Professional Documents

Culture Documents

Acc 179 P3Q1 - WF

Acc 179 P3Q1 - WF

Uploaded by

donatobrenda3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 179 P3Q1 - WF

Acc 179 P3Q1 - WF

Uploaded by

donatobrenda3Copyright:

Available Formats

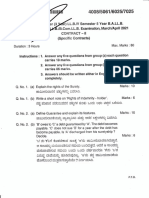

ACC 179 P3 QUIZ 1

Solve the following problems, and show your solution using T-accounts.

1. JYD Company provided the following information for the year 2023:

Credit sales

Gross P6,000,000

Discounts 300,000

Customers owed P2,000,000 on January 1 and P1,500,000 on December 31. What amount of collections

should be reported for the year 2023?

2. Using the information in No. 1, determine the amount of collections that should be reported for the year

2023 if the company also has cash sales.

Cash Sales

Gross P4,000,000

Returns and 200,000

allowances

3. ABC Company reported sales revenue of P9,200,000 in the income statement for the year 2023.

January 1 December 31

Accounts Receivable P2,000,000 P2,600,000

Allowance for uncollectible accounts 120,000 220,000

Advances from customers 400,000 600,000

What amount of collections should be reported for the year 2023?

4. The entity reported collections of P3,500,000 and P1,600,000 in the for the years ended December 31,

2020 and 2019 respectively. The entity reported accounts receivable of P600,000 and P1,000,000 on

December 31, 2020 and 2019 respectively.

What amount should be reported as sales in the income statement for the year 2020?

5. ABC Company reported the following balances:

December 31 January 1

Inventory P5,200,000 P5,800,000

Accounts payable 1,500,000 1,000,000

The entity paid suppliers P9,800,000 during the current year.

What is the amount of purchases during the year?

6. Using the information in No.5, determine the amount of Cost of Goods Sold.

Use the following information for numbers 7-10.

JYD Corporation provided the following data:

January 1 December 31

Accounts receivable P2,400,000 P2,700,000

Accounts payable 3,000,000 3,700,000

Sales returns totaled P500,000 of which 100,000 was paid to customers.

Cash receipts from customers after P1,000,000 sales discounts amounted to P16,000,000.

Cash payments to trade creditors totaled P10,000,000 after purchase discounts of P400,000. Purchase

returns amounted to P800,000, of which P200,000 was received from the supplier.

Determine the following:

7. Gross Sales

8. Net Sales

9. Gross Purchases

10. Net Purchases

11. Juan reported capital of P3,400,000 on January 1 and P4,800,000 on December 31, 2020. During the year

2020, Juan withdrew merchandise with a carrying amount of P200,000 and a sale value of P360,000. Juan

also paid a P2,000,000 note payable of the business with an interest of 12% for six months with his own

money. Determine the Net Income or loss for the year 2020.

12. ABC Co. provided you with the following information about its property, plant, and equipment account:

Beginning Ending

Equipment P100,000 P120,000

Accumulated Depreciation 15,000 18,000

Additional Information: a) Depreciation is 15% per annum. b) At the start of the year, ABC Co. acquired

equipment and at the same time disposed equipment with a carrying amount of P25,000 with accumulated

depreciation of P15,000 for P35,000. How much is the cost of the machine disposed?

13. Using information in no.12, how much is the cost of the machine acquired?

You might also like

- Kano Electricity Distribution PLC: K E D C ODocument1 pageKano Electricity Distribution PLC: K E D C ORabiu Hadi Salisu71% (7)

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

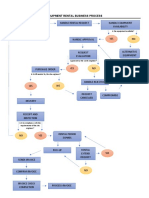

- Equipment Rental Business ProcessDocument1 pageEquipment Rental Business Processdimpy dNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Quiz Activity#2 INTACCDocument7 pagesQuiz Activity#2 INTACCGellie Buenaventura100% (1)

- Cash Basis Accrual Basis Exercises With AnswersDocument6 pagesCash Basis Accrual Basis Exercises With AnswersRNo ratings yet

- Financial Accounting and ReportingDocument26 pagesFinancial Accounting and ReportingJanaela90% (48)

- Audit Quiz 2Document4 pagesAudit Quiz 2Amir LM67% (3)

- Select The Correct ResponseDocument43 pagesSelect The Correct ResponseCrizel Dario100% (1)

- Canvass Ia QuizDocument32 pagesCanvass Ia QuizLhowellaAquinoNo ratings yet

- Cash and Accrual Basis ProblemsDocument1 pageCash and Accrual Basis ProblemsCAINo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- Far Noc Jpia QuestionDocument14 pagesFar Noc Jpia QuestionNathalie GetinoNo ratings yet

- ACC 111 Review Materials For Final Exam COPY To StudentsDocument4 pagesACC 111 Review Materials For Final Exam COPY To StudentsCondoriano BatumbakalNo ratings yet

- Afar - First Preboard QuestionnaireDocument15 pagesAfar - First Preboard QuestionnairewithyouidkNo ratings yet

- Intermediate Aactg.1Document5 pagesIntermediate Aactg.1Charmane MatiasNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- ACCTG-206B-FIRST-PREBOARD Without AnswerDocument16 pagesACCTG-206B-FIRST-PREBOARD Without AnswerRheu ReyesNo ratings yet

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- IA3 Cash Basis VALIXDocument18 pagesIA3 Cash Basis VALIXHafie DiranggarunNo ratings yet

- Acctg 323 MT ExamDocument10 pagesAcctg 323 MT ExamJoyluxxiNo ratings yet

- FAR Practice ProblemsDocument34 pagesFAR Practice ProblemsJhon Eljun Yuto EnopiaNo ratings yet

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- Second PreboardDocument6 pagesSecond PreboardBella AyabNo ratings yet

- Basic Accounting ReviewerDocument35 pagesBasic Accounting ReviewerJhane MarieNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- Practical Accounting Part 1Document18 pagesPractical Accounting Part 1Jonacress Callo CagatinNo ratings yet

- Pract 1Document12 pagesPract 1Kylie TarnateNo ratings yet

- 7077 - Cash and Accruals BasisDocument2 pages7077 - Cash and Accruals BasisKlare JimenoNo ratings yet

- Accounting ChangesDocument3 pagesAccounting ChangesAbby NavarroNo ratings yet

- Seeds of The Nations Accounting Quiz ON Basic AccountingDocument25 pagesSeeds of The Nations Accounting Quiz ON Basic AccountingHershey GalvezNo ratings yet

- AACA 1 QE (Suggested)Document7 pagesAACA 1 QE (Suggested)JamesNo ratings yet

- ReceivableDocument3 pagesReceivableBellaNo ratings yet

- 3b79070f9fdf9cd3f1dc5d6aeda6e1c3Document3 pages3b79070f9fdf9cd3f1dc5d6aeda6e1c3Vivian TamerayNo ratings yet

- MidtermExam Fin3 (Prac)Document10 pagesMidtermExam Fin3 (Prac)Raymond PacaldoNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Auditing Problem 1 22 22 PDFDocument26 pagesAuditing Problem 1 22 22 PDFKate NuevaNo ratings yet

- Financial Accounting Part 3Document6 pagesFinancial Accounting Part 3Christopher Price67% (3)

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- FSW-Cash Flow 070218Document8 pagesFSW-Cash Flow 070218March AthenaNo ratings yet

- 7294 - Cash BasisDocument2 pages7294 - Cash BasisJulia MirhanNo ratings yet

- Finals Answer KeyDocument11 pagesFinals Answer Keymarx marolinaNo ratings yet

- Final Examination AK (60 COPIES)Document9 pagesFinal Examination AK (60 COPIES)Sittie Ainna A. UnteNo ratings yet

- Balance Sheet Errors: Problem 1Document2 pagesBalance Sheet Errors: Problem 1Alyana SandiegoNo ratings yet

- Sample Problem AdjustingDocument17 pagesSample Problem AdjustingHanna Mae CatudayNo ratings yet

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- Adjusting Entries ProblemDocument3 pagesAdjusting Entries ProblemElla Mae SaludoNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Diagnostic AssessmentDocument7 pagesDiagnostic AssessmentChristine JoyceNo ratings yet

- What Amount Should Be Reported As Diluted Earnings Per Share?Document6 pagesWhat Amount Should Be Reported As Diluted Earnings Per Share?carinaNo ratings yet

- Midterm ExaminationDocument6 pagesMidterm ExaminationJamie Rose Aragones100% (1)

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- Master Budget.9Document3 pagesMaster Budget.9Hiraya ManawariNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Cash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Document3 pagesCash Basis Accrual Basis Single Entry Error Correction ASSIGNMENT 1Christine BNo ratings yet

- Financial Accounting and Reporting Review Questions - Week 2Document15 pagesFinancial Accounting and Reporting Review Questions - Week 2Fery AnnNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- DOH AO No. 2023-0014Document7 pagesDOH AO No. 2023-0014LEAH ROSE PARASNo ratings yet

- Alisha Project HRDocument79 pagesAlisha Project HRDebzane PatiNo ratings yet

- Lesson 2.1 The Global EconomyDocument9 pagesLesson 2.1 The Global EconomyRenelyn LimNo ratings yet

- NS Sarah TalleyDocument3 pagesNS Sarah Talleyankitaj169100% (1)

- Individual Assignment CB Feb 2020Document6 pagesIndividual Assignment CB Feb 2020Jalna IsaacNo ratings yet

- CONTRACT - LL March April 2021Document3 pagesCONTRACT - LL March April 2021205Y046 Rakshith K GowdaNo ratings yet

- Asian Paints Is India's Largest Paint CompanyDocument22 pagesAsian Paints Is India's Largest Paint Companymaku016_140695771No ratings yet

- Fashion Accessory Cost ComponentsDocument21 pagesFashion Accessory Cost ComponentsKim Laurence Mejia ReyesNo ratings yet

- Communication Skills (J. G. Ferguson)Document145 pagesCommunication Skills (J. G. Ferguson)Deni Budiani PermanaNo ratings yet

- Sfiligoi-Company Introduction 2022 - ENDocument7 pagesSfiligoi-Company Introduction 2022 - ENahmadmubarokharbarindoNo ratings yet

- MAS 2PB Oct 2014Document12 pagesMAS 2PB Oct 2014Rhad Estoque100% (1)

- CAA Finance Internship ReportDocument20 pagesCAA Finance Internship ReportNabeel Raja100% (4)

- Property Law II NotesDocument34 pagesProperty Law II NotesMancee PandeyNo ratings yet

- Priciples of Marketing Digital Assignment 2: Name:S.Jayagokul REG NO:19BCC0020Document9 pagesPriciples of Marketing Digital Assignment 2: Name:S.Jayagokul REG NO:19BCC0020Jayagokul SaravananNo ratings yet

- Unit - 3 GlobalizationDocument13 pagesUnit - 3 GlobalizationYathish Us ThodaskarNo ratings yet

- Oxifresh Joint Venture Agreement-CyrusDocument6 pagesOxifresh Joint Venture Agreement-CyruscheroenltdNo ratings yet

- Math 12 Abm Org MGT q2 Week 6Document15 pagesMath 12 Abm Org MGT q2 Week 6Ae BreyNo ratings yet

- UNIT II Weisbord Six Box ModelDocument4 pagesUNIT II Weisbord Six Box Modelsushil.tripathiNo ratings yet

- The Giorgio Armani PresentationDocument20 pagesThe Giorgio Armani PresentationSoukaina Abouaissa100% (1)

- William Michael Guthrie, CFA, CFP: National City Bank - Private Client GroupDocument3 pagesWilliam Michael Guthrie, CFA, CFP: National City Bank - Private Client Groupkurtis_workmanNo ratings yet

- Salesfoce Six-Steps-Reengergize-Field-Sales-ProductivityDocument18 pagesSalesfoce Six-Steps-Reengergize-Field-Sales-ProductivityCharles PereiraNo ratings yet

- Price List - BALIAN Water - 01 Sept 2023 PPN 11%Document1 pagePrice List - BALIAN Water - 01 Sept 2023 PPN 11%Marchellia GeovianyNo ratings yet

- Research Paper On Forever 21Document6 pagesResearch Paper On Forever 21jwuajdcnd100% (1)

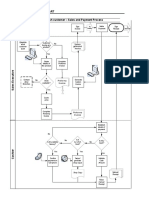

- As-Is-Flow Process Chart: No System Generated InvoiceDocument10 pagesAs-Is-Flow Process Chart: No System Generated Invoicepeter mulilaNo ratings yet

- College of Business Administration Major in Marketing ManagementDocument4 pagesCollege of Business Administration Major in Marketing Managementmark louie santosNo ratings yet

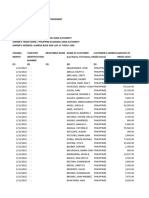

- System-Generated Excel File For January 2022 SalesDocument120 pagesSystem-Generated Excel File For January 2022 SalesGiomar BasalNo ratings yet

- International Trade Theory: Eighth EditionDocument29 pagesInternational Trade Theory: Eighth EditionCường ViNo ratings yet

- Competitors of AlibabaDocument3 pagesCompetitors of AlibabaMohitNo ratings yet