Professional Documents

Culture Documents

Financial Analysis - and - Airplane Value Analysis

Financial Analysis - and - Airplane Value Analysis

Uploaded by

wilmerCopyright:

Available Formats

You might also like

- Financial Accounting 9th Edition Hoggett Test BankDocument21 pagesFinancial Accounting 9th Edition Hoggett Test Bankengagerscotsmangk9jt100% (32)

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- AirbusDocument3 pagesAirbusHP KawaleNo ratings yet

- Variable Cost Per Unit: ChemlingDocument2 pagesVariable Cost Per Unit: ChemlingRameezNo ratings yet

- 3 Financial AccountingDocument17 pages3 Financial Accountingooagentx440% (1)

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Final Exam Financial Management NameDocument6 pagesFinal Exam Financial Management NameInsatiable LifeNo ratings yet

- Mock 2 Section C.thapelo MolibeliDocument17 pagesMock 2 Section C.thapelo MolibeliLerato SelloNo ratings yet

- Practice SetDocument10 pagesPractice Setkaeya alberichNo ratings yet

- FM M.com 2nd Sem 2015Document4 pagesFM M.com 2nd Sem 2015Khurshid AlamNo ratings yet

- Helmet Manufacturing Industry-293269 PDFDocument68 pagesHelmet Manufacturing Industry-293269 PDFJaydeep MoharanaNo ratings yet

- Mgmt2023: Financial Management April/May 2009 Answer KeyDocument2 pagesMgmt2023: Financial Management April/May 2009 Answer Keyshaneice_lewisNo ratings yet

- Brealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022Document25 pagesBrealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022farroohaahmedNo ratings yet

- Investment and Finance - Exam Preparation - 20240117Document4 pagesInvestment and Finance - Exam Preparation - 20240117ivanboronat66No ratings yet

- Real Estate Portfolio Valuation Model v3.4Document11 pagesReal Estate Portfolio Valuation Model v3.4daniellehynes69No ratings yet

- Group No. 2 (CF)Document15 pagesGroup No. 2 (CF)Dhrupal TripathiNo ratings yet

- Hdpe PP Woven FabricDocument83 pagesHdpe PP Woven FabricRashmi bansalNo ratings yet

- Class Week Starting On 11.03.2019Document16 pagesClass Week Starting On 11.03.2019Jeeva KumarNo ratings yet

- IRR, NPV & MIRR Introduction PDFDocument9 pagesIRR, NPV & MIRR Introduction PDFhenryNo ratings yet

- CH 13 Capital Budgeting DecisionsDocument9 pagesCH 13 Capital Budgeting DecisionsChesley MoralesNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- Chapter12 Capital BudgetingDocument93 pagesChapter12 Capital Budgetingahmedgalalali497No ratings yet

- BMA 12e SM CH 10 FinalDocument17 pagesBMA 12e SM CH 10 FinalNikhil ChadhaNo ratings yet

- T2 Lecture 1 Slides - SDocument69 pagesT2 Lecture 1 Slides - SKa Ki LauNo ratings yet

- Managerial Accounting An Introduction to Concepts Methods and Uses 11th Edition Maher Solutions Manual instant download all chapterDocument40 pagesManagerial Accounting An Introduction to Concepts Methods and Uses 11th Edition Maher Solutions Manual instant download all chaptertrashimbeb100% (8)

- Finance AssignmentDocument9 pagesFinance AssignmentMEHR SHEIKHNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Midterm - Solutions 1) Theoretical QuestionsDocument4 pagesMidterm - Solutions 1) Theoretical QuestionsMarcos CachuloNo ratings yet

- Bos 47907Document21 pagesBos 47907Raghunath ChoudharyNo ratings yet

- Managerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Document9 pagesManagerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Ahmed Mohamed AwadNo ratings yet

- Investment Banking ClassDocument20 pagesInvestment Banking Classlaiba mujahidNo ratings yet

- Shareholder - Value - Creation Final VBM Intro and Indicators Final BestDocument93 pagesShareholder - Value - Creation Final VBM Intro and Indicators Final Bestsuparshva99iimNo ratings yet

- Real Estate Finance & Investments Midterm I Solutions Name: ID#Document7 pagesReal Estate Finance & Investments Midterm I Solutions Name: ID#Jiayu JinNo ratings yet

- (Download PDF) Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manual Full ChapterDocument40 pages(Download PDF) Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manual Full Chapterallenabeshay52100% (10)

- The Winning Edge, Inc. - Case StudyDocument4 pagesThe Winning Edge, Inc. - Case Studyanon_389892490No ratings yet

- Toll Road Project Report: Original Work by Shri Krishna Singh BhatiDocument8 pagesToll Road Project Report: Original Work by Shri Krishna Singh Bhatishrikrishna.b.98No ratings yet

- Discussion QuestionsDocument35 pagesDiscussion QuestionsSriRahayuNo ratings yet

- CH 13Document42 pagesCH 13mariam mohammedNo ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting TechniquesMishelNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFKimberlyLinesrb100% (13)

- Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions ManualDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manualc03a8stone100% (22)

- Capital Structure Determination Capital Structure DeterminationDocument41 pagesCapital Structure Determination Capital Structure DeterminationLEM tvNo ratings yet

- 10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFDocument53 pages10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFThulani NdlovuNo ratings yet

- F9 Financial Management ACCADocument4 pagesF9 Financial Management ACCAFaheem AhmadNo ratings yet

- Working Capital and Current Asset ManagementDocument38 pagesWorking Capital and Current Asset Management2021-SC040 PRANAYSAKHARAMDHANDENo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingKonstantinos DelaportasNo ratings yet

- Mba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Document2 pagesMba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Vampire KNo ratings yet

- Concrete Sleeper FactoryDocument69 pagesConcrete Sleeper FactoryDhirendra Kumar PandeyNo ratings yet

- Concrete Sleeper FactoryDocument69 pagesConcrete Sleeper FactorySahityaNo ratings yet

- Fiinancial Management ContdDocument28 pagesFiinancial Management Contdnirbhai singhNo ratings yet

- Lockheed Tri Star and Capital Budgeting Case Analysis: ProfessorDocument8 pagesLockheed Tri Star and Capital Budgeting Case Analysis: ProfessorlicservernoidaNo ratings yet

- Spicejet LTD.: October 22 October 22, 2010Document37 pagesSpicejet LTD.: October 22 October 22, 2010sunilpachisiaNo ratings yet

- SMBC AC Investment Whitepaper FinalDocument11 pagesSMBC AC Investment Whitepaper Finalbolivianita24No ratings yet

- FM (3rd) May2015Document2 pagesFM (3rd) May2015JohnNo ratings yet

- Econ F315 1923 CM 2017 1Document3 pagesEcon F315 1923 CM 2017 1Abhishek GhoshNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- How To Start AAC Plant - : AAC Block Making Business IdeasDocument59 pagesHow To Start AAC Plant - : AAC Block Making Business IdeasThunder ThorNo ratings yet

- Capital Budgeting AnalysisDocument25 pagesCapital Budgeting AnalysisMuhammad M BhattiNo ratings yet

- FE (201312) Paper II - Answer PDFDocument12 pagesFE (201312) Paper II - Answer PDFgaryNo ratings yet

- Financial Management 14 JuneDocument3 pagesFinancial Management 14 JunerajNo ratings yet

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityFrom EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Boeing Crisis Communicatons GuideDocument64 pagesBoeing Crisis Communicatons GuidewilmerNo ratings yet

- UWR China 24-Inch AntennaDocument99 pagesUWR China 24-Inch AntennawilmerNo ratings yet

- Airline Strategies & Business ModelsDocument59 pagesAirline Strategies & Business ModelswilmerNo ratings yet

- Dangerous Goods Teaching BookDocument80 pagesDangerous Goods Teaching BookwilmerNo ratings yet

- Wind Gradients and TurbulenceDocument8 pagesWind Gradients and TurbulencewilmerNo ratings yet

- Turbukence4 - ENDocument29 pagesTurbukence4 - ENwilmerNo ratings yet

- M2 Surviveonthe MoonDocument13 pagesM2 Surviveonthe MoonwilmerNo ratings yet

- An Overview and Analysis of The Impacts of Extreme Heat On The AvDocument49 pagesAn Overview and Analysis of The Impacts of Extreme Heat On The AvwilmerNo ratings yet

- Mmel Jan 17, 2023Document330 pagesMmel Jan 17, 2023wilmerNo ratings yet

- QRH 3707 143 Rev22 Full - 1688712953729Document412 pagesQRH 3707 143 Rev22 Full - 1688712953729wilmerNo ratings yet

- SmartRunway SmartLanding Upgrade For Business AircraftDocument24 pagesSmartRunway SmartLanding Upgrade For Business AircraftwilmerNo ratings yet

- Baku Logistic BriefingDocument7 pagesBaku Logistic BriefingwilmerNo ratings yet

- All Weather Operations ManualDocument276 pagesAll Weather Operations Manualwilmer100% (1)

- Bru Ebbr BrusselsDocument60 pagesBru Ebbr BrusselswilmerNo ratings yet

- Eperf PromoDocument8 pagesEperf PromowilmerNo ratings yet

- Doors OperationDocument27 pagesDoors OperationwilmerNo ratings yet

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyNo ratings yet

- FMD 2022 Half Year Activity Report - FinalDocument78 pagesFMD 2022 Half Year Activity Report - FinalPaul WaltersNo ratings yet

- Books List - Rich WealthDocument5 pagesBooks List - Rich WealthsenawoNo ratings yet

- Research and Development Activities of Life Insurance CompaniesDocument15 pagesResearch and Development Activities of Life Insurance CompaniesHtet Lynn HtunNo ratings yet

- Portfolio TheoryDocument3 pagesPortfolio TheoryZain MughalNo ratings yet

- Nivmo 0001Document1 pageNivmo 0001rav prashant SinghNo ratings yet

- Chapter 5Document33 pagesChapter 5KarimBekdashNo ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Sumit Saurav - Term - Paper - FOFDocument7 pagesSumit Saurav - Term - Paper - FOFsumit saurabNo ratings yet

- Power of Strategy MM3201 Draft QuestionnaireDocument4 pagesPower of Strategy MM3201 Draft QuestionnaireDaniela GetaladaNo ratings yet

- Finance Chapter+3Document38 pagesFinance Chapter+3Rouvenn LaoNo ratings yet

- ch16 SolDocument12 pagesch16 SolJohn Nigz Payee100% (1)

- Peter Navarro PFDDocument12 pagesPeter Navarro PFDThinkProgressNo ratings yet

- Postgraduate Diploma in Business Management Qualification Delivery HandbookDocument13 pagesPostgraduate Diploma in Business Management Qualification Delivery Handbookveeru9No ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test BankDocument49 pagesFinancial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test BankCarrieSchmidtoryzd100% (9)

- Lecture 3 - Valuing Debt InstrumentsDocument33 pagesLecture 3 - Valuing Debt Instrumentschenzhi fanNo ratings yet

- Unit 2 - Legal - Forms - of - BusinessDocument14 pagesUnit 2 - Legal - Forms - of - BusinessKouame AdjepoleNo ratings yet

- Introduction To Financial ManagementDocument43 pagesIntroduction To Financial ManagementHazel Jane EsclamadaNo ratings yet

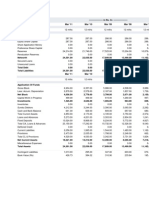

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Balance Sheet of InfosysDocument5 pagesBalance Sheet of InfosysLincy SubinNo ratings yet

- Gem PDFDocument683 pagesGem PDFBrooklets GeeNo ratings yet

- Piramal Fund Management Domestic Real Estate Strategy IDocument31 pagesPiramal Fund Management Domestic Real Estate Strategy IkanikaNo ratings yet

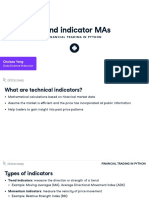

- Trend Indicator Mas: Chelsea YangDocument29 pagesTrend Indicator Mas: Chelsea YangHo Huu TienNo ratings yet

- Alert Company S Shareholders Equity Prior To Any of The Following PDFDocument1 pageAlert Company S Shareholders Equity Prior To Any of The Following PDFHassan JanNo ratings yet

- Tata Investment 2016 PDFDocument114 pagesTata Investment 2016 PDFSumit JhaNo ratings yet

- 247806Document51 pages247806Jack ToutNo ratings yet

- Mr. P Krishnamurthy, Ex-Cgm RbiDocument35 pagesMr. P Krishnamurthy, Ex-Cgm RbiKeigan ChatterjeeNo ratings yet

Financial Analysis - and - Airplane Value Analysis

Financial Analysis - and - Airplane Value Analysis

Uploaded by

wilmerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis - and - Airplane Value Analysis

Financial Analysis - and - Airplane Value Analysis

Uploaded by

wilmerCopyright:

Available Formats

Financial Analysis

Aircraft Evaluation

Techniques

BOEING is a trademark of Boeing Management Company.

Copyright © 2010 Boeing. All rights reserved.

Aircraft Evaluation

Equipment analysis Operational analysis

Financial analysis

Market

Considerations Strategic planning

Financing alternatives Other:

Image

Passenger preference

Economic analysis

Flexibility

Reliability

Copyright © 2010 Boeing. All rights reserved.

Agenda

Financial Evaluation of Projects

Time Value of Money

Cost Of Capital

Value Analysis Example

Sensitivity Analysis

Copyright © 2010 Boeing. All rights reserved.

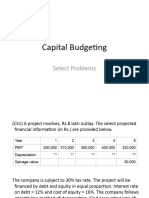

Financial Evaluation of Projects

Basic question

When it is time to invest in the business, how do we know what is a

good investment and what isn’t?

Basic answer

When the return on the investment is higher than the cost of the

money invested.

How do we measure this?

Copyright © 2010 Boeing. All rights reserved.

Financial Evaluation of Projects

Estimate relevant cash flows

Calculate a figure of merit for the investment

Payback period

Accounting rate of return

Profitability index

Net present value

Internal rate of return

Modified internal rate of return

Compare the figure of merit to an acceptance criterion

Copyright © 2010 Boeing. All rights reserved.

Time Value of Money

An Example Project

100

Cash out -100

50

23 23 23 23 23 23

Cash in

6 x 23 = 138

0

Cash

in and Net cash 38

out

-50

-100 Looks like a

-100

good deal!

-150

1 2 3 4 5 6 7

Copyright © 2010 Boeing. All rights reserved.

Time Value of Money

To properly evaluate a financial project, the amounts and the timing of

cash flows need to be considered.

Basic relationship: A dollar tomorrow is worth less than a dollar today

Year 1 2 3 4 5 6

Sum

Cash flow 23 23 23 23 23 23 138

Present value

at 10% 21 19 17 16 14 13 100

You could invest 17 dollars today at 10% to receive 23 dollars three years from

now. Seventeen dollars is the present value of 23 dollars three years from now.

Copyright © 2010 Boeing. All rights reserved.

Time Value of Money

The Value of the Project Depends on the Cost of the

Capital Invested

40

30

Net 20

present

value 10

-10

-20

-30

0 2 4 6 8 10 12 14 16 18 20

Cost of money, %

Copyright © 2010 Boeing. All rights reserved.

Cost of Capital

How would an airline calculate its cost of capital?

Typical Typical Overall

airline costs airline mix cost

Borrowed money (debt) 5% – 6%

Interest expense is tax deductible, so interest paid means taxes are reduced.

Debt cost after tax* 3.25% - 3.9% 55% 1.9%

Invested money (equity) 13% – 18% 45% 7.0%

“Weighted average cost of capital” 8.9%

Other adjustments 0.0%

Hurdle rate 8.9%

*Tax rate of 35%

Copyright © 2010 Boeing. All rights reserved.

Value Analysis - Example

The basic question: How can we compare two alternative aircraft?

The basic answer: By weighing the value each aircraft provides.

We measure the earning power of a capital asset such as a

commercial airplane by estimating its future cash flows and

discounting them back at the airline’s cost of capital.

787-8 767-300ER

Versus

Copyright © 2010 Boeing. All rights reserved.

Value Analysis - Example

Analysis Groundrules

10-year study

10% discount rate

Pretax analysis

7,480-km average trip length

625 trips per year

Number of seats

787-8 224 seats

767-300ER 218 seats

Age of aircraft

787-8 new

767-300ER new

Aircraft will be leased

787-8 $1,000,000 per month

767-300ER $650,000 per month

Copyright © 2010 Boeing. All rights reserved.

Value Analysis - Example

Passenger Revenue

6 more despill 1.9 more

seats passengers

$.082 yield,

$1,168 more net

revenue per trip

10 years,

10% discount,

$730K more net

2% esc 625 trips

$4.8m revenue per

NPV year

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Passenger Revenue

Additional seats provide additional opportunity for revenue

generation

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of $366.7M $371.5M $4.8M

passenger revenue*

NPV of: Number of flights x trip length x passengers x yield

*$0.08 yield per rpk, using spill model with passenger demand of 159

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

The 787-8 Generates $4.8 Million More Revenue Than the 767-300ER

767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Total $0 $4.8M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Cargo Revenue

Increased cargo capacity on the 787-8 provides additional

opportunity to generate cargo revenue

Advantage

767-300ER 787-8 767-300ER 787-8

10 year NPV of

Cargo Revenue* $13.9M $16.3M $2.4M

NPV of: Number of flights x trip length x kg x yield

*yield $2 per kg

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Total $0 $7.2M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Fuel Expense

The lower fuel burn and increased speed of the 787-8 generates

value

Advantage

767-300ER 787-8 767-300ER 787-8

10 year NPV of

fuel expense* $107.9M $91.2M $16.7M

NPV of: Number of block-hours x fuel burn per block-hour x fuel price per gallon

*Fuel price of $2.00 per gallon, 787 block time of 8.721 hr, 767-300 block time of 9.159 hr, 15-min ground time

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Total $0 $23.9M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

The 787 is designed for Low Maintenance:

Less Scheduled Maintenance

Longer Check Composite Structure Fewer Maintenance

Intervals Resists fatigue Tasks

Twice as long as the Resists corrosion Less inspections with

767 30% Fewer tasks composite structures

Less Unscheduled Maintenance

More Reliable More Durable Structure Health Monitoring

Systems Less accidental damage System monitoring

Designed for low life Easy to inspect Engine monitoring

cycle costs Quick repair techniques

No Pneumatic

system

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Maintenance

The 787-8 was designed for low maintenance costs

Advantage

767-300ER 787-8 767-300ER 787-8

10 year NPV of

maintenance* $26.2M $18.0M $8.2M

NPV of: Cost per flight-hour x number of flight-hours

*Includes airframe and engine labor and material for in-house and contract maintenance plus overhead

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Total $0 $32.1M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Landing and Navigation

The 787-8 higher MTOW results in higher landing and navigation fees

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

landing and navigation $26.3M $28.6M $2.3M

NPV of: (Landing fees + navigation fees per flight) x number of flights

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Total $2.3 $32.1M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Crew Costs

Increased speed reduces block hours and subsequent crew costs

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

crew costs* $78.9M $74.5M $4.4M

NPV of: (Flight crew + cabin crew cost per flight) x number of flights

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Total $2.3 $36.5M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Insurance

The lower insured value of the 767-300ER results in lower insurance

premiums

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

insurance* $3.5M $5.4M $1.9M

NPV of: Insurance rate x aircraft value

*Insurance rate: .07%

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Total $4.2 $36.5M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Ground Handling and Power

The slightly smaller 767-300ER generates a minimal cost savings

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

ground handling $11.4M $11.5M $0.1M

and power

NPV of: Cost per flight x number of flights

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Ground Handling -0.1

Total $4.2 $36.5M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Passenger Related Costs

The revenue advantage of carrying more passengers is reduced by

the cost of carrying them

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

passenger related $49.3M $50.0M $.7M

costs

NPV of: Cost per flight x number of flights

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Ground Handling -0.1

Passenger Cost -0.7

Total $5.0 $36.5M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Cargo Handling Costs

The revenue advantage of carrying more cargo is reduced by

the cost of carrying it

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

Cargo handling costs $7.8M $9.2M $1.4M

NPV of: Cost per flight x number of flights

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Ground Handling -0.1

Passenger Cost -0.7

Cargo Handling -1.4

Total $6.4 $36.5M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Schedule Reliability and Maintenance Days

The advanced technology of the 787-8 generates additional revenue

potential as there are less days out of service

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

$1.9M $1.0M $.9m

Reliability*

* Average per aircraft days out of fleet

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Ground Handling -0.1

Passenger Cost -0.7

Cargo Handling -1.4

Schedule Reliability 0.9

Total $6.4 $37.4M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Lease Expense

The advantages of the new 787-8 are reflected in a higher monthly

lease rate

Advantage

767-300ER 787-8 767-300ER 787-8

10-year NPV of

lease expense* $48.7M $74.9M $26.2M

NPV of: Initial deposit and monthly lease payments

* 787-8 lease rate of $1,000,000 per month, 767-300ER lease rate of $650,000 per month, 3-month deposit

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Scorecard 767-300ER advantages 787-8 advantages

Passenger revenue 4.8

Cargo Revenue 2.4

Fuel expense 16.7

Maintenance 8.2

Landing/Nav Fees -2.3

Crew Costs 4.4

Insurance -1.9

Ground Handling -0.1

Passenger Cost -0.7

Cargo Handling -1.4

Schedule Reliability 0.9

Lease Expense -26.2

Total $32.6 $37.4M

Copyright © 2010 Boeing. All rights reserved.

Value Analysis—Example

Conclusion

Based on this analysis, the New 787-8 generates $4.8 million

more value than the 767-300ER

787-8 advantages $37.4M

767-300ER advantages $32.6M

Net 787-8 advantage $4.8M

Copyright © 2010 Boeing. All rights reserved.

Sensitivity Analysis

It is important to look at the NPV calculations and determine

the critical variables and assumptions that will determine the

project’s success or failure…..

Passenger and cargo yields

Load factors and demand

Discount rate

Fuel price

Unit costs

Monte Carlo simulation

Copyright © 2010 Boeing. All rights reserved.

Financial Analysis

Summary

Time value of money is an important concept for any

investment evaluation

Financial analysis allows us to systematically compare

aircraft alternatives and identify opportunities

Sensitivity analysis helps us understand the impact of

changes to key variables

Financial analysis is one element in the aircraft acquisition

process

Copyright © 2010 Boeing. All rights reserved.

You might also like

- Financial Accounting 9th Edition Hoggett Test BankDocument21 pagesFinancial Accounting 9th Edition Hoggett Test Bankengagerscotsmangk9jt100% (32)

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- AirbusDocument3 pagesAirbusHP KawaleNo ratings yet

- Variable Cost Per Unit: ChemlingDocument2 pagesVariable Cost Per Unit: ChemlingRameezNo ratings yet

- 3 Financial AccountingDocument17 pages3 Financial Accountingooagentx440% (1)

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Final Exam Financial Management NameDocument6 pagesFinal Exam Financial Management NameInsatiable LifeNo ratings yet

- Mock 2 Section C.thapelo MolibeliDocument17 pagesMock 2 Section C.thapelo MolibeliLerato SelloNo ratings yet

- Practice SetDocument10 pagesPractice Setkaeya alberichNo ratings yet

- FM M.com 2nd Sem 2015Document4 pagesFM M.com 2nd Sem 2015Khurshid AlamNo ratings yet

- Helmet Manufacturing Industry-293269 PDFDocument68 pagesHelmet Manufacturing Industry-293269 PDFJaydeep MoharanaNo ratings yet

- Mgmt2023: Financial Management April/May 2009 Answer KeyDocument2 pagesMgmt2023: Financial Management April/May 2009 Answer Keyshaneice_lewisNo ratings yet

- Brealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022Document25 pagesBrealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022farroohaahmedNo ratings yet

- Investment and Finance - Exam Preparation - 20240117Document4 pagesInvestment and Finance - Exam Preparation - 20240117ivanboronat66No ratings yet

- Real Estate Portfolio Valuation Model v3.4Document11 pagesReal Estate Portfolio Valuation Model v3.4daniellehynes69No ratings yet

- Group No. 2 (CF)Document15 pagesGroup No. 2 (CF)Dhrupal TripathiNo ratings yet

- Hdpe PP Woven FabricDocument83 pagesHdpe PP Woven FabricRashmi bansalNo ratings yet

- Class Week Starting On 11.03.2019Document16 pagesClass Week Starting On 11.03.2019Jeeva KumarNo ratings yet

- IRR, NPV & MIRR Introduction PDFDocument9 pagesIRR, NPV & MIRR Introduction PDFhenryNo ratings yet

- CH 13 Capital Budgeting DecisionsDocument9 pagesCH 13 Capital Budgeting DecisionsChesley MoralesNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- Chapter12 Capital BudgetingDocument93 pagesChapter12 Capital Budgetingahmedgalalali497No ratings yet

- BMA 12e SM CH 10 FinalDocument17 pagesBMA 12e SM CH 10 FinalNikhil ChadhaNo ratings yet

- T2 Lecture 1 Slides - SDocument69 pagesT2 Lecture 1 Slides - SKa Ki LauNo ratings yet

- Managerial Accounting An Introduction to Concepts Methods and Uses 11th Edition Maher Solutions Manual instant download all chapterDocument40 pagesManagerial Accounting An Introduction to Concepts Methods and Uses 11th Edition Maher Solutions Manual instant download all chaptertrashimbeb100% (8)

- Finance AssignmentDocument9 pagesFinance AssignmentMEHR SHEIKHNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Midterm - Solutions 1) Theoretical QuestionsDocument4 pagesMidterm - Solutions 1) Theoretical QuestionsMarcos CachuloNo ratings yet

- Bos 47907Document21 pagesBos 47907Raghunath ChoudharyNo ratings yet

- Managerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Document9 pagesManagerial Finance Group 2C Online Wednesday Mid Term Ahmed Mohamed Mohamed Ibrahem ID: 20122069Ahmed Mohamed AwadNo ratings yet

- Investment Banking ClassDocument20 pagesInvestment Banking Classlaiba mujahidNo ratings yet

- Shareholder - Value - Creation Final VBM Intro and Indicators Final BestDocument93 pagesShareholder - Value - Creation Final VBM Intro and Indicators Final Bestsuparshva99iimNo ratings yet

- Real Estate Finance & Investments Midterm I Solutions Name: ID#Document7 pagesReal Estate Finance & Investments Midterm I Solutions Name: ID#Jiayu JinNo ratings yet

- (Download PDF) Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manual Full ChapterDocument40 pages(Download PDF) Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manual Full Chapterallenabeshay52100% (10)

- The Winning Edge, Inc. - Case StudyDocument4 pagesThe Winning Edge, Inc. - Case Studyanon_389892490No ratings yet

- Toll Road Project Report: Original Work by Shri Krishna Singh BhatiDocument8 pagesToll Road Project Report: Original Work by Shri Krishna Singh Bhatishrikrishna.b.98No ratings yet

- Discussion QuestionsDocument35 pagesDiscussion QuestionsSriRahayuNo ratings yet

- CH 13Document42 pagesCH 13mariam mohammedNo ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting TechniquesMishelNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFKimberlyLinesrb100% (13)

- Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions ManualDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manualc03a8stone100% (22)

- Capital Structure Determination Capital Structure DeterminationDocument41 pagesCapital Structure Determination Capital Structure DeterminationLEM tvNo ratings yet

- 10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFDocument53 pages10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFThulani NdlovuNo ratings yet

- F9 Financial Management ACCADocument4 pagesF9 Financial Management ACCAFaheem AhmadNo ratings yet

- Working Capital and Current Asset ManagementDocument38 pagesWorking Capital and Current Asset Management2021-SC040 PRANAYSAKHARAMDHANDENo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingKonstantinos DelaportasNo ratings yet

- Mba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Document2 pagesMba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Vampire KNo ratings yet

- Concrete Sleeper FactoryDocument69 pagesConcrete Sleeper FactoryDhirendra Kumar PandeyNo ratings yet

- Concrete Sleeper FactoryDocument69 pagesConcrete Sleeper FactorySahityaNo ratings yet

- Fiinancial Management ContdDocument28 pagesFiinancial Management Contdnirbhai singhNo ratings yet

- Lockheed Tri Star and Capital Budgeting Case Analysis: ProfessorDocument8 pagesLockheed Tri Star and Capital Budgeting Case Analysis: ProfessorlicservernoidaNo ratings yet

- Spicejet LTD.: October 22 October 22, 2010Document37 pagesSpicejet LTD.: October 22 October 22, 2010sunilpachisiaNo ratings yet

- SMBC AC Investment Whitepaper FinalDocument11 pagesSMBC AC Investment Whitepaper Finalbolivianita24No ratings yet

- FM (3rd) May2015Document2 pagesFM (3rd) May2015JohnNo ratings yet

- Econ F315 1923 CM 2017 1Document3 pagesEcon F315 1923 CM 2017 1Abhishek GhoshNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- How To Start AAC Plant - : AAC Block Making Business IdeasDocument59 pagesHow To Start AAC Plant - : AAC Block Making Business IdeasThunder ThorNo ratings yet

- Capital Budgeting AnalysisDocument25 pagesCapital Budgeting AnalysisMuhammad M BhattiNo ratings yet

- FE (201312) Paper II - Answer PDFDocument12 pagesFE (201312) Paper II - Answer PDFgaryNo ratings yet

- Financial Management 14 JuneDocument3 pagesFinancial Management 14 JunerajNo ratings yet

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityFrom EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Boeing Crisis Communicatons GuideDocument64 pagesBoeing Crisis Communicatons GuidewilmerNo ratings yet

- UWR China 24-Inch AntennaDocument99 pagesUWR China 24-Inch AntennawilmerNo ratings yet

- Airline Strategies & Business ModelsDocument59 pagesAirline Strategies & Business ModelswilmerNo ratings yet

- Dangerous Goods Teaching BookDocument80 pagesDangerous Goods Teaching BookwilmerNo ratings yet

- Wind Gradients and TurbulenceDocument8 pagesWind Gradients and TurbulencewilmerNo ratings yet

- Turbukence4 - ENDocument29 pagesTurbukence4 - ENwilmerNo ratings yet

- M2 Surviveonthe MoonDocument13 pagesM2 Surviveonthe MoonwilmerNo ratings yet

- An Overview and Analysis of The Impacts of Extreme Heat On The AvDocument49 pagesAn Overview and Analysis of The Impacts of Extreme Heat On The AvwilmerNo ratings yet

- Mmel Jan 17, 2023Document330 pagesMmel Jan 17, 2023wilmerNo ratings yet

- QRH 3707 143 Rev22 Full - 1688712953729Document412 pagesQRH 3707 143 Rev22 Full - 1688712953729wilmerNo ratings yet

- SmartRunway SmartLanding Upgrade For Business AircraftDocument24 pagesSmartRunway SmartLanding Upgrade For Business AircraftwilmerNo ratings yet

- Baku Logistic BriefingDocument7 pagesBaku Logistic BriefingwilmerNo ratings yet

- All Weather Operations ManualDocument276 pagesAll Weather Operations Manualwilmer100% (1)

- Bru Ebbr BrusselsDocument60 pagesBru Ebbr BrusselswilmerNo ratings yet

- Eperf PromoDocument8 pagesEperf PromowilmerNo ratings yet

- Doors OperationDocument27 pagesDoors OperationwilmerNo ratings yet

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyNo ratings yet

- FMD 2022 Half Year Activity Report - FinalDocument78 pagesFMD 2022 Half Year Activity Report - FinalPaul WaltersNo ratings yet

- Books List - Rich WealthDocument5 pagesBooks List - Rich WealthsenawoNo ratings yet

- Research and Development Activities of Life Insurance CompaniesDocument15 pagesResearch and Development Activities of Life Insurance CompaniesHtet Lynn HtunNo ratings yet

- Portfolio TheoryDocument3 pagesPortfolio TheoryZain MughalNo ratings yet

- Nivmo 0001Document1 pageNivmo 0001rav prashant SinghNo ratings yet

- Chapter 5Document33 pagesChapter 5KarimBekdashNo ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Sumit Saurav - Term - Paper - FOFDocument7 pagesSumit Saurav - Term - Paper - FOFsumit saurabNo ratings yet

- Power of Strategy MM3201 Draft QuestionnaireDocument4 pagesPower of Strategy MM3201 Draft QuestionnaireDaniela GetaladaNo ratings yet

- Finance Chapter+3Document38 pagesFinance Chapter+3Rouvenn LaoNo ratings yet

- ch16 SolDocument12 pagesch16 SolJohn Nigz Payee100% (1)

- Peter Navarro PFDDocument12 pagesPeter Navarro PFDThinkProgressNo ratings yet

- Postgraduate Diploma in Business Management Qualification Delivery HandbookDocument13 pagesPostgraduate Diploma in Business Management Qualification Delivery Handbookveeru9No ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test BankDocument49 pagesFinancial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test BankCarrieSchmidtoryzd100% (9)

- Lecture 3 - Valuing Debt InstrumentsDocument33 pagesLecture 3 - Valuing Debt Instrumentschenzhi fanNo ratings yet

- Unit 2 - Legal - Forms - of - BusinessDocument14 pagesUnit 2 - Legal - Forms - of - BusinessKouame AdjepoleNo ratings yet

- Introduction To Financial ManagementDocument43 pagesIntroduction To Financial ManagementHazel Jane EsclamadaNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Balance Sheet of InfosysDocument5 pagesBalance Sheet of InfosysLincy SubinNo ratings yet

- Gem PDFDocument683 pagesGem PDFBrooklets GeeNo ratings yet

- Piramal Fund Management Domestic Real Estate Strategy IDocument31 pagesPiramal Fund Management Domestic Real Estate Strategy IkanikaNo ratings yet

- Trend Indicator Mas: Chelsea YangDocument29 pagesTrend Indicator Mas: Chelsea YangHo Huu TienNo ratings yet

- Alert Company S Shareholders Equity Prior To Any of The Following PDFDocument1 pageAlert Company S Shareholders Equity Prior To Any of The Following PDFHassan JanNo ratings yet

- Tata Investment 2016 PDFDocument114 pagesTata Investment 2016 PDFSumit JhaNo ratings yet

- 247806Document51 pages247806Jack ToutNo ratings yet

- Mr. P Krishnamurthy, Ex-Cgm RbiDocument35 pagesMr. P Krishnamurthy, Ex-Cgm RbiKeigan ChatterjeeNo ratings yet