Professional Documents

Culture Documents

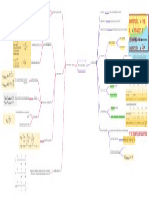

Mindmap QUANT - M1

Mindmap QUANT - M1

Uploaded by

Quyên ĐặngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mindmap QUANT - M1

Mindmap QUANT - M1

Uploaded by

Quyên ĐặngCopyright:

Available Formats

Today’s value of a cash flow that is to be received at some point in the future PV phần thu nhập mất đi do đã không

Present value vs Future value

lựa chọn một cơ hội đầu tư khác. Discount rate used to discount cashflows in future to PV

The amount to which a current deposit will grow over time FV

Opportunity cost forgo by choosing a course of action

Annual compounding

Required rate of return minimum rate must receive to accept the investment Nominal r.f = Real r.f + IP

Required ROR = nominal r.f + RP

Real risk-free rate

Nominal risk-free rate

Periodically compounding Lump-sum (single cashflow)

Inflation premium (IP)

Components Default risk premium -> Required rate of return = Real risk-free rate

+ Inflation premium + Default risk premium +

Continuously compounding Interest rate Liquidity premium + Maturity premium

Types of cashflow Premiums (compensate for bearing risk) Liquidity premium

R1: Time value of money

Maturity premium

Types of cashflow (GIÁ TRỊ THỜI GIAN CỦA TIỀN)

first cash flow (PMT) that occurs one period Ordinary annuity

from now (t1)

no reinvestment of interest

same interest overtime

Simple interest

increasing interest overtime

based on principal amount

first cash flow (PMT) that occurs immediately (t0) Annuity due

Annuity (Series of equal cashflow)

reinvestment of interest

first cash flow (PMT) that occurs one period from Compound interest

now (t1) Perpetuity based on principal amount + accumulate interest

never-ending sequential cash flows

NPV Effective annual rate (EAR) the rate investors actually realize as a result of compounding

(lãi suất thực hưởng)

Periodically compounding Type something

Type something Series of unequal cashflow

m→∞

Continuously compounding

Type something

Usage: The cash flow additivity principle can be used to solve problems Cashflow additivity rule

with uneven cash flows by combining single payments and annuities.

(quy tắc cộng dòng tiền)

You might also like

- Original PDF Economics of Money Banking and Financial Markets 12th Edition PDFDocument41 pagesOriginal PDF Economics of Money Banking and Financial Markets 12th Edition PDFwendy.ramos733100% (29)

- CIMA P1 Cheat SheetDocument2 pagesCIMA P1 Cheat Sheetasamy3010100% (1)

- Corporate Business Finance - MBCBF Muscat UNIVDocument2 pagesCorporate Business Finance - MBCBF Muscat UNIVsamaresh chhotrayNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Corporate Finance and ValueDocument1 pageCorporate Finance and Valueapi-3721037No ratings yet

- Financial Analysis of Fauji Cement LTDDocument27 pagesFinancial Analysis of Fauji Cement LTDMBA...KIDNo ratings yet

- LufthansaDocument36 pagesLufthansaAditya N Nair100% (1)

- Cfa - R1Document1 pageCfa - R1Thanh TuyềnNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Financial Mathematics FormulasDocument5 pagesFinancial Mathematics FormulasKhoaNamNguyenNo ratings yet

- FMP Interest Rates SSEIDocument1 pageFMP Interest Rates SSEIDIVYANSHU GUPTANo ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- AUDIT OF INVESTMENT - Debt SecuritiesDocument2 pagesAUDIT OF INVESTMENT - Debt SecuritiesJoshua LisingNo ratings yet

- Long Term Financing: After TaxDocument1 pageLong Term Financing: After TaxMa. Cristy BroncateNo ratings yet

- FormulaDocument2 pagesFormulaChu Thị Thanh ThảoNo ratings yet

- MM L1 Formula SheetDocument20 pagesMM L1 Formula SheetMlungisi MalazaNo ratings yet

- FMar Financial Markets Formulas Rob NotesDocument8 pagesFMar Financial Markets Formulas Rob NotesEvelyn LabhananNo ratings yet

- MapDocument1 pageMapddi40275No ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Bonds PayableDocument1 pageBonds PayableDarlyn AntoinetteNo ratings yet

- Measuring and Evaluate Bank PerformanceDocument1 pageMeasuring and Evaluate Bank PerformanceNguyen Hoai HuongNo ratings yet

- FIN - Chap 6 - Discount Cash Flows and ValuationDocument1 pageFIN - Chap 6 - Discount Cash Flows and Valuationduyennthds170525No ratings yet

- Chapter 4 (Money Market)Document29 pagesChapter 4 (Money Market)janellemoralestNo ratings yet

- HW#14 Ch9Document18 pagesHW#14 Ch9Young-Hun KimNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- Full download Finance for Executives: Managing for Value Creation 6th Edition Gabriel Hawawini file pdf all chapter on 2024Document44 pagesFull download Finance for Executives: Managing for Value Creation 6th Edition Gabriel Hawawini file pdf all chapter on 2024lioutauttley100% (1)

- (Download PDF) Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapter PDFDocument69 pages(Download PDF) Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapter PDFkingmajasrin40100% (11)

- CA Final AMA Summary Chart On Relevant Costing PDFDocument1 pageCA Final AMA Summary Chart On Relevant Costing PDFNksNo ratings yet

- Fin PrepDocument40 pagesFin PrepArijit GoraiNo ratings yet

- 13872-MSU Baroda Journalism PDFDocument2 pages13872-MSU Baroda Journalism PDFIrfan ShaikhNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Textbook Fundamentals of Financial Management Concise Edition Eugene F Brigham Ebook All Chapter PDFDocument53 pagesTextbook Fundamentals of Financial Management Concise Edition Eugene F Brigham Ebook All Chapter PDFmatthew.moniz582100% (16)

- Ebook Finance For Executives Managing For Value Creation PDF Full Chapter PDFDocument67 pagesEbook Finance For Executives Managing For Value Creation PDF Full Chapter PDFjulie.morrill858100% (38)

- Chap016 Capital Expenditure DecisionsDocument15 pagesChap016 Capital Expenditure Decisionsherwindo bagus saputroNo ratings yet

- IND AS 116 - P2-DraftDocument2 pagesIND AS 116 - P2-DraftSarun ChhetriNo ratings yet

- A 2 Quali ReviewerDocument4 pagesA 2 Quali ReviewerJASMIN RHYZEL C. PINEDANo ratings yet

- Chapter Five: Money MarketsDocument37 pagesChapter Five: Money MarketsLannie Mae SamayangNo ratings yet

- Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full ChapterDocument67 pagesFinance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapterjoyce.clewis414100% (20)

- Formula of Corporate FinanceDocument4 pagesFormula of Corporate FinancenswalehinfreelanceusaNo ratings yet

- Leave A Message Then Pass It On!!Document43 pagesLeave A Message Then Pass It On!!May RamosNo ratings yet

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalDocument2 pagesCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- Financial Derivatives CheatSheetDocument2 pagesFinancial Derivatives CheatSheetTiffanyNo ratings yet

- 1defined Benefits SummaryDocument2 pages1defined Benefits SummaryVince AbabonNo ratings yet

- Capital Expenditure DecisionsDocument30 pagesCapital Expenditure DecisionsWailNo ratings yet

- Investments 1Document1 pageInvestments 1Lyanna MormontNo ratings yet

- Current RatioDocument2 pagesCurrent RatioHafiz UllahNo ratings yet

- Reading 1 - Time Value of MoneyDocument34 pagesReading 1 - Time Value of MoneyAllen AravindanNo ratings yet

- Mind MapsDocument18 pagesMind MapsSOFT-TRENDSNo ratings yet

- 365+corporate Finance FormulasDocument6 pages365+corporate Finance FormulasSouradeep MondalNo ratings yet

- FIN - Chap 4 - Analyzing Financial StatementsDocument1 pageFIN - Chap 4 - Analyzing Financial Statementsduyennthds170525No ratings yet

- Previous Years Questions and AnswersDocument26 pagesPrevious Years Questions and Answerslucky420024No ratings yet

- Corporate Finance Cheat SheetsDocument7 pagesCorporate Finance Cheat SheetsDianeDianeNo ratings yet

- Chapter 18 Valuation Closing ThoughtsDocument18 pagesChapter 18 Valuation Closing ThoughtsdemelashNo ratings yet

- Cách Tính Ratios C A OCBDocument6 pagesCách Tính Ratios C A OCBTrình LimboNo ratings yet

- Security Valuation CA FinalDocument1 pageSecurity Valuation CA FinalAzru KhanNo ratings yet

- 2023 Level I NotesVideo R1 Module 1Document2 pages2023 Level I NotesVideo R1 Module 1robertNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- Cheat SheetDocument3 pagesCheat SheetnguyenbachptpNo ratings yet

- Module 3 - Cost of CapitalDocument59 pagesModule 3 - Cost of CapitalPrateek JainNo ratings yet

- A Guide To Venture Capital Term SheetsDocument22 pagesA Guide To Venture Capital Term Sheetsmlieberman0% (10)

- Options, Futures, and Other Derivatives, 5th Edition © 2002 by John C. HullDocument30 pagesOptions, Futures, and Other Derivatives, 5th Edition © 2002 by John C. HullHarry PasseyNo ratings yet

- INVENTORIES4Document2 pagesINVENTORIES4Katherine MagpantayNo ratings yet

- LFI - Workshop On Securities and Investment Laws - BrochureDocument5 pagesLFI - Workshop On Securities and Investment Laws - BrochureP S AmritNo ratings yet

- Chapter 6 Rural BanksDocument49 pagesChapter 6 Rural BanksChichay KarenJoyNo ratings yet

- Case ExhibitsDocument7 pagesCase Exhibitsug8No ratings yet

- Fins5514 L03 2023 PDFDocument80 pagesFins5514 L03 2023 PDFwilliam YuNo ratings yet

- GCSSF Dynamic DiscountingDocument7 pagesGCSSF Dynamic DiscountingMaharaniNo ratings yet

- Kalbe Farma TBK Billingual 31 Des 2021 ReleasedDocument163 pagesKalbe Farma TBK Billingual 31 Des 2021 ReleasedNanda IshermawanNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- E1.12 Percentages 2A Topic Booklet 1 - 1Document7 pagesE1.12 Percentages 2A Topic Booklet 1 - 1M MADANINo ratings yet

- Vegetron LTDDocument2 pagesVegetron LTDKinnary RoyNo ratings yet

- FM - Ii AssignmentDocument2 pagesFM - Ii Assignmentnewaybeyene5No ratings yet

- Real OptionsDocument18 pagesReal OptionsmakeyourcosmosNo ratings yet

- Zeus Case StudyDocument7 pagesZeus Case StudyBobYuNo ratings yet

- Money MarketDocument22 pagesMoney Marketprasham makwanaNo ratings yet

- New Final Updated IFRS 16Document66 pagesNew Final Updated IFRS 16janeth pallangyoNo ratings yet

- Chapter 4 SDocument17 pagesChapter 4 SLê Đăng Cát NhậtNo ratings yet

- L01 Practice Quiz Answer Key (BAINTE1L)Document2 pagesL01 Practice Quiz Answer Key (BAINTE1L)Ling lingNo ratings yet

- External Environment CHP # 2Document19 pagesExternal Environment CHP # 2Golam MostofaNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument21 pagesAccounting Cycle of A Merchandising Businesszedrick edenNo ratings yet

- Comparative Study On Npa of Public Sector Bank and Private Sector BankDocument45 pagesComparative Study On Npa of Public Sector Bank and Private Sector BankTushar SikarwarNo ratings yet

- Back Office Operations Module: Know Your Client, Anti-Money Laundering & Combating FinancingDocument8 pagesBack Office Operations Module: Know Your Client, Anti-Money Laundering & Combating FinancingrahulkatareyNo ratings yet

- Ilechukwu, Felix UbakaDocument8 pagesIlechukwu, Felix UbakaMariaa IvannaNo ratings yet

- Financial Statement Analysis OF Rafhan Maize Products Co LTDDocument17 pagesFinancial Statement Analysis OF Rafhan Maize Products Co LTDKhurram RazaNo ratings yet