDarDer DorNo ratings yet

- It FebDocument3 pagesIt Febchandra veerNo ratings yet

- Payment Plan: For Tata Housing Development Co. LTDDocument1 pagePayment Plan: For Tata Housing Development Co. LTDSushil AroraNo ratings yet

- HLF068 HousingLoanApplication V08Document5 pagesHLF068 HousingLoanApplication V08Permits & LicensingNo ratings yet

- Cover Sheet (Summary) : As Per Previous InvoiceDocument1 pageCover Sheet (Summary) : As Per Previous InvoiceKamlesh YadavNo ratings yet

- (ANSWER) Week 10 Problem 2Document3 pages(ANSWER) Week 10 Problem 2Vidya IntaniNo ratings yet

- LNL Iklcqd /: Grand Total 4,331 1,324 0 0 2,983Document1 pageLNL Iklcqd /: Grand Total 4,331 1,324 0 0 2,983Deepak kumar M RNo ratings yet

- IndoreDocument9 pagesIndorelapreeservicesNo ratings yet

- O2 Price List For Villas - Nov 13Document1 pageO2 Price List For Villas - Nov 13pradpmNo ratings yet

- North Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Document2 pagesNorth Delhi Municipal Corporation Tax Payment Checklist For The Year (2020-2021)Gautam BhallaNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListANKIT VERMA CLCNo ratings yet

- CostiDistri BatasanHills 12hrsDocument1 pageCostiDistri BatasanHills 12hrsJera May RaraNo ratings yet

- 1 SALN 2015 - 1oconDocument3 pages1 SALN 2015 - 1oconKarissaNo ratings yet

- Miraclz 231Document2 pagesMiraclz 231Hamza AhmedNo ratings yet

- Time Book and PayrollDocument9 pagesTime Book and PayrollStefano Abao OyanNo ratings yet

- DL Reg Aug CSD ListDocument14 pagesDL Reg Aug CSD Listfatrag amloNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check Listrxy8964No ratings yet

- Grill WorkDocument2 pagesGrill WorkAbijithNo ratings yet

- Micro FinanceDocument9 pagesMicro FinanceAssejerNo ratings yet

- Loan SPL.P Ay SPL - Pa y NET Amount of A.G. Subcripti OnDocument24 pagesLoan SPL.P Ay SPL - Pa y NET Amount of A.G. Subcripti OnMuralinadh SamayamantulaNo ratings yet

- Pre Final Bill Lakhnavali-1Document28 pagesPre Final Bill Lakhnavali-1Sajid SayeedNo ratings yet

- Payment COBLE Certificate New 3Document7 pagesPayment COBLE Certificate New 3mohammedshaddin260No ratings yet

- REF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00Document1 pageREF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00RajNo ratings yet

- Mont Tremblant 695 Rue de Lamontagne enDocument5 pagesMont Tremblant 695 Rue de Lamontagne enAnonymous Twci6g2BYNo ratings yet

- Real Estate ModelDocument13 pagesReal Estate Modelw_fibNo ratings yet

- A 312Document1 pageA 312KASATSANo ratings yet

- Datum B+G+5Document1 pageDatum B+G+5wess adelNo ratings yet

- Barola - Bill Ra - Prefinal - CHDocument12 pagesBarola - Bill Ra - Prefinal - CHSajid SayeedNo ratings yet

- ASK PP18 1BZ0-Oct2023 (A)Document32 pagesASK PP18 1BZ0-Oct2023 (A)Vijayagan ChinnappanNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- TariffDocument1 pageTariffbicava7460No ratings yet

- Assessment Year: 2016-2017: Statement of Income During The Income Year Ended On30.6.2016Document4 pagesAssessment Year: 2016-2017: Statement of Income During The Income Year Ended On30.6.2016ArnabNo ratings yet

- V. N. Hari: Sudhakar & Kumar AssociatesDocument35 pagesV. N. Hari: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- UrvishaDocument1 pageUrvishacathedraliteeNo ratings yet

- 02 Segment UpdateDocument74 pages02 Segment Updatedfsgd rhdfNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- The Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRDocument29 pagesThe Binomial Option Pricing Model (BOPM) : ©david Dubofsky and 17-1 Thomas W. Miller, JRrohanjha007No ratings yet

- T Code SAPDocument4 pagesT Code SAPGaparNo ratings yet

- 2018 Topic TestDocument7 pages2018 Topic Testjuniorpula8052No ratings yet

- FORMS OF FUTURE WILL or BE GOING TODocument13 pagesFORMS OF FUTURE WILL or BE GOING TOtatiana100% (1)

- Annual Report 0607Document45 pagesAnnual Report 0607Sudhir YadavNo ratings yet

- Public Finance, Chapter 3Document8 pagesPublic Finance, Chapter 3YIN SOKHENGNo ratings yet

- Ceo Letter To Shareholders 2023Document60 pagesCeo Letter To Shareholders 2023TanayNo ratings yet

- Bank of The Philippine Islands Vs Herridge G.R. No. L-21005 December 20, 1924 FactsDocument3 pagesBank of The Philippine Islands Vs Herridge G.R. No. L-21005 December 20, 1924 FactsYasuhiro KeiNo ratings yet

- Finance Bill or Finance Act - ArthapediaDocument4 pagesFinance Bill or Finance Act - ArthapediaSiddharth JhaNo ratings yet

- 0004 KKR - Investor - Presentation - August - 2010Document34 pages0004 KKR - Investor - Presentation - August - 2010Nuno1977No ratings yet

- Women EntrepreneurshipDocument16 pagesWomen Entrepreneurshipdeepanshu99990% (1)

- Mango Peel Product Final With FSDocument49 pagesMango Peel Product Final With FSJhasper Managyo100% (1)

- Islamic Structured Investment Products (Sip)Document15 pagesIslamic Structured Investment Products (Sip)Adib .iq02No ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital ManagementscottleeyNo ratings yet

- Ketan Parekh AccountDocument20 pagesKetan Parekh AccountdhruvinNo ratings yet

- ReasoningDocument80 pagesReasoningwork workNo ratings yet

- CFAS Module 2 - ReviewerDocument4 pagesCFAS Module 2 - ReviewerAthena LedesmaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument14 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionOsvaldo GonçalvesNo ratings yet

- Business Plan SampleDocument14 pagesBusiness Plan SampleGwyneth MuegaNo ratings yet

- Impairment of Assets: A Guide To Applying IAS 36 in Practice March 2014Document82 pagesImpairment of Assets: A Guide To Applying IAS 36 in Practice March 2014Markjoseph CarilloNo ratings yet

- Forecast Document (1) yNPZPDocument153 pagesForecast Document (1) yNPZPVasilis TsekourasNo ratings yet

- Strategic Plan: December 2019Document27 pagesStrategic Plan: December 2019Vedhica AgarwalNo ratings yet

- The Rise and Fall of Global Trust BankDocument26 pagesThe Rise and Fall of Global Trust BankKashish SehgalNo ratings yet

- Contrasting Lean Accounting With Traditional Standard CostingDocument1 pageContrasting Lean Accounting With Traditional Standard CostingAxl BenaventeNo ratings yet