Professional Documents

Culture Documents

Financial Highlights 2023

Financial Highlights 2023

Uploaded by

rohitgowda124Copyright:

Available Formats

You might also like

- How Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaDocument17 pagesHow Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaMeester KewpieNo ratings yet

- ACC406 - Final Project 2Document20 pagesACC406 - Final Project 2Wan Muhammad Akram100% (2)

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- Case Study On Rail RoadDocument31 pagesCase Study On Rail RoadSobia Kausar80% (5)

- Managements Discussion Analysis 2023Document116 pagesManagements Discussion Analysis 2023rootin.tootin.012No ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- 2019 2016Document149 pages2019 2016MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- 17 036192Document175 pages17 036192MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- 2024 02 22 2023 Annual Report RBIDocument273 pages2024 02 22 2023 Annual Report RBIemiliowebster6833No ratings yet

- Factbook-2017 0Document102 pagesFactbook-2017 0Mohamed KadriNo ratings yet

- Nyse FFG 2003Document122 pagesNyse FFG 2003Bijoy AhmedNo ratings yet

- Aeronautics 5.50 Missiles and Fire Control 7.70 Rotary and Mission Systems 11.30 Space 9.20 Corporate Activities 2.40 Total 36.10Document195 pagesAeronautics 5.50 Missiles and Fire Control 7.70 Rotary and Mission Systems 11.30 Space 9.20 Corporate Activities 2.40 Total 36.10MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- UntitledDocument7 pagesUntitledberti albertiNo ratings yet

- Factbook 2020Document99 pagesFactbook 2020Mohamed KadriNo ratings yet

- Q2 2023 Financial SchedulesDocument30 pagesQ2 2023 Financial SchedulesVinieboy De mepperNo ratings yet

- 22 001269Document176 pages22 001269Marcos AlvarezNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Finance Project AMDDocument35 pagesFinance Project AMDLuka KhmaladzeNo ratings yet

- Den FY2021 Financial Report-7Document6 pagesDen FY2021 Financial Report-7PAVANKUMAR S BNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Financial statements US GAAP Q4 2023 h92dd2Document8 pagesFinancial statements US GAAP Q4 2023 h92dd2xzavierxuNo ratings yet

- BUSS 207 Quiz 2 - SolutionsDocument4 pagesBUSS 207 Quiz 2 - Solutionstom dussekNo ratings yet

- Financial AccountingDocument21 pagesFinancial AccountingMariam KupravaNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- 2014 Annual Financial ReportDocument222 pages2014 Annual Financial Reportpcelica77No ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Nexa - Financial Statements 2020Document81 pagesNexa - Financial Statements 2020frankNo ratings yet

- Financial Summary Model Answer v03Document1 pageFinancial Summary Model Answer v03Ayesha RehmanNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- TGT CaseDocument7 pagesTGT CaseMikael SpenceNo ratings yet

- Biottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisDocument1 pageBiottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisLizza Marie CasidsidNo ratings yet

- Income Statement and Balance Sheet ExerciseDocument2 pagesIncome Statement and Balance Sheet ExerciseMujieh NkengNo ratings yet

- + UpdatedDocument22 pages+ UpdatedRobert ManjoNo ratings yet

- Security Bank Audited Financial Statements 2018Document165 pagesSecurity Bank Audited Financial Statements 2018David Angelo NapolesNo ratings yet

- Persistent Systems - 33rd Annual Report 2022-23Document2 pagesPersistent Systems - 33rd Annual Report 2022-23Ashwin GophanNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Net SalesDocument18 pagesNet SalesNAVEED ALI KHANNo ratings yet

- TFR 2023 eDocument69 pagesTFR 2023 eAntwanNo ratings yet

- INS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Document4 pagesINS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Thảo Thiên ChiNo ratings yet

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- FactBookFY 2021andq1 2022Document26 pagesFactBookFY 2021andq1 2022Prateek PandeyNo ratings yet

- Fs AnalysisDocument17 pagesFs AnalysisDarlene RoblesNo ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- PPAP in Annual Report 2023Document235 pagesPPAP in Annual Report 2023J5No ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Csgag Csag Ar 2022 enDocument604 pagesCsgag Csag Ar 2022 encbrnspm-20180717cdcntNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- 3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFDocument64 pages3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFsamullemNo ratings yet

- Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument9 pagesChapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- DCF TATA PowerDocument2 pagesDCF TATA PowerAman MankotiaNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- FB FinalDocument17 pagesFB FinalMohammad KhataybehNo ratings yet

- Financial Supplement Fy 2022 enDocument9 pagesFinancial Supplement Fy 2022 enAntonelly Baca MoncayoNo ratings yet

- Assignment 4 - Group Tran Thu ThaoDocument3 pagesAssignment 4 - Group Tran Thu ThaoPhan Nguyễn Quỳnh NhưNo ratings yet

- IL&FS Preference Shares IssueDocument4 pagesIL&FS Preference Shares Issuevish_dixitNo ratings yet

- Chapter 07Document16 pagesChapter 07baburamNo ratings yet

- MDR Factsheet The Netherlands September 2020Document6 pagesMDR Factsheet The Netherlands September 2020bacha436No ratings yet

- Yellow Frieght SystemsDocument9 pagesYellow Frieght Systemsbritson2000No ratings yet

- Standards of Professional Practice (SPP) : Annex "A"Document53 pagesStandards of Professional Practice (SPP) : Annex "A"Christian Rey AbuanNo ratings yet

- Weather Derivatives - The ImpactDocument2 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- User Manual FI03: Title: Module NameDocument35 pagesUser Manual FI03: Title: Module Namesksk1911No ratings yet

- Dua BelasDocument66 pagesDua Belasvanessa8pangestuNo ratings yet

- Ambuja Annual Review 2012Document108 pagesAmbuja Annual Review 2012Nilesh ChaubeyNo ratings yet

- Oracle Workflow Administrator's GuideDocument478 pagesOracle Workflow Administrator's Guidekpat3No ratings yet

- Variable Costing Segment ReportingDocument7 pagesVariable Costing Segment ReportingDhanylane Phole Librea SeraficaNo ratings yet

- Business Proposal Group 7 AssignmentDocument19 pagesBusiness Proposal Group 7 AssignmentTikaNo ratings yet

- Empirical Evidence of IFRSDocument15 pagesEmpirical Evidence of IFRSARINDA SHAFA NABILANo ratings yet

- Barclays PLC Organisational Behaviour Case StudyDocument6 pagesBarclays PLC Organisational Behaviour Case StudyAvinash MantriNo ratings yet

- ACS EDI Gateway Claims Payer ListDocument17 pagesACS EDI Gateway Claims Payer ListACS EDI Direct, IncNo ratings yet

- F1 - MCQ by Sir Fawad Mujahid, ACCADocument5 pagesF1 - MCQ by Sir Fawad Mujahid, ACCAMuhammad IdreesNo ratings yet

- Record To Report - General Ledger Accounting - 240401 - 004120Document11 pagesRecord To Report - General Ledger Accounting - 240401 - 004120Bharat ChekuriNo ratings yet

- ACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioDocument3 pagesACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioHomeworkhelpbylanceNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Performance Appraisal Form  - Narrative OptionDocument3 pagesPerformance Appraisal Form  - Narrative OptionShoTeR KSAzZNo ratings yet

- Multinational CorporationsDocument25 pagesMultinational CorporationssamrulezzzNo ratings yet

- Question Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesDocument3 pagesQuestion Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesAshish GangwalNo ratings yet

- 1 Hour Sigma LeanDocument74 pages1 Hour Sigma LeanGunawan tNo ratings yet

- Model Supply Chain Management Pada Produk Industri Agraris Dan TurunanDocument10 pagesModel Supply Chain Management Pada Produk Industri Agraris Dan TurunanMUHAMMAD HAFIDZ MUNAWARNo ratings yet

- (IT) IMPORTING FCL - Group 1Document40 pages(IT) IMPORTING FCL - Group 1Nguyên ThảoNo ratings yet

- BV300 Service Manuals (Volume 1 and 2)Document1,100 pagesBV300 Service Manuals (Volume 1 and 2)James GiancolaNo ratings yet

Financial Highlights 2023

Financial Highlights 2023

Uploaded by

rohitgowda124Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Highlights 2023

Financial Highlights 2023

Uploaded by

rohitgowda124Copyright:

Available Formats

Financial Highlights

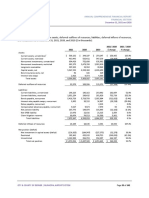

As of or for the year ended December 31,

(in millions, except per share, ratio data and employees) 2023 2022 2021

Selected income statement data

Total net revenue $ 158,104 $ 128,695 $ 121,649

Total noninterest expense 87,172 76,140 71,343

Pre-provision profit(a) 70,932 52,555 50,306

Provision for credit losses 9,320 6,389 (9,256)

Net income $ 49,552 $ 37,676 $ 48,334

Per common share data

Net income per share:

Basic $ 16.25 $ 12.10 $ 15.39

Diluted 16.23 12.09 15.36

Book value per share 104.45 90.29 88.07

Tangible book value per share (TBVPS)(a) 86.08 73.12 71.53

Cash dividends declared per share 4.10 4.00 3.80

Selected ratios

Return on common equity 17% 14% 19%

Return on tangible common equity (ROTCE)(a) 21 18 23

Liquidity coverage ratio (average)(b) 113 112 111

Common equity Tier 1 capital ratio(c) 15.0 13.2 13.1

Tier 1 capital ratio(c) 16.6 14.9 15.0

Total capital ratio(c) 18.5 16.8 16.8

Selected balance sheet data (period-end)

Loans $1,323,706 $1,135,647 $1,077,714

Total assets 3,875,393 3,665,743 3,743,567

Deposits 2,400,688 2,340,179 2,462,303

Common stockholders’ equity 300,474 264,928 259,289

Total stockholders’ equity 327,878 292,332 294,127

Market data

Closing share price $ 170.10 $ 134.10 $ 158.35

Market capitalization 489,320 393,484 466,206

Common shares at period-end 2,876.6 2,934.2 2,944.1

Employees(d) 293,723 271,025

309,926(e)

As of and for the period ended December 31, 2023, the results of the Firm include the impact of First Republic. Refer to Business

Segment Results on page 67 and Note 34 for additional information.

(a) Pre-provision profit, TBVPS and ROTCE are each non-GAAP financial measures. Refer to Explanation and Reconciliation of the

Firm’s Use of Non-GAAP Financial Measures on pages 62–64 for a discussion of these measures.

(b) Refer to Liquidity Risk Management on pages 102-109 for additional information on this measure.

(c) Refer to Capital Risk Management on pages 91-101 for additional information on these measures.

(d) This metric, which was formerly Headcount, has been renamed Employees but is otherwise unchanged.

(e) Included approximately 4,500 individuals associated with First Republic who became employees effective July 2, 2023.

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm with assets of

$3.9 trillion and operations worldwide. The firm is a leader in investment banking,

financial services for consumers and small businesses, commercial banking, financial

transaction processing and asset management. Under the J.P. Morgan and Chase

brands, the firm serves millions of customers, predominantly in the U.S., and many of

the world’s most prominent corporate, institutional and government clients globally.

Information about J.P. Morgan’s capabilities can be found at jpmorgan.com and

about Chase’s capabilities at chase.com. Information about JPMorgan Chase & Co.

is available at jpmorganchase.com.

You might also like

- How Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaDocument17 pagesHow Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaMeester KewpieNo ratings yet

- ACC406 - Final Project 2Document20 pagesACC406 - Final Project 2Wan Muhammad Akram100% (2)

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- Case Study On Rail RoadDocument31 pagesCase Study On Rail RoadSobia Kausar80% (5)

- Managements Discussion Analysis 2023Document116 pagesManagements Discussion Analysis 2023rootin.tootin.012No ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- 2019 2016Document149 pages2019 2016MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- 17 036192Document175 pages17 036192MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- 2024 02 22 2023 Annual Report RBIDocument273 pages2024 02 22 2023 Annual Report RBIemiliowebster6833No ratings yet

- Factbook-2017 0Document102 pagesFactbook-2017 0Mohamed KadriNo ratings yet

- Nyse FFG 2003Document122 pagesNyse FFG 2003Bijoy AhmedNo ratings yet

- Aeronautics 5.50 Missiles and Fire Control 7.70 Rotary and Mission Systems 11.30 Space 9.20 Corporate Activities 2.40 Total 36.10Document195 pagesAeronautics 5.50 Missiles and Fire Control 7.70 Rotary and Mission Systems 11.30 Space 9.20 Corporate Activities 2.40 Total 36.10MONTSERRAT VICTORIA MIRANDA BORDANo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- UntitledDocument7 pagesUntitledberti albertiNo ratings yet

- Factbook 2020Document99 pagesFactbook 2020Mohamed KadriNo ratings yet

- Q2 2023 Financial SchedulesDocument30 pagesQ2 2023 Financial SchedulesVinieboy De mepperNo ratings yet

- 22 001269Document176 pages22 001269Marcos AlvarezNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Finance Project AMDDocument35 pagesFinance Project AMDLuka KhmaladzeNo ratings yet

- Den FY2021 Financial Report-7Document6 pagesDen FY2021 Financial Report-7PAVANKUMAR S BNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Financial statements US GAAP Q4 2023 h92dd2Document8 pagesFinancial statements US GAAP Q4 2023 h92dd2xzavierxuNo ratings yet

- BUSS 207 Quiz 2 - SolutionsDocument4 pagesBUSS 207 Quiz 2 - Solutionstom dussekNo ratings yet

- Financial AccountingDocument21 pagesFinancial AccountingMariam KupravaNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- 2014 Annual Financial ReportDocument222 pages2014 Annual Financial Reportpcelica77No ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Nexa - Financial Statements 2020Document81 pagesNexa - Financial Statements 2020frankNo ratings yet

- Financial Summary Model Answer v03Document1 pageFinancial Summary Model Answer v03Ayesha RehmanNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- TGT CaseDocument7 pagesTGT CaseMikael SpenceNo ratings yet

- Biottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisDocument1 pageBiottech Data:: Part 1: Ratio Analysis: Perform The Following AnalysisLizza Marie CasidsidNo ratings yet

- Income Statement and Balance Sheet ExerciseDocument2 pagesIncome Statement and Balance Sheet ExerciseMujieh NkengNo ratings yet

- + UpdatedDocument22 pages+ UpdatedRobert ManjoNo ratings yet

- Security Bank Audited Financial Statements 2018Document165 pagesSecurity Bank Audited Financial Statements 2018David Angelo NapolesNo ratings yet

- Persistent Systems - 33rd Annual Report 2022-23Document2 pagesPersistent Systems - 33rd Annual Report 2022-23Ashwin GophanNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Net SalesDocument18 pagesNet SalesNAVEED ALI KHANNo ratings yet

- TFR 2023 eDocument69 pagesTFR 2023 eAntwanNo ratings yet

- INS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Document4 pagesINS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Thảo Thiên ChiNo ratings yet

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- FactBookFY 2021andq1 2022Document26 pagesFactBookFY 2021andq1 2022Prateek PandeyNo ratings yet

- Fs AnalysisDocument17 pagesFs AnalysisDarlene RoblesNo ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- PPAP in Annual Report 2023Document235 pagesPPAP in Annual Report 2023J5No ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Csgag Csag Ar 2022 enDocument604 pagesCsgag Csag Ar 2022 encbrnspm-20180717cdcntNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- 3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFDocument64 pages3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFsamullemNo ratings yet

- Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument9 pagesChapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- DCF TATA PowerDocument2 pagesDCF TATA PowerAman MankotiaNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- FB FinalDocument17 pagesFB FinalMohammad KhataybehNo ratings yet

- Financial Supplement Fy 2022 enDocument9 pagesFinancial Supplement Fy 2022 enAntonelly Baca MoncayoNo ratings yet

- Assignment 4 - Group Tran Thu ThaoDocument3 pagesAssignment 4 - Group Tran Thu ThaoPhan Nguyễn Quỳnh NhưNo ratings yet

- IL&FS Preference Shares IssueDocument4 pagesIL&FS Preference Shares Issuevish_dixitNo ratings yet

- Chapter 07Document16 pagesChapter 07baburamNo ratings yet

- MDR Factsheet The Netherlands September 2020Document6 pagesMDR Factsheet The Netherlands September 2020bacha436No ratings yet

- Yellow Frieght SystemsDocument9 pagesYellow Frieght Systemsbritson2000No ratings yet

- Standards of Professional Practice (SPP) : Annex "A"Document53 pagesStandards of Professional Practice (SPP) : Annex "A"Christian Rey AbuanNo ratings yet

- Weather Derivatives - The ImpactDocument2 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- User Manual FI03: Title: Module NameDocument35 pagesUser Manual FI03: Title: Module Namesksk1911No ratings yet

- Dua BelasDocument66 pagesDua Belasvanessa8pangestuNo ratings yet

- Ambuja Annual Review 2012Document108 pagesAmbuja Annual Review 2012Nilesh ChaubeyNo ratings yet

- Oracle Workflow Administrator's GuideDocument478 pagesOracle Workflow Administrator's Guidekpat3No ratings yet

- Variable Costing Segment ReportingDocument7 pagesVariable Costing Segment ReportingDhanylane Phole Librea SeraficaNo ratings yet

- Business Proposal Group 7 AssignmentDocument19 pagesBusiness Proposal Group 7 AssignmentTikaNo ratings yet

- Empirical Evidence of IFRSDocument15 pagesEmpirical Evidence of IFRSARINDA SHAFA NABILANo ratings yet

- Barclays PLC Organisational Behaviour Case StudyDocument6 pagesBarclays PLC Organisational Behaviour Case StudyAvinash MantriNo ratings yet

- ACS EDI Gateway Claims Payer ListDocument17 pagesACS EDI Gateway Claims Payer ListACS EDI Direct, IncNo ratings yet

- F1 - MCQ by Sir Fawad Mujahid, ACCADocument5 pagesF1 - MCQ by Sir Fawad Mujahid, ACCAMuhammad IdreesNo ratings yet

- Record To Report - General Ledger Accounting - 240401 - 004120Document11 pagesRecord To Report - General Ledger Accounting - 240401 - 004120Bharat ChekuriNo ratings yet

- ACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioDocument3 pagesACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioHomeworkhelpbylanceNo ratings yet

- BK Paper 45 MarksR3 PrelimDocument5 pagesBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Performance Appraisal Form  - Narrative OptionDocument3 pagesPerformance Appraisal Form  - Narrative OptionShoTeR KSAzZNo ratings yet

- Multinational CorporationsDocument25 pagesMultinational CorporationssamrulezzzNo ratings yet

- Question Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesDocument3 pagesQuestion Paper 2006 Comp. Delhi Set-1 CBSE Class-12 Business StudiesAshish GangwalNo ratings yet

- 1 Hour Sigma LeanDocument74 pages1 Hour Sigma LeanGunawan tNo ratings yet

- Model Supply Chain Management Pada Produk Industri Agraris Dan TurunanDocument10 pagesModel Supply Chain Management Pada Produk Industri Agraris Dan TurunanMUHAMMAD HAFIDZ MUNAWARNo ratings yet

- (IT) IMPORTING FCL - Group 1Document40 pages(IT) IMPORTING FCL - Group 1Nguyên ThảoNo ratings yet

- BV300 Service Manuals (Volume 1 and 2)Document1,100 pagesBV300 Service Manuals (Volume 1 and 2)James GiancolaNo ratings yet