Professional Documents

Culture Documents

Refund Sanction/Rejection Order

Refund Sanction/Rejection Order

Uploaded by

ooder69Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Refund Sanction/Rejection Order

Refund Sanction/Rejection Order

Uploaded by

ooder69Copyright:

Available Formats

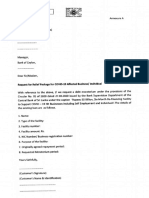

Government of India

Department of….

FORM-GST-RFD-05

[See Rule --]

Refund Sanction/Rejection Order

Reference No. : Date: <DD/MM/YYYY>

To

___________ (GSTIN)

___________ (Name)

____________ (Address)

Acknowledgement No. ………… Dated ………<DD/MM/YYYY>

Sir/Madam,

With reference to your refund application as referred above and further furnishing of information/ filing of

documents, refund calculation after adjustment of dues is as follows:

Refund Calculation IGST CGST

i. Amount of Refund claim

ii. Refund Sanctioned on Provisional Basis (Order

No….date)

iii. Refund amount inadmissible <<reason dropdown>>

iv. Balance refund allowed (i-ii-iii)

v. Refund reduced against outstanding demand (as per

order no.) under earlier law or under this law. Demand

Order No…… date……

vi. Net Amount of Refund Sanctioned

Bank Details

i. Bank Account no as per application

ii. Name of the Bank

iii. Bank Account Type

iv. Name of the Account holder

v. Name and Address of the Bank /branch

vi. IFSC

vii. MICR

I hereby sanction an amount of INR _________ to M/s ___________having GSTIN ____under sub-section

(…) of Section (…) of the Act. .

Date: Signature (DSC):

Place: Name:

Designation:

Office Address:

You might also like

- Covering Letter For Miscellaneous Remittances - LatestDocument2 pagesCovering Letter For Miscellaneous Remittances - LatestSALE EXECUTIVESNo ratings yet

- GST-RFD-05Document1 pageGST-RFD-05ooder69No ratings yet

- GST-RFD-04Document1 pageGST-RFD-04ooder69No ratings yet

- GST-RFD-04Document1 pageGST-RFD-04ooder69No ratings yet

- FORM-GST-RFD-04: (See Rule 91 (2) )Document1 pageFORM-GST-RFD-04: (See Rule 91 (2) )gst sikkimNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- GST RFD 03Document1 pageGST RFD 03antonyagustusNo ratings yet

- Form Vat 17: Notice For Payment of DemandDocument1 pageForm Vat 17: Notice For Payment of DemandPratik jainNo ratings yet

- Employee DeclarationDocument5 pagesEmployee Declarationloyalbliss14No ratings yet

- Statement of FactsDocument19 pagesStatement of Factsmau8684No ratings yet

- Forms of Registration Under Contract Labour Act 1970 PDFDocument7 pagesForms of Registration Under Contract Labour Act 1970 PDFGlendaNo ratings yet

- Form Vat 17: Notice For Payment of DemandDocument1 pageForm Vat 17: Notice For Payment of Demandsatyam Digostic CentreNo ratings yet

- Form D - Workman & EmployeeDocument4 pagesForm D - Workman & EmployeeAmarNo ratings yet

- Bank of Maharastra Non ResidentDocument2 pagesBank of Maharastra Non ResidentAAYUSH KUMARNo ratings yet

- Account Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Document4 pagesAccount Opening Form For Resident Individuals (Single/Joint) (SF/CA/FD/RD/OD/CC)Jyothi Pradeep KumarNo ratings yet

- VSB Application Form 15062020Document2 pagesVSB Application Form 15062020Sham DinNo ratings yet

- Form Vat 17: Notice For Payment of DemandDocument1 pageForm Vat 17: Notice For Payment of Demandsatyam Digostic CentreNo ratings yet

- Certification of No Existing Creditor ClosureDocument2 pagesCertification of No Existing Creditor ClosureJay GadianeNo ratings yet

- 1679046399297-Income Tax - 12BB Form and Annexure FormDocument2 pages1679046399297-Income Tax - 12BB Form and Annexure FormsiddharthbackupfilesNo ratings yet

- AF Registration of Workers AssociationDocument2 pagesAF Registration of Workers AssociationFranciz Oflear100% (3)

- Tolia AppealDocument7 pagesTolia Appealmau8684No ratings yet

- Blank NPS FormDocument6 pagesBlank NPS FormSurender TanwarNo ratings yet

- Sanction LetterDocument6 pagesSanction Lettersubhajitbarai0945No ratings yet

- LTA Reimbursement Claim Form For 2020-2021: Company NameDocument3 pagesLTA Reimbursement Claim Form For 2020-2021: Company NameAnish JainNo ratings yet

- Revised Form A2 Cum Application FormDocument3 pagesRevised Form A2 Cum Application FormnoshadNo ratings yet

- Inter Sector Shifting (ISS) Form May 2018Document2 pagesInter Sector Shifting (ISS) Form May 2018dsbisht50% (2)

- NonResident AOFDocument2 pagesNonResident AOFHatrRatNo ratings yet

- A. Registration Checklist: 1. DTI Registration Type 2. LGU RegistrationDocument2 pagesA. Registration Checklist: 1. DTI Registration Type 2. LGU RegistrationenggNo ratings yet

- Comm Bank Mandate FormDocument4 pagesComm Bank Mandate FormHimanshuNo ratings yet

- Neft Form.Document1 pageNeft Form.Amit AroraNo ratings yet

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Document48 pagesShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Annexure A B CDocument4 pagesAnnexure A B CAmila SampathNo ratings yet

- MORD Format - 28.05.2024 - Legal VettingFirrst Four PagesDocument4 pagesMORD Format - 28.05.2024 - Legal VettingFirrst Four PagesMohan KumarNo ratings yet

- Mumbai: For and On Behalf ofDocument2 pagesMumbai: For and On Behalf ofPradeepMathadNo ratings yet

- Return of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistDocument5 pagesReturn of Corpus (Roc) For NTPC SCSB and Ndcps-2007: ChecklistjvnraoNo ratings yet

- NEFT MandateDocument1 pageNEFT MandateAyan ParuiNo ratings yet

- Form 12BBDocument6 pagesForm 12BBmoin.m.baigNo ratings yet

- Allegis - Investment Proof Submission Form - 2018-19Document6 pagesAllegis - Investment Proof Submission Form - 2018-19Sachin Kumar J KNo ratings yet

- PFSADocument3 pagesPFSAkrsapsd7No ratings yet

- Board Resolution ClosureDocument2 pagesBoard Resolution ClosureJay GadianeNo ratings yet

- Form ISS - Inter Sector Shifting FormDocument7 pagesForm ISS - Inter Sector Shifting Formblack kobraNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Form-12BB Format - FY 2023-24Document2 pagesForm-12BB Format - FY 2023-24Sreedhar BodalapalleNo ratings yet

- Chit Fund FormsDocument45 pagesChit Fund Formssaisankar ladiNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Accreditation FormDocument2 pagesAccreditation Formrowena balaguerNo ratings yet

- BIO Undertaking CompanyDocument2 pagesBIO Undertaking Companygurpreet06No ratings yet

- Interim Order in The Matter of Neesa Technologies LimitedDocument14 pagesInterim Order in The Matter of Neesa Technologies LimitedShyam SunderNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- Form CDocument2 pagesForm CnthyagarajNo ratings yet

- From: To:: Annexure-ADocument3 pagesFrom: To:: Annexure-AAnilNo ratings yet

- Application Form For Outward Remittance From Nre AccountDocument1 pageApplication Form For Outward Remittance From Nre AccountArjun WadhawanNo ratings yet

- Rent Bill-Ajaz Ali PhulphotoDocument14 pagesRent Bill-Ajaz Ali Phulphotowajid100% (1)

- Declaration For Inward RemittanceDocument1 pageDeclaration For Inward Remittancepravinapp6No ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- 'RFD 06Document3 pages'RFD 06ahmgstserviceNo ratings yet

- Allotment Advice 859527Document1 pageAllotment Advice 859527jogagow939No ratings yet

- Drafting Written Statements: An Essential Guide under Indian LawFrom EverandDrafting Written Statements: An Essential Guide under Indian LawNo ratings yet