Professional Documents

Culture Documents

7 - CIR vs. Solidbank Corp

7 - CIR vs. Solidbank Corp

Uploaded by

Kevin BesaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 - CIR vs. Solidbank Corp

7 - CIR vs. Solidbank Corp

Uploaded by

Kevin BesaCopyright:

Available Formats

CIR vs.

Solidbank Corporation

G.R. No. 148191, November 25, 1003

FACTS:

The case involves the interpretation of whether the 20% FWT on bank’s interest income

should be included in the computation of gross receipts tax.

The respondent-Solidbank Corp filed a letter request for refund or tax credit certificate

and a petition for review with the Court of Tax Appeals.

Solidbank included in its computation of its total gross receipts the sum of P70mn

representing 20% FWT on bank’s interest.

CA ruled that 20% FWT on bank’s interest should not form part of the gross receipts in

computing 5% GRT since FWT was not actually received by the bank but was directly

remitted to the government.

The CIR filed a petition for review with the SC.

Hence, the present petition

ISSUES:

W/N 20% FWT on interest income should form part of the gross receipts in computation of

gross receipts tax.

RULING:

NO. The Court GRANTED the petition and held that 20% FWT on banks interest should be

included in the computation of the taxable gross receipts for GRT.

The FWT, although not received by bank, is constructively received and forms part of their gross

receipts or earnings. FWT is tax on passive income, while GRT is tax on business. They are

different taxes imposed on different matters.

Hence, the petition is GRANTED.

You might also like

- China Banking Corporation vs. CADocument1 pageChina Banking Corporation vs. CAArmstrong BosantogNo ratings yet

- Bank of America v. CA and CIR DigestDocument2 pagesBank of America v. CA and CIR DigestNichole Lanuza50% (2)

- CIR v. Solidbank Corporation, 416 SCRA 436Document1 pageCIR v. Solidbank Corporation, 416 SCRA 436Jolina LunaNo ratings yet

- CIR V Solidbank CorporationDocument1 pageCIR V Solidbank CorporationFrancis Ray Arbon FilipinasNo ratings yet

- F. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Document3 pagesF. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Rhenee Rose Reas SugboNo ratings yet

- Tax Case DigestsDocument2 pagesTax Case DigestsJANNNo ratings yet

- CIR vs. CityTrustDocument2 pagesCIR vs. CityTrustRea Jane B. MalcampoNo ratings yet

- Cir vs. Solidbank Corporation2Document1 pageCir vs. Solidbank Corporation2Raquel DoqueniaNo ratings yet

- Title Commissioner of Internal Revenue VsDocument1 pageTitle Commissioner of Internal Revenue Vskass aceraNo ratings yet

- Cir Vs SolidbankDocument3 pagesCir Vs Solidbankdiamajolu gaygonsNo ratings yet

- Commissioner of Internal Revenue V Solidbank CorporationDocument2 pagesCommissioner of Internal Revenue V Solidbank CorporationMarj CenNo ratings yet

- 142 CIR v. CitytrustDocument3 pages142 CIR v. CitytrustclarkorjaloNo ratings yet

- China Banking Corp Vs CIRDocument2 pagesChina Banking Corp Vs CIRric tanNo ratings yet

- CIR Vs Bank of CommerceDocument2 pagesCIR Vs Bank of CommerceAster Beane AranetaNo ratings yet

- Cir v. SolidbankDocument2 pagesCir v. SolidbankChariNo ratings yet

- 084 CIR v. Citytrust (Potian)Document3 pages084 CIR v. Citytrust (Potian)Erika Potian100% (1)

- 131 CIR V SolidbankDocument2 pages131 CIR V Solidbankk santosNo ratings yet

- Tax Chapter 3Document3 pagesTax Chapter 3lowienerNo ratings yet

- Commissioner of Internal Revenue vs. Citytrust Investment Phils., Inc., G.R. Nos. 139786 & 140857, September 27, 2006Document4 pagesCommissioner of Internal Revenue vs. Citytrust Investment Phils., Inc., G.R. Nos. 139786 & 140857, September 27, 2006xxxaaxxxNo ratings yet

- China Banking Corporation Vs Commissioner of Internal RevenueDocument6 pagesChina Banking Corporation Vs Commissioner of Internal Revenuemarc bantugNo ratings yet

- CIR Vs SolidbankDocument3 pagesCIR Vs SolidbankJoel MilanNo ratings yet

- Comm of Internal Revenue Vs Solidbank Corp - 148191 - November 25, 2003 - J. PanDocument26 pagesComm of Internal Revenue Vs Solidbank Corp - 148191 - November 25, 2003 - J. PanMaria Jesse Anne GloriaNo ratings yet

- 10 CIR V CitytrustDocument1 page10 CIR V CitytrustAnn QuebecNo ratings yet

- CIR V SolidbankDocument14 pagesCIR V Solidbankrj_guzmanNo ratings yet

- 1 119139-2003-Commissioner of Internal Revenue. v.20210505-12-8zwl24Document18 pages1 119139-2003-Commissioner of Internal Revenue. v.20210505-12-8zwl24RJ YuNo ratings yet

- Cir vs. Solidbank CorporationDocument1 pageCir vs. Solidbank CorporationRaquel DoqueniaNo ratings yet

- CIR vs. Solidbank Corporation, G.R. No. 148191Document19 pagesCIR vs. Solidbank Corporation, G.R. No. 148191Shay GCNo ratings yet

- 01 CIR vs. Solidbank CorporationDocument15 pages01 CIR vs. Solidbank Corporationada mae santoniaNo ratings yet

- Asianbank Corp. vs. CIRDocument1 pageAsianbank Corp. vs. CIRenzymadam2631No ratings yet

- Petitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutDocument16 pagesPetitioner Vs Vs Respondent Pablo M. Bastes, Jr. and Rhodora J. Corcuera-Menzon Esquivas Cruz Conlu & YabutAggy AlbotraNo ratings yet

- Tax CasesDocument8 pagesTax CaseskaiaceegeesNo ratings yet

- China Banking Corporation v. CADocument3 pagesChina Banking Corporation v. CAamareia yapNo ratings yet

- Cir Vs Bank of Commerce DigestDocument3 pagesCir Vs Bank of Commerce Digestwaws20No ratings yet

- Tax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Document22 pagesTax Cases (Marubeni, Wander Phils, Cyanamid and Dlsu) (Digest and Full Text)Harlene Kaye Dayag TaguinodNo ratings yet

- CIR vs. Bank of Commerce (2005)Document16 pagesCIR vs. Bank of Commerce (2005)BenNo ratings yet

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapNo ratings yet

- Commissioner of Internal Revenue v. Solidbank Corporation (416 SCRA 436)Document17 pagesCommissioner of Internal Revenue v. Solidbank Corporation (416 SCRA 436)Art BurceNo ratings yet

- GR 147375 - Cir Vs BirDocument15 pagesGR 147375 - Cir Vs BirMarianRapadasNo ratings yet

- TAXATION - Full TextDocument131 pagesTAXATION - Full TextJanine CastroNo ratings yet

- G.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentDocument11 pagesG.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentShie DiazNo ratings yet

- Cir V. Solidbank Corporation: FactsDocument3 pagesCir V. Solidbank Corporation: FactsJustine Jay Casas LopeNo ratings yet

- Cir V Ayala Cir v. WanderDocument4 pagesCir V Ayala Cir v. WanderPhilip Frantz Guerrero100% (1)

- Court Decision On GRTDocument11 pagesCourt Decision On GRTzeuqsaverNo ratings yet

- China Banking Corporation v. CADocument2 pagesChina Banking Corporation v. CANiko Mangaoil AguilarNo ratings yet

- Cir Vs Bank of Commerce DigestDocument1 pageCir Vs Bank of Commerce DigestMimmi ShaneNo ratings yet

- TAX Digest 3Document2 pagesTAX Digest 3Barrymore Llegado Antonis IINo ratings yet

- G.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentDocument39 pagesG.R. No. 147375 June 26, 2006 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentMadel PresquitoNo ratings yet

- Tax Digests Sections 31 To 33Document8 pagesTax Digests Sections 31 To 33Lani LauretteNo ratings yet

- 01 CIR vs. Solidbank CorporationDocument15 pages01 CIR vs. Solidbank Corporationada mae santoniaNo ratings yet

- Doctrine in Taxation Consolidated CasesDocument29 pagesDoctrine in Taxation Consolidated CasesStela PantaleonNo ratings yet

- BA NT & SA v. CADocument3 pagesBA NT & SA v. CAiwamawiNo ratings yet

- Commissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFDocument11 pagesCommissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFClarence ProtacioNo ratings yet

- Tax Alert - 2005 - OctDocument11 pagesTax Alert - 2005 - OctKarina PulidoNo ratings yet

- CIR v. BPI, G.R. No. 147375, 2006Document12 pagesCIR v. BPI, G.R. No. 147375, 2006BREL GOSIMATNo ratings yet

- PT&DST DigestsDocument18 pagesPT&DST DigestsHiedi SugamotoNo ratings yet

- TAX Cases To ReciteDocument29 pagesTAX Cases To ReciteJurico AlonzoNo ratings yet

- CIR v. Bank of Commerce (2005) Case DigestDocument2 pagesCIR v. Bank of Commerce (2005) Case DigestShandrei GuevarraNo ratings yet

- CIR v. Citytrust Investment Phils (2006)Document3 pagesCIR v. Citytrust Investment Phils (2006)Aila Amp100% (1)

- Tax Digests - FandialanDocument5 pagesTax Digests - FandialanjoyfandialanNo ratings yet

- EAFS009842702ITRTY122020Document6 pagesEAFS009842702ITRTY122020Kevin BesaNo ratings yet

- Antipolo - RPT Clean-Up Computation PDFDocument1 pageAntipolo - RPT Clean-Up Computation PDFKevin BesaNo ratings yet

- EAFS009635608RPTTY122021Document3 pagesEAFS009635608RPTTY122021Kevin BesaNo ratings yet

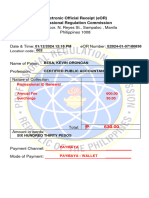

- Electronic Official Receipt (eOR) Professional Regulation CommissionDocument1 pageElectronic Official Receipt (eOR) Professional Regulation CommissionKevin BesaNo ratings yet

- Lwci Bir 1702 RT - 2023Document4 pagesLwci Bir 1702 RT - 2023Kevin BesaNo ratings yet

- 4 - US vs. Tang HoDocument1 page4 - US vs. Tang HoKevin BesaNo ratings yet

- Peralta vs. CSCDocument1 pagePeralta vs. CSCKevin BesaNo ratings yet

- 2 - Maceda vs. ERBDocument1 page2 - Maceda vs. ERBKevin BesaNo ratings yet

- Republic v. Spouses LibunaoDocument12 pagesRepublic v. Spouses LibunaoKevin BesaNo ratings yet

- CRIM 2 - Midterms 1Document24 pagesCRIM 2 - Midterms 1Kevin BesaNo ratings yet