Professional Documents

Culture Documents

Jaelon Trice - 6222841244 2

Jaelon Trice - 6222841244 2

Uploaded by

Jaelon TriceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jaelon Trice - 6222841244 2

Jaelon Trice - 6222841244 2

Uploaded by

Jaelon TriceCopyright:

Available Formats

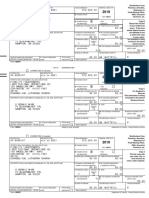

CORRECTED (if checked)

CREDITOR'S name, street address, city or town, state or province, country, 1 Date of identifiable event OMB No. 1545-1424

ZIP or foreign postal code, and telephone no.

12/31/2023

CITIBANK Form 1099-C

388 GREENWICH ST 2 Amount of debt discharged Cancellation

NEW YORK, NY 10013 $ 4000.00

(605) 331-1698

(Rev. January 2022) of Debt

3 Interest, if included in box 2 For calendar year

$ 0.00 2023

CREDITOR'S TIN DEBTOR'S TIN 4 Debt description

Copy B

13-5266470 342-88-4181 R103164240205 - DISPUTE REFERENCE # For Debtor

DEBTOR'S name This is important tax

information and is being

JAELON TRICE

furnished to the IRS. If

you are required to file a

Street address (including apt. no.) 5 If checked, the debtor was personally liable for

return, a negligence

728 N MORGAN ST penalty or other

repayment of the debt sanction may be

imposed on you if

City or town, state or province, country, and ZIP or foreign postalcode taxable income results

from this transaction

CHICAGO IL 60642 and the IRS determines

that it has not been

Account number (see instructions) 6 Identifiable event code 7 Fair market value of property

reported.

116663639939 G $ 2000.00

www.irs.gov/Form1099C Department of the Treasury - Internal Revenue Service

Form 1099-C (Rev. 1-2022) (keep for your records)

Instructions for Debtor see if you must include the interest in gross income.

You received this form because a federal government agency or an applicable

Box 4. Shows a description of the debt. If box 7 is completed, box 4 also shows

a description of the property.

financial entity (a creditor) has discharged (canceled or forgiven) a debt you

owed, or because an identifiable event has occurred that either is or is deemed Box 5. Shows whether you were personally liable for repayment of the debt

to be a discharge of a debt of $600 or more. If a creditor has discharged a debt when the debt was created or, if modified, at the time of the last modification.

you owed, you are required to include the discharged amount in your income, See Pub. 4681 for reporting instructions.

even if it is less than $600, on the “Other income” line of your Form 1040 or Box 6. Shows the reason your creditor has filed this form. The codes in this box

1040-SR. However, you may not have to include all of the canceled debt in your are described in more detail in Pub. 4681. A—Bankruptcy; B—Other judicial

income. There are exceptions and exclusions, such as bankruptcy and debt relief; C—Statute of limitations or expiration of deficiency period; D—

insolvency. See Pub. 4681, available at www.irs.gov/Pub4681, for more details. Foreclosure election; E—Debt relief from probate or similar proceeding; F—By

If an identifiable event has occurred but the debt has not actually been agreement; G—Decision or policy to discontinue collection; or H—Other actual

discharged, then include any discharged debt in your income in the year that it discharge before identifiable event.

is actually discharged, unless an exception or exclusion applies to you in that

Box 7. If, in the same calendar year, a foreclosure or abandonment of property

year.

occurred in connection with the cancellation of the debt, the fair market value

Debtor’s taxpayer identification number (TIN). For your protection, this form (FMV) of the property will be shown, or you will receive a separate Form 1099-A.

may show only the last four digits of your TIN (social security number (SSN), Generally, the gross foreclosure bid price is considered to be the FMV. For an

individual taxpayer identification number (ITIN), adoption taxpayer identification abandonment or voluntary conveyance in lieu of foreclosure, the FMV is

number (ATIN), or employer identification number (EIN)). However, the creditor generally the appraised value of the property. You may have income or loss

has reported your complete TIN to the IRS. because of the acquisition or abandonment. See Pub. 4681 for information

Account number. May show an account or other unique number the creditor about foreclosures and abandonments. If the property was your main home, see

assigned to distinguish your account. Pub. 523 to figure any taxable gain or ordinary income.

Box 1. Shows the date the earliest identifiable event occurred or, at the Future developments. For the latest information about developments related to

creditor’s discretion, the date of an actual discharge that occurred before an Form 1099-C and its instructions, such as legislation enacted after they were

identifiable event. See the code in box 6. published, go to www.irs.gov/Form1099C.

Box 2. Shows the amount of debt either actually or deemed discharged. Note: If Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

you don’t agree with the amount, contact your creditor. online federal tax preparation, e-filing, and direct deposit or payment options.

Box 3. Shows interest if included in the debt reported in box 2. See Pub. 4681 to

You might also like

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Connery 2021Document22 pagesConnery 2021ytprem agu100% (1)

- Uber Misc PDFDocument2 pagesUber Misc PDFWaleed A ElTahanNo ratings yet

- Richard Feeney w2's 2018 2Document3 pagesRichard Feeney w2's 2018 2Richy FeeneyNo ratings yet

- Form1099C-2022-PDF Reader ProDocument5 pagesForm1099C-2022-PDF Reader Proahmed.hany817818No ratings yet

- Walmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)Document1 pageWalmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)maria rodriguezNo ratings yet

- 2019 Form 1099-MISCDocument1 page2019 Form 1099-MISCKeller Brown JnrNo ratings yet

- Capital One TaxDocument2 pagesCapital One Tax16baezmcNo ratings yet

- Nonemployee Compensation: David Moore 62 CR 478 Jonesboro AR 72404 David Moore (870) 882-1488 430-57-7877 500-11-5427Document4 pagesNonemployee Compensation: David Moore 62 CR 478 Jonesboro AR 72404 David Moore (870) 882-1488 430-57-7877 500-11-5427davidmoore214No ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- Naresh Advani 3049987365Document2 pagesNaresh Advani 3049987365Thomas Sheffield100% (1)

- FormatDocument5 pagesFormatherbert2129765No ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- JL PDFDocument1 pageJL PDFJuegos DebeNo ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099Jesse Gibson100% (1)

- Form 1099GDocument2 pagesForm 1099GMarcus KreseNo ratings yet

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- CORRECTED (If Checked) : Form 1099-B 1aDocument1 pageCORRECTED (If Checked) : Form 1099-B 1aahmed adlyNo ratings yet

- Form 1099-G - 2022 - Template1 - Document 01Document8 pagesForm 1099-G - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- Form 1100Document1 pageForm 1100Hï FrequencyNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- Duplicate: Certain Government PaymentsDocument2 pagesDuplicate: Certain Government PaymentsPrincewill OdenigboNo ratings yet

- View FileDocument2 pagesView FilejpneebNo ratings yet

- Maria Bellucci 5165471196Document2 pagesMaria Bellucci 5165471196chde795No ratings yet

- BDSMDocument2 pagesBDSMmathewshallom77No ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- 1099a Example For 1041Document1 page1099a Example For 1041jigger manNo ratings yet

- Form 1099 PatrDocument5 pagesForm 1099 Patrahmed.hany817818No ratings yet

- Nonemployee Compensation: Copy B For RecipientDocument1 pageNonemployee Compensation: Copy B For RecipientNubia LisboaNo ratings yet

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDocument2 pagesCORRECTED (If Checked) : Payment Card and Third Party Network Transactionsvokhidov.holdingsNo ratings yet

- QRFS Olden WerldeDocument2 pagesQRFS Olden Werldespartalives75No ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- New York Department of Tax and Finance W-2G Tax FormDocument8 pagesNew York Department of Tax and Finance W-2G Tax FormStingah VelliNo ratings yet

- Interest Income: For Questions Please Call: 1-888-464-0727Document2 pagesInterest Income: For Questions Please Call: 1-888-464-0727Lisa Nielsen-SmithNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- Form 1099nec-PDF Reader ProDocument7 pagesForm 1099nec-PDF Reader ProSakib AhmedNo ratings yet

- 1099 Misc 1Document1 page1099 Misc 1Anonymous FR8yGDSVgNo ratings yet

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Document1 pageOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonNo ratings yet

- TWCCorrespondence 2Document1 pageTWCCorrespondence 2geeterbob123No ratings yet

- 1707 SunerDocument2 pages1707 SunerGSAFINNo ratings yet

- MABOTRUCKINGLLC22Document2 pagesMABOTRUCKINGLLC22Alex RojasNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- US Internal Revenue Service: F1099int - 1992Document4 pagesUS Internal Revenue Service: F1099int - 1992IRSNo ratings yet

- Mortgage Tax StatementDocument1 pageMortgage Tax StatementAriz10No ratings yet

- Mel RoeDocument2 pagesMel RoejesseNo ratings yet

- GM OEM Financials Dgi9ja-2Document1 pageGM OEM Financials Dgi9ja-2Dananjaya GokhaleNo ratings yet

- FB County Tax Statement-2022Document1 pageFB County Tax Statement-2022Sageer AbdullaNo ratings yet

- Form 1120 2023Document6 pagesForm 1120 2023DjibzlaeNo ratings yet

- DocumentDocument4 pagesDocumentMichele PadillaNo ratings yet

- 1099 Misc John NixonDocument1 page1099 Misc John NixonpayfallusdNo ratings yet

- Tax Bill 2022 120206 PDFDocument1 pageTax Bill 2022 120206 PDFLOUNGE HOMENo ratings yet

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- 154Th Place, Orland Park, IL 60462 - Resident Approval - SignedDocument19 pages154Th Place, Orland Park, IL 60462 - Resident Approval - SignedJaelon TriceNo ratings yet

- Ucc Financing Statement: Debtor'SDocument1 pageUcc Financing Statement: Debtor'SJaelon TriceNo ratings yet

- Nasdaq Omcl 2020Document225 pagesNasdaq Omcl 2020Jaelon TriceNo ratings yet

- Cover Letter CBDocument1 pageCover Letter CBJaelon TriceNo ratings yet

- Silver Bond SampleDocument2 pagesSilver Bond SampleJaelon TriceNo ratings yet

- Docket #2165 Date Filed: 8/3/2011Document62 pagesDocket #2165 Date Filed: 8/3/2011Jaelon TriceNo ratings yet

- Resume ModelDocument2 pagesResume ModelDeepak KaruppusamyNo ratings yet

- Due Diligence Procedures in Land Transactions in Kenya - Five Steps. - Begi's LawDocument12 pagesDue Diligence Procedures in Land Transactions in Kenya - Five Steps. - Begi's LawMartha MuthokaNo ratings yet

- Jib Service Crane For RTG-Terminal 2Document7 pagesJib Service Crane For RTG-Terminal 2YasirNo ratings yet

- Reliance Retail Limited: Total Amount (In Words) One Thousand Rupees OnlyDocument2 pagesReliance Retail Limited: Total Amount (In Words) One Thousand Rupees OnlyDevops LearningNo ratings yet

- America The Story of US Great Depression New DealDocument2 pagesAmerica The Story of US Great Depression New DealTori JemesNo ratings yet

- CH 4 Globalisation and The Indian Economy Class 10Document33 pagesCH 4 Globalisation and The Indian Economy Class 10Adhish RNo ratings yet

- OD427980832162006100Document1 pageOD427980832162006100nikhbiradarNo ratings yet

- UntitledDocument407 pagesUntitledCarrom KingNo ratings yet

- Accra Technical University: Department of Building TechnologyDocument13 pagesAccra Technical University: Department of Building TechnologyKj mingle100% (1)

- TDP Template FinalDocument9 pagesTDP Template Finaldeepak1007No ratings yet

- Project Report at BajajDocument59 pagesProject Report at Bajajammu ps100% (2)

- Introduction To Operation ManagementDocument9 pagesIntroduction To Operation ManagementKristle DimayugaNo ratings yet

- Elastomers Presentation BrochureDocument20 pagesElastomers Presentation BrochureFrench CorvetteNo ratings yet

- The Prevention of UnemploymentDocument17 pagesThe Prevention of UnemploymentPedro Alberto Herrera LedesmaNo ratings yet

- 1 Running Head: Grant Proposal Strategic PlanDocument6 pages1 Running Head: Grant Proposal Strategic PlanJoseph WainainaNo ratings yet

- Comprehensive Fixed Asset Problem Darby Sporting Goods Inc Has PDFDocument1 pageComprehensive Fixed Asset Problem Darby Sporting Goods Inc Has PDFAnbu jaromiaNo ratings yet

- Things I Learned After 30 Years of TradingDocument2 pagesThings I Learned After 30 Years of TradingKen MboteNo ratings yet

- E-Banking Act.1Document2 pagesE-Banking Act.1Christian Lorenz EdulanNo ratings yet

- BBFH107 - Business Statistics II Assignment IIDocument2 pagesBBFH107 - Business Statistics II Assignment IIPeter TomboNo ratings yet

- Noter Onayli Belgeler 12-09-2022Document6 pagesNoter Onayli Belgeler 12-09-2022MetinNo ratings yet

- BuxlyDocument13 pagesBuxlyAimen KhatanaNo ratings yet

- How To Become A More Effective LeaderDocument36 pagesHow To Become A More Effective LeaderSerpilNo ratings yet

- At1 Project Evalution - NusratDocument26 pagesAt1 Project Evalution - NusratNUSRAT JERINNo ratings yet

- Job Description - Maintenance Manager (Lift & Escalator)Document3 pagesJob Description - Maintenance Manager (Lift & Escalator)vessgmgdiablo93No ratings yet

- MRK - Fall 2023 - HRM619 - 4 - MC220205002Document7 pagesMRK - Fall 2023 - HRM619 - 4 - MC220205002hssdj2hfdmNo ratings yet

- E-Ticket Receipt: MR Seid NuhiuDocument1 pageE-Ticket Receipt: MR Seid NuhiuMUMUNo ratings yet

- EarningsperShare Finacc5Document3 pagesEarningsperShare Finacc5Miladanica Barcelona BarracaNo ratings yet

- ME8094 CIMs SyllabusDocument1 pageME8094 CIMs SyllabusJeganNo ratings yet

- BUU33532 - Financial Accounting II - HT - WK3 - 08.02.22Document3 pagesBUU33532 - Financial Accounting II - HT - WK3 - 08.02.22simiNo ratings yet

- The Final Research VIVAAN SAXENADocument35 pagesThe Final Research VIVAAN SAXENAPriti DuttaNo ratings yet