Professional Documents

Culture Documents

IAS 12 PG 87

IAS 12 PG 87

Uploaded by

contactpulkitagarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 12 PG 87

IAS 12 PG 87

Uploaded by

contactpulkitagarwalCopyright:

Available Formats

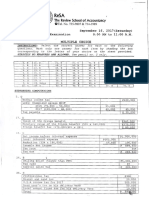

ACCA Financial Reporting (FR / F7)

CHAPTER 5: IAS 38 INTANGIBLE ASSETS

Example 21.4.1: temporary differences

Co purchase a NCA depnsop.ee .

Acc rule: HC $100, EUL 5 yrs, ERV=nil

T

Tax rule: Capital allowance @ 50% for 2 yrs bop a

: - .

Taxable profit before depreciation for year 1 to 5 = $100

Accounting profit before depreciation for year 1 to 5 = $100

Accounting base (AB)

Year 1 2 3 4 5

NCA

Historical cost 100 100 100 100 100

Acc depn (20 I C 40 ) C60 ) ( 80 ) ( 100)

Ab NBV (AB) 80 60 40 20 ' 0

>

i

Tax base (TB) 1 2 3 4 5

NCA derecognise

Historical cost 100 100 100 100 100

Acc capital allowance C 50 ) l 100) 0 0 0

TB TB 50 0 0 0 0

← f f f f

↳f TTD

arch

Da 30 60 40 20 O

:&

'

DTL (tax rate @ 20%) G → 12 8 4 O

14%4%4

→

Movement in DT

I

'

+6 46

soph ARE

Tp Taxable profit be4 CA 100 100 100 100 100

Cap allowance Coo) Coo )

-

-

-

Taxable profit 50 50 100 100 100

tax rate -

snot . -

tax prov for the year 10 10 20 to 20

Iaa

Year 1 2 3 4 5

Ap Acc pft be4 depn 100 100 100 100 100

depn ( 20 ) ( so) Cw) Cro ) Cro)

PBT So 80 80 So 80

Inc tax exp: ( wt )

Tax prov for crn year Cio ) cloy cm) Cr) CA )

{Zither RETIE

>

"

try

"

Inc/(Dec) in DT rag tee , 4 4 BOB

Profit for the year 64 64 64 64 64

Conclusion:

€① ⑧

For ASSETS ABg

> TB

taxable

TTD

Kab

Create a DTL

f

Dr Inc tax exp (SOPL)

Cr DTL (SOFP) 3 create prov

↳ taxi T .

87

You might also like

- Original PDF Principles of Managerial Finance 15th Edition PDFDocument41 pagesOriginal PDF Principles of Managerial Finance 15th Edition PDFwilliam.callaghan273100% (39)

- Midterm Partnership Liquidation AssignmentDocument6 pagesMidterm Partnership Liquidation AssignmentLee Suarez0% (1)

- Chapter 21Document16 pagesChapter 21Dick RodiNo ratings yet

- Prospective Analysis Theory and ConceptDocument32 pagesProspective Analysis Theory and ConceptEster Sabatini100% (1)

- Accounting Assignments Week 1Document12 pagesAccounting Assignments Week 1Taufan Putra100% (1)

- Cost of CapitalDocument4 pagesCost of CapitalBhhavya ChhedaNo ratings yet

- Fin Model Class9 Merger Model Using DCF MethodologyDocument1 pageFin Model Class9 Merger Model Using DCF MethodologyGel viraNo ratings yet

- 8 Tax CaseDocument5 pages8 Tax CaseDharmil OzaNo ratings yet

- Tax CaseDocument2 pagesTax CaseAnshika PandeyNo ratings yet

- Plate 1Document4 pagesPlate 1SilverNo ratings yet

- SolutionsDocument24 pagesSolutionsa86476007No ratings yet

- Hola-Kola: Section: E05 Group Number: G04 Name of ParticipantsDocument7 pagesHola-Kola: Section: E05 Group Number: G04 Name of ParticipantsSuvinay SethNo ratings yet

- 22 0021 - CC4.1CGDocument9 pages22 0021 - CC4.1CGakash.deria23-25No ratings yet

- Internal Reconstruction 08 - Class NotesDocument12 pagesInternal Reconstruction 08 - Class NotesVishu YadavNo ratings yet

- Theory of Costs: Short Run & Long RunDocument39 pagesTheory of Costs: Short Run & Long Runzahra naheedNo ratings yet

- CorrectionDocument2 pagesCorrectionLEE SIN YINo ratings yet

- Key AnswerDocument27 pagesKey AnswerMelvin Lee Felipe GarbinNo ratings yet

- Om ExerciseDocument6 pagesOm Exercisekristel lei diamanteNo ratings yet

- Om Exercise AnswerDocument6 pagesOm Exercise Answerkristel lei diamanteNo ratings yet

- PGDM CV DCF 20th August LectureDocument11 pagesPGDM CV DCF 20th August Lecturepratik waliwandekarNo ratings yet

- FM Sem AnswerDocument13 pagesFM Sem Answerjaikumar412003No ratings yet

- Ilustration 2Document5 pagesIlustration 2KiranNo ratings yet

- XXXXXXXDocument3 pagesXXXXXXXwritetomou26No ratings yet

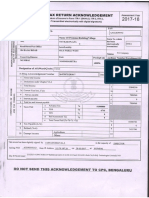

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Income Tax FinalDocument33 pagesIncome Tax Finalankush gaytriNo ratings yet

- Section C - Group 9 - Assignment 1Document20 pagesSection C - Group 9 - Assignment 1NEHA SARDANANo ratings yet

- SBCT Vor-Rwy-11 Iac 20231102Document1 pageSBCT Vor-Rwy-11 Iac 20231102Nivaldo FernandesNo ratings yet

- Acc - Q3cy10Document9 pagesAcc - Q3cy10Deepak GuptaNo ratings yet

- 05 July 2023Document12 pages05 July 2023sajedulNo ratings yet

- Theory of Costs: Short RunDocument45 pagesTheory of Costs: Short RunDyuti SinhaNo ratings yet

- Amalgamation Including AS 14 13 - Class NotesDocument11 pagesAmalgamation Including AS 14 13 - Class NotesMainak AdhikaryNo ratings yet

- Catatan + Latso 3Document2 pagesCatatan + Latso 3Mhd MahdiNo ratings yet

- Special Pension ProgramDocument1 pageSpecial Pension ProgramCollin RibarNo ratings yet

- แนวข้อสอบชุดที่ 5Document3 pagesแนวข้อสอบชุดที่ 5chaninat jaiareeNo ratings yet

- Cash Flow File No.1Document8 pagesCash Flow File No.1tomNo ratings yet

- Adobe Scan Mar 22, 2022Document1 pageAdobe Scan Mar 22, 2022Thor OdinsonNo ratings yet

- Subject: Student Registnat Ion No. - oS2-No. 19 1o 52Document1 pageSubject: Student Registnat Ion No. - oS2-No. 19 1o 52ShreyaNo ratings yet

- Payroll SummaryDocument3 pagesPayroll Summarynicole.upperNo ratings yet

- Cash Flows D.MDocument6 pagesCash Flows D.Mm.slug1212No ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Indian TAX: Ingome Return AgknowledgementDocument3 pagesIndian TAX: Ingome Return AgknowledgementnikhilbhorNo ratings yet

- 2023 Valuations Chapter 05 ProblemsDocument6 pages2023 Valuations Chapter 05 ProblemsShania LiwanagNo ratings yet

- 2nd PageDocument1 page2nd PageChristian CabacunganNo ratings yet

- Final Bill KRC Vetted As Per LAFCO 31-08-2017Document3 pagesFinal Bill KRC Vetted As Per LAFCO 31-08-2017shahzad_financeNo ratings yet

- Atomis Structure Quiz Solution Class 8thDocument5 pagesAtomis Structure Quiz Solution Class 8thNischalNo ratings yet

- Oct 2021 To Oct 2022Document1 pageOct 2021 To Oct 2022akshay20saNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Merak Fiscal Model Library: Algeria R/T (2005)Document3 pagesMerak Fiscal Model Library: Algeria R/T (2005)Libya TripoliNo ratings yet

- Butic 5Document1 pageButic 5Augustin TocarciucNo ratings yet

- KIOGA 2018 DuboisDocument49 pagesKIOGA 2018 DuboisLumea PoliticaNo ratings yet

- MAT Calculation: Setoff MAT Credits - End Net Tax PayableDocument2 pagesMAT Calculation: Setoff MAT Credits - End Net Tax PayableHardik ThackerNo ratings yet

- Kso TugasDocument7 pagesKso TugasRahmat Ramadhan RahmatNo ratings yet

- Practice Problems 2Document9 pagesPractice Problems 2Divyam GargNo ratings yet

- AdmissionOfPartner (Ratio, Revaluation)Document9 pagesAdmissionOfPartner (Ratio, Revaluation)Vansh RaghavNo ratings yet

- Sub Tools 360 PDFDocument2 pagesSub Tools 360 PDFJame SonNo ratings yet

- HWDocument24 pagesHWHala MNo ratings yet

- Miey - 1Document11 pagesMiey - 1parcoman222No ratings yet

- Book 1Document5 pagesBook 1Nhân NguyễnNo ratings yet

- Unit 3 Problems On Financial Analysis MAR 21, 2023Document5 pagesUnit 3 Problems On Financial Analysis MAR 21, 2023LOGESH WARAN PNo ratings yet

- Sbbi Vor-Z-Rwy-36 Iac 20231102Document1 pageSbbi Vor-Z-Rwy-36 Iac 20231102junior.ataidemauricioNo ratings yet

- B 23 5-Fev-24 To 4-Mar-24 7-Fev-2024 607.51 (XOF) - 20240514 - 141700 - 0000Document1 pageB 23 5-Fev-24 To 4-Mar-24 7-Fev-2024 607.51 (XOF) - 20240514 - 141700 - 0000krisNo ratings yet

- Tba810s SGSDocument6 pagesTba810s SGSjosue sotoNo ratings yet

- ProcessDocument40 pagesProcessFahad RazaNo ratings yet

- Appendix B IFRS S2 Sample WorksheetDocument2 pagesAppendix B IFRS S2 Sample WorksheetcontactpulkitagarwalNo ratings yet

- Appendix A IFRS S1 Sample WorksheetDocument4 pagesAppendix A IFRS S1 Sample WorksheetcontactpulkitagarwalNo ratings yet

- Bank FinTech Online Study Pack 2020Document41 pagesBank FinTech Online Study Pack 2020contactpulkitagarwalNo ratings yet

- @accaleaks F9-BPP PassCardsDocument129 pages@accaleaks F9-BPP PassCardscontactpulkitagarwalNo ratings yet

- Pricing Mechanisms - Paul Hastings - PWCDocument8 pagesPricing Mechanisms - Paul Hastings - PWCcontactpulkitagarwalNo ratings yet

- #MeToo in #MA - Introducing The Weinstein Warranty - Corporate - Commercial Law - AustraliaDocument2 pages#MeToo in #MA - Introducing The Weinstein Warranty - Corporate - Commercial Law - AustraliacontactpulkitagarwalNo ratings yet

- 1.2 Walker (Introduction To The City of London)Document13 pages1.2 Walker (Introduction To The City of London)contactpulkitagarwalNo ratings yet

- 2.1 Prof G A Walker (International Financial Markets) Summary DiagramDocument3 pages2.1 Prof G A Walker (International Financial Markets) Summary DiagramcontactpulkitagarwalNo ratings yet

- Investment Decision Rule For ItDocument2 pagesInvestment Decision Rule For ItIzzahIkramIllahiNo ratings yet

- Hhfa10 ch03 Student PPTDocument91 pagesHhfa10 ch03 Student PPTnoblevermaNo ratings yet

- Jawaban Soal Lat. Bu Iin+Soal (Visit ComDocument11 pagesJawaban Soal Lat. Bu Iin+Soal (Visit ComYhogan JayaNo ratings yet

- Public Finance & TaxationDocument4 pagesPublic Finance & Taxationfikremaryam hiwiNo ratings yet

- Written AssignmentDocument11 pagesWritten AssignmentJoseph KamaraNo ratings yet

- Forms and Activities of BusinessDocument45 pagesForms and Activities of Businessandrea jane hinaNo ratings yet

- Chapter 5. Income Statement, Balance Sheet - AppleDocument2 pagesChapter 5. Income Statement, Balance Sheet - AppleJodie NguyễnNo ratings yet

- Ebix: New Problems Emerge in Singapore, Sweden, and IndiaDocument30 pagesEbix: New Problems Emerge in Singapore, Sweden, and IndiagothamcityresearchNo ratings yet

- Problem 12-2 Cash Flow (LO2) : 1.00 PointsDocument37 pagesProblem 12-2 Cash Flow (LO2) : 1.00 PointsSheep ersNo ratings yet

- BAB 6 Efficient Capital MarketDocument61 pagesBAB 6 Efficient Capital MarketGirl HyukNo ratings yet

- Swing Trading MasterclassDocument20 pagesSwing Trading Masterclasscharles_399710661No ratings yet

- Acct Cheat SheetDocument3 pagesAcct Cheat SheetAllen LiouNo ratings yet

- Cipta Dana Cash: Asset ManagementDocument1 pageCipta Dana Cash: Asset ManagementFerrari .f488No ratings yet

- CH 1 To 8Document4 pagesCH 1 To 8John WickNo ratings yet

- Management Report Real MadridDocument92 pagesManagement Report Real MadridMohammad Feroz AzadNo ratings yet

- InventoriesDocument19 pagesInventoriesNoella Marie BaronNo ratings yet

- Maple Leaf Cement Factory AnalysisDocument54 pagesMaple Leaf Cement Factory Analysissahil karmali100% (1)

- Test 2 Review QuestionsDocument11 pagesTest 2 Review QuestionsMae Justine Joy TajoneraNo ratings yet

- 02 RebatesDocument53 pages02 RebatesughaniNo ratings yet

- CH 8Document1 pageCH 8Binat SanghaniNo ratings yet

- MCQ Adjusting EntriesDocument7 pagesMCQ Adjusting EntriesMara Clara100% (1)

- Spice House Business PlanDocument9 pagesSpice House Business Plananon_22054856No ratings yet

- ABC 10-ColumnDocument1 pageABC 10-Columnpor wansNo ratings yet

- JIT & Backflush CostingDocument5 pagesJIT & Backflush CostingMaureen LobinNo ratings yet

- Sunspot BeveragesDocument6 pagesSunspot BeveragesDeep GandhiNo ratings yet