Professional Documents

Culture Documents

CS1 - ML67 - PH M Kim Dung

CS1 - ML67 - PH M Kim Dung

Uploaded by

k60.2112343021Copyright:

Available Formats

You might also like

- Private Wealth Management Resource Guide 2008-2009Document12 pagesPrivate Wealth Management Resource Guide 2008-2009Nian GuNo ratings yet

- Presentation On HDFC Mutual FundDocument19 pagesPresentation On HDFC Mutual Fundvishwa_85No ratings yet

- Finance Assigment - Mirae Asset Case StudyDocument1 pageFinance Assigment - Mirae Asset Case StudyMy Anh DamNo ratings yet

- Investment Banking/Merchant BankingDocument3 pagesInvestment Banking/Merchant BankingManish Kumar GuptaNo ratings yet

- Assignment EmaarDocument12 pagesAssignment EmaarsabaNo ratings yet

- Group 6 AssignmentDocument15 pagesGroup 6 Assignmentbodundeemmanuel8No ratings yet

- Navjot (Internship Proposal Report)Document9 pagesNavjot (Internship Proposal Report)Navjot singhNo ratings yet

- Career Overview Banking and FinanceDocument5 pagesCareer Overview Banking and Financesupering143No ratings yet

- The Problem and Its SettingsDocument5 pagesThe Problem and Its SettingsHi JezNo ratings yet

- Landscape of Financial Services: Section - ADocument12 pagesLandscape of Financial Services: Section - Aanjney050592No ratings yet

- Introduction To Investment Banking - Career Guides #002Document100 pagesIntroduction To Investment Banking - Career Guides #0026bxw4nrz2hNo ratings yet

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1From EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1No ratings yet

- Apec AssignmentDocument17 pagesApec AssignmentHOPE MAKAUNo ratings yet

- 2.0 Background of Company (CIMB Bank) 2.1 History (CIMB 2013)Document6 pages2.0 Background of Company (CIMB Bank) 2.1 History (CIMB 2013)kilikalaNo ratings yet

- Implementing ERM in The Banking IndustryDocument5 pagesImplementing ERM in The Banking IndustryOlmedo Farfan100% (2)

- Investment Management - EditedDocument5 pagesInvestment Management - EditedRomelyn PacleNo ratings yet

- ANSWER - GB550 Financial Management Unit 1Document9 pagesANSWER - GB550 Financial Management Unit 1LAWRENCE KING'OLANo ratings yet

- Format - SIP Progress Report SamikshaDocument10 pagesFormat - SIP Progress Report Samikshavinuta wagheNo ratings yet

- Financial ServicesDocument42 pagesFinancial ServicesGururaj Av100% (1)

- Introduction To Venture CapitalDocument63 pagesIntroduction To Venture CapitalAbbos EgamkulovNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Introduction To Investment BankingDocument49 pagesIntroduction To Investment BankingĐặng Phước LộcNo ratings yet

- Broking Project Malaysia (Recovered)Document34 pagesBroking Project Malaysia (Recovered)goldhazyyNo ratings yet

- Cib CoursesDocument10 pagesCib CoursesEnusah AbdulaiNo ratings yet

- Finance Career Options Final - Doc RSBDocument3 pagesFinance Career Options Final - Doc RSBPrramakrishnanRamaKrishnanNo ratings yet

- CH 12Document15 pagesCH 12Shruti KritiNo ratings yet

- Sample ReportDocument33 pagesSample ReportPubg KillerNo ratings yet

- IVFA True NorthDocument8 pagesIVFA True NorthALLtyNo ratings yet

- Comparative Analysis of Business StrategDocument6 pagesComparative Analysis of Business StrategSagar AdhikariNo ratings yet

- IftDocument9 pagesIftAshher UsmaniNo ratings yet

- Financial Services and Merchant BankingDocument54 pagesFinancial Services and Merchant Bankingananya_nagrajNo ratings yet

- International Careers GuideDocument126 pagesInternational Careers GuideKent WhiteNo ratings yet

- SM Business Report - Team 4Document28 pagesSM Business Report - Team 4rini johnNo ratings yet

- Management Individual AssignmentDocument9 pagesManagement Individual AssignmentDevan MoroganNo ratings yet

- Issues Related To MarketingDocument25 pagesIssues Related To MarketingSmriti KhannaNo ratings yet

- Model Question Bank For VIVA - VOCE: If They Will Ask About Yourself DetailsDocument10 pagesModel Question Bank For VIVA - VOCE: If They Will Ask About Yourself DetailsBabu PentapatiNo ratings yet

- Unit 5 Mutual FundDocument9 pagesUnit 5 Mutual FundSneha GahlyanNo ratings yet

- EntrepreunerDocument5 pagesEntrepreunerKundan JhaNo ratings yet

- Entrepereneurship Final Exam Study NoteDocument27 pagesEntrepereneurship Final Exam Study NoteEsmael UtaNo ratings yet

- 7 P's of Services MarketingDocument169 pages7 P's of Services MarketingZulejha IsmihanNo ratings yet

- Faizi AssignmentDocument9 pagesFaizi AssignmentRida SyedNo ratings yet

- LT 3. Finacial Management - 1399-3!21!20-02Document72 pagesLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNo ratings yet

- Make My TripDocument14 pagesMake My TripPrapti KilleNo ratings yet

- Business Environment AssignmentDocument9 pagesBusiness Environment AssignmentprachiNo ratings yet

- Management For Financial Institutions PDFDocument25 pagesManagement For Financial Institutions PDFEkhlas Jami100% (2)

- Find Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalDocument11 pagesFind Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalMaryNo ratings yet

- Dissertation Topics in Financial MarketsDocument4 pagesDissertation Topics in Financial MarketsDoMyPaperForMoneyFargo100% (1)

- AmbitionBox Sample Placement GuideDocument15 pagesAmbitionBox Sample Placement GuideMayur MundadaNo ratings yet

- Banks in Microfinance-GuidelinesDocument7 pagesBanks in Microfinance-GuidelinesAvijit MajumdarNo ratings yet

- Running Head: Marketing PrinciplesDocument13 pagesRunning Head: Marketing PrinciplesAmir Aijaz MemonNo ratings yet

- FE Case StudyDocument4 pagesFE Case StudyMohammad Sameer AnsariNo ratings yet

- You Multinational Financial Management: An Overview Madura J. (2017) International Financial Management ChatgptDocument11 pagesYou Multinational Financial Management: An Overview Madura J. (2017) International Financial Management ChatgptGETAHUN ASSEFA ALEMUNo ratings yet

- Ib Assigment #1: Abdul Rafay AliDocument9 pagesIb Assigment #1: Abdul Rafay AlialibettaniNo ratings yet

- 3rd Term-Finance ManagementDocument65 pages3rd Term-Finance ManagementShreedhar100% (1)

- A Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses OnlineDocument44 pagesA Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses Onlinerushikesh2096No ratings yet

- Career Op Banking and FinanceDocument5 pagesCareer Op Banking and FinanceRishabh GuptaNo ratings yet

- 2 Industry and Company ProfileDocument8 pages2 Industry and Company ProfilePranav GaikwadNo ratings yet

- SS Report Gr1Document13 pagesSS Report Gr1DebayanNo ratings yet

- Finlatics IBEP 3Document11 pagesFinlatics IBEP 3Narayan ToshniwalNo ratings yet

- Banking 2020: Transform yourself in the new era of financial servicesFrom EverandBanking 2020: Transform yourself in the new era of financial servicesNo ratings yet

- Chap012 Quiz PDFDocument20 pagesChap012 Quiz PDFLê Chấn PhongNo ratings yet

- Chapter 16 - Practice (Ko Quiz)Document3 pagesChapter 16 - Practice (Ko Quiz)k60.2112343021No ratings yet

- Chapter 8-9 - QuizizzDocument9 pagesChapter 8-9 - Quizizzk60.2112343021No ratings yet

- Chapter 14 - QuizizzDocument7 pagesChapter 14 - Quizizzk60.2112343021No ratings yet

- Chapter 6 - ExercisesDocument4 pagesChapter 6 - Exercisesk60.2112343021No ratings yet

- Robinhood Securities LLC: Tax Information Account 636338105Document8 pagesRobinhood Securities LLC: Tax Information Account 636338105Sam BufordNo ratings yet

- Swift MessageDocument29 pagesSwift MessageAbinath Stuart0% (1)

- Functions of Stock ExchangesDocument5 pagesFunctions of Stock Exchangesgkvimal nathanNo ratings yet

- Interim Order in The Matter Siyaram Development and Construction Ltd.Document17 pagesInterim Order in The Matter Siyaram Development and Construction Ltd.Shyam SunderNo ratings yet

- LT Foods HDFC Research ReportDocument14 pagesLT Foods HDFC Research ReportjayNo ratings yet

- Kior LawsuitDocument22 pagesKior Lawsuitthe kingfishNo ratings yet

- BUSINESS FINANCE Module 2Document4 pagesBUSINESS FINANCE Module 2Jes M. MoñezaNo ratings yet

- NISM Series XIXA Alternative Investment Fund Category I and II Distributors Workbook Jan 2021Document263 pagesNISM Series XIXA Alternative Investment Fund Category I and II Distributors Workbook Jan 2021jackhack220No ratings yet

- Revised Corporation Code ReviewerDocument34 pagesRevised Corporation Code ReviewerJhanna Rose100% (7)

- 060 FATCA - QI Compliance PolicyDocument16 pages060 FATCA - QI Compliance PolicyVitalii LiakhNo ratings yet

- Chapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability ManagementDocument45 pagesChapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability Managementশাহরিয়ার মৃধাNo ratings yet

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationDocument3 pagesExhibit 1 Unitary Sec. Cert. - Domestic CorporationJoseph Reuben Balamiento0% (1)

- N BP Annual Report 2021Document406 pagesN BP Annual Report 2021ProNo ratings yet

- Issue of Share CapitalDocument2 pagesIssue of Share CapitalNainika ReddyNo ratings yet

- Traders Magazine Dec 2011Document68 pagesTraders Magazine Dec 2011connytheconNo ratings yet

- Learning Material Level 1 FinalDocument165 pagesLearning Material Level 1 FinalPpNo ratings yet

- Sum Inve TheoryDocument44 pagesSum Inve TheoryMj BauaNo ratings yet

- Company Law ProjectDocument28 pagesCompany Law ProjectpushpanjaliNo ratings yet

- IPO Document 7389V - 2010-11-5Document329 pagesIPO Document 7389V - 2010-11-5scribd.5.krys1964No ratings yet

- Assessment of Cash Management in DashenDocument58 pagesAssessment of Cash Management in DashenEfrem Wondale100% (3)

- Functions of State Bank of IndiaDocument7 pagesFunctions of State Bank of IndiaMitali Pardhiye64% (11)

- 300Document26 pages300Rinni JainNo ratings yet

- T BillsDocument23 pagesT Billspriyanka_pagedar73No ratings yet

- Sundaram Tax Saver Application FormDocument20 pagesSundaram Tax Saver Application FormPrajna CapitalNo ratings yet

- KPIT Technologies (KPISYS) : Optimistic RecoveryDocument11 pagesKPIT Technologies (KPISYS) : Optimistic RecoverygirishrajsNo ratings yet

- Vajiram Test Ans KeyDocument66 pagesVajiram Test Ans Keysakshi750singhNo ratings yet

- Code of Conduct and Ethics PDFDocument44 pagesCode of Conduct and Ethics PDFAnaniya ShaikhNo ratings yet

- Certificate and Resolution To Open Interactive Brokers AccountDocument3 pagesCertificate and Resolution To Open Interactive Brokers AccountVincentNo ratings yet

- WCM Week 5 Financial Securities OverviewDocument20 pagesWCM Week 5 Financial Securities OverviewsanjayNo ratings yet

CS1 - ML67 - PH M Kim Dung

CS1 - ML67 - PH M Kim Dung

Uploaded by

k60.2112343021Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CS1 - ML67 - PH M Kim Dung

CS1 - ML67 - PH M Kim Dung

Uploaded by

k60.2112343021Copyright:

Available Formats

Student: Phạm Kim Dung

Student ID: 2112343021

Class: ML67

CASE STUDY 1

Question 1: What is the main business model of MA? What are the main source of

revenues for the company?

MA main business model revolves around asset management, focusing on mutual funds,

ETFs, and alternative investments (asset management, wealth management, investment

banking, and life insurance)

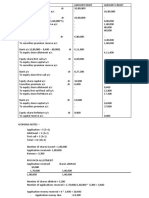

The main sources of revenue for MA are likely to come from its activities in the asset

management and financial services sector. It mainly includes management and performance

fees from invested assets, investment income from various financial instruments,

underwriting fees from securities offerings management, and other income sources such as

commissions, advisory fees, and revenue from insurance premiums. (securities brokerage

and trading fees are the major sources of revenue, accounting for 64.6% of the total revenue

in 2022)

Question 2: How MA develop in the international market, including Vietnam’s market?

MA expands globally by setting up offices in Asia, Europe, and North America. They also

grow through smart acquisitions, buying local asset managers to enter new markets. To

connect with each market, Mirae customizes its products and services to fit the specific

needs of local customers. This helps MA succeed in different parts of the world.

MA enters Vietnam by teaming up with local partners like BIDV. They aim to offer their

existing products to Vietnamese investors while creating new ones tailored to local needs.

However, they face challenges with regulations, competition, and building brand awareness

in Vietnam. Overcoming these challenges is key for Mirae Asset's success in expanding its

presence in the Vietnamese market.

Question 3: What ethical problems that MA might face and how to deal with such

problems?

MA is aware of potential issues, like conflicts of interest from managing various funds, giving

both investment and brokerage services. They're cautious about avoiding misleading info in

marketing and investment advice. MA also takes steps to prevent insider trading and market

manipulation, ensuring their practices stay ethical and trustworthy.

MA tackles challenges by having clear rules and strong oversight to avoid conflicts and

ensure ethical conduct. They believe in being transparent, openly sharing information with

investors about fees, risks, and potential conflicts. MA also focuses on educating investors,

helping them make informed decisions and spot potential issues. These efforts aim to build

trust and maintain ethical standards in the company's operations.

You might also like

- Private Wealth Management Resource Guide 2008-2009Document12 pagesPrivate Wealth Management Resource Guide 2008-2009Nian GuNo ratings yet

- Presentation On HDFC Mutual FundDocument19 pagesPresentation On HDFC Mutual Fundvishwa_85No ratings yet

- Finance Assigment - Mirae Asset Case StudyDocument1 pageFinance Assigment - Mirae Asset Case StudyMy Anh DamNo ratings yet

- Investment Banking/Merchant BankingDocument3 pagesInvestment Banking/Merchant BankingManish Kumar GuptaNo ratings yet

- Assignment EmaarDocument12 pagesAssignment EmaarsabaNo ratings yet

- Group 6 AssignmentDocument15 pagesGroup 6 Assignmentbodundeemmanuel8No ratings yet

- Navjot (Internship Proposal Report)Document9 pagesNavjot (Internship Proposal Report)Navjot singhNo ratings yet

- Career Overview Banking and FinanceDocument5 pagesCareer Overview Banking and Financesupering143No ratings yet

- The Problem and Its SettingsDocument5 pagesThe Problem and Its SettingsHi JezNo ratings yet

- Landscape of Financial Services: Section - ADocument12 pagesLandscape of Financial Services: Section - Aanjney050592No ratings yet

- Introduction To Investment Banking - Career Guides #002Document100 pagesIntroduction To Investment Banking - Career Guides #0026bxw4nrz2hNo ratings yet

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1From EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1No ratings yet

- Apec AssignmentDocument17 pagesApec AssignmentHOPE MAKAUNo ratings yet

- 2.0 Background of Company (CIMB Bank) 2.1 History (CIMB 2013)Document6 pages2.0 Background of Company (CIMB Bank) 2.1 History (CIMB 2013)kilikalaNo ratings yet

- Implementing ERM in The Banking IndustryDocument5 pagesImplementing ERM in The Banking IndustryOlmedo Farfan100% (2)

- Investment Management - EditedDocument5 pagesInvestment Management - EditedRomelyn PacleNo ratings yet

- ANSWER - GB550 Financial Management Unit 1Document9 pagesANSWER - GB550 Financial Management Unit 1LAWRENCE KING'OLANo ratings yet

- Format - SIP Progress Report SamikshaDocument10 pagesFormat - SIP Progress Report Samikshavinuta wagheNo ratings yet

- Financial ServicesDocument42 pagesFinancial ServicesGururaj Av100% (1)

- Introduction To Venture CapitalDocument63 pagesIntroduction To Venture CapitalAbbos EgamkulovNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Introduction To Investment BankingDocument49 pagesIntroduction To Investment BankingĐặng Phước LộcNo ratings yet

- Broking Project Malaysia (Recovered)Document34 pagesBroking Project Malaysia (Recovered)goldhazyyNo ratings yet

- Cib CoursesDocument10 pagesCib CoursesEnusah AbdulaiNo ratings yet

- Finance Career Options Final - Doc RSBDocument3 pagesFinance Career Options Final - Doc RSBPrramakrishnanRamaKrishnanNo ratings yet

- CH 12Document15 pagesCH 12Shruti KritiNo ratings yet

- Sample ReportDocument33 pagesSample ReportPubg KillerNo ratings yet

- IVFA True NorthDocument8 pagesIVFA True NorthALLtyNo ratings yet

- Comparative Analysis of Business StrategDocument6 pagesComparative Analysis of Business StrategSagar AdhikariNo ratings yet

- IftDocument9 pagesIftAshher UsmaniNo ratings yet

- Financial Services and Merchant BankingDocument54 pagesFinancial Services and Merchant Bankingananya_nagrajNo ratings yet

- International Careers GuideDocument126 pagesInternational Careers GuideKent WhiteNo ratings yet

- SM Business Report - Team 4Document28 pagesSM Business Report - Team 4rini johnNo ratings yet

- Management Individual AssignmentDocument9 pagesManagement Individual AssignmentDevan MoroganNo ratings yet

- Issues Related To MarketingDocument25 pagesIssues Related To MarketingSmriti KhannaNo ratings yet

- Model Question Bank For VIVA - VOCE: If They Will Ask About Yourself DetailsDocument10 pagesModel Question Bank For VIVA - VOCE: If They Will Ask About Yourself DetailsBabu PentapatiNo ratings yet

- Unit 5 Mutual FundDocument9 pagesUnit 5 Mutual FundSneha GahlyanNo ratings yet

- EntrepreunerDocument5 pagesEntrepreunerKundan JhaNo ratings yet

- Entrepereneurship Final Exam Study NoteDocument27 pagesEntrepereneurship Final Exam Study NoteEsmael UtaNo ratings yet

- 7 P's of Services MarketingDocument169 pages7 P's of Services MarketingZulejha IsmihanNo ratings yet

- Faizi AssignmentDocument9 pagesFaizi AssignmentRida SyedNo ratings yet

- LT 3. Finacial Management - 1399-3!21!20-02Document72 pagesLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNo ratings yet

- Make My TripDocument14 pagesMake My TripPrapti KilleNo ratings yet

- Business Environment AssignmentDocument9 pagesBusiness Environment AssignmentprachiNo ratings yet

- Management For Financial Institutions PDFDocument25 pagesManagement For Financial Institutions PDFEkhlas Jami100% (2)

- Find Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalDocument11 pagesFind Your Dream Finance Job: Explore The Best Opportunities On Our Finance Jobs PortalMaryNo ratings yet

- Dissertation Topics in Financial MarketsDocument4 pagesDissertation Topics in Financial MarketsDoMyPaperForMoneyFargo100% (1)

- AmbitionBox Sample Placement GuideDocument15 pagesAmbitionBox Sample Placement GuideMayur MundadaNo ratings yet

- Banks in Microfinance-GuidelinesDocument7 pagesBanks in Microfinance-GuidelinesAvijit MajumdarNo ratings yet

- Running Head: Marketing PrinciplesDocument13 pagesRunning Head: Marketing PrinciplesAmir Aijaz MemonNo ratings yet

- FE Case StudyDocument4 pagesFE Case StudyMohammad Sameer AnsariNo ratings yet

- You Multinational Financial Management: An Overview Madura J. (2017) International Financial Management ChatgptDocument11 pagesYou Multinational Financial Management: An Overview Madura J. (2017) International Financial Management ChatgptGETAHUN ASSEFA ALEMUNo ratings yet

- Ib Assigment #1: Abdul Rafay AliDocument9 pagesIb Assigment #1: Abdul Rafay AlialibettaniNo ratings yet

- 3rd Term-Finance ManagementDocument65 pages3rd Term-Finance ManagementShreedhar100% (1)

- A Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses OnlineDocument44 pagesA Study On Undestanding Consumer Behaviour Before Opting For Investment Related Courses Onlinerushikesh2096No ratings yet

- Career Op Banking and FinanceDocument5 pagesCareer Op Banking and FinanceRishabh GuptaNo ratings yet

- 2 Industry and Company ProfileDocument8 pages2 Industry and Company ProfilePranav GaikwadNo ratings yet

- SS Report Gr1Document13 pagesSS Report Gr1DebayanNo ratings yet

- Finlatics IBEP 3Document11 pagesFinlatics IBEP 3Narayan ToshniwalNo ratings yet

- Banking 2020: Transform yourself in the new era of financial servicesFrom EverandBanking 2020: Transform yourself in the new era of financial servicesNo ratings yet

- Chap012 Quiz PDFDocument20 pagesChap012 Quiz PDFLê Chấn PhongNo ratings yet

- Chapter 16 - Practice (Ko Quiz)Document3 pagesChapter 16 - Practice (Ko Quiz)k60.2112343021No ratings yet

- Chapter 8-9 - QuizizzDocument9 pagesChapter 8-9 - Quizizzk60.2112343021No ratings yet

- Chapter 14 - QuizizzDocument7 pagesChapter 14 - Quizizzk60.2112343021No ratings yet

- Chapter 6 - ExercisesDocument4 pagesChapter 6 - Exercisesk60.2112343021No ratings yet

- Robinhood Securities LLC: Tax Information Account 636338105Document8 pagesRobinhood Securities LLC: Tax Information Account 636338105Sam BufordNo ratings yet

- Swift MessageDocument29 pagesSwift MessageAbinath Stuart0% (1)

- Functions of Stock ExchangesDocument5 pagesFunctions of Stock Exchangesgkvimal nathanNo ratings yet

- Interim Order in The Matter Siyaram Development and Construction Ltd.Document17 pagesInterim Order in The Matter Siyaram Development and Construction Ltd.Shyam SunderNo ratings yet

- LT Foods HDFC Research ReportDocument14 pagesLT Foods HDFC Research ReportjayNo ratings yet

- Kior LawsuitDocument22 pagesKior Lawsuitthe kingfishNo ratings yet

- BUSINESS FINANCE Module 2Document4 pagesBUSINESS FINANCE Module 2Jes M. MoñezaNo ratings yet

- NISM Series XIXA Alternative Investment Fund Category I and II Distributors Workbook Jan 2021Document263 pagesNISM Series XIXA Alternative Investment Fund Category I and II Distributors Workbook Jan 2021jackhack220No ratings yet

- Revised Corporation Code ReviewerDocument34 pagesRevised Corporation Code ReviewerJhanna Rose100% (7)

- 060 FATCA - QI Compliance PolicyDocument16 pages060 FATCA - QI Compliance PolicyVitalii LiakhNo ratings yet

- Chapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability ManagementDocument45 pagesChapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability Managementশাহরিয়ার মৃধাNo ratings yet

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationDocument3 pagesExhibit 1 Unitary Sec. Cert. - Domestic CorporationJoseph Reuben Balamiento0% (1)

- N BP Annual Report 2021Document406 pagesN BP Annual Report 2021ProNo ratings yet

- Issue of Share CapitalDocument2 pagesIssue of Share CapitalNainika ReddyNo ratings yet

- Traders Magazine Dec 2011Document68 pagesTraders Magazine Dec 2011connytheconNo ratings yet

- Learning Material Level 1 FinalDocument165 pagesLearning Material Level 1 FinalPpNo ratings yet

- Sum Inve TheoryDocument44 pagesSum Inve TheoryMj BauaNo ratings yet

- Company Law ProjectDocument28 pagesCompany Law ProjectpushpanjaliNo ratings yet

- IPO Document 7389V - 2010-11-5Document329 pagesIPO Document 7389V - 2010-11-5scribd.5.krys1964No ratings yet

- Assessment of Cash Management in DashenDocument58 pagesAssessment of Cash Management in DashenEfrem Wondale100% (3)

- Functions of State Bank of IndiaDocument7 pagesFunctions of State Bank of IndiaMitali Pardhiye64% (11)

- 300Document26 pages300Rinni JainNo ratings yet

- T BillsDocument23 pagesT Billspriyanka_pagedar73No ratings yet

- Sundaram Tax Saver Application FormDocument20 pagesSundaram Tax Saver Application FormPrajna CapitalNo ratings yet

- KPIT Technologies (KPISYS) : Optimistic RecoveryDocument11 pagesKPIT Technologies (KPISYS) : Optimistic RecoverygirishrajsNo ratings yet

- Vajiram Test Ans KeyDocument66 pagesVajiram Test Ans Keysakshi750singhNo ratings yet

- Code of Conduct and Ethics PDFDocument44 pagesCode of Conduct and Ethics PDFAnaniya ShaikhNo ratings yet

- Certificate and Resolution To Open Interactive Brokers AccountDocument3 pagesCertificate and Resolution To Open Interactive Brokers AccountVincentNo ratings yet

- WCM Week 5 Financial Securities OverviewDocument20 pagesWCM Week 5 Financial Securities OverviewsanjayNo ratings yet