Professional Documents

Culture Documents

NewSyllabus 1056202071058945

NewSyllabus 1056202071058945

Uploaded by

divyanshtyagi2005Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NewSyllabus 1056202071058945

NewSyllabus 1056202071058945

Uploaded by

divyanshtyagi2005Copyright:

Available Formats

Annexure ‘CD – 01’

Course Title: Concepts of Economics for Managers Credit Units: 4 L T P/S SW PSD TOTAL CREDIT

/F A UNITS

Course Level: UG Course Code: ECON115 W

3- - - 2 2 4

Course Objectives: The purpose of this course is to apply micro economic concepts and techniques in evaluating business decision taken by firms.

The emphasis is on explaining how the tools of standard price theory can be employed to formulate a decision problem, evaluate alternative courses

of action and finally choose among alternatives. This course also deals with principles of macroeconomics. The coverage includes determination of

and linkages between major macro economic variables, the level of output and prices, inflation, unemployment, GDP growth, interest rates and

exchange rates.

Pre-requisites: Basic Knowledge of Economics

Course Contents/Syllabus:

Weightage (%)

Module I : Introduction of Economics & Demand & Supply Analysis and Theory of Consumer Behaviour 20

Introduction of Economics: Meaning, definition, nature and scope of economics. Law of demand and Supply.

Elasticity of Demand & supply. Determinants of demand and supply. Marginal utility theory, Indifference curve

theory, Consumer’s surplus.

Self -Work: An Assignment on “ Consumer Surplus”

Module II : Theory of Production & Market Structure 20

Production: Basic, Concept, Production function with one variable ,two variable, & all variable. Cost concept &

Revenue concept, Price & output determination under perfect competition, Pricing under monopoly,

Monopolistic Competition Oligopoly: Features and Kinds of oligopoly,..

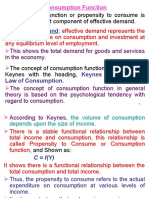

MoModule III : National Income & Consumption and Investment Functions 20

National Income Concepts and aggregates. Methods of calculating national income, and difficulties. Fiscal

Policy: Objectives& instruments. Aggregate consumption and investment functions: Average and Marginal

Propensity to consume, Factors affecting consumption functions, Static and dynamic Multiplier. Investment:

Types, Investment demand schedule and factors affecting investment decisions.

Module IV : Introduction to Money and Interest 20

Money: Types, Functions, Keynesian Economics: basic concept, Keynes Liquidity preference theory, Liquidity

trap, The anatomy of unemployment and inflation, The Phillips curve, Business cycles, Monetary Policy:

Objectives & Instruments.

Self -Work : An Assignment on “ Comparison of Inflation rate of India with developed Countries”

Module V : Recent Trends & Policies 20

Recent changes in Monetary and Fiscal Policy in India.

Nature and pattern of National Income in India.

Public policy initiatives in poverty alleviation and employment generation.

Course Learning Outcomes:

On successful completion of the course, students will be able to

1. Understand how households (demand) and businesses (supply) interact in various market structures to determine price and quantity of a

good produced.

2. Define the major characteristics of different market structures and the implications for the behavior of the firm.

3. Analyze the determinants of the relative strengths of fiscal and monetary policy for affecting gross domestic product.

4. Identify economic analysis to evaluate controversial issues and policies

Pedagogy for Course Delivery:

Remote classroom teaching shall be used for developing the concepts. Extensive use of case studies shall be made to

develop practical approach and inclination. Innovative discussions shall be carried out in class so that students learn to think

liberally using current knowledge base. The course will be taught through classroom teaching, PowerPoint Presentations, Video

and audio tapes, assignments, case studies and quizzes.

List of Professional Skill Development Activity:

Group discussion on Recent Market structures.

Presentation on current changes in Economic Policies

Assessment/ Examination Scheme:

Theory L/T (%) Lab/Practical/Studio (%) End Term Examination

40 N.A 60

Theory Assessment (L&T):

Continuous Assessment/Internal Assessment End Term

Examination

Components (Drop down) Project Class Test Present Attendance

ation

Weightage (%) 10% 10% 15% 5% 60%

Linkage of PSDA with Linked NA Linked NA NA

Internal Assessment to PSDA to PSDA

Component, if any 1 2

Mapping Continuous Evaluationcomponents/PSDA with CLOs

Bloom’s Level > Remembering Understandi Applying Analysin Evaluati Creating

ng g ng

Course Learning CLO2 CLO1 CLO4 CLO3

Outcomes

Assessment

type/PSDA

Mid Term

PSDA 1

PSDA 2

Text & References:

Ahuja, H.L. Advanced Economic Theory (Micro Economics), S. Chand &Co, New Delhi

Browning Edgar K. & Jacquel Line M. Browning: Micro Economics and application, Kalyani publishers, New Delhi.

Dewett. K.K. Micro Economics, S. Chand &Co, New Delhi

Price, M. C, Welfare Economics, Macmillian, London.

Ahuja H.L. Macro Economics, S. Chand &Co, New Delhi

Seth M.L. Macro Economics, Agarwal Publications, Agra.

R. Dornbusch & S. Fisher, Macroeconomics, Tata Mc. Graw Hill.

Mankiw, Principles of Macro Economics, Thomson Publication.

Sundharam, K.P.M, Money, Banking and International Trade, S. Chand &Co, New Delhi.

Baumol, W.J. Economic Theory and Operations Analysis, Prentice Hall of India, New Delhi.

Froyen, R.T., Macro Economics, (7th ed.), Pearson Education Inc., New Delhi.

Suraj B. Gupta , Monetary Economics-Institutions, Theory and Policy. S.Chand and Company Ltd. Delhi.

References:

Dewett, K. K, Modern Economic Theory: S. Chand &Co, New Delhi

Shapiro Edward, Macro Economic Analysis, Tata Mc. Graw Hill.

Gould John P. and Edward P. Lazear Micro Economic Theory, All India Traveller Book-seller, New Delhi.

Koutsoviannis Modern Micro Economics, Macmillan Press Limited, New Delhi

Additional Reading:

Bach, G., Economics, Prentice Hall of India, New Delhi.

Gould, J.P. and Edward P.L, Microeconomic Theory, Richard, Irwin. Homewood.

Jha, R. (2012), Contemporary Macroeconomic Theory and Policy, Wiley Eastern Ltd., New Delhi

Dominick Salvatore, Micro Economics Theory and Application, Oxford University Press.

Lipsey & Chrystal, Economics, Indian Edition, Oxford University Press.

You might also like

- Phillips Curve (Multiple Choice Questions)Document11 pagesPhillips Curve (Multiple Choice Questions)Nick100% (1)

- What Is Macro Environment AnalysisDocument3 pagesWhat Is Macro Environment AnalysisRobelyn D. Lazaro0% (1)

- Alesina, Alberto Et Al. (2010) - Fiscal Adjustments Lessons From Recent HistoryDocument18 pagesAlesina, Alberto Et Al. (2010) - Fiscal Adjustments Lessons From Recent HistoryAnita SchneiderNo ratings yet

- Statement of Purpose Tinbergen Institute - Marius MihaiDocument2 pagesStatement of Purpose Tinbergen Institute - Marius MihaiMarius-Mihail MihaiNo ratings yet

- NewSyllabus 14b74bb8 Bed6 4bdb 861e 31bb53f6b577Document5 pagesNewSyllabus 14b74bb8 Bed6 4bdb 861e 31bb53f6b577Anusheeka GhoshNo ratings yet

- NewSyllabus 235420207940610Document5 pagesNewSyllabus 235420207940610Mistry Of HistoryNo ratings yet

- AAB CD-01a - Feedback (ECON142)Document5 pagesAAB CD-01a - Feedback (ECON142)Chirag NayakNo ratings yet

- Self-Work: Kinds of Inferior Goods, Compensated Demand CurvesDocument4 pagesSelf-Work: Kinds of Inferior Goods, Compensated Demand CurvesrashiNo ratings yet

- Course Title: Credit Units: 3 Course Code: ECON605Document3 pagesCourse Title: Credit Units: 3 Course Code: ECON605Ubaid DarNo ratings yet

- Course Title: Credit Units: 4 Course Code:: Economics I Course Level: UG Course ObjectivesDocument3 pagesCourse Title: Credit Units: 4 Course Code:: Economics I Course Level: UG Course ObjectivesSatyam PathakNo ratings yet

- Course Title: ECONOMICS-III Credit Units: 4 Course Level: UG Course Code: ECON 304Document5 pagesCourse Title: ECONOMICS-III Credit Units: 4 Course Level: UG Course Code: ECON 304chhaayaachitran akshuNo ratings yet

- Management SyllabusDocument4 pagesManagement SyllabusShlokaNo ratings yet

- New SyllabusDocument6 pagesNew SyllabusPriyanshu DograNo ratings yet

- Course Level: UG: Annexure CD - 01'Document3 pagesCourse Level: UG: Annexure CD - 01'Harshit VermaNo ratings yet

- Course Title: Credit Units: 4 Course Code: ECON135: Macro Economics Course Level: UG Course ObjectivesDocument3 pagesCourse Title: Credit Units: 4 Course Code: ECON135: Macro Economics Course Level: UG Course ObjectivesAkash AgarwalNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- Revised BMS III SEM Common Syllabi TemplateDocument41 pagesRevised BMS III SEM Common Syllabi Templatebhavya.22048No ratings yet

- BBA Syllabus FinalDocument13 pagesBBA Syllabus FinalHimanshuNo ratings yet

- 1302019111943856 (5).docDocument4 pages1302019111943856 (5).docSheetal KumariNo ratings yet

- 163420197929824Document5 pages163420197929824Umang GoelNo ratings yet

- Format For Course CurriculumDocument4 pagesFormat For Course CurriculumAgamya GoyalNo ratings yet

- Course Title: Credit Units: 2 Course Code: ECON117: Course Level: UG Course ObjectiveDocument3 pagesCourse Title: Credit Units: 2 Course Code: ECON117: Course Level: UG Course ObjectiveNiral lakNo ratings yet

- Course Structure - Managerial Economics-AbsDocument9 pagesCourse Structure - Managerial Economics-AbsMba BNo ratings yet

- Format For Course Curriculum Course Title: Credit Units: 3 Course Code: IB601Document5 pagesFormat For Course Curriculum Course Title: Credit Units: 3 Course Code: IB601Pawan KumarNo ratings yet

- Course Title: Financial Management Course Code: FIBA601 Credit Units: 3Document3 pagesCourse Title: Financial Management Course Code: FIBA601 Credit Units: 3Mannat BhallaNo ratings yet

- Bba Ist Sem DSCDocument5 pagesBba Ist Sem DSCAbhishek YadavNo ratings yet

- CourseMarial - Ca11cinvestment Analysis and Portfolio ManagementDocument4 pagesCourseMarial - Ca11cinvestment Analysis and Portfolio Managementfash selectNo ratings yet

- SFM PDFDocument3 pagesSFM PDFarpan mukherjeeNo ratings yet

- Format For Course Curriculum: Course Level: PG Course Objectives: Course ObjectivesDocument5 pagesFormat For Course Curriculum: Course Level: PG Course Objectives: Course ObjectivesAkash Singh RajputNo ratings yet

- New SyllabusDocument5 pagesNew SyllabusAditi KediaNo ratings yet

- BFIA 2nd SEM COREDocument6 pagesBFIA 2nd SEM COREChetan SinghNo ratings yet

- Management AccountingDocument4 pagesManagement AccountingSakchiNo ratings yet

- Security Analysis and Portfolio ManagementDocument5 pagesSecurity Analysis and Portfolio ManagementSandeep SinghNo ratings yet

- NewSyllabus B069f0ac 0f6b 49b4 9def Df7a5f109ac3Document6 pagesNewSyllabus B069f0ac 0f6b 49b4 9def Df7a5f109ac3Pawan KumarNo ratings yet

- L T P/S SW/F W Total Credit UnitsDocument3 pagesL T P/S SW/F W Total Credit UnitsAkash GargNo ratings yet

- Scanning of Business Environment For LawyersDocument3 pagesScanning of Business Environment For LawyersTanyaNo ratings yet

- Scanning of Business Environment For LawyersDocument4 pagesScanning of Business Environment For Lawyersmadhav khanejaNo ratings yet

- Service MarketingDocument6 pagesService MarketingShashwat ShuklaNo ratings yet

- SyllabusDocument56 pagesSyllabusGautamNo ratings yet

- Strategic Financial ManagementDocument4 pagesStrategic Financial ManagementkaustubhNo ratings yet

- Mba Syllabus All SemestersDocument90 pagesMba Syllabus All Semestersrajkumarraghuwannshi1306No ratings yet

- BHMH2002 Introduction To EconomicsDocument4 pagesBHMH2002 Introduction To Economicstaikiki676No ratings yet

- Micro Finance SyllabusppDocument5 pagesMicro Finance SyllabusppHemang LathNo ratings yet

- ENTREPRENEURSHIPDocument5 pagesENTREPRENEURSHIPSam SharmaNo ratings yet

- Fundamentals of EntrepreneurshipDocument6 pagesFundamentals of EntrepreneurshipLoolik SoliNo ratings yet

- EASM Syllabus 202210 2537 FIN-4009EDocument5 pagesEASM Syllabus 202210 2537 FIN-4009ECamila VillamilNo ratings yet

- Aab CD 01Document5 pagesAab CD 01Ankita SharmaNo ratings yet

- Course Title: Economics For Engineers Credit Units: 2 Course Code: ECON132Document2 pagesCourse Title: Economics For Engineers Credit Units: 2 Course Code: ECON132Shubh GuptaNo ratings yet

- Format For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGDocument4 pagesFormat For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGLoolik SoliNo ratings yet

- Unit GuideDocument7 pagesUnit GuideHải Anh ĐặngNo ratings yet

- MSC in Financial Mathematics Course CatalogDocument20 pagesMSC in Financial Mathematics Course CatalogManthila AmarasenaNo ratings yet

- Pricing StrategyDocument4 pagesPricing StrategySandeep SinghNo ratings yet

- Readings: Dr. Nidhi Malhotra/Dr - Smita Dayal/Prof - Manav ViggDocument4 pagesReadings: Dr. Nidhi Malhotra/Dr - Smita Dayal/Prof - Manav ViggAbhishekNo ratings yet

- Gujarat Technological University MAM (Masters in Applied Management) - Dual Degree Programme Semester - IVDocument2 pagesGujarat Technological University MAM (Masters in Applied Management) - Dual Degree Programme Semester - IVSabhaya ChiragNo ratings yet

- Course Outline - Managerial EconomicsDocument6 pagesCourse Outline - Managerial EconomicsParvathaneni KarishmaNo ratings yet

- Syllabus of Private EquityDocument4 pagesSyllabus of Private EquityDeepanshu MalikNo ratings yet

- NewSyllabus 11620207770081Document4 pagesNewSyllabus 11620207770081Adarsh BhartiNo ratings yet

- Behavioural FinanceDocument4 pagesBehavioural FinanceGeetika RajputNo ratings yet

- Investment MGNT SyllabusDocument6 pagesInvestment MGNT Syllabusradhika vermaNo ratings yet

- NewSyllabus 1044202081843618Document5 pagesNewSyllabus 1044202081843618Rithika manhasNo ratings yet

- To Make Students Learn The Intricacies of Formulating and Implementing Financial Strategies and The Financial MixDocument3 pagesTo Make Students Learn The Intricacies of Formulating and Implementing Financial Strategies and The Financial MixGulzar AhmedNo ratings yet

- NLUJS PRINCIPLES OF MICROECONOMICS LIST OF bOOKSDocument5 pagesNLUJS PRINCIPLES OF MICROECONOMICS LIST OF bOOKSRicha sharmaNo ratings yet

- L T P/S FW No. of Psda Total Credit Units: Weightage (%)Document6 pagesL T P/S FW No. of Psda Total Credit Units: Weightage (%)parth dubeyNo ratings yet

- ECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsFrom EverandECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsNo ratings yet

- Chapter 4 Theories of Economic DevelopmentDocument26 pagesChapter 4 Theories of Economic DevelopmentAngelica Joy Manaois100% (1)

- Lecture 02 Macro-Econ102Document78 pagesLecture 02 Macro-Econ102HanaMengstu IelremaNo ratings yet

- 1 - GDP Per CapitaDocument28 pages1 - GDP Per CapitaTrung TạNo ratings yet

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghNo ratings yet

- Bcom Sem Vi Business EconomicsDocument36 pagesBcom Sem Vi Business EconomicsRamesh BabuNo ratings yet

- PolicyReview Labour and Employment-18781Document21 pagesPolicyReview Labour and Employment-18781Jeevan RegmiNo ratings yet

- Principles of Macroeconomics - Exam OneDocument6 pagesPrinciples of Macroeconomics - Exam OneOğuz GülsünNo ratings yet

- Consumption FunctionDocument24 pagesConsumption FunctionDeep Raj JangidNo ratings yet

- Answers To End of Chapter QuestionsDocument59 pagesAnswers To End of Chapter QuestionsBruce_scribed90% (10)

- Diskusi 6 Inggris NiagaDocument2 pagesDiskusi 6 Inggris Niagakevin culesNo ratings yet

- Unit-1 Introduction To Managerial EconomicsDocument13 pagesUnit-1 Introduction To Managerial EconomicsAsmish EthiopiaNo ratings yet

- Managerial Economics Lesson 1Document3 pagesManagerial Economics Lesson 1Seth F. DonatoNo ratings yet

- FRBM ActDocument8 pagesFRBM ActTanvi ShahNo ratings yet

- Assignment EcoDocument13 pagesAssignment EcoMuhammad AkmalNo ratings yet

- Keynesian Theory of Income Determination - SummaryDocument3 pagesKeynesian Theory of Income Determination - SummaryTishani HerathNo ratings yet

- Full Download PDF of Microeconomics: Principles, Problems, & Policies 20th Edition (Ebook PDF) All ChapterDocument43 pagesFull Download PDF of Microeconomics: Principles, Problems, & Policies 20th Edition (Ebook PDF) All Chapterswafopaulix70100% (8)

- Tutorial 8 Production: ST ND RDDocument1 pageTutorial 8 Production: ST ND RDShivang Agarwal0% (1)

- Regional Social Accounting: Social Accounting Is A Type of Accounting That A Business Performs ToDocument6 pagesRegional Social Accounting: Social Accounting Is A Type of Accounting That A Business Performs TocarolsaviapetersNo ratings yet

- ECONOMICS SS2 2nd TERM NOTES 2021-22 - 2Document64 pagesECONOMICS SS2 2nd TERM NOTES 2021-22 - 2isaac bakare100% (1)

- International Reserves Determinants andDocument6 pagesInternational Reserves Determinants andJuan Nicolas SalgadoNo ratings yet

- Central Bank - WikipediaDocument143 pagesCentral Bank - WikipediaDaxesh BhoiNo ratings yet

- 12 Economic Lyp 2016 Delhi Set2 PDFDocument20 pages12 Economic Lyp 2016 Delhi Set2 PDFAshish GangwalNo ratings yet

- Notes On Inflation: How To Measure InflationDocument2 pagesNotes On Inflation: How To Measure InflationMark WatneyNo ratings yet

- MUMURIPa SAMRAt CKPDocument10 pagesMUMURIPa SAMRAt CKPRafatul IslamNo ratings yet

- Introduction To Economics: Udayan RoyDocument23 pagesIntroduction To Economics: Udayan RoyLai Nwe YinNo ratings yet

- Foundations of Modern Macroeconomics: B. J. Heijdra & F. Van Der PloegDocument52 pagesFoundations of Modern Macroeconomics: B. J. Heijdra & F. Van Der Ploegtegegn mogessieNo ratings yet