Professional Documents

Culture Documents

What Are The Accreditation Requirements For New Importers

What Are The Accreditation Requirements For New Importers

Uploaded by

Marideth Gonzales DiazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Are The Accreditation Requirements For New Importers

What Are The Accreditation Requirements For New Importers

Uploaded by

Marideth Gonzales DiazCopyright:

Available Formats

What are the accreditation requirements for

new importers?

For new importers, the following pertinent documents are to be submitted:

Duly notarized accomplished Application Form and signed by owner (for Sole Proprietorship), responsible

Officer (for Corporation), Chairman (for Cooperative) and authorized partner (for Partnership);

Bureau of Customs Official Receipt (BCOR) evidencing payment of processing fee (Php1,000.00);

Corporate Secretary Certificate (Corporation) / Affidavit (Sole Proprietorship) / Partnership Resolution

(Partnership) / BOD Resolution (Cooperative) designating its authorized signatories in the import entries;

Two (2) valid government issued IDs (with picture) of Applicant, President and Responsible Officers (i.e.,

passport, UMID Card, SSS ID, Driver’s License, Alien Certificate of Registration and Alien Employment

Permit for aliens);

NBI Clearance of applicant (issued within six (6) months prior to the application)

Photocopy of DTI Registration or SEC Registration/Articles of Partnership and Latest General Information

Sheet, or Cooperative Development Authority Registration and latest Cooperative Annual Progress Report,

whichever is applicable;

Personal Profile of Applicant, President and Responsible Officers;

Proof of Lawful Occupancy of Office Address and Warehouse (i.e., Updated Lease Contract under the name

of the Corporation or Proprietor, Affidavit of Consent from the owner and the Title of the Property under

his/her name in case the property is used for free, Certification from the Lessor or Owner allowing the

sharing of office in case of Sublease);

Printed CPRS of the Company and updated notification of “STORED” status;

BIR Registration (2303);

Income Tax Return (ITR) for the past three (3) years duly received by the BIR, if applicable;

Valid Mayor’s Permit as certified by the Bureau of Permits and Licensing Office;

Proof of Financial capacity to import goods (Bank Certificate or other forms of financial certification) (Top

1000 Taxpayers and under SGL Companies are exempted);

Endorsement from the District Collector, if applicable;

Detailed sketch map of office and warehouse address; and

Company Profile with geotagged pictures of office with proper and permanent signage and pictures of

warehouse/storage area;

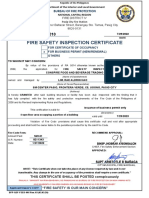

o Examples:

Note: Kindly use fastener with Table of Contents and proper tabbing (use letters). Thank You

Color Coding

Single - Red Folder,

Partnership - Blue Folder,

Corporation - Green Folder,

Cooperative - Yellow Folder,

Government - White Folder

You might also like

- Screenshot 2023-11-28 at 11.28.32 AMDocument2 pagesScreenshot 2023-11-28 at 11.28.32 AMmegahygiene100% (2)

- Requirements For DPWH RegistrationDocument3 pagesRequirements For DPWH RegistrationChamp041882% (11)

- United Nations Simplified Compliance Certificate: Reference NumberDocument1 pageUnited Nations Simplified Compliance Certificate: Reference NumberPeter OnyachNo ratings yet

- Application For Business Requirements - Secretary's CertificateDocument3 pagesApplication For Business Requirements - Secretary's CertificateAriel Joseph Sudara100% (2)

- Basic MP3 License AgreementDocument5 pagesBasic MP3 License AgreementThe Real Velocity FilmsNo ratings yet

- Capital Gains TaxDocument5 pagesCapital Gains TaxJAYAR MENDZNo ratings yet

- Non Individual - KYC Application FormDocument4 pagesNon Individual - KYC Application Formlaxmans20No ratings yet

- Business Permits RequirementsDocument2 pagesBusiness Permits RequirementsJurilBrokaPatiño100% (1)

- BOC Import License Documentary RequirementsDocument2 pagesBOC Import License Documentary RequirementsGabriel EmersonNo ratings yet

- Importer RequirementsDocument1 pageImporter RequirementsRomeo MirandaNo ratings yet

- What Are The Accreditation Requirements For New ImDocument6 pagesWhat Are The Accreditation Requirements For New ImLeo Cj PalmonisNo ratings yet

- Customs Requirements For Accreditation As Importer Requirement Note Action TakenDocument1 pageCustoms Requirements For Accreditation As Importer Requirement Note Action TakenkbongcoNo ratings yet

- BOC - New Importer RequirementsDocument2 pagesBOC - New Importer RequirementsGladys MendozaNo ratings yet

- Requirements and Procedure For BIR RegDocument3 pagesRequirements and Procedure For BIR ReglifemandrinkNo ratings yet

- BIR CGT RequirementsDocument3 pagesBIR CGT RequirementsGerald MesinaNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument6 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkNo ratings yet

- SIRV RequirementsDocument5 pagesSIRV Requirementsskylark74No ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument11 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsGrace G. ServanoNo ratings yet

- Bir COR Application RequirementsDocument3 pagesBir COR Application RequirementsJaemar FajardoNo ratings yet

- Taxpayer InformationDocument2 pagesTaxpayer InformationLecel LlamedoNo ratings yet

- Index For Capital Gains TaxDocument15 pagesIndex For Capital Gains TaxWilma P.No ratings yet

- Index For Capital Gains TaxDocument19 pagesIndex For Capital Gains TaxD GNo ratings yet

- Annex A: Name of Applicant/Entity: Business Address: Tel. No. Fax No. Tin: DateDocument2 pagesAnnex A: Name of Applicant/Entity: Business Address: Tel. No. Fax No. Tin: DateRamon Carpiso Jr.No ratings yet

- BIR Form 1707Document3 pagesBIR Form 1707catherine joy sangilNo ratings yet

- Capital Gains TaxDocument11 pagesCapital Gains TaxRoma Sabrina GenoguinNo ratings yet

- DTI, SEC, BSP and BOI RequirementsDocument22 pagesDTI, SEC, BSP and BOI Requirementsni_kai2001No ratings yet

- Capital Gains Tax - Bureau of Internal RevenueDocument1 pageCapital Gains Tax - Bureau of Internal Revenuetan limNo ratings yet

- Procedures in Capital Tax GainDocument6 pagesProcedures in Capital Tax GainJyasmine Aura V. AgustinNo ratings yet

- HSBC Account OpeningDocument6 pagesHSBC Account OpeningHojjat SoleimaniNo ratings yet

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Document43 pagesPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNo ratings yet

- Application For Taxpayer Identification Number (TIN)Document5 pagesApplication For Taxpayer Identification Number (TIN)iamjan_101No ratings yet

- BIR RegistrationDocument5 pagesBIR RegistrationGladys MendozaNo ratings yet

- TAX 103-Topic 1 - Registration & EBIR FormsDocument11 pagesTAX 103-Topic 1 - Registration & EBIR Formsmarialynnette lusterioNo ratings yet

- Application For TIN - Bureau of Internal RevenueDocument19 pagesApplication For TIN - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDocument1 pageBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNo ratings yet

- Bureau of Customs: Certificate of Accreditation As ImporterDocument1 pageBureau of Customs: Certificate of Accreditation As ImporterJaneal RezariNo ratings yet

- How To Secure CAR From BIRDocument4 pagesHow To Secure CAR From BIRkaiNo ratings yet

- New Company - Registration 2021Document6 pagesNew Company - Registration 2021Gladys MendozaNo ratings yet

- Tax LawDocument58 pagesTax LawChit ComisoNo ratings yet

- Legal AspectsDocument11 pagesLegal AspectsIsaiah CruzNo ratings yet

- 1901 For Self-Employed, Professional, & Single ProprietorshipDocument11 pages1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoNo ratings yet

- Requirement SEC RegistrationDocument14 pagesRequirement SEC RegistrationbrownboomerangNo ratings yet

- Capital Gains Tax LAW 101Document41 pagesCapital Gains Tax LAW 101Chit ComisoNo ratings yet

- FICA Requirements - 8Document3 pagesFICA Requirements - 8FrancisSunganiNo ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- Awareness On Business Registration, Invoicing and BookkeepingDocument70 pagesAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.No ratings yet

- Real Estate Lectures and AssignmentDocument3 pagesReal Estate Lectures and AssignmentsacostaNo ratings yet

- One Person CorporationDocument7 pagesOne Person CorporationBenedict IloseoNo ratings yet

- Sec Registration RequirementsDocument25 pagesSec Registration Requirementsmay .No ratings yet

- Philippine Business Registration Requirements Philippine Business Registration Requirements Philippine Business Registration RequirementsDocument2 pagesPhilippine Business Registration Requirements Philippine Business Registration Requirements Philippine Business Registration Requirementsrenz riveraNo ratings yet

- 1.1 Account Opening Checklist (Corporation)Document2 pages1.1 Account Opening Checklist (Corporation)angkalabawNo ratings yet

- HQP-HLF-002 Checklist of Requirements For RL - PenconDocument1 pageHQP-HLF-002 Checklist of Requirements For RL - Penconmaxx villaNo ratings yet

- BIRDocument111 pagesBIRAllied RandzNo ratings yet

- Capital Gains Tax For Onerous Transfer of Shares of Stocks Not Traded Through The Local Stock ExchangeDocument2 pagesCapital Gains Tax For Onerous Transfer of Shares of Stocks Not Traded Through The Local Stock ExchangemtscoNo ratings yet

- Land Bank of The Philippines Special Assets Department Checklist of Requirements For Ropa BuyersDocument2 pagesLand Bank of The Philippines Special Assets Department Checklist of Requirements For Ropa BuyersInoue PrintsNo ratings yet

- Mary JaneDocument7 pagesMary JaneMary Jane O ApelladoNo ratings yet

- Business RegistrationDocument67 pagesBusiness RegistrationRheneir MoraNo ratings yet

- FLH050-6 Cor - W3Document2 pagesFLH050-6 Cor - W3Alipot Bacud TabulaNo ratings yet

- Transfer of Land TitleDocument8 pagesTransfer of Land TitleAnonymous uMI5BmNo ratings yet

- Business Consultants & Business Advisors, Custom Services, Income Tax Sales Tax Consultant.Document1 pageBusiness Consultants & Business Advisors, Custom Services, Income Tax Sales Tax Consultant.TahirBajwaNo ratings yet

- How To Register A Corporation With SEC PhilippinesDocument2 pagesHow To Register A Corporation With SEC PhilippinesRoger JavierNo ratings yet

- List of Documents Required For CTEDocument4 pagesList of Documents Required For CTEdeepali_nih9585No ratings yet

- RMC No 37-2016Document6 pagesRMC No 37-2016sandra100% (1)

- Xiamen Jiya 84k .FXDocument1 pageXiamen Jiya 84k .FXMarideth Gonzales DiazNo ratings yet

- CIRR22-043 (1) SignedDocument1 pageCIRR22-043 (1) SignedMarideth Gonzales DiazNo ratings yet

- Treasury Announcement 2023.TREASURYMGD.04.11.001Document1 pageTreasury Announcement 2023.TREASURYMGD.04.11.001Marideth Gonzales DiazNo ratings yet

- Treasury Announcement 2023.TREASURYMGD.04.11.001 v2 SignedDocument1 pageTreasury Announcement 2023.TREASURYMGD.04.11.001 v2 SignedMarideth Gonzales DiazNo ratings yet

- Travel Forms Blank - 1Document2 pagesTravel Forms Blank - 1Marideth Gonzales DiazNo ratings yet

- Guidelines For Waiving of Penalty ChargesDocument3 pagesGuidelines For Waiving of Penalty ChargesMarideth Gonzales DiazNo ratings yet

- Accounting Policy - Advance To Employees - RevisedDocument7 pagesAccounting Policy - Advance To Employees - RevisedMarideth Gonzales DiazNo ratings yet

- 3RD Qtr-Kpi-Madel EscasinasDocument5 pages3RD Qtr-Kpi-Madel EscasinasMarideth Gonzales DiazNo ratings yet

- SA-2022-018 - Special Requests and Updated Service Fee Rates - February 14, 2022Document2 pagesSA-2022-018 - Special Requests and Updated Service Fee Rates - February 14, 2022Marideth Gonzales DiazNo ratings yet

- Travel Forms Blank - Tof-SignedDocument1 pageTravel Forms Blank - Tof-SignedMarideth Gonzales DiazNo ratings yet

- Cis BlankDocument1 pageCis BlankMarideth Gonzales DiazNo ratings yet

- Peza CetiDocument4 pagesPeza CetiMarideth Gonzales DiazNo ratings yet

- CertificateDocument1 pageCertificateCelPoxNo ratings yet

- SecCert LGU Permits Application (Oct 6, 2020) RevDocument1 pageSecCert LGU Permits Application (Oct 6, 2020) RevArnel Kevin Jan BesaNo ratings yet

- Mayor Permit RequirementsDocument2 pagesMayor Permit RequirementsNorman CorreaNo ratings yet

- HSE Training Certificate Expiry TrackerDocument3 pagesHSE Training Certificate Expiry Trackermazenfakhfakh9No ratings yet

- Ul Terminales MarnoDocument2 pagesUl Terminales MarnoDISTRIBUCIONES ESFERA SA DE CVNo ratings yet

- Encroachment AgreementDocument2 pagesEncroachment AgreementMarvin B. SoteloNo ratings yet

- Ind. Renewal of Registration of Dadiangas GlassDocument2 pagesInd. Renewal of Registration of Dadiangas GlassCharish PantaleonNo ratings yet

- MMRDA ApprovalDocument2 pagesMMRDA ApprovalzashNo ratings yet

- Fsic BusinessDocument1 pageFsic BusinessreferizaruthjoyNo ratings yet

- S 9.5C - Lock Out Tag Out PermitDocument2 pagesS 9.5C - Lock Out Tag Out PermitWILLIAMNo ratings yet

- Rainham Steel Rainham Iso9001Document2 pagesRainham Steel Rainham Iso9001Thomas WallaceNo ratings yet

- Certificate of Incorporation: Government of India Ministry of Corporate AffairsDocument1 pageCertificate of Incorporation: Government of India Ministry of Corporate AffairsNaras SimsNo ratings yet

- Resolution para Sa TubigDocument3 pagesResolution para Sa TubigKienth arnadoNo ratings yet

- Appendix C. Permits and LicensesDocument4 pagesAppendix C. Permits and LicensesEric John ConateNo ratings yet

- Registration Certificate of Ariis Educational LLPDocument1 pageRegistration Certificate of Ariis Educational LLPWasim Ahmed KalasNo ratings yet

- Certificate 14K - Initial 2023 - Bin Harkil Trading Company LTDDocument1 pageCertificate 14K - Initial 2023 - Bin Harkil Trading Company LTDmohammed arifNo ratings yet

- Work Permit Observations TrendDocument4 pagesWork Permit Observations Trendswaroop kumatNo ratings yet

- Janvi Manoj GrawkarDocument1 pageJanvi Manoj Grawkarashishtelrandhe64No ratings yet

- Cost of Doing Business in Zamboanga CityDocument2 pagesCost of Doing Business in Zamboanga CityJianna SepeNo ratings yet

- DL - Interim - Document - (JAZZY - GREEN - DL) .PDF (2) (1) (4) - 1Document1 pageDL - Interim - Document - (JAZZY - GREEN - DL) .PDF (2) (1) (4) - 1shawntaeadams04No ratings yet

- Fsic - Bus - Pasig - Ben 2 2022 - FsicDocument1 pageFsic - Bus - Pasig - Ben 2 2022 - FsicDiorella Micah ArcangelNo ratings yet

- Demolition Permit ChecklistDocument1 pageDemolition Permit ChecklistLemuel RobelNo ratings yet

- Certificate of Appearance: Head OfficeDocument4 pagesCertificate of Appearance: Head OfficeMylene OgayaNo ratings yet

- ChecklistDocument2 pagesChecklistTerra MetraNo ratings yet

- Application For Business Permit and License For Single ProprietorshipDocument2 pagesApplication For Business Permit and License For Single Proprietorshipaprilbaino4No ratings yet

- 2be PhotosDocument2 pages2be PhotosIctsol Cyber0% (1)