Professional Documents

Culture Documents

Oct20 Ques-1

Oct20 Ques-1

Uploaded by

absankey770Copyright:

Available Formats

You might also like

- Amazon Vs Walmart Teaching NoteDocument35 pagesAmazon Vs Walmart Teaching Notechinmay manjrekarNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- 70067bos56011 Final p2qDocument6 pages70067bos56011 Final p2qVipul JainNo ratings yet

- Derivatives (Q) .Document3 pagesDerivatives (Q) .chandrakantchainani606No ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- 73535bos59345 Final p2qDocument6 pages73535bos59345 Final p2qSakshi vermaNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Question No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)Document6 pagesQuestion No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)rahul26665323No ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answeradarsh agrawalNo ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- 5302 Facgdse02t L 4Document4 pages5302 Facgdse02t L 4piyousshil13No ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- SFM Q MTP 1 Final May22Document5 pagesSFM Q MTP 1 Final May22Divya AggarwalNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- Test Your Knowledge: Theoretical QuestionsDocument30 pagesTest Your Knowledge: Theoretical QuestionsRITZ BROWN33% (3)

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- (WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7Document4 pages(WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7ishupandit620No ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Company Accounts, Cost and Management AccountingDocument10 pagesCompany Accounts, Cost and Management AccountingmeetwithsanjayNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Afm RTP 2021Document42 pagesAfm RTP 2021rpj.group2018No ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- 44 Corporate Accounting May 2022Document8 pages44 Corporate Accounting May 2022premium info2222No ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesDocument3 pagesChapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesAryan JainNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerYash GoklaniNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Dec 17Document10 pagesDec 17cacow83838No ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Ty Sorn-T: (Time:Z%) Iours)Document4 pagesTy Sorn-T: (Time:Z%) Iours)shahisonal02No ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security Valuationsam kapoorNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- CCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomeDocument26 pagesCCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomegopalkpsahuNo ratings yet

- Entrep Module 3Document10 pagesEntrep Module 3JOHN PAUL LAGAONo ratings yet

- Obhai Report ModifiedDocument21 pagesObhai Report ModifiedShahriar Sakib50% (2)

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- ZaraDocument14 pagesZaraMax Tan50% (2)

- Mr. AzamDocument12 pagesMr. AzamSheraz azamNo ratings yet

- Global Strategies N MNCDocument28 pagesGlobal Strategies N MNCPratik AgarwalNo ratings yet

- Case Study TemplateDocument2 pagesCase Study TemplatePitabash BeheraNo ratings yet

- MEM Lecture 8 2014Document16 pagesMEM Lecture 8 2014Abhijeet DashNo ratings yet

- Muhammad Usama: Marketing EnthusiasticDocument1 pageMuhammad Usama: Marketing EnthusiasticMuhammad Usama MahmoodNo ratings yet

- Rambir Insurance Group 2Document15 pagesRambir Insurance Group 2Nitin AgarwalNo ratings yet

- Departmentation 100929013117 Phpapp02Document11 pagesDepartmentation 100929013117 Phpapp02Tamil SelvanNo ratings yet

- Binary Option - WikipediaDocument1 pageBinary Option - WikipediaDanila Merino ParedesNo ratings yet

- Chapter 9 Basic Oligopoly ModelsDocument9 pagesChapter 9 Basic Oligopoly ModelsJericho James Madrigal CorpuzNo ratings yet

- Index Futures PricingDocument21 pagesIndex Futures PricingVaidyanathan RavichandranNo ratings yet

- Sumer Final 2Document7 pagesSumer Final 2Gizachew MengeshaNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Process NumericalDocument11 pagesProcess NumericalDeepak R GoradNo ratings yet

- Mkt501 - 3 - Midterm Paper Solved by Silentlips.... NewDocument6 pagesMkt501 - 3 - Midterm Paper Solved by Silentlips.... Newzahidwahla1No ratings yet

- NTPC PPT UpdateDocument52 pagesNTPC PPT UpdateSanjay SatyajitNo ratings yet

- Enterp MaterialDocument35 pagesEnterp Materialjaina rose yambao-paner100% (1)

- Cooper Case StudyDocument16 pagesCooper Case StudyRahul RathoreNo ratings yet

- Short Run & Long Run Supply Curve Under Perfect CompetitionDocument4 pagesShort Run & Long Run Supply Curve Under Perfect CompetitionJahanzaib AhmedNo ratings yet

- Accountability and Responsibility in Corporate GovernanceDocument65 pagesAccountability and Responsibility in Corporate Governanceapril rose dinampoNo ratings yet

- Blue Chapter 2 EDITEDDocument21 pagesBlue Chapter 2 EDITEDTee BoyNo ratings yet

- Jhon Alvarez ENGDocument1 pageJhon Alvarez ENGJhon AlvarezNo ratings yet

- Distribution Management - SummaryDocument45 pagesDistribution Management - Summaryleni thNo ratings yet

- 03 Coordinate Sales PerformanceDocument7 pages03 Coordinate Sales PerformanceSAMUALE ASSEFA MEKURIYANo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

Oct20 Ques-1

Oct20 Ques-1

Uploaded by

absankey770Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oct20 Ques-1

Oct20 Ques-1

Uploaded by

absankey770Copyright:

Available Formats

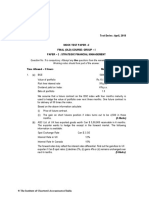

Test Series: October 2020

MOCK TEST PAPER

FINAL (NEW) COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

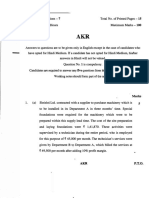

1. (a) Derivative Bank entered into a swap arrangement on a principal of ` 10 crores and agreed to

receive MIBOR overnight floating rate for a fixed payment on the principal. The swap was

entered into on Monday, 19th August, 2019 and was to commence on 20th August, 2019 and run

for a period of 7 days.

Respective MIBOR rates for Tuesday to Monday were:

8.15%, 7.98%, 7.95%, 8.12%, 8.15%, 7.75%.

If Fixed Rate of Interest is 8%, then evaluate

(i) the nature of this Swap arrangement.

(ii) the Net Settlement amount.

Notes:

(1) Sunday is Holiday.

(2) Work in rounded rupees and avoid decimal working.

(3) Consider 365 days in a year. (8 Marks)

(b) The following are the data on five portfolios:

Portfolio Return Standard Deviation Beta

A 15 7 1.25

B 18 10 0.75

C 14 5 1.40

D 12 6 0.98

E 16 9 1.50

You are required to evaluate the Reward to Volatility of these portfolio using:

Sharpe method and

Treynor's method

assuming the risk free rate is 6%. (8 Marks)

(c) Explain the problems that are faced in International Capital Budgeting Decision and how these

can be overcome. (4 Marks)

2. (a) You as a dealer in foreign exchange have the following position in GBP on 31 st October, 2019:

GBP

Balance in the Nostro A/c Credit 2,00,000

Opening Position Overbought 1,00,000

Purchased a bill on London 1,60,000

1

© The Institute of Chartered Accountants of India

Sold forward TT 1,20,000

Forward purchase contract cancelled 60,000

Remitted by TT 1,50,000

Draft on London cancelled 60,000

Decide the steps would you take, if you are required to maintain a credit Balance of GBP 65,000

in the Nostro A/c and keep as oversold position on GBP 20,000? (8 Marks)

(b) SAM Ltd. has just paid a dividend of ` 2 per share and it is expected to grow @ 6% p.a. After

paying dividend, the Board declared to take up a project by retaining the next three annual

dividends. It is expected that this project is of same risk as the existing projects. The results of

this project will start coming from the 4 th year onward from now. The dividends will then be ` 2.50

per share and will grow @ 7% p.a.

An investor has 1,000 shares in SAM Ltd. and wants a receipt of at least ` 2,000 p.a. from this

investment.

Interpret how the market value of the share is affected by the decision of the Board. Also advise

as to how the investor can maintain his target receipt from the investment for first 3 years and

improved income thereafter, given that the cost of capital of the firm is 8%. (8 Marks)

(c) “Sustainable growth is important to enterprise long-term development”. Explain this statement in

context of planning healthy corporate growth. (4 Marks)

3. (a) MK Ltd. is considering acquiring NN Ltd. The following information is available:

Company Earning after No. of Equity Shares Market Value

Tax (`) Per Share (`)

MK Ltd. 60,00,000 12,00,000 200.00

NN Ltd. 18,00,000 3,00,000 160.00

Exchange of equity shares for acquisition is based on current market value as above. There is no

synergy advantage available.

(i) Find the earning per share for company MK Ltd. after merger, and

(ii) Find the exchange ratio so that shareholders of NN Ltd. would not be at a loss.

(8 Marks)

(b) Mr. Y has invested in the three mutual funds (MF) as per the following details:

Particulars MF ‘X’ MF ‘Y’ MF ‘Z’

Amount of Investment (`) 2,00,000 4,00,000 2,00,000

Net Assets Value (NAV) at the time of purchase (`) 10.30 10.10 10

Dividend Received up to 31.03.2018 (`) 6,000 0 5,000

NAV as on 31.03.2018 (`) 10.25 10 10.20

Effective Yield per annum as on 31.03.2018 (percent) 9.66 -11.66 24.15

Assume 1 Year = 365 days

Mr. Y has misplaced the documents of his investment. Help him in finding the date of his original

investment after ascertaining the following:

(i) Number of units in each scheme;

(ii) Total NAV;

(iii) Total Yield; and

2

© The Institute of Chartered Accountants of India

(iv) Number of days investment held. (8 Marks)

(c) Explain various Asset Allocation Strategies. (4 Marks)

4. (a) Ram buys 10,000 shares of X Ltd. at a price of ` 22 per share whose beta value is 1.5 and sells

5,000 shares of A Ltd. at a price of ` 40 per share having a beta value of 2. He obtains a

complete hedge by Nifty futures at ` 1,000 each. He closes out his position at the closing price of

the next day when the share of X Ltd. dropped by 2%, share of A Ltd. appreciated by 3% and

Nifty futures dropped by 1.5%.

Interpret the overall profit/loss of Ram? (6 Marks)

(b) STR Ltd.’s current financial year's income statement reported its net income after tax as ` 50

Crore.

Following is the capital structure of STR Ltd. at the end of current financial year:

`

Debt (Coupon rate = 11%) 80 Crore

Equity (Share Capital + Reserves & Surplus) 250 Crore

Invested Capital 330 Crore

Following data is given to estimate cost of equity capital:

Asset Beta of TSR Ltd. 1.11

Risk –free Rate of Return 8.5%

Average market risk premium 9%

The applicable corporate income tax rate is 30%.

Estimate Economic Value Added (EVA) of RST Ltd. in ` lakh. (8 Marks)

(c) TRC Cables Ltd. (an Indian Company) is in the business of manufacturing Electrical Cables and

Data Cables including Fiber Optics cables. While mainly it exports the manufactured cables to

other countries it has also established its production facilities at some African countries’ due

availability of raw material and cheap labour there. Some of the major raw material such as

copper, aluminum and other non-ferrous metals are also imported from foreign countries. Hence

overall TRC has frequent receipts and expenditure items denominated in Non-INR currencies.

Though TRC make use of Long-Term Debts and Equity to meet its long term fund requirements

but to finance its operations it make use of short-term financial instruments such as Commercial

Papers, Bank Credit and Term Loans from the banks etc. If any surplus cash is left with TRC it is

invested in interest yielding securities. Recently due to stiff competition from its competitors TRC

has relaxed its policy for granting credit and to manage receivables it has formed a separate

credit division.

Further to hedge itself against the various risk it has entered into various OTC Derivatives

Contracts settled outside the Exchange.

Required:

Evaluate the major risks to which TRC Ltd. is exposed to. (6 Marks)

5. (a) Mr. A, a HNI invested on 1.4.2014 in certain equity shares as below:

Name of Co. No. of shares Cost (`)

X Ltd. 1,00,000 (` 100 each) 2,00,00,000

Y Ltd. 50,000 (` 10 each) 1,50,00,000

© The Institute of Chartered Accountants of India

In September 2014, 10% dividend was paid out by X Ltd. and in October 2014, 30% dividend

paid out by Y Ltd. On 31.3.2015 market quotations showed a value of ` 220 and ` 290 per share

for X Ltd. and Y Ltd. respectively.

On 1.4.2015, a technical analyst indicated as follows:

(1) that the probabilities of dividends from X Ltd. and Y Ltd. for the year ending 31.3.2016 are

as below:

Probability factor Dividend from X Ltd. (%) Dividend from Y Ltd. (%)

0.2 10 15

0.3 15 20

0.5 20 35

(2) that the probabilities of market quotations on 31.3.2016 are as below:

Probability factor Price/share of X Ltd. Price/share of Y Ltd.

0.2 220 290

0.5 250 310

0.3 280 330

You are required to:

(i) Analyze the average return from the portfolio for the year ended 31.3.2015;

(ii) Analyze the expected average return from the portfolio for the year 2015-16; and

(iii) Advise Mr. A, of the comparative risk in the two investments. (12 Marks)

(b) Explain the various problems that are faced in growth of Securitization of Instruments in Indian

context. (4 Marks)

(c) Explain various Market Indicators.

OR

Explain the term Angel Investor. (4 Marks)

6. (a) XYZ Ltd. has imported goods to the extent of US$ 8 Million. The payment terms are as under:

(1) 1% discount if full amount is paid immediately or

(2) 60 days interest free credit. However, in case of a further delay up to 30 days, interest at th e

rate of 8% p.a. will be charged for additional days after 60 days. M/s XYZ Ltd. has ` 25

Lakh available and for remaining it has an offer from bank for a loan up to 90 days @ 9.0%

p.a.

The quotes for foreign exchange are as follows:

Spot Rate INR/ US$ (buying) ` 66.98

60 days Forward Rate INR/ US$ (buying) ` 67.16

90 days Forward Rate INR/ US$ (buying) ` 68.03

Advise which one of the following options would be better for XYZ Ltd.

(i) Pay immediately after utilizing cash available and for balance amount take 90 days loan from

bank.

(ii) Pay the supplier on 60th day and avail bank’s loan (after utilizing cash) for 30 days.

(iii) Avail supplier offer of 90 days credit and utilize cash available.

© The Institute of Chartered Accountants of India

Further presume that the cash available with XYZ Ltd. will fetch a return of 4% p.a. in India till it

is utilized.

Assume year has 360 days. Ignore Taxation.

Compute your working upto four decimals and cash flows in ` in Crore. (10 Marks)

(b) A company is long on 10 MT of copper @ ` 534 per kg (spot) and intends to remain so for the

ensuing quarter. The variance of change in its spot and future prices are 16% and 36%

respectively, having correlation coefficient of 0.75. The contract size of one contract is 1,000 kgs.

Required:

(i) Calculate the Optimal Hedge Ratio for perfect hedging in Future Market.

(ii) Advice the position to be taken in Future Market for perfect hedging.

(iii) Determine the number and the amount of the copper futures to achieve a perfect hedge.

(6 Marks)

(c) Examine briefly the various innovative methods of funding the Startups. (4 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Amazon Vs Walmart Teaching NoteDocument35 pagesAmazon Vs Walmart Teaching Notechinmay manjrekarNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- 70067bos56011 Final p2qDocument6 pages70067bos56011 Final p2qVipul JainNo ratings yet

- Derivatives (Q) .Document3 pagesDerivatives (Q) .chandrakantchainani606No ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- 73535bos59345 Final p2qDocument6 pages73535bos59345 Final p2qSakshi vermaNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Question No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)Document6 pagesQuestion No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)rahul26665323No ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answeradarsh agrawalNo ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- 5302 Facgdse02t L 4Document4 pages5302 Facgdse02t L 4piyousshil13No ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- SFM Q MTP 1 Final May22Document5 pagesSFM Q MTP 1 Final May22Divya AggarwalNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- Test Your Knowledge: Theoretical QuestionsDocument30 pagesTest Your Knowledge: Theoretical QuestionsRITZ BROWN33% (3)

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- (WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7Document4 pages(WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7ishupandit620No ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Company Accounts, Cost and Management AccountingDocument10 pagesCompany Accounts, Cost and Management AccountingmeetwithsanjayNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Afm RTP 2021Document42 pagesAfm RTP 2021rpj.group2018No ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- 44 Corporate Accounting May 2022Document8 pages44 Corporate Accounting May 2022premium info2222No ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesDocument3 pagesChapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesAryan JainNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerYash GoklaniNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Dec 17Document10 pagesDec 17cacow83838No ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Ty Sorn-T: (Time:Z%) Iours)Document4 pagesTy Sorn-T: (Time:Z%) Iours)shahisonal02No ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security Valuationsam kapoorNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- CCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomeDocument26 pagesCCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomegopalkpsahuNo ratings yet

- Entrep Module 3Document10 pagesEntrep Module 3JOHN PAUL LAGAONo ratings yet

- Obhai Report ModifiedDocument21 pagesObhai Report ModifiedShahriar Sakib50% (2)

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- ZaraDocument14 pagesZaraMax Tan50% (2)

- Mr. AzamDocument12 pagesMr. AzamSheraz azamNo ratings yet

- Global Strategies N MNCDocument28 pagesGlobal Strategies N MNCPratik AgarwalNo ratings yet

- Case Study TemplateDocument2 pagesCase Study TemplatePitabash BeheraNo ratings yet

- MEM Lecture 8 2014Document16 pagesMEM Lecture 8 2014Abhijeet DashNo ratings yet

- Muhammad Usama: Marketing EnthusiasticDocument1 pageMuhammad Usama: Marketing EnthusiasticMuhammad Usama MahmoodNo ratings yet

- Rambir Insurance Group 2Document15 pagesRambir Insurance Group 2Nitin AgarwalNo ratings yet

- Departmentation 100929013117 Phpapp02Document11 pagesDepartmentation 100929013117 Phpapp02Tamil SelvanNo ratings yet

- Binary Option - WikipediaDocument1 pageBinary Option - WikipediaDanila Merino ParedesNo ratings yet

- Chapter 9 Basic Oligopoly ModelsDocument9 pagesChapter 9 Basic Oligopoly ModelsJericho James Madrigal CorpuzNo ratings yet

- Index Futures PricingDocument21 pagesIndex Futures PricingVaidyanathan RavichandranNo ratings yet

- Sumer Final 2Document7 pagesSumer Final 2Gizachew MengeshaNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Process NumericalDocument11 pagesProcess NumericalDeepak R GoradNo ratings yet

- Mkt501 - 3 - Midterm Paper Solved by Silentlips.... NewDocument6 pagesMkt501 - 3 - Midterm Paper Solved by Silentlips.... Newzahidwahla1No ratings yet

- NTPC PPT UpdateDocument52 pagesNTPC PPT UpdateSanjay SatyajitNo ratings yet

- Enterp MaterialDocument35 pagesEnterp Materialjaina rose yambao-paner100% (1)

- Cooper Case StudyDocument16 pagesCooper Case StudyRahul RathoreNo ratings yet

- Short Run & Long Run Supply Curve Under Perfect CompetitionDocument4 pagesShort Run & Long Run Supply Curve Under Perfect CompetitionJahanzaib AhmedNo ratings yet

- Accountability and Responsibility in Corporate GovernanceDocument65 pagesAccountability and Responsibility in Corporate Governanceapril rose dinampoNo ratings yet

- Blue Chapter 2 EDITEDDocument21 pagesBlue Chapter 2 EDITEDTee BoyNo ratings yet

- Jhon Alvarez ENGDocument1 pageJhon Alvarez ENGJhon AlvarezNo ratings yet

- Distribution Management - SummaryDocument45 pagesDistribution Management - Summaryleni thNo ratings yet

- 03 Coordinate Sales PerformanceDocument7 pages03 Coordinate Sales PerformanceSAMUALE ASSEFA MEKURIYANo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet