Professional Documents

Culture Documents

Suri July 062502

Suri July 062502

Uploaded by

Firoz Shaikh0 ratings0% found this document useful (0 votes)

9 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

9 views1 pageSuri July 062502

Suri July 062502

Uploaded by

Firoz ShaikhCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 1

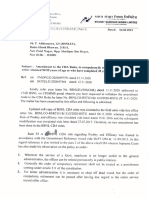

ORIGINAL FOR RECIPIENT / DUPLICATE FOR SUPPLIER

TAX INVOICE

‘SARASWATI CONSTRUCTION Trvoice:- SC/SRI/23-24/04

2972, NAYABAD Date :-07/10/2023

P.0- PANCHASAYAR , KOLKATA-700094 | Invoice Period :- JULY 2023

Mobile 9143842207 Cluster 1D ;- WBSUROO

Mall :khatua.d@gmail.com (Order No -1694586/2022/CM-WB ASN/S04

GSTIN :- 19AEYPKO238A1Z1 Date :- 19/12/2022

VENDOR CODE - 1221531 Place OF Service :- 19 (West Bengal

‘Tax is payable on Reverse Change :- No

Details of Service Receiver (Billed To) Details of Service Receiver (Billed To)

The AGM(Operation) / SURI OA, The AGM(Operation) / SURI OA,

(fo the GMTD, Asansol BA O/o the GMTD, Asansol BA

KANYAPUR polytechinic,Asansol-7133015 | KANYAPUR polytechinic,Asansol-7133015

State Code :- 19 (West Bengal State Code :- 19 (West Bengal

19AABCBSS76G3ZG GSTIN :- 29AABCB5576G37G

SLNO. DESCRIPTION AMOUNT,

SERVICE CHARGES

a Total Maintence Charges Rs. 17815=00

b. Additional incentive (Based on new cluster Police) Rs. (0-00

© Total Provisioning charges Rs. 0=00

. Total invoice Amount for the service(Mtce Rs. 47815=00

+Prov.Charges+Addl incentive) (a+b+c)

E GST @18% on Total Invoice Amount(GSTNO:- Rs. 3206-70

19AEYPKO238A1Z1) Payable by BSNL

f Total Payable Charges By BSNL (d + e) RS. 24021=70

PENALTY CHARGES

& Total Penalty for Maintenance Rs.

H. Additional Penalty for Mice Rs.

i Total Penalty for Provisioning Rs.

Z Total SLA Penalty (mtce+ Prov+Addl penalty) (g+hti) Rs.

ke ‘Add GST @ 18% On Total SLA Penalty(GSTNO:- Rs.

‘19AEYPKO238A12I) Payable by Franchisee

1 Penalty Payable by Franchisee (j+k) Rs,

mi Net Payable By BSNL (In Rupees) (f-1) Rs.

(Amount In Words = Rupees Twenty one Thousand and twenty two Only )

M/S SARASWATI CONSTRUCTION

Pre- Receipted Bill SARABWAT] seipmenen

Progra

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Inv 1902270267Document1 pageInv 1902270267Firoz ShaikhNo ratings yet

- Suri OCSC Hand OverDocument2 pagesSuri OCSC Hand OverFiroz ShaikhNo ratings yet

- Ankit Kumar RayDocument3 pagesAnkit Kumar RayFiroz ShaikhNo ratings yet

- Grade Card Tanvi-Tabassum (Periodic-Assessment 1-)Document2 pagesGrade Card Tanvi-Tabassum (Periodic-Assessment 1-)Firoz ShaikhNo ratings yet

- CV of Firoz ShaikhDocument2 pagesCV of Firoz ShaikhFiroz ShaikhNo ratings yet

- Agreement For Providing Wi-Fi Enterprise & RetailDocument4 pagesAgreement For Providing Wi-Fi Enterprise & RetailFiroz ShaikhNo ratings yet

- Bolpur Ocsc Lease Rent Sep 2023Document1 pageBolpur Ocsc Lease Rent Sep 2023Firoz ShaikhNo ratings yet

- Reply From BSNL Corporate OfficeDocument2 pagesReply From BSNL Corporate OfficeFiroz ShaikhNo ratings yet

- Akr Policy On PricingDocument4 pagesAkr Policy On PricingFiroz ShaikhNo ratings yet

- BSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliDocument3 pagesBSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliFiroz ShaikhNo ratings yet

- Padhlenotes - 9 - Social - H3-Nazism & Rise of HitlerDocument18 pagesPadhlenotes - 9 - Social - H3-Nazism & Rise of HitlerFiroz Shaikh0% (1)

- BSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliDocument3 pagesBSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliFiroz ShaikhNo ratings yet