Professional Documents

Culture Documents

BT B Sung Chapter 45

BT B Sung Chapter 45

Uploaded by

Yến Nhi VũCopyright:

Available Formats

You might also like

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Cases Master PDFDocument11 pagesCases Master PDFSam PskovskiNo ratings yet

- Victoria's Secret Annual ReportDocument13 pagesVictoria's Secret Annual Reportapi-373843164% (28)

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Advanced TheoraticalDocument9 pagesAdvanced TheoraticalMega Pop LockerNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Chapter 3Document4 pagesChapter 324a4013096No ratings yet

- FM Handout 5Document32 pagesFM Handout 5Rofiq VedcNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- Corporate Finance 09.06.2022 (2)Document6 pagesCorporate Finance 09.06.2022 (2)Мариела БушеваNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Wa0035.Document5 pagesWa0035.Barack MikeNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- Reading-39-Financial-Analysis-Techniques-2Document29 pagesReading-39-Financial-Analysis-Techniques-2An HoàngNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- CF Assignment 1 06102022 091143pmDocument1 pageCF Assignment 1 06102022 091143pmhadsem78No ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- C. Net Cash Flow From Operating Activities in 2009: Income Statement 2009Document4 pagesC. Net Cash Flow From Operating Activities in 2009: Income Statement 2009BảoNgọcNo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- 2019-20 Man 310 Financial Management Midterm Prepatory QuestionsDocument9 pages2019-20 Man 310 Financial Management Midterm Prepatory QuestionsKinNo ratings yet

- Investment Analysis and Portfolio Management 2012Document61 pagesInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- Homework Assignment DoneDocument6 pagesHomework Assignment DoneLong Le KimNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Tut 05 SolnDocument4 pagesTut 05 Soln张婧姝No ratings yet

- The Financial Statements Chapter 2Document37 pagesThe Financial Statements Chapter 2Rupesh PolNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- Est Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceDocument16 pagesEst Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceAEM EntertainmentNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Quiz 1 FIN 440 2Document2 pagesQuiz 1 FIN 440 2Anowarul IslamNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- Review FinalDocument10 pagesReview FinalNguyen Minh QuanNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Assets Liabilities and Owner's EquityDocument8 pagesAssets Liabilities and Owner's EquityAsef KhademiNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Ch02 Mini CaseDocument11 pagesCh02 Mini CaseCarl GarrettNo ratings yet

- Chapter 5 Class ExercisesDocument13 pagesChapter 5 Class ExercisesSky GatdulaNo ratings yet

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Institute of Business Management: Assignment - Spring 2020Document7 pagesInstitute of Business Management: Assignment - Spring 2020Sussi HizbullahNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 2 Financial Statement, Taxes - Cash Flow - Student VersionDocument4 pagesChapter 2 Financial Statement, Taxes - Cash Flow - Student VersionNga PhamNo ratings yet

- Exam 2022 AccountingDocument2 pagesExam 2022 AccountingEditz meniaNo ratings yet

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- Bank Mandiri: Equity ResearchDocument5 pagesBank Mandiri: Equity ResearchAhmad SantosoNo ratings yet

- Fin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementDocument7 pagesFin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementSamantha Nicoleigh TuasonNo ratings yet

- Multiple Choice KTQTDocument14 pagesMultiple Choice KTQTLê Thái VyNo ratings yet

- Ratio Analysis Formula Excel TemplateDocument4 pagesRatio Analysis Formula Excel TemplateAnita MalhotraNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Statement of Cash FlowsDocument75 pagesStatement of Cash FlowsDang Thanh0% (1)

- William Wenceslao - BA 202 Topic 6 Assignment - BY WILLDocument4 pagesWilliam Wenceslao - BA 202 Topic 6 Assignment - BY WILLWiLliamLoquiroWencesLaoNo ratings yet

- 019 Problem Solving With Answer GuideDocument30 pages019 Problem Solving With Answer GuideRestie John UlipNo ratings yet

- Intrepretation of Financial StatementsDocument6 pagesIntrepretation of Financial StatementsAarti KainNo ratings yet

- Marketing Outline PlanDocument27 pagesMarketing Outline PlanDM BonoanNo ratings yet

- Ch06 Harrison 8e GE SMDocument87 pagesCh06 Harrison 8e GE SMMuh BilalNo ratings yet

- Advanced Accounting: Elimination of Unrealized Gains or Losses On Intercompany Sales of Property and EquipmentDocument49 pagesAdvanced Accounting: Elimination of Unrealized Gains or Losses On Intercompany Sales of Property and EquipmentAndreas WoenardiNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Istilah Akuntansi Dalam Bahasa InggrisDocument16 pagesIstilah Akuntansi Dalam Bahasa InggrisDhuny OctavianNo ratings yet

- Simplified Business Plan RTLDocument7 pagesSimplified Business Plan RTLlarrydelossantos04291984No ratings yet

- Gleaning Information From Financial Statements: ReadingDocument1 pageGleaning Information From Financial Statements: ReadingYanetNo ratings yet

- Review of Chapter 8/9Document36 pagesReview of Chapter 8/9BookAddict721100% (1)

- Operating Budget of Healthcare OrganizationDocument15 pagesOperating Budget of Healthcare OrganizationAchacha Jr El PatronNo ratings yet

- 03 Income StatementDocument14 pages03 Income StatementapiNo ratings yet

- 2A. Financial Statement AnalysisDocument116 pages2A. Financial Statement AnalysisHitesh AgaleNo ratings yet

- Pa 2Document23 pagesPa 2Aditya DzikirNo ratings yet

- Ebit-Eps Analysis: Operating EarningsDocument27 pagesEbit-Eps Analysis: Operating EarningsKaran MorbiaNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- Business Mathematics 1631124113Document468 pagesBusiness Mathematics 1631124113Mushif JathoolNo ratings yet

BT B Sung Chapter 45

BT B Sung Chapter 45

Uploaded by

Yến Nhi VũOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BT B Sung Chapter 45

BT B Sung Chapter 45

Uploaded by

Yến Nhi VũCopyright:

Available Formats

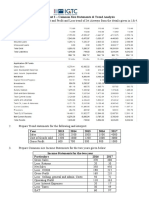

1.

CODOS corporation has the income statement and balance sheet as follow:

201 201

2017 8 2016 7 2018

Sales 80 90 Assets

Cost of goods sold (35) (50) Cash 5 5 7

Gross profit 45 40 Account receivable 10 15 25

Sale and administration (10) (15) Inventory 10 10 8

Depreciation (5) (7) Total curent assets 25 30 40

Operating profit 30 18 Net fixed assets 25 27 30

Interest expense (15) (8) Total assets 50 57 70

Earning before taxes 15 10

Income taxes (3) (2) Liabilities & Equity

Net income 12 8 Account payable 5 6 10

Accrued liabilities 5 6 10

Long-term debt 15 20 20

Common equity 25 25 30

Total liabilities & equity 50 57 70

a. Calculate: Net profit margin, ROA, ROE and interpret profitability of CODOS cop.

b. Calculate: inventory turnover, receivable turnover, fixed assets turnover, total asset

turnover and interpret them.

c. Calculate: debt to total assets, interest coverage ratios and assess the risk of CODOS’s

capital structure.

d. What are the main reasons making ROE of CODOS increase? (Using DuPont analysis)

2. ROPEE Corporation has the cash flow statement for the year end 31 December 2018 as below:

Cash collections $ 4,900

Cash paid to suppliers ($ 1,700)

Cash operating expenses ($ 1,500)

Cash taxes paid ($ 1,500)

Cash from operating activities $ 200

Cash paid for plant and equipment ($ 3,600)

Cash interest received $ 1,000

Cash from investing activities ($ 2,600)

Cash received from short-term debt issuance $ 2,000

Cash received from issuing equity $ 1,000

Cash from financing activities $ 3,000

Total change in cash $ 600

Interpret the cash flow statement of ROPEE Corp. for this year?

7. Given the following income statement and balance sheet for company BA (millions dollar)

Balance Sheet Income Statement

Assets Year 2016 Year 2017

Cash 400 450 Sales

Accounts Receivable 600 660 Discounts

Inventory 500 550 Net Sales

Total Current Assets 1500 1660 COGS

Plant, prop. equip 900 1250 Gross profit

Total Asset 2400 2910 SG&A

Interest expense

Liabilities EBT

Accounts payable 600 550 Taxes (30%)

Long-term Debt 500 1102 Net income

Total Liabilities 1100 1652

Equity

Common Stock 400 538

Retained Earnings 900 720

Total Liabilities & Equity 2400 2910

Using the income statement and balance sheet for company BA and additional information for 2017

(millions dollar): Depreciation expense: 30

Calculate the Cash flow from operating, investing and financing activities for the firm in 2017. Prepare

You might also like

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Cases Master PDFDocument11 pagesCases Master PDFSam PskovskiNo ratings yet

- Victoria's Secret Annual ReportDocument13 pagesVictoria's Secret Annual Reportapi-373843164% (28)

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Advanced TheoraticalDocument9 pagesAdvanced TheoraticalMega Pop LockerNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Chapter 3Document4 pagesChapter 324a4013096No ratings yet

- FM Handout 5Document32 pagesFM Handout 5Rofiq VedcNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- Corporate Finance 09.06.2022 (2)Document6 pagesCorporate Finance 09.06.2022 (2)Мариела БушеваNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Wa0035.Document5 pagesWa0035.Barack MikeNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- Reading-39-Financial-Analysis-Techniques-2Document29 pagesReading-39-Financial-Analysis-Techniques-2An HoàngNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- CF Assignment 1 06102022 091143pmDocument1 pageCF Assignment 1 06102022 091143pmhadsem78No ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- C. Net Cash Flow From Operating Activities in 2009: Income Statement 2009Document4 pagesC. Net Cash Flow From Operating Activities in 2009: Income Statement 2009BảoNgọcNo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- 2019-20 Man 310 Financial Management Midterm Prepatory QuestionsDocument9 pages2019-20 Man 310 Financial Management Midterm Prepatory QuestionsKinNo ratings yet

- Investment Analysis and Portfolio Management 2012Document61 pagesInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- Homework Assignment DoneDocument6 pagesHomework Assignment DoneLong Le KimNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Tut 05 SolnDocument4 pagesTut 05 Soln张婧姝No ratings yet

- The Financial Statements Chapter 2Document37 pagesThe Financial Statements Chapter 2Rupesh PolNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- Est Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceDocument16 pagesEst Time: 01-05 Financial Statements: Solutions To Chapter 3 Accounting and FinanceAEM EntertainmentNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Quiz 1 FIN 440 2Document2 pagesQuiz 1 FIN 440 2Anowarul IslamNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- Review FinalDocument10 pagesReview FinalNguyen Minh QuanNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Assets Liabilities and Owner's EquityDocument8 pagesAssets Liabilities and Owner's EquityAsef KhademiNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Ch02 Mini CaseDocument11 pagesCh02 Mini CaseCarl GarrettNo ratings yet

- Chapter 5 Class ExercisesDocument13 pagesChapter 5 Class ExercisesSky GatdulaNo ratings yet

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Institute of Business Management: Assignment - Spring 2020Document7 pagesInstitute of Business Management: Assignment - Spring 2020Sussi HizbullahNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 2 Financial Statement, Taxes - Cash Flow - Student VersionDocument4 pagesChapter 2 Financial Statement, Taxes - Cash Flow - Student VersionNga PhamNo ratings yet

- Exam 2022 AccountingDocument2 pagesExam 2022 AccountingEditz meniaNo ratings yet

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- Bank Mandiri: Equity ResearchDocument5 pagesBank Mandiri: Equity ResearchAhmad SantosoNo ratings yet

- Fin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementDocument7 pagesFin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementSamantha Nicoleigh TuasonNo ratings yet

- Multiple Choice KTQTDocument14 pagesMultiple Choice KTQTLê Thái VyNo ratings yet

- Ratio Analysis Formula Excel TemplateDocument4 pagesRatio Analysis Formula Excel TemplateAnita MalhotraNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Statement of Cash FlowsDocument75 pagesStatement of Cash FlowsDang Thanh0% (1)

- William Wenceslao - BA 202 Topic 6 Assignment - BY WILLDocument4 pagesWilliam Wenceslao - BA 202 Topic 6 Assignment - BY WILLWiLliamLoquiroWencesLaoNo ratings yet

- 019 Problem Solving With Answer GuideDocument30 pages019 Problem Solving With Answer GuideRestie John UlipNo ratings yet

- Intrepretation of Financial StatementsDocument6 pagesIntrepretation of Financial StatementsAarti KainNo ratings yet

- Marketing Outline PlanDocument27 pagesMarketing Outline PlanDM BonoanNo ratings yet

- Ch06 Harrison 8e GE SMDocument87 pagesCh06 Harrison 8e GE SMMuh BilalNo ratings yet

- Advanced Accounting: Elimination of Unrealized Gains or Losses On Intercompany Sales of Property and EquipmentDocument49 pagesAdvanced Accounting: Elimination of Unrealized Gains or Losses On Intercompany Sales of Property and EquipmentAndreas WoenardiNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Istilah Akuntansi Dalam Bahasa InggrisDocument16 pagesIstilah Akuntansi Dalam Bahasa InggrisDhuny OctavianNo ratings yet

- Simplified Business Plan RTLDocument7 pagesSimplified Business Plan RTLlarrydelossantos04291984No ratings yet

- Gleaning Information From Financial Statements: ReadingDocument1 pageGleaning Information From Financial Statements: ReadingYanetNo ratings yet

- Review of Chapter 8/9Document36 pagesReview of Chapter 8/9BookAddict721100% (1)

- Operating Budget of Healthcare OrganizationDocument15 pagesOperating Budget of Healthcare OrganizationAchacha Jr El PatronNo ratings yet

- 03 Income StatementDocument14 pages03 Income StatementapiNo ratings yet

- 2A. Financial Statement AnalysisDocument116 pages2A. Financial Statement AnalysisHitesh AgaleNo ratings yet

- Pa 2Document23 pagesPa 2Aditya DzikirNo ratings yet

- Ebit-Eps Analysis: Operating EarningsDocument27 pagesEbit-Eps Analysis: Operating EarningsKaran MorbiaNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- Business Mathematics 1631124113Document468 pagesBusiness Mathematics 1631124113Mushif JathoolNo ratings yet