Professional Documents

Culture Documents

Business Express Loan Application Requirements

Business Express Loan Application Requirements

Uploaded by

denpagatpatan.nscs0 ratings0% found this document useful (0 votes)

19 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views3 pagesBusiness Express Loan Application Requirements

Business Express Loan Application Requirements

Uploaded by

denpagatpatan.nscsCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

BUSINESS EXRESS LOAN APPLICATION REQUIREMENTS, RATES, & DETAILS

Loan Rates

Term Rate

12 Months 1.50%

18 Months 1.60%

24 Months 1.90%

36 Months 1.95%

FEES AND CHARGES

Processing fee PHP 3,000

Notarial fee for Sole Proprietorships PHP 400

Notarial fee for Partnerships and PHP 800

Corporations

DST Approved Loan Amount / 200 *

1.50

Penalty fee 3% of past-due amount for the

month

Eligibility Requirements

The businesses to which the loan will be applied for must meet the following

criteria:

o Duly registered to operate as a business in the Philippines;

o Must have been operating for at least 3 years, and profitable for the

latest 1 year.

o Must have no outstanding debt that exceeds 40% the company’s

monthly income

Each SME loan must be tied to the business’ primary owner; for

partnerships/corporations, this means:

o Owner with simple majority (individual with the single largest stake in

the company) must provide details and sign off on the loan application

form, and ultimately be the signatory in the surety agreement prior to

loan booking

o If simple majority is shared across multiple owners, only (1) of them is

required to sign off on the loan

Identified business owners will then be required to have:

o An existing account with Security Bank (at least 6 months old with PHP

50K ADB) OR Existing credit card (any bank; credit card number/s must

be provided in application)

o Permanent residency in the Philippines;

o At least 21 years of age at the time of application and not more than 65

years of age upon maturity of the loan

Documentary Requirements

SOLE PROPRIETORSHIP

Signed and Completed Application Form

Copy of 2 valid IDs with photo from primary applicant / owner / authorized

signatory

Latest ITR with BIR stamp

Latest (1) year Audited Financial Statements

Valid DTI Registration docs

Latest 3 months bank statement

List of customers/suppliers and details about their dealings

Valid Business or Mayor’s Permit

PARTNERSHIP/CORPORATION

Signed and Completed Application Form

Copy of 2 valid IDs with photo from primary applicant / owner / authorized

signatory

Latest ITR with BIR stamp

Latest (1) year Audited Financial Statements

Valid DTI/SEC Registration documents and GIS

Latest 3 months bank statement

List of customers/suppliers and details about their dealings (The following

documents will be required by the bank prior to loan booking:

Partnership / Board Resolution (authorizing signatory for accounts and loan,

credit investigation on both the business and owners)

Continuing Suretyship Agreement (for corporations) Client will be given

templates at point of application to prepare for the loan decision)

Valid Business or Mayor’s Permit

You might also like

- Principles of Corporate Finance 11th Edition Brealey Solutions Manual 1Document9 pagesPrinciples of Corporate Finance 11th Edition Brealey Solutions Manual 1fausto100% (57)

- Final Project - InternationalCorporateTaxDocument12 pagesFinal Project - InternationalCorporateTaxAssignment parttime100% (1)

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Enter A Better Life: Sub: Sanctlon Letter For Financial FacilityDocument2 pagesEnter A Better Life: Sub: Sanctlon Letter For Financial Facilityinfoski khan100% (2)

- Dsa Handbook2018Document19 pagesDsa Handbook2018Dayalan A100% (3)

- Peer To Peer LendingDocument16 pagesPeer To Peer Lendingykbharti101100% (1)

- TMV Solved ProblemDocument27 pagesTMV Solved ProblemIdrisNo ratings yet

- Security BankDocument2 pagesSecurity BankLiza SebastianNo ratings yet

- Security BankDocument2 pagesSecurity BankLiza SebastianNo ratings yet

- Loan TFSDocument9 pagesLoan TFSvishnu RasaaliNo ratings yet

- Chapter 1 IntroDocument10 pagesChapter 1 IntrosanyakathuriaNo ratings yet

- Coop Policies: 1. MembershipDocument9 pagesCoop Policies: 1. Membershippapotchi patototNo ratings yet

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasNo ratings yet

- Product Feature: S$500,000 5 Years 10.88% P.ADocument1 pageProduct Feature: S$500,000 5 Years 10.88% P.ACANo ratings yet

- Sop 2Document4 pagesSop 2Lalu VsNo ratings yet

- Loan Products of The City Bank LimitedDocument7 pagesLoan Products of The City Bank LimitedQuazi AsaduzzamanNo ratings yet

- Requirements On Car Loan FacilityDocument2 pagesRequirements On Car Loan FacilityKarl Kenneth FloresNo ratings yet

- HdbfsDocument34 pagesHdbfsMounicaNo ratings yet

- Loan Proposal SampleDocument4 pagesLoan Proposal SampleNewGen LyricsNo ratings yet

- Business Transport LoanDocument8 pagesBusiness Transport LoanJan RootsNo ratings yet

- ICICI Bank Car Loans Primary DetailsDocument11 pagesICICI Bank Car Loans Primary DetailsAastha PandeyNo ratings yet

- Business Installment Loan: FeaturesDocument6 pagesBusiness Installment Loan: FeaturesMd.Azam KhanNo ratings yet

- Forms of Business OwnershipDocument27 pagesForms of Business OwnershipLawrenceVillanuevaNo ratings yet

- Consumer Finance at Bank AlfalahDocument29 pagesConsumer Finance at Bank AlfalahSana Khan100% (2)

- BDO PresentationDocument24 pagesBDO Presentationshayacasey.millo.mnlNo ratings yet

- Loan Application Letter MK54146316ID47157512Document2 pagesLoan Application Letter MK54146316ID47157512J Eniyavan “Eniya”No ratings yet

- Company EstablishmentDocument13 pagesCompany EstablishmentKrishna Singh RajputNo ratings yet

- SBI Business LoanDocument12 pagesSBI Business LoanAjit SamalNo ratings yet

- Name:Rashi Milind Virkud Batch No: S220152Document31 pagesName:Rashi Milind Virkud Batch No: S220152Rashi virkudNo ratings yet

- Eligibility:: Please Click Retail Credit Interest RatesDocument8 pagesEligibility:: Please Click Retail Credit Interest RatesPriya S MurthyNo ratings yet

- Mortgage Training Slides Single License 2013Document82 pagesMortgage Training Slides Single License 2013ltlim100% (1)

- Start-Up Loan OverviewDocument8 pagesStart-Up Loan OverviewkkNo ratings yet

- Requirements For Offshore Banking License in BelizeDocument12 pagesRequirements For Offshore Banking License in BelizeBhagyanath MenonNo ratings yet

- Loan Application Letter MK12886562ID91140412Document2 pagesLoan Application Letter MK12886562ID91140412pkmeenakhat6No ratings yet

- Sample Credit PolicyDocument5 pagesSample Credit Policykrishna chandraNo ratings yet

- Clients Interview DiscussionDocument6 pagesClients Interview DiscussionchristophervaldeavillaNo ratings yet

- OPC Registration EntersliceDocument8 pagesOPC Registration EntersliceKamil HasnainNo ratings yet

- Comparative Study of Bank's Retail Loan Product (Home LoanDocument27 pagesComparative Study of Bank's Retail Loan Product (Home LoanDevo Pam NagNo ratings yet

- HDFC Ltd. Home Loan FeaturesDocument8 pagesHDFC Ltd. Home Loan FeaturesVishv SharmaNo ratings yet

- Loan Application Letter MK63626316ID46718930Document2 pagesLoan Application Letter MK63626316ID46718930Rohit KumarNo ratings yet

- XYZHL Application Form - Editable - FinalDocument5 pagesXYZHL Application Form - Editable - FinalamiteshnegiNo ratings yet

- A Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Document129 pagesA Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Freeman HuNo ratings yet

- Sources of Long Term Funds From HSBC BankDocument16 pagesSources of Long Term Funds From HSBC Bankadilhussain_876No ratings yet

- LXS-H09023-242564415 - Terms & ConditionsDocument23 pagesLXS-H09023-242564415 - Terms & Conditionsdewic29037No ratings yet

- Personal Loan Interest RateDocument6 pagesPersonal Loan Interest RateKatherine OlidanNo ratings yet

- Bullet Points For LocDocument2 pagesBullet Points For Locapi-24643888No ratings yet

- Planters BankDocument52 pagesPlanters BankkimNo ratings yet

- Listing ProcedureDocument3 pagesListing ProcedurenageswarcrickNo ratings yet

- CC Two-Wheeler-LoansDocument29 pagesCC Two-Wheeler-LoansRight ClickNo ratings yet

- On Standard CharteredDocument11 pagesOn Standard Charterednitin01.snetNo ratings yet

- Access Bank Creative Sector LoanDocument9 pagesAccess Bank Creative Sector LoanPelumi AdewoyinNo ratings yet

- Loan SBPPDocument46 pagesLoan SBPPDrasti DesaiNo ratings yet

- HBL Islamic Homefinance: Key FeaturesDocument6 pagesHBL Islamic Homefinance: Key FeaturesaftabNo ratings yet

- Meaning of Limited Liability Partnership (LLP)Document8 pagesMeaning of Limited Liability Partnership (LLP)bobby1993 DunnaNo ratings yet

- FindingsDocument5 pagesFindingsafifNo ratings yet

- Business Loan PolicyDocument7 pagesBusiness Loan Policyniteshparewa372No ratings yet

- Setting Up A Cooperative SocietyDocument2 pagesSetting Up A Cooperative Societyejogheneta100% (1)

- MBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit SchemesDocument68 pagesMBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit Schemeszargar100% (1)

- Patna Retail Assets CentreDocument31 pagesPatna Retail Assets CentreSatyajit BanerjeeNo ratings yet

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- 6 - Credit ManagementDocument12 pages6 - Credit ManagementjuvyoringotNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

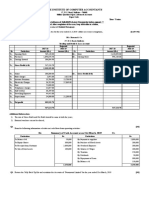

- The Institute of Computer AccountantsDocument1 pageThe Institute of Computer AccountantsankitNo ratings yet

- A1 EEP-I Project Final ReportDocument16 pagesA1 EEP-I Project Final ReportSAURAV KUMAR GUPTANo ratings yet

- Resume Dhumal JayeshDocument3 pagesResume Dhumal JayeshNeesonNo ratings yet

- SSG Expenses Report Final 2020-2021Document5 pagesSSG Expenses Report Final 2020-2021Loriee LineNo ratings yet

- The Next Commodity Supercycle - October 2020Document76 pagesThe Next Commodity Supercycle - October 2020Variant Perception Research88% (17)

- Federal Government Tells Todd, Julie Chrisley It Wants Their Nearly $1M Settlement From GeorgiaDocument22 pagesFederal Government Tells Todd, Julie Chrisley It Wants Their Nearly $1M Settlement From GeorgiaWSB-TV100% (1)

- Complete FormDocument58 pagesComplete FormFazrol RahmanNo ratings yet

- Dip IFR 2020 June QuestionDocument11 pagesDip IFR 2020 June Questionluckyjulie567100% (2)

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- Nep 2015 Volume 1Document320 pagesNep 2015 Volume 1Stacy Lyn LiongNo ratings yet

- Phil. Cpa Licensure Examination Regulatory Framework For Business Transactions ObligationsDocument12 pagesPhil. Cpa Licensure Examination Regulatory Framework For Business Transactions ObligationsSeddrinth DracoNo ratings yet

- Balance SheetDocument2 pagesBalance SheetShubham TiwariNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- Chapter 20: Inventory ManagementDocument49 pagesChapter 20: Inventory Managementinna zulfaNo ratings yet

- E Pso I D: Tnot NC Ito 1io, T Olle Tto 1to /1Document3 pagesE Pso I D: Tnot NC Ito 1io, T Olle Tto 1to /1KIMBERLY BALISACANNo ratings yet

- CitibankDocument20 pagesCitibankjosh321No ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Options Elite StrategyDocument6 pagesOptions Elite StrategyDaleep Singhal100% (1)

- Akun Impor Ud BuanaDocument1 pageAkun Impor Ud BuanaYusnita dwi kartikaNo ratings yet

- Testbank ProblemsDocument47 pagesTestbank Problemss.gallur.gwynethNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKanyaka PriyadarsiniNo ratings yet

- Subject: English (Term - Ii) : Arekere, B.G. Road, Bangalore-76Document4 pagesSubject: English (Term - Ii) : Arekere, B.G. Road, Bangalore-76JEENo ratings yet

- Tugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GDocument10 pagesTugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GrizkyNo ratings yet

- Quiz 1 - IPF 2022Document5 pagesQuiz 1 - IPF 2022Kunal MondalNo ratings yet

- DealList 20221116171339Document10 pagesDealList 20221116171339Gia GiaNo ratings yet

- Ba Economics 2019 BatchDocument71 pagesBa Economics 2019 BatchSatyam KumarNo ratings yet

- RBL Bank AR - 2020Document156 pagesRBL Bank AR - 2020anil1820No ratings yet