Professional Documents

Culture Documents

Disposal of Asset-Th & Exercise

Disposal of Asset-Th & Exercise

Uploaded by

Proficient CyberCopyright:

Available Formats

You might also like

- TAX Preweek Lecture (B42)Document24 pagesTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Modul Pembelajaran Akuntansi Keuangan 1 Pra UTSDocument10 pagesModul Pembelajaran Akuntansi Keuangan 1 Pra UTSirsaNo ratings yet

- CITN Study Pack - Taxation of Specialized BusinessesDocument219 pagesCITN Study Pack - Taxation of Specialized BusinessesOguntimehin AdebisolaNo ratings yet

- Planning On Sec. 35-Th. & ExerciseDocument2 pagesPlanning On Sec. 35-Th. & ExerciseProficient CyberNo ratings yet

- Capital Allowances Lecture Summary (All) 2020Document50 pagesCapital Allowances Lecture Summary (All) 2020Tatenda RamsNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- 71705bos57679 Inter P4a PDFDocument13 pages71705bos57679 Inter P4a PDFmonikaNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 3Document7 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 3Hung LeNo ratings yet

- Business DeductionsDocument46 pagesBusiness Deductionsdavid.ellis1245No ratings yet

- Teacher: Sir Adnan /sir Umair: Question PaperDocument91 pagesTeacher: Sir Adnan /sir Umair: Question PaperNadir IshaqNo ratings yet

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- IND AS 105 - Bhavik Chokshi - FR Shield V3 PDFDocument5 pagesIND AS 105 - Bhavik Chokshi - FR Shield V3 PDFlaksh sangtaniNo ratings yet

- Advanced Tax Laws and Practice: PP-ATLP-June 2009 24Document19 pagesAdvanced Tax Laws and Practice: PP-ATLP-June 2009 24Murugesh Kasivel EnjoyNo ratings yet

- 69769bos280322 P7aDocument14 pages69769bos280322 P7aharitaNo ratings yet

- Ca Final New Direct Tax Laws and International Taxation May 2018 1525Document31 pagesCa Final New Direct Tax Laws and International Taxation May 2018 1525pradeep kumarNo ratings yet

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Week 1 Trading StockDocument12 pagesWeek 1 Trading StockchelsdawNo ratings yet

- F1.3 Financial AccountingDocument8 pagesF1.3 Financial Accountingijustus61No ratings yet

- Income From PGBPDocument34 pagesIncome From PGBPjagan pawanismNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Maninder BaggaNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Test 12Document2 pagesTest 12Shehzad KhanNo ratings yet

- IND AS 38 - INTANGIBLE ASSETS RevisionDocument10 pagesIND AS 38 - INTANGIBLE ASSETS Revisionnimisha vermaNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- Topic 6:: Capital Allowances & Charges On Plant & MachineriesDocument18 pagesTopic 6:: Capital Allowances & Charges On Plant & MachineriesNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Accounts Audit 1Document2 pagesAccounts Audit 1RAJAT JAINNo ratings yet

- PGBPDocument32 pagesPGBPMr UniqueNo ratings yet

- Chapter 2 Business Expenses - StudentDocument47 pagesChapter 2 Business Expenses - StudentAng ZhitingNo ratings yet

- IAS 38 - Intangible Assets Question BankDocument37 pagesIAS 38 - Intangible Assets Question Bankcouragemutamba3No ratings yet

- Ilovepdf MergedDocument84 pagesIlovepdf MergedVinay DugarNo ratings yet

- Tax For Specific Industries PYQDocument1 pageTax For Specific Industries PYQShuhada ShoibNo ratings yet

- Aafr Ias 36 Icap Past Papers With SolutionDocument13 pagesAafr Ias 36 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- PGBP - PrintDocument50 pagesPGBP - PrintKamalakar ParvathiNo ratings yet

- Corporate Financial Statements IiDocument43 pagesCorporate Financial Statements Iisujata kumariNo ratings yet

- Capital Gains Tax Planning - EXEMPTEDDocument8 pagesCapital Gains Tax Planning - EXEMPTEDahanaghosal2022No ratings yet

- Taxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TDocument1 pageTaxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TEl Sayed AbdelgawwadNo ratings yet

- 34 FFFDocument23 pages34 FFFDaddyNo ratings yet

- Paper 18Document153 pagesPaper 18ahmedNo ratings yet

- E14 19 ProblemDocument2 pagesE14 19 Problemjustine reine cornicoNo ratings yet

- FAR2 ModelpaperDocument7 pagesFAR2 ModelpaperSaif SiddNo ratings yet

- Module 2.1 (Property, Plant, and Equipment)Document15 pagesModule 2.1 (Property, Plant, and Equipment)Hazel Jane EsclamadaNo ratings yet

- CE22 - 13 - DepreciationDocument61 pagesCE22 - 13 - DepreciationNathan TanNo ratings yet

- CA Ipcc n19p1Document27 pagesCA Ipcc n19p1rachitu2105No ratings yet

- 61089bos49694 Ipc Nov2019 gp1Document93 pages61089bos49694 Ipc Nov2019 gp1iswerya n.sNo ratings yet

- DT A MTP 1 Final May22Document14 pagesDT A MTP 1 Final May22Kanchana SubbaramNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- PGBP NotesDocument13 pagesPGBP NotesAyush AwasthiNo ratings yet

- Direct Tax or Indirect TaxDocument14 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- F5 Bafs 1 AnsDocument6 pagesF5 Bafs 1 Ansouo So方No ratings yet

- Capital Allowances Lecture Summary (Third) 2020Document19 pagesCapital Allowances Lecture Summary (Third) 2020Tatenda RamsNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- Comprehensive Examination (A-B-F)Document24 pagesComprehensive Examination (A-B-F)Khánh Linh LêNo ratings yet

- WBCHSE XI-Board Paper-2023 (Solutions)Document7 pagesWBCHSE XI-Board Paper-2023 (Solutions)duttabishal88465No ratings yet

- FR MTP ADocument347 pagesFR MTP ABabu DinakaranNo ratings yet

- MODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALDocument7 pagesMODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALmimi96No ratings yet

- Capital AllowanceDocument25 pagesCapital AllowanceNyaba NaimNo ratings yet

- 67721bos54327 Fnew P7aDocument11 pages67721bos54327 Fnew P7aPriyanshu TomarNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Planning On Sec. 35-Th. & ExerciseDocument2 pagesPlanning On Sec. 35-Th. & ExerciseProficient CyberNo ratings yet

- OD428004212213964100Document2 pagesOD428004212213964100Proficient CyberNo ratings yet

- TRDocument1 pageTRProficient CyberNo ratings yet

- S.M.Engineering & Co.: 91/S, Majlish Ara Road, Kolkata700041 MOB: +91 9830497443Document1 pageS.M.Engineering & Co.: 91/S, Majlish Ara Road, Kolkata700041 MOB: +91 9830497443Proficient CyberNo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocument4 pagesShri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesProficient CyberNo ratings yet

- 13.07.2022 Class Handout - GermanDocument4 pages13.07.2022 Class Handout - GermanProficient CyberNo ratings yet

- 2e3a2739-446c-48b8-b87c-ea72ed8ed9c9Document1 page2e3a2739-446c-48b8-b87c-ea72ed8ed9c9Proficient CyberNo ratings yet

- CLASS XII ENG A SONNET 116 (Notes)Document5 pagesCLASS XII ENG A SONNET 116 (Notes)Proficient CyberNo ratings yet

- Taxation Finance Act 2017 by Alan Melville Full ChapterDocument41 pagesTaxation Finance Act 2017 by Alan Melville Full Chapterjamie.nettles908100% (23)

- Summative-TestDocument2 pagesSummative-TestChristian DequilatoNo ratings yet

- Share Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atDocument1 pageShare Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atNicole Allyson AguantaNo ratings yet

- Income Tax Planning in India With Respect To Individual Assessee MBA ProjectDocument93 pagesIncome Tax Planning in India With Respect To Individual Assessee MBA Projectnirmala periasamyNo ratings yet

- Basics of AccountingDocument11 pagesBasics of Accountingkishenmanocha485No ratings yet

- Project On Income Tax - Project-On-Income-TaxDocument24 pagesProject On Income Tax - Project-On-Income-TaxDisha BaitadeNo ratings yet

- ACT 153 - Diagnostic Exam in Taxation Anydesk Attempt ReviewDocument30 pagesACT 153 - Diagnostic Exam in Taxation Anydesk Attempt ReviewIrish MagbanuaNo ratings yet

- Balance Day Adjustments & Preparation of Final AccountsDocument18 pagesBalance Day Adjustments & Preparation of Final AccountsNur Amira NadiaNo ratings yet

- Vce Final ReportDocument32 pagesVce Final ReportTushar GuptaNo ratings yet

- 304 - Fin - Advance Financial Management MCQ Test - 1Document8 pages304 - Fin - Advance Financial Management MCQ Test - 1Shubham ArgadeNo ratings yet

- Q1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsDocument17 pagesQ1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsCliNo ratings yet

- CMA Exam Review - Part 2 - Section E - Investment DecisionsDocument3 pagesCMA Exam Review - Part 2 - Section E - Investment Decisionsaiza eroyNo ratings yet

- Prefinals Acct 2 TestbankDocument2 pagesPrefinals Acct 2 Testbankur.luna82997No ratings yet

- Sample Chapter 1Document15 pagesSample Chapter 1Miera FrnhNo ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- RMC 77-21 (Checklist - Business Profits)Document2 pagesRMC 77-21 (Checklist - Business Profits)Hailin QuintosNo ratings yet

- Understand Financial Statements - Harvard ManageMentorDocument14 pagesUnderstand Financial Statements - Harvard ManageMentorSAROJNo ratings yet

- Q2 - Week 7 8Document4 pagesQ2 - Week 7 8Winston MurphyNo ratings yet

- ACCA P2 - Latest Revision NotesDocument198 pagesACCA P2 - Latest Revision NotesFive Fifth100% (1)

- Taxation - English Question 27.01.2023Document12 pagesTaxation - English Question 27.01.2023harish jangidNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Accounting FactsheetDocument1 pageAccounting FactsheetBhumika MehtaNo ratings yet

- Monthly Performance Report Craig Design and LandscapingDocument14 pagesMonthly Performance Report Craig Design and LandscapingShahnawaz JavedNo ratings yet

- CIR v. BOAC G.R. No. L-65773, April 30, 1987Document1 pageCIR v. BOAC G.R. No. L-65773, April 30, 1987Rizchelle Sampang-ManaogNo ratings yet

- Tax Clearance - FAQDocument5 pagesTax Clearance - FAQSarmila RavichandranNo ratings yet

- Problem P2 2ADocument2 pagesProblem P2 2ASHAMSUN NAHARNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesSilvia alfonsNo ratings yet

Disposal of Asset-Th & Exercise

Disposal of Asset-Th & Exercise

Uploaded by

Proficient CyberOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disposal of Asset-Th & Exercise

Disposal of Asset-Th & Exercise

Uploaded by

Proficient CyberCopyright:

Available Formats

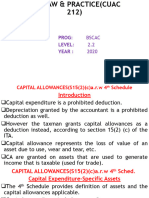

CORPORATE TAX PLANNING

PROFITS & GAINS OF BUSINESS OR, PROFESSION

DR. BARUN KUMAR DAS(BKD)

MOBILE NO. : 9830895854

(I)Uses of Assets:

(i) Business assets for General business purpose –

u/s 32: Depreciation, Additional Depreciation.

(ii) Business assets for Specified business purpose –

U/s 35AD = 100% of cost of eligible assets (except Financial Instrument, Goodwill &

Land) allowable.

(iii) Business assets for Power Units –

(a) Depreciation under SLM on ‘Individual asset’ without additional depreciation

(b) Depreciation Under WDV method on ‘Block of Assets’ with additional

depreciation

(iv) Business asset for Scientific Research –

100% of eligible assets allowable as deduction as per Sec 35.

(v) Asset purchased for Specified purpose but used as business asset –

(a) Assets purchased for Scientific Research –

= To be included in the block of assets at the ‘NIL’ Value.

(b) Assets purchased for Specified business u/s 35AD (within 8 years) = (Cost of

assets – allowable Depreciation) to be treated as business income.

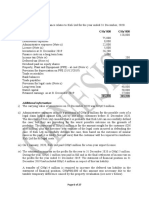

(II)Disposal of Assets:

Tax benefits are –

(i) Offsetting Short Term Capital Gains

(ii) Sale of assets used for Scientific Research:

(a) Sale after using as business assets –

included in the block at ‘NIL’ value.

(b) Sale without using as business asset-

(A) Lower of the following to be treated as Balancing charge u/s 41(3) –

(a) Sale proceeds + deduction allowed u/s 35 – COA

(b) Deduction allowed u/s 35

(B) There may arise Capital gains.

(iii) Sale of business assets by Power Units.

(iv) Sale of assets used for Specified business u/s 35AD – entire sale proceeds to be

treated as business income.

EXERCISE

PROBLEM NO.- 1:

G. Ltd. , a manufacturing Co. furnished the following information:

(a) Projected Net Profit for the year 2022-2023 --Rs.2,10,000 (without considering depreciation

& STCG)

(b) Position of P & M :-- on 1.4.22 Rs.3L + purchases during ‘22-‘23 Rs.1.2L – sale Rs.5L[part of the

block] =80K (STCG)

(c) The Co. can arrange a fund of Rs.1.5L on 01.1.2023 in order to reduce the tax liability.

Advise G Ltd. and show the impact on profit and taxability.

PROBLEM NO.- 2:

H. Ltd. , a manufacturing Co. furnished the following information for the P/Y 2022-2023:

(a) Projected Net Profit for the year 2022-2023 --Rs.20,00,000

(b) Details of the block of P & M[15%] :--

WDV on 1.4.22- Rs.5L

purchased on 1.6.2022- Rs.3L

sold on 31.1.2023- Rs.9L [part of the block]

(c) The Co. can arrange a fund of Rs.4L and wants to invest in another new P & M either on 11.3.2023

or, 11.4.2023.

Advise G Ltd.which one is best according to tax savings point of view.

You might also like

- TAX Preweek Lecture (B42)Document24 pagesTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Modul Pembelajaran Akuntansi Keuangan 1 Pra UTSDocument10 pagesModul Pembelajaran Akuntansi Keuangan 1 Pra UTSirsaNo ratings yet

- CITN Study Pack - Taxation of Specialized BusinessesDocument219 pagesCITN Study Pack - Taxation of Specialized BusinessesOguntimehin AdebisolaNo ratings yet

- Planning On Sec. 35-Th. & ExerciseDocument2 pagesPlanning On Sec. 35-Th. & ExerciseProficient CyberNo ratings yet

- Capital Allowances Lecture Summary (All) 2020Document50 pagesCapital Allowances Lecture Summary (All) 2020Tatenda RamsNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- 71705bos57679 Inter P4a PDFDocument13 pages71705bos57679 Inter P4a PDFmonikaNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 3Document7 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 3Hung LeNo ratings yet

- Business DeductionsDocument46 pagesBusiness Deductionsdavid.ellis1245No ratings yet

- Teacher: Sir Adnan /sir Umair: Question PaperDocument91 pagesTeacher: Sir Adnan /sir Umair: Question PaperNadir IshaqNo ratings yet

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- IND AS 105 - Bhavik Chokshi - FR Shield V3 PDFDocument5 pagesIND AS 105 - Bhavik Chokshi - FR Shield V3 PDFlaksh sangtaniNo ratings yet

- Advanced Tax Laws and Practice: PP-ATLP-June 2009 24Document19 pagesAdvanced Tax Laws and Practice: PP-ATLP-June 2009 24Murugesh Kasivel EnjoyNo ratings yet

- 69769bos280322 P7aDocument14 pages69769bos280322 P7aharitaNo ratings yet

- Ca Final New Direct Tax Laws and International Taxation May 2018 1525Document31 pagesCa Final New Direct Tax Laws and International Taxation May 2018 1525pradeep kumarNo ratings yet

- BBA 311-Financial Management Set 1Document10 pagesBBA 311-Financial Management Set 1Innocent BwalyaNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Week 1 Trading StockDocument12 pagesWeek 1 Trading StockchelsdawNo ratings yet

- F1.3 Financial AccountingDocument8 pagesF1.3 Financial Accountingijustus61No ratings yet

- Income From PGBPDocument34 pagesIncome From PGBPjagan pawanismNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Maninder BaggaNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Test 12Document2 pagesTest 12Shehzad KhanNo ratings yet

- IND AS 38 - INTANGIBLE ASSETS RevisionDocument10 pagesIND AS 38 - INTANGIBLE ASSETS Revisionnimisha vermaNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- b2-c1 Grande Finale Solving 2023 May (Set 2)Document17 pagesb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82No ratings yet

- Topic 6:: Capital Allowances & Charges On Plant & MachineriesDocument18 pagesTopic 6:: Capital Allowances & Charges On Plant & MachineriesNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Accounts Audit 1Document2 pagesAccounts Audit 1RAJAT JAINNo ratings yet

- PGBPDocument32 pagesPGBPMr UniqueNo ratings yet

- Chapter 2 Business Expenses - StudentDocument47 pagesChapter 2 Business Expenses - StudentAng ZhitingNo ratings yet

- IAS 38 - Intangible Assets Question BankDocument37 pagesIAS 38 - Intangible Assets Question Bankcouragemutamba3No ratings yet

- Ilovepdf MergedDocument84 pagesIlovepdf MergedVinay DugarNo ratings yet

- Tax For Specific Industries PYQDocument1 pageTax For Specific Industries PYQShuhada ShoibNo ratings yet

- Aafr Ias 36 Icap Past Papers With SolutionDocument13 pagesAafr Ias 36 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- PGBP - PrintDocument50 pagesPGBP - PrintKamalakar ParvathiNo ratings yet

- Corporate Financial Statements IiDocument43 pagesCorporate Financial Statements Iisujata kumariNo ratings yet

- Capital Gains Tax Planning - EXEMPTEDDocument8 pagesCapital Gains Tax Planning - EXEMPTEDahanaghosal2022No ratings yet

- Taxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TDocument1 pageTaxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TEl Sayed AbdelgawwadNo ratings yet

- 34 FFFDocument23 pages34 FFFDaddyNo ratings yet

- Paper 18Document153 pagesPaper 18ahmedNo ratings yet

- E14 19 ProblemDocument2 pagesE14 19 Problemjustine reine cornicoNo ratings yet

- FAR2 ModelpaperDocument7 pagesFAR2 ModelpaperSaif SiddNo ratings yet

- Module 2.1 (Property, Plant, and Equipment)Document15 pagesModule 2.1 (Property, Plant, and Equipment)Hazel Jane EsclamadaNo ratings yet

- CE22 - 13 - DepreciationDocument61 pagesCE22 - 13 - DepreciationNathan TanNo ratings yet

- CA Ipcc n19p1Document27 pagesCA Ipcc n19p1rachitu2105No ratings yet

- 61089bos49694 Ipc Nov2019 gp1Document93 pages61089bos49694 Ipc Nov2019 gp1iswerya n.sNo ratings yet

- DT A MTP 1 Final May22Document14 pagesDT A MTP 1 Final May22Kanchana SubbaramNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- PGBP NotesDocument13 pagesPGBP NotesAyush AwasthiNo ratings yet

- Direct Tax or Indirect TaxDocument14 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- F5 Bafs 1 AnsDocument6 pagesF5 Bafs 1 Ansouo So方No ratings yet

- Capital Allowances Lecture Summary (Third) 2020Document19 pagesCapital Allowances Lecture Summary (Third) 2020Tatenda RamsNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- Comprehensive Examination (A-B-F)Document24 pagesComprehensive Examination (A-B-F)Khánh Linh LêNo ratings yet

- WBCHSE XI-Board Paper-2023 (Solutions)Document7 pagesWBCHSE XI-Board Paper-2023 (Solutions)duttabishal88465No ratings yet

- FR MTP ADocument347 pagesFR MTP ABabu DinakaranNo ratings yet

- MODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALDocument7 pagesMODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALmimi96No ratings yet

- Capital AllowanceDocument25 pagesCapital AllowanceNyaba NaimNo ratings yet

- 67721bos54327 Fnew P7aDocument11 pages67721bos54327 Fnew P7aPriyanshu TomarNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Planning On Sec. 35-Th. & ExerciseDocument2 pagesPlanning On Sec. 35-Th. & ExerciseProficient CyberNo ratings yet

- OD428004212213964100Document2 pagesOD428004212213964100Proficient CyberNo ratings yet

- TRDocument1 pageTRProficient CyberNo ratings yet

- S.M.Engineering & Co.: 91/S, Majlish Ara Road, Kolkata700041 MOB: +91 9830497443Document1 pageS.M.Engineering & Co.: 91/S, Majlish Ara Road, Kolkata700041 MOB: +91 9830497443Proficient CyberNo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocument4 pagesShri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesProficient CyberNo ratings yet

- 13.07.2022 Class Handout - GermanDocument4 pages13.07.2022 Class Handout - GermanProficient CyberNo ratings yet

- 2e3a2739-446c-48b8-b87c-ea72ed8ed9c9Document1 page2e3a2739-446c-48b8-b87c-ea72ed8ed9c9Proficient CyberNo ratings yet

- CLASS XII ENG A SONNET 116 (Notes)Document5 pagesCLASS XII ENG A SONNET 116 (Notes)Proficient CyberNo ratings yet

- Taxation Finance Act 2017 by Alan Melville Full ChapterDocument41 pagesTaxation Finance Act 2017 by Alan Melville Full Chapterjamie.nettles908100% (23)

- Summative-TestDocument2 pagesSummative-TestChristian DequilatoNo ratings yet

- Share Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atDocument1 pageShare Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atNicole Allyson AguantaNo ratings yet

- Income Tax Planning in India With Respect To Individual Assessee MBA ProjectDocument93 pagesIncome Tax Planning in India With Respect To Individual Assessee MBA Projectnirmala periasamyNo ratings yet

- Basics of AccountingDocument11 pagesBasics of Accountingkishenmanocha485No ratings yet

- Project On Income Tax - Project-On-Income-TaxDocument24 pagesProject On Income Tax - Project-On-Income-TaxDisha BaitadeNo ratings yet

- ACT 153 - Diagnostic Exam in Taxation Anydesk Attempt ReviewDocument30 pagesACT 153 - Diagnostic Exam in Taxation Anydesk Attempt ReviewIrish MagbanuaNo ratings yet

- Balance Day Adjustments & Preparation of Final AccountsDocument18 pagesBalance Day Adjustments & Preparation of Final AccountsNur Amira NadiaNo ratings yet

- Vce Final ReportDocument32 pagesVce Final ReportTushar GuptaNo ratings yet

- 304 - Fin - Advance Financial Management MCQ Test - 1Document8 pages304 - Fin - Advance Financial Management MCQ Test - 1Shubham ArgadeNo ratings yet

- Q1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsDocument17 pagesQ1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsCliNo ratings yet

- CMA Exam Review - Part 2 - Section E - Investment DecisionsDocument3 pagesCMA Exam Review - Part 2 - Section E - Investment Decisionsaiza eroyNo ratings yet

- Prefinals Acct 2 TestbankDocument2 pagesPrefinals Acct 2 Testbankur.luna82997No ratings yet

- Sample Chapter 1Document15 pagesSample Chapter 1Miera FrnhNo ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- RMC 77-21 (Checklist - Business Profits)Document2 pagesRMC 77-21 (Checklist - Business Profits)Hailin QuintosNo ratings yet

- Understand Financial Statements - Harvard ManageMentorDocument14 pagesUnderstand Financial Statements - Harvard ManageMentorSAROJNo ratings yet

- Q2 - Week 7 8Document4 pagesQ2 - Week 7 8Winston MurphyNo ratings yet

- ACCA P2 - Latest Revision NotesDocument198 pagesACCA P2 - Latest Revision NotesFive Fifth100% (1)

- Taxation - English Question 27.01.2023Document12 pagesTaxation - English Question 27.01.2023harish jangidNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Accounting FactsheetDocument1 pageAccounting FactsheetBhumika MehtaNo ratings yet

- Monthly Performance Report Craig Design and LandscapingDocument14 pagesMonthly Performance Report Craig Design and LandscapingShahnawaz JavedNo ratings yet

- CIR v. BOAC G.R. No. L-65773, April 30, 1987Document1 pageCIR v. BOAC G.R. No. L-65773, April 30, 1987Rizchelle Sampang-ManaogNo ratings yet

- Tax Clearance - FAQDocument5 pagesTax Clearance - FAQSarmila RavichandranNo ratings yet

- Problem P2 2ADocument2 pagesProblem P2 2ASHAMSUN NAHARNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesSilvia alfonsNo ratings yet