Professional Documents

Culture Documents

Financial Knowledge, Financial Attitude and Financial Skill - Insights and Behavior of Students in Managing Finances in Indonesia 1-8

Financial Knowledge, Financial Attitude and Financial Skill - Insights and Behavior of Students in Managing Finances in Indonesia 1-8

Uploaded by

Lakupa Dan Adiphaty RajasenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Knowledge, Financial Attitude and Financial Skill - Insights and Behavior of Students in Managing Finances in Indonesia 1-8

Financial Knowledge, Financial Attitude and Financial Skill - Insights and Behavior of Students in Managing Finances in Indonesia 1-8

Uploaded by

Lakupa Dan Adiphaty RajasenaCopyright:

Available Formats

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

Financial Knowledge, Financial Attitude and Financial Skill:

Insights and Behavior of Students

in Managing Finances in Indonesia

Author:

1 2*

Umi Zar'in Arrafi , Adi Santoso

1

Muhammadiyah University of Ponorogo

Jl. Budi Utomo No.10, Ronowijayan, District. Ponorogo, Regency Ponorogo, East Java

Email: umizar9@gmail.com

2

Muhammadiyah University of Ponorogo

Jl. Budi Utomo No.10, Ronowijayan,District. Ponorogo, Regency Ponorogo, East Java

*

Correspondence Email: adisantoso@umpo.ac.id

History of article: Received: 4 Januari 2024, Revision: 18 Januari 2024, Published: 31 Maret 2024

DOI: https://doi.org/10.33197/jabe.v10i1.1697

ABSTRACT

Today's teenagers get many benefits from technology such as online shopping which makes

shopping transactions easier. Driven by the internet, popular celebrities and a lifestyle that aims to

appear trendier in line with global trends. Even though there are these conveniences, there are still

many young people who do not understand properly and correctly the application of financial

management science. Therefore, the aim of this research is to clarify the financial management

behavior of students at the Faculty of Economics using the variables financial knowledge, financial

attitude and financial skills. This research uses a quantitative approach using a purposive sampling

method, and the sample size is determined using the Slovin formula obtained from economics

students in 2020 and 2021. A Likert scale from 1 to 4 is used to measure the data. SEM (Structural

Equation Modeling) data analysis through the SMART PLS 4.0 application with a multiple linear

regression analysis model was used for data analysis in this research. The variables financial

knowledge, financial attitude and financial skills are known to have a positive influence on the

financial management behavior of economics students at Muhammadiyah University Ponorogo.

Keywords: financial; knowledge; attitude; skill.

INTRODUCTION

Indonesia is in the era of digital convenience, where technology has progressed very rapidly,

resulting in changes in social life, especially among teenagers (Rachman, 2021). Consumptive habits

for teenagers are normal now, especially with the ease of access to technology, it is easy for someone

to carry out transactions in market places. Driven by a lifestyle with the aim of looking more trendy

(Murtani, 2019) which is adapted from the internet, celebrities who are trending to world trends such

as South Korea which is the mecca for fashion and make up for young people. Not only that, the

habit of hanging out and having fun in malls or cafes has become one of the habits of teenagers

today.

Today's teenagers are greatly facilitated by technology such as online shopping (Vicamara, U.,

Santoso, A., & Riawan, R., 2023). Online shopping is a form of shopping activity that does not

require direct contact between sellers and buyers (Indrajaya, 2021). Online buying and selling

applications provide consumers with many features such as discounts and free shipping, making

people flock to make transactions (Tama, F. P., Chamidah, S., & Santoso, A., (2023). This

consumptive behavior will influence the difficulty of implementing good financial management

|Umi Zar'in Arrafi, Adi Santoso 1

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

behavior (Fajriyah & Listiadi, 2021), including students, the majority of whom still receive monthly

money from their parents.

Basically, someone who becomes a student already has certain knowledge (Abas, S., Santoso, A.,

Purwaningrum, T., Sutrisno, S., & Ahmad, M. F., 2023). However, in reality there are still many

young people who do not understand properly and correctly the application of knowledge related to

financial management (Santoso, A., Panyiwi Kessi, A. M., & Anggraeni, F. S., 2020). As a result,

young people are still unable to plan and manage money to achieve personal goals. Therefore, there

is a need to expand knowledge and skills to influence attitudes and behavior in appropriate financial

management.

Therefore, the aim of this research is to clarify how economics students' financial management

behavior is supported by financial knowledge, attitudes and skills. Through this knowledge, writers

and readers including teenagers, students and the general public can expand their knowledge about

financial management behavior and realize a degree of understanding in applying knowledge,

attitudes and skills in finance, the author hopes so. Managerial behavior, especially among

economics students.

LITERATURE REVIEW

Financial Knowledge

The term financial knowledge or knowledge is generally used synonymously with financial literacy

or financial education. Financial literacy is an individual's understanding and ability to manage their

finances (Mulyani & Desmintari, (2020); Iman, N., Kurniawan, E., & Santoso, A. (2020)). The

higher an individual's financial knowledge, the better their financial management behavior (Laily,

2019), on the other hand, financial literacy focuses on three dimensions: financial knowledge,

financial attitudes, and financial behavior so that the three are correlated and influence financial

management (Devi et al., 2019). With this, it can be concluded that financial knowledge is a person's

ability regarding financial understanding and a person's ability to manage finances. The indicators

used in this variable include knowledge of financial management, knowledge of saving and

preparation of financial budgets (Hidayat, A. S., & Paramita, R. S., 2022).

Financial knowledge is very important in shaping a person's behavior regarding managing their

finances. Financial knowledge helps individuals understand basic concepts such as income,

expenses, savings, investments, and debt (Kaiser, T., Lusardi, A., Menkhoff, L., & Urban, C., 2022).

Individuals who have a good understanding of these concepts are more likely to make wise financial

decisions. With adequate financial knowledge, a person can make wiser and more informed financial

decisions (Rachmawati, 2018). Financial knowledge allows individuals to better plan their finances,

including retirement planning, children's education, and emergency needs. Based on this

explanation, the proposed research hypothesis is as follows;

H1: It is suspected that financial knowledge influences financial management behavior

Financial Attitude

Financial attitude is the formation of an attitude in good financial management so that it can make

financial management easier (Aditya & Azmansyah, 2021). A person's financial attitude determines

their attitude and behavior in financial matters, both in terms of financial management, financial

planning and decision making (Budiono, 2014). Financial attitude has an important role in

determining financial success or failure, because it is a psychological tendency that is visible when

financial recommendations are implemented with certain pros and cons (Arifin et al., 2019). People

who have a good financial attitude are people who are able to manage money well and act

appropriately in financial management (Herdjiono et al., 2019). With this, financial attitude is the

attitude a person shows in managing finances. The indicators used in this variable are controlling

expenses, financial management mindset and attitude of not wanting to spend money (Nazah, K.,

Ningsih, A. W., Irwansyah, R., Pakpahan, D. R., & Nabella, S. D., 2022).

|Umi Zar'in Arrafi, Adi Santoso 2

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

Financial attitude can influence a person's financial management behavior. Attitude towards risk

plays an important role in financial management. Individuals who are more risk-averse may

gravitate towards investments that have the potential to provide high returns, while those who are

less risk-averse may prefer more stable options. Attitudes towards spending reflect how a person

views consumption and lifestyle. Individuals with a conservative attitude towards spending tend to

be more careful in managing their money, while those who are more consumptive may have a

tendency to take on financial risks. Individuals with a positive attitude toward financial planning

may be more likely to create a budget, set financial goals, and follow a long-term financial plan.

Attitudes toward financial education reflect the extent to which individuals are interested in

increasing their knowledge of finance. People who have a positive attitude towards financial

education tend to be more open to taking learning initiatives and improving their financial literacy.

Based on this explanation, the hypothesis proposed is as follows;

H2: It is suspected that Financial Attitude influences Financial Management Behavior

Financial Skill

Skill is an individual's skill or ability to be able to do something in a profession effectively.

According to Rei et al., (2019) financial skills are one way to find out attitudes towards financial

management. Financial skills are a technique for making decisions in financial management, starting

from preparing budgets to using budget funds (Kholilah & Iramani, 2013). Financial skills are

related to an individual's ability to make decisions related to finances (Goyal, K., & Kumar, S.,

2021). Based on the explanation above, financial skills are a person's ability to manage and use funds

so that they make appropriate decisions. The indicators used in this variable include financial

control, ability to prepare budgets and risk management (Morgan, P. J., & Long, T. Q., 2020).

Financial skills include the ability to create and manage budgets (Klapper, L., & Lusardi, A., 2020).

Individuals who have these skills can more effectively organize their financial resources, identify

spending priorities, and ensure that expenses do not exceed income (Yuesti, A., Rustiarini, N. W.,

& Suryandari, N. N. A., 2020). The ability to analyze expenses helps a person identify areas where

they can save or optimize the use of their money. This involves regular evaluation of expenditure to

ensure efficiency. Financial skills include the ability to manage debt wisely. This includes

understanding interest rates, installment arrangements, and strategies for paying off debt efficiently.

Investment skills include knowledge of investment instruments, portfolio diversification, and

understanding investment risks. Individuals who have these skills can make more informed

investment decisions. Based on this, the hypothesis proposed is as follows;

H3: It is suspected that financial skills influence financial management

Financial Management Behavior

The rapid development of technology and increasingly easy internet access means that someone can

easily get the items they want without having to leave the house (Walsh, B., & Lim, H., 2020).

Encouraged by a consumerist attitude, it can cause economic problems. Without proper financial

management behavior, it can result in someone thinking short-term and shopping impulsively (Amar

et al., 2019). This consumerist behavior trend causes poor financial management behavior, resulting

in a lack of savings, investment, plans for using funds in the future and emergency planning.

Financial management behavior is an individual's ability to organize, plan, budget, manage, control

and save money according to daily needs (Kholilah & Iramani, 2013). Financial management

behavior is related to a person's financial responsibilities, including how a person manages their

money (Dwinta, 2010). Financial responsibility is the process of managing money and other assets

productively. These variable indicators include consumption, cash flow management and savings

and investment. Based on this explanation, it can be concluded that financial management behavior

is what people do in planning, organizing and managing their finances to meet their daily living

needs (Zulfaris, et al., 2020).

|Umi Zar'in Arrafi, Adi Santoso 3

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

RESEARCH METHODS

The population in this study were students from the Faculty of Economics, Muhammadiyah

University of Ponorogo in 2020 and 2021, including Bachelor of Accounting, D3 of Accounting,

Management and Development Economics. To determine the population, a purposive sample was

used on the basis that the respondents were students who had at least taken financial management

courses. This results in a population of 546 people. The size of the research sample uses the Slovin

formula. The formula used in the sample is as follows:

Based on the results of these calculations, the number of samples used in this research was 100

samples.

RESEARCH RESULTS AND DISCUSSION

Measurement (Outer Model)

Validity test

Validity tests include convergent validity and discriminant validity. Convergent validity was

confirmed through outer loading and AVE. Based on Tables 1 and 2, the outer loading value for all

indicators is >0.7 so that all indicators are declared valid and contribute to the variables. Apart from

that, all AVE values for all variables are >0.5 so all variables are valid.

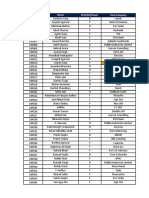

Tabel 1. Output Outer Loading

Financial Financial Financial Management

Financial Skill

Attitude Knowledge Behavior

X1.1 0,901

X1.2 0,952

X1.3 0,864

X2.1 0,838

X2.2 0,889

X2.3 0,969

X3.1 0,847

X3.2 0,974

X3.3 0,995

Y1.1 0,949

Y1.2 0,931

Y1.3 0,939

Primary Data Processed by Smart PLS 4, 2023

Tabel 2. Nilai Average Variance Extracted

No. Variabel Nilai AVE Keterangan

1. Financial Knowledge 0,810 Valid

2. Financial Attitude 0,821 Valid

3. Financial Skill 0,885 Valid

4. Perilaku Pengelolaan Keuangan 0,883 Valid

Primary Data Processed by Smart PLS 4, 2023

|Umi Zar'in Arrafi, Adi Santoso 4

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

Reliability Test

The reliability test in table 3 can be seen comparing Cronbach's Alpha which must be >0.7 so that

all indicators are declared reliable.

Tabel 3. Uji Reliabilitas

Cronbach's Composite Average Variance

rho_A

Alpha Reliability Extracted (AVE)

Financial Knowledge 0,927 0,932 0,927 0,810

Financial Attitude 0,934 0,934 0,932 0,821

Financial Skill 0,957 0,964 0,958 0,885

Financial managing behavior 0,957 0,958 0,958 0,883

Primary Data Processed by Smart PLS 4, 2023

Structural (Inner) Model Coefficient Determinasi R²

Based on the research results in Table 4, it can be seen that the R-square value criteria are included

in the "substantial" category. This shows that the model has a strong influence on the variables

included in the model. This can also influence behavioral variables in financial management.

Tabel 4. Nilai R-Square

R Square R Square Adjusted

Financial managing behavior 1,011 1,012

Primary Data Processed by Smart PLS 4, 2023

Path Coefficient

From the research results presented in the table, it can be seen that the relationship between variables

is determined through the t test with a significance level of > 1.96 and a significance level of 5%,

and the direction of influence is positive or negative. The results of hypothesis testing based on the

path coefficient can be explained using the research model in Table 5.

Tabel 5. Path Coefficient

Standard

Original Sample T Statistics

Deviation P Values

Sample (O) Mean (M) (|O/STDEV|)

(STDEV)

Financial Knowledge ->

0,455 0,445 0,076 6,034 0,015

Financial managing behavior

Financial Attitude -> Financial

0,175 0,165 0,086 2,064 0,040

managing behavior

Financial -> Financial managing

0,195 0,207 0,075 2,455 0,011

behavior

DISCUSSION

Financial Knowledge has A Significant Effect on Financial Management Behavior

The financial knowledge variable has a significant positive influence (O = 0.455) with a P value of

0.015 below 0.05, the first hypothesis is that financial knowledge has a positive influence on the

financial management behavior of economics students. The results of this research show that

financial knowledge has a significant positive influence on students' financial management behavior.

This means that financial knowledge has a very significant role in influencing financial management

behavior among students. The results of this research are in accordance with previous research

conducted by (Masdupi et al., 2019) which also found that financial knowledge has a significant

effect on financial management behavior.

Financial knowledge plays a crucial role in shaping a person's financial management behavior

(Sugiharti, H., & Maula, K. A., 2019). Financial knowledge provides a basic understanding of

financial concepts such as income, expenses, savings, investments, and debt. This understanding is

critical to making sound and informed financial decisions. With adequate financial knowledge, a

person can make wise financial decisions. They can evaluate available options, understand risks and

returns, and make decisions that suit their financial goals. Financial knowledge helps in short and

|Umi Zar'in Arrafi, Adi Santoso 5

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

long term financial planning. Individuals who understand financial planning concepts can create

effective plans to achieve their financial goals.

Financial knowledge helps individuals understand the financial risks they may face and how to

manage them. This includes investment risk management, insurance, and other precautions to

protect personal finances. Financial knowledge helps in understanding various investment

instruments and their associated risks. With this knowledge, a person can make investment decisions

that suit their financial goals.

Financial Attitude has a Significant Effect on Financial Management Behavior

The financial attitude variable has a significant positive influence (O = 0.175) with a P value of

0.040 below 0.05, so the first hypothesis states that financial attitude has a positive influence on the

financial management behavior of economics students. The results of this research show that the

financial attitude variable has a significant positive influence on students' financial management

behavior. The results of this research match previous research conducted by (Aditya & Azmansyah,

2021). In this way, financial attitude becomes a measure for understanding when making financial

decisions. This means that financial attitude influences the financial management behavior of

economics students.

Financial attitude influences an individual's risk tolerance. Those with a more risk-tolerant attitude

may be inclined towards high-return investments, while those with a more risk-averse attitude might

opt for safer, stable options. Attitude towards spending reflects one's approach to consumption and

lifestyle choices. A conservative financial attitude often leads to cautious spending, whereas a more

indulgent attitude may result in a higher inclination towards financial risks. Financial attitude

influences the inclination towards saving money. Those with a positive attitude towards saving are

more likely to consistently set aside a portion of their income for emergencies or long-term goals.

Individuals with a positive financial attitude are generally more inclined towards financial planning.

This includes setting clear financial goals, creating budgets, and adhering to long-term financial

plans. Financial attitude plays a crucial role in shaping one's approach to investments. A positive

attitude may lead to a proactive interest in learning about various investment instruments, while a

negative attitude might result in aversion or indifference towards investment opportunities. Attitude

towards financial education impacts an individual's willingness to enhance their financial literacy.

Those with a positive attitude are more likely to seek out information, attend financial education

programs, and stay informed about economic and financial developments.

Financial Skills Have a Significant Effect on Financial Management Behavior

The financial skill variable has a significant positive effect (O = 0.195) and the P value of 0.011 is

less than 0.05, so the first hypothesis states that financial skills have a positive effect on the financial

management behavior of economics students. The results of this research reveal that the financial

skill variable does not have a significant influence on students' financial management behavior. This

means that financial ability has less influence on financial management behavior. The research is in

accordance with previous research by Saskia & Yulhendri (2020) which shows significant value but

with different objects, namely MSMEs.

Financial skills play a pivotal role in influencing financial management behavior. The proficiency

in handling financial matters can significantly impact an individual's ability to make informed

decisions and manage their finances responsibly. Proficiency in financial skills involves the ability

to create and manage budgets effectively. Individuals with strong budgeting skills can allocate

resources wisely, prioritize expenditures, and ensure that spending aligns with income. The skill to

analyze expenses allows individuals to identify areas where they can save or optimize their spending.

Regular evaluation of expenditures ensures efficiency in financial management. Skills in investment

involve understanding various investment instruments, diversifying portfolios, and comprehending

the risks associated with investments. This knowledge aids individuals in making informed

investment decisions.

|Umi Zar'in Arrafi, Adi Santoso 6

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

Financial skills include the ability to manage income effectively. This involves career planning, skill

development to enhance earnings, and making wise decisions regarding income sources. Individuals

with financial skills are adept at setting realistic financial goals. These goals serve as a roadmap for

planning and guide behavior towards achieving both short-term and long-term financial objectives.

Proficiency in financial skills enables individuals to save and invest for the future. Understanding

savings instruments, retirement plans, and long-term investments contributes to building a secure

financial future.

CONCLUSION

The results of this research found that: 1). The financial knowledge variable has a significant positive

influence on the financial management behavior of economics students at Muhammadiyah

University of Ponorogo. Therefore, increasing financial knowledge has a positive impact on

behavior in financial management. 2). The financial attitude variable is positive and significant on

the financial management behavior of economics students at Muhammadiyah University of

Ponorogo. Therefore, improving financial attitudes has a positive impact on financial management

behavior. 3). The financial skill variable has a significant positive influence on the financial

management behavior of economics students at Muhammadiyah University of Ponorogo. Therefore,

improving financial skills has a positive impact on financial management behavior.

REFERENCES

Abas, S., Santoso, A., Purwaningrum, T., Sutrisno, S., & Ahmad, M. F. (2023). Implementation of

Persuasive Communication Through Student Enterprise, To Be Entrepreneurs at

Muhammadiyah University Ponorogo. YMER, 22(3), 1216-1231.

Aditya, D., & Azmansyah. (2021). Pengaruh Financial Knowledge, Financial Attitude, dan Income

terhadap Financial Behavior pada Usaha Mikro kecil dan Menengah di Kecamatan

Marpoyan Damai Pekanbaru. Jurnal Ekonomi KIAT, 32(2).

https://doi.org/10.25299/kiat.2021.vol32(2).8564

Amar, M. Y., Syariati, A., & Rahim, F. R. (2019). Enhancing hotel industry performance through

service based resources and strategic enterpreneurship (Case Study At Hotel Industries In

Indonesia). Academy of Entrepreneurship Journal, 25(3), 1–10.

Arifin, A. Z., Anastasia, I., Siswanto, H. P., & Henny, . (2019). The Effects of Financial Attitude,

Locus of Control, and Income on Financial Behavior. 59–66.

https://doi.org/10.5220/0008488200590066

Budiono, T. (2014). Keterkaitan Financial Attitude, Financial Behavior & Financial Knowledge

Pada Mahasiswa Strata 1 Universitas Atmajaya Yogyakarta. Skripsi Program Studi

Manajemen Fakultas Ekonomi Universitas Atmajaya Yogyakarta, 5, 1–15.

Devi, A., Agarwalla, S. K., Barua, M. S. K., Jacob, J., & Varma, J. R. (2019). a Sample Study in the

Kamrup. EPRA International Journal of Economic and Business Review, 509(February),

144–147.

Dwinta, I. dan C. Y. (2010). Pengaruh Locus Of Control, Financial Knowledge, Income Terhadap

Financial Management Behavior. Jurnal Bisnis Dan Akuntansi, 12(3), 131–144.

Fajriyah, I. L., & Listiadi, A. (2021). Pengaruh uang saku dan pendidikan keuangan keluarga

terhadap penge lolaan keuangan pribadi melalui literasi keuangan sebagai intervening The

effect of pocket money and family financial education on perso nal financial management

through financial literacy. 17(1), 61–72.

Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis.

International Journal of Consumer Studies, 45(1), 80-105.

Herdjiono, M. V. I., & Damanik, L. A. (2016). Pengaruh financial attitude, financial knowledge,

parental income terhadap financial management behavior. Jurnal Manajemen Teori dan

Terapan, 9(3), 226-241.

Hidayat, A. S., & Paramita, R. S. (2022). The Analysis of Financial Literacy, Financial Attitude and

Locus of Control Toward Financial Behavior on UNESA's Economic and Business

Students. Accounting and Finance Studies, 2(3), 157-176.

Iman, N., Kurniawan, E., & Santoso, A. (2020). Integrasi dan Digitalisasi Sistem Informasi

|Umi Zar'in Arrafi, Adi Santoso 7

JURNAL AKUNTANSI BISNIS DAN EKONOMI e-ISSN

Volume 10 Nomor 01, 2024 (Maret) 4684-6756

Manajemen Aset Wakaf (Simas Waqfuna). KOMIK (Konferensi Nasional Teknologi

Informasi dan Komputer), 4(1).

Indrajaya, S. (2021). Analisa Pengaruh Kemudahan Belanja, Kualitas Produk Belanja Di Toko

Online. Jurnal Ilmu Ekonomi Dan Sosial, 4, 134–141.

Kaiser, T., Lusardi, A., Menkhoff, L., & Urban, C. (2022). Financial education affects financial

knowledge and downstream behaviors. Journal of Financial Economics, 145(2), 255-272.

Kholilah, N. Al, & Iramani, R. (2013). Studi Financial Management Behavior Pada Masyarakat

Surabaya. Journal of Business and Banking, 3(1), 69. https://doi.org/10.14414/jbb.v3i1.255

Klapper, L., & Lusardi, A. (2020). Financial literacy and financial resilience: Evidence from around

the world. Financial Management, 49(3), 589-614.

Laily, N. (2019). Pengaruh Literasi Keuangan Terhadap Perilaku Mahasiswa Dalam Mengelola

Keuangan. Journal of Accounting and Business Education, 1(4).

https://doi.org/10.26675/jabe.v1i4.6042

Masdupi, E., Sabrina, S., & Megawati, M. (2019). Literasi keuangan dan faktor demografi terhadap

perilaku keuangan mahasiswa Fakultas Ekonomi Universitas Negeri Padang. Jurnal Kajian

Manajemen Bisnis, 8(1), 35–47. https://doi.org/10.24036/jkmb.10884900

Morgan, P. J., & Long, T. Q. (2020). Financial literacy, financial inclusion, and savings behavior in

Laos. Journal of Asian Economics, 68, 101197.

Mulyani, I., & Desmintari. (2020). Determinan perilaku manajemen keuangan umkm binaan kpw

bank indonesia provinsi dki jakarta. KORELASI I (Konferensi Riset Nasional Ekonomi,

Manajemen, Dan Akuntansi I), 1, 999–1010.

Murtani, A. (2019). Sosialisasi Gerakan Menabung. Seminar Nasional Hasil Pengabdian Kepada

Masyarakat 2019 Sindimas, 1(1), 279–283.

Nazah, K., Ningsih, A. W., Irwansyah, R., Pakpahan, D. R., & Nabella, S. D. (2022). The Role of

UKT Scholarships in Moderating Student Financial Attitudes and Financial Literacy on

Finance Management Behavior. Jurnal Mantik, 6(2), 2205-2212.

Rachman, A. A. (2021). Factors Affecting the Quality of SKPD Financial Reports in Cimahi City

Local Government. JURNAL ASET (AKUNTANSI RISET), 13(2), 300-313.

Rachmawati, R. (2018). Model Struktural Hubungan Budaya Organisasi, Kompetensi Pengguna,

Pengendalian Internal dan Kualitas Informasi Akuntansi Pemerintahan Daerah. MIX:

Jurnal Ilmiah Manajemen, 8(1), 136-150.

Santoso, A., Panyiwi Kessi, A. M., & Anggraeni, F. S. (2020). Hindrance of quality of knowledge

sharing due to workplace incivility in Indonesian pharmacies: Mediating role of co-worker

and organizational support. Sys Rev Pharm (A multifaceted review journal in the field of

pharmacy), 11(2), 525-534.

Saskia, D. H., & Yulhendri, Y. (2020). Pengaruh Tingkat Literasi Keuangan terhadap Pengelolaan

Keuangan pada Pelaku UMKM Binaan Rumah Kreatif BUMN. Jurnal Ecogen, 3(3), 365.

https://doi.org/10.24036/jmpe.v3i3.9912

Sugiharti, H., & Maula, K. A. (2019). Pengaruh literasi keuangan terhadap perilaku pengelolaan

keuangan mahasiswa. Accounthink: Journal of Accounting and Finance, 4(2).

Tama, F. P., Chamidah, S., & Santoso, A. (2023). The Influence Of Product Diversity, Shopping

Experience, And Service Quality On Consumer Purchase Decisions At Bumdes Krowe

Stores. JMM17: Jurnal Ilmu ekonomi dan manajemen, 10(2), 31-36.

Vicamara, U., Santoso, A., & Riawan, R. (2023). Thrift shopping intention: Understanding

determinant of second-hand apparel shopping behavior. Jurnal Ekonomi dan Bisnis, 26(2),

393-412.

Walsh, B., & Lim, H. (2020). Millennials' adoption of personal financial management (PFM)

technology and financial behavior. Financial Planning Review, 3(3), e1095.

Yuesti, A., Rustiarini, N. W., & Suryandari, N. N. A. (2020). Financial literacy in the COVID-19

pandemic: pressure conditions in Indonesia. Entrepreneurship and Sustainability Issues,

8(1), 884-898.

Zulfaris, M. D., Mustafa, H., Mahussin, N., Alam, M. K., & Daud, Z. M. (2020). Students and money

management behavior of a Malaysian public university. The Journal of Asian Finance,

Economics and Business, 7(3), 245-251.

|Umi Zar'in Arrafi, Adi Santoso 8

You might also like

- 1948-Article Text-6716-3-10-20230808Document9 pages1948-Article Text-6716-3-10-20230808ebdscholarship2023No ratings yet

- Learning Finance, Financial Literacy and Financial Technology As Predictors of Student Financial Behavior in The Covid-19 Pandemic EraDocument7 pagesLearning Finance, Financial Literacy and Financial Technology As Predictors of Student Financial Behavior in The Covid-19 Pandemic EraGabbie RevoñaNo ratings yet

- 1 PBDocument17 pages1 PBIDA NUR AENINo ratings yet

- 11553-35868-1-RVDocument12 pages11553-35868-1-RVdewi sariNo ratings yet

- 441-450Document9 pages441-450rizka.biokimiaipbNo ratings yet

- 2021 Financial Literacyand Financial Behaviourof University Studentsin MalaysiaDocument14 pages2021 Financial Literacyand Financial Behaviourof University Studentsin MalaysiaHONEST PASCHALNo ratings yet

- Ijaeb+ (1 1) +354-362Document9 pagesIjaeb+ (1 1) +354-362MohamedNo ratings yet

- Research Article On Financial Literacy Among College StudentsDocument25 pagesResearch Article On Financial Literacy Among College StudentsManju DahiyaNo ratings yet

- Factors That Influence Financial Behavior Among AcDocument10 pagesFactors That Influence Financial Behavior Among AcceszBigHit BabiesssNo ratings yet

- A Study On Financial Literacy and Financial Behavior of Young Professionals in Metro ManilaDocument11 pagesA Study On Financial Literacy and Financial Behavior of Young Professionals in Metro ManilaAirish Macam100% (1)

- 960-Article Text-3400-1-10-20231115Document15 pages960-Article Text-3400-1-10-20231115Dwi SyahraniNo ratings yet

- 186-Article Text-700-1-10-20230123Document11 pages186-Article Text-700-1-10-20230123Gabbie RevoñaNo ratings yet

- 9177-Article Text-34627-2-10-20230104Document19 pages9177-Article Text-34627-2-10-20230104Valeria WiwikNo ratings yet

- 310-Article Text-623-1-10-20230218Document13 pages310-Article Text-623-1-10-20230218ebdscholarship2023No ratings yet

- Enhancing Islamic Financial Literacy in Indonesian Youth Generates Broader Societal BenefitsDocument14 pagesEnhancing Islamic Financial Literacy in Indonesian Youth Generates Broader Societal BenefitsGlobal Research and Development ServicesNo ratings yet

- 751-Article Text-1291-1-10-20230919Document12 pages751-Article Text-1291-1-10-20230919ebdscholarship2023No ratings yet

- Article DownloadDocument14 pagesArticle DownloadBlack MoonNo ratings yet

- Financial Literacy Among The Millennial Generation - RelationshipsDocument16 pagesFinancial Literacy Among The Millennial Generation - RelationshipsYuslia Nandha Anasta SariNo ratings yet

- Financial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursDocument7 pagesFinancial Literacy, Financial Attitude, and Financial Behavior of Young Pioneering Business EntrepreneursqueenfaustineeNo ratings yet

- Group 3 ResearchDocument13 pagesGroup 3 Researchjohndale gtNo ratings yet

- 24 1 3 QuesDocument9 pages24 1 3 Quesstephanieceprado84No ratings yet

- 3748 8303 1 SMDocument6 pages3748 8303 1 SMPatricia KiarraaNo ratings yet

- The Effect of Financial Literacy On Investment Decisions (A Study On Millennial Generation in Five Big Cities in Indonesia)Document9 pagesThe Effect of Financial Literacy On Investment Decisions (A Study On Millennial Generation in Five Big Cities in Indonesia)Yuslia Nandha Anasta SariNo ratings yet

- Does Financial Perception MediDocument17 pagesDoes Financial Perception MediRetno Puspa RiniNo ratings yet

- 1 PBDocument14 pages1 PBReNz LimbingNo ratings yet

- 13 67 1 PBDocument12 pages13 67 1 PBHitman BangNo ratings yet

- Ijrss 9346Document7 pagesIjrss 9346Hassan AdamNo ratings yet

- 7887 27264 1 PBDocument14 pages7887 27264 1 PBWahyu MaulanaNo ratings yet

- 1 PBDocument13 pages1 PBnovaliafitrifelisa2No ratings yet

- Financial Behavior On Financial LiteracyDocument2 pagesFinancial Behavior On Financial LiteracyRichie PrejulaNo ratings yet

- Financial Satisfaction On Millennials: Examining The Relationship Between Financial Knowledge, Digital Financial Knowledge, Financial Attitude, and Financial BehaviorDocument12 pagesFinancial Satisfaction On Millennials: Examining The Relationship Between Financial Knowledge, Digital Financial Knowledge, Financial Attitude, and Financial BehaviorlovelyNo ratings yet

- Abm NewDocument46 pagesAbm NewSafiyya DevoraNo ratings yet

- Naskah PublikasiDocument24 pagesNaskah PublikasiOktavia FajariyantiNo ratings yet

- IJRISSDocument17 pagesIJRISSsalindongfrancisco24No ratings yet

- Financial Literacy and Financial Planning Among Teachers of Higher Education - A Comparative Study On Select VariablesDocument25 pagesFinancial Literacy and Financial Planning Among Teachers of Higher Education - A Comparative Study On Select VariablesRonald AlmagroNo ratings yet

- According To Rafi DRAFTDocument11 pagesAccording To Rafi DRAFTRogemae LorenNo ratings yet

- Financial Literacy Affects Financial Behavior Through Financial Attitude As An Intervening VariableDocument5 pagesFinancial Literacy Affects Financial Behavior Through Financial Attitude As An Intervening VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1 PBDocument6 pages1 PBAin AdikoNo ratings yet

- 20383-Article Text-72315-1-10-20221231Document16 pages20383-Article Text-72315-1-10-20221231Rakha Wijaya PNo ratings yet

- The Effect of Financial Attitude and FinDocument11 pagesThe Effect of Financial Attitude and Finwangjieqing1228No ratings yet

- Research Manu FinalDocument4 pagesResearch Manu FinalABM1 TAMONDONGNo ratings yet

- Financial Literacy and Financial Planning Among Teachers of Higher EducationDocument16 pagesFinancial Literacy and Financial Planning Among Teachers of Higher EducationTung TaNo ratings yet

- Research PaperDocument4 pagesResearch Paperneelashi maruNo ratings yet

- 2291-Article Text-5217-1-10-20230317Document14 pages2291-Article Text-5217-1-10-20230317RelinasinagaaNo ratings yet

- Maslow Manuscript - Group1-3Document42 pagesMaslow Manuscript - Group1-3Nor-ain SaripadaNo ratings yet

- A Survey On Financial Literacy Among Young Professionals of Bogo CityDocument37 pagesA Survey On Financial Literacy Among Young Professionals of Bogo CityRenz LephoenixNo ratings yet

- Course: Business Research MethodsDocument9 pagesCourse: Business Research MethodsBhuvnesh KumawatNo ratings yet

- Ijaeb+ (1 1) +393-401Document9 pagesIjaeb+ (1 1) +393-401Mariene Thea DimaunahanNo ratings yet

- Jurnal Bijak RepositoryDocument24 pagesJurnal Bijak RepositoryVijay ShanigarapuNo ratings yet

- 17987-Article Text-62455-1-10-20220624Document9 pages17987-Article Text-62455-1-10-20220624NitaNo ratings yet

- Faktor Yang Memengaruhi Kepuasan Keuangan Pengguna: Financial Technology Di SurabayaDocument12 pagesFaktor Yang Memengaruhi Kepuasan Keuangan Pengguna: Financial Technology Di SurabayaTasya asNo ratings yet

- IJMSSSR00884Document12 pagesIJMSSSR00884aubreynacasabug2001No ratings yet

- Microsoft Word - A Survey On Financial Literacy Among Young Professionals of Bogo City PDFDocument37 pagesMicrosoft Word - A Survey On Financial Literacy Among Young Professionals of Bogo City PDFRenz LephoenixNo ratings yet

- BRM ASSIGNMENT 2 - Raneem BilalDocument5 pagesBRM ASSIGNMENT 2 - Raneem BilalRaneem BilalNo ratings yet

- A Graduate Research Project Proposal On "Financial Literacy Among Business Graduate Students of Kathmandu"Document7 pagesA Graduate Research Project Proposal On "Financial Literacy Among Business Graduate Students of Kathmandu"Binay Acharya100% (5)

- 18293-Article Text-81190-1-10-20230531Document20 pages18293-Article Text-81190-1-10-20230531hafith mNo ratings yet

- Factors Affecting Investment Decisions Studies On Young InvestorsDocument7 pagesFactors Affecting Investment Decisions Studies On Young InvestorslaluaNo ratings yet

- Evaluating The Financial Levels of Student ConsumersDocument8 pagesEvaluating The Financial Levels of Student ConsumersjojoivaninuguidanNo ratings yet

- CHAPTER 1 TO 5 TO PRINT EditDocument54 pagesCHAPTER 1 TO 5 TO PRINT EditNormae Ann P. LinogNo ratings yet

- Learning to Manage Money: Financial Education from Childhood to Adolescence. Teaching Your Children to Save, Spend, and Invest WiselyFrom EverandLearning to Manage Money: Financial Education from Childhood to Adolescence. Teaching Your Children to Save, Spend, and Invest WiselyNo ratings yet

- Dila ArtikelDocument17 pagesDila ArtikelLakupa Dan Adiphaty RajasenaNo ratings yet

- LOA BISMA Reny Et AlDocument1 pageLOA BISMA Reny Et AlLakupa Dan Adiphaty RajasenaNo ratings yet

- SSRN Id2900778Document13 pagesSSRN Id2900778Lakupa Dan Adiphaty RajasenaNo ratings yet

- Peter Senge The Fifth DisciplineDocument17 pagesPeter Senge The Fifth DisciplineLakupa Dan Adiphaty RajasenaNo ratings yet

- Ingo O. Karpen - SDL - 2015 (1) - CompressedDocument21 pagesIngo O. Karpen - SDL - 2015 (1) - CompressedLakupa Dan Adiphaty RajasenaNo ratings yet

- Invoice - 158Document1 pageInvoice - 158Lakupa Dan Adiphaty RajasenaNo ratings yet

- Invoice - 158Document1 pageInvoice - 158Lakupa Dan Adiphaty RajasenaNo ratings yet

- The Vitality of Employee Based Pharmaceutical Brands' Equity in Indonesia: Relationship Between Environmental Management Accounting and Organization PerformanceDocument10 pagesThe Vitality of Employee Based Pharmaceutical Brands' Equity in Indonesia: Relationship Between Environmental Management Accounting and Organization PerformanceLakupa Dan Adiphaty RajasenaNo ratings yet

- Paranormal Evidences-Are They Justified EditedDocument16 pagesParanormal Evidences-Are They Justified EditedLakshmi PrabaNo ratings yet

- Business Ethics - A, BDocument3 pagesBusiness Ethics - A, BArnab Kumar SahaNo ratings yet

- 3 Object Oriented Modeling and DesignDocument9 pages3 Object Oriented Modeling and DesignMaya M SNo ratings yet

- Joints in Steel Construction - Simple Connections - Part 02 PDFDocument4 pagesJoints in Steel Construction - Simple Connections - Part 02 PDFkakem61No ratings yet

- Computer POST and Beep CodesDocument8 pagesComputer POST and Beep CodesJDNo ratings yet

- GP Maths Grade 10 June 2023 P2 and MemoDocument11 pagesGP Maths Grade 10 June 2023 P2 and Memoshaybusiness022No ratings yet

- Midterm Exam For Form 3 CompleteDocument8 pagesMidterm Exam For Form 3 CompleteCHRISTOPHER SCALENo ratings yet

- Scap Assignment 2Document11 pagesScap Assignment 2ARYAN KESHRINo ratings yet

- WB4 Short Form - Dual Branding - 10-24-19Document2 pagesWB4 Short Form - Dual Branding - 10-24-19joseNo ratings yet

- Cortana Tutorial: Raphael Mudge, Strategic Cyber LLCDocument61 pagesCortana Tutorial: Raphael Mudge, Strategic Cyber LLCcastillo_leoNo ratings yet

- Practice Test 2-8: Tudent EgreeDocument5 pagesPractice Test 2-8: Tudent EgreeThùy LinhNo ratings yet

- Simple Sentence and Subject Verb AgreementDocument4 pagesSimple Sentence and Subject Verb AgreementAre prety neldaNo ratings yet

- Surfaces Overview: Open Nozzle - SLDPRTDocument10 pagesSurfaces Overview: Open Nozzle - SLDPRTdhaNo ratings yet

- Abap Webdynpro Tips For Beginners: Windows and ViewsDocument14 pagesAbap Webdynpro Tips For Beginners: Windows and ViewsEr.Tousif MollickNo ratings yet

- 0606 w10 Ms 23Document8 pages0606 w10 Ms 23Khoo Kian ChaiNo ratings yet

- Menz Issue 1Document40 pagesMenz Issue 1Dan Moore100% (2)

- 1 - Introduction To Accountign - Icap - Questions and Answers PDFDocument202 pages1 - Introduction To Accountign - Icap - Questions and Answers PDFM.Abdullah MBIT100% (1)

- XXXXXXX XXXXXXXXXXXXX XX Dsfasdfasdf Res: 00000000000Document3 pagesXXXXXXX XXXXXXXXXXXXX XX Dsfasdfasdf Res: 00000000000asksrsinfotechNo ratings yet

- Senate Bill 1483Document15 pagesSenate Bill 1483SAS NwSSUNo ratings yet

- Temporary Sream and Wetland CrossingDocument139 pagesTemporary Sream and Wetland CrossingFranklin GarciaNo ratings yet

- Angle Closure GlaucomaDocument289 pagesAngle Closure GlaucomaWilson100% (1)

- SKB Salary Scale Budget 2013 Vols 1-2Document23 pagesSKB Salary Scale Budget 2013 Vols 1-2Kerine HeronNo ratings yet

- Simplifications PDF Set 5 PDFDocument22 pagesSimplifications PDF Set 5 PDFHriday MittraNo ratings yet

- BSBTWK502 Project PortfolioDocument11 pagesBSBTWK502 Project Portfoliobarun ghimireNo ratings yet

- TP Complete UserManual 1.2Document66 pagesTP Complete UserManual 1.2BENEGUSENGA TADEONo ratings yet

- Service Manual: KDL-52V4100 KDL-52V4100 KDL-52W4100 KDL-52W4100Document114 pagesService Manual: KDL-52V4100 KDL-52V4100 KDL-52W4100 KDL-52W4100Carolina López GonzálezNo ratings yet

- Failure of Rolling Contact BearingsDocument21 pagesFailure of Rolling Contact BearingsLuis NunesNo ratings yet

- 11 19 2125-02-00be Eht Rts and Cts ProcedureDocument17 pages11 19 2125-02-00be Eht Rts and Cts ProcedureDalaPaulaNo ratings yet

- D 2Document9 pagesD 2jhouvanNo ratings yet

- Roll No. Name PPO/PPI/Finals Final CompanyDocument48 pagesRoll No. Name PPO/PPI/Finals Final CompanyYash AgarwalNo ratings yet