Professional Documents

Culture Documents

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

Uploaded by

Venkatasubramanian KrishnamurthyCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Warren E. Buffett, 2005: Case Studies in FinanceDocument2 pagesWarren E. Buffett, 2005: Case Studies in FinanceNakonoaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The 10 Laws of Trust Peterson en 26075 PDFDocument5 pagesThe 10 Laws of Trust Peterson en 26075 PDFVd Dv100% (1)

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- MadHCRenganathanstreetregularisation OrderDocument21 pagesMadHCRenganathanstreetregularisation OrderVenkatasubramanian KrishnamurthyNo ratings yet

- GO88 - 101008 TN Samadhan Sale TaxDocument2 pagesGO88 - 101008 TN Samadhan Sale TaxVenkatasubramanian KrishnamurthyNo ratings yet

- Vat Schedule TNDocument40 pagesVat Schedule TNVenkatasubramanian KrishnamurthyNo ratings yet

- CurrentConsumptionreasonThe State of Tamil Nadu Vs TVL - Sri Jayalakshmi Crusher On 6 August, 2009Document3 pagesCurrentConsumptionreasonThe State of Tamil Nadu Vs TVL - Sri Jayalakshmi Crusher On 6 August, 2009Venkatasubramanian KrishnamurthyNo ratings yet

- Xer Tech ExerciseDocument7 pagesXer Tech ExercisePushpendra AhoriyaNo ratings yet

- MBA-Financial and Managerial Accounting Question BankDocument87 pagesMBA-Financial and Managerial Accounting Question BankElroy Barry100% (3)

- CO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFDocument12 pagesCO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFshalabh_hscNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- S&P Agreement - SA708DDocument5 pagesS&P Agreement - SA708DJojo Al-hami Zurairi Y.MNo ratings yet

- Schnabl SyllabusDocument9 pagesSchnabl SyllabusAli SharifiNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Management Advisory Services 1Document2 pagesManagement Advisory Services 1Alelie dela CruzNo ratings yet

- Fund TestDocument1 pageFund TestAbdi Mucee TubeNo ratings yet

- AEC 501 Question BankDocument15 pagesAEC 501 Question BankAnanda PreethiNo ratings yet

- Dr.G.R.Damodaran College of ScienceDocument23 pagesDr.G.R.Damodaran College of ScienceAbdullahNo ratings yet

- ProjectDocument66 pagesProjectSoham DalviNo ratings yet

- Socio Economic OffencesDocument24 pagesSocio Economic OffencesRohit Vijaya ChandraNo ratings yet

- AE 212 Quiz 1 MidtermsDocument5 pagesAE 212 Quiz 1 MidtermsKharen ValdezNo ratings yet

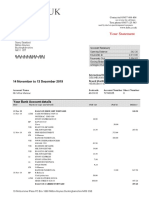

- 2019 12 13 - StatementDocument8 pages2019 12 13 - StatementMarisac MihaiNo ratings yet

- Case Study On Indian MetroDocument4 pagesCase Study On Indian MetroAyushi DwivediNo ratings yet

- Handouts MPA 401Document28 pagesHandouts MPA 401Muhammad Imran Irshad JalloNo ratings yet

- Sohn Investment Conference Presentation, June 9, 2022Document49 pagesSohn Investment Conference Presentation, June 9, 2022aitilopNo ratings yet

- Sbi & IciciDocument31 pagesSbi & IciciAnu_Yadav_633275% (4)

- T. Co M: R EadingDocument15 pagesT. Co M: R Eadingarun1974No ratings yet

- Yes Bank PolicyDocument4 pagesYes Bank PolicyAman AmickNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Current Affairs Monthly Issues - May - 2020Document88 pagesCurrent Affairs Monthly Issues - May - 2020amruthaNo ratings yet

- Investment Brief SUMMER 2019 FINALDocument16 pagesInvestment Brief SUMMER 2019 FINALMeeraNo ratings yet

- Rent Agreement-2Document1 pageRent Agreement-2raghu rajNo ratings yet

- AYMENT by CESSION 1255 The Debtor May Cede or Assign HisDocument3 pagesAYMENT by CESSION 1255 The Debtor May Cede or Assign HisTom KnobNo ratings yet

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

Uploaded by

Venkatasubramanian KrishnamurthyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

TVL - Medi Herbs Vs The Commercial Tax Officer On 7 April, 2010 Chit Rare Fund

Uploaded by

Venkatasubramanian KrishnamurthyCopyright:

Available Formats

Tvl.

Medi Herbs vs The Commercial Tax Officer on 7 April, 2010

Dated: 07.04.2010 CORAM: The Honourable Mrs.JUSTICE CHITRA VENKATARAMAN Writ Petition Nos.27093 to 27095 of 2006 Tvl.Medi Herbs 154, Veli Semmandalam Housing Board Cuddalore-607 001. 98, Nehru Place .... Petitioner in all these W.Ps. Vs. 1. The Commercial Tax Officer Cuddalore Town Assessment Circle Cuddalore-607 001. 2. The Registrar Tamil Nadu Taxation Special Tribunal Chennai-600 001. 3. The State, Government of Tamil Nadu represented by the Secretary Commercial Taxes Department Fort St. George Chennai-600 009. .... Respondents in all these W.Ps. W.P.No.27093 of 2006 is filed under Article 226 of The Constitution of India praying for the issuance of a writ of Certiorarified Mandamus calling for the records of the first respondent in its Rc.A4/8220/02: TNGST. 4381584/97-98 dated 22.2.2006, to quash the same and to further direct the first respondent to pay the balance of interest due to the petitioners for the year 1997-98 as mandated in Section 24(4) of the TNGST Act, 1959, read with Rule 32(2) of the TNGST RULES, 1959 as per their application dated 9.2.2006 within a set time frame. W.P.No.27094 of 2006 is filed under Article 226 of The Constitution of India praying for the issuance of a writ of Certiorarified Mandamus calling for the records of the first respondent in its Rc.A4/8220/02: TNGST. 4381584/98-99 dated 22.2.2006, to quash the same and to further direct the first respondent to pay the balance of interest due to the petitioners for the year 1998-99 as mandated in Section 24(4) of the TNGST Act, 1959, read with Rule 32(2) of the TNGST Rules, 1959 as per their application dated 9.2.2006 within a set

Indian Kanoon - http://indiankanoon.org/doc/621129/ 1

Tvl.Medi Herbs vs The Commercial Tax Officer on 7 April, 2010

time frame. W.P.No.27095 of 2006 is filed under Article 226 of The Constitution of India praying for the issuance of a writ of Certiorarified Mandamus calling for the records of the first respondent in its Rc.A4/8220/02: TNGST. 4381584/99-2000 dated 22.2.2006, to quash the same and to further direct the first respondent to pay the balance of interest due to the petitioners for the year 1999-2000 as mandated in Section 24(4) of the TNGST Act, 1959, read with Rule 32(2) of the TNGST Rules, 1959 as per their application dated 9.2.2006 within a set time frame. For Petitioner : M/s.P.K.Krishnasamy and R.Senniappan For Respondents: Mr.R.Mahadevan Additional Govt. Pleader (Taxes) ORDER The petitioner herein seeks quashing of the order passed by the first respondent herein dated 22.2.2006 and to direct the first respondent to pay the interest due to the petitioner for the Assessment Years 1997-98, 1998-99 and 1999-2000. 2. Certain facts are not in dispute in this case. The three writ petitions relate to the assessment years 1997-98, 1998-99 and 1999-2000 respectively. The original assessment for the assessment year 1997-98 was made on the petitioner on 27.5.1999 and for the assessment years 1998-99 and 1999-2000, on 31.3.2000. As against the assets, the petitioner filed appeals before the Appellate Assistant Commissioner. The appellate authority passed the order on 7.4.2000 for the Assessment year 1997-98 and on 14.8.2001, for the Assessment years 1998-99 and 1999-2000 respectively. While rejecting the appeals, the appellate authority, however, directed assessment on the turnover relating to herbal shikakai powder as assessable at 11%. Consequent on the appellate order refixing the rate of tax as 11%, in respect of the assessment year 1997-98, 1998-99 and 1999-2000, the assessing authority passed consequential orders under Section 39-A of the Tamil Nadu General Sales Tax Act, 1959 on 28.6.2000 for the assessment year 1997-98 and in respect of 1998-99 and 1999-2000, the order was passed on 2.7.2002. It is stated that the Revenue filed appeals before the Sales Tax Appellate Tribunal and the same was dismissed. Consequent on the rectification order passed on the application of the petitioner by the Tribunal, the petitioner claimed refund of the excess tax paid for the above-said years. In respect of all these years, the respondent received copies of the appellate orders on 28.5.2000 in respect of the assessment year 1997-98 and on 14.9.2001, for the assessment years 1998-99 and 1999-2000. 3. It is seen that the petitioner approached the Tamil Nadu Taxation Special Tribunal in O.P.Nos.911 to 913 of 2002 seeking direction to the Commercial Tax Officer to issue the refund voucher of the excess payment of tax collected from the petitioner under protest for the assessment years 1997-98, 1998-99 and 1999-2000 in accordance with the first appellate authority's order with interest at 12% per annum as per Section 24(4) of the Tamil Nadu General Sales Tax Act. Under order dated 14.11.2002, the Tamil Nadu Taxation Special Tribunal ordered the said petitions and granted interest at the rate of 1/2% per month for twelve months as against the claim for 1% for twelve months on the amounts to be refunded. Aggrieved by the same, the petitioner moved this Court in W.P.Nos.7215 to 7217 of 2003. By order dated 6.1.2006, the writ petitions were disposed of, setting aside the order of the Tamil Nadu Taxation Special Tribunal, directing payment of interest at 1% as against 1/2% granted, holding that the assessee could approach the Assessing Officer for payment of interest as contemplated under the Rules, and on such application made, the Assessing Authority was directed to dispose of the same within a period of four weeks from the date of receipt of the order copy. Accordingly, the petitioner made his application, placing reliance on Section 24(4) of the Tamil Nadu General Sales Tax Act, 1959 read with Rule 32(2) of the Tamil Nadu General Sales Tax Rules, 1959.

Indian Kanoon - http://indiankanoon.org/doc/621129/

Tvl.Medi Herbs vs The Commercial Tax Officer on 7 April, 2010

4. By order dated 22.2.2006, the Commercial Tax Officer rejected the plea for grant of interest, citing Section 39-A of the Tamil Nadu General Sales Tax Act that, if any excess amount is found to be due, the said amount shall be refunded to the assessee without interest. The assessing authority felt that since the order rejecting the grant of 1/2% interest per month was cancelled by this Court, the question of grant of interest does not arise and hence, the petitions seeking payment of interest were rejected. Aggrieved by the same, the petitioner has come before this Court contending that having regard to the provisions of Section 24(4) of the Tamil Nadu General Sales Tax Act and Rule 32(2) of the Tamil Nadu General Sales Tax Rules, if the refund had been made within a period of 90 days, then the question of payment of interest would not arise. However, when the payment is beyond 90 days, the petitioner is entitled to be granted interest as per Section 24(4) of the Tamil Nadu General Sales Tax Act, 1959. 5. Learned counsel submitted that when the refund voucher had not been issued immediately on the passing of the order under Section 39-A of the Tamil Nadu General Sales Tax Act, when the refund voucher was issued only on 5.2.2003, the petitioner is entitled to be compensated by way of interest. Referring to Section 24(4) of the Tamil Nadu General Sales Tax Act, he submitted that the petitioner cannot be denied of the statutory interest and the delay on the part of the respondents could not stand in the way of interest being paid to the petitioner, as provided under Section 24(4) of the Tamil Nadu General Sales Tax Act, 1959. 6. As already pointed out, on the admitted facts as regards the assessment year 1997-98, the giving effect order for the Assessment Year 1997-98 under Section 39-A of the Tamil Nadu General Sales Tax Act was made on 28.6.2000; and for the Assessment Years 1998-99 and 1999-2000, on 2.7.2002. As far as the first assessment year is concerned, the respondent received the order copy on 23.5.2000 and for the second assessment year, the order of the appellate authority was received on 24.9.2001. 7. Section 39-A of the Tamil Nadu General Sales Tax Act states that consequent on an order passed in an appeal or revision or review under the Act, if any change becomes necessary in the order of assessment, the appropriate appellate authority, or revising or reviewing authority has to amend the assessment accordingly. Any amount over-paid has to be refunded to the assessee without interest if paid within 90 days or if further amount has to be collected from the assessee, it shall be collected in accordance with law. Admittedly, there is no time limit fixed under Section 39-A of the Tamil Nadu General Sales Tax Act to pass such consequential order by way of an amendment to an order of assessment. Section 24(4) of the Tamil Nadu General Sales Tax Act provides that where payment of tax is found to be in excess on final assessment or revision of assessment or as a result of an order passed in an appeal, revision or review, the excess amount shall be refunded to the dealer after adjustment of arrears of tax, if any, due from him and if the excess amount is not refunded within a period of 90 days from the date of order of assessment or revision of assessment and in the case of an order passed in an appeal, revision or review, within a period of 90 days from the date of receipt of the order, the Government has to pay interest at the rate of 1% or part thereof on such amount for each month or part thereof after the expiry of the said period of 90 days. The Explanation appended to Section 24(4) of the Tamil Nadu General Sales Tax Act states that the expression "order passed in appeal, revision or review" shall not include an order passed in such appeal, revision or review with a direction to make a fresh assessment order. 8. Rule 32 of the Tamil Nadu General Sales Tax Rules speaks about communication of the order of the appellate authority and giving effect to the order of the authority wherever review has to be made on the assessment made consequent on the result of the appeal or revision. Rule 32(2) of the Tamil Nadu General Sales Tax Rules provides that the assessing authority has to give effect to the order of the appellate authority or revisional authority and where the assessing authority giving effect to the order of the appellate authority or the revisional authority resulting in a refund to be made of the excess tax paid by the assessee within a period of three months from the date of communication of the order, the assessing authority shall serve a notice in Form C to the assessee, notifying the dealer as to the adjustment of the excess tax towards arrears, if any, or in the absence of arrears, to refund the amount along with a notice, by sending a voucher to the dealer for claiming refund of the amount without interest from the treasury. Rule 33(2)(e) of the Tamil Nadu General Sales Tax Rules states that if a refund is made within a period of 90 days from the date of receipt of the

Indian Kanoon - http://indiankanoon.org/doc/621129/ 3

Tvl.Medi Herbs vs The Commercial Tax Officer on 7 April, 2010

revisional authority's order, the Department is not bound to grant any interest under the provisions of the Act, which means, any refund voucher issued beyond the period of 90 days would certainly carry interest under Section 24(4) of the Tamil Nadu General Sales Tax Act. 9. Reading all these provisions together, it stands to reason that even though Section 39-A of the Tamil Nadu General Sales Tax Act does not provide for a period for passing of an order, yet, a combined reading of Rule 32(2) of the Tamil Nadu General Sales Tax Rules as well as Section 24(4) of the Tamil Nadu General Sales Tax Act, which contemplates payment without interest if made within 90 days from the date of receipt of the order made in an appeal or revision or in the case of an assessment, from the date of order of assessment, it stands to reason that the order to be passed under Section 39-A of the Tamil Nadu General Sales Tax Act must necessarily follow the time limit given under Section 24(4) of the Tamil Nadu General Sales Tax Act read with Rule 32(2) of the Tamil Nadu General Sales Tax Rules. In the circumstances, where an authority takes his own time and causes inordinate delay in giving effect to an order under 39-A of the Tamil Nadu General Sales Tax Act, by reason of an order passed by the appellate authority, an assessee is entitled to have refund of tax paid with interest at 12% per annum. Hence, the claim of the petitioner to have the payment of interest on the belated refund order cannot be slightly rejected. 10. It is no doubt true that under Section 24(4) of the Tamil Nadu General Sales Tax Act, the contemplation is that interest shall be paid from the 91st day from the date of receipt of the order passed in an appeal, revision or review as against 90 days from the date of the order of assessment and revision of assessment. In the present case, even though the appellate authority had passed an order, particularly with reference to the assessment years 1998-99 and 1999-2000, received by the respondents on 14.9.2001, yet, for the reasons best known, the giving effect order was passed on 2.7.2002 only beyond the 90 days' time limit. The order on revision of the assessment was passed only on 5.2.2003. Hence, applying the provisions for Section 24(4) of the Tamil Nadu General Sales Tax Act as well as to Rule 32(2) of the Tamil Nadu General Sales Tax Rules, the only conclusion that one draws in this case is that the petitioner is entitled to have the interest paid as per Section 24(4) of the Tamil Nadu General Sales Tax Act. 11. The petitioner claimed interest payable for the assessment year 1997-98 from 21.8.2000 to 4.2.2003 since the 90 days' time limit expired on 20.8.2000. For the assessment year 1998-99 and 1999-2000 the delay was 13 months and 23 days i.e., from 13.12.2001 to 4.2.2003. Having regard to the admitted fact that the revisional order for the assessment year 1997-98 was not passed within 90 days and that it was made only on 5.2.2003, I have no hesitation in allowing the writ petition for the year 1997-98 that on the expiry of the 90 days' time limit, the petitioner is entitled to have the interest paid from the 91st day from the date of receipt of the appellate order. 12. As far as the assessment years 1998-99 and 1999-2000 are concerned, even though the appellate authority's order was received on 14.9.2001, yet for reasons best known, the giving effect order under Section 39-A was made only on 3.2.2003, which means that the same was made beyond the 90 days' period contrary to Rule 32(2) of the Tamil Nadu General Sales Tax Rules and Section 24(4) of the Tamil Nadu General Sales Tax Act and hence, going by the 90 days' limitation provided for under Section 24(4) of the Tamil Nadu General Sales Tax Act, if an order under Section 39-A of the Tamil Nadu General Sales Tax Act giving effect to the appellate order is not made within a period of 90 days, the assessee is entitled to have the interest paid as per Section 24(4) of the Tamil Nadu General Sales Tax Act. The mere fact that Section 39-A has not provided for a time limit does not mean that an order can be passed at any time that an authority deems fit, thereby ignoring the impact of Section 24(4) of the Tamil Nadu General Sales Tax Act. 13. Hence reading Section 24(4) of the Tamil Nadu General Sales Tax Act and Rule 32(2) of the Tamil Nadu General Sales Tax Rules into Section 39-A of the Tamil Nadu General Sales Tax Act, when the giving effect order under Section 39-A had not been made within the 90 days' time from the date of receipt of the order of the appellate authority, the petitioner is entitled to be granted interest on the expiry of 90 days from the date of receipt of the appellate authority's order.

Indian Kanoon - http://indiankanoon.org/doc/621129/ 4

Tvl.Medi Herbs vs The Commercial Tax Officer on 7 April, 2010

14. When the order of the appellate authority has attained finality, the sheer absence of a provision prescribing any time limit, in Section 39-A not does not justify the view of the respondents that the petitioner is not entitled to claim interest as contemplated under Section 24(4) of the Tamil Nadu General Sales Tax Act. 15. In the circumstances, going by the provisions of Section 24(4) of the Tamil Nadu General Sales Tax Act read with Rule 32(2) of the Tamil Nadu General Sales Tax Rules, on account of the extraordinary delay in passing an order under Section 39-A of the Tamil Nadu General Sales Tax Act by nearly 13 months in the case of Assessment Years 1998-99 and 1999-2000 and in the case of assessment year 1997-98, by more than 29 months, I have no hesitation in granting the relief to the petitioner, thereby directing the first respondent to pay interest to the petitioner at 12% per annum on the refund ordered on expiry of the 90th day from the date of receipt of the appellate order for the Assessment Years 1997-98, 1998-99 and 1999-2000. The first respondent shall pass the order granting interest as per Section 24(4) of the Tamil Nadu General Sales Tax Act within a period of twelve weeks from the date of receipt of a copy of this order. The writ petitions are ordered accordingly. No costs. Connected M.P.Nos.1, 1 and 1 of 2006 are closed. ksv To The Commercial Tax Officer Tambaram I Assessment Circle Chrompet, Chennai

Indian Kanoon - http://indiankanoon.org/doc/621129/

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Warren E. Buffett, 2005: Case Studies in FinanceDocument2 pagesWarren E. Buffett, 2005: Case Studies in FinanceNakonoaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The 10 Laws of Trust Peterson en 26075 PDFDocument5 pagesThe 10 Laws of Trust Peterson en 26075 PDFVd Dv100% (1)

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- MadHCRenganathanstreetregularisation OrderDocument21 pagesMadHCRenganathanstreetregularisation OrderVenkatasubramanian KrishnamurthyNo ratings yet

- GO88 - 101008 TN Samadhan Sale TaxDocument2 pagesGO88 - 101008 TN Samadhan Sale TaxVenkatasubramanian KrishnamurthyNo ratings yet

- Vat Schedule TNDocument40 pagesVat Schedule TNVenkatasubramanian KrishnamurthyNo ratings yet

- CurrentConsumptionreasonThe State of Tamil Nadu Vs TVL - Sri Jayalakshmi Crusher On 6 August, 2009Document3 pagesCurrentConsumptionreasonThe State of Tamil Nadu Vs TVL - Sri Jayalakshmi Crusher On 6 August, 2009Venkatasubramanian KrishnamurthyNo ratings yet

- Xer Tech ExerciseDocument7 pagesXer Tech ExercisePushpendra AhoriyaNo ratings yet

- MBA-Financial and Managerial Accounting Question BankDocument87 pagesMBA-Financial and Managerial Accounting Question BankElroy Barry100% (3)

- CO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFDocument12 pagesCO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFshalabh_hscNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- S&P Agreement - SA708DDocument5 pagesS&P Agreement - SA708DJojo Al-hami Zurairi Y.MNo ratings yet

- Schnabl SyllabusDocument9 pagesSchnabl SyllabusAli SharifiNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Management Advisory Services 1Document2 pagesManagement Advisory Services 1Alelie dela CruzNo ratings yet

- Fund TestDocument1 pageFund TestAbdi Mucee TubeNo ratings yet

- AEC 501 Question BankDocument15 pagesAEC 501 Question BankAnanda PreethiNo ratings yet

- Dr.G.R.Damodaran College of ScienceDocument23 pagesDr.G.R.Damodaran College of ScienceAbdullahNo ratings yet

- ProjectDocument66 pagesProjectSoham DalviNo ratings yet

- Socio Economic OffencesDocument24 pagesSocio Economic OffencesRohit Vijaya ChandraNo ratings yet

- AE 212 Quiz 1 MidtermsDocument5 pagesAE 212 Quiz 1 MidtermsKharen ValdezNo ratings yet

- 2019 12 13 - StatementDocument8 pages2019 12 13 - StatementMarisac MihaiNo ratings yet

- Case Study On Indian MetroDocument4 pagesCase Study On Indian MetroAyushi DwivediNo ratings yet

- Handouts MPA 401Document28 pagesHandouts MPA 401Muhammad Imran Irshad JalloNo ratings yet

- Sohn Investment Conference Presentation, June 9, 2022Document49 pagesSohn Investment Conference Presentation, June 9, 2022aitilopNo ratings yet

- Sbi & IciciDocument31 pagesSbi & IciciAnu_Yadav_633275% (4)

- T. Co M: R EadingDocument15 pagesT. Co M: R Eadingarun1974No ratings yet

- Yes Bank PolicyDocument4 pagesYes Bank PolicyAman AmickNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Current Affairs Monthly Issues - May - 2020Document88 pagesCurrent Affairs Monthly Issues - May - 2020amruthaNo ratings yet

- Investment Brief SUMMER 2019 FINALDocument16 pagesInvestment Brief SUMMER 2019 FINALMeeraNo ratings yet

- Rent Agreement-2Document1 pageRent Agreement-2raghu rajNo ratings yet

- AYMENT by CESSION 1255 The Debtor May Cede or Assign HisDocument3 pagesAYMENT by CESSION 1255 The Debtor May Cede or Assign HisTom KnobNo ratings yet